Obama Answers Reagan’s Question

In an interview, President Obama says that Americans are worse off than they were four years ago.

In his one and only debate with Jimmy Carter during the 1980 election, Ronald Reagan summed up the choice that he and the President were putting before America’s voters in one question:

For a large number of Americans, the answer to Reagan’s question was a clear and emphatic no. During Jimmy Cater’s Presidency, America had experienced slow growth made worse by massive price inflation, energy prices that were persistently unstable thanks mostly to political factors half a world away, and a general sense that the country was headed down the wrong path. Internationally, the nation was being humiliated by a hostage crisis in Iran that had been going on for more than a year and didn’t seem to be likely to end soon, terrorism in the Middle East that threatened war, and Soviet expansion into Afghanistan. It’s no surprise then, that when Americans walked into the polling booth on November 4th, they answered Reagan’s question with a resounding no.

Yesterday, in an interview with ABC News’s George Stephanopoulos, President Obama answered Ronald Reagan’s question too:

Calling himself an “underdog,” President Obama today said the faltering economy is a drag on his presidency and seriously impairing his chances of winning again in 2012.

“Absolutely,” he said in response to a question from ABC News’ George Stephanopoulos about whether the odds were against him come November 2012, given the economy. “I’m used to being the underdog. But at the end of the day people are going to ask — who’s got a vision?”

The American people, he conceded, are “not better off” than they were four years ago.

“The unemployment rate is way too high,” he said of the 9 percent jobless rate, the highest in more than half a century.

Here’s the video of the interview:

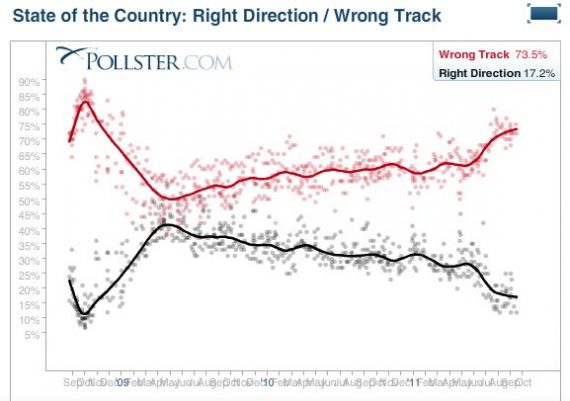

Realistically, of course, there’s really no way the President could answer the question any other way. While some economic statistics may say that we’re in better shape, nominally, than we were when he took office during the height of the 2008 financial crisis, the public perception of the state of the economy is decidedly negative. The most personal measure economic health, the unemployment rate, remains stubbornly high and is likely to stay so long after the voters are tallied on Election Day 2012. And poll after poll has shown the public to be incredibly pessimistic about the state of the economy and, the direction of the country:

The good news for Obama is that things seem so bad now, that even a slight improvement over the next twelve months could inure to his benefit. Much of that is beyond his control. Even if his jobs plan were to pass Congress in full today, which isn’t going to happen, it’s impact on the economy isn’t likely to be large enough over such a short period of time to make a significant difference. Most importantly, though, America’s immediate economic future doesn’t necessarily lie in American hands. The ongoing Eurozone Crisis, which is far from resolved, could yet result in a financial crisis not unlike what the world experienced in 2008. While the economic impact in the U.S. of such an event isn’t expected to be as severe as it would be in Europe, it would still likely push us into another recession — which we may be headed for anyway — which makes any hope of recovery before the election completely pointless.

A year from now, people will be asking themselves Reagan’s question once again. If the answer they give is the same one the President gave yesterday, then he is going to have a problem regardless of how much the Democrats try to demonize the eventual Republican nominee.

“[Obama] is going to have a problem regardless of how much the Democrats try to demonize the eventual Republican nominee.”

If the Republicans nominate a demon, is it really demonizing to point that out?

Yes, we are a big disappointment to Obama. We are soft. We are not worthy. We must work harder to meet the demands he places upon us. We are a big disappointment to the Obama.

How about turning the vision into a reality? No more slogans. no more promises. no more things that brief well or sound good. Do something. Anything. maybe it doesn’t work. but do something.

The James Carville rule applies: “It’s the economy, stupid.” Obama knows it. If the Republicans actually nominate Romney, Obama will have a very difficult time getting re-elected. If they nominate somebody more Tea Party favorable, then he’s got a much better chance of being re-elected.

Correctly observed. Obama is trying to cast himself as an underdog, since America tends to favor them. But Obama isn’t an underdog. He was in fact quite successful in jamming his agenda down the throats of Americans. It’s his socialist policies that have failed.

Obama isn’t an underdog. He’s just wrong for America.

I always thought this was a rehtorical question anyway. Do you really think Obama should answer yes? Is it his fault if the answer is no? Congress holds the most blame for there not being an improvement (and when the dems had congress we were well on our way to recovery)

I wonder when Wall Street and Corporate America are going to start thinking about what a government run by today’s GOP is going to do for the economy. I mean, I’ve seen some bitter liberals suggest that President Romney and a Republican Congress will simply embrace massive Keynesian stimulus efforts when they take control, the economy will boom and Democrats will be consigned to electoral defeat for years to come. That seems unliken given that…

A. A GOP controlled Congress in 2013 will likely be even more full of Tea Party/Randian types than it is now. Does anyone think a Republican flood in November 12 will brings boatloads of moderates to power? Won’t we just have a governing majority even more certain that tax cuts solve everything?

B, If we don’t do anything about it in the next year and a half, the economy the GOP inherits will be worse than the one we have now and any solution will be significantly more difficult to enact.

Mike

Once again Bithead displays his oral obsession and his ignorance regarding the definition of socialism.

He’s nothing if not consistent.

This actually is a very good strategy by Obama. Civil and criminal trial attorneys for decades have been engaging in similar strategies, with great success. In essence you preempt the other side’s best argument by making the argument yourself. Then you downplay it. You minimize it. By the time the other side gets their turn it feels to a jury ike they’re piling on.

Axelrod definitely is on his A-game.

@Davebo:

He’s not consistent.

I was thinking about this too and of course the answer is “No.” Well….for me, it’s true but it’s not like Obama helped me. For the country…..not so much.

But then again, we don’t live in the United States of Obama. There are 299,999,999 million other people in this country who need to do their part, too. So if the answer is “no,” then we need a long look in the mirror.

Tsar is spot on. He nullifies the point…now you have to argue specifics. Say what you would do better. Tougher to do.

Only about 1% of us could say that they are, but they aren’t satisfied with that.

Tougher to do when all you’ve got is supply side economics…which is all we’ve heard in the debates…and which is proven to be bogus economic theory.

There’s zero chance his bill will have a significant impact on the economy any time soon. Spread over the next four years the $440 billion works out to less than 1% of GDP, which contracted nearly seven percent in the course of the financial crisis. There is no way anything short of a massive, well targetted stimulus will have sufficient positive impact prior to make a difference in the 2012 election because the average American is indebted to the tune of 300% of their earnings. The private sector cannot deleverage on its own very quickly, certainly not before we’re well into the next presidential term.

@Hey Norm: Norm, I’m confused. You say supply side won’t work. Since Bush and Obama have spent like drunken sailors, which to me constitutes Keynesian demand economics, and we are still mired in a depression, what is your prescription for economic policy?

@Pete: There’s a trillion dollar hole in private sector spending. This is matched by a government deficit of roughly one trillion dollars, which is sufficient to prevent the economy from falling off a cliff, but not enough to get it off of life support.

Stimulus isn’t simply a matter of spending money: the rate we spend it at is the critical factor. We need a massive stimulus over a relatively short time-frame sufficient to push the economy back up to its maximum productive capacity, on the order of $2 trillion in a single fiscal year on top of what we’re already spending.

If you think this is a depression, you really need to read some history books.

@anjin-san: And the authors of those history books write the unvarnished truth? Historians write with no bias? It’s a depression where I live. I am happy for you that you haven’t been touched.

@Ben Wolf: Not so sure that will work like it has in the past. People seem to have sobered up about living off credit. I think the economy needs a structural adjustment where the savings pool is built up so that the value of capital increases and then is directed to rebuilding business that produces more REAL wealth (manufacturing, primarily). The value of our currency has depreciated for years as the Fed has accommodated all sorts of spending and we have enjoyed an illusory wealth increase.

A 2 trillion dollar stimulus would more than likely be used to pay down debt, which is good, but would not initially be invested in productive activity. We have popped the debt bubble built up over 50 years and feeding that again with a stimulus would re-inflate it so that it would just pop again somewhere down the road.

Ben, I meant to say that if a stimulus just reignites our debt orgy, we haven’t gained anything in the long term; just postponed the inevitable pain of structural adjustment. The credit bubble is what got us here. We need to build up savings which is REAL wealth. It is not easy. Just imagine you and your family trying to do it. Lifestyles have to change.

You’re right, so we have to structure the stimulus in such a way it cycles through the economy before it goes into retiring debt.

I would respond to this by arguing we need legislation to address lending practices, on the order of “no 20% down, no house”, etc to ensure this doesn’t happen again, not that we’ll get it. The economy just isn’t going to recover until enough of that debt goes away; the problem I have with waiting foe the economy to sort itself out is that a lot of people who didn’t go on a credit card spree, such as the graduating university class of 2011, are largely unemployed. We also know that being out of work their first year significantly reduces their lifetime earnings.

I am in favor of better savings rates, but how has that worked out in Japan?

I have been lucky the last few years, but I know plenty of people who are hurting. I also know a lot of people who lived through the depression, and they all say the same thing – it was much worse than what we are currently experiencing. One reason is the social safety net we now have in place. But the GOP is hard at work to take care of that, no?

@Davebo: Hardly. It’s just that the socialists keep trying to hide it’s meaning and how nit comes about. It is after all the only way to get it in place.