Taxing ‘The Rich’

It's a relative thing.

Richard Rubin and Joe Pinsker for WSJ (“‘I Don’t Think of Myself as Rich’: The Americans Crossing Biden’s $400,000 Tax Line“):

President Biden is back on the campaign trail, and so is his favorite tax-policy number: $400,000.

In his successful 2020 presidential run, Biden pledged to protect households from tax increases if their income was below that threshold. He reupped the promise for his re-election bid and is planning to draw tax-policy contrasts with Republican rival Donald Trump in a Tuesday speech in Pennsylvania.

If Democrats have any power next year, the $400,000 cutoff will be the floor in negotiations over who pays more and who doesn’t. Have income below that and you will be spared. Above that line, and your 1040 is on the menu as Democrats seek trillions of dollars for new programs and middle-class tax cuts.

Republicans are campaigning for extending expiring tax cuts enacted in 2017 at all income levels, while Biden and Democrats say they will protect at least the bottom 97% of households from higher taxes. The competing antitax pledges appeal to voters’ pocketbooks while limiting debate to the top sliver of households and restricting policymakers’ ability to generate revenue.

In particular, the Biden pledge’s persistence highlights shifting political coalitions as affluent suburban voters drift from the Republican Party. Biden’s promise helps Democrats reassure upper-middle-class Americans that they can vote for the party without risking their bank accounts. But it also limits Biden’s tax policies and gives critics a ready target.

Notably, Biden isn’t adjusting the $400,000 to account for inflation during his first term, keeping the round number he started with. That amount in May 2020, when Biden articulated the plan, is equivalent to more than $487,000 now.

Because of inflation and economic growth, the pool of $400,000-and-up households increased to 3.4 million in 2022, up 33% from 2019, according to census data analyzed by the Economic Innovation Group, a Washington, D.C., think tank. The percentage of households above that line climbed to 2.6% from 2.1%.

[…]

Biden’s pledge is often interpreted as a bright line between “middle class” and “rich,” but it wasn’t intended that way. According to administration officials, $400,000 was set so middle-class households can see they will be comfortably below it.

“It put in very precise terms who was intended to benefit,” said Ben Harris, a campaign aide during 2020 and an assistant Treasury secretary in the Biden administration. “It was less a definition of who was rich and more a value judgment about rewarding work and labor.”

Compared with the full population, households with incomes above $400,000 are more likely to include children, and they are disproportionately white and Asian-American. They are also concentrated in urban areas. In Washington, D.C., in 2022, 6.1% of households were above the line; in Mississippi, 0.8% were.

As the headline suggests, the report includes anecdotal quotations of folks who are just over the $400,000 line who don’t think they’re “rich” because they worked hard to get where they are rather than inheriting wealth. A representative example:

In Louisville, Ky., $400,000 feels like plenty to David Deyer.

“We have it pretty nice in the Kentucky area,” Deyer said. He and his wife are about $25,000 under the threshold.

The 33-year-old, who works in business development for an HVAC contractor, said they can travel internationally and make monthly charitable donations on par with their mortgage payments.

Deyer said he could afford higher taxes but doesn’t think of himself as rich. He and his wife make coffee to avoid Starbucks and buy fruit based on what is on sale.

“We’re not extravagant people with high-end country-club memberships or a private jet or anything like that,” he said. He declined to say who he is voting for.

Objectively, a $400,000 household income is rich even in the DC area; the median is $117,432. It’s fantastically so in Louisville, where the median is $63,114. Indeed, I’m shocked that a 33-year-old with a seemingly mundane job brings in that much. At the same time, a lot of upper-middle-class folks clearly think that they’re just working stiffs and that “the rich” are the people with wildly lavish lifestyles that they can only dream of.

While Rubin and Pinsker are clearly trying to paint the Biden proposal in a bad light, they actually have a reasonable point. The $400,000 threshold that was trotted out in the 2020 campaign indeed hits a lot more people—and represents a lower point on the income curve—now than it did then. If the point is public policy and not rhetorical, the number should adjust for inflation.

For that matter, it’s long been obvious to me that the number should be regionally adjusted. While $400,000 is a high household income even in San Francisco (median $136,689), basic subsistence is simply much more expensive in some parts of the country than others. Indeed, the federal government has long understood this, including rather sizable locality pay adjustments for its own employees, which currently range from 45.41% in the San Jose-San Francisco-Oakland area to $17.11% in the Reno-Fernley area.

Well, first of all, good for them. I am familiar with this kind of thing. Keep doing the stuff you did when you didn’t have all that money.

However, you do have all that money. I *ahem* have been through this transition. All that money changes things. Lots of things. You keep a lot of your frugal habits, that’s great. It’s still different for you.

You’re not one of the “rich people” but you are, uh, rich. Totally.

Thing is, you’re probably in the 2 percent, maybe? But wealth is so stratified, there is so much inequality in our society now, that the .2 percent are very very different from the 2 percent. They, and I are not part of that shindig. I don’t really know a good word for these guys other than “the .1 percent”.

And let’s be clear, if you’re Warren Buffet, you maybe have the trappings, but you think you should probably pay more in taxes. And he’s not the only one. So I’m not trashing an identity, I’m trashing an attitude.

I personally do not have a good plan for addressing this, but I think this extreme wealth distribution is driving so many of the issues we see these days.

@Jay L Gischer:

I was in the 5%, now retired at 64.

Some could say that I am rich. And I would agree. Because rich is something that can go away (and likely will).

It’s not legacy money. Legacy money is when economic downturns or familial crisis has no effect on lifestyle today or for foreseeable years to come.

The folks in the 1% own 50% of the stocks in the US. They’ve seized the means of production and hold that shit tight.

That is wealth. Wealth is beyond rich. Rich is fleeting and unlikely to survive one generation because US capitalism is built to bleed off the money from the rich and middle class. We are the marks for which every scheme is made. And there are SO many.

HOWEVER… last year my income was about $20K (spending money out of savings). And per my tax return that makes me part of the poor. With $4.5M net worth, by the rules the game is played, I’m poor. My taxes were zip, and I qualify for ACA until I hit Medicare and Plan G next year.

And that is why someone who is “rich” is telling you: The “whole flat” tax bullshit is exactly that: Bullshit.

I gladly paid my taxes on my income and will continue to do so as I pull savings out of my long-term investments.

But to cry for the poor folks making $400,000 is just a smokescreen for the real class warfare: Get the billionaires and make them pay. As they should. Because they have benefitted from over 100 years of people paying taxes in America that makes all that they do today possible.

And they must pay it forward for the generations to come.

Almost everybody in America thinks of themselves as middle class. At least that’s what they tell pollsters when asked about it. When I was growing up in the 60s and 70s, raised on the paycheck of a widowed school teacher, we were middle class. Now, as I approach Medicare eligibility, I still think of myself as middle class. My sociologist son points out that it takes an awfully broad definition of middle to includes folks who are lucky enough to frequently find themselves with an income in the top 1%, but that doesn’t change how I feel. And feelings are really what the American middle class is about.

For a late Boomer like me, if your family cared about education but you paid for an in-state college with a combination of Pell grants, work study, and summer jobs, it’s likely that you’re never going to lose the feeling that you’re middle class. If your summer vacations involved long drives in a station wagon looking for off brand motels because only rich folks stayed in fancy-pants spots like the Holiday Inn, that middle class feeling is always going to be with you. And if the family could afford those driving vacations only because your mom bought your clothes at Cardin’s Smoke and Water Damaged Salvage Outlet, you definitely are going to have that middle class (at best) feeling lurking inside you.

So I get it when a guy pulling in $400k says that he doesn’t feel rich. I don’t feel rich either. But I know without a doubt that 13-year-old me would have had no hesitation in labeling me as what I am–a rich old fart. And since I got where I am with the help of other people’s taxes, it seems a little too much like pulling the ladder up after me to bitch about the marginal tax rate on income over $400,000 going up to the rate that was in place under the sainted Ronald Reagan.

Edited to add: Saw that while I was typing @Jay L Gischer and @Liberal Capitalist said about the same thing I did, only better. I think a lot of the “I’m not really rich” attitude from people who objectively are in the top 1% comes because we get to see how different life is for those in the top 0.1% and how little they pay.

@Liberal Capitalist: I didn’t wade into the argument on Nextdoor.com, but somebody was whining that the administrative fee on their property taxes was a percentage as opposed to a fixed amount (because it’s the “same amount of administrative work” regardless of your property’s worth). As a proponent of a wealth tax, I am in obvious disagreement with their stance, even though I understand the simple worldview they hold.

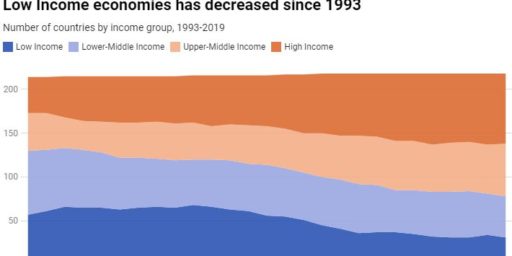

The most important fact to know: From WWII to the 70’s, when productivity went up, everyone benefitted – management, capital owners and rank and file. Since the 1970’s the vast majority of all gains in productivity has gone to capital owners and management.

Nationally, $400k is about the top ~4% of income or better. In 2021, it was top 2.5% based on IRS data, but they don’t have anything newer, and inflation has changed that. In that year, about 3% of tax returns reported this level of income or higher (4.6 million filers), so a small number of Americans.

If you look at it state-by-state, $400k is top 1% or higher for many states and is still like the top 5-6% for the richest state.

The idea that this is anywhere close to the breakpoint for the middle class is pure sophistry.

@Roger: I got bad news for you: if you qualified for Pell Grants back in the day, you were below the median by a piece or so. Still, congrats on becoming middle class, and more from what you describe.

@just nutha: yeah, I get it. By the metrics most of my friends and I were below middle class but in our heads we were all middle class just like now we’re above it by income but still think of ourselves as middle class, not upper class.

So by being frugal and not drinking Starbucks I too can hit 400k annually? Zoinks!

People don’t seem to understand that the difference between one million dollars and one billion dollars is approximately one billion dollars.

It’s a level of scale that is incomprehensible to most folks.

Millionaires are not the enemy – hell, people with 10 million are not the enemy. The enemy has thousands of times more than your neighborhood millionaire.

And all this abortion/birth control/religion/racism/etc. nonsense is just a distraction so that we don’t pay attention to their off-the-charts levels of rent seeking.

Elon Musk alone has tapped into the U.S. Treasury more than any other person I can think of in modern times.

Enough is enough.

Minor quibble: the excerpt states “…He and his wife are about $25,000 under the threshold.” To me, that reads as though both he AND his wife work, and both of them contribute to that $375K.

@Jen: Yes, that’s a poorly-worded sentence. Since he’s the one being interviewed—and just the way things tend to work in relationships—I’m assuming he has both the more prestigious job and the higher income. So, say he’s making $200,000 and she’s making $175,000. Those are both incredibly high salaries for relatively young folks anywhere in the country outside of a handful of prestige professions.

Another thing to bear in mind is that the rich and their stooges focus exclusively on income taxes, whereas in the real world people pay all kinds of fees, taxes of other sorts, assays, etc and that makes up a much larger share of the poor’s income than it does the rich. As Kevin Drum highlights in a chart, from 1980 to 2018 the real world rates those in the 30th to 95th percentile paid didn’t move much, and what movement there was went downwards. What changed? The poor pay dramatically more, and the rich pay dramatically less. At the top end they pay half of what they used to in taxes. Oh, and this isn’t in Drum’s chart, since the poor simply don’t have enough money to make up for the dramatic reductions on the wealthy and the corporations, we borrow much, much more money than we used to during good times to make up the difference.

But remember, as long as Republicans say they are the fiscally responsible party, it must be true.

The official definition of the rich is, ‘anyone who makes more than me, regardless of what I make.’

There are many levels of rich, but only a few significant ones:

– Enough to eat and a permanent roof over your head

– Ability and education (both school and practical learning) to move to a different place to find a better job

– Ability to take weekends off and take vacations

– Ability to withstand a job loss for 1 year or more and still maintain your life style

– Having enough wealth that you can live off that and don’t have to have a job

Everything else is just gradations between significant markers

@Tony W:

…which is why taxing wealth would be so much more fair than taxing income, and taxing all income equally would be so much more fair than giving handouts to those whose income is mostly capital gains and dividends.

But taxing wealth is hard — people are good at hiding wealth and lying about it. They hide income and lie about that, too, but it’s harder to do effectively. (Which is why the GOP fights so hard to keep the IRS underfunded for enforcement.)

Through a combination of luck and hard work, I’ve put myself in range of these tax increases. And that’s a good thing — I deserve to be taxed more, and I won’t really notice the difference in my lifestyle. But if that’s true of me, it’s 1000 times more true of the filthy rich and the grotesquely overcompensated.

As for people objecting that they aren’t “rich”… OK. We’ll settle for “taxing the top 5% whether they are rich or not”. Would that make them happier?

(And James, your locale adjustment argument is bogus. People who make $400k per year or more live where they want to, after taking into account the cost of living. It’s a voluntary expense, like buying a Porsche, if they live in expensive areas.)

I’ve never made $400K in a year. I’ve come very, very, very close several years, but never actually hit$400K. And I’m sure as hell “rich”, and I’ve lived most of my life in Los Angeles and New York City.

Why?

Because I grew up eating ketchup sandwiches from week old bread from the Wonder Bread outlet bakery.

Because I wore the same three pair of pants to school for an entire semester because I didn’t have any other pants.

Because I had to glue leather patches inside of my sneakers so that the hole at the bottom didn’t cause cuts to the bottoms of my feet.

Because I had to have cereal with powdered milk because my single mom couldn’t afford regular milk.

Because until I started working full time at 15, all my clothes came from Goodwill, Salvation Army, garage sales, or swap meets.

Because I had to walk 1.5 miles to school every day while my friends rode bikes because my mom couldn’t even afford a used bike.

So you’re complaining about making $400K per year, anywhere, FVCK YOU!

If you complain about making $400K anywhere, you’ve never been poor. If you had been poor – really poor- at any point in your life, you’d be giving thanks for that $400K because you’re one of the lucky ones that figured it out.

/rant

@DrDaveT:

I would also add, overall wealth is probably a steadier metric than yearly income for most people, which again would make it a better basis for taxing. Twice I have received rather unexpected windfalls that moved me several tax brackets up for the year, but my overall status of … we’ll call it “well off” … didn’t significantly change. Not that I’m complaining about the surprise bonuses, but I got nailed on taxes those two years. If they had been spread out, my overall tax rate would have been lower and probably more appropriate for my overall wealth level. (I know there are ways to amortize losses and gains in some cases, but those didn’t apply in my case.)

That said, I acknowledge that taxing wealth is incredibly difficult.

@EddieInCA: I think I could still tolerate everything on your list except this:

I would starve to death first.

@MarkedMan:

That’s the big problem.

It’s not all due to the tax structure, nor to the cuts to the corporate tax rate. Various forms of deregulation have a lot to do with it, as well as lax oversight.

But most of all, it’s the belief that Reagan’s Voodoo* Economics not only work, but is the only way to maintain a prosperous, equitable, free market economy; all evidence to the contrary notwithstanding.

*I think this s the first time I’ve ever said this: Apologies to Voodoo.

@EddieInCA:

OMG, that’s why. I never clocked that. Duh. I can still taste that Carnation powder. Has to be really, really cold to resemble milk.

@Michael Reynolds: We were a “Sanalac” family when I was growing up.

Back in the day I could empty that tube into the square yellow container, snap on the blue lid, shake that bitch up, and have it back in the refrigerator in 10 seconds flat.

@Michael Reynolds:

It actually is milk. Dehydrated, but milk. Granted re-hydrating it doesn’t result in the same texture and taste, but the nutrients survive rather well.

When I’ve made use of it, I found it works better as an ingredient than a drink. For making oat meal in the microwave, as an example.

Now, we also sell a lot of it to a variety of customers. I don’t think it’s cheaper than fluid milk, though it keeps longer and doesn’t need refrigeration.

@Jay L Gischer:

Pay how much more in taxes? And why? Do the recipients of those tax benefits through government handouts deserve them? Did they work for them? Take risk of capital for them? And are those taxes better used in the public sector?

The only argument for taxation and wealth redistribution is one of a civil society and provision for public goods. We should take pity on the incapable, the impaired. We need to pay for the national defense, or infrastructure. We are far past that; there is plenty of money. The money is siphoned off to special interests. Its a giant poker game: buy off and elect a politician in the hope that the tax pot they control and can provide to a special interest has a good ROI. And BTW, our infrastructure sucks. Infrastructure bills are now pork bills. The common good is now a nonsense argument. The wealth is redistributed to buy votes. Student loan forgiveness, anyone? Green new deal??

And we solve almost no social ills with money. In fact, we probably exacerbate them.

Wealth inequality is almost singularly the product of two things: those who can, and those who buy Washington and State influence. Your argument is for continuing US suicide.

@Jack:

Enough to provide for the common defense, promote the general welfare, and secure the blessings of liberty to ourselves and our posterity.

See above.

Do you? At any rate, who cares? If everyone is better off (or at least no worse off), isn’t that enough?

See above — who cares? Would you rather everyone were worse off, if it meant that nobody got rewarded who didn’t “take risk of capital”?

(And btw there isn’t much risk involved in a diversified portfolio, which is what 99% of that capital is sitting in.)

Just how prosperous a nation do you think we would be without roads? Schools? Stable banks? Enforceable contracts? Potable water? Law enforcement? Courts? You know — the public sector.

It used to amaze me that the very people who pride themselves on their investment savvy are so inept at it when it comes to public goods. Then I realized — they’re not inept; they just want a free ride.

@Michael Reynolds: I was grown and had left home for college before I figured out that the reason milk tasted worse at the end of the month than the beginning was because the gallon of milk my mom bought on the 1st had been recut so many times by the 30th that it was almost 100% reconstituted powdered milk. I was not a quick study.

@Jack: I don’t understand myself as arguing for any policy at all. So, I can’t say I understand your remarks.

What I said is “inequality is a big problem that I don’t know what to do about.” That’s what I said.

I like to think I say what I mean, and I mean what I say. Hmm?

@Jack:

Bullshit. Sweden. Norway.Canada/ Denmark. Finland. All do wealth redistribution through taxation. USA isn’t in the top 20 for “Quality of life”.

Best Countries for Quality of Life”

By taxing all income equally, especially income on stocks, bonds, and options, we’d fix alot of our countries issues. Other countries do this well. We don’t.

@DrDaveT:

Europe tried taxing wealth for a long time and mostly gave up. Overall, it’s a terrible idea IMO because it involves making subjective and disputable judgments about value, and the compliance and enforcement costs are high.

Taxation is a situation where you want compliance and enforcement costs to be low and the rules and obligations to be clear to everyone in advance. This is one reason why VATs are superior, IMO.

So, rather than a wealth tax, I’d much rather see a progressive value-added tax.

@Jack: I assume you are referring to government handouts such tunnel and bridge projects, subsidies for Tesla (which kept them in business for years), space contracts, the F35 boondoggle, military contractors, and secret service agent hotel rooms at double the normal booking price to guard Trump at Merde-a-Lardo.

@Andy:

Government’s have no problem making subjective and disputable judgments about value when it comes to your house or car.

@EddieInCA: I was lucky I usually had a slice of bologna to go with the ketchup and bread.

@DrDaveT:

I hope I’m wrong, but my sense is that Jack’s answer is “Fwk yeah!”

@Andy: I’m intrigued! How do you make value-added taxation progressive? The usual position for people favoring value-added tax is (as is common in most “preferred” taxation systems) is “I don’t buy very much, so the impact on me would be low.”

@Andy:

If it wasn’t clear, I agree completely. While taxing wealth would be much more efficient and fair if it could be done cheaply and accurately, your arguments are correct. It can’t.

I favor a combination of progressive income taxation, progressive (in terms of duration held) capital gains taxes, and luxury taxes. VAT, but only on non-staples. Oh, and much higher inheritance taxes than currently, with no loopholes through weird trusts. Call it an “intergenerational transfer tax” instead, and tax every form of spending on your kids above what normal people might do.

The part the filthy rich don’t want to discuss is that the marginal utility of money, once you are filthy rich, is essentially zero. There is nothing at all that you can do with $11 billion than you can’t do with $10 billion — the marginal utility of that billion dollars is zero, except for ego boost. And society would be better off if the $10 billionaire burnt that extra billion, rather than keeping it — at least burning it would be anti-inflationary.

Dear Richard Rubin and Joe Pinscher, $400k per year is rich. Crazy insane rich. Extremely rich. Like how could I possibly spend that much money in a year rich.

Maybe they should do a Cletus safari, not to meet MAGAs but to meet the 90%.

@Tony W:

Indeed.

Heck, I don’t think that most people understand that the difference between 1 and 2 million dollars is ONE MILLION DOLLARS, which is a lot of dollars. I think most people think that 2 is just one more than 1, so it’s not that much more.

(I say this to not all detract from your broader, very apt, point–I just find innumeracy is rampant–and I see it even in work circumstances, which kind of sparks my observation, specifically a convo I was involved in recently wherein the goal is 5 million in grant funding, and it was observed that we are at almost 3, wherein it was observed that we are also there! Well, not exactly–2+ million is still a lot).

It seems worth noting that Jack is pointing out one of the main mythologies of American conservativism: that wealth and power distributions are just and are the result of just systems. As such, all talk about tax levels becomes, to them, about taking something away from people who have earned it fair and square.

I know because this was the version of American free enterprise that I was raised on.

Now, I would argue that any strict evaluation of objective reality shows that the system is not just, and therefore that the distributions of wealth and power that it produces is not just.

The notion, for example, that Jeff Bezos, and Jeff Bezos alone deserves his money is a bit absurd. Just off the top of my head, late in the day, I would point out that with the internet and the postal service, Amazon would not be what is it. And those are government creations. And, of course, there are a myriad of other factors (not to mention the labor of Amazon workers) to put into that discussion.

To be clear: I am not being snarky to Jack, nor am I asking people not to argue with him, but it just struck me as a really good illustration/reminder of an alternative world view.

@Steven L. Taylor:

Hate to disagree with you, Dr. Taylor, but in fact the difference between 1 and 2 million dollars (in terms of utility) is far less than the difference between 0 million and 1 million. The marginal utility of cash is sharply diminishing. There are certainly many things you can do with 2 million dollars that you can’t do with 1 million, but they are dwarfed by the difference between what you can do with 1 million and what you can do when flat broke.

In theory, progressive taxation policy should be based on empirical studies of the marginal utility of wealth. In practice, that ain’t ever going to happen, because the wealthy can buy policy.

@Jack:

Reducing wealth accumulation, and the power imbalances that it creates, is a perfectly fine and common argument for taxation.

You can also go full MMT and claim that taxation is about contracting the money supply (preventing devaluation of currency as the government prints what it needs), rather than an effort to pay for government services.

@DrDaveT:

You beat me to it.

And this is related to another advantage the rich/wealthy have: they have more than enough to live on, so all that extra money can be put into the most aggressive investments for a long period of time (the laws of probability nearly guarantee a large return in this case). This is compared to the guy scraping by with a few small investments, hoping it will cover some of his retirement; he’ll be advised to stay conservative so he doesn’t lose the little he has. Because it’s *that* much more important to him, i.e. he would actually be assuming risk to his own well-being.

@Franklin:

No, you wouldn’t. If you’ve ever been anywhere near having to eat ketchup sandwiches, you wouldn’t say things like this.

@Michael Reynolds:

You had Carnation powdered milk, MR? That was lucky. That government powdered milk was horrid, along with that 5-lb block of constipation-inducing cheese and that gallon can of chopped meat. But at least we didn’t starve.

@DeD:

@DeD:

You said what I was thinking. If you’ve never been that hungry, you don’t know. And I don’t mean that disrespectfully to anyone.

My family’s situation was tougher than even some in the neighorhood in similar situations because my mother was too proud to accept any government assistance. She never accepted food stamps, never accepted any sort of welfare, and never, ever, would take charity from anyone. She would just work more hours or create a third, fourth, fifth side hustle. My mom is my fucking hero.

@Jack: “Take risk of capital for them?:”

Remember, kids — if your job entails risks to your health, whether you work as a firefighter, a meatpacker, or on a construction crew, you are entirely worthless and a drain on society. But if you risk capital, then you a master of the world and deserve all the money you can grab.

@DrDaveT:

I was not arguing the utility of 0 v 1 or 1 v 2, not at all. I totally agree with what you are saying. I was trying, perhaps poorly, to make a point about how poorly people think about numbers. (It wasn’t an observation about taxes, either, in that specific case).

@wr: Indeed.

@DrDaveT:

This point is worth underscoring when speaking of taxes, the more money you make (and the more wealth you have) the less of an impact on your life of taxation.

I make enough money that I get a small raise during the last couple of months of the year because I hit the cap on FICA taxes. I do not notice this bump and only really know about it because I know the cap exists because I pay attention to public policy. (BTW, I forget how many months, because it really doesn’t matter to me). I make a good salary, and it would not bother me one iota if that cap was lifted–because at scale that would make a difference for funding important programs. I doubt, very seriously, that most people who make enough ($168,000 or more) would much notice this change. Indeed, if you are making 168,000 or more and are so living paycheck-to-paycheck that this change would adversely affect your life, you may be making some poor choices. (And again, yes, I know living in NYC, DC, etc. is expensive, but still).

To me, this is a small illustration that at some point, a few more marginal dollars doesn’t make that much of a difference. And this would clearly be exponentially more true as your income goes up.

@Steven L. Taylor:

The definitive long-format work on this topic is The Meritocracy Myth.

The bizarre part is that 99% of the “must lower taxes” crowd think that roads and bridges and public schools and clean water and stock markets and trash collection and policemen and fire fighters and pure foods and drugs and sewer services and freedom from military invasion are all good things to have. But they somehow think that (1) we could still have them at their present levels without paying for them, and (2) there is nothing else conceivable that could be a worthwhile public good paid for through taxes. People who live in countries with actual universal health care find this inexplicable, if not outright insane.

@EddieInCA:

To you, she was a hero, because you are alive today.

Sadly, she fell for the “poor-but-proud” mythology that the wealthy have created in this country.

Poor-but-proud means that you are alone. Because you don’t need anything from anybody. You don’t organize, you don’t trust others, and you take what you get to “make it”.

Poor-but-proud is bullshit. The wealthy organize. The wealthy network. The wealthy do everything they can to help other wealthy people and to ensure that poor-but-proud stay in their place.

School vouchers is a way for the wealthy to ensure their money doesn’t go to the “undeserving”. Fraternities and sororities ensure that legacy is maintained, and connections are made.

Do you think it’s a coincidence that Trump and Melania went to Palm Beach to pass the hat to billionaires?

Trump bangs the poor-but-proud / victimization message at his rallies but carries a completely different message to his peers. Project 2025 codifies his plans.

I’m sorry for your mom, Eddie.

We gladly took the powered milk and government cheese. Unemployment benefits and food stamps made sure that we didn’t starve when economic downturns happened. Pell grants made sure that I and my brother and sister got an education. (She, now an HR VP, he a CEO of his own company). This sounds like success, but to get there took a lot of stubborn effort to break the poor-but-proud roadblocks.

A hand-up is not a handout. And until America gets that, we will continue our unabated march to third world status.

(And, considering my years in Brasil, I would say that many of today’s US poor-but-proud are already much worse off than the third-world.)