China’s Flailing Economy

Xi's government is taking a drastically different approach to the slowdown.

For well over a decade, experts have predicted that China’s unprecedented string of economic growth would eventually end. That seems to be have finally come to pass, albeit largely by design.

Bloomberg (“Run It Cold: Why Xi Jinping Is Letting China’s Economy Flail“):

Xi Jinping’s quest to rewrite the playbook that drove China’s economic miracle for a generation is facing its sternest test yet.

The $18 trillion economy is decelerating, consumers are downbeat, exports are struggling, prices are falling and more than one in five young people are out of work. Country Garden Holdings Co., with 3,000 pending property projects up and down the country, is on the cusp of default and protestors have gathered at Zhongzhi Enterprise Group Co., one of the biggest shadow banks, demanding their money as payments are halted.

Many of those woes can be traced back to President Xi’s determination to shift away from the debt-fueled growth model of his predecessors. Even as the real estate crisis deepens, there’s been only limited measures to cushion the blow, prompting forecasters such as JPMorgan Chase & Co., Barclays Plc and Morgan Stanley to downgrade their projections for China’s economic growth this year to below the government’s 5% target.

Foreign investors are pulling money out, with the central bank boosting efforts to stanch the yuan’s tumble toward the weakest level since 2007. Treasury Secretary Janet Yellen this month termed China a “risk factor” for the US while her boss President Joe Biden called China’s economy a “ticking time bomb” at a recent campaign event.

But where Biden has opted to run his economy hot, spending trillions of dollars on household stimulus and infrastructure to goose the economy, Xi is running his cold in a bid to finally break China’s addiction to fueling growth with speculative apartment construction and low-return projects funded by opaque local borrowing. If China is a “ticking time bomb,” Xi’s aim is to defuse it.

The clash of economic philosophies between the world’s two largest economies is already shifting investment flows and may delay the date at which China overtakes the US, or perhaps mean that moment will never arrive. The risk for Xi and his team, led by Premier Li Qiang and Vice Premier He Lifeng, is that the determination to avoid excessive stimulus undermines confidence across the nation’s 1.4 billion people.

China is undergoing an “expectations recession,” said Bert Hofman, former China country director at the World Bank. “Once everybody believes that growth will be slower going forward, this will be self-fulfilling.”

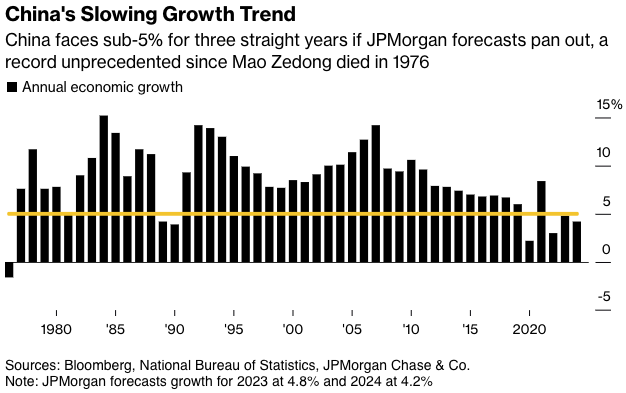

They provide this graphic for context:

When three years of modest growth is a cause for concern, you’re in pretty good shape. But analysts have long argued that China needed to sustain much higher levels of growth just to keep up with the demands of the population because their system relies on performance-based legitimacy. (Some argue otherwise, though.)

In the worst-case scenario, this dynamic ends in stagnation, or “Japanification,” something some economists see a warning of in China’s latest consumer price data showing deflation. Falling prices are both a symptom of weak demand, and a drag on future growth as households delay purchases, business profits fall and real borrowing costs rise.

What Bloomberg Economics Says…

“The sharper downturn in the property sector, challenges in reigniting animal spirits among entrepreneurs and a deepening rift in relations with the US mean expectations on growth have been revised down. The old downside scenario has now become the base case — with expectations that by 2030 annual growth will have slowed to around 3.5%.” — Tom Orlik, Bloomberg’s chief economist

If global markets get spooked, a China slump could trigger an exodus of investors out of riskier assets around the world — as occurred in 2015, when a messy China devaluation and domestic stock meltdown unnerved Yellen, then the Federal Reserve chair, enough to call off an interest-rate hike. We’re not there yet, but a repeat performance could see expectations on the Fed upended again, with a pause turning into a cut faster than the markets expect.

One indication of the differing economic approaches between the US and China can be seen in nominal GDP, which doesn’t adjust for inflation. American nominal growth is clocking a 6.5% pace this year against 4.8% for China, according to Bloomberg Economics, which still sees the world’s second-biggest economy expanding faster in real terms. The strengthening US dollar against the yuan has also contributed to China’s rival pulling away, for now, in the global race when GDP is measured in dollars.

There’s a certain churlishness in analyzing the economy of a country of 1.4 billion souls in terms of great power competition but, alas, it’s the situation in which we find ourselves. We see the PRC as a revisionist power seeking to radically change the terms of the so-called liberal world order. A weakened China is good news in that light, even if it’s potentially a humanitarian disaster.

Or maybe not. Again, Xi has made a deliberate policy choice.

Xi and the Communist Party’s leadership haven’t sat on their hands. A drip feed of announcements followed a Politburo meeting last month, highlighted by proposals such as faster infrastructure spending, liquidity support for developers and lower housing purchase restrictions. Then came the surprise cut to interest rates last week.

But to understand why they haven’t done more, it’s important to assess how the economy looks from Beijing’s perspective — and Xi’s own views on the best way to achieve his overarching goal of turning China into a nation that “leads the world in terms of composite national strength and international influence by the middle of the century.”

Parts of the economy are booming: electric vehicles, solar and wind power, and batteries. In those areas, investment and exports are growing at double-digit rates, exactly the kind of hi-tech, green growth that Xi wants. Even amid its austerity in some areas, the state is devoting resources to foster this form of growth, issuing bonds to fund high-speed rail and renewable energy infrastructure on a scale unmatched anywhere in the world, cheap loans for businesses, and generous support for consumer demand through tax breaks for EV buyers.

Meantime, spending on services like travel and restaurants has rebounded strongly compared to a lockdown-hit last year. Starbucks reported 46% sales growth in China last quarter, domestic flights are running about 15% above their pre-pandemic level and travelers are complaining that budget hotels are hiking prices due to soaring demand. That generates a lot of jobs, helping ease the leadership’s fear of mass unemployment.

It was the longtime elite consensus, of which I was a part, that a growing China would inevitably be a more liberal China because we would see the rise of a middle class and the concomitant demands for more power from those people. It had proven true essentially everywhere on the planet, including among the “Asian Tigers,” which included Taiwan.

Alas, the CCP made sure that didn’t happen. Moving to more of an internal, consumer-based economy would seem like a very good thing. But, certainly, Xi is not planning the demise of his power base.

Trouble is, those new growth engines aren’t making up for the massive drag from the real estate slump.

Beijing estimates what it calls the “new economy” — its name for those green manufacturing sectors, plus other hi-tech areas like microchips — grew 6.5% on-year in the first half and accounted for a little more than 17% of GDP. By contrast, real estate construction spending slumped almost 8% in the first half and the property sector provides about 20% of GDP when related industries are thrown in.

The real estate industry was upended starting in late 2020, when authorities laid out “three red lines” detailing leverage benchmarks that builders had to meet if they wanted to borrow more. By the end of 2021, property giant China Evergrande Group had defaulted, followed by an unprecedented surge in debt failures at other builders. Fast forward to today, and Country Garden, which like Evergrande was once China’s top developer by sales, is warning that there are “major uncertainties” about its ability to pay off its bonds.

It’s not just the property companies and related industries — construction, steel, cement, glass — that are feeling the impact of real-estate sales falling some 50% below their peak levels in 2020. The contraction has also hammered household confidence. Home values are dropping, and in all likelihood much more than the modest, single-digit figures in official data. That’s a major risk when real estate accounts for as much as 70% of China’s household wealth, along with 40% of collateral held by the banks, according to estimates from Citigroup Inc.

The hit to wealth is leaving households feeling poorer, reducing their consumption appetite, in a second blow to growth. And as companies lower their expectations for profits and scale back investment and hiring plans, the impact mushrooms. Cities have been warning about an excess of gig-economy private taxi drivers, in a sure sign of weak labor demand.

Even planned economies are subject to bubbles, apparently.

Some are calling for Beijing to break the cycle with strong confidence-building measures. Central bank adviser Cai Fang recently urged direct stimulus to consumers. He and like-minded economists say a few trillion yuan (hundreds of billions of dollars) financed by central government borrowing would stimulate consumption.

But Beijing is unlikely to accept those proposals. For China’s leaders “the best way to support consumption is through supporting employment, which is believed to be best done by supporting the corporate sector,” via tax cuts, said Wang Tao, UBS Group AG’s chief China economist.

This is not an unfamiliar debate.

The idea that Xi is letting the economy go cold is is an interesting take but definitely a contrarian one. Most observers think that it has more to do with the re-nationalization of industry (without explicitly saying that is the aim). Since Xi has assumed power his government has increasingly dictated corporate policy to align with his political goals, and has not hesitated to jail or disappear anyone who doesn’t follow along. Even Jack Ma, essentially China’s Bill Gates, has been arrested. Wealthy and powerful. Just one example: tutoring is a huge deal in China and many companies grew by offering foreign language classes. A few of these were huge and when I lived there I saw their advertising everywhere. Literally overnight the Chinese government sent out the word (they rarely make things explicit in law) that foreign language learning was to be drastically deemphasized and these companies shank to nothing. This government realignment of the markets has been repeated in virtually every industry. Wealthy and powerful Chinese are no longer investing in China, but rather devoting their attention to other markets. As recently as 10 years ago Chinese students would study abroad, maybe work a year or two, and then go back to China to join a rapidly growing company as a manager or even department head, and some of them even created their own startups with readily available venture capital. That process seems to have slowed down dramatically, as prospects for the young seem to have completely dried up. I’ve seen reliable estimates that the new-grad unemployment is above 40% and a big portion of those who are working are drastically underemployed.

Xi may be claiming to be deliberately cooling the economy due to financial reasons, but it seems much more likely that he is turning it back into a communist economy, and we know all too well what those look like.

Krugman this morning tackles the question of the effect of a 2008 melt down in China on the US and reasons that it won’t effect us much. He estimates the US investment exposure in China is about $550B, while comparing this to the at risk, domestic commercial real estate market that is $2.5T.

@MarkedMan:

When I saw the ‘deliberate cooling’ theory I was seized by a coughing fit and my cough sometimes sounds as if I’m speaking actual words. In this case, ‘bullshit, cough cough, bullshit.’

Two observations: 1. China is difinitely facing economic challenges cause by several factors including effects of Covid-19 lockdowns, property sector slump and US led economic/tech containment of China, however, it is early to suggest that China will economically collapse or stagnate like Japan in the 1990s, China is not Japan both in scale and economic dynamism, the Chinese economy more dynamic than anything Japanese economy was in the 1990s even if the Japanese economy most more majure comapared to China’s in the 1990s. 2. Chinese economic problems are getting more attention than any other economy’s woes, those are are suggesting Chinese economy is ”failing” or ”collapsing” are at the same time arguing that the US economy doing well which is questionable as US economy is projected to either go into recession or at best soft land, this shows that there is great dislike and even ill wish for China and its economy among Western media circles, even some Western writers and analysts are celebrating China’s imminent economic demise, While China is not immune to economic crisis or collapse, the Chinese have shown time and gain they can overcome economic hurdles, I think Chinese government has not yet run out tools and ideas to deal with its current economic woes, a 4-5% growth is achievable unpto 2030 if the property sector problems are dealt and domestic comsuption is improved in the next few months.

I think I heard someone say that if a kid works even part of a day it still counts as work, so the reality is far bleaker than 1-in-5.

@MarkedMan:

Authoritarian economy with communist trappings.

I don’t think we have any idea what a communist economy looks like. The proletariat has never been well represented by any Dictatorship of the Proletariat. Do the workers own the means of production?

I think a case could be made that Germany, with the Works Councils, is closer to communist ideals than China, and I wouldn’t categorize Germany’s economy as even remotely communist.

I may be showing my incremental leftist bias* here though. I don’t think capitalism in its current form is serving the best interests of most people, and needs to be fundamentally changed (in tiny increments that don’t adversely affect me). Understanding what things are, rather than what they call themselves, is step one.

——

*: it could be worse. I could be an incrementalist Trotskyite, who believes conditions must be made worse to trigger the great worker revolution, but who wants to make them very slowly worse, to try to find the minimum level of awfulness, but just end up maximizing suffering. Oh, crap, I think I just figured out Kirstin Sinema.

We would view mass economic suffering in China as a humanitarian disaster, but would the Xi? My ex who has become the rare millennial millionaire doing business with the Chinese thinks the CCP would just as soon oversee mass death than relinquish socioeconomic control. I was horrified at the suggestion, but maybe he is right.

I suspect our coverage of Asian economies suffers from Western biases. Our journalists seem to take it for granted that Asian cultures share our priorities, hence the general tone of surprise and confusion in coverage of China’s economic moves.

It’s reminiscent of the strum and drang about Japan’s “stagnation” when I was a kid. It’s very American to think an economy must endlessly grow. That’s our bias: we are hostile to wealth redistribution. We prefer growth to fund our desired improvements in quality of life via increased revenue.

It is not at all clear that more collectivist and Confucian societies want or need relentless economic growth, especially in an era of low and declining birth rates. And so we are just now seeing revisionist takes on Japan’s trajectory. Yes they have the similar issues seen now in many developed nations — like alarming suicide rates due to loneliness and alienation — but turns out Japan maintains social stability and pretty high standards of living without chasing the growth growth growth gollum like we do.

These nation’s have their own goals and values. Xi’s China is looking more throwback and neo-Maoist everyday. As long as China’s ruling class remains rich and powerful, do they really care if swaths of the Chinese middle class fall back into poverty? I wouldn’t bet on it.

Japan has a Gini co-efficient of 32.9. China’s is worse, 38.2. Ours is 41.5. China’s distribution of wealth is nearly as bad as ours. I’d suggest the number is too kind to China, they still have hundreds of millions of people in deep, rural poverty, while their billionaires swan around foreign capitals buying 5,000 euro purses.

The elite in China is looking at a whole hell of a lot of Chinese still in huts, and no growth means they stay in those huts. They need growth in a way that we don’t because you can’t keep ’em down on the farm after they’ve seen Shanghai. And their demographic situation is similar to Japan’s, but Japan’s Development Index is about the same as ours, while China is rubbing elbows with the Dominican Republic. To top it off, China seems to want a defense spending war with the West. I don’t think Confucius is getting them out of this mess.

@Daryl: But the next thing to look for is how quickly the Chinese people adapt to the rest of the process:

@Michael Reynolds:

Can’t they? If the CCP says, “Suck it up and stay on the farm like the cog in the wheel you are,” how many Chinese will rebel? You can’t keep Americans on the farm, but they are not us.

I remember my college roommate excitedly explaining the Tiananmen Square Massacre to the two Chinese students on our hall, when they inquired about the Tankman poster on our wall. They had never heard of the incident, and they weren’t moved by it. The response was basically, ‘Oh well, those people must have done something very incorrect, to prompt that government response.’

We see mass economic pain for poor people in China as a ‘mess’ for us to beat our chests about, in a show of superior American chauvinism. That’s fine. But China’s ruling class — powerful and filthy rich and likely stay that way no matter what — may see such pain as a bump in the rule. Are Putin and Russian oligarchs moved by Russia’s mess?

The Chinese goverment brought Jack Ma to heel, and nobody batted an eye. Chinese tennis star Peng Shaui accused a leading party official of rape, was disappeared, then resurfaced denying she ever claimed assault and insisting she had no right to do or say anything but be an ordinary Chinese girl.

They can’t control people with less money and power?

@Gustopher: Further refined, Dirigiste authoritarian country with Communist trappings (as one can certainly have authoritarian economies without or with generally limited dirigisme / state direction). Xi seems very heavily inclined to a heavy Dirigisme without so far being really on a path to Communist economy in at least the 50-90s sense.

@Ambed Josuf: While certainly China failing narrative is as of now rather over-done, rather of a similar feel to the 1980s over-done Japan will own everything, it’s not either purely wish-casting (to borrow that term used in political threads here) nor purely malelovant. The structure and depth of the policy mis-response with respect to real estate and the pivot to a fairly ham-handed Dirigisme with clear bias to control over most efficient economic policy, along with simply ceasing to publish certain economic data is not the signs of a political order (the Xi approach specifically, not necessarily CP China broadly) that is well-positioned to get past significant hurdles.

It is too early to declare China moribund, failing or the like. Not too early to note that China is on a bad path and its current specific governance (the Xi governance ) does not look by historical analogy or present action to be one that is positioned to address in an effective way.

@DK: Indeed, CP likely does have the power, but sets itself on a path to a long-term decline, as of course such responses are indicative of the Xi Goverance method slowly strangling the relative dynamism that reforms unlocked. Without that, hard to imagine a successful economic response to structural issues that Xi’s governance so far have only excacerbated.

Jack Ma example is one that causes domestic entrepreneurial capital not to seek domestic growth but ways out into bigger world, Singa, etc.