Streaming Wars Killing Streaming Dream

Disney is making some unwelcome moves.

Two related stories, both involving the House the Mouse Built, show the continually evolving world of entertainment.

WSJ (“ESPN Plans to Stream Flagship Channel, Eyeing Cable TV’s Demise“):

ESPN is laying the groundwork to sell its channel directly to cable cord-cutters as a subscription-streaming service in coming years, according to people familiar with the matter, a shift with profound implications for the company and the broader television business.

Executives at ESPN and its parent, Disney for years have said it was inevitable that the sports-TV channel would one day be available as a stand-alone streaming service. Now, as consumers increasingly cut the cable-TV cord, the company is actively preparing for that shift under a project with the internal code name “Flagship,” the people said. The company has set no firm timeline for the change.

ESPN would continue to offer the TV channel after launching a streaming option, the people familiar with the matter said. Still, the change could have a major impact on cable-TV providers, since ESPN is one of the main attractions of the cable bundle. The providers pay to carry the ESPN channel and would have to compete with the new streaming service.

ESPN has begun securing flexibility in its deals with cable providers to offer the channel directly to consumers, the people said. The financial terms of those deals couldn’t be learned. The company is having similar discussions with pro sports leagues as those rights deals come up and has secured the same flexibility from at least two major leagues, the people said.

The sports-media giant took its first step into streaming in 2018 with the launch of ESPN+, a monthly streaming service whose live programming includes golf events, certain Major League Baseball and professional hockey games, as well as a variety of scripted and unscripted programming. It has 25.3 million subscribers.

But ESPN+ doesn’t offer access to the ESPN channel itself, including high-value programming like National Basketball Association and National Football League telecasts that are only available on TV. Project “Flagship” is about helping ESPN transition the full channel to streaming.

[…]

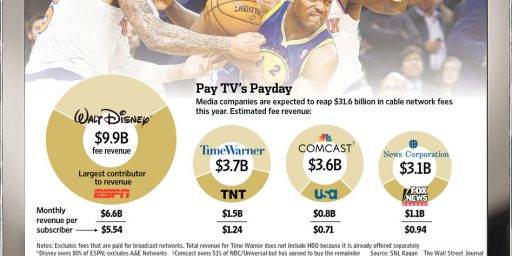

ESPN has long brought in a lot of revenue—and profit—for Disney. But cord-cutting is casting a larger shadow on the business.

Some 74 million households had access to ESPN via traditional cable packages or digital distributors like YouTube TV, as of last September, down almost 11% from 2019, according to company filings.

In the most recent quarter, income from Disney’s traditional television networks, including ESPN, fell significantly to $1.8 billion, from $2.8 billion in the year-earlier quarter.

ESPN’s work on the strategic shift dates back to the early days of Iger’s efforts to offer direct-to-consumer subscriptions.

Disney+, which was launched in 2019, has grown to 157.8 million customers. Still, Disney+ lost 4 million subscribers in the most recent quarter amid stiff competition. The transition to streaming has been costly. Direct-to-consumer losses over the past year alone topped $4 billion.

Iger reiterated his commitment to a streaming-focused future when he returned to the top job in late 2022.

“We’re in a very interesting transition period, but one that I think is inevitably heading toward streaming,” he said earlier this year, adding that the company is “not going to abandon the linear or the traditional platforms while they can still be a benefit to us and our shareholders.”

While one could argue this is good for consumers—allowing people who only want ESPN to get the service without subscribing to some sort of television bundle (whether cable, satellite, or one of many aggregated streaming options like Disney-owned Hulu or Google-owned YouTube TV)—it represents the further atomization of the market. The promise of cord-cutting was that we would somehow simultaneously pay less money than we were for the bundle and also get access to any show that there ever was on demand. We’re moving further and further from both realities.

The second story provides yet another illustration.

DEADLINE (“Disney Removes Dozens Of Series From Disney+ & Hulu, Including ‘Big Shot’, ‘Willow’, ‘Y’ & ‘Dollface’“):

Disney is starting to pull content from streaming, with dozens of series and specials slated to leave Disney+ and Hulu on May 26, Deadline has learned. The titles, which are being removed from Disney’s streaming services globally, include Disney+’s Willow, Big Shot, Turner & Hooch, The Mighty Ducks: Game Changers, Just Beyond, Diary of a Future President, The Mysterious Benedict Society and The World According to Jeff Goldblum and Hulu’s Y: The Last Man, Dollface, The Hot Zone, Maggie, Pistol and Little Demon.

The list features largely short-lived series, specials and direct-to-streaming movies.

The move, which comes with a content impairment charge of $1.5 billion to $1.8 billion, was announced during the recent Disney earnings call on May 10.

“We are in the process of reviewing the content on our DTC services to align with the strategic changes in our approach to content curation,” CFO Christine McCarthy said. At the time, no details were provided on the content that would be removed.

Disney is the latest media company to purge content from its streaming platforms in a cost-cutting measure as the industry is rethinking costs and strategy in that arena with a renewed focus on profitability. Warner Bros. Discovery removed a slew of series from HBO Max, with AMC and Showtime also undergoing a similar scale back.

For more insight into the issue, read Deadline’s The Streaming Purge: Behind The Wave Of Library Content Removals & Its Impact On The Creative Community, which predicted the current Disney program cuts.

From a pure business standpoint, I get it: it costs companies money to keep low-performing shows on the air, whereas they get to stop paying residuals—and sometimes even get tax write-offs—for shows they take off the air. But one imagines that, while small in terms of the Disney+ subscriber base, large numbers of people are watching or would eventually have watched these shows. (The only one I’ve seen is Mysterious Benedict Society, which we watched with the kids and was quite good.) And, again, the theoretical promise of streaming, whether audio or video, was forever access to everything.

Indeed, Disney+ was must-subscribe from Day 1 for those of us with younger children because of the combination of the vast Disney vault plus Star Wars and Marvel content, all of which Disney owns. Presumably, the mainline Star Wars and MCU films will remain forever but I could definitely see some of the lesser material being cut. Indeed, Marvel’s Project Hero, Marvel’s MPower, and Marvel’s Voices Rising: The Music of Wakanda Forever are reportedly part of this culling.

Again, I get it from a business standpoint. And there’s already more quality content in the vaults than I’ll ever get around to seeing. But it’s a step backward to quite possibly lose all of these shows forever.

Expecting, and thereby paying for, less service keeps appearing to be the winning move, at least based on my ROI model for a person of limited income. Still, anyone who didn’t know that the promise of “everything for less money” would collide with “there’s no such thing as a free lunch” is probably scratching their heads now (and still believes that cutting taxes always raises prosperity, too 🙁 ).

In publishing it’s called being ‘remaindered.’ You see the bargain bins of books knocked down to a dollar. Then the book is no longer in circulation and lives on only via e-Bay. How long then does it last before disappearing altogether?

Bookstores cull underperforming books. Libraries cull to make space. I’m packing up for a move – not all the books are coming with us. I suppose it’s a surprise that the digital world has such narrow limits when we were sold a myth of eternal abundance, but the practice itself is not new.

I’m surprised that Disney is not going back to an older strategy (back in the movie theatre days) and pulling its greatest hits and then waiting ten years for a brand new generation to binge on them. This current strategy may succeed or it may not. This is all new to the streamers also.

I’m not too sure how much direct cost is being cut. Are the shows being deleted from storage? I kinda doubt it. Those assets have some value, and storage is really, really, really cheap.

Maybe high-bandwidth streaming-ready storage is more expensive. It could be a lot more expensive, though and still not be very expensive.

This feels to me like it’s more about “those shows aren’t very popular, and I hate looking at them because they remind me of decisions that didn’t work out well” more than “we’re going to save a lot of money”.

Another possibility is that this is like Chevy cancelling the Volt and making EV pickup trucks at the same plant. It’s not like the Volt wasn’t successful and profitable. It’s more that they think this will be more profitable.

Another possibility is that Disney wants to create some artificial scarcity. The want viewers not to be able to think, “I’ll watch that show later”, but instead think, “That show might not be around later, better watch it now”.

And, while as @Michael points out, this is a pretty common practice, it is also why I spend a lot of time curating my music collection, rather than relying on someone else’s streaming service.

Anything someone else controls can be taken away from me, at any moment. It has happened several times to me already. Including platforms on which I had engaged with a community.

I find the “everything” part far more interesting than the “for less money” part.

I suppose it comes down to how streaming operates. I admit: I’ve no idea. Consider that millions may log in to watch the same show or movie, but not at the same time. Some may stream it nonstop, others may pause, others may rewind or skip ahead, etc. And they all get a near seamless experience. How do they do it?

A physical video rental is easy to comprehend. The DVDs were right there on the shelf. Ditto Netflix when it rented DVDs by mail.

The idea is that in streaming the shows and movies take only space in a server, so you can cram in every movie and TV show ever made. the reality is not that simple. Servers are stacks of RAM storage media. There is this much room and no more. And this goes before considering things like residual payments and such.

It might be easier for a DVD rental by mail to accumulate every movie and TV show, accepting the limitation there are only X many copies of each, and you may have to wait days or weeks for a given title sometimes.

BTW, on a related note, I read recently that the cheaper ad-supported subscriptions bring in more money for streamers than the more expensive ad-free ones.

The explanation is simple. The streamer gets paid for showing ads. On a monthly basis, this ads up to more, on average, than the price of the ad-free subscription. Look for the latter to get more expensive or disappear entirely.

@Michael Reynolds: Yes, a great point on remaindered books. But the promise of digital is that there’s no real reason to remove anything and, indeed, a good reason to keep everything. Which, presumably, these companies would under a different business model.

The problem is that the consumers and the companies have different incentives here. For the former, more niche programming is obviously better. And, if the content was simply theirs forever after having produced it (which was indeed the case once upon a time), the companies would oblige. But, presumably, it costs more in accounting and residuals to keep niche shows on than they’re worth.

I’m surprised that Disney does not trot out the old “move popular theatrical movies into the vault for 10 years” and wait for the next generation of viewers. So the withdrawal of the unpopular seems to be the streaming strategy de jour. We are in the experimental stage of this technology. It remains to be seen if it is successful.

@Scott:

We’re traveling backward in time. It will be series and live events ad-supported, prestige series (née HBO) on subscription streamers, high-end movies in theaters and lower end features straight to cable, er, streaming. It’s the 80’s but with far, far more hassle.

I suppose it comes down to how streaming operates. I admit: I’ve no idea. Consider that millions may log in to watch the same show or movie, but not at the same time. Some may stream it nonstop, others may pause, others may rewind or skip ahead, etc. And they all get a near seamless experience. How do they do it?

Many copies of the content on many servers in many locations. An entire infrastructure to map a user’s DNS request to a server best situated to provide access to the content. An entire infrastructure to monitor internet behavior and dynamically modify the DNS mapping. An entire infrastructure to manage getting content onto the servers. Active measures to defeat DDoS sorts of attacks. It’s often cheaper to buy service on someone else’s infrastructure. Akamai, for example, has ~400,000 servers in ~1400 locations globally and all of the other infrastructure. Their annual revenue selling the use of that is about $4B per year. Disney is probably big enough to eventually roll their own delivery infrastructure. But when Disney+ started, it was all delivered through Akamai and some other providers.

@Michael Reynolds: I’m not as sure of the “high-end movies in theaters” part. It seems to me that ticket prices are starting to price people out of theaters. Then again, a neighbor and I were noting that we’ll end up getting priced out of our apartments shortly, so it might be that life in the bottom third sucks big time. But beyond my picayune concerns is my observation that home theater has take a larger role in the lives of the middle rich and serves to keep a segment of the audience that used to go to theaters out of them. Covid may have been a bigger game changer than we realized.

@James Joyner:

The current promise of digital is that there’s archival copies of everything. But to actually serve it up, there has to be many copies on many servers in many places, on a highly distributed architecture. If it’s not generating enough revenue, it’s a money loser. We may eventually reach the point where the content delivery networks can juggle both the high-demand content and low-demand stuff. But we’re not there yet.

This discussion has me thinking about “the long tail”, which is a specific prediction about the internet and how it works – that because the internet audience is a global audience, things with a smaller audience will become more available.

And in the large corporate world, things are trending the other way. Disney, and Netflix, and Hulu and others are positioning themselves as the new intermediaries, the people who decide what everyone watches. They want to take the role of TV networks. In music, this is Spotify and Apple Music and Amazon’s offerering.

And what is also happening is we see other people routing around the intermediaries. Things like Bandcamp and Substack. Also YouTube. We live in the world where there is very nice money to be made in small artistic endeavors – with viewerships of 10,000 or 100,000.

We’re still in a Cathedral vs. Bazaar situation. That dynamic will probably never die, but the Bazaar has a fighting chance as long as we can prevent ISPs from blocking content.

Which is one of many reasons I support Rule 230 and Net Neutrality.

Is it possible that some of these series that were removed from Disney (or the series HBO removed from Max) will end up being licensed out to streamers like Freevee, Tubi, or maybe even Netflix?

I doubt that Disney is doing this deny paying residuals (but I could be totally wrong here). If they sell to Freevee (Amazon), then Disney gets a bit of money back for a show that they spent a lot on, and Freevee gets new content that they can insert Ads into, so they also make some money off the deal. Win, win.

What I have just said is very simplistic, but to just remove the content and no one ever sees it again as it gets locked into a digital vault, that just seems like something Disney and other streamers should not have to do.

Disney may no longer consider some shows Disney+ worthy, but I bet streamers that provide free content if you are willing to tolerate ads, they would love to stream the equivalent of Disney’s sloppy seconds/leftover/abandoned product.

@just nutha:

Absolutely. I dislike theaters and avoid them. But I’ve been surprised at their resilience.

@inhumans99: “I doubt that Disney is doing this deny paying residuals (but I could be totally wrong here).”

I doubt that, too, since the only way a residual is generated is if one of their customers watches the show, which means they’re making a customer happy.

I believe I read this morning that Disney is taking a two billion dollar write-down on the shows they’re pulling. That’s probably about two billion times more than all the residuals they’ll pay on all these shows in a year.

@Jay L Gischer:

There is a reason James keeps using the word “residuals“.

The bigger the streaming service, the more expensive it is to keep something in inventory. I do not believe how many people watch, or don’t watch, the show/movie/thing impacts the cost.

@inhumans99:

I think that that and things like PlutoTV and RokuTV. It will be the return of having to watch commercials for a lot of this content.

Or, if you really want it, having to purchase your own copy.

@Steven L. Taylor: I won’t be surprised if the networks just will switch out from broadcasting over the airwaves to streaming over the internet and forget about the cable carriers. No difference to most of the consumers.

@Michael Cain:

That’s far more than what I imagined.

Another thing I thought would come from streaming is a more uniform global service. But that’s still not the case. Netflix in Mexico doesn’t have the same programming as Netflix in the US. Much the same goes for other services. Some aren’t even available in some countries.

@Michael Reynolds: I don’t follow the industry enough to draw any conclusions, I’m looking at other factors. For example, the little town in which I live is the 4th lowest in the state for per capita income and has a population of ~12000, but is still managing to support a business that designs home theater systems. I’m assuming that home theater systems are not so sophisticated that only a few people in the world can design them so that most of the business of the firm I mentioned is local.

Still, it’s also the only place in a roughly 50 mile radius that has a movie theater that is still open and said theater is a multiplex that is an anchor store for the mall that has been dying for a decade or so. (Still, as long as the mall houses the county library, it’s future may be secure.)

@SKI: If that’s true (streaming services are paying residuals on availability rather than actual streams), hen this wave of cutting availability of underperforming shows makes perfect sense and I’m shocked it doesn’t happen more.

I don’t distrust you, I just don’t recognize your source and don’t know how much to trust them. And it’s opposite of the Spotify model.

Contracts will incentivize all sorts of behavior when things don’t go as hoped.

@Kathy: I worked for a major streaming company in the early days of streaming – like most people were on dial-up internet in those days.

I can tell you that the majority of our expenses were outgoing bandwidth. Companies like Akamai would host your content and serve it up on demand, and we went to great lengths to secure our streams from being streamed without our web “player” that served up ads – our main revenue source. Those hosting providers charge by the megabit for streaming – and can handle thousands, and these days tens-of-thousands of simultaneous sessions.

The internet bandwidth was, 20-25 years ago, very, very expensive, and I imagine it still is. Those are the hard costs, no matter what somebody streams. When combined with residuals and transactional costs on certain titles, it’s no wonder services choose to look closely at what people are streaming and what value they get from it.

It’s a complex business model with high variable/usage costs and largely fixed revenue. So the incentive is to keep people from streaming anything, ideally, and still pay their monthly fee. Of course, customers will cancel if there’s no value, so they have to find the minimum they can offer without losing subscribers.

@Tony W:

Isn’t that the gym membership business model?

Not that long ago, there was Netflix and not much else. The narrative I recall as to why we’re now inundated with studio-owned services, is that the studios decided they could make more money streaming their own content rather than licensing it to Netflix.

It seems now they didn’t think things through, or perhaps made egregious assumptions as to how many subscribers they’d get.

I figure if studios begin removing content from their service and licensing it to competing services, then they may as well not have bothered with their own service to begin with.

Are residuals paid on “availability” or are they paid on streams, or partial streams? I mean, it seems weird to pay on “availability”, but it might be a guaranteed base income for the producer of the show.

A 2 billion dollar writedown is attention worthy, though. I’m not sure what that valuation is based on, though. Full lifetime potential value of those properties? Maybe. And I get to reduce my AGI by it right now? I guess.

My own particular guiding star for this kind of situation is “make money first, then pay taxes”. I do not like tax law to have too much influence on my investments. It can get you into some really crappy stuff very fast. Also, I don’t think bean counting mixes all that well with creative stuff.

Naturally, the CEO of Disney (right now we’re back to Bob Iger, right?) probably is a more experienced businessman than me, but it does suggest to me that maybe there’s some stuff that needed to be cleaned up?

Speaking as a no-nothing about this industry but I do run a business maybe they can change how they pay for these low volume shows. Pay on an as watched basis? The low volume shows are facing zero residuals now so I would think they would accept that.

Steve

Well, this hits close to home. THE ONE AND ONLY IVAN is among the movies being purged by Disney Plus. We aren’t going to hang ourselves but a lot of people put a lot of excellent work into that movie and they did a great job. Now, poof!

A little more detail wrt data storage:

Data centers are estimated to be approximately 3% of global energy consumption.

I don’t see a citation. According to this DOE page, US data centers account for about 2% of energy consumption. Alas, also no citation. But I think the DOE would be a pretty solid source.

Well, shit. No one knows anything.

I couldn’t find a good money passage to blockquote. But here is the gist:

The data used to estimate current and future energy consumption by data centers is missing, questionable, or outright bad.

For example, one source commonly quoted in media reports, a French think tank named The Shift Project, uses data extrapolated from network traffic. But a few subsequent papers have called that approach into question.

Oh, and of course Bitcoin plays some role in energy consumption and those suck fucks have every incentive to avoid an accounting of their bogarting of energy.

—

Storing and transmitting data is not cheap at scale. And those costs can be volatile if energy is indeed the largest expense for data centers.

@Kathy: Technically, the gym-membership business model is that the cost of the membership compared to the alternative methods of duplicating the service offered is cheap enough that you don’t feel troubled by not using the gym enough. And at less than Disney+ would cost me per month, gym membership’s model probably works better than streaming given that I don’t have to join additional gyms to do different exercises. (Although I’m positive that there are heirs to Veblen’s consumers who join one gym to do cardio, another to lift weights, another to do yoga, and another to do tai chi.)