The “Buffett Rule” Isn’t Supported By The Evidence

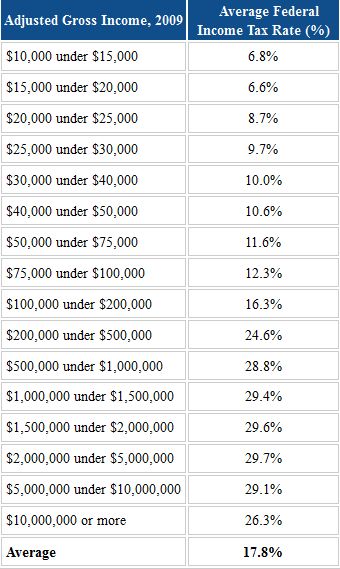

Over at Carpe Diem, University of Michigan Economics Professor Mark Perry put together this chart:

All that comes from IRS data, and Perry reaches several important questions:

1. The U.S. federal income tax system is highly progressive (as it’s intended to be, and not regressive as Buffett wants us to believe from his “analysis” of his and his employees’ tax rates) and higher income groups pay taxes at a higher rate on average, as a share of their taxable income, from a low of 6.8% on incomes between $10,000-$15,000 to a high of 29.7% for incomes between $2,000,000-$5,000,000.

2. For federal income taxes, most secretaries would probably be paying an average federal tax rate of 9-12%, and most of the “super-rich” bosses with incomes of $200,000 or more would be paying average federal income tax rates about three times higher than their secretarial staff members, i.e. 25% or higher.

In other words, the evidence simply doesn’t support that super-rich individuals like Warren Buffett are paying taxes at a lower rate than, say, a secretary.

Does that chart take into account what they are supposed to pay or what they actually pay? Does it include all the breaks and defferements and the like for capital gains? How about money being sheltered in offshore accounts that they should be paying taxes on but aren’t thanks to loopholes?

Perry’s article really skirts the edge of intellectual dishonesty… The whole point of Buffet’s argument is that people as rich as he is can use various loopholes to keep their money from being taxed as income in the first place (esp. via capital gains). All Perry’s done is pull up the brackets and say “Yes, if you got a paycheck for $x, you’d owe $y in taxes. See – that’s what the numbers say!”

Something tells me that chart doesn’t tell the whole story. The Super-Rich like Buffet are more likely to itemize their returns in in doing so take advantage of numerous tax loopholes and deductions which aren’t readily available to the average secretary that files a short form and can’t afford a zip code’s worth of tax layers.

yeah, seriously Doug – you are criticizing Buffet”s argument without lifting a finger to understand what his argument is. As such, you totallly misrepresent him…this is a lazy, bizarre post.

I have one word for you…EFFECTIVE TAX RATES

Wow… Doug… you totally ignored the evidence. Indeed, the article does skirt the edge of intellectual honesty. How’d you miss the obvious BUT on this, Doug?

@legion:

This is how Doug operates; he can’t make his argument by honest means so he uses any intellectually dishonest means of muddying the water.

What more do you expect, he is a lawyer of course. My apologies to both of Americas intellectually honest lawyers (my cousin and her law partner). ;>)

Did any of you criticizing Perry bother to look at the source data from the IRS, which includes actual returns and tax receipts going as far back as 2009, not just the tax tables?

I see that the person making $10M plus is paying less in taxes than the person making $501K.

I guess in Doug’s world that’s fair.

In mine, not so much.

For everyone complaining about dishonesty in the data, measures of effective tax rates which take into account deductions show the same exact thing: http://economix.blogs.nytimes.com/2009/04/08/how-much-americans-actually-pay-in-taxes/

Also, the capital gains tax is not a loophole, it is double taxation. Dollars invested must first be earned, at which point they are taxed. Subsequent capital gains are already reduced by the lower base investment caused by the initial taxation, plus what that investment would have earned (and that’s not to mention the corporate income tax, which also reduces the individual return). This gain that is never realized is just as much of a tax as the “income tax”, but none of these measures effectively count it as such, which makes the actual tax rates on the wealthy deceptively low, not high. And then there’s the fact that capital gains taxes are not tied to inflation, which means even phantom gains are being taxed, theoretically producing in some investments an effective tax rate higher than 100%!

@Doug Mataconis: Yes Doug I did, and that chart still doesn’t show a complete picture of what is going on.

Actually Eddie, that $10,000,000 earner is paying much more than the $500k in actual dollar amounts. Which is what matters to me.

@Doug Mataconis:

So if the 500K guy pays 10% (50K), and the 10 million guy pays 1% (100K), that conforms to your concept of “fair”???

Question: Was it just federal taxes Buffett meant, or all taxes? I can think of FICA, for one, which would definitely favor the ultra-rich. Anyone over 250,000 dollars would pay less %wise there.

@Doug Mataconis:

The percentage is far more important than the actual dollar amount. If someone earning $10,000,000 has a tax bill of $40,000.00 at the end of the year that’s only 0.4% of their income. But If I had a tax bill of $40,000.00 at the end of the year that would be 105% of my income and I’d end up living in a cardboard box.

These rates are for income tax, not capital gains.

Doug should have a companion chart showing the percentage of income in each tax bracket that is comprised of income vs. capital gains.

Ceterus parabus Perry might be correct. But if the secretary is taxed on salary which comprises 100% of income, but the millionaire earns 80% capital gains and. 20% income , then Buffet seems to be right.

Please feel free to shred this point if the above IRS stats factors this in.

OK, I admit that I was gullible enough to actually look at the IRS page that Prof Perry refers to. Which, as he says, proves that we do indeed have a progressive income tax policy. Then I looked at the method of filing a tax return if you are like Mr Buffett a professional investor and discovered that ‘Schedule D’ is amazingly complex and that I was definitely wise to not become an accountant. But it does demonstrate that income from investments held over 1 year AND that puts one in the tax bracket that pays 25% or more (which is pretty low — starts with annual income about $35K) is taxed at 15%. Now there is also a deduction for the expenses involved in the initial purchase — brokerage fees and the like. And there is also a deduction for ‘depletion’ of the investment. And whatever you claim on Schedule D is subtracted from the total income. So someone like Mr Buffett whose income is (I bet) 100% from investments gets a really sweet deal. His secretary, assuming she is paid a salary or hourly wage, not so much.

So you have demonstrated that apples are not oranges. Brilliant!! The conservative mind is an awesome thing!!

The data used by Citizens for Tax Justice, a group in favor of increased progressivity of tax rates, broadly supports the findings above (while arguing that it’s not enough).

The top 1% pays a greater portion of its income to federal taxes than any other group. Marginally more than the next 4%, but significantly more than the middle 20%. The top 1% pays less in overall taxes (state and local taxes tend towards regressivity) than the next 9%, but more than everybody else.

Here are some slightly older numbers from the Congressional Budget Office that break down the numbers further.

Personally, I think our system could use greater progressivity. I don’t have a problem with newer tax brackets for higher earners. But the numbers do not seem to support the notion that high earners generally pay less than middle earners. If the CTJ could have demonstrated that was the case, they surely would have.

The original IRS table does say “All figures are estimates based on samples—money amounts are in thousands of dollars except as indicated.”

It is interesting, and it does say that the average of samples above $10M do pay significant tax.

But there must be loopholes for them to be paying tax at a lower rate than the people below them.

@Doug Mataconis:

Of course that’s what matters to you, Doug. That says alot about you. And, again, none of it good.

In your world, if the $500K guy paid $400K in Taxes, and the $10M guy paid 400K in Taxes, that would be fair?

(I really wonder if they are sampling deep enough to find “carried interest” types.)

I think many forget that income taxes are only about 46% of the revenue which pays for the federal budget.

The rest is payroll taxes, corporate tax, tariffs, etc.

So lets say the top 1% pays half of all income taxes.

That means in effect, they are paying about 23% of all revenue to the treasury.

However, they control 50% of the wealth in this country so how can anyone in their right mind say that this is a progressive tax.

If they paid 50% of ALL taxes, they would still be UNDER-TAXED according to a true progressive system.

This is why I hate it when so many dumb$hit right wingers bring this up by saying “50% of Americans pay NO taxes and the top 10% pay half of the income tax. Thanks socialist devils …err Democrats.”

What they miss is that the bottom 80% which controls 10% of the nation’s wealth pays over 50% of ALL taxes in the U.S.

And Mr. Mataconis should know better than throw out another “don’t tax the wealthy because its unfair” article.

You spoiled selfish baby boom prick$ should quit whining ad nauseum about the poor little rich guy who is unappreciated for all the sacrifice he has to make for the rabble.

They’re lucky they can still breathe free and not be rotting in a dungeon somewhere.

Those percentages are their rate paid on “taxable income”. But the entire point of the argument is that the ultra-rich have ways of excluding things from taxable income.

Ben, Warren Buffet’s argument (that he is paying less than his secretary) is based on his own “taxable income.” The CBO numbers I reference above use “comprehensive household income”, does not limit itself to taxable income and is defined as the following:

The CTJ has a vested interest in determining that the rich are not paying their fair share, so one imagines that if there were better numbers to demonstrate that the rich are paying less, they would have used them.

Here’s a slide from the CBO that’s a bit dated (2007) but is current enough to be useful. I breaks-out the various taxes by type and quintile – see slide #3 in particular.

Here’s more CBO data (excel file) that also breaks out the top 10, 1 and .1% going back to 1979. You can see for yourself how things have changed since before the Reagan era.

Our system, overall, is progressive. It may be the case that a few mega-billionaires, like Buffett, are able to game the complexities of the tax system to pay less. We can’t really know since all we have are aggregate data and not the individual numbers. Ironically, the AMT was originally created to deal with those kinds of tax payers.

I guess it depends on how you count FICA taxes. I’m a self employed carpenter and for me that’s 15% starting at dollar 1. If someone is employed their employer pays 1/2 of that for them. But it really depends on how you count it. Suppose an employer pays someone $10 per hour and pays an additional $3 per hour in FICA and worker’s comp. Isn’t that extra $3 actually a tax coming out of the employee’s income, which would otherwise be $13 per hour?

Does anyone remember the Alternative Minimum tax? That was supposed to work to do what Obama’s proposal will do. (Note I didn’t call it a bill since it doesn’t exist as such) If you look at the AMT now, you’ll find not only did it not work to the stated end, but now dips into the incomes of middle class Americans… not the rich.

How are we to asume that Obama’s tax will work any better at rippng off the rich?

Haha,

If I had a nickle for every time a wingnut lied and said federal income tax is the only tax Americans pay…Obama would by trying to raise my tax rate.

The average effective rate for the top 400 taxpayers is around 18%. (that’s straight from the IRS stats site, if you’d like to confirm). So there are certainly a number of people that this would hit.

As one of those people that does taxes for the superrich, I can assure you there are no magical loopholes fairies I can turn to in order to make taxes disappear. In the normal course, there’s a pretty limited set of things that a tax accountant can do to reduce tax beyond what should be paid.

The problem with the title is that the data doesn’t show the rule is unsupported, it just says that it may not catch as many as we’d think.

That isn’t at all the same as saying those few Buffett-like money managers deserve their very special tax advantage.

As a U-M grad, I’m embarrassed by the massive oversimplification that Professor Perry put forth. The only way that chart could have possibly been useful is if we had a simple tax code, which we do not.

Upon reading the full post, I’m still not impressed. Professor Perry eventually mentions capital gains and dividends in the last paragraph, for example, but dismisses them as if they are inconsequential. While there’s an argument to be made whether those should be taxed and how much, dismissing them completely to support your own position seems a tad dishonest.

@john personna:

I agree – we simply don’t know what a few individuals pay in comparison. I don’t think we can say for certain one way or another whether the “Buffet rule” is true or not. Although the aggregate data clearly shows that federal taxes are progressive, our tax system is so complex that individual circumstances can vary widely. That’s one of the major reasons why I think we need reform to simplify the tax code.

@Andy:

I think the table does show us, within sampling error, that the tax rate is fairly progressive. There is a break in that progressivity at the high end though. If we believe in progressive tax, that error should be fixed.

I think Doug and others are falling into a political trap. They are defending the very wealthy (million dollar earners are beyond millionaires) and claiming that we can’t be progressive, because that is class warfare.

They’ve fallen to defend a position the mass of the country has moved far beyond. We expect progressive tax. And many of us see that bending the curve, just a bit, at high incomes, can be a big piece of deficit resolution.

(Actually, on “carried interest” it is worse than that. Doug is saying “don’t look at the tax break these individuals get, look at the averages.” Obviously averages do not prove anything about individual tax rates.)

There is one underlying assumption that seems to be less spoken than the name “Lord Voldemort.”

That assumption is that the “rich” don’t get any of the services from the federal government.

I mean, the “balance” is always a trade off where the “rich” get taxed while everybody else loses some services from the federal government, which the “rich” have to pay for.

Funny how that is never explicitly said.

I love these “fair” arguments. If my next-door neighbor earns a million dollars and is forced to give the government ~300k, and I make $500k, and am forced to give the government ~$140k (let’s ignore marginal effects for the time being), and neither one of us consumes appreciably more government resources than the other one, then I don’t think it is fair. I think he is getting screwed, by about $160k.

@Tom Mathers:

So, if your other neighbor lost his job and got cancer, how much would he pay?

(The theory is that “rich neighbor” makes up for “poor neighbor.”)

Money earned on investments is INCOME and should be taxed and the standard income tax rate.

Ignoring the capital gaisn income loophole is not an accident… it’s just another way of lying about the facts.

My understanding of the Buffett Rule is that it is going to be specifically directed at private-equity fund managers, who are currently able to get their “work income” taxed at “capital gains” tax rates through the carried interest tax break. This is the actual reason the uber-wealthy investment managers have low effective tax rates. Anyhoo – it’s all moot, because until we have a specific proposal, it’s unclear who will be taxed under it.

@Scott O.:

But then you get to pull half of self-employment tax back off. It’s line 27 of your 1040 and comes from line 13 of your schedule SE. Even though self-employed, you’re only paying the employee portion.

If for some reason, you’ve been remitting the total employer and employee portions employment taxes to the IRS, I would suggest you find someone to prepare your tax returns, because you are clearly incapable of doing it yourself correctly.