Stimulus Spending Doesn’t Work – Tax Cuts Do

Via Jonathan Adler, I see that world-renowned economist Robert Barro and his student, Charles Redlick, takes to WSJ to summarize their research report showing that stimulus spending doesn’t work. Oddly, take cuts do.

The bottom line is this: The available empirical evidence does not support the idea that spending multipliers typically exceed one, and thus spending stimulus programs will likely raise GDP by less than the increase in government spending. Defense-spending multipliers exceeding one likely apply only at very high unemployment rates, and nondefense multipliers are probably smaller. However, there is empirical support for the proposition that tax rate reductions will increase real GDP.

Given that this comports with my own sense of how things work — and that Barro is sufficiently important that I was aware of him as a political science graduate student in the early 1990s — makes me somewhat confident in the results. That they mostly relied on massive increases in defense spending during wartime, for reasons that are empirically sound but nonetheless muddy the research finding — detracts somewhat.

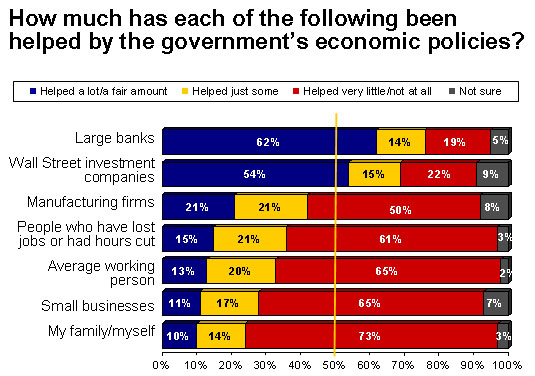

What’s interesting, though, is that public opinion seems to match up well with Barro and Redlick’s findings. Kevin Drum points me to this chart from John Judis showing that most people think the stimulus helped large banks and Wall Street investment companies but not the little guy:

I’m generally skeptical of asking ordinary people questions of this sort since they don’t have the training to make useful evaluations. (Full disclosure: Neither do I.) Nonetheless, I both think they’re right in this case and, regardless, what they think will influence how they vote.

I’m generally skeptical of asking ordinary people questions of this sort since they don’t have the training to make useful evaluations. (Full disclosure: Neither do I.) Nonetheless, I both think they’re right in this case and, regardless, what they think will influence how they vote.

There is a nice section in Taleb’s books, written with a slightly different emphasis in each, on batting averages.

It might seem a far cry from stimulus, but it illustrates (if you have time, read it) how we tend to rely on numbers while not really understanding their uncertainty. To put it in a nutshell, someone may get a Sports Illustrated cover spot, and then turn in an average season the following year. Was it because a star player declined, or was it because average players may get a good year?

The number economists use to gauge stimulus, the multiplier, is even more vague than a home run average. Not only that, they only have half a dozen US “games with one player” to consider. I’m pretty sure they are over-mining the data.

I’d have slightly more confidence if their study was global, and compared multiple players (countries) in each game (recession).

… I’ll outsource the rest to Nassim Taleb. Don’t trust numbers that do not have proven predictive power.

Same comment from a different angle:

When they looked at these past US conditions, they chose a few economic inputs among many (spending, tax) but left many out (cost of oil, trade balance).

They got a correlation, but was it … like the famous example of Butter in Bangladesh?

Tax Cuts Work? Not..

“Kevin Drum points me to this chart from John Judis showing that most people think the stimulus helped large banks and Wall Street investment companies but not the little guy”

That’s not what the chart is about. Read the heading.

More money has been doled out in non-stimulus, so I’m not sure why you think that chart should reflect stimulus.

Yes James, that makes sense. Ask not the people who the policies effect. Ask the elite under intelligent over educated experts how a policy is effecting our lives. After all, this is the thinking that led to this situation. Instead of representing, those who do the academic work, led by those who cannot apply what they have learned to the real world, so they teach, get the acknowledgement of their peers believing they know what is best for the rest of us poor unwashed. That is the kind of thinking that gets a person killed during a revolution. What you refer to as ordinary people is so elitist, I think you need to check yourself, James. Are you special? Do you have an IQ above 143?

In our present circumstance tax cuts would have another very strong impact on the economy by establishing a sense of confidence for business and consumers going forward. Businesses were especially wary of the incoming administration’s plans and immediately looked to hunker down. Higher taxes and more regulation were likely so risks needed to be minimized.

A tax cut would have established that Obama had some understanding and empathy for the productive class, the producers and makers, instead of the government class. Unfortunately he sent the wrong message and we find ourselves in the 21st century malaise. With no certainty or stability on the horizon I doubt business will be looking to expand for some time. That will delay any recovery and perhaps create a self fulfilling prophecy of a double dip recession.

Tax cuts are more than money transfers. They establish the environment in which business will operate and consumers will spend. The multipliers have been established for them yet government continues to think more government is the answer. Not only is there no multiplier there is tremendous inefficiency and waste.

If our president wants a recovery I suggest he drop Waxman-Markey, drop health care reform in it’s present form, freeze regulations, cuts taxes minimally, and talk up who really makes the world go round, American business.

What are we trying to stimulate? Jobs, wealth? Will the jobs create wealth or just better unemployment statistics? Is the stimulus designed for political purposes or righting a foundering ship? Who and what creates wealth? If the answer is free citizens who can use their intellectual capital to create physical capital, they need not be constrained by arbitrary looting of their hard earned rewards. Keep taxes low, keep spending low, and as the US Constitution mandates,”…promote the general welfare…” not provide it.

You do realize that Obama DID cut taxes as part of his stimulus package, right?

We don’t have a strongly planned economy, but we seem to be drawn to mild versions of economic planning. Even the conservative wing in US politics thinks they can plan a free market with their tax cuts.

All planning error is compounded because every problem, every economic condition, is a new one. Any moment in history is arguably like another in some way or another, but it is always a loose comparison. One person can say this is like 1964 another can say it is like 1972.

With respect to stimulus and tax cut, it’s important to remember that we were IN a regime of tax-cut before this crisis hit. We have been, as James blogged earlier, operating at low tax rates from a US historical perspective.

The first question is, if tax cuts work, why didn’t they? We had pretty anemic growth and poor employment even as we cut tax to a US low.

BTW, I saw an interesting chart this morning on total US debt. What was different about it was that it went back decades, and broke out “financial sector” debt. That sector was responsible for more of total US debt that I suspected. Wall Street gone wild.

Drew and I disagree on a lot, but we agree that more of our problems are debt problems than most people will admit.

Steve,

That’s impossible. Obama is a Commie Nazi Socialist Fascist Autocrat Banana Republic Dictator therefore he cannot have cut taxes. QED.

These two subjects — how large is the multiplier & who people think were helped by the government– have essentially nothing to do with each other.

I challenge you to explain how people thinking that banks were helped more than the average person causes the multiplier to be low.

I’m willing to bet you can not do it.

In our present circumstance tax cuts would have another very strong impact on the economy by establishing a sense of confidence for business and consumers going forward. Businesses were especially wary of the incoming administration’s plans and immediately looked to hunker down.

Right, everybody “hunkered down” right after Obama was elected. That is, of course, if they survived the last months of the Bush administration. Everybody was pretty well hunkered long before Obama showed up.

Come on Pug, you’ve got to believe the temporal anomaly! We learned about those from Star Trek reruns. After Commie Nazi Socialist Fascist Autocrat Banana Republic Dictator Obama builds his time machine he will go back to corrupt the otherwise excellent Bush economy.

Yah… gotcha… all them Bush Tax cuts really helped me… Just like those Reagan tax cuts made my life so much better…

This is a joke, I truly wish I did not work for a living, than I would have time to reply to this idiocy (yah, I know, I am a troll,)

James, before you get your panties in a bunch, who designed the tax cuts? You? Me? Let us get real… the same bunch of bozos who designed the bail out which was needed for the dereg designed by the same guys…

Do we really have to go through this crap again?!?!?!

Barro’s recycling a column from last January that was thoroughly de-bunked. Menzie Chinn & James Hamilton have data here: http://www.econbrowser.com/archives/multipliers/index.html

and for those Krugman, Thoma, DeLong, et al http://economistsview.typepad.com/economistsview/2009/09/government-multipliers-once-again.html

And new player(s) http://www.voxeu.org/index.php?q=node/4036

By now, we should know that if it’s on Murdoch’s editorial page, it’s tainted by dogmatic bullshit.

James, interesting responses. You present evidence and the first response you get is we can’t trust evidence of any kind, and then the ideological comments spew forth. Great stuff. Really makes it tough to imagine a conversation is even possible.

Old news? Hmm, maybe James can do his take on inequality and how it might be driving tea parties.

Background.

Alex and Steve, I guess I didn’t realize taxes were monolithic now. A little cut here or there accompanied by massive deficit spending that has to lead to higher taxes or inflation, or both, does not impress me as a tax cut, regardless of President Obama’s political inclination.

Let’s see. Obama inherited an economic train wreck from Bush. Nine months into his administration we are poised for positive growth.

Kinda hard to see how this translates into an Obama screw up…

Heh, it turns out that Barro’s number is not just a normally bad economic talisman, it is an especially bad one:

@Charles

Yeah, well at least Megan’s honest, Charles:

Ah, didn’t mean to imply that you’re not honest, Charles–sorry if it came across that way.

Yes Charles, the book “fooled by randomness” is exactly about how we trust some kinds of numbers too much. It really is worth a slow and thoughtful read.