Fed Will Take Action ‘If’ Economy Falters

The Fed chair, seemingly oblivious to the fact things are pretty bad already, promises to do something if the economy falters. But he's about out of arrows in his quiver.

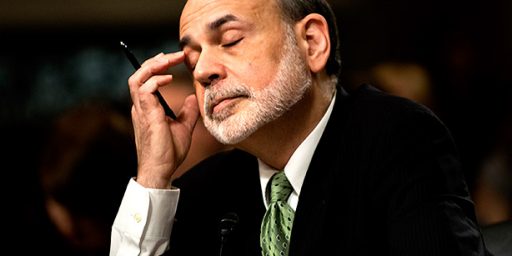

When I saw the AP headline “Bernanke: Fed will take action if economy falters,” my reaction was, Dude, what are you waiting for? The economy faltered two years ago and the “recovery” has been, to say the least, modest.

My second thought, though, was What can the Fed actually do at this point? Interest rates are practically zero at this point.

Bernanke described the economic outlook as “inherently uncertain” and said the economy “remains vulnerable to unexpected developments.”

Although Bernanke acknowledged the recent pace of growth is “less vigorous than we expected” he still believed the economy would pick up next year. And he again seemed to downplay the odds of an another recession as he sought to bolster already shaky consumer and investor confidence.

Bernanke stopped short of committing to any specific action. But he raised the prospect of another Fed purchase of securities, most likely government debt or mortgage securities, to drive down rates on mortgages and other debt to spur more spending by Americans.

“I believe that additional purchases of longer-term securities should the FOMC choose to undertake them, would be effective in further easing financial conditions.” he said. The FOMC stands for the Federal Open Market Committee, the group of Fed policymakers that makes decisions on interest rates and other steps to aid the economy.

The other two options he laid out are:

- Providing more information in the Fed’s post-meeting policy statements about how long Fed policymakers would continue to keep rates at record lows. For more than a year, the Fed has been pledging to hold rates at ultra-low levels for an “extended period.”

- Cutting to zero the interest the Fed pays for banks to keep money parked at the Fed. That rate is now 0.25 percent.

“The issue at this stage is not whether we have the tools to help support economic activity and guard against disinflation. We do,” Bernanke said. “The issue is instead whether, at any given juncture, the benefits of each tool, in terms of additional stimulus, outweigh the associated costs or risks of using each tool.”

While I’m not an economist, those measures — which they’re inexplicably holding in reserve until things really get bad — strike me as amazingly tepid. Interest rates are at the lowest level in memory, so I don’t see them as a barrier to investment.

Mostly, people making decisions about long term spending lack confidence that the economy is going to rebound. If I’m worried the price of the house that I’m thinking of buying is going to drop 20 percent over the next couple of years, offering to sell it to me at 1% APR isn’t going to easy my concern. Similarly, if the banker doesn’t think the guy across the table from him is going to have a job in six months, the fact that he’s not making any interest on the money, anyway, won’t suddenly turn it into a prudent risk.

Going back to the early 1980s, we’ve come to rely on the Fed and the manipulation of monetary policy to be the primary mechanism for stimulating and cooling the economy. But we’ve pretty much exhausted the limits of that for this recession. What else you got?

what is he going to do, make interest rates negative ? Oh, yea, print more money … cool, I like money …

It’s pretty clear Bernanke has a secret plan, and a public plan, as any fed cheif should.

I don’t think he tells outright lies in the public plan, he is just a little slow, a little cautious, and where possible he emphasizes the good news over the bad.

I think James you are responding to the public comments as if they were the plan, and not just another verbal move in a long chess game.

Yikes, are you turning pro-stimulus now of all times?

I just think he’s out of moves.

I don’t think government spending — or tax cuts — is going to do much more for us, either. The economy has to fundamentally restructure but not sure how to do it.

I do agree with Dave Schuler — and now Paul Krugman — that one way the government can help is to start strongarming China to end its currency manipulation. Beyond that, though, I just think we’re waiting for creative destruction and whatever the Next Big Thing is.

I think you might be seeing now why stimulus had a following a year or two ago.

But no, Bernanke isn’t out of moves. He’s limited, but he has moves. The blogs seem to be clustering around the idea of QE2. We’ll see.

FWIW, I think China’s exchange rate is more a political sideshow than a fast path to recovery. Even if you could move the Yuan, that would not reverse globalziation, and bring jobs back from Canada or Mexico.

James Joyner says:

Friday, August 27, 2010 at 14:56

(It’s more like harassing China is the one anti-globalization move in the political arsenal. It’s not that it would work, it’s that’s all there is.)

FWIW, I think it’s all about the 10,000 resistance level.

john personna says:

Friday, August 27, 2010 at 15:48 owd.

“FWIW, I think it’s all about the 10,000 resistance level.”

It fell below 10,000 this morning so why didn’t it continue it’s decline. It’s not about the 10,000 resistance level which is largely imaginary. It’s because a) the restatement was better than expected and stilled double dip fears b) corporate profitability and balance sheets remain strong c) much of the restatement was due to strong imports which actually suggests increased economic activity d) there wasn’t much inventory building

“It’s more like harassing China is the one anti-globalization move in the political arsenal. It’s not that it would work, it’s that’s all there is.)”

How do you know it wouldn’t work? In fact these trade imbalances will have to be corrected at some point because they are unsustainable and that means the Chinese currency which is grossly undervalued (25-50% are the estimates) will have to revalued at some point and it makes much more sense for the Chinese to cooperate in a gradual move that doesn’t destabilize their economy than the alternative. The US has lots of leverage if it wants to apply it.

I’m not a big technical analysis guy, but I do accept resistance levels when I see them work. Especially big fat resistance levels with a 1 and four 0s. 10,000 is big psychologically. Now, I don’t get at all why you would think breaking through a resistence level and then retreating would be a disproof of them. That is exactly what we’d expect. They will be tested. Mr. Market will either break through with strength, of change his mind and bounce back. Possibly he’ll test again.

Now sure, like a good market recap “analyst” you can name half a dozen things that happened today was well … but for me the striking thing has been the strength of the 10,000 boundary each time it ws tested over the last four months.

On China, here are the trade rakings:

http://www.census.gov/foreign-trade/top/dst/2010/06/balance.html

Let’s start with China supplying 40% of our goods. Let’s say Yuan adjustment was so severe as to cut that by 10% (of the 40%). You’ve just impacted trade by 4%. You think that’s a big deal?

You _can_ run it with some dramatic change, say halving Chinese imports, but by then you’ve certainly left the realm of political possibility.

(I read that table wrong. Can’t find one right off with the info I need. % of total imports coming from China.)

john personna says:

Friday, August 27, 2010 at 16:38

“I’m not a big technical analysis guy,”

The Dow went down to 9900 or thereabouts this morning. The reason it closed up 250 points on this number had little to do with largely imaginary resistance levels and everything to do with fundamentals some of which I mentioned. Had the fundamentals not been there, the presence of a 1 and four 0’s wouldn’t have made a bit of difference however important you may “feel” they are.

john personna says:

Friday, August 27, 2010 at 16:43

“Let’s start with China supplying 40% of our goods. Let’s say Yuan adjustment was so severe as to cut that by 10% (of the 40%). You’ve just impacted trade by 4%. You think that’s a big deal?”

I made no suggestions about how the Chinese should go about managing the revaluation of their currency. I just pointed out it’s overvalued by 25-50%, it’s distorting the entire world trade system by allowing the creation of huge trade imbalances and ultimately it can’t be allowed to continue. Or do you think otherwise? Do you think it just goes on indefinitely until the Chinese have US dollar reserves of ten trillion?

Joe, I understand that not everyone is going to accept that there are such a things as resistance levels. It relies, for instance, on an understanding that the EMH is disproved(*) and that there can be lots of human nature showing up in markets in one form or another(**). What I don’t understand is why you think a naked denial would be compelling.

* – http://www.amazon.com/Myth-Rational-Market-History-Delusion/dp/0060598999

** – http://www.amazon.com/Irrational-Exuberance-Robert-J-Shiller/dp/0767923634

On China, I don’t get it so much. China owns China’s currency. They’ve managed it to their benefit, certainly, but I’m having trouble seeing how reasonable (and possible) changes would impact us.

Camaros would still be built in Canada either way.

john personna says:

Friday, August 27, 2010 at 19:48

“Joe, I understand that not everyone is going to accept that there are such a things as resistance levels……What I don’t understand is why you think a naked denial would be compelling.”

It’s not a naked denial. I gave four reasons! You haven’t given one that isn’t pure blue skying. I don’t say resistance levels don’t exist for psychological and at month end technical reasons, but given the current skittishness of the market there’s no way it would have closed 250 points above 9900 unless the fundamentals were there. You’re welcome to believe otherwise.

Sorry, I didn’t get that you think those reasons they trot out for each day’s news summary had anything more than coincidence going for them. Seriously, read a book. Taleb’s Fooled By Randomness is good one for blowing up industry claims for cause and effect. There are others.

And, actually yeah, I think you did dismiss resistance levels above, with nothing more than “today’s news” as alternative.

Finally, re. Taleb, the cruelest fact in the market is that you never know when you are right. Even when you win, you don’t know if you won for the right reasons. Maybe you bought because the 10K level “looked strong” and then the market bounced to 15K. Was it the level or was it blah, blah blah?

Who was right? No one ever knows, but I can say within that fuzzy form of confidence (which is not much) the 10K resistance looks strong.

BTW, I speak of downward resistance at 10K, not upward. Mr. Market has been trying rallies off that base. I kind of feel like the 10K level will fold, but I thought it should have done two months ago when the soft spot, possible double dip, started to show. So who knows. Mr. Market may still be on lithium.

john personna says:

Friday, August 27, 2010 at 19:52

“but I’m having trouble seeing how reasonable (and possible) changes would impact us.”

With due respect John if you don’t understand how having a trading relationship with a partner whose currency is falsely undervalued relative to ours by as much as 50% then I’m left somewhat bemused. At its most basic (and assuming all other things were equal) it means their widget sold in our market is half the price of a domestically produced widget which is thus rendered uncompetitive; whereas our widget sold in their market is twice the price of a domestically produced product and thus rendered uncompetitive. Such a situation might be tolerable for a few years to allow a third world country to develop an industrial infrastructure but when it’s the second largest economy in the world it’s clearly an abuse of our mutual trading relationship.

That is the political argument, Joe. It carefully avoids doing the math. Show me what percentage change you think you can get in the Yuan, and then show me what percentage change in US imports that will produce.

http://useconomy.about.com/od/tradepolicy/p/Trade_Deficit.htm

john personna says:

Friday, August 27, 2010 at 20:16

“Sorry, I didn’t get that you think those reasons they trot out for each day’s news summary had anything more than coincidence going for them.”

Sometimes the obvious is more than just coincidence. And those btw were my reactions before I read word of comment from the media who I disregard completely. You’re welcome to believe these reasons were not material but not to be offensive.

john personna says:

Friday, August 27, 2010 at 20:45

“That is the political argument, Joe.”

Actually it was an entirely economic argument focused only the math and its consequent impact on relative competitiveness. Would you like to tell me exactly where politics entered into it?

I found “blue skying” offensive enough to push back. And I still think I’ve got the better answer there, with Taleb, Shiller, and Fox lining up for irrational, emotional, and unpredictable markets.

Within that framework, a 10K resistance (maybe I should call it support) level makes about as much sense as anything, until times change and it’s left in the dust.

LOL, the fact that it doesn’t claim a single number? Imports change? GDP change? Employment change?

It is a political issue because it is framed as a fairness issue. It may be a fairness issue, and tear it up if you can get China to move … but remember what this thread is about, and how China came in?

James thought it might be a cure for the US economy. How exactly, with numbers?

john personna says:

Friday, August 27, 2010 at 20:45

“U.S. received one-third of its imports from Canada and China, with Mexico, Japan and Germany contributing an additional 20%.”

Somewhere above you were claiming 40% of US imports came from China! To be honest I don’t know what the figure is other than it is substantial and is made up of a lot more than christmas decorations and blue pots.

at Friday, August 27, 2010 at 17:10 I wrote:

(I read that table wrong. Can’t find one right off with the info I need. % of total imports coming from China.)

john personna says:

Friday, August 27, 2010 at 21:04

“LOL, the fact that it doesn’t claim a single number? Imports change? GDP change? Employment change?”

I don’t think you understand the difference between an economic theorem and a political issue. I’ve never mentioned politics just the economic impact of currency valuations on relative competitiveness. And btw to arrive at the data you mention would require a detailed breakdown of all Chinese visible and invisible imports. Can you provide this?

Are you conscious that you are asking me to disprove an argument you cannot prove?

Are your arguments default-true or something?

“(I read that table wrong.”

Oh

john personna says:

Friday, August 27, 2010 at 21:29

“Are you conscious that you are asking me to disprove an argument you cannot prove?”

I’d say you don’t have to be Keynes to figure out that if a major trading partner has a currency that is undervalued by 50% then he enjoys a major competitive advantage both in your domestic market and elsewhere. If the Euro was undervalued by 50% we’d all be driving Mercs and Beamers. Sorry if this doesn’t make sense to you. Politics doesn’t enter into it at the purely economic level, but of course it does soon afterwards when one of the partners realizes he’s being screwed.

Throwing crazy hypotheticals, like $15K BMWs(*), is a prime example of political argument.

* – assuming you mean, by %50 overvaluation, a %50 reduction, and given a $30K BMW 325i

Let me ask an insidious question. Right now the cheapest coffeemaker on the shelf is $20, and was made in China. What would happen if the cheapest coffeemaker on the shelf was suddenly $25, and was made in china?

Would the US labor picture change? Or would $5 more dollars still go to China?

See, the trick is that even with “fair” valuation, China is likely to remain the world’s lowest cost producer. They still have massively subsidized materials and energy, and a huge low cost labor pool.

john personna says:

Saturday, August 28, 2010 at 08:43

Throwing crazy hypotheticals, like $15K BMWs(*), is a prime example of political argument.

Nothing crazy about it. If the Euro was 50% undervalued and this was reflected in the sticker price, then BMW and Mercedes sales would go through the roof. This would be the economic consequence of greatly reduced transfer pricing. Politics has nothing to do with it.

“See, the trick is that even with “fair” valuation, China is likely to remain the world’s lowest cost producer. They still have massively subsidized materials and energy, and a huge low cost labor pool.”

If the Yuan was fairly valued, then as a lower cost producer China Inc would just make much more profit, assuming their volume stayed the same, which it wouldn’t of course which is the entire point. You also seem to think this is purely a matter of our competiveness within the US rather than globally. The most conservative estimate has the Chinese currency falsely overvalued by 25% so why you’re in denial is hard to understand until I remember that a few weeks back you were claiming 0.9% CPI inflation was actually deflation.

Joe, the BMW example is crazy because there are world-prices for things, and the exact relation to price and exchange are not direct. For instance, BMW could buy scrap steel from the US with dollars, and then sell cars back to the US for dollars. Thus, a component of the production cost has a dollar basis. Thus, a change in US to Euro would not change the cost of production by the same rate.

Denial? Me? I’m not the one floating fantasy currency adjustments and then fantasy outcomes.

You know the currency adjustment you get is going to be less than the one you want. Why? Because we have very little negotiating power. China owns too much US debt.

And you shouldn’t really fault my early deflation call when so many big guns have hopped on board since 😉

john personna says:

Sunday, August 29, 2010 at 15:58

“And you shouldn’t really fault my early deflation call when so many big guns have hopped on board since ;-)”

To start with that’s not the issue you said 0.9 INFLATION was DEFLATION. It’s not. And would these big guns include Ben Bernanke Chairman of the Fed who on Friday said we’re definitely not yet in a deflationary period.

“the BMW example is crazy because there are world-prices for things, and the exact relation to price and exchange are not direct. etc etc”

This is all irrelevant like your claim this was a political issue. If the Euro was 50% undervalued and it was reflected in the sticker price which would probably come down by 25-35% then the market share of Beamers and Mercedes would increase massively.

Joe, is it that hard to admit I was calling a trend? It is obviously true that trailing CPI or PPI (the only numbers we have) don’t show deflation. Duh.

And then BMW price fantasy? Pulling imaginary European over-valuations and price changes out of your butt?

Joe, I often agree with you on politics, but on economics you have a strange allegiance to the small picture, and a great deal of defensiveness.

BTW, just to reinforce that I was right, and if anything risk-taking and early, my question was “does Bernanke see this deflation coming and is he just accepting it?”

You went off on how since we were not in inflation yet, there was no reason to ask.

Well, now the whole world is asking.

john personna says:

Sunday, August 29, 2010 at 17:30

“Joe, is it that hard to admit I was calling a trend?”

Sorry buddy you said we had entered a deflationary period. Either your memory is faulty or the other applies. I’m the first to concede we’re hovering on the edge and said so repeatedly at the time we were talking about it but that is not the same as actually experiencing deflation at present which you insisted was the case.

“And then BMW price fantasy? Pulling imaginary European over-valuations and price changes out of your butt?”

I was giving you a very simple economic example of what would happen if the Euro was 50% falsely undervalued as is the Yuan. To which you responded with a load of gobbledegook about politics, BMW’s cost of goods, and other irrelevancies. And even there you don’t understand what you’re saying. BMW sources most of it high added value components from within Germany although it would of course have higher commodity costs for imported iron ore, rubber, bauxite, oil etc. And then of course they get paid for those shiny high value beamers in relatively overpriced dollars which fatten BMW’s bottom line and strengthen the foreign reserves of the Fatherland. I’ll stop being defensive about economics when you display some knowledge of the subject.

“Well, now the whole world is asking.”

The world had been asking if it’s going to happen for at least 12 months but that doesn’t mean it happened yet.

Joe, you’d be a little more sane if you took other people’s calls about the future, about trends, as calls.

It is insane to say your call is false because it hasn’t happened yet.

BTW, on the BMW … you make up numbers to make yourself happy. It is a form of self-abuse.