The Unemployment Hole Is Deeper Than You Think

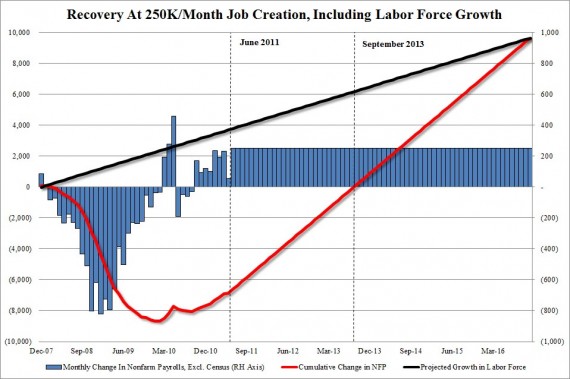

Tyler Durden posts this chart showing that, even if the economy added 250,000 jobs per month, it would take 66 months, or until nearly the end of a second term for President Obama, before we returned to the job levels of December 2007:

Now, tell me, how are we going to do that? Because I don’t see how it happens.

well, maybe there is no going back, and this is the new normal. given the reactions from congress and the WH, it sure as hell seems like it will be.

It doesn’t _have_ to be the new normal, but the plutocrats that run this country (both left and right) seem to be willing to accept it. On our behalf. Thanks, guys.

Actually, Chief, the hole is deeper than you think.

Between the “stimulus” and QE1 and QE2 the Feds over the past two years have thrown upwards of 2 trillion dollars at the economy. Yet the labor force today has almost 500,000 fewer people than it did in Jan. 2009, much less at the 2007 peak.

The chances of the economy adding 250,000 net jobs per month are less than zero. It’s more likely that we’ll start seeing over the short term net declines in W-2 employment, perhaps as soon as this fall.

What Keynes never learned is that government spending cannot in reality create sustainable economic prosperity. Private investment derived from savings and profits is what creates jobs. When there’s no incentive to save (negative real interest rates) and profits are scarce (overregulation, lack of demand) jobs won’t be created. Which means that sustainable prosperity is a pipe dream.

The worst part about it is that now we also have a catastrophic deficit and debt scenario. Pouring gasoline on fire never works out too well.

My recollection of The General Theory is that Keynes wouldn’t have said it could. I suspect your problem is more with Keynesians, neo-Keynesians, and people seeking partisan advantage and taking Keynes’s name in vain while doing it than it is with Keynes.

You mean socialists, right?

To put the magnitude of the task into some perspective we haven’t seen consistent 250,000 or better month-on-month job growth in the United States since the mid-1980s, that was only for six months or so, and it followed the deep Fed-driven recession of the early 1980s.

Another issue that bears mentioning: not all jobs are created equal. Just to pick a WA example out of the hat if you fired every petroleum engineer in the country and then rehired him or her at minimum wage taking orders shouted through a clown’s mouth the net job loss would be zero. However, the effect on the economy at large would be quite severe.

Dave:

It’s not really a clown’s mouth. It’s a Jack-in-the-Box. There is a difference, you know, and I find your ignorance on this invalidates the rest of your point.

I bow to your greater expertise in this area.

Tsar, Dave,

I think the intent is that upticks in gov’t spending are supposed to _substitute_ for commercial spending during economic downturns, propping up the GDP until companies are willing/able to go back to “normal” operations. At least, that’s the impression I’ve gotten from my econ profs. Our problem is that businesses appear to have no interest in spending for the foreseaeble future…

What’s this “we” shit, Marconis? You don’t want to do a damn thing at all about the job situation except maybe to see things get worse so that your death-cult masquerading as a political party can do better in the 2012 elections. If unemployment rose to 30% you’d be fine with it if the only alternative was something that could even arguably be called soshullism. Because, as we all know, soshullism makes Baby Jeesus cry or some stupid shit like that.

What some morons never learned is called “history”. For example during the second world war huge amounts of government spending on military hardware that was exported, and purchased on credit, wound up creating a huge and sustained middle class and a real sustained economic prosperity that lasted into the 70’s. Of course this military spending wound up hiring huge numbers of people in the middle class who in turn had money to spend causing demand.

Later during the clinton presidency higher tax rates on the rich wound up causing a record increase in job growth- 23 million new jobs during his presidency. My hypothesis why is that faced with higher taxes on money being taken out of the business as profits and owner salaries, pressed companies to invest in workers, equipment and expansion. Notice as soon as bush came in and pushed his record tax cuts for the rich, job growth completely cratered, even before 9/11.

As for “overregulation” its hard to imagine what your talking about, or if you even know what your talking about. The financial sector was “underregulated” during bush. They crashed the economy. Is your concern that if the financial sector is properly regulated or as righties call it “over regulated” they wont be able to continue the mortgage backed CDO scam again? is that your point?

We can always just make up other problems and pretend to deal with those. I mean that’s what Washington is doing right now, creating an abstract deficit problem, and then attacking that.

No really, there is no plan. Maybe Democrats have one, but they aren’t talking about it. Republicans simply want to redistribute as much wealth as possible to the wealthy, and don’t care at all about unemployment.

Unemployment is actually a good thing for the investor; increased competition in labor markets allows them to extract greater amounts of money of out labor, increasing returns to capital.

The real “socialists” are Republicans, who seek to use government to protect corporations from competition while simultaneously redistributing money from the middle classes to the top 1%. It’s corporatist for sure, but depends upon the government redistributing money upwards while helping incumbent business interests increase private profits through the appendages of the state.

Tsar,

Your grasp of Keynesian economics appears to be only slightly weaker than your grasp of current events. Just as a quick reminder, corporations have been doing alright the past few years (most profitable quarter in the history of US business was Q3 2010). So clearly lack

Government spending is supposed to substitute for private spending in order to maintain or boost aggregate demand. Sadly, that did not happen in a meaningful way (cuts at the state and local level effectively neutered the federal stimulus. The problem however, remains the same, lack of aggregate demand. Investment does not create jobs. Savings does not create jobs. Consumption (read demand) creates jobs. Right now consumers balance sheets are severely strained which is limiting our recovery. Corporate balance sheets are, by comparison, doing extremely well. The solution is for the government to increase the short-term deficit to boost aggregate demand. Build a massive rail network, renovate the US’s failing highway system, rebuild all the ports, etc. Civil engineers have given us failing grades forever-this is the perfect time to fix that. There are tons of people with applicable skills are out of work, borrowing is cheap, and it’d help the job market. Then, when the unemployment rate drops and growth is up above 3% or so annually, we roll in Clinton level taxes for all income brackets and-voila-medium term deficit solved. This is not difficult.

@Tsar:

You claimed that profits are scarce due to overregulation. But corporate profits are, in fact, not scarce at all. Quite the opposite.

In fact, as strong as they are, they would have been much better if the financial markets had been properly regulated over the last 10 years.

Profits are not scarce at all. In fact they are hitting all-time highs. Like I said, unemployment is in the interests of economic elites as it reduces the negotiating position of labor, increasing returns on capital as labor costs lessened.

New Deal plus World War II = massive government deficit-financed stimulus, results in decades of real prosperity. Keynes vindicated.

Decades of tax-cuts and de-regulation results decade of negative to flat growth, massive unemployment. Reaganism decisively debunked.

Reagan-worshipers to deny all reality. More tax cuts, plus austerity, to plunge US into depression. Neo-Reaganism-Hooverism to be debunked, but too late.

John Cole said it best:

Quote

“Between the “stimulus” and QE1 and QE2 the Feds over the past two years have thrown upwards of 2 trillion dollars at the economy.”

Realize that most of that money went to the banks and benefiting mostly the top 1% that used it to speculate in stocks and commodities. Very little was earmarked for job creation.

John Cole is a horse’s ass.

Cole is right that the right still wants to “magic” the jobs back into being:

1) tax cuts

2) magic happens

3) jobs!

Again, read Why Don’t Jobs and Corporate Profits Match Up?

What Matt and Aaron said. And John Cole might be a horse’s ass, but what does it say about conservatives when that horse’s ass is making more more sense than 99 per cent of all conservative pundits?

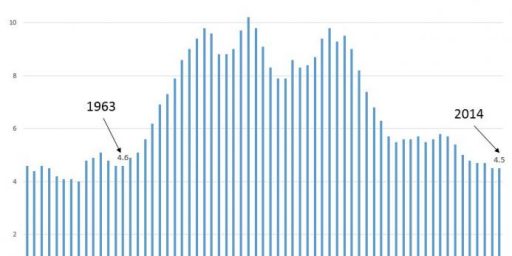

Tax rates are lower now than any point in the last 50 years. Conservative theory says we should be booming. Why aren’t we?

Where John Cole and other Balloon Juicers get it wrong is that Obama and Dems get a mere sigh of disappointment for lowering taxes, job and infrastructure neglect, war mongering, insider trading and lobbying, and civil liberties erosion while Republicans are basically distilled evil (99% pure!).

A vote in America, Republican or Democratic, is a vote for Goldman Sachs. But the culture and partisan wars are simply sooooooooo enticing…who’s penis is in the news today? I simply must know! That’s true political journalism!

This, as Obama has stated, is “the new new norm”. Obama has no intention of working to restore the economic conditions that would allow for job creation. He believes that taxes are not high enough and that the best solution is trillions of dollars in more borrowing. The democrat party, and even many in the GOP, are going to stay locked in step with him.

The 2 biggest problems, why there is no change, is because the American people don’t want it to change and no one is willing to make the personal sacrifice needed. The USA is dead.

Barring this last month, where a lot of bad things weighed things down, jobs haven’t just been being created at a higher rate, they’ve been growing… last several months being more than the last several years put together. Barring a game changer, the rate of job growth should snowball slowly.

EVERYONE JUST SITS HERE AND WHINES!! THERE IS NO REAL INTELLIGENT DISCUSION ON JOBS GAINED/LOST IN ANYONES STATE!! ALL I KNOW IS THERE IS NO JOBS OUT THERE, AND THERE WONT BE ANY IN A LONG TIME!! HERE IN NJ THERE IS NO JOBS!!

WHY WOULD ANYONE HIRE NOW? HIGH GAS/PRICES/UNEMPLOYMENT EQUALS NO JOBS AND NO RECOVERY OF THE ECOMOMY!!

IT ONLY TAKES COMMON SENSE TO FIGUIRE THIS OUT, SEEMS THAT MOST PEOPLE HAVE LOST THAT HERE!!