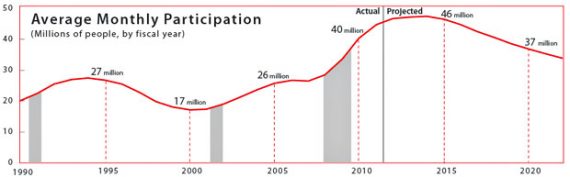

Number Of People Receiving Government Benefits To Rise Through At Least 2014

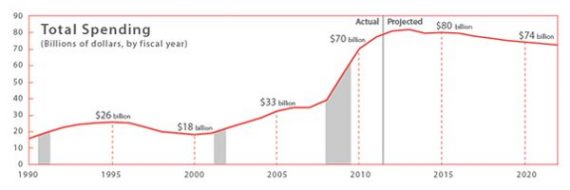

Kevin Drum, points to the above chart from a new Congressional Budget Office report that essentially projects that the number of people receiving benefits like food stamps will continue to rise for at least the next two years. The report also suggests that spending on these programs will follow roughly the same pattern:

Drum comments:

The takeaway from this is that the Great Recession is still nowhere near over. Technically it might have ended three years ago, but out in the real world things are still mighty fragile for a lot of people.

The report largely agrees:

Almost two-thirds of the growth in spending on SNAP benefits between 2007 and 2011 stemmed from the increase in the number of participants. Labor market conditions deteriorated dramatically between 2007 and 2009 and have been slow to recover; since 2007, both the number of people eligible for the program and the share of those who are eligible and who participate in the program have risen.

About one-fifth of the growth in spending can be attributed to temporarily higher benefit amounts enacted in the American Recovery and Reinvestment Act of 2009. The remainder stems from other factors, such as higher food prices and lower income among beneficiaries, both of which have boosted benefits.

If nothing else, these numbers are yet further evidence of just how pathetically weak the “recovery” has been, especially out in the real world, and how vulnerable we really are to another recession that would be rather painful for a lot of people.

Really, Doug?

I would have thought the big lesson was about safety nets, and the role of government.

Food Stamps Helped Many Families Weather The Recession

It wasn’t so long ago that Republicans were posting budgets that just slammed SNAP back to 2007 levels.

Hmmm.

So the big lesson for you there was about weakness in the “Obama recovery,” rather than say the Ryan / Romney plan to gut these same programs?

Darn. Maybe I was condescending just then!

It’s been a recovery in a technical sense only, and given the size of the private sector’s liability sheet it will be so quite a while. You can’t dig out from under that much debt in only four years.

@Ben Wolf:

There was an interesting graph bouncing around a little while back. I can’t find a link now, but I think it might have been on Calculated Risk and/or The Big Picture. It was unemployment, but a graph centered on the bottom rather than the start of the recession. In that chart this recovery looked pretty good compared to the previous 2 recessions and recoveries.

That’s good news / bad news I guess. We are recovering as strongly as we have in recent episodes, but recovering at that rate gives a long slog to make up all the jobs lost. As you say, it is a big hole to fill.

You mean economic inequality is going to continue to widen?

Shocking. Shocking.

Meanwhile in other news:

Boehner and Ryan both say Catholic Bishops are simply wrong when they say The Ryan plan fails to meet “moral criteria”.

Toomey (R-PA) says the people in America who really need help are a “small segment”.

And the recovery is going to continue to be weak as long as we keep shedding, or at this point not gaining public sector jobs.

http://www.epi.org/publication/public-sector-job-losses-unprecedented-drag/

Reagan and both Bush’s depended on public sector growth to help fuel recovery.

Perry’s Texas Miracle depended on public sector job growth.

Every time Obama has tried to increase aid to States to prevent public sector job loss he has been rebuffed by Republicans.

Why do Republicans want a weak economy do you suppose?

@john personna: We’re in the final stage of a debt-driven boom/bust cycle exactly as described by Minsky. There’s little any president can do directly to accelerate a recovery under those circumstances, thought the Republicans will no doubt claim they can fix everything in five seconds. I’m worried about the long-term after the recovery, when the cycle starts again.

Clearly the solution is another round of austerity measures!

@Gromitt Gunn:

Austerity in the luxury of starting wars (against Iran for instance) might actually help …

@Gromitt Gunn:

It’s interesting. The Republicans are floating “Obama made it worse,” but apparently in the really childish-emotional way that they don’t have to describe how.

And of course, they have to completely ignore that they asked for austerity, which is failing spectacularly in Europe.

Truly, the Republicans would have made it worse.

Definitely we need a lot faster growth and a lot more net job creation. It would help if the regulatory environment weren’t so harsh. It also would help if corporate tax rates here were competitive with the other leading industrialized nations. Right now the U.S. has the highest combined corporate tax rate anywhere. Not good.

Definitely we need to deal with the bad debt overhang. We need to restructure bad debt once and for all, not simply to subsidize it with public dollars and to keep kicking the can down the road. We need to stop bailing out bondholders. Let them take losses. They lent money at spread. They took risks. They made bad decisions. It’s time to stop having taxpayers subsidize those poor allocations of capital. FASB also should go back to requiring mark-to-market accounting. Stop the shell game.

We need new management at the Fed. Right now they’ve leveraged themselves something like 53-1. Insane. There’s also far too much base money being held for nothing. It’s an inflation time bomb. This won’t end well. Time to change course. Before it’s too late.

Jesus-god…

The regulation bugaboo. What crap. And the US is a low tax nation…one of the lowest in the developed world.

If your stand is based on fallacies and fantasies…well…I’m just saying.

@Tsar Nicholas:

It is kind of sad that the right essentially lies, using “top marginal” or “combined” in places where the “effective” numbers are needed to make the case.

The math for effective rate is not hard. Use it.

Using the top marginal rate as your exemplar drives me almost as batty as the Joe the Plumber types freaking out over making > $250K or whatever it is, and acting like the US Tax Code actively prohibits them from reorg-ing into a corporate form and preventing schedule K gains.

@john personna: Huh? John, FYI, Japan recently lowered its corporate tax rate. Once Japan did that the U.S. took over the top spot as the nation with the higest corporate tax rate. I used the term “combined” because Japan is not a federal republic and we are. Obviously in the U.S. you also have to factor in state corporate tax rates. I could have said “effective” too. Look, this is not a closely guarded secret. Even the U.S. media made a big deal about the U.S. taking over from Japan the title of the nation with the highest corporate tax rate. You can Google it. It’ll show up. You’re shooting the messenger of a message that can’t be gainsaid.

@Tsar Nicholas:

Sure, I can google:

US a low-tax country, and getting lower

Really, as you read those right wing sites which skew with things like “combined” it’s important to understand what they are doing. They are painting a worst case theoretical tax rate, based on companies filing the worst tax return evar.

Bruce Bartlett:

So … what’s a thinking RINO to do? Just roll our eyes and let the GOP play to the economically illiterate? Or does truth matter?

@john personna: Oh, you literally want to talk in terms of effective taxes. Actual taxes paid. Total corporate income divided by total paid-in taxes. John, that doesn’t make any sense.

Sure, of course, the likes of GE, Citigroup, IBM, Boeing, Merck, and the rest of the Fortune 500, gets tons of tax breaks, tons of loopholes, and thus they pay a lot less than their nominal marginal rates would indicate. But those are not the job creators.

The vast majority of net job creation is by small and mid-sized businesses. A sizeable percentage of those companies pay the highest marginal federal corporate tax rate, given that the threshold for that rate is not that high. State corporate tax rates generally are fixed by categories of businesses. Thing is, John, these small and mid-sized businesses paying the highest marginal rate are not like GE. They don’t get every tax break under the sun. They pay a higher effective tax, in the literal sense. In that respect, every dollar paid in taxes is one less dollar for capital investment and, germane to this discussion, hiring employees. That’s really what this is all about.

Oops, dyslexia alert. Total paid-in taxes divided by total corporate income, that is. Yikes.

Umm, not really…

Except for those companies that are simply sitting on their cash…

Ireland has a really low corporate tax rate… I think they are in a recession right now. As in their GDP is contracting.

@Tsar Nicholas:

That’s kind of funny.

Your original complaint, about corporate taxes being the highest in the world is going to be a centerpiece of the Romney campaign.

No doubt they also would be surprised that someone would “literally want to talk in terms of effective taxes. Actual taxes paid.” Why do that when they can run a “truthy” campaign with some other numbers?

@Tsar Nicholas:

BTW, if you want to get on board with fixing stuff like this, great:

The thing is, you don’t really want to talk about them, right? You said forget about them (and their low tax rate) and let’s talk about some other group (for which you have no “actual taxes paid” numbers).

Why in the free world would we talk about actual taxes paid…when we can talk about ficticious taxes paid?

Look…Republicans made a concious political decision in 2009 to not recover from the massive contraction they left in their Presidential wake. They decided that a bad economy was going to be to their benefit. Now Romney is going around the country blaming Obama for the mess. It’s plain as day…and it’s quite possibly the most cynical action by a major political party ever…bordering on treason.

If Obama cannot make this argument then Romney’s lies will convince the stupid vote and cynicism will win in November.

@Hey Norm:

It will be interesting to see how tuned the average/lazy voter is to that message. Congress, and especially GOP Congress members, did suffer amazingly low approval rates as they blocked bills and engaged in stunts.

Can voters really forget that, and just believe Obama was running the economy? And gas prices?

I’ve heard a right meme that Obama can’t blame other people for his economy. While that is also childish and sad, it worries me for the same reason. People might have short memories, and just be ready for some feel-good messages from the “knows business” guy.

(I suspect that Obama can’t but proxies must remind on tea party budget rejections, etc.)

@ JP…

He’s the knows business guy…but then he puts out garbage like this:

http://www.slate.com/blogs/moneybox/2012/04/18/the_government_needs_balance_sheet_accounting.html

Which is just nonsense. Yet the stupid vote will eat this up. And the wingnuts…well when you prefer to talk about fictional tax rates rather than actual…where you see where they end up.

Take the trajectory from 8 years of Bush and tack that on to our current position…because Romney is essentially promising Bush economics…Can the country handle that? Bush created 7000 private sector jobs a month for eight years. If Romney wins I hate to imagine the country by 2020.

Sure, it doesn’t work in reality, but does it work in theory?

😉