AIG Precedent: Taxing Pro Athletes

Scott Ott reports that the other shoe has dropped:

With the debate over AIG executive bonuses nearly bringing official Washington to a standstill in the past three weeks, the Obama administration today expanded its plan to control Wall Street executive pay, adding provisions to limit compensation for star performers in the National Football League (NFL), National Basketball Association (NBA) and Major League Baseball (MLB).

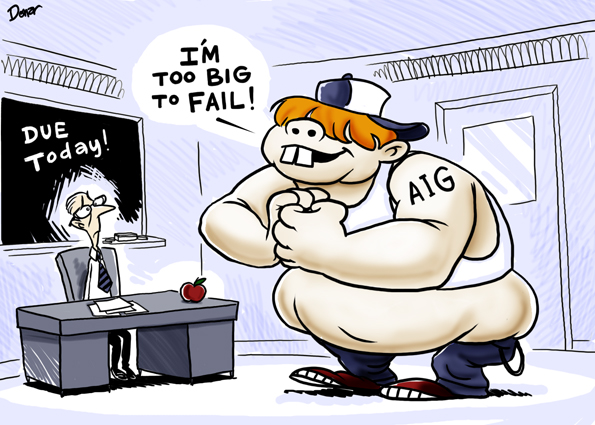

“Some of these sports stars, like AIG execs, have negotiated sweetheart deals paying them millions of dollars, and yet they lose games,” said White House spokesman Robert Gibbs. “The president shares the outrage of the American people at these obscene salaries and bonuses. There’s nothing that makes the little people feel littler than the thought of these fat cats getting fatter just because that have specialized skills that are in high demand in a free-market economy.”

Indeed, the White House released a recent poll showing that 75 percent of Americans answered ‘Yes’ to the following question: “Do you believe President Obama should personally limit the compensation of anyone who earns a lot more than you do?”

More at ScrappleFace.

It could happen. Reductio creep and all that. And, really, a lot of athletes get huge bonuses, whether for signing their contracts or achieving relatively easy performance milestones. It’s true that none of the sports leagues are getting federal bailouts but many teams are getting local funding for their stadia and all benefit from exemptions to anti-trust laws.

Yeah, for sure that’s the fundamental gallstone in the financial crisis. I mean, golly, what’s a little person to think when the exercise of those, high-demand, specialized skills leads to a situation where the highly-demanded, specialized-skilled go, “Oh shit, can you help a brother out? I seemed to have had carnal knowledge of the pooch here, and I’m in danger of losing my summer home in the Hamptons. Can you loan me $100 billion? Thanks. Knew you’d understand.”

This idea is appalling. I have to believe it will never take hold because if it does, highly motivated, talented people will simply take their skills elsewhere. As for the little people, they will rue the day everyone becomes equal.

My husband doesn’t make the kind of bonuses that we’re talking about but the fact that he could, then the government could take 90% of it makes me ill. I don’t care what everyone else makes, let the atheletes and celebs make millions, it doesn’t affect my life. But it does affect my life when you take money out of my pocket. I don’t understand people who believe that no one else should be making more money than they do, how can you have a happy life with so much spite.

I’ve made no secret whatever of my distaste for Mr. Owens. That said, his response is the response of Joe Everyman. Leaving the ethical questions aside for just a moment, I wonder if Obama and company are recognized how close to the dangerous edge there walking on this one, in terms of public opinion.

Those tea parties women hearing so much about? One gets the sneaking suspicion that there going to get an awful lot of high profile people involved with them in the very near future assuming that the Democrats don’t alter course.

Athletes can command their salaries, because sports franchises are popular and make a lot of money. Bonuses (money) should not be shoveled at people who lose a lot of money. And especially not at people who almost destroyed the global financial system.

If the Bills signed TO, and then no one went to any games and the Bills went bankrupt, you’d have a pretty good case for not giving him a bonus.

The people who screwed up our entire system only have talent for destruction and the talent to line their own pockets in the short term. That’s not the type of highly specialized skills we should be trying to reward.

I don’t understand people who think they deserve to take home millions of taxpayer dollars after they create a global economic crisis.

Steve;

Thing is, they didn’t.

Now, governmental interference in the market, did.

Given that fact, are you really prepared to apply the same fix?

Didn’t think so.

steve s, that isn’t at all what I meant by what I said. I honestly do not believe that this law will only be used to keep AIG employees and other companies who have received taxpayer bailouts from getting money they don’t deserve. I believe it will be used to take money from anyone who receives a large bonus regardless of who they work for and that is not ok imo.

Yes Bithead, the government FORCED AIG to leverage 30 to 1 on securities that, by definition, were ultra-risky. Gee golly, the SEC put a gun to those executives heads and said, “Dammit, people, I ORDER you to use mathematical models that don’t consider the possibility that housing values might go down!”

Truly, the Financial Collapse is all the government’s fault.

I believe taxing pro athletes is the wrong way to do things, what about salesmen, C.E.O’s of privately owned business’ etc.? I live in Calif. & suggested to our “governator” that the owners of the teams should be hit with a sales tax on their trades of players. Owning a pro sports team today is just business and just another way to hide money & not pay income tax. Owners treat players as a commodity trading them whenever or however they want – they are a product! Tax them! It won’t work if only Calif. does it, but if it’s a Federally mandated tax…….

Government caps on CEO and professional athlete salaries?

And the problem is?

P.S. to the person above who said it doesn’t affect you- you’re wrong. It absolutely affects you. It directly affects what you and everyone else is paid. It directly affects income inequality and the concentration of the vast majority of wealth in the hands of a tiny minority. Now you may not care, that’s your prerogative, but you’re simply wrong when you say it doesn’t affect you.

Alex, you still ignore the FACT that government caused the collapse.

It was NOT the leveraging that caused the collapse of the credit markets… it was government telling banks to loan money to people who couldn’t afford it that did that. The leveraging collapsed not as a natural course but as a response to governmental interference.

And by the way, Alex, markets almost never collapse on their own. A look at history shows such occurrs.. almost invariably because of government action.

Bithead,

Even if that was true (and as someone who has friends in the mortgage industry, I can tell you that it wasn’t), you’re still ignoring the plain fact that the big banks and financial firms invested in securities that were backed by admittedly sub-prime mortgages! If the problem was merely limited to people unable to pay back their mortgages, we would not be in the place we are today. The numbers of foreclosures, though bad, are too small. It’s the fact that people leveraged 30 to 1 based on the supposition that mortgages by people who couldn’t afford their homes would NOT foreclose that caused the current crisis.

If you’re unwilling to admit the fact that the markets did, in fact, screw up big time, then you’re not going to contribute anything positive to solving it.

Bullshit. Markets have a natural cycle as a natural consequence of delays in communication and production. Larger swings are often caused by overvaluing of certain commodities an products due to runs– see e.g. the Dutch tulip bulb collapse, the dot-com bubble burst, etc. Government can make things worse or better, but even if we had a “night watchman” state, we would still see a business cycle and we would still see recessions.

You seem to forget I was in that business for eight years, myself.

And guess what drove that, Alex? Comon, man.

Look, let’s save some time here.

Darrel Issa has a report out you should see, linking Countrywide Financial’s treatment of Democratic pols and their reluctance to reform Fannie Mae and Freddie Mac. Here is the locus of the blamefor our finacial conditon, folks. For all the redirection of blame and anger redircted at ‘the rich’ and ‘risky betting’ etc, the fact remains none of it would have been a problem without the government’s involvement in the housing markets, and the corruption Democrats brought to the party.

Which of themselves, absent government influence wouldn’t have been nearly the issue we have now, Alex. Government made the problem worse on an order of scale. It always does.

If you’re going to claim, then that the leveraging was risky, what you’re really saying is that it’s the capitalist’s fault for having bet the government wasn’t going to totally muck things up, isn’t it?

Watching Alex and Bit spar is interesting.

With all the focus on MBS’s, leverage, the 2000’s and on, one wonders about root causes.

Housing prices distinctly took off in Q3 1996. (See the Case Schiller size and quality adjusted index). It would seem logical to inspect policies in this period, plus or minus 6-12 months. Capital gains tax reductions on housing is a candidate. CRA mandates are a candidate. Subprime lending is a candidate. Stock market wealth effect is a candidate. House buyer greed is a candidate. Syndication, selling off bad loans to Freddie is a candidate. And so on…….

But these issues all pre-date 2000. And it all started either with government policy initiatives, or the prevailing environment in the 90’s.

Bummer for Clinton apologists.

But true.