Hourly Pay in U.S. Not Keeping Pace With Price Rises

NYT – Hourly Pay in U.S. Not Keeping Pace With Price Rises

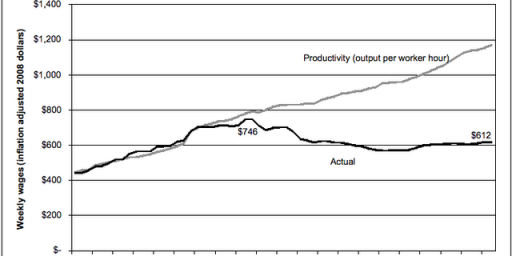

The amount of money workers receive in their paychecks is failing to keep up with inflation. Though wages should recover if businesses continue to hire, three years of job losses have left a large worker surplus. “There’s too much slack in the labor market to generate any pressure on wage growth,” said Jared Bernstein, an economist at the Economic Policy Institute, a liberal research institution based in Washington. “We are going to need a much lower unemployment rate.” He noted that at 5.6 percent, the national unemployment rate is still back at the same level as at the end of the recession in November 2001.

Even though the economy has been adding hundreds of thousands of jobs almost every month this year, stagnant wages could put a dent in the prospects for economic growth, some economists say. If incomes continue to lag behind the increase in prices, it may hinder the ability of ordinary workers to spend money at a healthy clip, undermining one of the pillars of the expansion so far.

***

On Friday, the Bureau of Labor Statistics reported that hourly earnings of production workers – nonmanagement workers ranging from nurses and teachers to hamburger flippers and assembly-line workers – fell 1.1 percent in June, after accounting for inflation. The June drop, the steepest decline since the depths of recession in mid-1991, came after a 0.8 percent fall in real hourly earnings in May.

Coming on top of a 12-minute drop in the average workweek, the decline in the hourly rate last month cut deeply into workers’ pay. In June, production workers took home $525.84 a week, on average. After accounting for inflation, this is about $8 less than they were pocketing last January, and is the lowest level of weekly pay since October 2001. On its own, the decline in workers’ wages is unlikely to derail the recovery. Though they account for some 80 percent of the work force, they contribute much less to spending. Mark M. Zandi, chief economist at Economy.com, a research firm, noted that households in the bottom half of income distribution account for only one-third of consumer spending.

Nonetheless, coming after the bonanza of the second half of the 1990’s, the first period of sustained real wage growth since the 1970’s, the current slide in earnings is a big blow for the lower middle class. Moreover, the absence of lower income households could also weigh on overall economic growth – putting a lid on the mass market and skewing consumption toward high-end products. “There’s a bit of a dichotomy,” said Ethan S. Harris, chief economist at Lehman Brothers. “Joe Six-Pack is under a lot of pressure. He got a lousy raise; he’s paying more for gasoline and milk. He’s not doing that great. But proprietors’ income is up. Profits are up. Home values are up. Middle-income and upper-income people are looking pretty good.”

So, people earning hourly wages are falling behind high skill workers in their buying power. Philip Greenspun offers an interesting contrast between the jobs requiring high and low IQs. Ruy Texuira, on the other hand, thinks it’s President Bush’s fault, for reasons he doesn’t specify.

Steve Antler points us to Annenberg’s Fact Check, which paints a somewhat different picture. For one thing, the number of people working in the “bad” jobs is declining while those working in “good” jobs is growing.

A new set of numbers from the Bureau of Labor Statistics actually shows solid growth in employment in relatively higher -paying occupations including construction workers, health-care professionals, business managers, and teachers, and virtually no growth at all in relatively lower-paying occupations including office clerks and assembly-line workers. It’s the most detailed breakdown yet — looking at 154 different job and industry groupings.

***

Even after adjusting for inflation — including the rising price of gasoline –those earnings are up just over 1% since January 2001, despite the recession and the initially slow recovery. These statistics come from a different BLS survey and cover a somewhat different time period than the figures cited by Kerry. They are going to be controversial and won’t settle the good jobs/bad jobs argument. There’s also plenty of evidence that large numbers of Americans are indeed worse off now than they were before 2001, including the fact that more than 1 million Americans have been out of work for a full year or more.

So, the problem isn’t so much the buying power of the employed but the people whose jobs went away permanently, eaten by the business cycle.

Also, a rather obvious point:

The very recent decline in inflation-adjusted earnings has more to do with rising oil prices than with any change in job quality. The Consumer Price Index has risen 2.3% since August, but with energy prices taken out it has risen only 1.6%. So, if energy prices hadn’t spiked, inflation-adjusted average weekly earnings wouldn’t have declined.

Higher oil prices are a double whammy, in that they not only hit consumers directly at the gas pump but indirectly through increased production and distribution costs for virtually every product they buy. Traditionally, though, these spikes have been temporary, as increased prices cause companies (and countries) to begin pumping more oil to take advantge of the market. That won’t necessarily happen this time, as part of the increase in price is the rising standard of living–and thus demand for petroleum products–in the developing world, most notably China.

UPDATE (1945): Apropos this story, Kevin Drum has started a contest:

[A] prize for the least laughable explanation for why CEO pay has gone up 7x since 1980 based on supply and demand. At a minimum, winning entries should explain the following:

* Why the supply of CEOs has decreased.

* Why the demand for CEOs has increased.

* Why the elasticity of the CEO demand curve is apparently steeper than for any other commodity on the planet.

Fair questions beyond my knowledge of economic theory. My guess is that the reason is the same that pay for NFL quarterbacks and NBA benchwarmers has skyrocketed, despite league expansions, well beyond that of beer vendors in the venues where these athletes play. (This denies the premise of bullet 3.) I honestly don’t understand that phenomenon either, just that there seems to be a trend.

James, any chance you’d post a story that’s critical of the Bush administration without distorting it with your commentary?

The decline in hourly wages is bad news no matter how you look at it. The Elites don’t much care, and Rove may have issued talking points to minimize it, but a heck of a lot of poor and middle-class swing voters who live with wages that are outpaced by inflation know this is an awful situation — especially when the Elites continue to congratulate each other for giving themselves tax relief.

“Philip Greenspun offers an interesting contrast between the jobs requiring high and low IQs.”

One of the most spiritually destructive (not to mention just plain personally insulting) cornerstones of the “conservative” point of view is the constant insinuation that people who are poor are either mentally deficient or morally corrupt.

As G.K.Chesterton pointed out long ago, a poor man is one who has not got much money. Period. Nothing about his politics, his intelligence, or his moral state can be legitimately presumed from that fact.

And for the Christian among us, I would also share Chesterton’s fine observation that all people are valuable in the same sense that all pennies are valuable, because they bear the image of the King.

An individual’s worth as a human being and his financial status don’t have much to do with one another. It’s simply untrue, though, that at the aggregate level there aren’t differences in intelligence between those at the top and the bottom of the earnings brackets. There is certainly randomness in the economy–people like Monica Lewinsky get wealthy, for example–but that’s not the same as the economy being largely random. It isn’t.

James:

I believe you’re stating that, by and large, the smartest people have the most money.

Yeah, the Elites have got you too.

Such a statistical skew of intelligence and wealth is certainly a fact in a country like ours where we all worship Mammon six of the seven days of the week, and where, up to now, there has been plenty to go around.

But there is one other numerical fact that is worthy of consideration: the steady concentration of American wealth into fewer and fewer hands since 1968.

As Margaret Thatcher remarked, “Capitalism is the only alternative.” But as Karl Marx pointed out long ago, Capitalism is going somewhere.

Looking at where Capitalism is going is blasphemous tresspass on the territory of the High Priests of Mammon, so I don’t expect many Americans to be doing it anytime soon.

But as wealth concentrates, maintenance of the ordinary American lifestyle demands ever greater increases in the slope of the GDP curve. Not just increases in growth, but increases in the rate of growth. I don’t think we can sustain such increases in growth rate indefinitely.

The alternative, which we have already begun to see signs of in the “joblessness” of our current “recovery”, is a slow but steady economic deterioration of the quality of American lives from the bottom of the pyramid up.

Ronald Reagan and Margaret Thatcher utterly defeated Lenin. But the real conflict with Marx is yet to come.

Am I reading this thread right? Is Marx still “in play”? In the U.S.? If so, who is advocating that his tenets should be a part of our domestic economic policy? Have I missed something in the current national dialogue? Wow.

Yeah, Capitalism sure stinks. That’s why Germany and even *France* have decided to give it a try after all these years of Socialism and the wonderful economy it created.

No Jim, Marx isn’t still “in play,” and you’re not the one who’s missing something. Just as there are people who haven’t quite grasped the meaning of 9/11, there are even people who still haven’t quite grasped the meaning of the events in 1989 through 1991.

Good. I thought Joseph was in possession of some secret information. Kinda like an Ex Ambassador who has been back in the news.

Being one of the few people I know who has actually read Marx before forming an opinion of him, I can tell you confidentially that the overwhelming majority of his theorizing is about Capitalism. Most people have not read him and do not know this.

I can also tell you that Capitalism in the real world behaved pretty much as Marx predicted up to about 1940.

Between 1940 and 1970 agressive government intervention into the marketplace in the form of regulation, encouragement of unionization, abandonment of European colonies, and cooperative social programs changed Capitalism’s course markedly, for a time, away from Marx’s model.

Since 1970 the political activities of gentlemen such as yourselves has steadily eroded the will of first-world governments to sustain such regulation and management. And Capitalism is correspondingly reverting back to its pre-1940 pattern of rapid concentration of wealth.

Of course, if you persist in choosing the seats on the bus that face backward you can’t see where the bus is going.

A challenge to you: can you name any other thinker you respect, and agree with politically, who presents a clear picture of where Capitalism is headed?

don’t waste you time with mcgehee. he fancies himself a deep thinker, but there is little he knows that doesn’t fall somewhere between cliche and common knowledge. of course, he hasn’t read marx. nor has he read locke, mill, smith or von thunen, whose the theories on the natural wage would illuminate this discussion. but he’s got opinions on the economy, and what workers should be paid. it’s the economy according to rove.

Nepas the All-Knowing proclaimed: don’t waste you time with mcgehee. … of course, he hasn’t read marx.

The hell you say.

I’m sure this is the first time you’ve ever been wrong, Neepy. Don’t let it get you down — you’ll get used to it eventually.

oops. shouldn’t have said he didn’t read. should’ve said he didn’t understand it.

visit his site, folks. you’ve never seen such a pathetic cry for acknowledgement nor such a collection of dull, hackneyed thinking. check out the first sentence of the post he references here — ‘I borrowed a copy of this tome years ago from the library at the college where I got my bachelor’s — figured since I was majoring in poli sci I might as well have a leg up on people who would rather talk about Marx’s theories than know what they are.’ yep that’s our mcgehee — the only one who knows what’s going on.

at the same time, though, there’s something sad about it too. he’d be worthy of sympathy if he didn’t have such disdain for the world around him and if he wasn’t so desperately seeking to be accepted by the elites by carrying their message of loathing for what makes our nation great.

This all goes to prove that if you name your son Jared, his quips will go over everyones head and most people will think he is just trying to smear the POTUS on the old weak economy ruse one more last time.

My challenge is still open, and, if you don’t like mine, James has drummed up an equally entertaining one in the update.