The Truth About Those “Devastating” Sequester Cuts

To listen to President Obama, and even many Republicans, the budget cuts set to go into effect later this week will devastate a wide swath of America. However, Veronique de Rugy takes a look at the cuts and finds very little evidence for the assertion that these cuts are as damaging as we’re being led to believe:

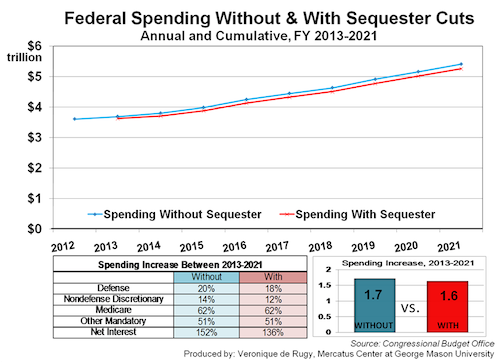

Changes in spending from sequestration result in new budget projections below the CBO’s baseline projection of spending based on current law. The federal government would spend $3.62 trillion in the first year with sequestration versus the $3.69 trillion projected by CBO. By 2021, the government would spend $5.26 trillion versus the $5.41 trillion projected. Overall, without a sequester, federal spending would increase $1.7 trillion (blue line). With a sequester, federal spending would increase by $1.6 trillion (red line).

A further breakdown of the percentage of budget programs reveals that sequestration provides relatively small reductions in spending rates across the board. With sequestration, defense increases 18% (vs. 20%); nondefense discretionary increases 12% (vs. 14%); Medicare roughly increases at the same rate; and net interest increases 136% (vs. 152%).

While the sequester projections are nominal spending increases, most budget plans count them as cuts. Referring to decreases in the rate of growth of spending as “cuts” influences public perceptions about the budget. When the public hears “cut,” it thinks that spending has been significantly reduced below current levels, not that spending has increased. Thus, calling a reduced growth rate of projected spending a “cut” leads to confusion, a growing deficit, and an ever-larger burden for future generations.

The best way to explain it, is with this chart, which shows very little actual change in Federal spending over the next eight years:

We can argue that the across the board method by which these cuts are being implemented is less than ideal, but to argue that the cuts themselves are “devastating” is simply not true. Any politician saying otherwise is lying. And, yes, that applies to President Obama.

Fear is invading DC. The fear that the people aren’t so upset with the cuts. That they realize they can stop feeding the monster and not die.

The good news is, Republicans do not have control of the Federal government.

That’s the only silver lining I can see in this travesty.

Doug, google “Veronique de Rugy.”

The only joke is de Rugy’s continuing war with math.

Firstly her initial numbers are inaccurate. CBO projects an $85 billion reduction in the first year, not a $70 billion reduction as she states. Secondly there’s this little thing called a spending multiplier, which even the austerity obsessed IMF now acknowledges could be as high as 1.7, so take that 85 billion and increase it to $150 billion in terms of its effect on private sector spending. That’s a full percentage point of GDP at a time we’re lucky to get even one percentage point of growth. Okun’s Observation indicates a loss of one percentage point of output will cost an additional 0.5 – 0.8 percentage points of unemployment, so add that to the current headline unemployment figure of 7.9%.

The only thing we get from de Rugy (whom to my knowledge has never made a successful economic forecast) is that people like de Rugy, secure on wing-nut welfare courtesy of those lunatics also know as Charles and David Kocxh, don’t give a shit what this does to people outside their circle.

@al-Ameda:

That is why that anything that is bad about the sequester but that if the government continues to function the Democrats will get all of the credit. The role of the Republicans for the next few years is to just serve as the scapegoat for the Democrats.

Macroadvisors estimates that the sequester will reduce 2013 GDP by 0.6%, the employment level by 700,000 jobs and the unemployment rate by 0.25%.

Shorter Doug – “It won’t hurt me, and if others get hurt, I won’t lose any sleep”

Personally I don’t think the sequestration cuts enough. The DOD budget needs to be cut in half.

you cant assume budget increases if a budget isnt passed..

we do not have a budget for this fiscal year (since Oct 1)

we’re under a “continuing resolution” which means this years budget continues last years…

so this years cuts are cuts, until a budget is passed…

@marmico: The macroadvisors estimate is flawed in that it presumes A) the Fed will delay raising interest rates due to a weakened economy and B) “markets” will respond favorably to this by taking out more loans and spending more.

B will not happen, it’s wishful thinking. There will not be a rebound effect due to market confidence because the fundamentals aren’t there.

It’s fairly consistent in most polls for a quite a while now, that the #1 concern for most Americans is JOBS.

While it’s certainly possible to make an argument the the sequester cuts may not be “devastating” to the economy as a whole (although they certainly will be devastating to the people who lose their jobs), there’s almost no doubt that they’re going to further weaken an already middling economy.

So let’s just stipulate; sure, not “devastating”.

But so what?

Not in any way, shape or form, helpful to addressing the jobs situation either.

@al-Ameda: hard to tell with all the hype, you’d think they had all 3 branches wrapped up.

Is there less defending to be done? Less healthcare to pay? Less air traffic to control than last year? Is there no inflation? No population increases?

The funny thing is that for all the talk right wingers like to state about moochers… there is really only one class of people that expect free service from the government. And that’s privileged assholes.

A nation cant be productive unless it is producing things.

It only costs a $1.36 per hour for a china worker.

Even at minimum wage we are about 6 times more expensive.

So, my question to all Republicans and Democrats alike , regardless of any other issue out there, is “How would you suggest we start producing things here in the US again while at the same time being able to beat China either by cost or some other ‘unknown’ measure?”

http://www.huffingtonpost.com/2012/03/08/average-cost-factory-worker_n_1327413.html

@Samson: The key variable in cost competitiveness is exchange rate, not wages.

I’m more worried about the long-term effects of cuts to discretionary spending than raw economic effects. Discretionary spending hits scientific research, education, infrastructure, and (I think) some programs like food stamps. Cuts to welfare/food stamp programs aren’t good (healthy food costs more, and it’s hard enough to get already) while blindly cutting scientific research, education will hurt innovation, mobility, and “human capital”, while cuts in infrastructure may lead to higher costs later is maintenance and repair is skimped on.

An $85 billion cut. We’re spending a trillion dollars a year more than we should. Can you imagine what is going to happen when other countries stop buying our debt, interest rates rise, and inflation goes through the roof. The government will not be able to control the economy under any terms. Prepare now. If nothing else, remember that tough times yield tough people.

As long as those not paying attention (or caring) refer to lower increases in spending as “cuts,” then honest discussions and framework can’t exist. The true numbers are still merely projections, guesstimates or whatever you want to hang your bias on to get your point across. The fact remains that there still exists too much fear-mingering and class warfare in politics as a means and tactic to convince one side or another to agree on an issue – not the facts or truth about the issue that would potentially lead to real dialogue and honest solutions to the problems we need to face. One can nit-pick a number, but the fact remains that there are no cuts when spending increases each and every year, which is what the OMB and other economists and common people understand when they look at the numbers and projections being offered – in lieu of a real budget. We certainly want to take care of those needing help and hopefully stem the tide of massive waste which many feel is acceptable in the inherent form of government program administration. As long as we continue to elect lawyers in the majority to guide and run the nation, we should not be surprised by the results or the rhetoric involved . . .

@babtwo:

Says who?

Other countries do not fund U.S. spending. It is literally impossible for them to do so.

The Federal Reserve sets rates.

How? If interest rates spike it would, according to mainstream and austrian thinking, dampen aggregate demand and push the country toward disinflation.

The above statement as written has no meaning.

@Ben Wolf:

If this 1.7 spending multiplier is accurate, then why don’t we increase government spending by $10 trillion, and therefore add $17 trillion to our GDP?

Keynesian economics never seems to stand up to simple logic.

Oh and to your statement on inflation not being possible if interest rates were to rise, the 1970’s would beg to differ.

@Ross C: Gee, the sequester went through and the markets today hit an ALL-TIME HIGH. That makes your economic prognostication wrong and your opinion worthless.

@Don K: @Don K: Non sequitur. I never said anything about the sequester damaging the economy, nor does it follow that one good day for the stock market means that our economy is in great shape.