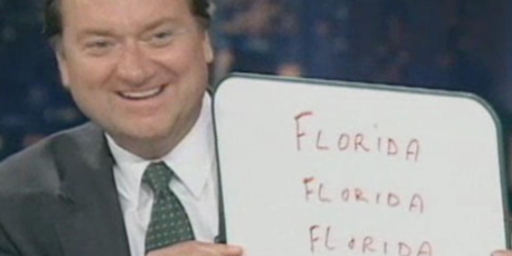

Donald Trump Is Now Florida Man

Donald Trump is moving his permanent residence south, where he should be right at home.

President Donald Trump, who was born and grew up in New York City’s Queens borough and spent the vast majority of his adult life living in Manhattan, is now officially a resident of Florida:

He came of age in Queens, built Trump Tower, starred in “The Apprentice,” bankrupted his businesses six times, and drew cheering crowds and angry protesters to Fifth Avenue after his election. Through it all, President Trump — rich, bombastic and to many Americans the epitome of a New Yorker — was intertwined with the city he called his lifelong home.

No longer.

In late September, Mr. Trump changed his primary residence from Manhattan to Palm Beach, Fla., according to documents filed with the Palm Beach County Circuit Court. Melania Trump, the first lady, also changed her residence to Palm Beach in an identical document.

Each of the Trumps filed a “declaration of domicile” saying that the Mar-a-Lago Club, Mr. Trump’s resort in Palm Beach, will be their permanent residence.

The president confirmed the decision on Twitter after The New York Times reported on the move, saying that he would “be making Palm Beach, Florida, our Permanent Residence.”

“I cherish New York, and the people of New York,” he added, “and always will.”

But he didn’t have much nice to say about the public officials of New York.

“I have been treated very badly by the political leaders of both the city and state. Few have been treated worse,” he said, describing his decision as the “best for all concerned.”

Some New York leaders shared the sentiment. “Good riddance,” Gov. Andrew M. Cuomo tweeted. “It’s not like Mr. Trump paid taxes here anyway. He’s all yours, Florida.”

In the documents, Mr. Trump said he “formerly resided at 721 Fifth Avenue,” referring to Trump Tower. That has been his primary residence since he moved into the skyscraper off 57th Street in Midtown Manhattan in 1983.

An attachment lists his “other places of abode” as 1600 Pennsylvania Avenue, the address for the White House, and his private golf club in Bedminster, N.J., where he spends warm-weather weekends and a few weeks every summer.

Since becoming president, Mr. Trump has spent 99 days at Mar-a-Lago compared with 20 days at Trump Tower, according to NBC News. Although Mr. Trump ran his presidential transition from Trump Tower and some aides had expected him to spend many weekends there in his Louis XIV-style triplex on the 58th floor, his presence created traffic headaches for New Yorkers and logistical and security challenges for the Secret Service.

White House officials declined to say why Mr. Trump changed his primary residence, but a person close to the president said the reasons were primarily for tax purposes.

In his Twitter posts on Thursday night, the president claimed that he paid “millions of dollars in city, state and local taxes each year.” There is no way to fact-check his assertion; he has never released his tax returns.

Mr. Trump, who is deeply unpopular in New York, was infuriated by a subpoena filed by Cyrus R. Vance Jr., the Manhattan district attorney, seeking the tax returns, the person close to the president said. Changing his residence to Florida is not expected to have any effect on Mr. Vance’s case, which Mr. Trump has sought to thwart with a federallawsuit.

It was unclear how much time he would spend in New York in the future or if he would keep his triplex at the top of Trump Tower. Under New York law, if he spends more than 184 days a year there, he will have to pay state income taxes.Florida, which does not have a state income tax or inheritance tax, has long been a place for the wealthy to escape the higher taxes of the Northeast.

The Washington Post notes, New Yorkers aren’ t exactly sad to see him go:

President Trump — a lifelong New Yorker who was for decades one of the city’s most prominent denizens — has changed his permanent residence from Manhattan to Palm Beach, Fla.

In paperwork filed with the Palm Beach County clerk and comptroller in late September, Trump declared, “I am, at the time of making this declaration, a bona fide resident of the State of Florida.” Melania Trump, the first lady, filed an identical document.

The form, known as a “declaration of domicile,” lists 1100 South Ocean Blvd. as the president’s new home — Trump’s Mar-a-Lago resort, which he sometimes calls his “Winter White House” and where he has spent nearly 100 days since taking office, according to one tally.

In his first public comment on the change of address, which the New York Times first reported Thursday evening, Trump said he “hated having to make this decision, but in the end it will be best for all concerned.”

“I cherish New York, and the people of New York, and always will,” Trump wrote in a series of Twitter messages late Thursday, “but unfortunately, despite the fact that I pay millions of dollars in city, state and local taxes each year, I have been treated very badly by the political leaders of both the city and state. Few have been treated worse.”

(…)

Because Trump has refused to make his tax documents public, it’s unclear how much money he stands to save in the move, but Florida notably does not have a state income tax or an estate tax.

In New York, meanwhile, the state’s top tax rate is nearly 9 percent, and the city’s top rate is nearly 4 percent. The state’s top estate tax rate — applying to fortunes greater than $10.1 million — is 16 percent.

“The move to Florida could save him a lot of money,” said commentator and former President Clinton aide Keith Boykin on Twitter, “but we don’t know how much because he won’t release his tax returns.”

Here are the Tweets from the President:

1600 Pennsylvania Avenue, the White House, is the place I have come to love and will stay for, hopefully, another 5 years as we MAKE AMERICA GREAT AGAIN, but my family and I will be making Palm Beach, Florida, our Permanent Residence. I cherish New York, and the people of…..

— Donald J. Trump (@realDonaldTrump) November 1, 2019

….New York, and always will, but unfortunately, despite the fact that I pay millions of dollars in city, state and local taxes each year, I have been treated very badly by the political leaders of both the city and state. Few have been treated worse. I hated having to make….

— Donald J. Trump (@realDonaldTrump) November 1, 2019

….this decision, but in the end it will be best for all concerned. As President, I will always be there to help New York and the great people of New York. It will always have a special place in my heart!

— Donald J. Trump (@realDonaldTrump) November 1, 2019

And here are responses from New York Governor Andrew Cuomo, New York City Mayor Bill DeBlasio, and DeBlasio’s wife Chirlane McCray:

:

The paperwork that Trump and his wife Melania used to accomplish this move is fairly simple and can be seen here. Basically, all it consists of is a document filed with the State of Florida declaring the Sunshine State in general, and Mar-A-Lago specifically, to be his primary home state and state of residence. As long as Trump follows through on that by spending most of his time (with the exception of his time in the White House) in Florida, then the change will be in effect.

In addition to the savings created by the fact that there is no state income tax in Florida, something that may not actually mean much to Trump relatively speaking, there are also several other tax-related advantages to the move. A primary one is that the state has no estate tax, which will benefit Trump’s heirs when he dies. By contrast, New York has a 16% Estate Tax rate on estates worth more than $10 million. Ironically, another reason motivating the move could be the 2017 Republican tax bill, which changed the rules regarding the deductibility of state and local property taxes Additionally, the state has a generous homestead exemption which allows residents to protect their primary residence from attachment by judgment creditors in the event someone gets a personal judgment against Trump in the future. On that note, it’s worth noting that there is currently at least one multi-million lawsuit against Trump filed by a former contestant on The Apprentice who claims that the President sexually harassed her during her time on the show. That Florida exemption does not apply, though, to property that Trump may own in other states.

In any case, this move isn’t entirely surprising. Since becoming President, Trump himself has spent less than 30 days in New York at his Trump Tower penthouse, although this does not include the time that Melania Trump spent there from January to June 2017 to allow their son Barron to complete his school year rather than transferring to a new school in the middle of the year. Most of that time has coincided with events such as the annual meeting of the U.N. General Assembly and various fundraisers. Going forward, Trump will not be liable for state or city taxes unless he spends more than 184 days in his Manhattan residents. He has spent most of his time at Mar-A-Lago, with the exception of the summers when he has preferred to stay at his golf club resort in Bedminster, New Jersey. The fact that he’s pulling up roots and moving to Florida is therefore consistent with his preferences over the past three years.

So, he’s all yours Florida. And I have a feeling that Trump is going to fit right in.

And New Yorkers throw the biggest Farewell…. oooopps, I mean “Don’t let the Door Hit You in the Ass on the Way Out” party ever.

Trump really is a whining little brat, isn’t he?

Old greedy white people with money moving here and not wanting to pay money for schools etc is part of why this state is fucked up.

He really should take his gaudy building with him.

Great, does that mean Secret Service can move out of Trump Tower and the damn security zones be taken down? Trump and family have inconvenienced a lot of people over the last few years by making it harder to move around in an already congested city.

Correct me if I’m wrong but if you do business in a state, you still have to pay certain taxes though, right? Like, selling real estate – which is where all his money is tied up in. Yeah, the kids will get more from the estate but the estate ain’t worth that much if you can’t move the properties. For instance, who the hell is going to buy Trump Tower when they put it on the market?

So I’m guessing the 3 prominent adult offspring aren’t making the move to Florida? Which means they and DJT will reside in different states?

One possible step closer to VP Ivanka Trump, maybe?

@Surreal Norm: I don’t think that will harness the NY vote for Trump, if that’s the plan.

@CSK:

Oh it won’t. NY won’t budge at all. It’s just that every once in a while I encounter some absurd speculation that Donald Trump is trying to prop up one of his kids as a VP candidate for 2020. Trump’s newly established Florida residence makes that constitutionally possible, albeit nowhere near reality-adjacent. But since when has being reality-adjacent been a consideration for Trump?

@Surreal Norm: “Reality-adjacent”…nice phrasing.

May Trump’s Florida home be infested with alligators….and banana spiders….and wolf spiders….and giant African land snails…and palmetto bugs.

Could someone release my last post from moderation. I put in a bunch of links to the wildlife (and bug-life) that Trump is likely to find running around the kitchen….11 foot alligators anyone?

Giggle.

I just want to point out that trump has been Florida Man for a long long long time. He’s just making it official now.

Interesting article bringing together all the state tax issues which may be why Trump is fleeing too Florida. (The author helpfully points out that Trump’s moving isn’t going to fix his tax problems–he’s still on the hook to pay all of it.)

….which makes me wonder–is Trump stupid enough to think that if he moves to Florida all those nasty New York State investigations go away, because poof, he’s left the state!?

@grumpy realist: He thinks he’ll get more love in Florida.

Trump is a greedy old loser snowbird.

Florida Man Abides.

@Kathy: He really doesn’t need to. He has an equally gaudy-looking building in Florida already.

….forgot the hybrid pythons which are also now showing up as well…

(It might reach -24F here in Chicago, but at least I don’t have to worry about the wildlife aside from the damn cicadas who have decided my window screens are the perfect spot to call for mates!)

P.S. forgot to mention that I guess this move means Upper Crust NYC aristocrats 1 Trump 0

@grumpy realist: Oh, yes. The crowd he always yearned to join, but they rejected him, and he’s never forgotten that.

Some NYC inhabitants are all but dancing in the streets.

Ouch, that’s gotta burn….

I’ve heard it said that people go to Florida to die. I lived there for 10 years and feel it’s an accurate statement, but I REALLY hope it’s true in this case!!!

@grumpy realist: Yes.

@CSK: Yes.

@Teve: Yes.

Anymore questions?

Has anyone considered the extradition aspect of the move? tRump is currently under investigation for tax evasion, fraud, and a multitude of other criminal acts in New York. Moving to Florida could make facing any charges or trials more difficult if Florida drags its feet extraditing him. I think the move is an indirect admission of guilt and a fear of legal repercussions.

Moving to Florida is not going to stop Trump from being extradited if he were criminally charged in New York. Legally speaking, there is nothing that Florida authorities can do to halt an extradition.