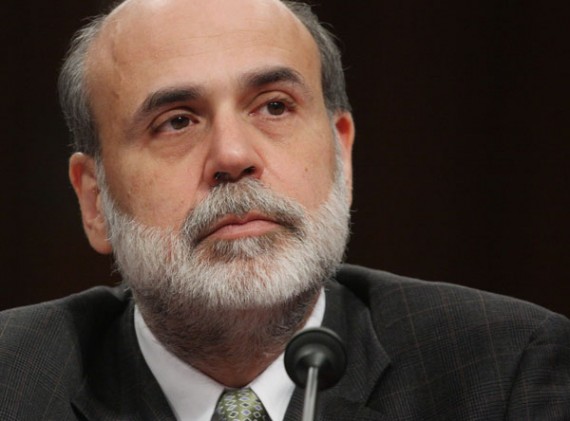

Ben Bernanke: GOP Spending Cuts Will Not Harm Economic Growth

Speaking before Congress yesterday, Fed Chairman Ben Bernanke debunked the assertion that the GOP's relatively modest $61 billion spending cut package would significantly harm economic growth.

Responding to reports, including a Moody’s analysis that Alex Knapp wrote about the other day, Fed Chairman Ben Bernanke testified yesterday that the GOP’s proposed package of $61 billion in spending cuts would not have a significant impact on economic growth:

Federal Reserve Chairman Ben Bernanke says a plan from House Republicans to cut $61 billion in spending this year would not harm economic growth.

The GOP’s proposed spending cuts, passed as part of a continuing resolution, would probably reduce “growth on the margins” and lower gross domestic product by only one- or two-tenths of a percent, Bernanke told the Senate Banking Committee.

(…)

“Two percent [reduction in growth] is enormous and would be based on $300 billion in cuts,” Bernanke told the panel in his semiannual report to Congress. “SixBer

ty billion to $100 billion isn’t sufficient to create that kind of effect.”

Although Bernanke didn’t provide a projection of possible jobs losses from the spending bill, he said the proposed spending cuts aren’t likely to lead to the 700,000 job losses predicted by Moody’s Analytics chief economist Mark Zandi.

He reiterated previous statements that, while the debt and deficits are major issues for the nation, Congress needs to tackle the issue of long-term budget imbalances.

“Sixty billion won’t have much impact on the long run,” he said. “Congress needs to address the budget deficit over a 5- to 10-year window.”

Bernanke said he would like to see the nation’s structural budget deficit reduced by 2 to 3 percentage points in the next decade.

Bernanke’s analysis is similar to that of economist John Taylor in his own dismantling of the argument that reduced government spending is a bad thing:

The analysis in this Goldman-Sachs report is based on the same type of “large multiplier” theory that predicted that the stimulus package of 2009 would stimulate economic growth. Research by me and my colleague John Cogan finds that more up-to-date theories, which bring important incentive and expectations effects into account, show far smaller multipliers. In these models a reduction in the growth of spending will immediately crowd in private investment. Moreover, by following the stimulus money, we found that in actuality the stimulus package of 2009 had no material positive effect on economic growth or employment. The same economic theory which said the stimulus would increase economic growth in the past two years, says that reversing that spending will reduce growth now. It was wrong in the past and it is highly likely to be wrong again.

As I have written before, the old-style Keynesian approach used by Zandi has many of the same flaws that are found in the Goldman Sachs approach: excessively large multipliers, inaccurate predictions of the effect of the 2009 stimulus, failure to recognize that reducing uncertainty about the debt can have positive effects, especially if it is done in a credible way by reducing spending growth now, not postponing it to a date uncertain in the future. After stating that “too much cutting too soon would be counterproductive,” Zandi claims that this is what the “House Republicans want” and what their budget does. But it’s simply not credible to say that a budget that has government spending increasing at 6.7 percent per year cuts spending too much too soon.

In sum, there is no convincing evidence that H.R. 1 will reduce economic growth or total employment. To the contrary, there is more reason to expect that it will increase economic growth and employment as the federal government begins to put its fiscal house in order and encourage job-producing private sector investment.

The Goldman-Sachs report that Taylor refers comes to conclusions very similar to the Zandi report in that it claims that the GOP cuts would have a significant impact on economic growth It’s also worth noting that Zandi was the architect of the Administration’s dubious stimulus package, which ended up costing at least $228,000 per job “saved or created,” and which fell far short of the economic impact that Zandi and others were claiming that it would at the time that it was being considered by Congress As a general rule, an economic forecasters who was so spectacularly wrong on his signature political achievement ought be doubted when he’s commenting on someone else’s work.

We’ve already tried the ideas that Zandi and his ilk put forward and it’s resulted in a sluggish economy and massive debt. Feeding the government pig isn’t working, it’s time to try something new

Is he right about QE2?

Steve

You know your headline and your nut graf disagree, right?

As a general rule, an economic forecasters who was so spectacularly wrong on his signature political achievement ought be doubted when he’s commenting on someone else’s work.

Does the same go for Goldman-Sachs?

Also, your assertion that the stimulus caused a “sluggish economy and massive debt” is, while a conservative/libertarian shibboleth, not supported by, you know, facts.

The GOP’s proposed spending cuts, passed as part of a continuing resolution, would probably reduce “growth on the margins” and lower gross domestic product by only one- or two-tenths of a percent, Bernanke told the Senate Banking Committee.

Maybe the spending cuts are worth slower growth, but you and the Rs should at least be honest that the cuts will negatively affect growth and then make the case that slower growth is worth it. This hand waving that there’s nothing to see here is pretty disingenuous.

Or put another way, Ben Bernake says GOP plan “won’t have much impact on the long run.”

“Research by me and my colleague John Cogan finds that more up-to-date theories, which bring important incentive and expectations effects into account, show far smaller multipliers.’

So he is increasing the effect of such things as rational expectations theory in his model? It’s been a long time since I’ve studied such things and maybe things have changed, but it’s been shown that these assumptions do not really hold when applied to aggregate behavior. So I don’t see how increasing its influence = more accuracy.

IIRC, again it’s been awhile, govt spending multipliers increase when nominal interest rates are zero, or close to zero–which has been our environment for several years now. I believe that this is pretty much consensus thought amongst economists. I wonder if he took this into account.

> the stimulus caused a “sluggish economy

And you prefer what? The depression that the GOP led us to the brink of? “sluggish” is vibrant health compared to what Obama inherited from his predecessor.

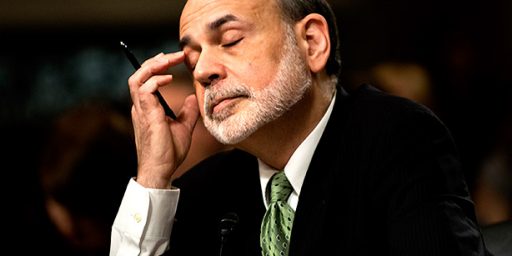

Further remarks by Bernanke:

Bernanke said that a $60 billion cut along the lines being pursued by Republican in the House of Representatives would likely trim growth by around two-tenths of a percentage point in the first year and one-tenth in the next year.

“That would translate into a couple of hundred thousand jobs. So it’s not trivial,” he said in response to questions from members of the House Financial Services Committee.

Steven, you beat me to it. So our range here is that GOP spending cuts will cost the private sector somewhere between 200,000 and 700,000 jobs. That seems significant to me!

So to get a roughly 4% (more or less meaningless in the long term) decrease in the deficit it is worth it to take a .2 – .5% decrease in GDP growth and loose between 200K and 500K jobs (when employment is at 9%)?

I was wondering the same thing. Do we think Bernanke would have said the proposed cuts won’t do damage if the Fed hadn’t embarked on QE2?

What if he said tax cuts for the rich won’t do damage?

… or tax increases for that matter?

Alex,

Government jobs. Which are, for the most part, a deadweight loss to the economy

Government jobs. Which are, for the most part, a deadweight loss to the economy

Are the unemployed former government workers, who have less money to spend as consumers and are likely collecting unemployment, a boost to the economy?

Doug: Can’t imagine it’ll be pretty when that many of those government employees find themselves looking for work in an already-ugly unemployment situation.

By the way, are you sure he means all are government jobs?

Doug,

The government job losses are assumed. Manzi, Goldman Sachs, and Bernakke are talking about the lost of jobs due to slowed GDP growth. That’s private sector.

Do you have an analysis of the “deadweight loss” of government jobs? I would argue that teachers and law enforcement officials add quite a bit of positive value to the economy.

Do you have an analysis of the “deadweight loss” of government jobs?

Unexamined articles of faith will not be subject to analysis. They’re just true, just because.

Are the unemployed former government workers, who have less money to spend as consumers and are likely collecting unemployment, a boost to the economy?

You beat me Mantis. I’d really like to hear the deficit hawks explain how higher unemployment will boost an economy dependent on people having jobs and spending money.

But I’m sure having the Invisible Hand punch another 500,000 in the back of the head will free up badly needed labor for more productive work . . . oh wait.

I must say, it is nice that so many happily employed people here are so willing to knock the economy and potentially devastate the lives of hundreds of thousands of people to further their all-important ideological goal of reducing the size of government. Do you ever consider how it affects other living, breathing people? Are they just government trough-feeders that deserve what they get? I guess it’s easy to just think of them as numbers. Many probably also cheered the Iraq war and still think it was worth it, despite the hundreds of thousands of dead and wounded….

“Do you have an analysis of the “deadweight loss” of government jobs? ”

I’m curious to hear this too.

I would argue that not only teachers and police officers add quite a bit positive to the economy, but I’d say that’s true about waste-water workers, food safety inspectors, and the folks down at the coroner’s office, too.

I would argue that not only teachers and police officers add quite a bit positive to the economy, but I’d say that’s true about waste-water workers, food safety inspectors, and the folks down at the coroner’s office, too.

Government can never add value to anything because it just can’t, so shut up.

“But apart from the sanitation, the medicine, education, wine, public order, irrigation, roads, the fresh-water system, and public health, what have the Romans ever done for us?”

Do you ever consider how it affects other living, breathing people?

Yes, they do, but only billionaires.

“But apart from the sanitation, the medicine, education, wine, public order, irrigation, roads, the fresh-water system, and public health, what have the Romans ever done for us?”

Splitter!

Beautiful quote!

Sadly I suspect Doug will remain silent on this thread.

Oh, he’ll probably accuse someone of being a troll…

Or that we’re members of a little cult.

Inconceivable. How about $1.5T in cuts? After all, that’s just the deficit this year.

Bastards,

Yeah, because we didn’t have any of those things before 2000, and the federal budget has grown 40% since then.

You people (hey, if AG Holder can use, it mst be ok) seem to think that beause you are doing good deeds it is ok to spend money you don’t have. You are dead f***ing wrong.

> Which are, for the most part, a deadweight loss to the economy

could you detail for us a bit how they are a “deadweight loss”? I could just as easily say the same thing about attorneys. Law school standards and bar exams have been so badly watered down that I know people who were not smart enough to be good waiters that are practicing lawyers. We have a large surplus, and the result is a lot of frivolous lawsuits or rackets like Unruh Act suits that are pretty much a deadweight loss on the economy.

> You people (hey, if AG Holder can use, it mst be ok) seem to think that beause you are doing good deeds it is ok to spend money you don’t have

Yet when a business uses credit to expand, or stay afloat during a rough patch, it is an act of sacred wonderfulness. I guess no one told them they are using money they don’t have.

When I bought my car, I used money I did not have. Am I a bad man?

anjin-san, are you a bad man? Well, I’ll let your conscience guide you. But are you claiming the US Government actually has the money to pay off all those treasury notes? Really? Perhaps you don’t have to do so but I’ve always had to offer collteral for my debts. What collateral beyond the good faith and credit (snort) of the United States is offered as collateral? Or maybe you’re a fan of inflation or even the repudaition of the debt.

Also, I’m curious as to whether you expect the US to file for bankruptcy as a reorganization or liquidation once the debt cannot be paid? And perhaps you can tell me what court the US goes to file for protection from its creditors. What’s that? You mean individual or corporate bankrptcies aren’t the same as defaults by sovereign governments? Who knew?

Frankly, I’ve grown weary of the childish gainsaying. You’ll have to find someone else to respond to your trolling.