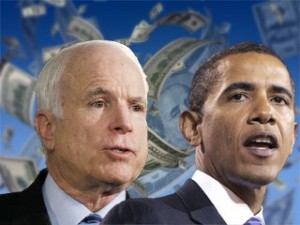

2008 Presidential Candidates’ Tax Plans

The Tax Policy Center, a joint effort by the Brookings Institute and the Urban Institute, has looked at both candidates tax proposals and…well it isn’t pretty. Basically both candidates do not believe in fiscal responsibility, both are pandering, and neither of them are willing to make the hard decisions. Which is somewhat to be expected given that the voters don’t want candidates that put forward a sound fiscal policy (anyone who claims otherwise is a lying partisan hack).

The Tax Policy Center, a joint effort by the Brookings Institute and the Urban Institute, has looked at both candidates tax proposals and…well it isn’t pretty. Basically both candidates do not believe in fiscal responsibility, both are pandering, and neither of them are willing to make the hard decisions. Which is somewhat to be expected given that the voters don’t want candidates that put forward a sound fiscal policy (anyone who claims otherwise is a lying partisan hack).

McCain’s plan is to make permanent the tax cuts of 2001 and 2003, extend the AMT Patch, increase the number of dependent exemptions, and lower corporate taxes and the estate tax with a few other changes as well. The overall impact from 2009 to 2013 would be to add about $1.5 trillion to the deficit and $4.2 trillion from 2009-2018. This is not good in that current deficits must eventually be paid. If the deficit is paid for via tax increases then this additional increase in the deficit would mean higher future tax rates. Add in the revenue shortfalls for Social Security and Medicare and taxes will have to increase to very high levels. Alternatively the deficit could be addressed by drastic cuts in spending, but then things like Medicare, spending on infrastructure and defense would have to be drastically reduced. Not exactly all that great sounding either. Basically this proposal is an irresponsible proposal.

Obama’s plan is much more complicated in that it makes more use of phase-ins to limit the revenue losses of various “wonderful” programs that Obama is offering. The report notes that the impact of these phase-ins has the effect of raising the marginal tax rates for households which can have a deleterious impact on work effort which in turn could adversely impact household income and economic growth.

Obama also relies on what can be described as focused pandering to various voting constituencies such as the elderly. Obama proposes to eliminate the tax burden for all person’s 65 and older who make $50,000 or less. What is wrong with this? Well if you make just over $50,000 then you will face a dramatically higher marginal tax rate which again could have an adverse impact on the decision to work and how much to work. Further, this violates the notion of vertical equity in that two people each earning $45,000/year would be treated differently even though income wise they are identical. In one case one person is say 28 and the other is 68. In short, Obama’s focused pandering to the elderly would discriminate on age.

Also consider that we are looking at a future where government expenditures on the elderly are scheduled to rise dramatically and yet Obama proposes to cut their taxes even further (most elderly already pay little or no federal taxes). This is a rather unseemly attempt to ensure that the elderly vote for him. Change we can believe in, more like pandering we can believe in.

Obama’s plan will also add to the deficit as well, but not as much as McCain’s. From 2009 to 2013 Obama’s plan would add $900 billion and from 2009 to 2018 it would add $2.8 trillion to the deficit. It is fair to say that neither candidate has any inclination towards fiscal responsibility…unless these plans are basically lies and that once in office the candidates will actually turn around 180 degrees and act responsibly. I wont be holding my breath though.

Both candidates appear to be disconnected from reality when it comes to their respective tax plans. Each plan would add to the deficit, would not address the issue of complexity of the tax code or would increase it, and each plan is an attempt to pander to the voters. In reading about these plans it reinforces my views of politicians, whenever talking lie, lie, and lie again. Yes we can have lower taxes, balance the budget and give everyone a pony too.

UPDATE (Dave Schuler)

I’ve corrected a typographical error which reported the deficit 2009-2018 under the Obama plan as $2.8 billion rather than the correct $2.8 trillion figure.

Whoa there. Did you do the math right? You’re saying that both candidates are fiscally irresponsible, but according to your numbers McCain is 1500 times less responsible than Obama. Did I read it right? 4.2 trillion versus 2.8 billion?

Since there’s no likelihood whatever of either candidate getting his plan through the Congress intact we should probably be even more concerned. Historically, Congress has shown relatively more willingness to cut taxes rather than curb spending.

Budget balancing isn’t just an executive function;it’s mostly the province of the Congress. Both parties are engaging in magical thinking, the Republicans in believing in the mystical power of tax cuts and the Democrats in believing that the surplus during the Clinton Administration was due to good management rather than good fortune.

Democrats in believing that the surplus during the Clinton Administration was due to good management rather than good fortune.

So, it’s not the case that Clinton raised taxes – despite the tales of horror and destruction on the right? It’s not the case that the government got smaller under Clinton? It’s not the case that welfare was reformed under Clinton? It’s not the case that wise fiscal policy prevailed under Clinton?

Post hoc propter hoc.

I give the Clinton Administration credit for not getting in the way but not for the boom of which it was the beneficiary.

Dave, isn’t one of the criticisms of liberals that we’re just tax n’ spend? So, in a time of great economic expansion, wouldn’t you have predicted that government spending, in a Democratic administration, would sky rocket? Wouldn’t the size of government balloon? One doesn’t have to give credit to Clinton for the economic situation. Good management during a boom is just as important as good management during a bust. And the record shows that Clinton managed that boom extremely well. Rather than ballooning government spending, he brought it under control. Rather than expanding the size of the government he actually shrank it. Rather than simply spend the surplus from the economic boom, he increased taxes and reduced the deficit.

So, I can’t really see your logic here. I don’t think anyone is claiming that Clinton was responsible for the great economic conditions – well, not too many. But to say that he didn’t manage the government extremely well is to simply be blind to the facts. You seem to be simply looking at the money flowing in and saying that wasn’t due to his great management. Fair enough. But to ignore what he did while this money was flowing in is to believe that there is no such thing as management and that management only occurs when there’s budgetary difficulties.

I mean, really Dave. You seem to have a one dimensional viewpoint here.

Yet another reason I will vote for Obama in the hope that he wins so that the Republican party will learn that true conservatives are tired of liberals like Bush who like to spend, spend, spend (thinking of the prescription drug plan and everything else in the past 8 years). if Mccain wins then it will take another 4, 8, 12 years before the repubs learn their lesson and find a real conservative.

Hal, Clinton tried to raise taxes more than he actually did. The Republican controlled house forced his hand and they compromised to a large degree. Clinton was smart enough to work with the republicans, but he did inherit a growing economy due to the collapse of the Soviet Union/Cold War and he did reduce taxes (capital gains) in ’97, i believe. He managed his legacy pretty well as it applied to the economy. One reason we got to a balance budget is because the military budget was cut back.

If you people would spend a little time learning about the Fair Tax, you might find the idea enlightening and promising.

Who holds the purse strings?

The Democrat Congress will be a hobble or a crop depending on who is elected.

In the interest of freedom and budget,I choose hobble!

Thanks for catching that error Dave.

I agree with Dave regarding Clinton by the way. He was smart enough to compromise with the Republicans and not raise taxes too much to hinder the growing economy he largely inherited. He also favored free trade which probably didn’t hurt either. Overall, I think Clinton did a fine job as President, but he was the beneficiary of some good timing that was largely beyond his control. If he had gotten his health care plan though, it would have likely been really bad for the deficit, irrespective of the growing economy.

It helped tremendously that he was working from a Cold War baseline and was able to cut the military by a third. A process, incidentally, already put into motion by Bush 41.

Most of the business cycle is out of the government’s control. If basic Republican dogma were correct, we should have had a bad economy while Clinton was in office, and had a continuous boom with Bush in office. That is not what we have seen.

Our spending has become our big issue. So much of it lies outside the discretionary budget, that it will take a major push to overhaul big programs, like Medicare, to rectify. In the meantime we just run up debt. In what way is that considered conservative?

Steve

Holy crap. Those seniors are the same ones who are responsible for most of our $9 trillion debt. At some point before those leeches die off, the Millenials need to take out their ear buds and get really angry. And this is “their” candidate who is supporting this bunk?

Those seniors are the same ones who are responsible for most of our $9 trillion debt.

“”””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””””

Fence;

If you mean by forming a welfare state and raising a generation of whiny Millenials,who are now permanently addicted to government handouts and programs, then your probably right! Those of us opposed to the this trend have paid without benefit for what those in power have called the the “New Deal” or the “Great Society”.

Please don’t resent at least that portion who fought the good fight and now seek some respite from the seige.

This is not to say that the proposal is “fair” or even justified.

Kind of funny how Dave Schuler responded to my initial comment with “Post hoc propter hoc”. All the comments in response have been saying “in retrospect, he enjoyed the advantage of X, Y and Z so he really didn’t do anything at all. If that isn’t the fallacy of “after this, therefore because of this”, I don’t know what is.

It’s pretty clear that to take advantage of luck you have to be good. Simply having luck isn’t good enough.

I know y’all are genetically incapable of ascribing to democrats anything good, but this world view you have to explain Clinton is quite amazing.

Bush did not raise taxes! GOP scare, Dems will raise taxes? And yet, since Bush did not raise taxes, are we any better off today for It? Not raising taxes means something else will go up like medical bills and insurance, financial fees, etc. It is time to wake up from the scare tactics and embrace real change that is positive and not words with no deeds which leads to decaying of America.

Correction. Bush raised our children’s and our children’s children’s taxes. The Iraq war, alone, is going to cost trillions. His tax cuts to the wealthiest cost another couple of trillion.

IIRC, this whole taxing the future to pay for the present has been classified by James and others as a ponzi scheme.