Job Growth Weakens, Unemployment Rate Jumps To 9.1%

After several months where it seemed like things were turning around, the May jobs report was depressingly bad.

After several months when it seemed like the jobs market was turning around, today’s May report from the Bureau Of Labor Statistics is really quite depressing:

U.S. employment rose far less than expected in May to record its weakest reading since September, while the jobless rate rose to 9.1 percent as high energy prices and the effects of Japan’s earthquake bogged down the economy.

Nonfarm payrolls increased 54,000 last month, the Labor Department said on Friday, with private employment rising 83,000, the least amount since June. Government payrolls dropped 29,000.

Economists polled by Reuters had expected payrolls to rise 150,000 and private hiring to increase 175,000 in May. The government revised employment figures for March and April to show 39,000 fewer jobs created than previously estimated.

(…)

The Labor Department said severe weather last month, including tornadoes and flooding, in the Midwest and the South did not materially affect data collection.

It also said that while some workers in those regions may have been temporarily displaced from their jobs, it found “no clear impact of the disasters on the national employment and unemployment data for May.”

Economists still believe the lull in activity will be temporary. They cite high gasoline prices, bad weather and disruptions to motor vehicle production because of a shortage of parts from Japan as factors weighing on growth.

“It is clear we have temporarily entered a soft patch,” said Christopher Probyn, chief economist at State Street Global Advisors in Boston, before the report.

“Nobody knows how soft and how long, but the best case view is that the fundamentals of the recovery remain intact and the economy will re-accelerate in the second half of the year.”

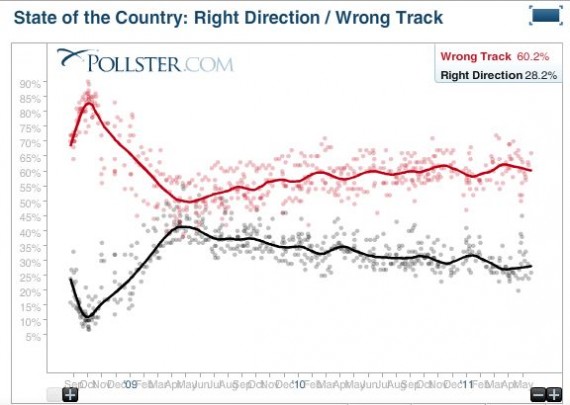

And the worst case scenario is that we’ve reached the limits of what has been an incredibly anemic recovery and that we’re headed for a period of stagnation, or worse. More importantly, with more than six million people still unemployed it really doesn’t matter if we are officially in a recession or not. For these people, and by extension to the economy as a whole, we are so far away from a healthy economy that we may as well be in a recession. That’s why we see nearly 2/3 of the country believing that the country is on the “wrong track,” a number nearly as high as it was in the depths of the 2008 financial crisis:

That perception of the state of the country is likely to remain pessimistic as long as we continue to have jobs reports like the one released today and, politically, that just can’t be good news for the party currently controlling the White House

Did you say “jumps?” Funny, I heard it reported differently:

This has been a funny few days for me, as I see everyone and his uncle express surprise at numbers that are not surprising at all. Look at the graphs on this CR page. We might have a slight tweak on the trend, but that is all.

The story is, and has been, a slow jobs recovery.

Now, another piece of data that has been out there has been the contraction measured by the Consumer Metrics Institute. They have us at 500+ days of contraction, and 100+ days since the last inflection/downturn.

What I keep asking is why does everyone pretend surprise?

Is it just a game, in run-up to 2012? Are we shocked, shocked, to be in a recession?

I should note again that a certain Wall Street (and financial TV) group wanted everyone to see a bull stock market as “proof” of an economic recovery. It’s possible that the market is now ready for a pull-back. And, the same imbeciles who thought the market was sending a message will say that it is sending one now.

Of course, an alternate narrative is that the economy has been in a slow slog, and the hucksters and gamblers ran up the market on nothing but fumes. Of course they’ll pretend otherwise.

The pessimism will continue and it won’t help the party out of the White House either. Just like “it’s the economy, stupid” no one being hit with layoffs or no economic security cares about the national debt or social conservatice ideology.

Unexpectedly!

Seasonably, this probably isn’t that shocking of a number, but it does follow the trend of which to me has not been one showing that businesses have been gaining traction in hiring. Some are, yes, but a vast majority are instituting measures to streamline production through cost cutting measures which eliminate positions. There just isn’t enough money or security in the future to justify adding on people. Unless of course you’re McDonald’s and robots to flip burgers are more expensive than out of work people.