Why Americans Are So Anxious About Inflation

Prices are way up, even though the CPI is back under control.

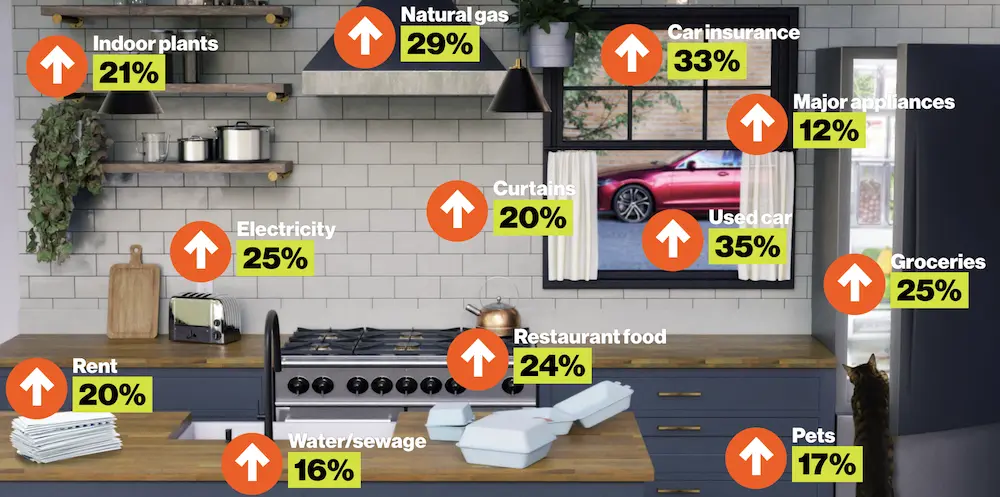

The image above sits atop the Bloomberg report “Just How Bad Is the US Cost-of-Living Squeeze? We Did the Math.” By being specific rather than using the traditional generic indicators, it’s helpful in explaining why Americans feel overwhelmed despite an overall state of economic health.

After years of inflation, US consumers are shouldering a burden unlike anything seen in decades — even as the pace of price increases has slowed.

It now requires $119.27 to buy the same goods and services a family could afford with $100 before the pandemic. Since early 2020, prices have risen about as much as they had in the full 10 years preceding the health emergency.

It’s hard to find an area of a household budget that’s been spared: Groceries are up 25% since January 2020. Same with electricity. Used-car prices have climbed 35%, auto insurance 33% and rents roughly 20%.

Those figures help explain why Americans continue to register strong dissatisfaction with the economy: Consumers’ daily routines have largely returned to their pre-pandemic normal, but the cost of living has not.

And the government data reports that show easing inflation are cold comfort, because they simply indicate prices are growing at a slower pace, not that they are returning to early 2020 levels.

At the same time, housing affordability is at its worst on record, auto-loan rates have soared, and borrowing with a credit card has never been so expensive.

Many Americans have seen their pay rise rapidly since 2020, but much of those gains have been gobbled up by inflation. Some of the fastest wage increases in decades have left the average American largely no better off than before.

Not only have prices overall have gone up by almost a fifth in under four years—faster than they had in the entire previous decade—but they’ve gone up even more on goods and services that people pay most attention to. For those who aren’t affluent, rent and used cars going up that much are not only crushing but almost guarantee not being able to rise above one’s current circumstance. One can’t save up for a down payment on a house if rents keep going up. And, of course, the radical increase in interest rates leave people trapped in their current homes.

Alas, the authors then shift in a way that drives me nuts:

Consumers’ frustration with prices and elevated borrowing costs could help decide whether President Joe Biden wins a second term: Four in 10 swing-state voters in a recent Bloomberg News/Morning Consult poll said the economy was their top issue in the 2024 presidential election.

While feelings are what they are, it makes no sense to judge Biden based on how much prices have gone up since the pandemic. He wasn’t President the first year of that.

The rest of the report is a deeper dive into the price categories followed by colorful quotes for Regular Americans that may or may not be representative. But, for example, in the discussion of groceries, we get:

A pound of ground beef now costs $5.23 on average, up from $3.89 in January 2020. Coffee is up some $2 a pound. Prices for fresh fruits and vegetables are nearly 14% higher. At one point, the price of a carton of eggs was triple its pre-pandemic price.

“It’s a huge slap in the face and I’m surprised that some people are saying inflation’s coming down,” said Ryan Essenburg, 50, who lives in California’s Bay Area. “It’s hard. You go get your bill and it’s like, ‘What’s happening here?’”

In October 2020, a Census Bureau survey showed a four-person household spent an average of $238.32 in a week on food at home. Three years later, a similar survey showed that figure had jumped to $315.22 — roughly 32% more.

Grocery inflation is anticipated to return to less than 2% next year, but that might not offer consumers much relief.

“I don’t see any other way than food overall is going to be taking a higher share of people’s disposable income than before,” said Brandon McFadden, a professor in food policy economics at the University of Arkansas. “You can’t wiggle out of buying food.”

And, of course, this hits the working-class voters who are most likely to shift their allegiance from election to election harder than it does college-educated professionals and other higher earners. They’re legitimately squeezed and anxious.

That it’s largely irrational to blame Biden or, indeed, any politician for this is really beside the point. That prices have gone up here less than they have in most other OECD countries is of little comfort to those struggling to pay their bills.

At the same time, aside from expressing sympathy for these price increases, I’m not sure what it is Biden is supposed to do about it. Apparently, good old-fashioned demagoguery is the current plan.

President Joe Biden took aim at corporations Monday for charging prices he said were artificially high even though the rate of inflation has slowed and some shipping costs have fallen.

“Any corporation that has not brought their prices back down, even as inflation has come down, even as the supply chains have been rebuilt, it’s time to stop the price-gouging,” Biden said at the launch of a new White House supply chain initiative. “Give the American consumer a break.”

While it’s true that the annual rate of inflation has cooled from its high last summer, this doesn’t translate directly into falling consumer prices. It only means that prices are rising at a lower rate.

Prices for some everyday goods have fallen over the past year, a reality reflected in lower Thanksgiving costs this year, for example. And lower costs have in turn left some consumers with more money in their budgets for things like Black Friday shopping, which rose 7.5% this past weekend over a year ago.

As Biden runs for reelection, the White House has sought to claim these broad spending and pricing trends as victories for the president and his economic agenda, dubbed Bidenomics.

But the argument that Biden deserves the credit for a strong economic recovery has proven to be a tough sell to voters, who consistently give the president low marks on the economy.

“We understand that people are still not feeling it, we get that,” White House Press Secretary Karine Jean-Pierre said Monday, ahead of the president’s supply chain event.

This is a more useful approach:

Faced with a skeptical audience, targeting so called junk fees, which Biden said “companies sneak into your bill,” offers the White House with a chance to directly show voters what Biden is doing on their behalf.

It also provides the president with an easy target in the inflation blame game.

“Junk fees take real money out of the pockets of average Americans,” Biden said Monday. “They can add up to hundreds of dollars, weighing down family budgets and making it harder for families to pay their bills.”

Eliminating hidden charges on everything from airline tickets to cell phone bills is hardly going to make up for higher rents and grocery bills. But the practice seems inherently unfair and may well be within the President’s authority to address.

James,

It’s the economy stupid. Inflation may be under control now, but voters aren’t forgetting those grocery and rent increases.

For that reason alone, I think Biden will lose a year from now. Not helping him is his age and the Democratic party leadership having their heads thoroughly planted in the sand concerning that.

Somebody will say the polls aren’t that bad right now. They aren’t good either and I recall in 2020 commenters here thinking the polls* had Biden having a chance in Texas of all places. We know what happened. I will give my theory again- The people being polled are telling the questioners what they think the questioners want to hear and not who they favor.

We better all hope Trump drops dead of a heart attack. 4 trials** or no trials, he is going to win next year.

*- The 2024 Almanac of American Politics, which I own, stresses many times how awful Presidential polling was in 2020.

**- Even if convicted, Trump will have the court tied up in appeals for years. He is litigious and everyone here knows it.

After record sales on Black Friday and Cyber Monday (not to mention that the fed is thinking about cutting interest rates) it seems to me that whatever is causing people to tell pollsters how anxious they are about the economy hasn’t stopped them from spending like a drunken sailor.

Why should prices return to prices four years prior?

As long as consumers are willing to buy at an inflated prices, there is no incentive for producers to roll back prices to 2020 levels.

@Rick DeMent:

But how much of that is due to price increases*? How much is it due to those days not being stressed or marketed so heavily the last few years due to the pandemic?

*- I love making this analogy. Tiger Woods is all time PGA Tour money winner. That’s because he plays today and not 40-50 years ago. If Jack Nicklaus (Winner of 5.7 Million lifetime) had played with purses as they are today, he won 18 majors, was runnerup 19 times, top 5 finishes 56, and a three time winner of the Tournament Players Championship (Now called the Players Championship, would Woods still be #1. Maybe or maybe not but it would be close. Note that Nicklaus won 17,500 with his 1962 us open triumph. Woods winning the same tournament 46 years later, took home 1.35 million. This year’s winner, Wyndham Clark, took home 3.6 million. Clark’s two wins this year have earned him more money than Nicklaus did in his entire career.

Maybe 50 years from now, the future version of Tom Brokaw can write “The Whiniest Generation.”

@Bill Jempty: for the Nikolaus/woods comparison: his 1962 purse equals 178k in today’s money. So, no, it isn’t close at all in today’s money much less when Woods won his.

Using 1962 for the 5.7 million lifetime is 58 mil in today’s money. Woods 121 million lifetime winnings (no endorsements or anything else in that figure). Again…not even close. It would be even further apart if we based the calculation in the last year he won a tour championship (1986)

That it’s largely irrational to blame Biden or, indeed, any politician for this is really beside the point.

I’m not sure this standard was applied to Donald Trump when it came to COVID. Biden and company spent at least the first year of his administration willfully ignoring the problem of inflation, likely because paying attention to it would have gotten in the way of all the spending they wanted to do. Then they moved into gaslighting the public and only now are they giving the problem of inflation any attention at all.

By the way, all the talk of fascism lately has got me wondering…if Trump wins the White House in 2024, have you thought about what are you prepared to do when the Biden Administration (and Washington DC as a whole) decides Trump just doesn’t get to be President? Joe Scarborough is on TV talking about how Trump will start executing people if he gets back in charge and that’s with still a year to go.

It’s not just Black Friday. Consumer spending has remained strong during the inflationary period. When asked about their personal finances the majority of people are positive. What I think this shows is that wage increases have kept up or exceeded prices for most people. However, the price increases, a loss, outweigh wage increases, a gain, because people always worry more about losses even if they gain overall. In economics they refer to revealed preferences. People are complaining about inflation but still spending a lot.

Steve

None of those increases in the graphic above this post are as great as the increases since 2020 in both housing prices and mortgage rates. (Double whammy – high mortgage rates applied to higher prices). Lots of interesting charts in this gift link to the Post.

“GiftWaPO”

ETA: Lots of us old farts, Silents (me) and Boomers living in nice houses bought when housing was a lot more affordable.

@Thomm: @Thomm:

In today’s money.

Let’s compare Nicklaus last year 1986 vs Woods 2008. Just doing the math in my head, and only counting tournaments with round figures, the PGA Tour played for 4 time higher money in 2008. If you add in the non round numbers its over 10 I’m sure.

How about this Palmer in 1962 was the leading money winner with 81,000 thousand. Viyah Singh led in 2008 with 6.6 million. Singh won over 80 times as much money. Norman 1986, the last year Nicklaus won a tournament, Singh won 10 times as much.

I don’t have have the time to juggle the numbers. But it is not as simple as comparing today’s dollars to yesterday’s dollars. Gasoline prices, lets use the worst state average, are 20 times higher today than 1962. PGA Tour leading money winner money has gone up over 260 times from 62 to today.

@TheRyGuy: “if Trump wins the White House in 2024, have you thought about what are you prepared to do when the Biden Administration (and Washington DC as a whole) decides Trump just doesn’t get to be President?”

I try to imagine what it must be like to be so desperate for attention from strangers that you’d choose to come across as such a total idiot, but I just can’t. What exactly do you get for posting as a moron? Where’s the thrill?

Ran across an interesting economic statistic the other day. The percentage of paid off home mortgages is at an all time high. Means that boomers are staying put or are locked into their fixed assets or can’t sellout because of high interest rates.

I’m one of those people. Almost 70 and house paid off. Also in a bit of a house lock also. If we move, we lose our property tax freeze.

As for prices here is San Antonio: at Costco, gas is $2.39, ground beef is $3.99, boneless pork loins are $1.99/lb. Eggs are $3.99/two dozen, grade AA. Coffee has not gone up. Wine has not gone up. Large avocados are $5.29/1/2 doz. Boneless chicken breasts recently dropped to $2.99/lb.

As economists point out, a fixed basket is only an approximate point on food prices as people will switch to a different product if a price gets out of line.

When the aggregate supply is lower than the aggregate demand, prices and services rise.

The pandemic certainly did a number on the global economy. Drought and extreme weather are causing lots of disruptions, leading to higher prices. Volatility in oil markets. Volatility in agriculture. Don’t discount price gouging and fixing by some businesses, taking advantage of the situation.

There will be more pandemics and more extreme weather. Viruses and bacteria thrive in warmer climates and since we have one party here in the most powerful nation in the world that denies the fact that climate change is real so they can continue to promote personal greed over the public good (that’s FREEDOM, folks!) I expect this pattern to hold.

@wr: “When nothing is true and everything is possible….”

Remember when “conservatives” haughtily told us that “words have meaning”? Good times.

I’m an old guy, and I believe that many commentators on this site are too. It’s hard for me to be sympathetic to concerns about inflation. For one thing, we survived the 1970s when inflation was higher and lasted longer. Mortgage rates 7.5%? Pfft, mortgage rates were 10% in my day. Secondly, we already have a lot of stuff. Young people have material needs that force them into the market, but I have a houseful of furniture, appliances, and tools that were bought a long time ago. My wife and I exchange books at Xmas because we have all the material things we need.

The Republicans have positioned themselves as the party of fiscal responsibility even though every GOP president in my long lifetime has run bigger deficits than their predecessor. Has any economist correlated the Trump tax cuts with inflation? Why not?

@Bill Jempty:

Not much really because the big price increase were in things like Gas, housing, and other things not generally given as presents at Christmas.

A search on the news about fast food prices brought up this from CBS News posted 15 hrs ago.

So is that inflation is down from the 9% burst to 3% really going to be seen as good news? After all, the 3% is 2.5 times higher than inflation has been in the economic memory of Millennials and Gen X.

And used car prices are up as a direct consequence of the Democrat war on gasoline vehicles and the driving up of the prices of new vehicles, meaning fewer used cars coming on the market and higher wealth individuals turning to used cars, which btw are still in the $32k range for a vehicle newer than 2012 or so.

Well, Democrats really wanted the post-pandemic presidency. Seeing it as a crisis to exploit. But the economy was always going to be an issue so Joe Biden may have just saved Trump from the troubles. And when Trump takes office in Jan 2025, he’ll be starting from the new baseline like how Reagan was a breath of fresh air after the economic mess of 1976-1980

Perceptions matter

@Scott:

That looks to me like a non-issue. Just sell the old house and use the proceeds to pay cash, no mortgage for the new house, that’s what we do.

@JKB:

Bullshit. New cars got expensive because in short supply because of supply chain disruptions. For example, you can not build a new car without the microchips that got scarce. Gasoline and EV not a significant factor.

My preface to this comment is that as an attorney, I primarily work in residential real estate transactions (currently, FML). I started practicing as an attorney doing this in 2008. Interest rates were 8-10% depending. My first couple of closings ended in screaming knife fights. The only good thing that came out of the Financial Collapse was that it was hard and swift. By 2010-11 it was largely over, maybe a couple more years to flush out the system. We’ve largely corrected for that now so something similar is almost certainly not going to happen. Or at least it won’t be caused by real estate. Now, now we are well and truly fucked. This is the perfect storm of malaise. High interest rates, but still well under historical highs. @Scott:’s Boomers aren’t moving and aren’t dying. Or, like in my neighborhood, the Boomer’s all died or got put in “facilities” and their kids who are deathly afraid of the CITY, sold their parent’s/grandparent’s dumps to the up and coming Chinese family, who promptly renovated it and now it’s worth significantly more (thank you so much), but that’s done. The worst houses got torn down, the rest fixed. As an aside, the Southside Italian mobster types also built a couple more 2-3 lot McMansions, so things are returning to normal (they have bad timing and these garish monstrosities are going to bankrupt them again.)

I’ve talked to other attorneys, I’ve talked to realtors, I’ve talked to lenders. No one in this industry has any idea how we’re getting out of this. We can’t build fast enough and most of the building is going into higher end homes for older people. We need a ton of starter condos and 2-3 flats. Those aren’t being built. The boomers aren’t dying fast enough. Middle aged people like me locked in a rate at or below 2% so really can’t move. Young people don’t have enough money and there isn’t really any “starter’ homes anymore. Hell, a huge portion of my practice was REOs and there aren’t even any of those right now.

Like, one conceivable way of fixing it would be for the government to buy down the interest rates on a loan for say a forgivable mortgage on the property. But, I can barely type that without laughing.

And then there’s this:

https://qconline.com/news/state-regional/business/jury-verdict-threatens-to-upend-home-buying-and-selling-in-illinois-changes-are-already-underway/article_9912be6e-ddfd-5559-b8ab-ee59672ca854.html

I don’t know if this has been talked about here, but holy crap, this is about to make everything worse. I have no idea which asshole billionaire is bankrolling these suits, but this is going to make everything so much more expensive. I currently charge a flat rate of $450 per transaction and on sells I get paid for selling title insurance and doing the clearance. If there’s volume and everyone gets along I make a good living. I also do this contingency so if it doesn’t close, i don’t get paid. If I’m going to be representing a buyer without a realtor? $1,500 up front, “non-refundable*). If I lose the ability to sell title insurance, every transaction now costs $2,500. Smart people will continue to have lawyers and realtors. Everyone else will get fucked and by fucked, title claims and lawsuits will surge. We did it Don! We won!

That it’s largely irrational to blame Biden or, indeed, any politician for this is really beside the point.

Maybe it’s irrational, but I want to set up one of those machines that fires tennis balls, like American Gladiators style, and I want to shoot tennis balls at Jerome Powell. Like, I could spend days gleefully doing that. Just happily cackling.

*In reality, in IL all attys fees are refundable, but I’ll document the hell out of it to make it less refundable.

@JKB: New cars are now being advertised below MSRP. Just bought a 2023 Subaru Forester, fully loaded at invoice. Been shopping with my daughter for used cars, 2020 and newer. Compact SUVs are around 20-25K. Never saw a 2012 used car, period, regardless of the price.

@JKB:

This is unequivocally false. The pandemic caused all kinds of havoc on the car market. New cars couldn’t be produced because of chip shortages, which sent everyone running to buy used cars, the prices of which then skyrocketed. Did you miss all of this? There are literally thousands of articles out there about this, JKB.

On the consumer purchasing side, it is not all roses. Total household debt reached $17.29 trillion in Q3 2023, with credit card balances reaching $1.08 trillion, the largest yearly increase on record. Delinquencies are rising too.

Nate Silver chimed in yesterday

The McDonald’s theory of why everyone thinks the economy sucks

As I said perception matters:

Of course personal expenditures were artificially down in December 2020 due to the lockdown oppression.

@Jen:

And yet now, car dealers have vehicles on their lot that have been there for 200 days costing interest money every day.

But it is true the car mfrs prioritized the top trim packages (high profit) leaving the less extravagant purchaser to do without. And Ford has been mfring lemons (again), oil leaks within 20k miles. And they screwed up the massive recall so bad they are under federal investigation.

@Scott:

To be fair, JKB hasn’t written something that could be called “nonfiction” in about 3 years, whereas you are dealing with the real world. It’s like trying to explain to my 3 year old that turtles (probably) can’t learn ninja skills in real life–it’s going to be a very trying conversation, and in the end what’s the point?

@Bill Jempty:

“We better all hope Trump drops dead of a heart attack.”

How indicative of moral character.

@Jen:

This is something I’ve been wondering about but haven’t found any clear articles. Maybe the data isn’t out there yet. One thing that is the result of the pandemic is that we are more of a cashless society than ever before. I put everything on a credit card (s) and pay them off every month. So my average balance is part of the $1.09T. So the real question is how much of the national balance is paid off each month. And what is the role of debit cards. Are people using them more or less? And apparently, installment payments are growing on on-line purchase sites. More complexity.

@JKB:

Thank you for reminding us why the scorpion stung the frog.

@Rick DeMent:

25% of sales are on line. 75% are still brick and mortar. When you parse the data (not just published on line sales, which are on a higher, share capture trajectory) you see an overall year over year of 2-3%, vs a, say, 5% as one might expect. Hardly spending like drunken sailors.

Add to that delinquent payments and levels and defaults on credit card debt and you get quite a different picture. The consumer is about tapped out.

Perhaps not listening to MSNBC, CBS, Reuters, NYTimes etc might be helpful…………

@Jen: but his betters told him that is the reason the ATPs were so high (that stands for Average Transaction Prices for those not in the business like I had been for well over a decade). Just like his betters are telling him that things have not returned to equilibrium with the ATPs. I have smacked around his erroneous claims about the business before and think I have given the regulars a good understanding of what was actually going on at the time. I am kinda surprised he still isn’t blaming Cash for Clunkers for pre-owned prices. I actually saw someone try that a few weeks ago.

Plus, he and those he gets his info from conveniently ignore that a used car at 8-10 years old has a lot more life left in it than one that was at that age even 10 years ago. The very late 90s and early 2000s were a low mark in long term material quality and longevity the industry hadn’t seen since the early 80’s.

@steve:

Wage increases have not kept up with prices. All you need to do to evaluate this falsity is consider fixed income. From there, the incidence of price increases varies widely. But most sources would cite a net reduction in purchasing power of 10% +/-.

Its not the messaging, or jiggered polling – its peoples real economic reality.

@JKB:

I see. How does this statement square with your original comment that the move to EVs is causing all of this? (Electric vehicles don’t have internal combustion engines, so they aren’t leaking oil.)

Once again, you are engaging in goalpost shifting when challenged. It’s getting old.

With discussion about inflation versus wage growth, there’s a ton of good analysis out there. The answer is a solid “it depends.” Here’s a particularly wonky article that shows how things vary from sector to sector:

https://www.ppic.org/blog/wage-growth-is-struggling-to-keep-up-with-inflation/

Additionally, this article is a good analysis of why, even when wages have surpassed inflation, that has only happened relatively recently, which means it’s going to feel like things are lagging for a while. Here are two articles on that:

https://www.cnbc.com/2023/09/07/wage-growth-vs-inflation-heres-when-workers-may-catch-up.html

https://www.bankrate.com/banking/federal-reserve/wage-to-inflation-index/

@Slugger

I was a kid in the 1970s, so remember it well but didn’t experience it in the same way as an adult would have. But I would note that Gerald Ford and Jimmy Carter both failed to get a second term largely because of the poor economy.

@Scott: It is indeed very complex, which is why I flagged the point about rising delinquencies. That’s the more important point. Mortgage delinquency rates increased in Q3, as did car loans, which hit a 29-year high.

If you have credit cards, car loans, and home mortgages all hitting higher delinquency rates, yet consumer spending continues, it means people are–broadly speaking–spending more than they can keep up with paying. Since credit cards are variable interest rates, people are essentially paying waaaaay more to service debt. U.S. personal savings rate was 3.40% in September, which is down from 4.0% in July.

ETA: I didn’t finish my thought, which is that even if you are currently employed, if you are paying more to service credit card debt, it doesn’t really matter if inflation ebbs a bit–you’re still seeing monthly payments suck up even more of your income because of variable finance rates.

I too charge just about everything and pay my cc bill in full, every month (my card has a fantastic points system). But that’s NOT the norm.

@Jack:

But if your view of the economy wears in the same galaxy as realty the would have been in the crapper. It wasn’t and your are a fool.

@Jack:

How about the morals of Trump, jerk? What about his threats to prosecute political opponents? His calls for citizen arrests of a prosecutor. Joe Scarborough thinks Trump could execute people. I don’t think he would, but what about his minions. On Jan 6 they didn’t storm capitol hill to have a wiener roast?

I just want to elaborate a little on this post.

Arnold Palmer may have had his best year in 1962. He won 8 times and two of them were majors and he finished 2nd in a third and his winnings were 81-82,000. 2023 major championship winners took home 3.5 million. Some golfers got that for winning non-majors. If you take Palmer’s 8 wins and times them by 3 million you have 24 million or more just for his wins. Nicklaus was the best golfer for almost all of 17 years (62-78) and if you determine his winnings by today’s value (lets say just 2 million) his 68 wins in that time frame are worth over 130 million dollars and that’s not including all his non-winning earnings. Woods has 121 Million from official wins and Nicklaus count is official only also. I left out his 5 wins after 78 too because those were his lesser years even if he had 3 major wins in them. Tom Watson was the dominant golfer then and Nicklaus play rates like that of Hale Irwin, Ray Floyd, Curtis Strange, Tom Kite, for example. This website has him rated #3 but I think that’s a little overrated. Top 10, yes, Top 5 maybe.

I’ll ask a version of my, ‘is there a solution to Gaza?’ question:

@Jack: @JKB:

Put Trump in the WH. Now explain to me what he, or any other POTUS, can do about inflation?

Spoiler alert: a POTUS can no more control inflation than can the UK’s PM or France’s president or Russia’s Tsar Vladimir. If you disagree, and believe Trump could fix inflation, show us your work. Show us how. Be aware that there are people here who know economics pretty well, so an answer that amounts to, “Trump will bluster,” is not gonna cut it.

@Slugger: Trump tax cuts were several years out and while very bad economic policy for multiple other reasons, have approximatley fuck all to do with 21-23 inflationary spike. So no, it would not be a good use of time except to partisan excuse makers to undertake that analysis.

Having sympathy due to living through the 1970s is precisely useless as a response.

If you want to lose, continue with the snide poo pooin to convince yourself that ignoring the inflationary spike impact is a great idea.

Luckily it does seem Biden’s team has rather better political instincts although they should really stop the silly Bidenomics sale – it’s all the mark of the nerds trying to copy the cool kids slogan.

@Matt Bernius: There is a strong effect – speaking not of USA but global patterns – of serious lagging on popular sentiment relative to market change. So this lagging is entirely within broad international experince and patterns. With energy prices falling and hopefully to continue (as God in heaven a Trump II administration is a nightmare I do not wish to observe) this should help overall changeable sentiment (ex-party political partisans of course).

@Beth: This describes the distortive effects of the globally unique USA 30 yr plus fixed rate mortgage with no adjustment – really do not see this in rest of world and such lock in is profoundaly long-term distortive. But USA made the choice back in the 60s as I recall so…. voila lock in of a distortive real-estate wealth holder favourable structure with long term generational rigidities generation structurally built in. Unintended long-term consequences.

@Michael Reynolds: Well – fiscal policies and tax policies can indeed effect inflation (upwards or downwards), but then this requires Congress / Parliament to pass tax rises etc. One rather does not expect however Trump would do anything deflating at such.

@Scott: After some poking around, it looks like most of those data are self-reported. A JD Power survey found 51% of Americans don’t pay their cards off in full every month, while a Lending Tree survey on the same issue found only 35% of Americans pay off their cards each month.

The Federal Reserve says 45% pay off their cards each month. So, somewhere between 35% and 49%, which is a pretty wide difference.

Meanwhile, census data and the NY Federal Reserve estimated that in 2022, the average American household carries credit card debt of $7,951 a year. Now add rising variable interest rates to that–even if you’re paying more than the minimum monthly payment, the amount of interest will feel oppressive.

Well, this aligns with what I’ve been arguing for some time now about averaged and aggregate statistics hiding a lot of variability.

And I’ll return to people on fixed incomes. The COLA for Social Security, for example, has gone up 17.8%, if we include the coming adjustment in January 2024. That’s a lot, but still less than many of the core needs listed in the article. And not everything gets COLA. Medicare premiums and copays also increased higher than inflation. Etc.

As for Presidents getting the blame, that’s just the way things are and always have been. It’s very annoying, especially when partisans who know better play games depending on whose side gets gored.

However, things do seem to be improving, so by the time the election rolls around, the situation may be better for Biden. Real Estate, though, could be a different story.

@Beth:

I’m certainly seeing that here on the front range of Colorado. Although there have been a lot of apartments constructed in my area, the rents for a typical 2 bedroom are more than my mortgage on a 5 bedroom house.

I’m also one of those middle-aged people with a rate of 2.25% who has also seen their home value increase substantially (along with property taxes). We’re fortunate that we don’t plan on moving anytime soon (four years minimum, as that’s when our youngest gets out of High School).

I feel a bit OK about our good fortune because we did get fucked in 2007 trying to sell our house in Florida when we moved to Texas just as the bubble broke. But I see a lot of people dealing with a similar situation now.

@Slugger:

Because of a job change caused by the recession, I sold a house in MI in 1982. I’ve forgotten the numbers, but we had to sell it on a land contract because rates on conventional mortages had exceeded the state’s usury law. One can have an argment about how much of current inflation to blame on Biden, but there was no question Reagan and Volker were responsible for the early 80s. They bragged about it. There may be a legit argument about whether the tight money was neccessary, but none about what caused it.

@Beth: Building contractors were cutting off short pieces of 2×4 and mailing them to Volker with statements that Volker might as well have the 2x4s, there was nothing the contractors could do with them.

@TheRyGuy:

This is wrong.

After the too-small stimulus in response to the 2008 credit/housing crash, the recovery took many years and hurt a lot of people. And hurt people unevenly, with a lot of families still not out of the hole.

Democrats, even preceding the Biden administration, largely decided that they would rather risk a too-large stimulus than a too-small stimulus, arguing that a small burst of inflation on all was less harmful than a large segment of the population getting completely clobbered. See all the stimulus that happened under Trump and voted for by Democrats in congress for that timeline. Biden continued this, and embraced it.

So, it’s just factually incorrect to say that they ignored inflation. They made a very calculated risk based on the tradeoffs.

And, given that our inflation over this period was lower than peer nations, and that our economy is humming along, it was probably the right choice. (Inflation is complicated, with increasing supply and labor costs, along with profit taking, so you can make lots of arguments with the data — economics is sort of like a science, but more like research into dark matter than Newtonian physics)

And, in the end, politicians don’t get a lot of credit for choosing the least bad option.

There was a lot of spending that Democrats wanted, but a lot of that is anti-inflationary or less-inflationary-than-status-quo. The expanded Child Tax Credit was a great example, as it reduces costs on government programs later by keeping families out of poverty and falling into a poverty spiral where they need more government services.

@Beth: The news about the change in fees for buyer/seller agents could turn out to be really destructive in the short term. Still, out where I live selling houses for a little as 1.5% was starting to be a thing shortly after I bought my first condo in 1979. (To be fair, my first condo was purchased for ~$60k in a neighborhood–actually region of 3 or 4 contiguous suburbs–where a typical house was already selling for ~$150k. And that condo currently has a Zestimate at ~$700k in a neighborhood of $2mil.+ houses, so the ground was already fertile for cut-rate brokerage.)

As interesting to me as the article itself were the real estate ads that followed. A house in Moline was listed at $80k. It appeared to be one whose lot was crying out for a McMansion to be built on it. It reminded me of a house I walked by in my neighborhood (pop. 12,000 and on the register as the 4th poorest city in Washington State in the last listing I saw on the interwebs). The house in my neighborhood looked very similar in size but it had the added features of an “abandoned to the elements” look–including a broken window or two and having been originally built (in 18??, the listing agent had no info) on a few dozen cinder blocks, some of which were crumbling. That house was being offered for the low, low, discount fixer up price of $186,000.

It’s gonna suck big time to be under median in income for the forseeable future. On the plus side, spacious dome tents have gone way down in price since I couldn’t afford to get one for camping back in my 20s. And I guess modern tent stakes can bore down into the tarmac.

@gVOR10:

Rumor has it that he used them to construct a tribute wall in his rec room. 🙁

Just want to say, the whole, “fixed income” canard is straight trash in some ways. You know who is *truly* on a fixed income? Your Walmart worker. They do not do yearly raises. There are people who work there for 5 years+ that make the same as when they are hired unless the minimum wage in their state rises or corporate decides to give everyone an increase corporate region wide. I spoke with some in the rural county I am from in VA that had been hired in the early to mid 2010’s that did not get a single raise until the state raised the minimum wage. No yearly COLA increases for them. No real investment income from long vested 401ks, pensions, or small portfolios. And do you think most of them are homeowners that can even attempt to sell? Maybe if they inherited the family home. But, I guess when the world is look at and reported through a middle to upper-middke class lens, the Groundlings are easy to miss.

@Thomm: Well duh! A good point all the same. Especially about the Groundlings being hard to see.

Jack- The percentage of people living on fixed income is tiny. It would include people like railroad workers who were not eligible for Social Security. So that tiny percentage of people should be unhappy. The larger point is that on average, just like every other year for hundreds of years, some people made more money than others. Some had wage hikes higher than the inflation rate and some didnt, but on average people had wage increases higher than inflation. That means some people, most people, came out ahead. However, people really only look at prices and not their increased pay.

Thomas point above is important, though low wage workers in general have done better in the last few years. However, most of our economic gains over the last 50 years have gone too the upper percentiles, especially the top 0.1%.

Steve

@Thomm:

Except that Walmart workers can go get another job that pays better, or work their way up the ranks in the company to get a better-paying position. And wages at the low end of the labor market have increased faster than middle-income wages, though not by enough.

Fixed income is called that for a reason.

@steve:

Fixed income includes people on Social Security, disability, etc.

And my comments about the well-known effects of inflation on people on fixed incomes should not be interpreted to suggest that those at the lower end of the wage scale are doing fine and dandy. Many are not.

My point is that the people who say the economy is great and those who complain about it are dumb or uninformed, should realize that the economy isn’t great for everyone. Inflation has hurt a lot of people (including those whom inflation tends to hurt the most – fixed income people) and continues to do so for a non-trivial number of people, which doesn’t show up in national averaged statistics.

@Thomm:

Lots of pensions are fixed amount with no COLA, I have two such. Investment securities suffer from inflation also, even stocks do not appreciate enough to offset inflation, plus there is a capital gains tax ding.

Plus, of course, the high interest rates caused by inflation are taxable income.

@Andy: People on Social Security are not on fixed income. There are COLAs every year. Same as my military pension. Unless, of course, you really mean people on fixed purchasing power. Some people, like my wife on her future teacher retirement, are truly on fixed income as she won’t get a COLA. Like a lot of things, we may be quibbling on small things while missing the larger issues.

And I’ll point out for those who may not be regulars here that I am the legal court-appointed Guardian for my sister, who is institutionalized with dementia.

She is on a fixed income. Her expenses have risen faster than what she gets from social security. The small nest egg she received from my father when he died has helped, as has her small 401k, but both have gone down in value, and the sustainable amount of income from those has underperformed inflation. Plus, the assets are being spent down and are not growing. All told, her assets are expected to run out a year or two earlier, thanks largely to inflation. Statistically, she will still probably die before that happens, but it is a cause for concern. And I know plenty of other families dealing with dementia who are in a much worse position.

So anyone who suggests that I don’t know what I’m talking about because I’m relatively secure in middle-income land, probably should not make stupid assumptions.

@Gustopher:

his comment is clearly not in respectto the initial spending but post.

Now in fact it was US Fed and not per se the Presidential authorities that were slow to react (but so w, however the Biden administration and even more so the Left end of Democrats were pushing for more spending at a time when data was already showing inflationary

The Biden administration certainly – and initially quite justifiably – took a calculated bet. Less justifiably but not unreasonably after. However, after it became rather clear there was overshoot and significant inflation pressure from such overshoot, the Left aka progressive wing has been stuck in denialism and party-political blindered minimising, rather than an admission of overshoot and pivot back. (As has been eviden there, and e.g. with Drum)

The overall character of reaction including to Andy rather highlights the partisan reation to minimise (which I suppose can be partially understandable in reaction to the foolishness and stupidity of JKB & ilk claims)

Aside from Left political fiction writing, there is no such thing as ‘spending that is anti-inflationary’ – it may be justified but current spending is current demand and excess demand is inflationary pressure. This is a nonsense comment of incohrent party political just-so story making.

Long-term efficiencies can come through from current investment side spending (as like indeed the renewable energy focused “IRA”) that can eventually result in such being deflationary in long-run or medium-run effect, but at time of expenditure, despite political spin, it is inflationary in nature, and it is immediate that is the political problem of the moment, not your medium or long-term results.

@Scott:

Maybe definitions have changed, but “fixed income” has always included people on Social Security and other benefit programs. A quick Google tells me that is still typically the case, though some limit the term to income that gets no COLA adjustments.

I’m using the broader definition.

@Beth:

We gave Covid a shot.

There’s been a lot of reporting of a spike in respiratory illness in China, and there’s something going on with dogs here, so maybe there’s something brewing out there that will increase available housing stock.

Land is expensive and in short supply in urban and semi-urban areas (the area before the suburban sprawl that can extend outwards forever until you hit the cows). If the zoning requires single-family homes, they are going to be built for the people who can most afford that expensive, limited land.

the vast majority of Seattle was zoned for single family housing with large minimum lot sizes, and it means there’s very little population infill in that semi-urban section. Mother-in-law units and backyard cottages are now allowed in more places, but we need a lot more density than that.

I want a surcharge on property taxes for single family zoning. Or a rebate for higher density zoning, if “raising taxes” is terrifying. Something that pushes people financially to allow the just a bit more density, and allows splitting plots up to build the small rowhouses that are the entry-level homes (or mid-level homes, or entry-level for software engineers) Seattle needs.

We also need an industrial policy that means more jobs in Centralia and Yakima, where there’s more space to build housing.

” for a non-trivial number of people, which doesn’t show up in national averaged statistics.”

No, it does. IIRC about 60%-65% of people earned above inflation rates. That means that 35%-40% did not. It’s never the case that everyone’s earnings stay ahead of inflation. Also, I understand that you are using the broad common definition but it’s good to look at what it really means. As to specifics, anyone who has significant medical care or medical care adjacent outlays is likely to lag inflation since medical costs have usually increased faster than general inflation. Of note, they did not under Biden in 2022 (or was it 2021).

Steve

@Andy: Probably a leftover from the past. Social Security COLAs began in 1975.

@Lounsbury:

The Child Tax Credit cut childhood poverty in half. Do you know how expensive it is for the government to have impoverished children? Social services are a fortune and have high overhead, and are often structured like a trap here*. And, at a point where the economy was stumbling, people were going to have a much harder time pulling themselves up by their bootstraps.

That absolutely paid for itself in real time.

——

*: we have too many benefit cliffs when you start making a bit more money, to the point where a person’s effective income goes backwards if they earn more, as they lose their health care, etc.

@Lounsbury: Also, the Biden Administration put a lot of effort into unclogging our ports and distribution systems. That wasn’t free.

It did, however, limit the scarcity-related price-increases. And since those scarcity-related price-increases were never fully rolled back and became corporate profit-taking, that may well explain why our inflation was better than our peer nations.

@Gustopher:

I’ll take “things people say in Washington, but not Pennsylvania” for $100, Alex!

@steve:

That’s kind of my point. Looking at averages hides a lot of variability.

“That it’s largely irrational to blame Biden or, indeed, any politician for this is really beside the point.”

I understand the basic impulse to say this, but its to deny that politicians have any say over the purse strings of the nation, or a President to bully legislation through Congress. If memory serves, Biden’s spending agenda was proudly proclaimed by…….uh, Biden. And his sycophants and political supporters. One might give him somewhat of a pass on supply chain issues early in his tenure, but he wanted the job after all. And then he advocated spending like crazy. Only after inflation became a political problem did the horribly labeled Inflation Reduction Act (a pork barrel if I have ever seen one) seem politically expedient. Shorter: leaders deal with the hand they are dealt. eg Trump had things going just fine until he let Fauci basically take over covid policy. He paid a price.

Biden just points fingers. And his press secy is either dumb as a box of rocks, or a propagandist: stating that “prices are coming down.” Well, no. They continue to rise at, depending on the index and the basket of goods, 3-5%. I doubt too many people are getting raises to match.

@steve:

You should go back and read what Thomm said. Don’t interpret “fixed income” narrowly and to your preferred partisan advantage. Perhaps the better phrase would be wages or investment income incapable of matching inflation.”

If you were correct there would be no complaining about inflation. Perhaps you should reconsider basic assumptions.

@Bill Jempty:

You win. The commenter has the same morals as Trump.

And anyone dipping so low as to quote Joe Scarborough….well. That’s a conversation stopper.

Speaking of Jack. 18. Period.

Who was TW’s Arnold Palmer and Gary Player when he broke in? Who was his Lee Trevino mid-career? Who was his Tom Watson?

There is always a lot of talk about the depth of field in the last 20 years. Its true, but its off point. There have always been the guys who get hot one week and come out of nowhere. One hit wonders. Marvelous golfers. But not multiple major winners. Going into a major there really, at any given time, are only 4-8 real guys. Guys with the balls to do it.

Jack had Arnold Palmer (8?), Gary Player (6?), Tom Watson (8?), Lee Trevino (6?)and Billy Casper (3?). Who did Woods really have? Perhaps (finally) just Phil Mickelson and Ernie Els. Who else. Really. Goosen? (2) Maybe.

Tiger was a great, great golfer. So were Hogan, Snead, Palmer, Player, Watson. And now, we have the tragedy of Rory. The promise of Rahm, Thomas, the hopeful return of Spieth and maybe the emergence of Hovland.

But so far, its Jack.

@Bill Jempty:

You, and everyone else in this subthread, are relentlessly ignoring the fact that PGA purses are as high as they are today almost entirely because of Tiger Woods.

Tiger Woods single-handedly took professional golf out of the country club ghetto it had lived in for 100 years. He made it popular with the masses. He was marketable. Which drove advertising dollars, which drove purses. Every pro golfer today owes Tiger Woods millions of dollars, because without him we would still be seeing the (inflation adjusted) equivalent of the purses that Nicklaus and Palmer and Trevino and Watson played for. He personally revolutionized the entertainment product that is PGA golf.

@Scott:

Hey, Scott. I’m in the Boerne hill country. I notice some items have gone down in price and am getting a bit more bang for the buck. Not much, but some.

@Jack:

Could you unpack that, please? I don’t know this story. What “things” were fine?

@Gustopher: If a line item actually reduced other spending, then it is was a spending reduction net, however a tax credit shifting from direct spending to indirect is a reallocation. Of course your example is an indirect effect assertion, and rather pulling up by the hair to bootstrap the Left “not really inflationary” partisan argument.

@Andy: no, it is indeed typcal to include, although so your ussage is entirely normal.

In end the political lesson may be that regardless of abstract analyses about lost growth, politically being more cautious on response is better as populations everywhere absolutely hate, hate, hate inflation and at same time generally undercount and do not credit broad based gains. And at same time political partisans will remain willfully blind to their own-side policy missteps rather than admit action, making it harder to adjust.

Politically avoidance of inflationary spikes risk a safer bet.

Different than the macro-economic analysis certainly but such are the biases of human mental constructs.

@DrDaveT: I don’t think that’s quite right, even as one who became a fan of the game largely because of Woods. Arnold Palmer had popularized the sport and helped move it away from the country clubs decades before and, indeed, the game was pretty popular even as a spectator sport in the 1960s and 1970s. Woods was the golf equivalent of Garth Brooks or the Magic Johnson-Larry Bird combo, taking something that had been around a long time and infusing some new energy into it and thus increasing its popularity.

@Andy: yeah….they can go to another low wage dead end job in the rural area they live in. And, moving up? You ever notice a badge on a person saying 20+ years, yet still a cashier, because they exist, and train team leads and above when hired in from outside. As I said…they get no COLA adjustment like a person on SS, Disability, or SSDI. When the phrase, ‘fixed income” is uttered, I bet a person on a blue vest and name tag never even crosses your mind and they should.

@Andy: To further make my point, I had to take a job for a few months at Walmart in the rural area I grew up in. When I was hired on, I was making the exact same as coworkers that had been there for over 15 years because we had the same job title.l.and they get no annual raises. I actually kinda of lucked into my new job at a cigar lounge. The owner came through my line and asked if I liked cigars. I am more of a pipe smoker for such things, and we chatted for a bit and got a long very well. He invited me to check out the place which I did the next day. After he gave me a tour, he asked me if I would come work for him. 8f I didn’t have my background in real commission sales, a real estate license (inactive), and such, I would have been brought in here at the state’s minimum wage, instead he matched what I had been making (14 an hour) and in three weeks on the job, am being moved to a salary based pay plan with some profit sharing/commission. My ex coworkers couldn’t do the same since they had not had the life experiences I have had after I left the area in 1999.

@James Joyner:

Sorry, no.

Yes, Arnold Palmer (and to a lesser extent Nicklaus and Trevino and Chi Chi Rodriguez) had made golf a sport you could televise. That was the first (necessary) step.

Tiger Woods took that marginal product and made it a mass market. Check the numbers. We’re talking an order of magnitude increase in advertising revenue, galleries, sponsorships, charitable donations… All because of Woods. Without Tiger Woods, there would be no “minor leagues” Nike / Korn Ferry / whatever tour. Without Tiger Woods, no World Golf Championship or FedEx Cup or any of the other current trappings of top-tier professional golf. It was a quantum leap.

@DrDaveT: The NBA Finals weren’t even on television the two years before Bird and Johnson came into the league. Player salaries quintupled over the course of the next decade.

I don’t know that I ever watched a round of golf before Woods’ emergence. But even as a kid I knew who Arnold Palmer, Jack Nicklaus, Lee Trevino, and many more golfers were. It was already a fairly big deal when Woods catapulted them to another level.

@DrDaveT: @James Joyner:

Tiger Woods galleries were/are roaming circuses never before seen on Tour. I have been in a handful. Sure, Arnies Army was a thing—but the sheer scale of the crowds aren’t comparable. The amount of non-golfer interest that Tiger brought into game simply cannot be in question or compared.

Tiger is on par with Michael Jordan. He transcends golf and sports. People that don’t care about golf or sports know who he is—they bought tickets to golf tournaments to watch him play. They stopped watching and buying tickets when he stopped playing regular.

Watching Tiger Woods live is like being in a concert moshpit for 18 holes–its miserable. But watching him ply his craft is worth the pain. When you watched him warm up next to best players in the world–it was clear he was in a different category all unto himself.