Poll: Americans Support Sacrifice For Others, Not Themselves

A new poll finds strong support for raising taxes on other people and staunch opposition to cutting programs that benefit themselves.

A new poll finds strong support for raising taxes on other people and staunch opposition to cutting programs that benefit themselves.

POLITICO (“Battleground Poll: Hike taxes on rich“):

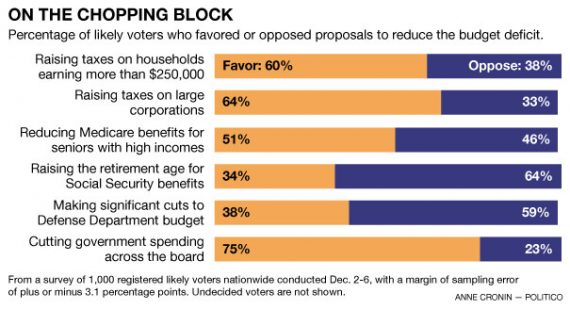

A new POLITICO/George Washington University Battleground Poll finds that 60 percent of respondents support raising taxes on households that earn more than $250,000 a year and 64 percent want to raise taxes on large corporations.

Even 39 percent of Republicans support raising taxes on households making more than $250,000. Independents favor such a move by 21 percentage points, 59 to 38 percent.

Only 38 percent buy the GOP argument that raising taxes on households earning over $250,000 per year will have a negative impact on the economy. Fifty-eight percent do not.

[…]

Three in four voters want to “cut government spending across the board,” but 59 percent oppose making significant cuts to the defense budget and 46 percent support ending foreign aid.

The slightest majority backs reducing Social Security and Medicare benefits for seniors that have higher incomes, but 64 percent oppose raising the retirement age to begin collecting Social Security benefits.

This is not surprising, in that it’s consistent with both other polling and human nature. Indeed, it’s rather surprising that only 60% favor raising taxes on those earning over $250,000 when that threshold impacts only 2% of taxpayers.

That two thirds favor taxing large corporations more is to be expected, given the backlash created by the financial crisis and various reports of mega-profitable companies paying zero taxes. While our nominal corporate tax rate is much higher than the norm in the developed world, there are enough loopholes in the system that the effective rate is often quite low. That “large corporations” only nominally pay taxes, passing them on as an expense to consumers, doesn’t mitigate the fact that most Americans perceive them as getting over.

The biggest disconnect in the polling is that, while there’s very little support for cuts in Social Security and Defense—two of our biggest ticket items—there’s overwhelming support for generic spending cuts. I suspect that this is simply a function of people liking the idea of smaller government while disliking the reality of smaller government.

Was everyone they asked feeding off the military-industrial complex? Why not cut the military?

Americans don’t realize it, but they do like big government.

I received one of these polling calls, and the wording of the questions can be maddening. First they ask if you support cutting benefits for current benefit recipients, or for those near receiving benefits. Then they ask if you consider raising the retirement age a cut (personally, I do not. I see it as a necessary step as lifespans get longer).

For people in my age range (mid-40s), I’d have to guess that part of the reluctance to reduce future benefits or raise the retirement age probably comes from the realization that they aren’t saving enough for retirement.

An honest question, because no one I’ve talked to seems to have a definitive answer: is the $250,000 gross income, or adjusted gross income?

I don’t think the data support your headline. As you point out, a substantial number of people do not want to cut taxes on the top 2%. And we don’t know how many of the 2% support raising their own taxes, but extrapolating freely from the overwhelming support of Mr. Obama from the Silicon Valley crowd (not exactly minimum wage workers) I suspect there are quite a few who fall into that category. (I voted for Obama and for California prop 30.)

Also, as grumpy mentions above, pushing to keep military funding high is not an interested vote.

@Jen:

Lifespans are not necessarily getting longer. Average lifespans have gotten longer since the 1930s, but that’s a function largely of reduced infant mortality, not of increased lifespans on the back end (if you have less 1-2 year olds dying, the average age goes up).

Secondly, most of the increased lifespans are being captured by those who are already better off. The average life expectancy of someone a 65 year old was about 78 in 1940 and about 83 in 2005; or, in other words, a gain in the average length of retirement of only five years over six decades. And that’s for everyone; the poor, blacks, etc. saw their lifespan go up less than that.

Alternative spin on the poll numbers:

People actually consider the marginal utility when balancing tax increases for high incomes vs cutting fixed income payments on which many retirees depend.

Not a single person in the top 2% is going to lose their home or be forced to choose between going without food vs going without medication because of an increase in the taxes on what money they earn above and beyond $250K.

However, they may be forced to choose between the 2 bedroom in Boca and the 3 bedroom in Miami, vs just getting the 3 bedroom in Boca.

I also checked carefully, to see if this poll did ask people making $250K+ what they thought.

That would be interesting.

For course, if you are asking the general population you can say that they are misrepresenting on either raising or lowering taxes, because either one is statistically “on someone else.”

There is also the life-arc aspect. If I made more than that at one point, in my younger years, and paid higher tax, am I precluded from saying that kids today should pay the same rate? Or would that be “taxing someone else” by your rules?

Work harder. Millions of able-bodied welfare recipients are depending upon you.

Speaking of which, there are two fundamental problems with socialistic policies in democratic nations, in addition to the oft-repeated mantra about eventually running out of other people’s money to spend: (1) whereas the rich do get poorer by “paying their fair share,” thereby making the likes of rich liberals and full-time academics and students quite happy, the ranks of the poor also grow exponentially and they too get poorer; (2) democracies become de facto national suicide pacts if and when the public figures out ways by which they can vote themselves largesse funded by other people.

Elections and policies have serious long-term consequences.

All part and parcel of the big U.S. slide.

This not at all surprising to me. My question anytime I encounter someone who strongly favors “smaller government” is always something along the lines of “ok, so what government programs or benefits that you, or someone close to you, receives are wasteful and should be cut?”

The reply is normally one of two things. They either erroneously claim that they get no benefit at all from the government. Or, they just ignore the question and launch into (yet another) rant about all the “moochers” who get benefits they don’t deserve.

On the flip side, while since I fall squarely in the middle class I’m kind of glad that politicians are so scared to raise my taxes; but if I’m honest about saying the Clinton economy wasn’t so bad, then I really shouldn’t be opposed to my own tax rates going back up too.

@Tsar Nicholas:

So you must have shorted the US Government by now, right?

@Rafer Janders: Interesting–where are you pulling your data from? The reference I used shows US life expectancy rates in 1940 were age 60.2 for men, 65.2 for women, all races. For 2010, the most recent year available, it is 76.2 years for men and 81.1 years for women, all races, which is an increase of 16 years–not insignificant.

Combine that with the population bubble created by the Baby Boomers, and, increased health care costs, and there is a Medicare expense problem.

But again, if there’s a data discrepancy, I’m happy to look at it.

http://www.ssa.gov/policy/docs/ssb/v67n3/v67n3p1.pdf

Life expectancy at 65 is different from just life expectancy. The latter involves infant/childhood mortality. If you’re discussing SS, what matters is life expectancy at retirement (at benefit eligibility).

That has grown too, though much less, and it’s mostly been the relatively affluent who account for the increase (though the report I linked to splits the population 50/50, so this isn’t some 1% vs 99% thing. Perhaps if you split the data that we it gets even more stark, I don’t know).

Planet Money talked to five economists that represented both the left and the right and came up with six policies that they all agreed were sound and improvements over current policy. The result? They were universally hated.

Polls like these and California’s budget mess (which has been largely driven by ballot initiative) demonstrate that the average voter isn’t very good at coming up with economic policy. This is neither new or very surprising.

@Al:

California is straightening itself out, and related to this topic, some of the richest precincts did vote for tax increases on themselves.

@michael reynolds: Obviously, there are a substantial number of individuals who vote against their personal interests out of principle, concern for the greater good, habit, or sheer stupidity. I’m just saying that the aggregate result here is that most people favor raising taxes on others and oppose cutting spending that they perceive benefits them.

Defense spending is in the latter category. Most think more dollars given to the Pentagon means more security and safety.

@Al:

I think PM kind of chose big ideas loved by economists for that piece, revolutionary things, and not simple pragmatic steps loved economists.

If we make improvement it will be by incrementalism, not revolution,

@James Joyner:

Is the attachment to defense spending really about people feeling safe from foreign militaries, or is it a matter of national pride in being able to kick anyone else’s rear end?

People want a republic’s tax rate, but an empire’s military budget.

@Jen:

But that’s an increase in the overall average, which as I noted is due largely to decreasing infant mortality, and doesn’t tell us as much about how much longer old people are living (it tells us more about how much less young people are dying). The number you really have to look at is life expectancy at age 65, at or near retirement age — that is, once you hit 65, how much longer can you expect to have?

We also have to look at life expectancy across incomes and careers — for those at the top of the income scale, the number of years after 65 has increased, but for those at or near the poverty level — the very people who depend most on Social Security — life expectancy is actually stagnant or, in some cases, decreasing. Basically, gains in life expectancy are very strongly correlated with income and class. More stats here:

http://www.ssa.gov/policy/docs/workingpapers/wp108.html

@Al:

5 of those 6 amounted to: stop taxing income and start taxing consumption. Plus, legalize pot.

I note that “cut government across the board” has the highest approval – 75%. My guess is that this is a combination of the erroneous belief that there is spending that matters much beyond medicare, SS and the military and an attempt, however clumsy, at fairness. A cut of government across the board means you will gore your own ox – nobody’s is spared. I think such cutting is bad policy, but I’m hesitant to assume, looking at these numbers, that it means the American people are basically a bunch of selfish jerks.

A new poll finds strong support for raising taxes on other people and staunch opposition to cutting programs that benefit themselves.

In isolation, yes, but the data does seem to suggest that people generally will support cuts to programs that benefit them as long as everyone else is sacrificing. Which cut gets the strongest support in that poll? “Cutting government spending across the board” gets 75% support, easily the most popular. I believe people understand that would mean cuts to programs they like, but they are ok with it as long as everyone else takes a cut too. People tend not to support the idea of cutting a program they like when the question is just about that program because they think it is the only thing being cut and it goes against a general idea of fairness.

I think it would be more interesting to put the various plans in front of people. So you take POTUS’ 2013 budget, the GOP’s plan (to the extent you can get them to actually fill in the blanks and agree that yes, this is in fact our plan), and, just for kicks, The People’s Budget (progressive caucus) and something CATO or some similar libertarian think-tank puts together. Lastly, have an option for “status quo” (which would signal a willingness to borrow at negative real interest rates, increase the national debt, but avoid tax hikes and spending cuts, at least in the short term).

A really good poll might have folks rank their preference, 1 through 5. I’d love to see the results of such a questionaire… if anyone would actually put in the time & effort required to complete it.

@James Joyner:

You’ve done this theme more than once, and I really don’t get it.

Are you suggesting a special voting mechanism where people vote by income level?

Or one where only marijuana smokers can vote on legalization?

Really your formulation rejects that we are collectively a society and have rights to set rules for the whole society, including minorities. If we reject that we get some kind of Balkinization, where every group makes their own rules.

@Rob in CT:

People who say yes to “across the board” might interpret that to mean everyone’s ox is evenly gored.

Right, JP. That’s what I was trying to say (mantis said it slightly better, moments after I did).

The entire small govt idea is a mirage. Combined federal and state budgets are well over $5 trillion and they’re not going down in any material way. The states that vote the reddest are the mendicants with the biggest begging bowls. The major recipient of federal/state

spending either directly or at a second remove is private sector business. So who the heck do we think we’re kidding. The administrative state is not about to disappear. The challenge is to run it as efficiently as possible and fund it adequately so that it operates for the public good. For the past four years tederal tax receipts have been running at around 15% of GDP when they should be 19% of GDP and so obviously tax rates have got to go up and a good place to start is the wealthiest so popular wisdom is not that far off the mark.

@Rafer Janders: Ah, got it. Thanks for the clarification.

@john personna: @Rob in CT:

I got a little lost there, sorry.

Really I think life-arc analysis is most important to this whole thing, and expectations.

We are told that young Republicans favor tax cuts for the rich, because they see themselves getting there.

Can young Democrats favor higher taxes for the rich, even as they see themselves getting there?

Indeed, it’s rather surprising that only 60% favor raising taxes on those earning over $250,000 when that threshold impacts only 2% of taxpayers.

Actually it’s not at all surprising given that opposing such raises is the central economic platform of one of our major parties and so tribalism and a relentless barrage of propaganda keeps a large bloc of voters ideologically in line.

Back when we looked at countries tax and spending levels by GDP, we saw some happy countries which both spend and tax higher than we do.

They just manage to match them. It shouldn’t really be that hard.

We’ve just gotten on this weird track in the US that spending and tax are separate questions, with separate answers.

Interesting.

I already addressed this last night.

=-=-=-

The obvious issue with these numbers, is that they fly in the face of the recent election. Are we realy to believe that the same people who voted in a dyed in the wool socialist, who ran a campaign on his dramatically increased government spending, did so because they wanted to see spending cuts across the board?

If we assume, (and we must, for the moment) that both the polling and the election results are both valid and free of fraud, then there’s got to be another reason for the obvious disparity between the election results and the polling data.

The most obvious, is exactly the one I suggested a few weeks ago… and it’s a conclusion that Kristol and Barnes won’t like very much, I fear… and its one I’ve already pointed out… most recently when I reposted my complaints about Romney…

Conservatives sitting on their hands in large numbers in the last election is the only way to explain all of this. Yet, it’s the one conclusion the denizens of The Weekly Standard dare not draw, because it is they and people like them who have been urging us toward the mythical political center…. and who have been active in pushing out all vestages of real conservatism.

The people…as a whole are far more conservative than the offerings of the GOP and the consultant class driving them, have been offering. And its time this factor was taken seriously, and as a prime motivator in choosing candidates. Failure to seek out and promote real conservatives, not centrists, means only one outcome…The GOP will not win another election.

@john personna:

Define young. 😉 I’m 35, and if $250k/yr in household income is “there” then we might get there. Well, maybe not since I assume when we talk about $250k of income we’re talking AGI. But then I’ve advocated that my taxes (taxes on the sub-$250k cohort) go up too. If the economy wasn’t so sluggish, I’d still back just letting the entire tax cut package expire (obviously, I want other reforms too, but that’s the “easy” option) right now. That was the status quo ante, before the Bushies blew up the budget. I think that should be the next step, perhaps for 2014, assuming the $250k+ increase goes through and the economy continues to slowly improve.

I would prefer means testing Social Security over raising the retirement age. As others have noted, blue collar bodies tend to both earn less and break down earlier than white collar ones. Expecting someone to continue to man a garbage truck or work construction at 67 is much different than expecting someone to work on spreadsheets. Our retirement system should account for that.

What’s hilarious about this, Florack, is that it doesn’t even occur to you that YOU are the one whose assumptions are invalid. It doesn’t occur to you that the “died in the wool socialist” has repeatedly advocated a mix of cuts and tax increases, with more in cuts than in tax increases (I do believe he’s on the record as backing a roughly 2.5 to 1 ratio).

The problem, Eric, is your refusal to engage with reality.

@john personna:

Young Republicans oppose larger taxes for the rich because that would pay for services for the poor, and if there’s one thing young Republicans all have in common it’s contempt for those less fortunate than themselves, especially if those less fortunate have dark skin.

Fark. Dyed in the wool, not died in the wool. Heh.

Anyway, the point stands: asserting that POTUS is a socialist is what flies in the face of the evidence.

He’s a liberal. He is also reality-based, so he knows that spending has to be brought down in addition to taxes going back up. As a liberal, he would like to match them up at a higher level than a “dyed in the wool” conservative would. Say, 21% of GDP versus… oh, I don’t know… 15% (which would roughly match the current tax level. A pure cuts plan to balance the budget, leaving aside the likely impact on the economy for a moment, would result in federal spending at ~15% of GDP). That’s a real difference. But you can’t actually grapple with it, because you’re still frothing about the fantasy/strawman Obama, instead of engaging with the real one.

@Gromitt Gunn:

I think that’s a very interesting point. I used to be a waiter. Now I’m a writer. 67 year-old writer? Assuming general health, no problem. 67 year-old waiter? Big problem.

@Eric Florack:

I’m not seeing that. Romney’s vote count was about 700,000 MORE than what McCain received.

Romney, 2012 – 60,781,275

McCain, 2008 – 59,948,323

Romney also received more electoral votes than McCain did, so if conservatives stayed home, the numbers don’t show it.

@Rob in CT:

This from day one. They have never come close to getting Obama. It’s like watching bad impressionists. They get nothing right about Obama.

@Eric Florack:

First, Obama won with a smaller number of voters than in 08.

I’m not quite sure what the significance of this is. FDR won with a smaller number of voters in 1940 than 1936….does this mean he didn’t have a mandate for his wartime presidency. Turnout in 2012 was down to 126 million from 132 million in 2008. Obama won comfortably with 51% of the vote to Romney’s 47% and a popular vote margin of around 5 million. Romney polled about a million more votes that McCain so I don’t see where the hand sitting comes from either. The fact is the absolute ceiling on the Republican vote is around 60 million (the most they ever got was 61.5 million for Bush in 2004) while the Democratic ceiling is higher. The Republicans more or less maxed their vote but the democratic coalition turned out to vote FOR Obama and hence he won easily. On the other hand I can only endorse your desire Eric that the Republicans nominate more far right candidates. The more the better.

@HarvardLaw92:

Yes, but you fail to account for the vast hordes of ghost conservatives who are totally real, and totally not just the rather dull fantasy of rather dull people.

The Republican voters who sat this out, to the extent there were many, may have been indie types who are not Eric’s kind of Republican. There’s also the question of whether Sandy had a measurable impact on the vote totals (if voting was down a bit in in the Northeast, wouldn’t that likely hurt Dems more than Reps?). And how many Dem-leaners sat this one out (angry at warmonger Obama, sellout grannie starver Obama, etc)?

But look, you know what’s going on here. There is only ever one answer for Florack: Conservatism didn’t fail/wasn’t rejected by the public. It was failed, by a bad candidate. Next time: MOAR CONSERVATIVE!

Yes, please. Oh please oh please.

@michael reynolds:

LOL, good point.

@Rob in CT: obama has offered no real spending cuts outside the military.

Can someone explain why the only government spending the left will ever cut is the military?

And ypu tell ME…. Where does ‘From each according to his ability’ run afoul of OBamas mantra?

@Rob in CT:

I will agree that Romney was an awful candidate, and his own combination of errors & Dark Ages policy positions in the primaries combined to torpedo him. The peculiar schedule and make-up of the Republican primary season combines to saddle them with weak candidates, time and time again.

That having been said, the True Believer™ conservatives will never accept that 1) they do not constitute an absolute majority of the electorate or 2) that running to the right costs them elections.

And you know, speaking as a moderate to liberal leaning voter, that’s just fine with me. Why work to defeat them when they’re seemingly scope locked on defeating themselves?

@john personna:

Your defense of slavery has been duly noted.

@john personna: As a nation, we keep going at the budget from the revenue side, trying to nail down the amount of money we will have and then hope to balance the budget. Seems like that never works. Maybe we need to start voting on SS, Medicare, Defense spending and spending cuts, etc. and see what we need. Then build the tax structure to fund it. Let’s make the politicians vote on the goods and services the government will or will not supply. The other way has not worked. This may not work either but it is worth a try.

@Eric Florack:

The only government spending that anybody will ever cut is the spending that nobody likes, and that’s pretty much negligible.

The American voter, for all his bellowing to the contrary, loves HIS government spending. He just hates everybody elses. Cut Social Security or Medicare and you anger seniors, the moderates and the left. Cut the military and you anger seniors, some moderates and the right.

The bottom line is that anybody cutting anything will be set aflame on the campaign trail, so we get rhetoric but no actual cuts.

Because, at basis, the voters don’t actually want them.

This is false, and weasel-worded to boot.

Medicare and other non-military spending categories are on the table. So this is not so. However, as to why “the left” prefers military spending cuts to other spending cuts: because there is a general belief that military spending is well above what is necessary to accomplish the mission of our armed forces and because people on the left generally tend to think that a dollar spent on education, healthcare, etc. is a dollar better spent than one spent on another submarine.

And ypu tell ME…. Where does ‘From each according to his ability’ run afoul of OBamas mantra?

Doh, screwed up my tags at the end there. I think it’s obvious that the blockquote is actually my response.

I think the interpretation here is just kind of silly.

Tax rates on the wealthy are at historic lows, and the deficit is at historic highs. People know this, and they can put one and one together and get two — even if they really are oversimplifying and should be putting one, one, zero point three and countless other factors and getting seventeen instead.

The Republicans talk about raising taxes on the job creators, the Democrats talk about restoring rates to the Clinton era, and most people know that unemployment was lower in the Clinton era. Voila — if you want lower unemployment, recreate the situation of the 1990s for the job creators.

I’m always fascinated by the superficiality of the longing for the Clinton era tax increases/rates.

There are several fallacies. First, the baseline economic performance of the country was on a better footing then. Second, add the ObamaCare tax increase and the invocation of Clinton era rates falls 4%, or 10%, short of the proposal. Third, long forgotten is that Clinton passed a countervailing capital gains tax reduction, and certainly not an increase.

You add to this the simple arithmetic that the proposed rates and absence of spending control mean we are going to get absolutely no material deficit reduction and one is left asking WTF??

I’m always fascinated by the superficiality of the longing for the Clinton era tax increases/rates.

There are several fallacies. First, the baseline economic performance of the country was on a better footing then. Second, add the ObamaCare tax increase and the invocation of Clinton era rates falls 4%, or 10%, short of the actual proposition. Third, long forgotten is that Clinton passed a countervailing capital gains tax reduction, and certainly not an increase.

You add to this the simple arithmetic that the proposed rates and absence of spending control mean we are going to get absolutely no material deficit reduction and one is left asking WTF??

PS

And for those longing for the supposed glory years of the 50’s, and their supposed 80-90% rates, you really need to do some homework. The 250 or so taxpayers subject to those rates, after deductions taken into account, would today leave only Warren Buffet, Bill Gates and some rap, rock’n’roll, or movie stars or a few corporate execs subject to them.

@Rob in CT:

If you spend money on a railroad, or a bridge repair, or a school, it gets put to productive purpose right away. The economic benefit is simultaneously long-lasting, immediate and a multiplier, as people start to use that bridge to drive to work and school, move goods back and forth, etc. and can do so for decades.

But if you spend money on a tank, what does it do to add value to the economy? Once built it just kind of…sits there.

Indeed, hence not wanting full expiration at this time.

That should be factored in, sure.

Forgotten by some. Others remember, and differ strongly as to whether it was a good idea.

The idea is to start chipping away, from both sides, now. But again, as you obviously know: the economy is more fragile now than it was in the 90s. So the reason I’m not going “WTF!?” is that I recognize that and therefore accept a more cautious approach at deficit reduction.

We can gently apply the brakes. Or maybe we should just slam the car into a brick wall? That’ll stop it, but it tends to cause other problems…

@Drew:

True.

Better would simply to look up the charts people have made showing the % of total tax burden borne by various income groups. The tax burden at the top was decreased.

I don’t love this chart, but it’s one example of what I’m talking about:

http://www.datapointed.net/2011/03/relative-us-income-taxes-1913-2011/

This article contains a number of good charts:

http://www.theatlantic.com/business/archive/2012/04/how-we-pay-taxes-11-charts/255954/

@Drew:

I don’t know anyone who is longing for a 90% rate. We’re talking about a 4.6% increase on only that portion of income above 250k. It’s a return to a slightly higher rate that at the time it was first invoked notably did not cause the economy to blow up, or increase the deficit, or lead to billionaires going Galt, or to slavery.

Mr. Florack, you may stop right there.

@Rob in CT:

In support of your point, the typical American believes that 25% of the federal budget goes to foreign aid, something that consistently polls as a low priority. It's closer to 1% of the budget.

@grumpy realist:

Because most people don’t see “the military-industrial complex.” That’s an abstraction. What’s real is the kids who graduated from the local high school and joined the Army.

rob:

Both those links are excellent, thank you. I’m going to list them again:

U.S. Taxes By Income Level Over The Years (link)

How We Pay Taxes: 11 Charts (link)

james:

I hear two different narratives:

A) You better not raise my taxes. Why? Because I’m a job creator, and if you raise my taxes that will reduce my profits (because it’s a cost I can’t pass along to my customers). When you take away my profits, I am no longer motivated to grow my business and create jobs.

B) You better not raise my taxes. Why? Because I will just pass along that extra cost to my customers. I won’t be hurt a bit, and my profits won’t be effected, but don’t you feel sorry for my poor customers?

Conservatives are telling both of those stories. Trouble is, they are contradictory. Don’t you think you should decide what you really believe, and pick one?

drew:

The one who “really need[s] to do some homework” is you.

The top rate is interesting, but what really matters is the effective rate. The effective rate for the rich is now roughly half what it was in 1953. If we returned to that level (just for the top 1%), roughly half the deficit would go away. Link.

@michael reynolds:

It’s a return to a slightly higher rate that at the time it was first invoked notably did not cause the economy to blow up, or increase the deficit, or lead to billionaires going Galt, or to slavery.

Or stop small businesses hiring……the favorite Republican fiction. Of course it’s a fiction aimed at people who have never read an economics textbook and thus don’t understand that the only reason a business adds the cost of a worker is if he/she is going to add to revenue and the bottom line. It has nothing do with marginal changes in tax rates.

@Drew:

And for those longing for the supposed glory years of the 50′s, and their supposed 80-90% rates, you really need to do some homework.

Strawman bs…..no one is longing for 80-90% tax rates

I’m most impressed by the public’s support for cutting spending across the board, which is equivalent to letting our economy bleed out. Brilliant stuff there, America.

@jukeboxgrad: Both can be true. It depends on how the business is structured.

@Drew:

Ultimately American democracy rejected slavery – but when we think of our noble history, we don’t start the clock in 1860, or 1960. We are proud of the American experiment going right back to slave holding founders.

We are a nation with a contradiction.

@Drew:

Funny how many rich old guys, who made their nut under those earlier tax rates, swear they’d never do it again.

I disbelieve.

@Mikey:

Actually both are bs conceptually. Decisions about enlarging or shrinking one’s business do not revolve around the marginal tax rates of its owner.

@Dave Schuler:

Yep. Last I checked, foreign aid clocked in around .6% of federal spending. I’m not going to bother to do it, but I wonder what the number is if you remove the money that goes to Israel and Egypt (b/c, as I understand it, the Egyptian money was for peace between Egypt & Israel)… I’d guess a significant chunk of the “cut foreign aid!” people would balk at cutting Israeli aid (though I doubt a majority).

The NYT had a decent tool you could use to close the deficit (or not) a while back. While I might quibble with the options they provided, I don’t think anyone could play their game and fail to realize where the meat (erm, pork?) is in the budget. It’s like Krugman said: the Federal government is an insurance company with an army. From a budgetary standpoint, that’s about right.

@scott:

As a nation, we keep going at the budget from the revenue side,

Total nonsense the budget is driven by expenditures. The only reason we have a big problem at the moment is that revenues fell to 15% of GDP for 4 years while expenditures jumped initially to 25% of GDP. They’re now running in the 23’s and forecast to go into the 22’s for the next four years.

@john personna:

That´s the problem. To most people, middle class are themselves, poor people are people that have less money than them and rich people are people that are richer than they are. Republicans usually defends cutting “spending” (But no Medicare, Defense or SS) because most Republicans are usually White Retirees that thinks that the government spends too much with people of color. Democrats are a much different coalition, but they don´t generally see themselves as rich(Even if they are).

The problem is that both parties talks like if taxes are a choice. They aren´t.

@ Eric Florack

The first mistake here is the one that far-right Republicans like yourself continue to make as you sit in your talk radio echo chamber. Everyone is NOT a Santorum Republican. If we Republicans think this election was a lesson that we need to put more Tea Party conservative Republicans on the ballot then the party will be doomed to an existence as the perennial second fiddle.

The Republicans put themselves in a position where they had to choose between fringe nut-jobs like Bachmann and Santorum and a vacuous big business empty suit like Romney. By doing this and alienating candidates who would have been better for the country, like Huntsman and yes, even Ron Paul, they sealed their 2012 defeat. I voted McCain in ’08, but I was so disgusted with the direction of the party, the increasing jingoism, racism, and faux-patriotism that I voted for Obama.

The amount we spend on defense, particularly given our lack of many natural enemies is insanity. At the same time, obviously we have to alter/cut the present state of SS and Medicare. SO:

Why is it that many on right only want to cut invisible expenses like PBS or NPR and completely ignore the elephants in the room?

@Rob in CT:

It’s like Krugman said: the Federal government is an insurance company with an army. From a budgetary standpoint, that’s about right.

Exactly right……and it’s a very big army. It’s hard to remember a period in modern history which I’d date from the 18th century when the major military power in the world had military expenditures equal to those of all the other powers in the world combined.

And in a related matter (link):

@Rob in CT:

No, the problem is that people underestimate the cost of government while they overstate the taxes that they pay. That´s the problem when you talk about Social Security and Medicare, and that happens in most countries of the World.

That´s part of the problem in Southern Europe. Here in Brazil everytime that someone complains about high taxes I point out that in fact taxes are pretty low considering that most people retires at age 55. If the government tries to make any curb to the benefits of retired people everyone begins to talk like if they are throwing granny under the precipice, but these things are unsustainable.

For those who aren’t aware of him, Andy Borowitz (cited above) is a humorist.

@scott:

No, taxes are going to go up, because there is a higher proportion of retirees among the population.

@Brummagem Joe: True, but I was just pointing out there’s no inherent contradiction between the two positions JBG was highlighting.

@john personna: I’m not suggesting that popular will doesn’t matter. I’m analyzing why taxing the rich–i.e., somebody else–is the popular will.

@jukeboxgrad: They can both be true. A business has to recoup it expenses, so costs imposed by higher taxes have to be reflected in price. At the same time, businesses compete against foreign corporations that pay different tax rates, so may not have the ability to pass along the costs and maintain a competitive price. That reduces profits, and thus incentives to engage in business, competitiveness, or both. Alternatively, it encourages setting up shop or otherwise shifting one’s tax burden elsewhere.

@James Joyner:

You might also want to ask why “concentrate the wealth in the hands of the very few,” is a good policy.

People love to talk about the “Fall of Rome,” meaning the various barbarian invasions. They talk less about the fall of the Roman Republic, which expired in large degree because the Senatorial class had concentrated all wealth in their own hands — indeed to such an extent that they had a hard time finding legionaries since those worthies were required to own property.

It was the concentration of wealth and the disenfranchisement of the farmer/worker class that led to the societal instability that brought on the empire. The Wal-Mart heirs have as much wealth as the bottom 40% of Americans combined. The top 1% and the top 1/10th of 1% have more and more at the same time as the middle class is slipping. That is not a recipe for social stability. What it is (given our democratic system) is a recipe for the many taking from the few.

The few can address this by perhaps paying enough now to keep the safety net in place, or even by (gasp!) paying their workers a living wage and taking less profit, or they can insist on more and more and more until the Fox News propaganda starts wearing thin even for their dimwitted southern white men audience and the whole country starts voting to strip the rich down to their shorts.

I think what people like Drew and the GOP miss is that the votes are in the hands of the “mob.” The mob can come for their stocks and bonds and real estate any time the mob decides to. The danger is not raising marginal rates to 39.6% from 35%. The danger is in so screwing the working people that they unite.

@James Joyner:

Neat footwork JJ but you’re giving answers to scenarios juke box didn’t propose…..and I look forward to all these small businesses setting up shop elsewhere……or are you planning to domicile this blog in Belize?

@James Joyner:

BTW JJ I suggested Belize because I understand there’s a recently vacated Mr Kurtz type internet compound available for rent…..LOL

I love this “elsewhere” notion. If I wanted to cut my taxes by more than the proposed increase, I’d move to Florida. Am I moving to Florida? No. Humidity. Plus, no offense to Floridians, but it has taken over as the sleazy-and-crazy capital of America.

The other “elsewheres” are foreign countries where I’d still have to pay the IRS unless I emigrated permanently and became a citizen. In which case I’d be paying local rates which would be as high or higher.

So unless there’s some new business district in Antarctica I don’t know about, I’d say the “elsewheres” are blowing smoke.

Yes, one wonders why taxing the people who’ve taken all the money for themselves, rather than taxing the people who don’t have any money, is the popular will….

@James Joyner:

Since the time of Milton Friedman, if not earlier, its been a conservative trope that that liberals or the lower classes are selfish in that they vote benefits for themselves and/or others at the expense of those poor, benighted rich folks , often trotting out a quote from Burke or Bastiat.

In a word, its BS . What people are for is SHARED sacrifice, viewed proportionately. Again, its important to realise what all this Republication hollering about class warfare and victimizing the job creators is about. Its about returning tax rates to the rates of 1999-not a time of unreconstructed Marxism.

What will be the effect of this tax increase on the wealthy? It will just mean that they’ll buy a cheaper third car or a smaller second house-a much smaller effect that it would have on a poor to middle class person. In this tough economy, those making over $250,000 are the ones that can best offer contributing to deficit reduction.

What’s amazing is how far right wing propaganda has shifted the Overton window. I would understand this scorched earth resistance if Administration was talking about a 50 or 60 per cent top tax rate but 39.5? The job creators of the 1950s and 60s would think that a 39.5 per cent a top rate was a gift, compared to the 70 per cent rates they were seeing. ( Yes, I know they had more and different deductions, but there is no question that the tax burden on the wealthy has dropped sharply since the 60s).

mikey:

You’re right that there’s no contradiction in the real world, but there is a contradiction in the cartoonish world described by the conservative talking points.

In the real world, when my business taxes are raised the consequence will be some combination of the following:

– I’ll raise prices and transfer the new burden to my customers

– I’ll bear that burden myself in the form of lower profits

– I’ll cover the cost by finding a way to lower costs in other areas

– I’ll cover the cost by finding a way to increase sales and profits

– Some other possibilities I’m not thinking of

It will probably be a combination of things, and not just one thing. And there is no single, universal answer; the answer will vary greatly depending on the industry and the company.

That’s the real world, but the world of the conservative talking point is quite different. It’s an oversimplified cartoon. James said this:

That’s a cartoon, because he sees only one possible outcome, which he describes as a certainty. And then there is the alternate cartoon, which also sees only one possible outcome, which is described as a certainty. In the alternate cartoon, higher taxes inevitably hurt my profits, so I decide that job creation isn’t worth the effort.

Each cartoon is silly on its own, but they are especially silly when heard alternately, because they each deny the possibility expressed by the other one.

joe:

I agree. This is the broader, more important point. I might take tax rates into account, but this would be far less important than other factors.

james:

You’re contradicting yourself. It is not the case that “costs imposed by higher taxes have to be reflected in price.” That is only one possibility. Another possibility is that I do “not have the ability to pass along the costs,” and instead the cost is reflected in a profit reduction.

You’re on the right track by recognizing the possibility of more than one outcome, but you take a step backward when you say “have to be.”

@James Joyner:

One funny thing is that you keep telling this to a thread full of people who have been top bracket, and support slightly higher taxes on their past, present, or future selves.

Obviously we don’t count, and you need some low earners to make your point?

@jukeboxgrad:

That is very well put. I’ve made the case in the past – to the annoyance of some conservatives – that my response to higher taxes is to become more productive in order to keep my lifestyle at par. Incidentally, when I have to be more productive, I also have some knock-on effect in creating jobs in publishing. So as much as they don’t like to hear it, my reaction to an extra 4.6% marginal will be to work harder, do more, make more. At some point that could be self-defeating if rates went high enough, but we’ve already had 39.6% and we all did fine and no one stopped working.

@Andre Kenji:

Unsustainable? You mean Brazil is running out of doctors and nurses and clinics and houses and food? Sounds like you need to make investments in your national productivity, not increase the retirement age.

@john personna:

One funny thing is that you keep telling this to a thread full of people who have been top bracket, and support slightly higher taxes on their past, present, or future selves.

On this occasion we agree……I often wonder where JJ pitches his arguments

I find it telling that right above this article is one that says: “Republicans Will Cave On Tax Hikes For High Income Earners”

@James Joyner:

Willie Sutton famously said he robbed banks because that’s where the money is.

Similarly, we tax the rich because that’s who has the money.

looks like the party of JFK has flipped his famous quote around to deal with their narcissism!? they also prefer to receive than give, sad culture.

michael:

Thanks for the compliment.

I bet that’s pretty common. There seems to be a distinct lack of evidence that higher taxes convince people to work less. People who have studied the subject end up making discoveries like this (pdf, p. 4 in the pdf, printed page number 553):

So this is why revenue doesn’t always go up as much as it should when rates go up. It’s not that people are working less; it’s that people are smart about how to hide income, by collecting it in a form that’s non-taxable. If we wanted to make this harder to do, we could.

@Ben Wolf:

The problem aren´t nurses or doctors. There are plenty of them.

The problem is that there are too much people retiring at very young age. The AVERAGE age of retirement is 52, and lots of these people gets their full salary. Pensions that goes to widowed spouse or children are also very generous.

Seriously, there is a very bizarre(And sexist) entitlement that allows unmarried daughters of people from Military and Judges to get a full pension for life(While they are unmarried) . The Army spends 2 billion dollars per year only with that; It´s a Nimitz-class aircraft carrier every two or three years.

No matter how incorrect that idea is…the so-called War on Terror, much like the Cold War before it, has done wonders to keep the military-industrial complex propped up…

Of course any kind of reasonable conversation cannot be had when people spew rank horse$hit like this…the President is quite far removed from being a “socialist”…

Oh really? Perhaps that’s why so many of those Silicon Valley liberals actually think it is fair that they pay more in taxes to help the country as a whole…if we want to talk about narcissism, let us look no further than Mitt Romney and gasbags of his ilk who prattle on about how they simply can’t pay more in taxes because they are the “job creators” or the various jackasses who right after the election talked about how they were going to lay off workers or raise prices on their customers because their bottom lines were supposedly going to suffer…

@Rafer Janders:

Willie Sutton famously said he robbed banks because that’s where the money is.

A progressive taxation system is a new concept for JJ. It’s un American in his mind….LOL

@bill:

looks like the party of JFK has flipped his famous quote around to deal with their narcissism!? they also prefer to receive than give, sad culture.

Acrually the people who have done the flipping are the rich who were receiving a smaller share of the national income at the time and paying higher taxes upon it. It’s the narcissisim of garages with elevators and stealing pension funds so you can pay yourself bonuses that’s the problem.

James, this is also the attitude of our elites, who shudder at the thought of not getting even more tax breaks, or the horror of benefits not being chopped, while greedily lapping up more crony capitalism and bailouts for themselves.

We’ve tried that approach for a couple of decades, with only disaster to show for it – let’s try the opposite for a while.

@Jen: “Then they ask if you consider raising the retirement age a cut (personally, I do not. I see it as a necessary step as lifespans get longer). ”

Since we’re not living in a labor market favorable to 60-year olds, lifespan is irrelevant.

@Barry:

Exactly. If people can’t retire at 67, what are they going to do? Know that many jobs keen on keeping 67-70 year olds on the books?

@Rafer Janders: Heck, what’s the labor market like for over-50’s?

@Rafer Janders:

And they are hoarding it. Taxes can be a good way to force re-circulation of capital back into the economy.

Yes. This is important, and it’s something a lot of people don’t understand. Some articles discussing this phenomenon can be found via here.

Wait a sec, I distinctly remember all the high net worth types fleeing the country…

Heh.

I agree with your tax, sir, but will fight to the last drop of JP’s blood to keep my constituents from paying it……………..

http://washingtonexaminer.com/democrats-urge-delay-for-job-killing-obamacare-tax/article/2515711#.UMf0Ubb2Ez5

@Drew:

I love that I’m your Moriarty.

@Ben Wolf:

And people mean actual spending cuts, not just a reduction in the rate of increase in spending.

This is akin to practicing Medieval medicine – a regimen of bloodletting and leeches prescribed for low grade influenza.