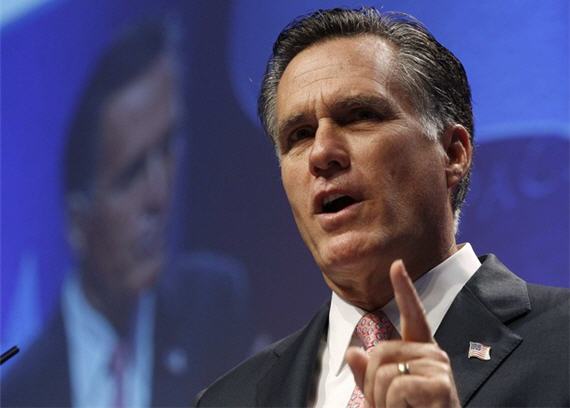

Mitt Romney Unveils Economic Plan To Mixed Reviews

Mitt Romney's jobs plan is detailed, but it doesn't seem to be impressing anyone.

Yesterday, Mitt Romney became the latest Presidential candidate to unveil his own economic plan, but it’s not getting the most enthusiastic reception:

Mitt Romney unveiled his plan to rejuvenate the American economy here Tuesday, offering a detailed outline that includes repealing President Obama’s health care law, cutting the corporate tax rate, placing sanctions on China as a currency manipulator and immediately reducing taxes on savings and investment by the middle class — and promised to push many of these policies on his first day in the Oval Office.

With his business background, Mr. Romney has portrayed himself as the presidential candidate best prepared to steer the nation at this time of economic distress, and his economic plan is a classic Republican blueprint that relies on tax cuts and reduced regulation — not stimulus — to jump-start the economy.

Standing in front of a large banner that read “Day One, Job One,” Mr. Romney detailed the 10 actions he would take the first day of his presidency. Five are executive orders, and the other five are pieces of legislation, including the tax changes, he would send to Congress and request action on within 30 days.

“The right course for America is to believe in growth,” Mr. Romney, a former Massachusetts governor, said at the McCandless International Trucks dealership here. “Growing our economy is the way to get people to work and to balance our national budget.”

In the plan, whose stated goal is to “restore America to the path of robust economic growth necessary to create jobs,” he promised to immediately cut the corporate income tax rate, currently topping out at 35 percent, to 25 percent. Although he did not outline any specific proposals for closing loopholes or otherwise simplifying the tax code, he also promised to make permanent the tax cuts on individuals enacted under President George W. Bush and to eliminate taxes on dividends, interest and capital gains for anyone making less than $200,000 a year.

In an effort to stimulate American exports, Mr. Romney said he would push free-trade agreements with Colombia, Panama and South Korea as well as officially place sanctions on China for keeping its currency artificially low, a move that makes Chinese imports cheap to American consumers and has led to trade imbalances.

Mr. Romney also vowed to make it easier for American companies to drill for oil in the United States and to cut federal discretionary spending on anything other than security measures by 5 percent — or $20 billion. He said he would consolidate government training programs and order that any new regulations add no new costs to the economy.

To a large degree, this is seems a like a pretty standard Republican plan. There’s nothing here that’s nearly as daring as Jon Huntsman’s proposal to eliminate nearly all tax deductions and tax credits. Of course, Huntsman can afford to be daring, Romney, who is now battling Rick Perry for the lead in the race for the GOP nomination, cannot, and this plan seems to reflect that. The most outside-the-box thing here seems to be the idea of taking on the Chinese on currency reform. Of course, other Presidential candidates have talked about “getting tough” with a foreign trade competitor (the Japanese in the 80’s, the Chinese today) and then not exactly followed through on it once elected. Additionally, it’s hardly politically risky for Romney to attack the Chinese in an American Presidential election.

The reaction from economists is, to say the least, mixed, with many pointing out that there isn’t all that much historic evidence to support the idea that tax rates are the prime motivator behind individual economic decisions. Others point out, as I noted above, that a confrontational approach with China isn’t really in the interest of either the United States or China.

On the political side, even Romney’s fellow conservatives aren’t all that impressed. David Frum calls the plan one step forward, and two steps back:

A President Romney would take office in January 2013, at a time when even on a best-case scenario more than 10 million Americans will still be unemployed or under-employed, more than half of them for a very long time. What to do for them? On this urgent topic, the plan falls dismayingly quiet. Even if Romney’s policies do raise the long-term growth rate of the United States beginning sometime about 2014, unemployment won’t return to normal levels until a Romney second term. That portends almost a decade of very high unemployment.

Since the long-term unemployed tend to become unemployable, such a scenario portends that millions of Americans will likely never return to work at all. What to do about them? Put them on disability pensions? Create federal make-work programs? But the Romney plan calls for early and rapidly enlarging cuts to federal spending, militating against those two obvious answers. What then?

The second failing is illuminated by Mitt Romney’s speech announcing his new plan. In the speech, Romney laid great stress on raising the incomes of middle-class Americans. Good! But as his adviser Glenn Hubbard can tell him with graphs and charts, the heaviest weight on middle-class incomes is the rise in the cost of employer-provided healthcare, which devoured every dime of extra employee compensation during the Bush years.

Until health care costs are controlled, it’s again hard to see how wages can grow. So where’s the plan for health-care cost control?

Along the same lines, the Wall Street Journal chides Romney for not addressing entitlement reform in any meaningful way and also for his unfortunate decision to make the Chinese the economic enemy:

By far the most troubling proposal is Mr. Romney’s call for “confronting China” on trade. This is usually a Democratic theme, but Mr. Romney does Mr. Obama one worse by pledging to have his Treasury brand China a “currency manipulator” if it doesn’t “move quickly to bring its currency to full value.” He’d then hit Beijing with countervailing duties.

Starting a trade war is a rare policy mistake that Mr. Obama hasn’t made, but Mr. Romney claims it is a way to faster growth. His advisers say he doesn’t favor a 25% tariff on Chinese goods as some in Congress do, but once a President unleashes protectionist furies they are hard to contain.

His economic aides say this idea comes directly from Mr. Romney himself, which is even less reassuring. It looks like a political maneuver to blunt the criticism he’ll receive because some of Bain Capital’s companies sent jobs overseas, or perhaps this is intended to win over working-class precincts in Pennsylvania and Ohio. But giving Americans the impression that a trade war will bring those jobs back to the U.S. is offering false hope. It also distracts from the other fiscal and regulatory reforms that are needed to attract capital and create jobs.

Both Frum and the Journal make valid points. Failing to address the health care cost issue would likely mean that all those promises about new jobs will go unfulfilled, and starting a trade war with China will merely harm American consumers and businesses with the Chinese. Most of all, though, I’ve got to wonder about Romney’s communication skills here. Who unveils a 59 point plan in an election campaign? Does Romney actually believe that anyone other than a policy wonk is going to delve into a 160-page book?

Probably not. As Allahpundit notes they’re most likely hoping that people will hear that Romney has a 59 point plan and conclude that he’s serious about fixing the economy. I’m not sure that’s going to be enough, though. The American people may not spend their days delving into the specifics of economic policy, but they’re going to want to know some details about what Romney is proposing without having to read the whole book. Unless the Romney campaign is able to summarize these ideas in a way that’s easy to communicate, people are going to tune them out. They’ll get their first chance tonight at the Reagan Library.

Is this the same as the jobs plan? Others might note other things, but I was struck by a combination of two:

– counter China’s trade practices

– expand free trade to more asian countires

… It’s kinda like he didn’t see where the China problem came from …

So, it’s:

1) Fewer people with health insurance.

2) More money for rich people.

3) Trade war with China.

I like it! It’s genius! It solves all our problems at once!

This is my favorite part.

According to Kevin Drum, in 2004 the Tax Policy Center estimated that repealing capital gains and dividend taxes entirely would save the median earner $70. Think $70 will appreciate enough for me to help my kids with college?

re China: To keep it in perspective, Obama threatened to brand China a currency manipulator in hopes of seeking concessions from China, and indeed the valuation shifted slightly before Obama called off the threat. I don’t know if that’s because of the threat or China got nervous about the value of U.S. treasuries.

@PD Shaw: The change in valuation of the renminbi was a sop to the administration’s ridiculous threats. Not that it matters: China would have to divest itself of its dollar holdings to revalue its currency against the dollar, and the only alternate currency which could absorb that much capital is the Euro, which ain’t such a good bet anymore.