Another Disappointing Jobs Report

March's Jobs Report was nothing to write home about.

Going into today’s release of the March Jobs report, most analysts expected that we’d see that the economy had added something between 150,000 and 190,000 jobs last month. Partly that was based upon the good-but-not-great job creation numbers we saw for January and February and the signs, from at least some sectors of the economy, that the economic conditions were improving albeit modestly. Surely, though, there were some signs of economic weakness, especially in the retail sector where companies like Wal-Mart reported significantly lower sales figures from a year beforehand. Then, there’s the question of what impact, if any, the sequester, which didn’t actually go into effect until March 1st and hasn’t resulted in significant layoffs to date, would have on the economy. Those are questions that we still don’t know the answer to, but today’s report seems to indicate that the economy remains as generally anemic as it has been for pretty much the entirety of this so-called recovery:

Total nonfarm payroll employment edged up in March (+88,000). Over the prior 12 months, employment growth had averaged 169,000 per month. In March, employment increased in professional and business services and in health care, while retail trade employment declined. (See table B-1.)

Professional and business services added 51,000 jobs in March. Over the past 12 months, employment in this industry has grown by 533,000. Within professional and business services, accounting and bookkeeping services added 11,000 jobs over the month, and employment continued to trend up in temporary help services and in several other component industries.

Job growth in health care continued in March, with a gain of 23,000, similar to the prior 12-month average. Within health care, employment increased by 15,000 in ambulatory health care services, such as home health care, and by 8,000 in hospitals.

Construction employment continued to trend up in March (+18,000). Job growth in this industry picked up this past fall; since September, the industry has added 169,000 jobs. In March, employment continued to expand among specialty trade contractors (+23,000). Employment in specialty trade contractors has increased by 128,000 since September, with the gain about equally split between the residential and nonresidential components.25

Within leisure and hospitality, employment in food services and drinking places continued to trend up in March (+13,000). Over the past year, the industry added 262,000 jobs.

In March, retail trade employment declined by 24,000. The industry had added an average of 32,000 jobs per month over the prior 6 months. In March, job declines occurred in clothing and clothing accessories stores (-15,000), building material and garden supply stores (-10,000), and electronics and appliance stores (-6,000).

Within government, U.S. Postal Service employment fell by 12,000 in March. Employment in other major industries, including mining, manufacturing, wholesale trade, transportation and warehousing, information, financial activities, state government, and local government, showed little change over the month.

(…)

The change in total nonfarm payroll employment for January was revised from +119,000 to +148,000, and the change for February was revised from +236,000 to +268,000.

Despite the disappointing job growth numbers, the unemployment rate actually declined to 7.6%, but at least one reason for that is likely the fact that the Labor Force Participation Rate dropped to 63.3%, the lowest rate it’s been at since 1979. If the participation rate were at the same level it was at in January 2009, the unemployment rate would be 10.98%. If it were at the same level that it was it just a year ago in March 2012, the unemployment rate would be 8.3%. Now, at least some portion of this decline in labor force participation can be attributed to an aging population and the fact that the Baby Boom Generation is continuing to retire, but that doesn’t wholly account for the drop-off of some half a million people from the labor force in just one month as reflected in today’s report. Clearly, we’re still seeing people who are looking at a tremendously weak job market and just giving up. For that reason, the Unemployment Rate itself doesn’t really give us a full picture of what’s going on in the job market, we’ve got to look at job creation and, even with the revisions for January and February, that has been incredibly weak for quite some time now. Taking into account the revisions, job growth has averaged +169,000 per month for the past 12 months. Additionally, for the first three months of 2013, we’ve averaged +168.000 new jobs, whereas we averaged some +262,000 new jobs. As economists will tell you, we need a growth rate somewhere in the range of +250,000 just to keep up with population increases. So, in some sense, we’re continuing to lose ground. At the current rate, it would take us until sometime in late 2024 to get back to where things were before the recession.

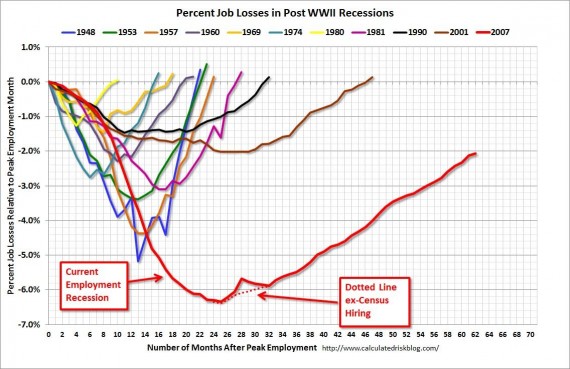

Since a picture is worth a thousand words, this chart from Calculated Risk provides yet again an apt demonstration of just how deep the jobs recession remains:

There will much debate about what’s going on here. We’ve seen a Spring slowdown in hiring going on four years now, so it’s possible that this is just a repetition of that somewhat odd cycle, but of course the chattering class will seek to find some political explanation for all of this. Within minutes after the report was released, former Obama adviser Austen Goolsbee, who is part of CNBC’s regular panel on Jobs Report Day, attempted to pin blame for March’s weak jobs report on the sequestration cuts. As I noted above, those cuts only went into effect on March 1st, and there have been few reports of actual job losses associated with those cuts at this point. Instead, as Joe Weisenthal notes, it seems more likely that another political decision is playing a role here. Specifically, we’re referring to the end of the Payroll Tax Cut which expired at the end of 2012 and, since January, has resulted in not-insignificant increases in the amount of money deducted from Americans’ paychecks. When Wal-Mart noted its declining sales in February, it cited the payroll tax as one of the primary causes and, indeed, for the economic groups likely to shop at that store, even a small decrease in disposable income is likely to have an impact on spending. Weisenthal suggests reinstating the Payroll Tax Cut, but I’m not so sure that’s the answer. This cut was never meant to be permanent and, as long as it was in place, the funds that it was supposed to be raising for SSI were being taken out of general revenues in a manner that was having a significant impact on the ability of Congress to put together real budget cuts. Besides, the tax cut was always meant to be temporary. Bringing it back now doesn’t seem to me to be accomplishing anything other than kicking the can down the road.

Whatever the cause, though, it’s clear that the labor market remains weak and it’s becoming ever more likely that this is the new normal rather than something we’re going to recover from any time soon.

It’s only the “new normal” so long as we refuse to do what literally _any_ first-year econ student could tell you we should have been doing for the last 5 years – increasing government spending to stabilize GDP and get people working. When people are working, they have money. When they have money they buy things. When they buy things, companies grow. When people _don’t_ have money, they don;t buy things, and the economy contracts. It ain’t rocket science.

Record corporate profits, the Dow and S&P at all-time highs, the government giving out tax breaks to companies to spur them to expand projects and hire people, and yet still they’re not hiring anyone. I wonder why that is? Oh yeah, and CEO salaries are up almost 800% since 1980.

The problem with always saying the sky is falling is that it has less oomph when it actually happens.

This isn’t just “another” bad jobs report, it is the worst jobs report in 6 six months.

I guess though if you beat the always-bad drum, it’s hard to shift your framing.

Although I’m sure there will be those who blame the sequester I think the real culprit is the restoration of the payroll tax.

@legion: “increasing government spending to stabilize GDP and get people working.”

That’s true enough, though the fact that so few governments around the world have followed that policy indicates that it’s a bit more complicated than that, at least politically and culturally.

Deeper than that, in my view, is that we’ve spent 1 or 2 generations indoctrinating business leaders into thinking efficiency isn’t just one economic virtue but the only economic virtue. Well, since job creation is an unavoidably inefficient process, what should we expect? If we had smarter government policy, things would probably be better…but by how much and at what cost? If our basic economic paradigm is broken or dysfunctional, truly radical policy changes are the only things that can fix it.

Mike

Unfortunately this report was downright horrific, not merely disappointing.

Last month the nation’s labor force declined by 496,000. Think about that for a moment. That’s equivalent to the entire population of a major metropolis. Although payroll employment edged up by 88,000 (not nearly enough to keep pace with population growth) household, i.e., total employment last month declined by 206,000. Again, equivalent to the entire population of a major city. Wage growth last month actually was negative, when you factor in inflation.

The ghastliest set of ironies lie in this set of stats:

13.3%: black unemployment

9.2%: Latino unemployment

6.7%: white unemployment

22.1%: unemployment, ages 18-19

13.3%: unemployment, ages 20-24

5.5%: unemployment, ages 55-plus

Regressive dystopia.

And keep in mind the Federal Reserve mortgaged our future to obtain this sort of “recovery.”

Overall the prospects are bleak. Europe West with much higher crime rates is a very sad denouement for what once was such a strong nation.

@Ben:

Well, don’t expect Doug to ask probing questions like that! If he did, that might lead him to wonder about his Freedom Works-inspired anti-Keynesianism, and may be concede a role for government in stimulating aggregate demand-kind of like what actual economists want to see done.

@stonetools:

Smells like “class warfare” to me.

@MBunge:

The problem here is that the austerity program appeals to the moralist in us:

“The party is over. We need to tighten our belts, put government on a diet, and finally address long term debt. We need to put our house in order NOW.”

Wrong again, Bob. Economics isn’t a morality play. We need to do what works. And what works is plenty of stimulus in the short and medium term to get businesses humming and people back to work. THEN we can start to do long term deficit reduction and all the things that address the concerns of economic moralists.

People like the moralist message and democratically elected politicians respond by enacting the economically wrong, but politically popular, austerity program. That dynamic is at least partially behind the 2010 Republican surge.

Every country that has recovered even moderately has enacted some form of stimulus. Every country that has enacted austerity has remained in recession, or is recovering only weakly. Maybe its time for political leaders to educate the public on the need for reality based economic reform.

@stonetools:

Check today’s news. We are about to get some free stimulus from the Japanese.

(They plan, amazingly, to double their money supply through QE.)

We slashed another 12,000 Public Sector jobs last month.

During previous recoveries we ALWAYS added Public Sector jobs.

Bush 43 for instance would have added about 16,000 jobs.

That’s a net loss of 28,000 jobs.

It ain’t rocket science, bubba.

Tsar…

Until you break that number dow,n so that we can understand how and why the labor force declined, it’s a totally meaningless piece of data. Logic would dictate that retiring baby boomers would account for a large chunck. We can’t tell how large from the gross number.

If your opinion is based on meaningless data, then your opinion is meaningless.

It’s rather amusing that a libertarian is lamenting the disappointing jobs report while being ideologically opposed to the best ways to create more jobs…

@legion:

Of course, we’ve been spending money like mad men, and…………

@legion:

Go back to Russia, you goddam commie.

@Tsar Nicholas:

Tsar Nicholas gets the most thumbs down at this site. Which, in my opinion, makes him the greatest commenter here.

Look at the stats he cites, people. Look at government spending. Through the roof, and nothing to show for it.

WTFU.

@Drew:

He didn’t cite any stats about go0vernment spending, because the stats show the deficit is declining. You might actually want to read a business report, or God forbid, an economics textbook before commenting.

Well, first off, we should accept that little is going to change until a regime change in the DC. Good or bad, barring some massive event, we have the policies we are going to have until Obama leaves office. How hopeful the change in 2017 depends on how different his replacement is and how many minions get shown the door. A friend in housing construction told me that things just started drying up last November after hopes for change in Washington were dashed. We’ll see if a good Republican showing in 2014 can spark some hope in business owners.

The other growing drag is the Obamacare implementation. Right now, no one knows what it is going to look like, how much it is going to cost and even when the hammer falls. But the persistent stream of news is it keeps getting worse. Another good or bad as a program, Obamacare is going to be a drag on employment and the economy until it is fully implemented. Then whether it continues will depend on business experience with the actual program.

And odd effect of Obamacare will be more part time positions filled by the same employee as they try to patch together enough work. As well as more OT by current full-time workers as they try to make up the losses to their disposable income due to Obamacare-induced healthcare “insurance” rate increases. Let’s face it the basic design of Obamacare was to raise healthcare “insurance” rates on the young and healthy.

But there are some good signs. While many have given up on the dismal employment scene, they haven’t just sat down. I read just yesterday an article on how a lot of 50-somethings are starting businesses. Pretty much every personal story started off with a layoff 3 or 4 years ago. So we have people out of the wage-slave trap who are building potential for when things settle down and people have hope again. I would expect a good number of unemployed college grads are working the other end, although with less initial personal investment due to the student loan overhang. On the upside, they are better with the internet and so don’t need as much start up capital. But they too would be dropping from the wage-slave rolls as they move into owner.

@Drew:

You run a business, right Drew?

How were your profits last quarter? Did you hire anyone? Did you give your employees a wage increase this year?

That would be Soviet Union. But, oops, can’t go back it collapsed. It wold be better to say, learn from your mistakes, commie.

@stonetools:

Gee, I guess the debt hasn’t increased more in the last 4 years than in the entire history of earth……….

@Ben:

Six businesses, actually. And, in order, level to up, yes, and yes.

Dickhead.

And who’s life did you improve the last quarter, shit for brains?

@stonetools: Absolutely. However the fact that the electorate are ignorant of economics is unfortunate, but not critical. The electorate have always been ignorant of economics. What Scott Adams of Dilbert fame called inDUHviduals. Bright enough, but unconcerned and ignorant about things that don’t impact them day to day. This didn’t used to be a problem. There was a solid elite consensus that in a recession you did stimulus. As long as Republican leaders agreed with Democrats that stimulus was needed, they didn’t really have to educate the public. The real problem is that the Republican Party has decided to go nuts. Why do Republicans hate America?

@Drew:

Maybe if you bothered to read those economic textbooks I mentioned, you would understand that the size of the national debt is less important than its ratio to the size of the economy. Once we look at that, we see that the size of the national debt isn’t that crucial a factor in determining economic growth. Indeed, we have often had the economy grow fast DURING times of national debt growth.

So wrong again, Bob. The growth of national debt is independent of the unemployment rate. I might add that during the time of Saint Ronald of Illinois, the national debt and unemployment BOTH grew rapidly 1980-2.In fact

Maybe we should start reading Saint Ron out of the conservative church, along with the Bushes.

@Drew:

Easy there, man. I was honestly asking a question. No need to get insulting or defensive.

And I’m pleasantly surprised by your answers. Because for a large portion of corporate America, the answer to those questions is: up or way up, no, and not a chance. And I’m wondering why that is. And where all those profits are going. Because they don’t seem to be going towards expanding their business.

It seems like since the election things are going downhill even quicker. One problem is that many banks are sitting on money from the fed and not getting it out to people. Credit requirements are now way too strict. The banks are not helping people in trouble; don’t believe all the ads. If you want to have a house built, plan on putting down 25%, that is what most banks are requiring from builders. The only construction going on around here is a new “convenience” store.

And therein lies the sum total of Drews understanding of economics…or more appropriately…total lack of understanding.

@Dave Schuler:Dave I think you nailed it over at your place:

Tyrell

“even quicker”? What exactly are you talking about? The economy started improving almost immediately when Obama took office in 2008, and had continued to improve, albiet not as rapidly as we wish it would, ever since.

Or do you miss the economy Bush left us? 500K a month job losses, stock market free fall, banking system on the brink of collapse?

That sentence appears to be talking about two separate things…people having houses built…and builders building on spec. Because if I want a house built the bank doesn’t require a down payment from the builder…they require on from me. So it’s apparent to me that either Tyrell is intentionally trying to mislead…or has no idea whereof he speaks. Either way the comment is meaningless.

@Ron Beasley:

What it reminds me of is the 1937-8 recession. The consensus among economists is that it was caused by the government, which had done massive stimulus, turning around and cutting sharply back on spending. They did so because Very Important People told the government that there had been enough stimulus and it was time to “balance the budget” ,cut spending, and increase taxes. The result:

The Roosevelt Administration and Congress responded by quickly implementing new spending on WPA and other relief programs, and quelle surprise! the economy recovered, albeit more slowly than it crashed.

What’s disheartening is that we don’t seem to learn from history, even if we remember it. Witness Drew and Doug.

@anjin-san: Some of my friends lost good jobs since 2008 and have found nothing substantive. In our area home construction has been at a complete standstill. Two houses nearby were started and the builders went off and just left them. Lots are up on foreclosure auction and get nothing. When we moved here about eight years ago things were wide open – lots of new homes and some new businesses. Now it is zilch. Look, I am not blaming this on Obama. A lot of it is the fault of the trifling Congress – most of them have been around too long and do nothing: Reid, Pelosi, McConnell, Bohner. Time for term limits!!

And I don’t go by what the stock market does. That does not improve the job situation. It also does not help with the “fight now, pay later” war strategies of the last several years.

@Dave Schuler:

[Nodding] Yep, a 2% hit on everyone receiving wage income, which is nearly the entire workforce. The payroll tax holiday was just about the best tax-side stimulus we have available, and now it’s gone. I wouldn’t say “not the sequester, FICA!” but rather a combination of both. They each put some drag on the economy.

This is the expected result of austerity (mild austerity, but austerity nonetheless). The curious bit isn’t this, it was Jan & Feb, which were ok and revised upward:

Not that those are eye-poppingly good, mind you, but it suggests there was some lag time before the impact of the FICA increase… or it sequestration (which just got started) was important, or it suggests that a third factor is involved.

But look, folks, let’s get real. All we really need to do is give Drew a tax cut and everything will be fine.

@ Tyrell

Again, what are you talking about? The Bush administration cooked the books regarding paying for Iraq and Afghanistan. One of the first things Obama did was end this practice. Perhaps the costs look worse to you because they are not being hidden.

I think anyone who has an IRA or a 401K is very interested in how the stock market does. I got back in the market the week Obama took office, and it’s worked out nicely. That is money we need for retirement.

We were in a credit driven bubble. The bubble popped. A lot of the “prosperity” of the housing boom was fool’s gold.

@anjin-san: Bush Administration: that is exactly who I am talking about with these costly dragged out wars. Vietnam was similar and the economy was bad throughout the ’70’s. Now we have North Korea starting junk. Great to hear about your investments. I have a few friends who have made some the last several years investing on line, not Hollywood type income, but good enough.

It was a miss and could be upwardly revised as these numbers often are. In the headline number the 65k of upward revisions for the previous two months got lost of course so the total gains for the three months was 500k which is not a disaster by any means. The sequester probably had a minor effect…Doug just because it didn’t technically go into effect until March 1 doesn’t mean that businesses weren’t delaying hiring decisions…it is the March hiring numbers we’re talking about here. All that said hiring remains relatively weak, emphasise relatively, because businesses have probably learned to do more with less and overall demand remains subdued although there are bright spots like autos. This means that QE isn’t going away anytime soon because it’s the only game in town in the absence of sensible fiscal stimulus which is being blocked by Republicans who want to cut spending still further which if it happened would cause further job losses. Yes Doug… spending cuts result in job losses. Not inconsequentially the Dow got over its early vapors and closed down about 40 points and was off 0.1% on the week. Certainly not time to press the panic button but I’m sure the usual suspects (most of whom have an agenda) will.

said Doug Mataconis, never.

The thing that’s hardest for dickish, “I blame Obama!,” commentators to explain is why this is a world recession, and why the US is actually growing more strongly than other OECD nations:

I blame Obama?

(We can presume that some commentators are preemptively dickish, because they know they don’t have the data.)

@Rob in CT: Every first quarter over the last three years has been unusually good, followed by sluggish growth for the remaining three quarters. It suggests to me that tax returns are providing a brief stimulus and that BLS methodology for seasonal adjustments is suspect.

BTW, an interesting article at Forbes:

We’ve known that globalization and automation are the twin pincers attacking US jobs. What this is saying is that it’s even worse. US companies find it hard to invest and grow here, and turn a profit, because the Chinese are willing to invest and grow at a loss. They provide Foxxcon cheap energy and infrastructure because they must, to keep the game going.

See also “Chinese ghost cities.”

Well, the jobs report is certainly no Kamala Harris.

More people left the workforce than got jobs… a trend which has been all too prevelant since Obama decided to use the power of government to make things “fair”.