The Two-Income Trap

It's just as possible to live on one income as it was in 1970. But not really.

In his post “Living on a single income in modern America,” Kevin Drum examines a survey from American Compass showing widespread concern that it’s no longer possible to support a middle-class lifestyle with a single earner. He runs the numbers, though, and, in inflation-adjusted dollars, “Individual men earned more in 2020 than in 2010. More than in 2000. More than in 1990. More than in 1980. As much as in 1970. And way more than in 1960.”

He adds, “The American Compass report makes the usual point that even if earnings are flat, expenses have gone up in some important categories: rent, health care, education, and so forth. True enough. But expenses have also gone down for things like food, clothing, and TVs. It’s about a wash in the end.” Indeed, that’s what adjusting for inflation is supposed to do: allow comparisons over time.

He then offers three possible explanations:

- Alex Tabarrok theorizes that we have more money for stuff but less time for it—so we rush through everything and feel harried even though our standard of living is actually as high as it’s ever been.

- Another possibility is that we really do have less money for common goods because we spend a lot of it on stuff we didn’t even have half a century ago: computers, videogames, the internet, cell phones, and so forth. We can argue all day long about whether this tsunami of new technology really improves our standard of living,¹ but there’s no question that on a pure money basis it makes us seem a little poorer because we’re spreading our income around on more stuff.

- Finally, there’s waste. We buy and then discard an awful lot of stuff these days, which means that much of our income is squandered and actual consumption of stuff we enjoy has gone down. This makes us seem poorer because, in a way of our making, we are. If we lived a little more carefully, we’d probably all end up a little happier and more prosperous too.

Tabarrok’s explanation doesn’t strike me as plausible in that we have more leisure time than ever.

Drum’s two explanations have some merit but are actually a subset of what I think is really going on. More on that shortly.

In his conclusion, though, Drum pulls a rope-a-dope:

Then again, here’s a final possibility: it’s all a mirage. We’re not mostly dissatisfied with modern life. Long-term polls certainly don’t show it—not among men vs. women, not among the entire population, and not among the middle-aged

He produces graphs General Social Survey data over the last half century, showing relatively mild fluctuations in happiness over that period. And then ends with a zinger:

Despite all this, if you carefully choose to write only about the borderline working class—as our news outlets and scholars so often do—you can certainly get the impression that everyone is living hand to mouth. In reality, it ain’t so.

While I think this is generally right, it strikes me perfectly plausible that Americans are simultaneously 1) generally happy, 2) living a richer lifestyle than their 1970s forebears, and 3) stressed out of their minds about their economic status.

It’s true that American men earn almost exactly what they did in 1970 in inflation-adjusted dollars. But we’re living 2023 lifestyles. As Drum notes, that includes a lot of technology that simply didn’t exist in 1970 and a lot of throwaway consumption on fast fashion and the like. We live in radically bigger houses. We drive much nicer and more powerful cars. We go out to restaurants much more regularly. And we’ve done it largely on the basis of two incomes (and greater debt).

My late father was already expressing frustration with this trend forty years ago, as married women with children were just starting to work outside the home routinely. He realized his one income was increasingly competing with two. And Elizabeth Warren—who was decidedly more in favor of this trend than my father—identified the Two-Income Trap two decades ago. Men earning what they were in 1970 wasn’t enough to keep up with the Joneses in 2004; it sure isn’t in 2023.

Essentially, then, this is classic relative deprivation. Men have stayed even in earning power over the decades but the standard of living is increasingly based on dual earners. The household could still afford a 1500-square foot house, one modest automobile, and a modest one-week vacation on one income. They’d still be better off in most tangible ways than their 1970s counterpart. But they’d feel poor in comparison to the modern lifestyle.

This is all compounded by a radically different media environment. We have a much better idea how the other half lives now. Indeed, the curation of social media means we actually have an idealized sense of how others live.

I’d be interested to see how household debt accumulation layers into this. A dual-income household with a mortgage, two car loans, credit card, and student loan debt is going to be vastly different now than even 10 years ago, much less 20 or 30 years ago. Even if they are making more, servicing the debt load is stressful and can make one feel like they are living hand to mouth.

In part the stress regarding economic status stems from job insecurity. Go back 50-60 years and a worker expected to be laid off during a recession, but also expected to be called back when business picked up. That (almost) never happens today, a layoff or any termination today means that you are looking for a place of employment and you aren’t guaranteed comparable salary and benefits.

Or maybe how we measure inflation is flawed so the adjusted income is at least equally flawed.

A couple of things come to mind. First, it is hard for people to see outside of their economic station. Sure, the Washington Post star columnist who says, “Of course many people in a big city are struggling to get by on $400K per year” comes across as clueless, but it happens at every level, looking up and looking down. I remember once going in with a medical device salesmen who was showing me how hospitals actually used the monitoring equipment we developed. In many hospitals there is a “monitoring” room where dozens or hundreds of monitor feeds are piped in so the “technicians” can page a nurse if an alarm goes off. This is a minimum wage job with high turnover, because the environment is chaotic. The salesman walked into the room and said, “Lunch is on us today, we can have it delivered. You can order anything you like.” The women were excited, and I realized this was a real treat for them. What did they order? Popeye’s Fried Chicken. Think about that. These women worked in a high stress environment and got any extra hours they could, yet getting seven or eight dollars worth of fast food was really something to look forward to. I come from a working class background but I have to admit I have trouble understanding what it means to provide for a family when sometimes you find you don’t even have bus fare in your pocket.

The second thing is that over the past 40 years our industries have become astoundingly more productive. The amount of labor going into a widget has shrunk astronomically. Yet virtually all of the benefit of that has gone to management and investors. Almost none of it has gone back to the people who actually do the work. In fact, in many once well-paying industries it has gone significantly downhill, thanks to the “efficiencies” that private equity/venture capital firms have wrung out of the business they degrade.

Wow, the same as fifty years ago. Up until then we’d seen steady progress. Then it seemed like all the curves flattened. That was right around when Republicans started getting national political power again. But I’m sure that’s coincidence.

Part of the issue is how we define “poor”–or, more to the point, how we “feel” poor (which is touched on above). A “poor” person has a sizable house or apartment, car, big-screen TV, cable, internet, smart phone, current fashions, and eats out several times a week (probably including lunch every work day).

But we’re “poor”.

Just look at houses. Part of my studies in uni included architecture. I can generally tell the decade a house was built based on three basic criteria: 1) style (of course), 2) porch to garage ratio, and 3) size.

A “modest, middle-class” house today has 2.5 garage bays, no porch, and clocks in at about 2500 square feet (the average size of a new home in the US)*.

===

* By comparison, my spacious 1920 craftsman bungalow clocks in at 1400 sq ft (plus an unfinished attic), and comfortable houses 3 adults. It could easily handle a family of four.

@Mu Yixiao:

This is… bizarre. Come to visit me and I will show you around West Baltimore. Or visit me when I’m on vacation in the Adirondacks and I’ll show you what rural poverty looks like.

One thing I don’t see mentioned is housing costs as percentage of income.

Everyone has to live somewhere. It’s quite a difference if you’re spending 20% of your income on housing or 40%.

Education is far more expensive, too. Again, a cost that you can’t really forego if you want anything resembling a middle-class lifestyle.

I wonder whether the relative increase of such unavoidable costs is adequately captured in the inflation-adjusted numbers.

Maybe the percentage of one’s income that is truly disposable has become a lot smaller.

ETA: As I suspected:

Home price/median household income ratio:

1970: 4.0

2022: 7.76

In short, housing has become twice as expensive compared to total household income.

Assuming that there are a lot more double income households nowadays than in 1970, housing may be close to four times as expensive (in inflation-adjusted terms) compared to fifty years ago.

Again, you have to live somewhere.

I’ve no doubt that part of the feeling is also due to the systematic, intentional, and predatory destruction of private pension funds for the economic benefit of the investor class. Defined contribution plans are an incredibly poor substitute for a properly funded and managed defined benefit plan.

There’s been an expansion of at least the sense, if not actually, in what Orwell called the “shabby-genteel”. Viewed flipped from above, those trying to live a middle class lifestyle on a working class salary. And we’ve a lot of these being produced on the lie that a college credential guarantees a good income regardless of course of study. We see it in the incredulousness of many college-credentialed at the income of grimy plumbers, electricians, etc. How can they make more money than a college credentialed English, history, et al, major? After all, they went to college so “deserve” more than someone who works eith their hands, right?

–George Orwell, The Road to Wigan Pier, ch 8

@MarkedMan:

I know what rural poor looks like. But you took that comment out of context–hence “poor” being in quotes. It goes to people feeling like they’re poor, when they’re really not.

Go into any forum (live or online) where people under 30 are talking, and you’ll hear them say that they’re poor, the boomers took all the wealth, there is no middle class anymore…. all while sitting at their MacBook Air, listening to music on their iPhone 11, through $300 AirBuds, and sipping $10 coffees.

@Mu Yixiao:

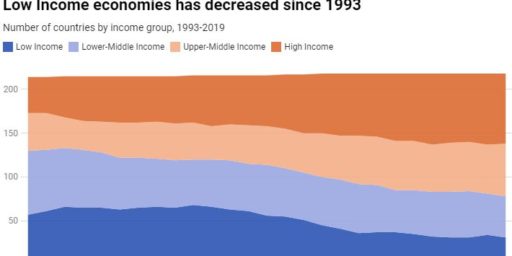

They did. Look at the graph in my previous comment.

Boomers got something for cheap (houses, education) that a) generated them wealth; b) subsequent generations were forced to pay A LOT more for.

Saving on $10 coffees isn’t going to get you a house, you fool.

It’s both facile and stupid to point to the supposed moral failings of others while ignoring actual data.

@JKB:

The problem with you MAGAts is that you believe your emotions, and your opinions based on those emotions, and not facts.

The MAGA party, even before they became fully MAGA, has waged a decades long war on education, which JKB is simply parroting, like a good rube does.

It’s critical to any possible success for MAGA that their voters remain dumb.

Sorry about that. I was surprised that was coming from you and should have realized I was misreading it.

My wife and I are on the higher end of middle class and we are completely aware how that compares to others, both in the US and internationally. When I was in the peace corps most of the women in my village knew every single thing they owned. Think about that. How many spoons do you own, and how do they differ from each other? How many plates? How many bowls? Which is the one you give to the honored guest? How many pairs of underwear do you own? Are you wealthy enough to have pajamas? In other words, could you afford to spend money on something you only wore while sleeping?

@JKB:

Where the hell do you come up with this nonsense? It feels a bit like projection.

Also, most of those positions now have some form of additional educational requirements, usually a certificate completion or training program.

JKB’s point can be argued with (I would argue with it), but it was a legitimate point and not an insult, an attack or some loonie internet thing.

@MarkedMan:

Mu’s not entirely wrong. My semi-retirement gig was selling motorcycles, I can’t count the number of buyers that came in and bought bikes w/nothing down and when you filed the loan ap, their income was $250k or more, but when the determination came back, they had credit scores of around 650 (pretty bad and borderline not qualified). There are definitely many high income persons living paycheck to paycheck. And I should add, unnecessarily.

@Jen:

Same place he heard the J6 terrorists had no firearms: Fox News, right wing blogs, talk radio, Republican meme pages, Candace Owens, MAGA Twitter etc.

You know. The rightwing lie machine and disinformation bubble. Puts Putin’s propagangda regime to shame in the amount of patholgical dishonesty and sheer nuttery.

@Sleeping Dog: Anyone who thinks the average GenZers is buying motorcycles and making $250k yearly is hopelessly out of touch.

@drj:

This is my favorite Xer/Boomer fallacy. Not just because it peddles the silly “Save for a down payment by buying less avocado toast and cofeee” canard, it’s a lame attempt to dunk on the young that inadvertendly reveals the out-of-touch privilege of the interlocutor. Most coffee is in the $4.50-$6.

$10 coffee where? Bergdorf Goodman? Sounds like Lucille Bluth telling her son, “It’s *just* a banana, Michael. How much could it cost. Ten dollars?”

My millennial bestie has an outdated laptop that is falling apart, and he can’t afford a new one. Coffee is a luxury that has to wait for Starbucks’ Christmas collection.

This is the closer to the reality of the average urban under-40 dweller — not $250k salaries, motorcycle purchases, and MacBooks. But you actually have to know young people to know that, rather than thinking dumb caricatures seen online make you an authority.

Maybe slightly OT but my favorite claims about being poor are the people who claim they know what it is like to be poor because the had to eat ramen in college and have 2 or 3 roommates to afford an apartment. Almost all of them having upper middle class parents.

Steve

@steve: This is true, many people do not know what serious poverty looks like. But I was surprised when working with homeless and working poor learn how many had upper middle class or even rich parents.

And I also don’t think just aiming for the bare minimum of not being super poor is what America should want for its children.

@DK: Not to speak for Sleepingdog, but I’m familiar with the store…so, my estimation is that he’s not speaking to GenZers, but there are plenty of millennials and GenXers, along with some residual latter boomers, who fit the description. The store he is referring to pulls customers from Maine, NH, VT, and MA.

@DK:

Well, even if you drink one $10 coffee every day of the year, that’s going to add up to $3650.

That is not going to make a difference when it comes to qualifying for a mortgage.

Add another $2500 for the MacBook, iPhone, and AirBuds over three years and you’ll end up with less than $4500 annually. Still, a pathetically low sum when you compare it to buying a house.

Even if the caricature is true (which, of course, it isn’t), it’s still a dumb and lazy argument.

What is a “middle-class lifestyle?”

Relative income over time we can measure and quantify, something as subjective as a middle-class lifestyle is quite a bit more difficult.

@gVOR10:

Other things that were going on at that time:

– US imports started exceeding exports starting in 1971

– The final changes to make US currency fiat money

– Overseas competition from Europe and Asia that rebuilt their economies and were able to start out-competing the US.

– Rolling back the severe restrictions on immigration that had been in place for the last half-century

Also, we did not see steady progress up until the 1970’s. Living standards declined during the Depression and WWII and then doubled over the next 20 years, thanks to starting from a low baseline and the US being the dominant economic power on the planet while most everyone else had their economies destroyed. That set of circumstances was never going to last.

“This is all compounded by a radically different media environment. We have a much better idea how the other half lives now. Indeed, the curation of social media means we actually have an idealized sense of how others live.”

A thousand times this. Though I’d say it’s not just about how the “other half” lives but about how our peers live. Instagram will show me a dozen photos of my next door neighbor’s kitchen remodel and Facebook will show me how my sister’s kids are “doing” (or at least the posed pictures she chooses to put up there) and TikTok will show… whatever TikTok shows. So not only do we see folks well beyond us in much more detail, but we see idealized versions of folks just like us and we compare our messy, real life to their social media portrayals and that is always a comparison we are going to feel bad about afterwards.

@DK:

Oh. Only $6. Well then.

Yeah. I am “out of touch” with the cost of a Starbucks coffee–but it has nothing to do with priviledge. It has to do with not paying for a cup of coffee every day when I can make it at home for about 15¢ a cup (call it 20¢ with the spoon of sugar and dollop of cream).

Which is not what I said. It’s not that less avocado toast will make for a down payment–but paying attention to how you spend your money, and saving where you can. If they’re spending money on all the Apple stuff I listed, where else are they spending money they could be saving? They bitch about not being able to afford a house (when they’re making $200k coding at Google), but are they making efforts to save for one? Or are they buying toys?

@DK:

Who said anything about Gen Zer’s, but my experience is that that many were early millennials.

edit. And BTW who are you to deny someone’s experience?

@Kazzy: A number of years ago, I was listening to an NPR show while driving, and the guest went into detail about how much the depictions of middle-class families on TV shows had changed. From the clothing to other details, like granite countertops in kitchens, to the size of the houses, the ways in which families that were supposedly middle-income had changed a lot. Some organization had tallied what kind of income would really be needed to live as they were on the shows, and it was solidly upper-income.

I’m not sure what to call it, but there’s absolutely an inflation of what is depicted to be middle class across a lot of different media formats.

@drj:

Education is part of why housing is so expensive, as you desperately want to get a house in a good school district, but so does everyone else.

And that’s why @Mu Yixiao’s “houses are bigger now because people are wallowing in luxury while claiming to be poor” doesn’t hold water — those are the houses in the better school districts, at least in any growing city. Housing stock gets replaced with what can sell for more so long as there is enough demand.

Also, no one has mentioned health care costs. That, along with the housing and education, has way outpaced inflation and the costs have been increasingly pushed onto the individual rather than the employer.

On the other hand, you are far more likely to survive cancer. But again, since you don’t have the option to buy into 1970s health care to save money (maybe you get seen by veterinarians?), I’d say the right comparison is the cost of what’s available to buy into, rather than feature by feature parity.

@Jen: Oh. Yeah, I didn’t mean to imply that’s what he himself is saying about GenZers but I see why my comment read that way.

I was just using his comment as a jumping off point to say many seem to be bizarrely off about what they think the typical young worker is spending money on.

@Sleeping Dog: I don’t know if she still does it but years ago my sister’s church group would put together grocery runs for people down on their luck and she was one of the ones who delivered them. It was an eye opener to her when she would show up in a neighborhood full of houses that cost way more than hers did, only to find that the (always) woman living there with a a couple of kids had literally no furniture and, until she arrived, nothing in the refrigerator. This happened at least a couple of times and she never knew what led to those circumstances. She assumed divorce, but who knows?

@Sleeping Dog:

As a member millennial, I emphatically deny that the experiences of those who claim the average GenZer or millennial is spending money on expensive luxury items is representative of my peers, and I will die on that hill. With my boots on.

@DK:

I think it really depends on where you are. I work in Manhattan as a teacher. Most of my colleagues are between 25-35 (I’m one of the oldest as I push towards 40 this summer). They almost all live in desirable neighborhoods in Manhattan or Brooklyn, order lunch in 50-75% of the time, and routinely walk in with coffee they purchased at one of the pricier coffee shops. So it is not a caricature made up whole cloth. These people do exist. They aren’t everyone in their age cohort but they do very much exist and I do hear them complain about how unfair things are. When I point out that I commute in from a rental in the suburbs, bring a homemade lunch 95% of the time, and make coffee at home, it is dismissed as some sort of impossible lifestyle.

I have no problem with their life choices but if your expectation is to be 20-something, working a low-to-middle-income job (which, fair or not, is the going rate for teachers), live in hot neighborhoods in a pricey city, and routinely dine out, you’ve got to make sacrifices somewhere. For most of us, money is finite. If we spend it on one thing, we don’t have it to spend on other things. If you treat certain choices as requirements, you’re going to find that you have fewer options and choices elsewhere.

@DK: I don’t think that was his point. The average anybody is not making $250K. That puts you well into the top 5% in the US.

@Mu Yixiao:

The Apple stuff lasts a lot longer. It gets regular security and software updates, and is generally built to a much higher level of quality.

(Other manufacturers are getting the cheapest shit available that matches some numbered performance spec and throwing it all together, knowing that they won’t be the ones supporting it and it’s essentially disposable)

A lot of the big software companies moved employees over to Apple laptops not because it was cool, but because the total cost of ownership was lower.

It’s the classic good shoe that lasts forever, rather than the constant need to replace the crappy shoe. It’s the frugal choice, if you can afford it.

The vast majority of Google jobs are generally in very expensive locations. Housing in NYC, SF, Seattle and Mountain View is pricey.

@Jen:

Yes. Someone pointed out at least 20 years ago — I forget who — that when the phrase “keeping up with the Joneses” came into common use, the Joneses were a family down the street but in the same general neighborhood and with the same general sort of income. By 20 years ago, the Joneses were a family on TV with an underlying lifestyle enabled by the producers’ budget, in space often dictated by the shooting needs. Friends was a classic example. I recall estimates that the six main characters’ apartments represented on the order of a half-million dollars per year just for the rent.

@Mu Yixiao: No most are us not buying “toys,” we can’t afford them after the greed and economic/political mismanagement of our parents and grandparents’ generations caused two massive recessions, while they cut taxes for billionaires and failed to address a housing crisis and climate disaster (also an economic calamity).

Most are of us also not buying $10 or $6 coffee everday. We also pay attention to where we spend money and save when we can, despite the false rumors to the contrary. And very few of us make $200k yearly, certainly not those who complain about wage stagnation and greedflation, unlike many of the conservative-minded people here who downplay or deny the longterm deleterious effects of Reaganomics on American youth and the working classes more broadly.

Of course, you’d know all that already if you were a millennial (as I am), rather than someone thinks you’re an authority on us based on stereotypes and caricatures seen online somewhere.

From the LGBT community to young people, some people on this site love spreading misinformation and rightwing propaganda about groups they don’t belong to and with whom they apparently have little sustained, intimate experience. It’s a good thing that we finally have some young people and gay people in the mix to bring a dose of accuracy to this oft-embarrassing orgy of bs stereotyping.

@MarkedMan: You don’t have to me that. Tell it to the people writing out-of-touch nonsense like this about American youth:

@Kazzy:

Nowhere did I write “They don’t exist.”

I said they’re not representative of the cohort, and they’re not.

FWIW, I worked at a ritzy private school in West Los Angeles for a few years, hardly anyone ever came in with coffee daily. We had drip coffee in the teacher’s lounge, I’m surprised to hear that some schools apparently don’t, or that it’s underutilized.

@DK:

Then you have never looked at someones credit application, the credit report and the bank’s determination. You don’t know what you are talking about.

@Sleeping Dog: And you are not a millennial and have never lived or banked as one. I have forgotten more about my peer group than you will ever know. My knowledge of millennial cultural habits can run circles around you everyday of the week and twice on Sunday.

@Mu Yixiao:

I agree with all that, but I think that’s the case with almost every generation. Young people are generally not disciplined, which is something that gets developed and honed with experience. In my own case, I was not very responsible with money, and I cringe at how much I wasted – a lot of it spent on literally getting wasted. My friends weren’t much different.

I remember a guy from my early Navy days who was from Argentina. He was a bit older, came to the US, and joined the Navy. He saved just about every penny he earned. He ate every meal in the base dining hall (free), he lived in the base dorms (free), he didn’t own a car. On port calls he went on the official tours (cheap). He didn’t drink. He didn’t buy stupid shit. This was back in the early 1990’s and he would save most of his pay every year, something like $30k. Meanwhile his younger American peers blew through their paychecks. I blew through most of mine, but having depression-era parents taught me at a young age that I always needed to save something.

Even today, in my more introspective movements, I sometimes think back to that guy when I’m about to make a dumb purchase.

And it’s not like helicopter parenting has helped. We’ve tried to avoid that with our own kids, but norms have changed, and what used to be normal stuff will get a neighbor to call CPS or the police. And among my upper-middle-class peers, I see a LOT of parents do way too much (IMO) helicoptering, resulting in young adults who have to learn things the hard way once they are on their own.

The TLDR version is that self-discipline doesn’t form naturally, and status-seeking among peers is very powerful. That leads almost everyone to make sub-optimal decisions, particularly the young and less experienced.

Once again, it looks like some aspect has gone off the rails in this discussion.

I can 100% back up Sleeping Dog’s assessment on the high end motorcycle purchases*. These bikes are usually luxury items, not a primary means of transport. That doesn’t mean that the purchasers have spotless credit records–one of the fastest ways to get dinged on a credit report is too many inquiries in too short a time period, e.g., people who are doing a lot of shopping.

I’m not sure how the whole side discussion on generational spending came into play, but I don’t think it’s relevant to Sleeping Dog’s point–which, (I think) is that just because someone is earning a lot doesn’t mean they have a lot of cash on hand, especially if they’re drowning in debt.

*Sleeping Dog has known my husband for years, through that shop.

@Jen: It’s fair to say that some people spend beyond their means, in every generation. Maybe a more useful question is “what are the circumstances of someone who is reasonably well educated, reasonably hard working, and reasonably sensible with their money?” But it’s a tough one to answer generation by generation. Opportunities and the chance for success could vary widely, but to get a good measurement you would have to pull out an awful lot of complicating circumstances.

There are 72 million millennials in the US – more than the population of France or the UK.

No one has any special authority to speak on their behalf or generalize about them more than one can generalize about the French. Like any huge cohort, millennials run the gamut from shit-bags to geniuses, from poor to rich, from criminals to saints. There are certainly some entitled pricks among that 72 million, as well as some prolifigates, but those are representative of a sub-group or sub-culture, not the millennial cohort generally, and are seen in all generations.

@Sleeping Dog:

As the owner of 6 motorcycles (and a boat) I can only add that addiction is a struggle.

@Andy:

Good question! I will refer to an article from the dreaded rag USA Today for some suggestions. Let’s ask ourselves how many of these boxes did most Americans (including significant numbers of the working class) expected to be able to check off on their “things to have” lists?

1. Ability to travel someplace on vacation (at least sometimes).

2. Purchase of a new car (Remember when your dad used to tell you “buying a used car is just buying someone else’s problem?” I do.)

3. Pay off debts

4. An adequately-sized reserve income to actually cope with some sort of reversal?

5. Save for retirement (okay, okay, nobody actually used to DO that one–still there’s a difference between “didn’t” and “can’t”)

6. Pay routine medical expenses without going into debt (back in the 80s and 90s, I lived for many years without medical coverage for years on end, but still paid for the services of the allergist and for various other medical expenses out of pocket; in fact, it used to be less than my premiums would have been lots of those years)

7. Dental work (or even routine dental care, though lots of that was covered by dental insurance)

8. USA Today‘s list left off own a house in a neighborhood with good schools, but it was on the list that ChatGPT for Bing provide in its answer, and I might alter that to pay rent on a dwelling I’m not sharing with someone else, but mileage will vary for this point

I don’t know many young people beyond high school age, so I can’t say how many of these things are routine still. Based on the stories Luddite tells me about his coworkers, I have to guess that most of the items are on their “dream about someday” lists rather than their “check-off” lists. I’ll close by noting that one of the “what’s wrong with this picture” things that I’m noticing these days is that the list of people who need student loan debt relief includes single people with incomes below $125k and married couples with incomes below $250k. It seems to me that if people at such income levels require government sponsored debt relief the question about “middle-class lifestyle” is not “what is it” but rather “who, if anyone, does it include?”

Back to you, Andy.

@Daryl:

@Jen:

I will say that I split my 25 – 30,000 annual miles almost 50-50 between a car and my bikes.

And also that I am pretty much unsupervised (single).

Small point regarding Boomer wealth. Where do you think it goes when we die? Between insurance and whatever we don’t manage to piss away between now and the end, my kids will leap into the 5% if not the 1%.

Note to Millennials: support voluntary euthanasia.

@Daryl:

The only reason that my garage doesn’t overflow is my wife. I’m at the buy one, you must sell one stage.

@DK: If it helps any, I saw both the point he was making about debt levels and your side point about debt levels/purchases by younger people complementing each other. And the “whole” story is probably larger still. (Assuming that someone can capture the whole story in a single view–or even multivolume book series.)

@Kazzy:

I’d be interested in exploring how they are doing that on teacher’s salaries, but I’ve already read the story about the Seattle who, upon getting the windfall increase a few years ago (to over $60k!!!–how outrageous is that!!!), was still living in her mom’s basement because she still couldn’t make the rental income threshold in the area, so the answer might be wasted on me.

@Gustopher: Shoes are problematical these days. The last three times I got my $350 Cole Haans repaired, the fault for which I had brought them to be fixed had been simply glued over and refaulted at the first wearing. Moreover, I mostly wear casual shoes now and am not too hard on them, so I usually get two or more year’s wear. In that context, buying disposable for $20/pair makes more sense than buying Sketchers at $90+ and still tossing them when they wear out–in about the same time.

When I was in Korea, little kiosks on street corners had old men and younger women (sometimes) that shined and repaired shoes and they even rebuilt people’s casual and running shoes. I’ve not seen this service where I live–not even in Portland or the toney rich-people (aka, the people claiming middle class status on our thread) suburbs (tho Beaverton still has a shoe repair shop–for as long as the 80-mumble guy who owns it keeps it open).

@DK: You young whippersnappers need to get it through your heads: from a marketing perspective there is no housing crisis. The market is meeting the needs of people who can afford housing just fine. There are no gluts to clear and the shortages among people who can actually buy product are relatively small–we don’t even have the *bidding over asking price* conditions that prevailed in most cities anymore. The fact that many people do not earn wages that cover rent or allow them to buy is not a market problem. It can’t work miracles, after all–no matter what conservatives like JKB say.

The people who need housing should go to places where housing costs are lower. Zillow shows me houses that I could buy for the spare change in my emergency/vacation trips fund every day. They’ll just need to figure out how they will manage the longer commutes. [eyeroll]

@Daryl: My husband had six at one point. Thankfully we’re down to three now.

@Sleeping Dog: Our agreed-to policy here is that he can do what he wants with the bikes he has, but no new debt. So, if he changes his mind from the combination he has now and wants a brand new one, he has to figure out which one(s) he sells to get to that new purchase.

@Just nutha ignint cracker: @DK: And thank you for bringing this point up. I was on the phone with my older (and more MAGAesque) brother yesterday and this rant has been building up for a day and a half now. [cleansing breath]

@DK: Wow! The situation with not having coffee–and adequately sized coffee makers–is a serious problem, particularly in schools. While I was in grad school, I substituted at a middle school in a small town. At the seasonal unseasonable thaw following the blizzard the week before, the river overflowed its banks and contaminated the reservoir. The 100 cup coffee urn in the faculty lunchroom saved the school from an emergency closure by having a brew time long enough to sterilize the water so that we had water for the staff and students to drink all day. (Why the school had a 100 cup urn for 1o or 12 staff had always been a puzzle to me, but I assumed it was for PTA meetings and such.)

@Jen: Years ago, my Discover Card bill used to come with a FICO score included. I would notice in passing that it was 840 and go on about my business. One day, I noticed my FICO score had gone down to 825 and had an asterisk by it. Consulting the note at the bottom of my statement, I discovered (no pun intended) that my score had been lowered because I didn’t use credit cards for my purchases enough (I usually paid for things with cash or a debit card from my CU) and that I paid my bills in too timely a fashion as I had no credit card balances, so my FICO score had been lowered.

I stopped paying even passing attention to my FICO score from that day. It became easier when Discover went to paperless billing with a monthly reminder of my balance and minimum payment via email. And I still pay my balances off monthly.

@Michael Reynolds: Mine, such as it is will be going to relief agencies, endowing a couple of scholarships–much less expensive than I thought–at a community college and a university that takes indigent students, and an agency or two that provide services specifically to homeless families and children who age out of the custodial service system.

No kids.

@Mu Yixiao: “They bitch about not being able to afford a house (when they’re making $200k coding at Google), but are they making efforts to save for one? Or are they buying toys?”

If they’re working at Google, then they’re going to be hard pressed to find the shabbiest starter home within a two-hour commute for less than $1.5 million. I just spent some time in Berkeley, where the first house my parents bought — an assistant professor and a then stay-at-home mom with three kids — for 27K with a little down payment help from her parents. It sold three years ago for $1.8 million and is currently “Zestimated” at just under two mil.

So they need a down payment of $400k, which they have to gather while also paying $3K to rent a crummy one-bedroom apartment, car payments and the student loans they racked up getting the degrees they needed to achieve that fabulous $220k/year position.

And oh yeah — all those “toys” you think they’re so foolish for buying are actually the tools of their trade. But they’re not what you use for work, so clearly they’re just indulgences.

By by cracky, if they simply eliminated everything from their lives that brought them any pleasure, they could probably afford that house in seventeen or eighteen years, by cracky!

@wr: That’s in line with prices in Seattle, though. Before I was born, my parents bought the house I grew up in (their second purchase) for $12k–my dad working in a warehouse rather than a university, thus the scale/neighborhood difference. That house’s Zestimate is currently $780k, so both have appreciated at similar rates. ,

In fact, strictly speaking, your parents’ house may not have done as well.ETA: My mistake. I misread.@wr: that’s the main thing–the need to be in a high COL area if you want to have a well-paid job with a future.

I would have had to move to near D.C. where the housing prices have shot up to a ridiculous level except that now we’re able to do all of our work from home which means am still in the Midwest.

(COVID was good for something, it turns out.)

@Michael Reynolds:

Good heavens. We are not going to help our parents and grandparents kill themselves. That kind of grief would be Boomers’ final slap in our faces, the last insult lol

No, let them stay as long as possible and suffer till the bitter end.

@Just nutha ignint cracker:

The “teachers are living luxury Manhattan lifestyles” definitely caught my eye too. But rather than accuse anyone of, um, exaggerating the facts for narrative effect, I just pointed out that drip coffee in teachers’ lounges has long been a thing and expressed surprise his colleagues weren’t taking advantage of it.

Do I really believe that teachers at that school are living in the Upper East Side and Park Slope, stopping at Starbucks everyday on their way in?

No comment.

Thank you for being sane and funny, as usual.

@Mu Yixiao:

Houses for sure. And the rest of the stuff, because Americans used to have a lot less stuff and much more modest expectations.

In 1965 my parents bought a new, 1650 sq. foot home in the northern part of Marin County (not nearly as ritzy as the southern part). 27K. That would be about 236K today. Two car garage, decent sized lot, no A/C. Nice area surrounded by hills.

We had a Ford sedan and a Ford wagon. One TV & one phone. Vacations to national parks and a college alumni camp – cabins or tents. My father was an up and coming attorney, we lived somewhat larger than most of our neighbors.

People got by with much less and much lower expectations. At that time, we did not even have any credit cards. I think people were happier then, but that’s another discussion.

it’s all a facade. The main drivers of why we feel we can’t keep up or save, etc…are still the same. The pace of housing, education, Healthcare, child care (the things you need) far outpace wage growth. Sure prices of Tvs, cell phones, electronics in general are cheaper, so you feel things are great, but people are still mortgaged to the eyeballs and carrying ridiculous amounts of debt nowadays. Has to break at some point. And this chart is over 6 years old.

For most us workers, real wages have barely budged for decades

While this is has been going on, most of the benefits of the US economy, which has had considerable growth, flow to the top, where they are the least needed and least useful.

The folks at the top of the food chain have done a good job convincing those who came after the boomers that boomers are to blame for their economic problems.

@Just nutha ignint cracker:

We have a problem that good, well-paying jobs are really concentrated in a few metro areas in this country, which makes them very expensive (and requires higher pay…)

This also leads to the less fortunate areas emptying out, leaving bitter old people behind to the point where Wyoming has a population of two dozen people, two of whom will be senators, and one in the House. That’s not good for me in Seattle.

So I’ll take 2/3s of your eye rolling comment and say “yes, absolutely, we need people to move to cheaper areas.”

We also need to develop these cheaper areas — some giant government thumb on the scale with payroll tax, perhaps? An actual industrial policy? Don’t know.

The current hands-off approach isn’t creating something that works for the nation as a whole.

Or merge the empty states together. (Or make Washington DC part of Wyoming…)

@wr:

@Mu Yixiao:

About a year and a half ago we sold our place to a young (so young!) couple from the east coast. Both worked remotely for major tech companies in the Bay Area. They were very well qualified financially, strong down payment, solid savings.

I hope they are ok now. It’s not hard to imagine that if one of them was laid off and couldn’t replace their income quickly, they could be in trouble. They bought at the absolute top of the market.

I don’t understand this inter-generational finger-pointing. The people who are engaging in it are being played by the folks who sit on the mountaintop raking in the chips. Wishing the best for others costs us nothing, and it produces a much better outlook on life for those who practice it.

@Just nutha ignint cracker:

That seems like a reasonable list in general, but of course, the details are often much different now. I’m not sure how to make an apple-to-apples quantitative comparison across large cohorts.

I did find this article/book summary that shows some data that millennials are not doing poorly as a cohort and in many cases, they are doing much better.

@wr:

Working at Google in the Bay area isn’t representative though. No one has to work for Google and those with the skills to get a job there can land jobs in less expensive areas. In other words, if you get a job at Google, you have to understand the tradeoffs of living in that area, and accepting those tradeoffs is a choice.

The Bay Area is also an example of how NIMBY, bad housing policy, and bad company policies conspire to make that area a housing price and cost-of-living freak show.

One area where younger generations can legitimately blame older generations is the creation and perpetuation of bad housing policies.

@Gustopher: there’s also the fact that as you get older, the closer you want to be to good medical facilities and places that have things like ambulances and street lights. Hence the unwillingness to plonk yourself down in the middle of Wyoming. The scenery might be great, but that can’t replace hip surgery.

@Just nutha ignint cracker:

My hunch is that many of them are living far closer to paycheck-to-paycheck than would be necessary with different spending habits. And, hey, that’s there bag. I won’t tell them what they should or shouldn’t do. I’m just noting what I see.

We do have fairly low premiums on our benefits, which surely helps. I don’t know if they’re saving for retirement, via the employee plan or individual plan. I don’t know if they have emergency funds socked away. Many of them have partners who work, though none that I know of who are in particularly lucrative fields (e.g., they are teachers themselves, work in the service industry, and/or are early career themselves).

There is nothing wrong with their lifestyle. But it is not particularly conducive to long-term financial stability. If they don’t care about that or don’t care about that right now (and young people thinking short term is pretty normal), such is life.

So, no, a coffee a day isn’t the reason they can’t afford 20% down in this market. But a $5 coffee and a $12 salad and a $3000/month apartment in downtown Brooklyn and regularly using DoorDash or UberEats or whatever and the mindset that permits that sort of decision making is unlikely to leave one well positioned for a down payment.

If you want to tell me there are people who have more financially frugal mindsets who still struggle to make a down payment, I won’t argue with you. Hell… I’m one of them myself (my fiance and I learned that our rental is being sold and we quickly dove into the housing market only to come up empty, primarily because we are two school teachers with three kids and we were trying to buy in the VERY expensive school district our kids are in… which is it’s own financially questionable decision; in the end, we found an affordable rental).

There are lots of reasons why it is hard for people to buy homes or just make ends meet these days. Some of those are structural and some of those are self-inflicted. Why is it so verboten for some to acknowledge the latter?

@Andy:

RE: The Bay Area, what housing policies do you think would have been better? Break it down for us. In 1970, the population here was about 4.5 million – and all the prime real estate had already been developed. Yes, all the prime land was gone half a century ago.

Today, the population is roughly 7.5 million, so we’ve added 3 million people and the infrastructure, schools, shopping centers, and so on they need – after the best real estate was gone. The Bay Area, and to some extent California, are victims of their own success. Too many people want to be here, and the market is still telling us that this is a very desirable place to be.

The fastest-growing city here is Brentwood, with an average home price of 800K. You’re going to commute from Brentwood to SF? Welcome to Hell.

And what about NIMBYs? Show me a place with expensive homes and people living in them that have enough juice to hamstring development that is rolling out the red carpet for said development that will degrade the lifestyle that they paid so much for. That’s an everywhere thing, not a Bay Area thing.

Endless growth will eventually bring unpleasant consequences. The people in FL & TX who are crowing because “everyone is moving here” will see that those who do not learn from history are doomed to repeat it.

@Kazzy: and

Must be why the majority of “young people” keep warning about and voting on the need to fix climate disaster before it’s too late — some even delaying childbearing based on this future threat — while the majority of “old people” support a party that denies climate change, in part because many can’t see or don’t care about the looming danger.

Stereotypes are fun tho.

@Andy:

Tech has consolidated in a few expensive cities, especially the big tech (which is less transferable than you would think to smaller companies — totally different problems, and effectively a different thought process)

It’s also about where you can find another job if you need to without uprooting your life (again, as many are transplants as is, moving to where the jobs are).

The less expensive cities in tech are Austin or Seattle rather than SF, not Minneapolis or whatever Podunk you’re thinking of.

@DK:

Voting and take real action with day-to-day life decisions are two very different things.

I’m not criticizing nor stereotyping. I studied adolescent and early adulthood psychology/development in college. There are brain development reasons why younger people tend to (not always) make life decisions with shorter time horizons in mind.

As I said, there are lots of structural issues at play… such as letting teenagers agree to take on debt that exists in quantities and on timelines they can barely fathom, along with minimal or barely adequate financial education to help them better understand it.

You’re doing quite a bit of stereotyping yourself, making assumptions about why people have the perspectives they do.

@anjin-san:

Allow more density in zoning. That’s how you make more housing when there isn’t land to expand.

Related to the OP, Matt Yglesias has a good essay on this.

Bingo! You are one of the very few who see through the Power Elite’s misleading metrics, foisted on the masses by corporate media: Inflation, GDP, “The Economy, . . . ” Well done.

A more honest metric might be the comparison of costs for rent, homes, university, property taxes and recreation, adjusted by the inverse of desirability of locale, comparted to GS15 salary. By that metric, how does life today compare with 1970? Or 1960? Or 1950?

@drj: Well doen! Where did you get the home price to income data?

@Andy:

That’s a very simple answer to a complicated problem, and I don’t see it as a solution.

For at least 30 years or so, subdivisions in the Bay Area have consisted of large homes, packed together very, very densely and most often adjacent to freeways. Also, mega condo and apartment development, again usually close to freeways.

In the 80’s, subdivisions began going into places like Brentwood, that had previously been farmland. Almost 60 miles from SF. Small yards, even in large, somewhat expensive homes. These outlying areas were built out quickly, so whatever housing relief they provided was relatively short-lived.

I’m not seeing where we are going to get much, if any more in the way of density.

How much time do you spend in the Bay Area? I’m not being snarky, just curious.

The home that I mentioned earlier in the thread that I lived in as a child was built in ’64. This was when the last prime, flat tracts of land were being developed. That building cycle started in ’54. Previously most of the area was dairy ranches. It only took about a decade for the prime real estate to be used up. After that, new housing is built wherever they can carve lots out in the hills.

Some variations of this cycle went on throughout the Bay Area.

There is also the question of how much growth do we want to have? The population here has roughly doubled since 1970, and the negative effect on the quality of life has not been trivial. Do we just keep building until the area becomes a place you don’t want to live?

@anjin-san:

I used to visit the bay area regularly but haven’t been there in about 15 years.

I realize it is politically extremely difficult to do, but the reality is that increasing density is the only option if the area is geographically confined and one wants to increase the amount of housing and reduce prices. If one doesn’t want to increase housing and reduce prices, well, then the status quo works. There are always going to be tradeoffs.

That’s for the people in that area to decide. If they are happy with how things are, that’s fine, but it’s also a choice. Same with the tech industry based there – at what point and under what circumstances would they be incentivized to move? I don’t know the answer. I guess as long as they can keep attracting employees, even if those employees have brutal commutes or live in vans (which are also choices). They may be forced to relax remote work policies as one example.

@Andy:

There’s also the option of building up other cities.

A lot of the density of people comes from the density of jobs (and vice versa), so it would require some significant government intervention.

Some of the density also comes from people fleeing Red America, as San Francisco has always been a haven from the queer community.

In both cases, the solution is the same — make other areas more attractive to take the pressure off the major metro.

Unfortunately, you run into incentive problems at the local level (SF and CA want tax revenue, and so don’t want to “lose” to St. Louis or Kansas City), and no one is thinking about it at the national level. Businesses also want to locate where there are already workers skilled in whatever they need, with no thought beyond profit.

Also, with climate change, we might be interested in building up some of the places that have more water resources, and gently encouraging people to leave places like LA.

The solution to SF, Seattle, LA, NYC and the like is a large scale federal reindustrialization plan. Because the federal government is the only organization with the right scope of interest.

@Andy:

I have a hard time envisioning any development plan that would significantly lower housing costs. And if someone did come up with one, where would the infrastructure to support them come from? The aging Richmond bridge has dropped chunks of concrete onto the lower roadway. Highway 37 is highly susceptible to climate change-driven washouts. Similar problems abound. Do we really want to put more cars on the roads?

The Bay Area is a very expensive place to live in. As are NYC, Honolulu, LA, Arlington, Seattle, and so on. Is this a problem to be solved, or simply a reality of the marketplace that we should accept?

@Gustopher:

This is a very good point. Living in the most desirable urban coastal areas in the US is unaffordable for many/most people. It just is.

I want a Porsche Taycam Turbo, but I can’t afford one. Until recently, I had a 350z, which I could afford and was not a bad compromise. We don’t get everything we want, and there are a lot of good places to live in this country that could be even better with some societal effort.

@anjin-san: I had a 2005 350Z roadster. Easily the most fun car I’ve ever owned.

@anjin-san: This.

While there would be quite a lot of room for increased density (Sunset district and Inglesite are pretty much in the city centre and seem to have, at first glance about half the density of a comparable European city centre), it’s doubtful that that is either desired or would help a lot with prices given the induced demand factor.

Nevertheless it should be pointed out, that the happiness of existing residents is essentially bought with the misery of the commuting underclass (I disregard the commuting upperclass -they chose that life :D).

In the end high population density is an advantage when it comes to high-value industries and thus self-perpetuates. It’s basically the gold rush, just with well-educated people instead of gold. And like back then, it tends to lead to price-gouging frenzies.

@James Joyner:

I do miss my (2004) Z. I also had a 260Z back in the day. But the mileage was getting up there. I have a mid-size SUV (Mazda, looks sharp and is reasonably fun to drive) now, which is a lot more useful if we ever have to evacuate.