Redistribution from the Feds? Not Really.

There really isn't a lot of redistribution happening in the United States.

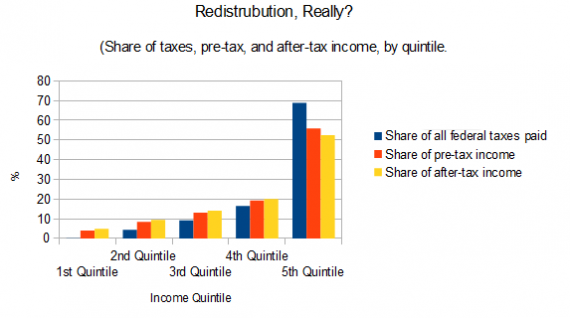

Contrary to my colleague Doug’s description of the Federal government as existing primarily to redistribute wealth, there is actually very little wealth re-distribution in the United States. The chart above uses numbers I pulled from the latest CBO report showing shares of taxes, pre-tax income, and after-tax income by quintile in 2007 (last year available).

As you can see, there’s very little difference between shares of pre- and post-tax income.

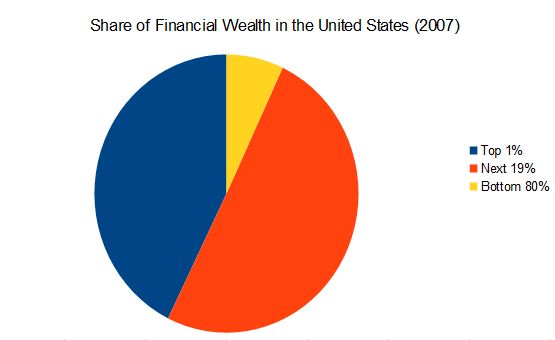

And remember, the above is simply representative of income — not wealth. Here’s a breakdown of financial wealth in the United States in 2007 (last year available):

As you can see, this is why the wealthy in this country pay most of the taxes — they have most of the money, by a staggering amount.

This is pure semantics. Doug (rightly) pointed out that the overwhelming majority of government expenditures are transfer payments. The fact that rich people are still rich after they’re clipped isn’t an answer to that.

Social Security, for instance, is pure redistribution. If it was an actual pension plan, it would pay benefits from a separate source of funds collected over the life of the program and reseeded with current revenue. But it doesn’t — it pays benefits to retirees from payroll taxes levied on current workers. Every worker, even those who pay no income taxes, is having his/her income redistributed to fund it.

Wealth and income are not the same thing. “Staggering” or not.

It wouldn’t matter if the federal governmeng only redistributed a single dollar; to the Doug’s of the world, that is far too much.

Facts don’t resonate with right libertarians because they reason from broad principles rather than empiricism. So they’ll continue to fantasize about a redistributionist state that paradoxically has historically low tax rates and allows the wealthiest to pay a lower effective rate than their secretaries.

@Alex

The fact that the government is incompetent at redistribution isn’t surprising. It’s incompetent at most things. Dodd is right that the order of magnitude doesn’t really matter either.

@Ben,

By what right does the state take my money and give it to someone else simply by virtue of their “need”?

Where I come from, that’s theft

Oh Dodd, you do prove my point.

What is it about SS you guys hate so much? Is it that you actually like the idea of stepping over homeless elderly on your way to the ATM?

“Here’s a breakdown of financial wealth in the United States in 2007”

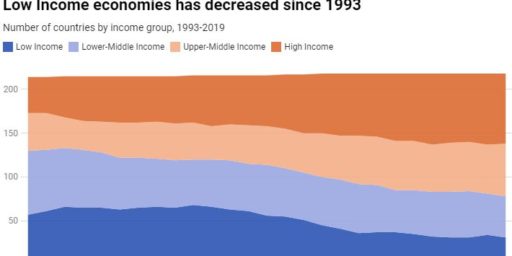

Wonder how much that’s changed…..and in what direction.

PS. If you turn that pie chart around, it looks an awful lot like Pac Man is eating the bottom 80%.

This is what I think is so strange about this “Sweat from my brow!” screaming from the libertarian circles.

Since when is being born by the right woman an achievement? It was your mother that did all the work in that respect. So taxing you for not having to sell your labor on such a crowded market (there are some who will be 90 % sure of never getting into a college, and there are those who are 90 % sure of getting into one) and therefore making more money is not a strike against meritocracy. In fact, I would say some redistribution is essential for meritocracy.

For example, neither of my parents were very rich but I was born Caucasian and in a healthy community. I got support from my family and lots of academic aid when I was getting crushed by stress in high school and got excellent grades – but without government aid I would not have gotten into a college. My upward mobility would have stopped there. So while I will have to pay plenty taxes towards others despite my less-than-privileged beginnings, I think I should pay some amount because there are many born in the wrong area who *I never really had to compete with*. So it’s all relative really. Not all of my accomplishments were my own – I had less competition than I would have had in a real land of opportunity.

I mean, if it wasn’t for redistribution those with more would just accumulate more and more until the forces of dialectics would create a big revolution again. That’s no way to maintain a stable nation.

Do the income reports include all forms of income, such as Social Security and Medicare/Medicaid payments?

And it seemed to me that Doug’s point was the purpose of the government has shifted to providing payments to individuals. Call it re-distribution or call it simply the bureaucratic movement of funds, but if over 50% of all federal payments are to individuals, it seems to me that the federal government has become a bankroll to its citizens, handing them back their own (or another’s) money after inefficiently “processing” it.

The numbers are staggering. The top 20% own about 80% of all wealth liquid and illiquid (basically real estate). But it gets even more staggering once you strip out real estate and look at liquid wealth (stocks, bonds, mutual funds, IRA’s, 401Ks, etc) then the top 10% of the country own 90%…90%…of all liquid assets. And we also score low on social mobility despite the endless bloviating about the American Dream. For most American it remains that just that… a dream. To be honest I can’t remember the exact number but were in the teens somewhere (below France hahaha). The reason the richest are paying the taxes is because as Willy Sutton famously remarked that’s where the money is !

Dodd and Doug –

The biggest problem I have with your characterization is that the article Doug linked to confuses “payment for services” with “checks to individuals.” Medicare is payment for services rendered to those eligible, not a direct payment to those individuals. Ditto VA hospitals, student loans/grants, etc.

Doug,

Without the state, you have no money.

Doug,

It Isn’t theft because you entered into a contract. When you were born your parents contracted for you by conferring U.S. citizenship upon your cute little head. That contract made you responsible for observing things like laws and constitutions, and that contract continues to be in effect until expressly repudiated.

You don’t like the terms of the contract? Reject your citizenship and find a country that will contract with you on terms more to your liking.

Isn’t that all countries really are in libertarian philosophy? Contractors among whom individuals should be allowed to move freely?

Dodd says:

Saturday, February 19, 2011 at 14:58

“This is pure semantics. Doug (rightly) pointed out that the overwhelming majority of government expenditures are transfer payments.”

Er no it’s not semantics. In ancien regime France the vast majority of income and wealth went to the nobility who weren’t liable for taxes. The consequence being the state ultimately went bankrupt and the world had its first popular revolution. No doubt you might prefer this system but most wouldn’t.

“Where I come from, that’s theft”

What planet is that and where can I get a ticket?

“By what right does the state take my money”………um………isn’t that obvious?

I find libertarians who cry “Taxation is theft” as tiresome as Marxists who cry “Property is theft.” Wrong on both accounts!

Slightly different, but related question for Alex (and anyone else), from your perspective is there a good primer of the concept of “the commons?” From my basic understanding of that idea, it appears that is something that’s intimately tied up in this convo (and often left out/under considered in many libertarian critiques).

” So they’ll continue to fantasize about a redistributionist state that paradoxically has historically low tax rates and allows the wealthiest to pay a lower effective rate than their secretaries”

On another thread Doug claims he votes Republican because he rejects Democratic economic hackery. In fact the principal source of our fiscal problems are Republicans who in the 29 years since 1980 during which they have been in power for 20 of them have increaed the public debt 11 times while GDP has increased five times. Obviously rationalism isn’t on the curriculum at George Mason.

Alex Knapp says:

Saturday, February 19, 2011 at 15:14

Doug,

“By what right does the state take my money”

“Without the state, you have no money.”

As I’ve long pointed out Doug at bottom is a nihilist like most far right Republicans/Libertarians.

Joe

Neither you nor Alex have provided a reason why redistribution by the state is at all a moral act, and that is the main reason I oppose it.

And if we’re going to get into the tired, old “nihilst” canard again let me know and I’ll go take the dog for a walk because I’m not going to down that silly road again.

“Neither you nor Alex have provided a reason why redistribution by the state is at all a moral act, and that is the main reason I oppose it”

Seems to me the real question is what are the apprpriate limits of taxation. All the nihilist stuff and its variants are just evidence of a weak mind. What’s really going on in the country is that the limits have apparently been reached, or exceeded, and there is serious pushback.

“Neither you nor Alex have provided a reason why redistribution by the state is at all a moral act, and that is the main reason I oppose it.”

Wait, your argument was that redistribution was theft. Theft occurs in the context of a legal regime which defines it as the wrongful or felonious taking of another’s property. That same legal system has stated for centuries that taxation and redistribution are legal (i.e. they aren’t theft).

Now you move the goal posts to morality. What is moral about the vast increase in human suffering and death if we end the welfare state? Answer me that question.

Doug Mataconis says:

Saturday, February 19, 2011 at 15:28

“Neither you nor Alex have provided a reason why redistribution by the state is at all a moral act, and that is the main reason I oppose it.”

Since when has govt been about morality? I doubt you’re ever going to find an entirely moral system of governance even in a monastery. Govts are instituted amongst men for entirely different purposes than the propagation of morality. The mere fact you don’t seem to comprehend this attests to your essentially nihilistic world view…even if the Dog agrees with you

Yes Ben, redistribution is theft and theft is morally wrong. Unlike some I don’t believe that governments should be treated as amoral institutions. When they do something wrong, which is more often than not, the fact that it was supported by a majority is largely irrelevant.

Drew says:

Saturday, February 19, 2011 at 15:40

“Seems to me the real question is what are the apprpriate limits of taxation. All the nihilist stuff and its variants are just evidence of a weak mind.”

Well that ‘sprobably because you don’t understand what nihilism means. Philosophic concepts obviously bore you so you rely on “commonsense”

Unless you want to move government to a fee for service model, redistribution is utterly necessary. By your logic, no government can be moral.

These are the facts of the case. And they are undisputed.

* [T]hese “direct payments to individuals” accounted for more than two-thirds of federal spending in 2010. That’s a post-war high. [Doug]

*Quintiles 1, 2, 3, and 4 have a higher share after-tax income than pre-tax income. [Alex]

*Quintile 5 has a lower share of after-tax income than pre-tax income. [Alex]

Doug,

I’ll ask you again: is the vast increase in human suffering and death that would result from ending the welfare state more moral than redistribution?

All I ask is a direct answer to this question.

The bottom line is, though, as I argued back in December, to govern is to redistribute. If we want government (and we all do, whether we want to admit it or not) it is doing to be redistributing things.

A main problem in this discussion (especially the “taxation is theft” approach) is that it pretends like the only people who benefit from government are those who receive welfare checks and the like. This simply isn’t the case.

Who was it, for example, who benefited the most from the various financial bailouts? There are a lot of wealthy people who benefited a whole lot more from that, certainly as measured in dollars, than did the poor.

I find the libertarian view to be appealing on many levels. However, the bottom line is that government is far more of a positive force than most Americans like to admit (and that is allowing for flaws, inefficiencies, mistakes and the like).

Government creates the basic context in which we all operate our daily lives (basic public order, the method to move goods from point A to point B, insurance that my money is safe in the bank, protecting my property rights, …the list is long).

@James –

I don’t disagree with that. I was merely pointing out that in the grand scheme of things, there ain’t a lot of redistribution.

Doug Mataconis says:

Saturday, February 19, 2011 at 15:52

“Unlike some I don’t believe that governments should be treated as amoral institutions.”

Nothing to do wih amorality. Governments simply don’t exist to provide a moral framework for society. They exist to regulate and control political and social relations in society. And like most human institutions from the family to he RC church they are imperfect.

@Doug

“Neither you nor Alex have provided a reason why redistribution by the state is at all a moral act, and that is the main reason I oppose it.”

I can give you a prudential argument for it. Look at the pie chart. Absent redistribution of some sort, in an effort to attenuate the inequality, it’s quite likely that those at the top of the distribution would harness the police power of the state to insure that the bottom 80% remain the bottom 80%. That chart is probably a very good representation of the Soviet Union, with the party leadership at the top, the mid-level party functionaries in the 19%, and the proles in the remaining 80%. That system was only sustained by brute force. I think the libertarian wealth distribution would be sustainable only by similar impositions. Not a pretty prospect.

> By what right does the state take my money and give it to someone else simply by virtue of their “need”?

I agree, just because the military, schools, roads and so on need some of my money, doesn’t mean they should get any of it.

James Joyner says:

Saturday, February 19, 2011 at 15:57

All numerically accurate of course but we’re talking about wealth redistribution and you’re ignoring the ownership of capital which is almost entirely concentrated in Quintile 5. Once you take into account the accumulation and ownership of wealth which after all is most people’s economic goal, there’s damn all redistribution

@Alex –

Sure. I’m sure we had higher levels of distribution back in the day of 90% top marginal rates.

And I fundamentally agree with you and Steven that redistribution of resources is simply the nature of modern government. That’s Doug’s point, too, although he’s less resigned to it.

This discussion is unreal. Doug thinks governments exist for some moral purpose. They don’t. Doug and others think taxes constitute theft even when society agrees via political and legal process that they should be collected. Doug and others claim wealth is being redistributed from rich to poorer groups when in fact such redistrbution as has occurred over the last 30 year has actually been to richer groups who now own a huge share of national wealth. Finally Doug after wholesale rejection of our entire political/economic/social system is upset to because his outlook is described as nihilistic. Duh

> And I fundamentally agree with you and Steven that redistribution of resources is simply the nature of modern government. That’s Doug’s point, too, although he’s less resigned to it.

I don’t see how you’re going to avoid it and still have a government. In an ideal world the military might be volunteer, defence contractors might give jets and tanks out of patriotism, people might build roads and bridges out of civic pride, teachers might teach for the joy – but right now everyone wants to get paid. And that involves a massive redistribution of resources. People pay for all of the above whether they’re using (or want to use it) or not. Without money there is no government, and for gov’t, money means taxes, and taxes means taking money from some people and redistributing it to others.

What’s the alternative?

Here’s my moral argument for redistribution (based on the idea that things are often inherently contradictory in the real world):Western/American Capitalism, while not a zero sum game, inherently must produce loser (see “Wealth of Nations” amoung others).

Success, despite libertarian claims, is not simply based in individualism — meaning that no one individual succeeds or fails on his or her own abilities by themselves. In fact, there’s more than enough statistics to show that many key aspects of our own success and failure are largely outside of the bounds of our own control. I’m not suggesting the individual doesn’t play a role, but it’s not as pronounced as we like to believe.

Contingency plays a huge role in all of this — meaning that by luck (or lack there of) of birth, genetics, violence, acts of others — one can start at an advantage or disadvantage, can have their entire life taken away from them, etc.

If one’s success is bound up within a system that in always already inherently biased towards the sucecss of a subset of the culture, and always inherently biased towards the failure of another subset, to some degree our own success is, in fact, based on the relative failure of others (again, I’m not saying zero-sum here, it isn’t zero sum, but it isn’t “pull yourself up by your own bootstraps either.”).

Under these conditions, the need to support other members of our society seems to me to be a moral necessity.

Faced with that we can:

Go back to Dickensian times and wait for death to decrease the surplus population (which I’m hoping you would agree is not a particularly moral position).

Say ok, but then it should be up to the individual to give. I don’t disagree that individuals should give, however, there is always the famed “free rider” problem. More over, what is being described about is a system (not an individual’s) moral responsibility.

Have a combination of institutional social safety net and individual/organizational giving. Clearly this is the most moral of the options from both an invidual and systemic perspective. Thus the better question to ask is not *is it more to redistribute* but rather what is the most effective way for the government to be involved in the distribution (and the Regan answer doesn’t work be because of what’s articulated in “b”).

btw, to the social darwinist, who say that nature isn’t fair, given that we are reflexive beings and that we accept to play the game (i.e. live in the US), that means that you have choosen to work within a system that is, to some degree, immoral and inherently unfair. Suck it up and do whats right!.

Finally, if you really refuse to think this is a moral issue, at least admit it’s a practical one. In keeping with one’s own survival, there is a significant amount of economic and historical precidence for understanding that it is one’s own best economic (not to mention social interests) to maintain a stable social structure. That can’t be down without some level of redistribution to keep people living and not revolting. The rapid disintergration of a “future” for the lower middle class led to the “tea party.” Do you really want to imagine what would happen if all social safety nets were taken away?

James Joyner says:

Saturday, February 19, 2011 at 16:24

“And I fundamentally agree with you and Steven that redistribution of resources ”

Except there isn’t in fact much redistribution of resources. Unfortunately there appears to be lamentable lack of understanding here of how wealth is created and accumulated.

In the sense that it is rare that a given citizens pays taxes and receives benefits in equal measure, there is alway redistribution and it is more complicated than simply wealth accumulation. This is what I am getting at.

If you book the current wars it is certainly not true that the majority of spending is transfer payments … unless you are playing games, transfers to soldiers, widows, orphans.

Alex;

You’ve got that backward….. Without the taxed, the state has no money.

Your premise is nonsense. We merely hired them to print the notes which represent our efforts.

Axel;

I was orphaned at 12, educated by Andrew Carnegie, and managed to at least reach that third quintile [swag] …. and in your twisted racist brain you want to deny my efforts and attribute my small success to the fact that some in our society perceived me as white? Nonsense!

Doug:

I think you’re a very smart guy and a very perceptive critical thinker. If it isn’t obvious by my constant presence here, I really like the blog and what you’ve brought to it.

But I get the feeling that there are two different things going on in your head: a libertarian faith, and a separate critical intelligence, and the twain never meet.

You’re like a scientologist who can make cogent arguments against over-reliance on psychology and then be utterly unaware that what he himself believes is nonsense. Put simply you’re too smart to be a libertarian. It’s a faith for you, something you adopted perhaps before the full flowering of your critical intelligence.

The problem is that in this environment you’re frequently challenged to test your own presuppositions, to challenge your own faith. That’s unavoidable in the context of a political blog where you so often point out the mote in your neighbor’s eye.

The libertarian argument that government can never be more than a necessary evil doesn’t strike me as principled, it strikes me as juvenile. It is of a piece with, “I didn’t ask to be born.” The fact is we need government. So describing it as evil makes no more sense than arguing that air and water and food are evil.

Government is necessary to our survival as individuals and as a civilization, possibly even as a species. Libertarians when pushed understand this, but they can’t dirty their hands with grubby reality when pure theory seems so attractive. Attractive and of course exculpatory. “I didn’t ask to be born.”

It’s not a principle or a philosophy, it’s a pose.

Steven L. Taylor says:

Saturday, February 19, 2011 at 16:41

Steven there is little or no redistribution of wealth in a downward direction going on. In a sentence wealth is created when economic activity take place during which value is generally added to a product or service. So when a SS/Medicare recipient is handed cash (which he might spend at Wal Mart) or services like a Medicare funded colonosopy he’s involved in transactions that all create wealth which ultimately ends up in the pockets of holders of Wal Mart or GE stock. I realise this is a gross over simplification but you get my drift. Now before anyone says yes but if all these wealthy folks didn’t have to finance part of Medicare/SS they could keep it and spend it on Roll Royces which would also create economic activty. True. But there’s a limt to how much these folks can consume (How may RR’s do you really need). Societies composed of a huge underclass dedicated to serving the needs of the very rich aren’t very effective generators of national wealth. A classic case being what happened in Britain and France in the 18th century.

The US is a hugely efficient wealth producing machine most of the benefits of which flow to the richest 10% of society. But the continuation of this depends on the maintanance of demand. Halve the demand for colonoscopies and lot of doctors are going to be out of business and GE will sell less equipment. In fact this is the flaw at the center of the entire suppy side, reduce taxes, cut social programs philosophy. We have created an economy which is 70% dependant on consumer spending and yet we’ve been progressively reducing the real spending power of 80-90% of the population for 30 years. Can we get it out of our head that temporary transfers of cash that create economic activity that ultimately enlarges the wealth of the top 10% constitutes redistribution because it isn’t. In fact the long term solution to our problems involves some real ttransfer of wealth in either cash or kind.

floyd says:

Saturday, February 19, 2011 at 17:12

Alex;

You’ve got that backward….. Without the taxed, the state has no money.

Floyd: we are the state. Okaaay?

michael reynolds says:

Saturday, February 19, 2011 at 17:23

Michael: Like me you obviously fancy yourself as a bit of an intellectual so you might find this essay on agnotology (culturally induced ignorance) interesting. At bottom I think this is Doug’s problem. He’s obviously a bright guy and like you I enjoy a joust with him but he’s essentiallly a prisoner of a cockamamie belief system.

http://crookedtimber.org/2011/02/17/shibboleths/

Micheal;

Too much air is hyperventilation, too much food is obesity, too much water is drowning,

Too much government is tyranny. It strikes me as juvenile to depend on any of the above without acknowledging the dangers and controlling your intake of each.

Joe;

If you believe your own premise, then you must see the need for the skeptic to balance the gullible.

Joe:

You know what? I never knew the precise meaning of shiboleth. I was getting by on a contextual understanding. Interesting link. My lesson for the day.

floyd:

Of course too much is a problem. Libertarians don’t take that rational approach. They want to breathe while denouncing air. That’s why it’s nothing but posturing.

Floyd — Too little air is suffocation. Too little food is starvation. Too little water is fatal dehydration. And too little government is anarchy, mob rule, random violence and the law of the jungle It’s Somalia.

So now that we agree that there’s a right amount between none and too much, perhaps we can move away from absolutes.

Micheal;

You must understand the perspective of the libertarian…. To him, the government has become evil in excess, just as the drowning man would denounce water… at least until the threat is mitigated for a time, then he might seek a drink in thirst, but never a baptism without hope of a return to the surface for a breath of the air of liberty.

. It is more perspective than posturing.

Wr;

You first.

floyd says:

Saturday, February 19, 2011 at 18:10

Floyd: believe me I’m the ultimate unbeliever and sceptic and one of the things I don’t believe in is absolutes. I’ve been proved wrong too often.

Then let’s start with this: Taxation is not theft. Taxation is vital to the survival of a modern civilization.

Too much taxation is tyranny. Too little taxation yields anarchy which is tyranny of a different sort.

As in many things, moderation is the point. The point is to find the right mix, not for libertarians to talk nonsense about taxation being theft, or for communists to talk nonsense about property being theft.

We have real problems, we need real solutions, so let’s work toward finding solutions rather than making ourselves feel better by striking poses.

Would you agree?

This thread has taken quite the Aristotelian turn!

@floyd,

The question is can a libertarian articulate, beyond generalities, a state of government that ISN’T evil in excess.

It seems to me that the radical individualistic center that most libertarians I’ve met seem to take really doesn’t allow much room for compromise.

Michael;

Who could possibly disagree with such glowing platitudes?

We do have real problems, most of which were caused by too much government and confiscatory tax policies. The solution does not lie in more of the same.

Don’t make the same mistake that WR did … I have never advocated “none” while I perceive many here who advocate “too much”.

I am neither an anarchist nor a libertarian, but I do believe their lack of faith in government is essential to offset the blind faith of those who see their salvation in pushing the balance further toward totalitarianism.

You are right, taxation is not, by definition, theft… but sometimes confiscation “smells as sweet”.

@Floyd: Beyond “deficit” can you articulate, not in generalities, our real problems, most of which were caused by too much government and confiscatory tax policies.

Matt B;

Yes.

I find it odd that anybody could look at that pie chart and say “BOY, THE RICH IN AMERICA SURE ARE GETTING SCREWED OVER, YEP!”

Perhaps more relevantly, I find it odd that anybody could look at the chart and say, “Why yes, that appears to be sustainable.” (xref sam’s comment @ 16:12)

Good thread!

Floyd:

There you go: you guys never have anything.

Like I said, it’s a pose.

@Michael… I was waiting for someone else to say it.

Again, please could any libertarian articulate, beyond generalities, three things:

1. A state of government, from a libertarian perspective, that ISN’T evil in excess.

2. Beyond the current debt (which I’m not denying is something that needs to be dealt with) what “real problems” are caused by too much government and confiscatory tax policies.

3. What goods/services, from a libertarian perspective, *are* worth paying taxes for.

Ben writes to Doug, “I’ll ask you again: is the vast increase in human suffering and death that would result from ending the welfare state more moral than redistribution?

“All I ask is a direct answer to this question.”

Doug writes…

…

…

…

A true libertarian wouldn’t pay for police protection, for its a centralized effort for distributed protection (socialism, as opposed to decentralized competition of one’s true individual resources).

Just like Doug, a true right wing libertarian, like all those skinny white beta males, would have been killed in a social Darwinist paradise of true unrestricted competition.

> Seems to me the real question is what are the apprpriate limits of taxation. All the nihilist stuff and its variants are just evidence of a weak mind. What’s really going on in the country is that the limits have apparently been reached, or exceeded

Compared to what? From a historic perspective, the current federal tax burden is not looking too bad.

> Who could possibly disagree with such glowing platitudes?

And you answer is to what? Provide right wind fox new platitudes?

> By what right does the state take my money and give it to someone else simply by virtue of their “need”?

The average American (to say nothing of white collar professional) has a life that is better that that of almost everyone who ever lived by many orders of magnitude. The endless “poor little me, I have to pay taxes” whine from the right pretty much makes me want to puke.

I will be writing a large check to the IRS in April. While I would not mind having the money to go kick it in the South of France for a bit, I am grateful to have a good income, a nice home (brand new speakers!) and so on. I certainly will not be feeling sorry for myself on April 15.

Floyd:

No one on this thread is suggesting government shouldn’t be checked. So please quit the childish posturing.

Matt b asks:

“@Floyd: Beyond “deficit” can you articulate, not in generalities, our real problems, most of which were caused by too much government and confiscatory tax policies.”

Floyd does not answer:

“Matt B;

Yes.”

And THAT… in a nut shell, sums up this whole discussion.

Floyd, next time, why don’t you drop all pretense of arguement and just say: “It is so because I sat it is so!!!”

Alex: thanx for the graphs… a picture is worth a thousand words.

Doug M (and others): That pie chart puts the lie to all your whining.

the question Ben Wolf asks above of Doug is unlikely to be answered, or confronted–it is to the consideration of the state what theodicy is to religion. to ask it is to question directly the validity of the premises which suspend in the air the “jam tomorrow” ideology of today’s right. that ideology promises to accelerate, and perhaps complete, the sellout of the average person in this country, in order that those most rewarded by our system should feel they are treated “fairly”.

i’m inclined to think this nation–and the world–is more of a mule than a horse. he in the saddle can kick and kick, but there is a limit to endurance. beyond it, i’d give little weight to abstractions and appeals to morality, compared to the living, breathing, bleeding needs of human beings.

I was kind of confused by those charts. They don’t show anything about whether redistribution is ongoing, just whether it is complete.

Now it is true that when the bottom 80% of citizens hold 15% of the wealth, we haven’t been very effective in redistribution … but it might also show that some transfers are justified.

I see homeless on the streets, and 20% of citizens hold 85% of the nation’s wealth. Can we tax them? Is it “unfair” to them? Should we rely instead on charity? From whom? Should others in that bottom 80% attempt to address all social ills? Do they have the money?

BTW, I think a friend is going to try to touch me for rent money (again). How far do you go for non-family in a situation like this?

floyd says:

Saturday, February 19, 2011 at 19:10

Floyd: where do they teach your particular line in Delphic bs? The last time I heard anything quite like it was from a girlfriend when I was going through a thankfully brief flower power period as a teenager.

So once again Doug writes a post based on either deliberately or accidentally skewed facts (income tax versus payroll tax and the current situation in Wisconsin).

These discrepancies are pointed out to him, yet again, and Doug moves on to his next McMegan diatribe.

Lather, Rinse, Repeat.

The irony is that the current government he disdains ensures he reaps easily 5 times the benefit of the average welfare recipient.

JP

“I was kind of confused by those charts. They don’t show anything about whether redistribution is ongoing, just whether it is complete.”

The top 1% of income earners are now corralling around 23% of all earnings which is back where it was in the late twenties. Their share of income has been steadily rising for years so who knows if the trend will continue and where it will top out? The same phenomenon has occurred with ownership of wealth (which in my opinion is the more telling figure) but I can’t bring the exact figures to mind at the moment.

” How far do you go for non-family in a situation like this?”

No one other than my kids has ever touched me for for money…probably because of my forbidding aspect.

I suspect that Doug is what is known as a “rights absolutist” libertarian. He (and probably Dodd) are the flip side of Pierre-Joseph Proudhon: “Property is theft”. Consider Doug:

These two positions represent the extremes. Property is theft vs. Any appropriation of my property to benefit someone else is theft.

One of the most honest expressions of Doug’s position is Sasha Volokh’s Asteroid defense and libertarianism:

I think it’s safe to say that most of us (mostest most of us) would say there’s something unreasonable about that position. But it’s also true, I think, that most of us would have a hard time articulating why we think it unreasonable. Nevertheless, we’d think someone advancing that argument lacks a sense of proportion. Our categories of moral judgment are not susceptible of clear-line demarcation. What counts as reasonable, as displaying a sense of proportion, varies. In some cases, we are rights absolutists, in others, utilitarian. We don’t have a one-size-fits-all moral scheme. The only thing common to all our commonplace moral judgments is this sense of something’s being reasonable, as being proportionate to the circumstances within which the judgment is made.

And most of us would say, if pressed, that an imposition on our rights to our property in the interests of relieving the suffering of others (taxation) is a reasonable imposition: it is not disproportionate to the good being sought. We would measure the “suffering” of the taxed against the suffering of the sick, and come to the conclusion that it is reasonable to impose on the former in the interest of relieving the suffering of the latter. That the kinds of suffering involved are not commensurate, and that the suffering of the sick trumps the suffering of the taxed.

The thing that strikes me about that kind of “rights absolutism” is that it denies human history.

We are people of the tribe, or tribes. We have always had rules of income distribution, be they social or political. You’ve got to be a particular kind of modern geek to miss that.

Reminds me of a story … a Dane was living with the Eskimos in the 1920’s. This was back when Greenland was very much Denmark’s wild west. So, they are dog-sledding when the dogs scent a polar bear. Now, a modern reader might think this was bad news, but no. The dogs were excited because this meant bear for dinner. So the let the dogs off their leads, and chase after them bearing only spears. When they arrive the dogs have circled and pinned down the bear, and it’s the hunter’s work to strike the killing blows.

The Eskimos say to the Dane “you have the honor, make the first strike,” which he does, and then they finish it. Then they all laugh, because he was fooled. The man who makes the first strike only gets a bear-skin vest out of the deal, but the man who makes the second strike gets pants 😉 Or something like that.

Ancient rules of income distribution.

sam says:

Sunday, February 20, 2011 at 08:43

I enjoyed that Sam. Are you a philosophy major? Doug gets very upset when I suggest his belief system is ultimately nihilistic. Am I going too far?

I don’t know if it’s nihilistic, I just think it’s juvenile.

Hence my suspicion that it’s an article of faith for Doug, adopted earlier in life (teenage years most likely) and never subjected to serious scrutiny since.

Doug’s clearly not a teenager, but his core political stance is owned entirely by asbergers people, assholes and teenagers. Really with libertarianism there’s no third alternative. There’s no “normal” wing.

And also (thanks to Brummagem for the definition) it’s a shibboleth, a standard of identity. Sort of like gang colors or a Team Jacob t-shirt. LP members always want to stand apart carrying a “Who, Me?” sign. That’s the juvenile element: a need to remain as outsider and truth-telling critic, while never accepting personal responsibility for anything. “I didn’t ask to be born.”

Back in the day, Joe, back in the day.

There was a bit about Adam Smith on Planet Money a little while back. They pointed out that Smith’s worldview could not have been created 100 years earlier, because the power of the nobility and the church were too strong. There were too many “visible hands” for the “invisible” to be seen.

It took the rise of the state, the power of the state, to subdue prince and cardinal.

Now it is a sort of natural progression that we could all be free individuals making free association, and that the state could ensure that and only that. But the irony is that it needs the coercive power of the state, to keep that stasis.

Right, JP. Libertarianism as we know it today is an artifact of the modern industrial state.

“And also (thanks to Brummagem for the definition) it’s a shibboleth, a standard of identity. Sort of like gang colors or a Team Jacob t-shirt. LP members always want to stand apart carrying a “Who, Me?” sign.”

Michael: there were some interesting reflections in that essay and in other blogger’s comments about the essay on the extent to which “the shibboleths” are really believed. The sort of consensus that emerged was that the leadership of the Republican party apparatus don’t really believe most of this stuff but find it useful for career development whereas the rank and file generally do. Even the bright ones like Doug. I have some personal experience of this as my eldest son is a very heavyweight conservative lawyer (Federalist etc) much heavier than Doug I’m sure, but even he has some odd preconceptions although perhaps not quite so off the wall. Since my other two are equally bright and stalwart liberals it makes for interesting Christmas dinners.

“It took the rise of the state, the power of the state, to subdue princeand cardinal”

Actually I’d say it was the prince and cardinal who created and consolidated the nation state. In so doing they set in motion forces which inevitably led to economic deveopment, greater economic and social freedom, rationalism, the decline of religion, the emergence of the middle classes, industrialisation, etc etc, and their own eclipse..

Royalty with supporting religion worked thousands of years. You could say that was all “setting forces in motion,” but it dwarfs our small slice of post monarchic civilization.

john personna says:

Sunday, February 20, 2011 at 13:43

The nation state didn’t come into existence until the 16th and 17th centuries and it was basically achieved by centralising monarchies creating standing armies. In some cases the monarchs themselves were overthrown or had their power curtailed by the very forces they set moving. Notably in Britain where it happened twice. Once you create standing armies you need to create wealth to pay for them (the Royal Navy is one of the great govt stimulus programs of history) which means trade, industry, science, et al.

I think you are talking, as sam said, about the industrial revolution.

Rome was a nation state, with a standing army.

I guess “nation state” has a narrower meaning that that. But regardless, lost of kings, emperors, bishops, and priests, maintained nation and empire for thousands of years.

What set Smiths age apart was the rise of … his class.

BJ’s correct: the modern concept of the nation-state and the current system of such states is usually linked to the Peace of Westphalia 1648.

john personna says:

Sunday, February 20, 2011 at 14:08

“Rome was a nation state, with a standing army.”

Actually it was a city state and in the ancient world.

> Rome was a nation state, with a standing army.

The Roman legions were not a standing army in the way we think of one. They tended to be funded and controlled directly by individuals in the Roman ruling class, thus having as much and often more loyalty to an individual than to the state. You also need to make a distinction between Republican Rome and Imperial Rome when discussing Roman affairs. The two were very different animals.

Steven L. Taylor says:

Sunday, February 20, 2011 at 16:08

I’d put it before then really. The peace of Westphalia brought the thirty years war to an end and several of the participants in that war notably France, Sweden, the Hapsburg Monarchy were very definitely nation states before then. In the 16th century Spain was a nation state as was Britain. Essentially the gunpowder age allowed the nation state to emerge because all of a sudden you didn’t need a lot of skill to operate weapon systems and artillery rendered obsolete the castle stronghold so monarchies were able to subdue other power centers in their realms(ie. over powerful nobles) much more easiily.

anjin-san says:

Sunday, February 20, 2011 at 16:31

I don’t think the Roman experience has much to do with the pre-modern or modern world which is what were talking about. The sack of Rome occurred in AD 410 roughly 1200 years before the period when the nation state as we know it emerged. So there was a slightly bigger gap than between now and the Norman conquest. What similarities exist between the Norman experience and the present day world order…not a lot really.

JP — Royalty with supporting religion is as good a description of the Republican agenda as I’ve ever read. Thanks!

Re John on February 19, 2011 at 15:08:

Social Security and other direct payments (like disability) are considered income. Medicare, Medicaid merely pay for things which we’d have to pay for otherwise, and are not.

Don’t get caught up in semantics.

Look at the transition in thought that came with the enlightenment. Steam engines, theories of moral sentiment, and invisible hands.

Social Security bought T-bills from the Feds sometime ago. The feds spent that money so Social Security has lots of federal IOU’s in it. So not only do the Feds owe China lots of money plus interest they owe social security. The bill will come due. Medicare, Medicaid would be cheaper if individuals paid for it themselves or all the socialist programs were left to the states and not the Feds. The states cannot print or coin money to pay their bills, nor can idividuals. In order to pay for the high demand the Feds create with their free or cheap costs is printing fiat money to pay the bills. That is why we live in an inflationary society since raising and leaving the Gold standard over the last 80 years. That is why the dollar buys less as time goes on. If minimim wage rose by 10 times then the cost of living would probably rise about the same since generally speaking when the Feds print fiat money there is a larger increase in the money supply versus goods produced. Even the printing press has limits because if you print to much then you get higher inflation which hurts those with less wealth than those with more. What this means is that the price we will pay for all this excessive spending will be some type of inflation plus rationing, or complete abandonment of all of these socialist programs in the long term future. The gap between the rich and poor will never change much.

Somewhere along here .. someone should point out that it’s not that ‘everyone wants to be paid’ (they do, and rightly so), but that the 1% that own 40% of everything want to be paid ‘dividends’ on their ‘capital’ – i.e. a percentage (not small!) of what everyone else is paid. And ‘redistributing’ is just cutting down on that pork barrel slush fund.

The government pays $500 for a $5 toilet seat .. just who do you think gets the other $495? The guys’n’gals on the production line who made it? The truck driver? I don’t think so.

It’s not “the government’s” fault, it’s the defense contractor’s. And that’s just in the public sector. How much do the big stakeholders in major companies make?

I don’t know .. I don’t know how they do it* .. if I did I wouldn’t be writing about it here.

*and it’s for sure I don’t know how they square it with their conscience and still find room to complain…

Please keep the facts straight Social Security isn’t a charity or a hand out by big brother. We paid into it for decades and no matter who the hell spent it we desire our money back. Anything less is a thief by the people we trusthed most to do the right thing. Consider who collects Social Security these are the people that worked all their lives and can no longer support themselves. Not because the are lazy but because they have a contract with the state. The senate and congress use the money paid into the plan because they could not muster the balls to live on the taxes they collected. Now instead of owning up to their miss management they want to cut benefits. Inflation is out of control and you guys are talking bs while our government is lining the pockets of the top 2 present. That what the pie chart screams out to me!!!!!