Revised GDP Figures Show Strong Growth, Until You Look At The Details

3.6% GDP growth in the 3rd Quarter, but the devil is in the details.

The first revision of 3rd Quarter Gross Domestic Product was released today and, while it looks like good news on the surface, a closer examination of the numbers reveals that there’s little to be happy about and, potentially, a sign of problems in the future:

The economy expanded much faster than first thought in the third quarter, as the government on Thursday revised its estimate of growth in the period to a 3.6 percent annual rate from 2.8 percent.

That was significantly better than the 3.1 percent pace economists had been expecting, and it marked the best quarter for growth since the first quarter of 2012, when output jumped by 3.7 percent. It also marked the first time since then that growth had exceeded 3 percent.

Much of the improvement came from additional stocking up on inventory by businesses as well as a slightly improved trade picture.

Inventory changes are notoriously volatile, so while the healthier signals would be welcomed by economists, inventory gains can essentially pull growth forward into the third quarter, causing fourth-quarter gains to slacken.

Indeed, Wall Street was already estimating that the fourth quarter of 2013 would be much weaker than the third quarter, with growth estimated to run at just below 2 percent, according to Bloomberg News.

The anemic pace of fourth-quarter growth also stems from the fallout of the government shutdown in October, as well as the continuing fiscal drag from spending cuts and tax hikes imposed by Congress earlier in 2013.

Still, if the better data on growth from the Commerce Department on Thursday is followed by more robust numbers Friday for the nation’s November job creation and unemployment, it increases the odds the Federal Reserve will soon ease back on stimulus efforts. The jobs data is scheduled to be released by the Labor Department at 8:30 a.m. Friday.

The labor market data for October was significantly better than expected, despite the government shutdown, and the consensus among economists polled by Bloomberg News is that the economy may have created about 180,000 new jobs in November, while the unemployment rate may have fallen to 7.1 percent from 7.3 percent in October.

Federal Reserve policy makers next meet on Dec. 17 and 18, with an announcement and news conference with the Fed’s chairman, Ben S. Bernanke, scheduled for the afternoon of Dec. 18.

Investors are eager for signs of stronger economic growth after years of only tepid gains, but they are also nervous about how quickly the Fed will step back from its aggressive stimulus efforts and let long-term interest rates begin to inch back up.

“You can never be unhappy with a 3.6 percent number for gross domestic product,” said Ian Shepherdson, chief economist at Pantheon Macreconomics. “But the details are more sobering than the headlines. Apart from the inventory numbers, the revisions are pretty trivial.”

For instance, he said, “Final sales, meaning the demand for goods and services excluding inventories, actually slowed. Either companies thought demand would accelerate and built inventories in anticipation of sales that didn’t happen, or they’re building anticipation of stronger demand in the fourth quarter.”

This 3.6% growth rate is significantly better than the initial estimate 2.8% that was released last month, if all you’re doing is looking at the surface numbers rather than what lies underneath. However, that doesn’t necessarily appear to be the case. The main reason for what is undeniably a huge increase in GDP growth turns out to be a massive increase in inventories held by American businesses. As Reuters notes, inventories as reported grew up $30 billion more than expected and accounted for nearly 1.7 percentage points of the advance in GDP growth that was reported today. Indeed, taking inventory growth out of the equation completely puts the overall GDP growth rate at an anemic 1.9 percentage points, far below what is considered ideal. Obviously, some of that inventory is likely to be sold during the Christmas shopping season but, as Tom Blumer notes, that’s not necessarily going to lead to strong increases in revenues or profits, especially if, as early sales figures seem to indicate, retailers are going to have to attract increased sales traffic by heavily discounting prices to entire consumers. More importantly, a large spike in inventory growth in the 3rd Quarter most likely means much slower inventory growth in the 4th Quarter with the consequent impact that will have on GDP growth for that part of the year.

Matthew Yglesias is among those cautioning against viewing today’s report as overly good news:

The key phrase here is “private inventory investment” which is when businesses build up their stock of goods. Inventory investment tends to swing. If firms build up inventories of unsold goods in one quarter, they typically spend down that inventory in the next quarter. The workhorses of exports (selling stuff to foreigners), PCE (selling stuff to Americans), and nonresidential fixed investment (so companies can make the stuff they sell to foreigners and to Americans) all decelerated.

Relatedly, Gross Domestic Income—an alternative procedure for counting up the same concept that GDP measures—rose only 1.4 percent in this report. The GDI approach is generally more accurate, further underscoring there are a lot of dark clouds to this silver lining.

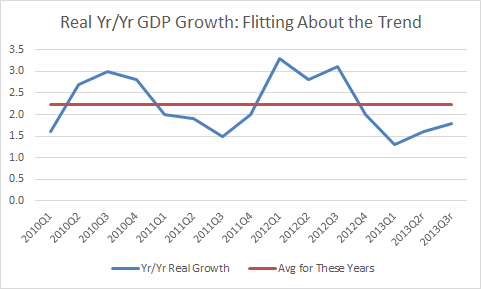

Jared Bernstein, meanwhile, notes that even with today’s “good” number, GDP growth over the past three years remains stuck in a relatively unimpressive range between 2.0 and 2.5 percent growth:

[W]hat you really want to do here is block out some noise and boost us some signal by taking year-over-year changes.

That’s what I do in the figure below, along with an average over this time period of the past few years. As you see, growth has flitted around a trend just north of 2%. That’s about the economy’s trend growth rate right now, and again, what’s wrong with the trend?

Well, I’ll tell you: we’ve settled into it-the trend, that is-too soon. We’ve yet to close the output gaps in either GDP or jobs that persist and continue to weigh on many households, for whom growth is more something they read about in the paper than experience themselves.

After such a deep recession, you want a “bounce-back” period before you settle into the pattern of trend growth in the picture. To be clear, I’d much rather be there than south of that line, but policy makers must not take too much solace from the trend when it really represents an unsatisfactory “new normal.”

Here’s the chart that Bernstein created, and you can see exactly what he’s referring to:

So, yes, it was nice to see a solid GDP figure for once, but since its based on a one-time inventory spike it should not be take as a sign that we’re suddenly entering a period of substantially stronger growth. As the chart shows, we had a similar spike in 2011 and 2012 and still ended up reverting to the mean after a quarter or two, and all the available evidence indicates that this is likely what will happen going forward. We’re still stuck in a cycle of relatively slow growth, which is the main reason why our job growth has been, at least up until now, so pathetically weak.

Tomorrow, we’ll get the Jobs Report for November, and we’ll see where things stand in that regard. Currently, analysts are estimating about 180,000 new jobs created last month, a respectable number just like today’s GDP number is, but hardly anything to cheer about.

One thing for sure, I sure do miss those days back in late 2008 and 2009 when the economy was shedding jobs at a rate of over 700,000 per month.

I’m not sure that conservatives could ask for more – there is no net growth in government sector jobs, we have reduced the rate of government spending which also serves to slow growth, the ratio of deficit to GDP has been steadily been decreasing, unemployment is slowly decreasing, and overall net growth is a modest 3% or so.

Except for the fact that Obama is a Democratic president, Republicans would normally be happy with the progress the economy has made since the 2008 financial catastrophe.

I think the possibility of a banking collapse was my personal favorite. So many of my elders have told me stories about the depression over the years, I have always wondered what it was really like to live through one.

Damn that Obama for not letting us go over the cliff!

If the economy grew at 15 per cent, Doug would be bad-mouthing the economic report. His shtick is pretty tired now.

“The economy is growing, but because Obama is still President, things still suck” . Write that next time, Doug, rather than going through the pretense of analysis.

Doug’s post reminds me of an old farmer joke. Grew up in a small community in Minn. Seemed like there was always something; late spring, too much rain, no rain, grasshoppers, something. When they did have a decent crop prices were depressed. One year everything came together, seed, fuel, and fertilizer prices way down, perfect weather, and crop prices way up. Best year the farmers had ever had. At the hardware store I overheard an older local farmer, known for a sour outlook, “Yep, them heavy crops sure do take a lot out of the soil.”

OK, maybe it isn’t a trend, but isn’t a quarter at a 3.6 rate a good thing?

I guess the question is, last quarter did Doug do a post that noted there were positive signs buried in the data? The issue here is lag, right? You have solid growth but signs point to slowed growth next quarter. The reverse should have been true last time.

I could have missed it because I glaze over at this point, b/c Doug’s economic report posts all seem the same. Did you notice last quarter that data indicated reason to hope for a good quarter this quarter? If not, you might want to ask yourself why you find the negative stuff now, but not the positive then. It might have nothing to do with your politics – I tend to be slightly pessimistic about this stuff and could easily see myself falling into the same pattern.

…

And this is absolutely spot on.

Every time I hear “better than expected economic news” I can almost read Doug’s coming post. It’s like you are the anti-pollyanna of economics Doug.

@al-Ameda:

Well I am. In fact, they are demanding more.

@OzarkHillbilly: He wants to be Cassandra, and is royally irked that his predictions of DOOM! DOOM! DOOM! aren’t coming true?

Like a lot of the Bitcoin fanatics, so certain that the US currency is about to collapse on us.

How about a Bitcoin thread, Doug? It’s turning into a pretty wild sleigh-ride, what with one Bitcoin (momentarily) being more valuable than one troy oz. of gold and the price shooting up, up, and awayyyyy into the stratosphere.

(Reminder to self: tattoo “tulip bulbs” on chest of next Bitcoin starry-eyed tub-thumper who I run into.).

President Obama is going to pivot to the economy…again.

While the numbers here are good, there still remains the great issue of unemployment. I’ve been unemployed for a time, it’s godawful; and reading happy GDP numbers sure doesn’t help.

@Gavrilo: Wow, sure is sad watching you root for America to fail, and seeing how desperate you are at signs of success.

@wr:

This whole “rooting for America to fail” nonsense is really lame. I think it sucks that gdp growth is so small. I think it sucks that unemployment is still over 7%. And, I think it sucks that our President doesn’t even pretend to care anymore.

@anjin-san:

Not to worry. Republicans are more than willing to leverage their demands into a default on American debt securities. Clearly, they too are curious as to whether or not another Great Depression is what we really need to restore that lovely idyllic early 20th century pre-socialist order to America. It’s all deeply moving.

@Gavrilo:

I don’t suppose you remember the jobs bills, that the House refused to pass?

Alert voters might understand how gridlock affects this.

They might even remember which party has gridlock as a plan.

For the last several years, since around 2006, the job situation has been in a cycle, better illustration would be a sink drain. People I have known had well paying jobs with banks, utility companies, even state government. They they got laid off or their jobs were “riffed”. These were well paying jobs and had great benefits. Now some are still unemployed. Some have been able to get occasional work, such as assembling instructional books or selling shoes. These are low skilled, low pay jobs with no benefits. These people are in their early 40’s and early 50’s. The outlook for them is not good.You know something is wrong when school teachers get laid off. Things are going down hill completely. I would like to see statistics that go back several years and show average wages compared to inflation. And people who have returned to work: are they making more then they did? My pay has been frozen since 2009 and it looks like it will stay that way: all the while prices on food have in many cases doubled. A bag of fiery Cheetos was $1.88. Now it is almost $4 and I think the bag is even smaller. A large candy bar is $2, was $1. Canned drink was 50 cents about three years ago. Now it is over $1. Fruit and vegetable are also too high. People can’t live on these rising food prices. $1 for a small cup of coffee at a fast food place !

The pattern is clear: things ain’t getting better. There’s too much month and not enough money. I think that a lot of time the government wants to sugar coat things. I go by what I am seeing, feeling, and making.

“I fell into to a burning ring of fire. I went down, down, down, and the flames got higher” (Cash, “Ring of Fire”)

@Gavrilo: Lmao, there is a jobs bills that has been sitting in Congress for well over two years now that the house refused to bring up.

This is becoming tedious.

Doug and his Republican friends do what they can to sabotage the economy… Then complain the economy has been sabotaged.

Doug’s an ass.

End of story.

Absent the Republican austerity effort this GDP would be… What…another point higher?

Tomorrow the jobs report will come out… Held back by Government cuts…and Doug will whine about the weak recovery… That policies he advocates has engendered.

Like I said…it’s getting tedious.

@ Gavrilo

I don’t know about you, but my net worth has gone up quite a bit during the Obama years. Considering the utter disaster he inherited, he has done a damn good job.

Then you are an anomaly and probably part of the 1%.

I don’t see how this post is “anti-Obama.” Pretty much every mainstream economist has painted the economic picture the same way Doug has and I would label the majority of economists centrist to left-of-center (from the average American viewpoint.) This recovery (and the one after the small recession in 2001-02) have simply not stacked up to recoveries of the past. And that can be the case without it being “Obama’s fault.” (Especially since the last tepid recovery was during Bush’s term.) Personally, I think it has more to do with advances in productivity associated with technology than any macro-economic policies.

@C. Clavin:

The BLS report is out…and yup…another 7000 Federal Govt jobs cut.

Take into consideration that every Republican President has added jobs…and you have a net loss of perhaps twice that.

And this has been going on for years.

Still we added over 200K jobs.

We ‘ll see if Doug acknowledges that his policy wishes are holding back the economy.

@gtleviathan:

It’s not anti-Obama per se. It’s pessimistic, and virtually the same as every such post Doug writes, which gets a little tedious, especially given Doug’s politics (the guy’s a libertarian who wants the government to shrink. Things he says he wants are being done. Some of us would like a little recognition of that. This is the result, at least in the short-term). I wasn’t reading his economy posts in, say, 2004. I suppose it’s possible he was pessimistic then too, but I haven’t gone to the archives and checked.

I agree with your overall diagnosis. This has been building for a long time (30-40 years, IMO).

@TarianinMO:

My net worth has also increased in the last 5 years…considerably.

And no… I’m not a 1%er.

@ TarianinMO

Nope, not a 1%er. By a long shot.

Why is it so hard for you to imagine people net worth going up under Obama? Consider the full recovery of the stock market that was devastated when he took office, along with the recovering real estate market, which also lost tremendous value under the previous President.

@TarianinMO: @anjin-san: Me too. Not 1%, and my net worth has gone up considerably. I believe you’ll find this is the rule, not an exception. Considering the unremitting opposition of Republicans to economic polices they supported under W, Obama has worked miracles. Look at the real numbers, Tarianin, not what you hear in the CEC bubble.

@C. Clavin: $4 for a bag of Doritos. $1.50 for a small cup of coffee.