California’s IOU’s (Updated)

As has been widely publicized cash-strapped California has decided to temporize on its budget impasse by issuing IOU’s to creditors. This brings up an interesting question.

As has been widely publicized cash-strapped California has decided to temporize on its budget impasse by issuing IOU’s to creditors. This brings up an interesting question.

Article I Section 10 of the U. S. Constitution states:

No state shall enter into any treaty, alliance, or confederation; grant letters of marque and reprisal; coin money; emit bills of credit; make anything but gold and silver coin a tender in payment of debts; pass any bill of attainder, ex post facto law, or law impairing the obligation of contracts, or grant any title of nobility.

California’s IOU’s sound very much like “bills of credit”. Regardless of the prudence of the state of California’s decision, is it violating the law?

Update

There’s another wrinkle in this story. There’s an SEC Staff Statement to the effect that the California IOU’s are securities under federal law and those who purchase them are protected by the anti-fraud provisions of federal security law:

The staff of the Securities and Exchange Commission has expressed its belief that California’s recently-issued IOUs are “securities” under federal securities law. As such, holders of these IOUs and those who may purchase them are protected by the provisions of the federal securities laws that prohibit fraud in the purchase or sale of securities.

California began issuing the IOUs (called “registered warrants” by California) on July 2 to certain individuals and entities, including citizens who were entitled to a tax refund or vendors who were entitled to payments. The IOUs are obligations of the State of California, are negotiable, and bear interest. The staff’s view that the IOUs are securities does not affect California’s right to issue or repay the IOUs.

In addition to the antifraud provisions of the federal securities laws, other parts of the federal securities laws also apply to the purchase and sale of the IOUs. Persons acting as intermediaries between buyers and sellers of the warrants may need to register as brokers, dealers or municipal securities dealers, or as alternative trading systems or national securities exchanges.

Broker-dealers, as well as any potential secondary markets, should be aware that the requirements of the securities laws and the rules of the Municipal Securities Rulemaking Board apply to the IOUs.

Finally, although the IOUs are labeled “registered warrants,” they are not registered with the SEC. There is no registration requirement that applies because the IOUs are municipal securities.

I interpret this as mostly affecting the secondary market and having little to do with the question I raised in the body of the post.

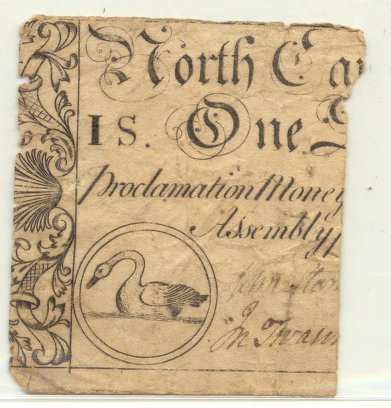

The image above is a fragment of a one shilling bill of credit issued by the North Carolina Colonial Assembly in 1754.

I’m trying to buy these below face value, and I intend to pay my quarterly estimate state taxes with them. If I can get them even at 95 cents per face dollar, that’s a big difference to me. Unfortunately I have only been able to acquire a few hundred dollars worth so far.

PS California also issued IOUs during the budget impasse of 1992, and New York also used them in the 80’s. This is not without precedent.

I did read another interesting take on this being a “currency” this morning, but I’m sure legally (as well as practically) it turns on them being interest bearing vehicles.

They are bonds, debt obligations.

The problem is not government IOUs, all governments issue statements acknowledging a debt. It’s when the statements are transferable to third parties as a store of value. It also matters whether the transactions are voluntary.

The problems here are twofold: (1) promoting speculation in commerce imposes a transaction cost on the entire system, and (2) irregular currency is a vehicle for fraud.

odograph, the interest-bearing part is probably irrelevant. From the Constitutional annotations at Cornell:

California is messed up, no doubt, and needs to reform its budget process. But this currency thing seems a bit of deflection from the real story, that California is running a deficit. The IOUs are the bonds that implement that.

PD, you can buy California Bonds, on paper, here:

http://www.buycaliforniabonds.com/

Interesting, registered warrants are not payable on demand but rather only at maturity. Yet, California is pressuring banks to buy these warrants at face value from clients. Yet to their clients the transaction looks like a check deposit. Chase’s information on their purchase program indicates that Chase will accrue the interest on maturity of deposited IOUs but will put back the face value of the IOU on the customer should California default at maturity. So in essence the banks are taking unsecured debit obligations from depositors as collateral for a full recourse loan with interest paid by the debt obligations value at maturity. I wonder what that is doing to the banks’ reserves?

I suppose intention is the key here but I find it strange that California can influence banks to purchase the IOUs at face value, in essence to treat them like money and not run afoul of the bills of credit. Also, I doubt CA will accept the IOUs as payment for taxes since that would be treating them like money. Can California move to stop a secondary market in discounted IOUs from developing without the IOUs becoming essentially a currency?

There is no issue with bonds. The states can clearly borrow money. It’s an entirely voluntary transaction, with its risks known beforehand.

What we have here is the state trying to meet its past obligations with paper. It’s the same problem the Revolutionary soldiers faced when they got home from the war and the states gave them paper IOUs that they could try to sell to the banks for sometimes pennies on the dollar. Its part of what led to the repeal of the Articles of Confederacy.

Isn’t it about time for some creditor of California to take the state into bankruptcy court?

PD, states can issue bonds (and secondary markets trading them are of course allowed). At the same time, I keep hearing that states can’t run deficits. They are supposed to all run balanced budgets.

Those two ideas are in a little bit of conflict, but the idea must be that a bond is always paid by current receipts, and no current expenditures are simply turned over.

FWIW, my google results:

I think the semantic question, of whether an IOU is money, is less important to our future than the more fundamental question about what it means for them to run deepening deficits.

We’ll be in deeper trouble when we don’t just need to worry about the Federal debt but need to add up all the little State ones too!

Diane: States cannot declare bankruptcy. The federal government has exclusive jurisdiction over bankruptcy, and has not provided a mechanism for state governments to invoke the protection of bankruptcy court.

California IOU’s? They’re “not worth a continental” in my book.

Variation of an old Soviet-era joke:

“State employees in California have finally struck an agreement with the Schwarzenegger administration they can all live with. If the state pretends to pay its employees, then they’ll pretend to work.”

PD Shaw, those would be the Articles of “Confederation,” and they were not repealed, they were superceded by another document. Articles of Confederacy came along three score and eleven years later.

Oh, well, no one reads the Constitution anymore. That’s old hat. Why would any political body follow the law? The law is for the little people.

What’s the point of passing a budget so long as you can print these things and hand them out to creditors?

Nice post, but your title contains a superfluous apostrophe. “IOUs” is the plural form of “IOU”, while “IOU’s” is possessive.

Sorry; it’s a pet peeve.

Basically the author is concerned about Article I Section 10 of the U.S. Constitution which states:

No state shall enter into any treaty, alliance, or confederation; grant letters of marque and reprisal; coin money; emit bills of credit; make anything but gold and silver coin a tender in payment of debts; pass any bill of attainder, ex post facto law, or law impairing the obligation of contracts, or grant any title of nobility.

He equates “emitting bills of credit” with the California IOU’s. I’m skeptical given that IOU’s have been used at least twice before in California’s history. I suspect the key is that acceptance of the California IOU’s has always been voluntary. Indeed, I’m of the opinion that as long as creditors are willing to go along, the state can pay with anything it wants.

Think about it for a second. If I owe you $5000.00 and in lieu cash I offer you my car as payment, you can if like, accept payment in that for and the debit is satisfied.

It seems clear to me that what Article I Section 10 is trying to prevent is forcing creditors to accept non-monetary compensation for legitimate debts-something that you do see in a lot of economically dysfunctional countries.

Actually as long as we’re here, the very next clause is rather interesting too:

make anything but gold and silver coin a tender in payment of debts,

Does this mean I can demand that my state tax refund be paid to me in gold? I mean this isn’t some kind of phony baloney “constitutional right like abortion or gay marriage that supporters insist is implied…despite the fact that there’s no evidence for any such thing. This is an actual express provision of the U.S. constitution. It says it right there in black and white. It hasn’t been repealed ergo it’s valid law.

Well maybe, but my guess is that somewhere along the way there was a court case where it was found that what the founders meant was “the state has to pay you with real money” and the closest thing we have to real money these days is that green stuff the fed keeps churning out to pay Obama’s bills.

This is just the sort of thing that makes Ron Paul supporters crazy…ok more crazy. Anyway it’s an interesting little constitutional quirk.