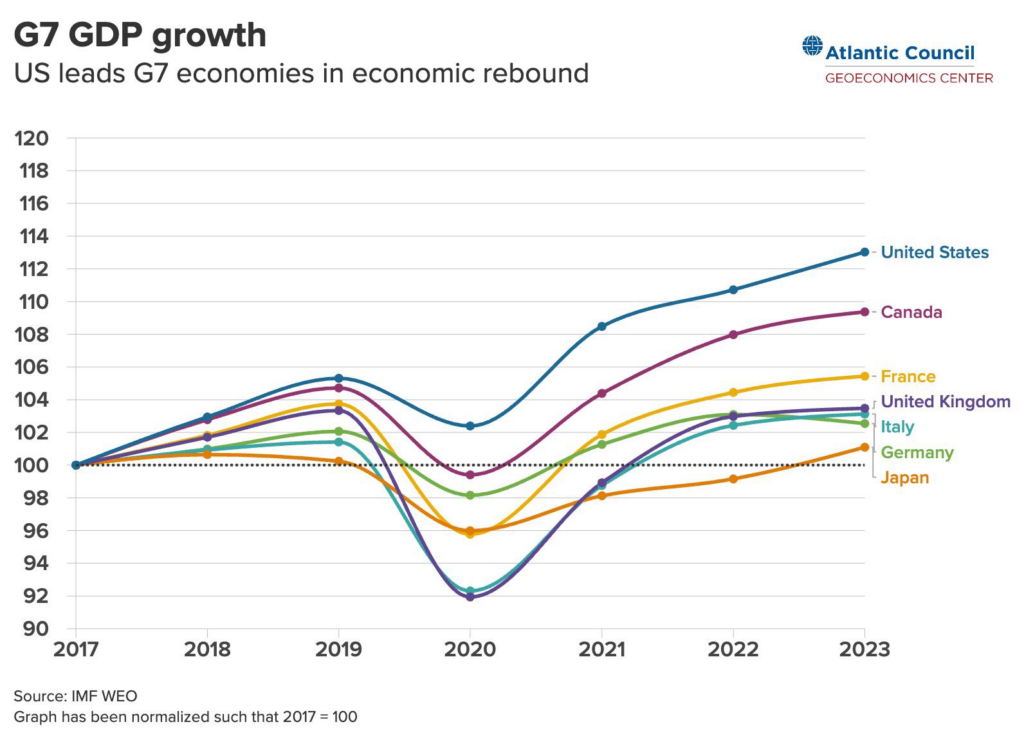

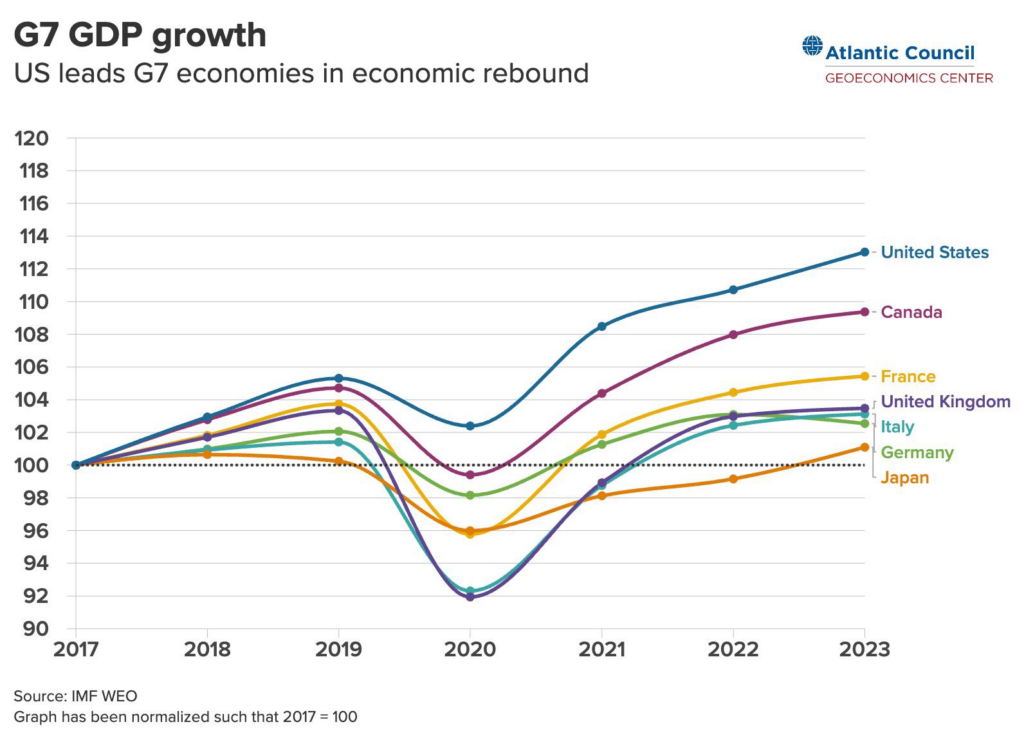

A Graph to Ponder

Post-Covid recovery edition.

I know macro-level GDP growth isn’t everything one needs to know about economic policy, but there is little doubt that the US has recovered better from the pandemic than our European allies.

I know macro-level GDP growth isn’t everything one needs to know about economic policy, but there is little doubt that the US has recovered better from the pandemic than our European allies.

Biden did that!!

Given a relatively high immigration rate and a government that borrows and spends a couple trillion dollars per year, it would be more surprising if the US wasn’t leading the pack.

Pet peeve. I really don’t think GDP is growing at 113%. I was trained as an engineer to be very careful and explicit about units of measure. Economics types aren’t. That chart shows GDP relative to 2017 as a baseline. It is not “GDP growth”. It’s no wonder economics is a mystery to most people. It seems to be a mystery to most econ reporters.

They flooded money into the economy in the late 1960s using Vietnam as the excuse. It took over a decade of stagflation and Ronald Reagan to sort out that inflationary stimulus. People were flush when the cash was flowing but were hard up as the prices caught up with the injection of money.

It just happened faster this time. Of course, we don’t have the factories being shipped offshore and an oil crisis is only what Biden is doing to appease the climatistas, not under ME control.

The graph shows several things IMO:

– The US economy was growing much faster before the pandemic (and if you go back further than 2017, you’d see that the US has outperformed its peers for longer than 2017)

– The US economy declined much less during the pandemic.

– The US economy returned to the previous growth trend while the others did not.

– The UK and Italy arguably had the tightest and longest-lasting lockdown restrictions of the G7 countries, which probably explains why they dipped so low. By contrast, Japan and the US arguably had the least lockdown restrictions, which probably helps explain why the dips there are shallow.

– I’m not super familiar with Japan’s covid stimulus efforts, but generally it looks like they were more long-term unlike ours which pumped a lot of money in a short period of time. That might explain why their post-covid recovery has been anemic compared to ours. Japan also never had our inflation.

@JKB:

That’s seriously revisionist. Paul Volker jacked interest rates sky high during the Carter administration, the pain of that seriously contributed to Carter’s defeat.

ETA: I had an enormous floating rate bridge loan on my new house during that, so I have very vivid recollection of the associated stress, I wasn’t sleeping well at nights. And, BTW, Volcker crashed the housing market with that action.

@charontwo: Under Volker/Reagan we sold a house on land contract because the rate on conventional mortgages would exceed Michigan’s usury law. During the winter the banks had people driving around looking for signs of occupancy at the houses they held paper on so they had a chance of intervening in abandoned houses before the pipes froze.

And Volcker backed off only when the Mexican banks threatened to belly up. Uncle Milty Friedman, patron saint of Monetarism, declared that if Volker loosened inflation would roar back. Volker had no choice but to loosen, and the economy recovered nicely.

@gVOR10: the baseline and comparators are showing growth in a comparative fashion against the normalised baselin, it simply is not presented in percent growth terms.

@Andy: Japan has a number of quite different structural factors, such as material real population contraction in constrast to USA and population growth (GDP growth versus GDP Per Capita is relevatory).

@JKB: @charontwo:

His comment is reductionist but not revisionist (although also overly party political in framing). Mr Reagan had pretty much fuck all to do with taming inflation.

The late 1960s-early 1970s did indeed see significant policy errors (as well as for USA massive Guns & Butter spending), however the leading Central Banks of the world – or their inheritors (European Central Bank obviously not existing in the 1970s) learned important lessons on the errors of central banks of the early to mid 1970s in underestimating 2nd order persistance of inflationary feed throughs.

Thus the very similar ECB and Fed policies (followed in a tardy fashion by Bank of England due to the Brexit squeeze foolishness). While the Left inflation denialists in USA spent 2022-23 whinging on about Fed, the Fed rather likely has delivered to Biden a near spot on counter-balance to the modest policy error of the late stage Covid over-stimulus – an error in retrospect but a quite understandable one worth having been made in likelihood given the unknowns of the time. If Biden is not unlucky and there is not another pricing shock (or escalation of stress as like Red Sea) then timing of sentiment for November should be nearly perfect – in any case a rather better inflation positioning than if Fed had done what the Left inflation denialist fraction had foolishly been desiring in 22-23 period.

@gVOR10: While like Presidentialism – it is necesary to point out the the Fed Chair is not a oneman show dicatator, not a CEO of the Fed by either law or structure – the rate setting is in fact an actual committee decision. People do like to tell reduced to one person tales but that’s not how it actually works.

@JKB:

Where to start? Spending grew as fast, perhaps faster under Nixon than under LBJ. Nixon took us into permanent deficit spending. Clinton got it back under control, but GW Bush flushed the surplus to give rich folks tax cuts.

Inflation exploded under Nixon and Ford. By the time Carter was in office, the damage to the economy had been massive. Despite the fact that Carter had inherited a terrible economy after 8 years of GOP administrations, Republicans were quite successful at blaming the whole mess on him.

Carter appointee Paul Volcker eventually got inflation under control. Reagan? Massive budget deficits.

JKB hit it first. Helicopter money. Then came the inflation, which, if properly measured is still 4-5%.

You can’t highlight one aspect without acknowledging the other.

I come down on the side that inflation is tearing people to shreds. The most vulnerable. Apparently a majority of Americans agree.

@gVOR10: Like Lounsbury notes, that chart is not stating 113% growth.

JKB, is this Biden’s oil crisis you’re referring to?

Oil barrel field production of US crude has increased nearly literally every month during the Biden administration. Vox summary of overall US oil situation

Fun conspiracy theories certainly use real words, but the stats from the US Energy Information Adminstration are… reality.

@gVOR10: The graph normalizes each country’s 2017 GDP at 100 and shows fluctuation relative to that baseline. Otherwise, the sheer size of the US economy (roughly 13 times Canada’s) makes visual comparison challenging.

@Steven L. Taylor: @James Joyner: I said in my comment that that’s what it is. Did you all skip past the chart title that reads, and I quote, “G7 GDP growth”.