Where Will The Jobs Come From, And When Will They Get Here?

If you’re looking for a job in some of America’s hardest hit cities, it may be awhile before you find one:

A new economic report commissioned by the U.S. Conference of Mayors, which is meeting this week, predicts that at least 50 metro areas, or about one-in-seven cities, in this country won’t see a return to pre-recession employment levels until 2020.

Many people have said that the unemployment rate could be a key to Obama’s chance of re-election. So, many people have been watching and predicting what it could be by the end of 2012. The mayors’ analysis predicts that of the 363 metro areas in the report 75 will still have double-digit rates of unemployment by the end of the this year. Overall, IHS put the unemployment rate at 8.6% at the end of 2011, and says that gauge won’t go below 8% until sometime in 2013

In New York, employment is supposed to regain its pre-recession level by the middle of 2013. That means the job market in the Big Apple will probably feel pretty healthy by the end of 2012. However in Los Angeles, the jobs market is not supposed to return to its peak until mid 2018. So Los Angeles votes are likely to still be pretty unhappy with Obama, at least when it comes to the economy, when they head to the polls next year.

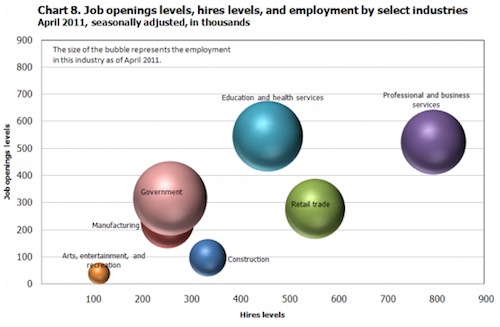

Meanwhile, if you’re looking for a job now, Matthew Yglesias passes along this chart showing where recent job growth has been:

Education and health services are the fastest growing fields, but if you’re looking for work in construction, manufacturing, or retail, you’re going to have a rough go of it.

Education and health services are the fastest growing fields, but if you’re looking for work in construction, manufacturing, or retail, you’re going to have a rough go of it.

Computer science graduates are getting lots of offers. Just one data point.

Economists battle on many fronts. Some, like tax level and stimulus effect, are closely mapped with political agenda, and break along party-philosophical lines.

Others have policy implications, but are less directly tied at first sight to an economist’s political identity.

One of those minor battles, which has huge bearing on your question, is “do we have Structural unemployment or is it cyclical ( or Keynesian) unemployment?”

The easy answer is both ;-), but the greater the structural component, the harder it is to find any easy answer.

Could you make that chart a little smaller? I can still almost read some of the labels.

In other news today:

The GOP Myth of ‘Job-Killing’ Spending

This is like one-upping the “stimulus didn’t ‘work’” arguments. It’s completely contrary to logic, that spending in an environment of cratered aggregate demand would be a negative … but hey … it’s all about how it feels.

Truthiness has given way to something nastier.

Are Taxes High or Low? A Further Look

If it feels good, believe it?

Simple answers:

Where are they going to come from – Jobs are only going to come from demand. The corporations sitting on tons of $$$ are waiting for demand. Nothing more. Not tax cuts, not certainty, not the rapture. Demand. It’s part of that basic formulation: Supply and Demand.

When – Only when politicians, on both the right and the left, forget this myopic focus on the debt. It is stupid, unfounded, and very, very, dangerous.

What is needed short-term is real stimulus, not a chain-saw-slashing of Government spending and hence jobs. In the medium term a cautious return to the fiscal balance of the Bush 41 and Clinton administrations is needed – a moderate increase in revenues and moderate cuts in spending. In the long-term, reforms to entitlements and defense as required – not as driven by political hyperbole.

@ personna….

I’m with you on the “stimulus didn’t work” myth.

There are people in my office right now – permanent white collar professionals – that are only here because of the stimulus. If projects partially funded by Obama’s stimulus had not come along those people would definitely have been laid off. We are confident that as the economy improves they will transition to other new non-stimulus projects. That is the purpose of government stimulus – to fill the gaps in slow times. I can testify that Obama’s stimulus did that. In addition these projects are capital improvements and investments. Unlike tax cuts they won’t go away – infrastructure remains. That’s another point lost on the deniers; it’s not a one-to-one equation. You can’t say X number of jobs were created or saved and the Stimululs cost X number of dollars so those jobs cost $X per job. It only works that way on Fox News.

Interesting, the jobs are supposedly coming in education and health services both heavily dependent on government spending for growth. Government spending that would come from the tax dollars from the seriously depressed non-government spending dependent fields if those people had jobs to pay taxes on the income.

I’m sensing a possible glitch in the success of their forecast.

What a weird loop, JKB. You are faulting the unemployed for not paying taxes, but continuing to consume educational and health-care resources?

I guess if we could stop teaching and curing people in a recession, that would reduce costs.

It’s a grim picture out there in Realityville.

It’s even worse for the generation that’s at present coming of age. The unemployment rates for kids aged 16-24 absolutely are staggering. Check out Table A-10 of the monthly labor report from BLS. Great Depression types of figures. Literally.

Unless Junior can break into the health care or related fields or unless he possesses technical skills that can keep him employed or allow him to tap into the for-profit education and job training sectors it’s going to be a very, very hard row to hoe. Then juxtapose onto the ghastly labor markets the fact that in 10 years (perhaps much sooner) inflation and interest rates both will be substantially higher and the picture gets darker still.

If there was a way directly to short sell Generation Y I’d be doing it. Very few of them will make it.