“The” Social Security Problem

The quote below is posted over at Dead Parrots by Victor. It is a very good post that looks at the Social Security problem ans lists all the basic issues surrounding Social Security reform.

I outlined some of the facts surrounding “the Social Security problem awhile ago. But it struck me while reading Matthew Yglesias that it is important to have a common understanding of what the “problems” are, even if you are like Matthew and claim that there are none. So, without further ado, here are the basic questions that I think should be asked when evaluating any Social Security reform:

1) Does the plan result in system “solvency”? Over the next 75 years, the system is some $4 trillion in the hole.

2) Is the plan intergenerationally fair? Or, on a related note, if you look at Social Security as an investment, will future generations even come close to getting their money back?

3) What is the impact on future budgets? Solvency over the 2005-2080 time period could theoretically be achieved by putting $4 trillion of bonds into the system today from the general treasury. That, of course, actually would do nothing to “fix” the system. In future years, the programs expenses will outweigh its revenues; right now, the system is running surpluses which helps to mask our General Fund difficulties. In 30 years, it will be dragging the system rather than pumping into it.

3a) Will it reduce future outlays? Not only is the difference between revenues and expenses an issue, but the absolute level of government expenditures in the future is an issue.

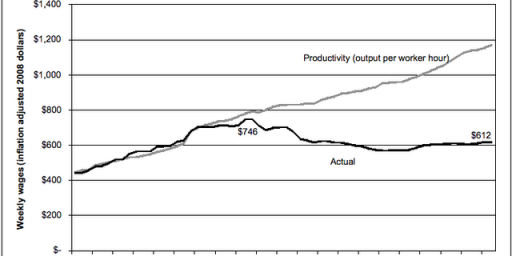

4) Is there an impact on national savings? This one is abstract and the most important, although the most difficult to quantify or achieve. We need to increase our saving and investment to increase our productivity. Increasing productivity and/or immigration are the only two real ways to provide for the increase in the number of retirees in the future without adversely affecting standards of living.

No single “solution” will help all four issues. For example, an increase in taxes will help solvency (1) but hurt intergenerational fairness (2) while not reducing expenses (3a). Different people will also disagree with respect to which questions are most important. But I think keeping these issues in mind can help communication and help frame a solution. Or solutions, plural.

very good!