The 1% are Paying Slightly Less Tax Than They Owe!

An interesting but rather misleading report from a Biden Treasury official.

NYT (“The top 1 percent are evading $163 billion a year in taxes, the Treasury finds.“):

The wealthiest 1 percent of Americans are the nation’s most egregious tax evaders, failing to pay as much as $163 billion in owed taxes per year, according to a Treasury Department report released on Wednesday.

The analysis comes as the Biden administration pushes lawmakers to embrace its ambitious proposal to beef up the Internal Revenue Service to narrow the “tax gap,” which it estimates amounts to $7 trillion in unpaid taxes over a decade. The White House has proposed investing $80 billion in the agency over the next 10 years to hire more enforcement staff, overhaul its technology and usher in new information-reporting requirements that would give the government greater insight into tax evasion schemes.

The proposals have been met with deep skepticism from Republicans and business lobbyists who argue that the I.R.S. cannot be trusted with more power and that the proposals are an invasion of privacy.

Democrats are counting on raising money by collecting more unpaid taxes to help pay for the $3.5 trillion spending package they are drafting. On Thursday, the House Ways and Means Committee is set to begin formally drafting its voluminous piece of the 10-year measure to combat climate change and reweave the nation’s social safety net, with paid family and medical leave, expanded public education, new Medicare benefits and more.

The Treasury Department estimates that its tax gap proposals could raise $700 billion over a decade.

This leaves me with two, slightly contradictory, thoughts.

On the one hand, we’re clearly underfunding the IRS’s investigatory capacity. While I have some sympathy for those who fear invasions of privacy and the potential for overreach (see, for example, the infamous BOLO program wherein the Obama IRS targeted Tea Party groups for special scrutiny) it’s been clear for some time now that the ultra-wealthy are able to evade paying what they owe through sheer accountant overmatch. See my 2019 posts “Taxing the Very Rich” and “It’s Hard to Audit the Rich, So We Go After the Poor” for more background.

On the other, if $163 billion is the upper end of the delta between what’s owed and what’s paid—which is what I take from “as much as”—it’s a drop in the proverbial bucket. The Treasury’s annual take from taxes is around $4 trillion. And if “$700 billion over a decade” is the wished-for result, it’s really not going to put much of a dent into a $3.5 trillion package. We’re still left with $2.8 trillion!

Further, the Treasury report was not written by career professionals but by a Biden appointee:

The department’s report, which was written by Natasha Sarin, deputy assistant secretary for microeconomics, makes the case that narrowing the tax gap is part of the Biden administration’s ambition to create a more equitable economy, as audits and enforcement actions will be aimed at the rich.

Sarin is a brilliant scholar of the sort we wish to attract to these political appointments. She’s superbly qualified and, indeed, this analysis is right in her wheelhouse. But she’s pushing an ideological agenda—the one she was hired to push!—here, not simply doing accounting. Indeed, the “report” is titled “The Case for a Robust Attack on the Tax Gap.”

By contrast,

A Congressional Budget Office report last week found that expanding the enforcement capacity of the I.R.S. would not raise as much money as the Treasury Department projects. The analysis, which did not include the information reporting part of the tax gap plan, estimated that the additional enforcement funds would raise $200 billion over a decade, while the Treasury Department projected it would raise about $320 billion over that time.

Because it’s nonpartisan, CBO is likely a more reliable source here. (Although, in fairness, the linked report was authored by CBO Director Phillip Swagel. While his credentials are likewise quite impressive, he’s decidedly conservative.) Even if we split the difference and estimate that we’ll take in an additional $260 billion over the next decade, we’re not doing much toward “closing a revenue gap.”

Beyond that, it’s not clear from the original Treasury report what exactly the gap is. Their claim is straightforward enough:

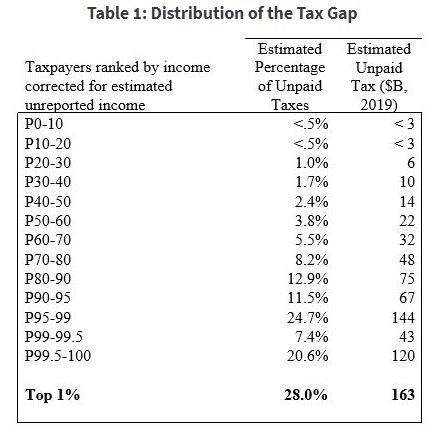

Today’s tax code contains two sets of rules: one for regular wage and salary workers who report virtually all the income they earn; and another for wealthy taxpayers, who are often able to avoid a large share of the taxes they owe. As Table 1 demonstrates, estimates from academic researchers suggest that more than $160 billion lost annually is from taxes that top 1 percent choose not to pay.

And it’s accompanied by this handy-dandy chart:

But “choose not to pay” does a lot of work here. How much of this is simply taking advantage of perfectly legal “loopholes” in the code and how much is hidden or otherwise unreported income? The former, presumably, aren’t recoverable or, indeed, even rightly owed. (To the extent we think the loopholes unjust, we should simplify the code and close them.) The latter, obviously, should be recovered and, indeed, met with stiff penalties up to imprisonment for sufficiently egregious cases.

The bottom line here is that all of this smacks more of going after the rich for political optics than it does tax collection. That’s amplified by the rhetorical heat aimed at “the top 1%” when their own estimates show that the top 5% actually accounts for a higher delta than the top 0.05 percent—and those in the 99-99.5 range are actually more complaint than lower groups.

Certainly, this claim (from Sarin’s report) is absurd:

The tax gap also has meaningful implications for fiscal policy. These unpaid taxes mean policymakers must choose between rising deficits, lower spending on important priorities, or further tax increase to compensate for lost revenue—which will only be borne by compliant taxpayers.

Whether we collect $20, $26, or even $32 billion extra a year from the rich, it’ll have next to zero impact on the deficit or taxing and spending decisions made by Congress. Even pre-COVID, our annual budget deficits were in the $700-$900 billion range; it was over $3 trillion last year and will likely be higher this year. And the total spending outlays were in the $4 trillion range before COVID and new political realities shifted them into the $6 trillion range. The amount of revenue in question here is literally a rounding error.

So, sure, let’s fund the IRS appropriately to go after scofflaws. Let’s enforce the tax code fairly. And let’s punish the most egregious offenders severely. But let’s not pretend this is why we can’t pay our bills.

Just when I think you might have actually woken up a bit…

@rachel: I’m not going to divert this thread with a rehash of an eight-year-old controversy but it’s simply not a matter of debate that the Obama IRS singled out Tea Party groups for special scrutiny. The link is to a post by Matt Bernius, who’s hardly a right-winger.

Let’s start by getting them to pay what they already owe.

Some of us believe that they should be paying far more anyway. Let’s start with the very baseline of honesty: paying what they actually owe.

It wouldn’t be a rehash if you hadn’t used provocative language in your post. “Infamous” my aunt fanny. The IRS was investigating whether Tea Party groups were using tax-deductible donations for political campaigns. Something that is already against the law. It was the Tea Partiers’ expectation that such fine upstanding patriots as themselves should be above question. Got a problem with the IRS enforcing laws relating to donations, James?

@James Joyner:

As IRS Targeted Tea Party Groups, It Went After Progressives Too

Is the IRS singled out groups by going after other groups for the same reasons at the same time? That is not what “singling out” means.

Do better.

@Jen:

Again, I’m in favor of this! My objections are that 1) it’s not clear that all of the amount in question is actually “owed” vice simply exploiting perfectly legal loopholes in the code; 2) there’s a cynical targeting of “the 1%” when their own data actually support either a broader (5%) or narrower (.05%) framing; 3) the amount in question is minuscule compared to their stated objective.

@James Joyner: You may not want to rehash this but your use of “singled out” is doing an awful lot of work here. The IRS singled out organizations that professed to be non-political and therefore exempt but had seemingly political names. That is exactly the type of pre-screening they should have been doing and a perfectly appropriate investigative tactic.

I dont really expect this to make up for all of the new proposed spending, but its a good start. We know form there Panama Papers, the Swiss bank scandals, the Cayman Islands, etc that the wealthy are very good at hiding money. We also know that the GOP has continually cut funding to the IRS so it has been even easier to hide money, or mostly I suspect, just take sketchy deductions knowing they wont get audited or challenged. You can pretty easily find tax lawyers/accountants who will make it clear that there is a lot of gray in tax law. There is also a lot of stuff that is almost certainly illegal but they know you are unlikely to get caught and if you do the only penalty is paying the tax plus a penalty. With high chance of not getting caught the risk of a penalty is a good bet.

Steve

Back in 2016, during the first presidential debate, Hillary Clinton pointed out that Donald Trump had paid no federal taxes for a number of years. His response: “That makes me smart.”

Obviously, taxes are for dummies.

What mindless hackery is this?

Did you even look at the “handy-dandy chart” you included in your post?

It clearly shows that the unreported income of the richest Amsericans is higher – both in relative and absolute sense – than that of those in lower income groups.

So it’s a no-brainer to go after the rich if you want to collect more owed tax revenue. It would be stupid to do so otherwise.

The data in the chart are derived from a study titled “Tax Noncompliance and Measures of Income Inequality.” So that’s your answer right there.

Really, this is some incredible sloppy, reflexive must-defend-the rich nonsense.

And then there is this:

How on earth is it absurd to argue that owed tax that is not being collected necessitates alternative sources of revenue or decreases in spending?

“it’s been clear for some time now that the ultra-wealthy are able to evade paying what they owe through sheer accountant overmatch.” This implies evaders have simply smarter accountants. While that may be so, I believe its more a matter of more accountants and a better toolset. Evaders use techniques like setting up hundreds of interlocking companies, making it extremely difficult for tax agencies to find income. The IRS needs more accountants but it also needs more sophisticated tools to examine returns. And because of these complex techniques evaders use, its very hard to estimate the tax gap for these folks. So I would take any gap estimates as very rough estimates.

Yet, the political optics are really quite good. Non-compliance by the ultra-wealthy to a taxing schema that already favors them is nearly impossible to defend rhetorically. (I say “nearly” because Trump’s “That makes me smart.” wasn’t laughed out of the room.) The everlasting ability to get away with tax cheating is as straightforward an example of unequal justice under the law as you’ll ever see. (“Sheer accountant overmatch” is a nice turn of phrase, BTW.) The rules favor them and they still don’t think the rules apply to them.

Fairness is the appropriate pitch for Democrats when it comes to taxation. The egregious wealth and income inequality we are trending toward in the US are genuine issues when it comes to sustaining our democracy. Making tax compliance about everyone doing their fair share to fund the great nation we want to live in has worked politically in other advanced democracies. It can work here – start with “fair” first because it is the easier argument, then move on to how we define “share” later.

@Jen:

The problem is that “what they owe” is not a fixed value -it’s subjective. The complexity of the tax code means there are often multiple interpretations, especially when it comes to defining income and the adjustments that affect taxable income, like deductions.

I even see this in my own taxes as much of my income is from my independent contract work. I honestly don’t know how much I will owe until I plug everything into Turbotax and there are various legal options I can take that affect the final number. And we aren’t anywhere close to being rich.

So my preference is to make the tax code simpler and more difficult to game. That would provide a lot more value than throwing money at enforcement. And it would help people like me to understand what they will actually owe without needed to buy software or hire an accountant.

OK…this is just flat out false.

But I certainly don’t want to rehash eight year old conspiracy theories you raise, yourself.

Pushing back on nonsense would be impolite.

@Andy:

Absolutely. I’d just note that a simpler tax code can be made to be more difficult to game, but you really have to disincentivize the cheating by making it criminally costly and socially abhorrent for the whole thing to work.

The loophole part of the “non-compliance” is really that the rich can afford talented accountants and attorneys and the sums are enough to make their fees inconsequential. This means the IRS has to put in an honest days work to counter them. Further down the income scale, it is cheaper to pay off the government than to fight it.

On the hidden income side, one wonders if The Big Guy paid taxes on his 10%. But then the same goes for all the long serving career DC politicians and political operatives on both sides. Jeff Bezos has less need to hide income than Joe Biden, Mitch McConnell or Nancy Pelosi, to name a few.

The liberty to keep and use your earnings to generate wealth for yourself by participation in markets and enterprises is the least talked about liberty and the most infringed.

Concerted effort has been made over the American centuries to not let taxation be viewed as an infringement on a personal liberty but rather have continued to be viewed as tribute owed to the king. Long forgotten is that not only should taxation have representation, it should also only be for the common good.

–Civil Government in the United States (1902), John Fiske

On the more factual side of this discussion;

$163B a year would certainly put a dent in the $350B a year cost of the Infrastructure Bill.

And gawd knows there are plenty of shenanigans in the tax returns of gazillionaires who are not paying taxes.

My fear with the IRS is that they will simply go after the low-hanging fruit. Middle and Lower Class Citizens will get scrutinized and punished for innocent mistakes.

Complex tax returns of the wealthy which require more work to analyze, and are fought back against by lawyers, will be avoided. They require, you know, hard work.

Ah yes, the age old “they shouldn’t be allowed to do what the tax code allows them to do”, which makes this performative political optics expressing “grr” over a tax code they evidently don’t have the horsepower to overhaul.

In other words, get back to me if they can demonstrate evasion, and I’ll get on board, but I’m absolutely not interested in another gripefest about avoidance.

@Andy:

What’s wrong with doing both?

Many years ago during the height of the Reagan “Taxes are Pure Evil” era and no politician wanted to be associated with raising them, Congress made a few hundred little tweaks to the laws that resulted in no net change in tax liability. A friend cautioned me about one in particular that would affect me. After looking at it, I went back to him, puzzled. “This change has negligible effect on my taxes and I don’t see how it could have much of an effect on anyone’s. Why did they do it?” His reply: “They want to close revenue gaps on new spending but don’t want to appear to raise taxes. So for each new increase in spending they make a tweak to the tax code that appears to have little effect. It’s an easy thing for individuals to miss so a couple years down the road they get a bill for a few dollars, plus a few hundred in penalties. Tax accountants know about it though, so anyone who makes enough to use one won’t be affected. Bottom line, the rich and powerful aren’t hurt and the average guy gets shafted, just as it was designed.” That’s Reaganism in a nutshell, right there.

@steve:

Yup. I point to a lot of this in the 2019 posts referenced above. We should absolutely go after this stuff–and tighten the laws.

@drj:

My point is that the numbers amount to a rounding error in terms of both the annual budget deficits and annual spending. Raking in an extra few billion—which, again, I support!—would have next to zero impact on policy decisions.

Well, of course. Those in the lower groups (myself included!) derive their income essentially entirely from wages and the Feds take their cut off the top. But, as noted in the post, the progression isn’t linear. Ostensible compliance is actually much higher in the P99-99.05 group than in many of the lower groups.

@Scott F.:

Oh, I get the politics of it. I’m just pointing out that the actual return here is minuscule.

@Daryl and his brother Darryl: It’s not a conspiracy theory. The TIGTA audit referenced in the linked Bernius post makes it clear that Tea Party and other right-leaning groups were on the BOLO list and were subject to special scrutiny. It’s true that some progressive groups were also caught in the operation but that doesn’t change the fact that political adversaries of the President were targeted. (I’m quite sure Trump tried to do the same.)

@James Joyner:

Then why did you bring it up?

Apparently Dr. Joyner’s blogposts are now being delivered ex cathedra.

As I’ve said several times that the big problem is our tax enforcement strategy is entirely backwards: instead of starting with the taxpayers and trying to figure out where they’re hiding their money, we should be starting with the money and figuring out who owns it.

The key to this is a federal escheat law. Any property that doesn’t have an obvious owner is abandoned property and will be held in escrow by the government until the owner comes forward and claims it. Now instead of the IRS having to go through all hoops trying to show person X owns Y through some complex financial scheme and never reported it, X will have to demonstrate their ownership to get their stuff back.

@MarkedMan:

Sure, but the point of simplifying the tax system is that it becomes easier (and cheaper) to enforce. Win-win. And the proposal being discussed here is certainly not doing both.

@James Joyner:

$163bn is 4% of $4 trillion. And that’s only the top 1%!

The P95-99% group is responsible for another $144bn/3.5%!

In other words, if the top 5% would pay their legal share, the Treasury would increase its annual tax haul by 7.5%.

You really think this is a “rounding error?”

This is just unserious nonsense.

FYI: the Treasury report mentions the “1 percent” only twice.

The report usually employs terms like “wealthy taxpayers,” “high earners, “higher earners,” and “higher-income taxpayers,” etc. This, of course, includes a far larger group than merely the 1%.

@Andy: We’re in agreement (and, as a freelance writer I am fully aware of how indeterminate tax estimates can be).

But you can’t look at the way the truly wealthy are able to manipulate these rules and not come to the conclusion that they are not paying what they would if they were truly honest and transparent.

I tend to associate payment of taxes with patriotism–if you’re trying to find loopholes, you aren’t pulling your weight.

@drj:

Please define “their legal share”. As I noted, there is always a presumption that greater scrutiny will discover evasion, and that figure expresses a maximum projection. As long as they are indeed complying with the tax code, however egregiously it may have been stretched, they are paying their legal share. Possibly not their moral share, but that’s an entirely different argument.

What I’m hearing is “they should pay more”, and that’s an argument for changing the tax code, not wasting limited resources picking fights they’re overwhelmingly going to lose.

In other words, this statement is presuming illegality, and they’re maximizing the amount they’d expect to recoup. It’s better expressed as “at most such and such amount”, and even that presumes that the less than stellar examination personnel at the IRS will prevail against firms like mine in going after it (they usually don’t, because – let’s face it – if they were any good at what they do, they mostly wouldn’t be working for the IRS in the first place.)

I have an S-Corp. No idea really what that means. In April I scroll through a billion (approximate) lines of bank statements and Amex bills looking for travel expenses (easy this year) or charity or office expenses. It’s a pain in the ass. It’s a huge time suck, and it makes very little difference in the final hit. I could do my bookkeeping as I go along through the year, but that just makes it worse, because then I’m a year-round bookkeeper, which I resent.

It’s all this boring, baffling, bullshit game I have to go through when the IRS already knows what I earned and knows what I should pay, but no, that’s too easy, much better to build a system by and for tax accountants and tax attorneys that forces their insufferable tedium on all of us.

Here’s my tax reform proposal: pick a reasonable fucking number. 20%? 25%? Don’t make me jump through hoops and justify what percentage of what tank of gas is a business expense, I have a life to lead and if I wanted to be an accountant I’d have paid attention in math classes. I mean, Jesus Christ, just give me the number. Don’t force me to participate in this grubby, un-fun, sado-masochistic ritual, just tell me the number, here’s your check, and don’t bother me for the next 12 months, I’m tryna work here.

@drj:

$163bn is the top end of a range proposed by an advocate for this policy. The chances that this proposal would collect that much are basically nil. When evaluating policy, I think we need to be realistic about the effects. This is particularly true with enforcement since there isn’t a linear relationship.

@Jen:

You are in the minority then – everyone who has access to “loopholes” will take advantage of them. Plus, loopholes aren’t illegal – they are purposely built into the system. The rules that give tax filers so much leeway are, for the most part, intentionally designed to create a gray area in terms of interpretation. And the more rules and complexity, the greater the opportunity for unforeseen synergies that clever accountants can take advantage of. Enforcement doesn’t work well to address that since it can’t make a gray area black-and-white.

As one example, there is that Trump tax return that was leaked last year I think. That tax return has been litigated with the IRS for a decade now. People like Trump get audited every year. The fact that his final tax return hasn’t been adjudicated is not a problem with enforcement – it’s a problem with differing interpretations of the tax code.

@Andy:

Yes, I know.

I find it appalling. I also find the fact that I’m in the minority about this appalling. I very much prefer the systems in the UK/Europe where it’s not left up to individuals to report their income, because people can be gross, greedy liars.

I once had an accountant tell me I was “too honest.” That kind of makes my blood boil.

@James Joyner & @rachel:

I’m weighing in as I wrote the analysis that James linked too (I really should start contributing articles again to OTB at some point). I do recommend giving it a scan as my goal in it was to preverve as much nuance I could at the time:

https://www.outsidethebeltway.com/the-bolo-list-and-the-question-of-optics-vs-effectiveness/

The real issue with the BOLO list was how it was tuned–what terms were automatic flags on the 501c3 evaluation. While there were terms that caught both conservative and progressive groups, the official list (which was, last I checked, not released) seemed to be over-tuned towards the conservative side (flags like “patriot,” “9/12,” abnd “tea party”).

That, plus the increase in volume at the time of conservative-leaning groups applying, let to the disparities in outcome.

In that way, this was no different than other forms of profiling.

Which get’s to James’ original statement:

Honestly, I have problems with this phrasing too. Part of the issue (as with the notion of profiling) is the degree to which we are concerned about intent versus impact.

The degree to which this was intentional (i.e. we are out to specifically get conservative groups) or more of a systemic issue (i.e. these are the terms that seem to be popping up the most) is up for debate. So if you feel that targeting requires specific intention, then I can see the problems with James’ statement. However, if we look at outcomes, all research does indicate that Conservative groups were impacted at a disproportionate rate (see my article above). So as with other disparities (like those in the criminal legal system) there does seem to be something that had a real impact on those groups.

(Aside: given my work in criminal legal system reform since writing that article, I have to confess that I have become less and less concerned with intent and more concerned with impact the more I learn and the older I get.)

And as I note at the time, that caused people on both sides of profiling arguments to switch their usual positions (progressives being against profiling in other cases defending the use of profiling here and conservatives who reject the idea of intentional and systemic bias in profiling suddenly focusing on it).

@James Joyner:

Wait-wut? Both sides of the political spectrum were caught up in an operation? And it had a higher than average success rate? Holy targeted scrutiny, Batman!!!

I would also like a simplified tax code. I expect we will get one and one that wont favor the wealthy sometime in the next 25 years. Should be a just a bit easier than passing a constitutional amendment. Meanwhile I will settle for enforcement of what we have.

Steve

OK, let’s stipulate that tax evasion is the liberal counterpart to conservatives’ waste, fraud, and abuse, which also exists, is also too small to pay for what they claim it will, and is also sometimes in the eye of the beholder. We go after waste, fraud, and abuse anyway.

Kennedy reduced the marginal rate to roughly the revenue maximizing rate. Since then we’ve cut and cut again. And the wealthy still bitch about their taxes. Read Piketty on wealth concentration and the ability of the wealthy to manipulate the system in their favor. And I see no reason Democrats shouldn’t play it for whatever political gain they can get. And I wish they’d run on real tax reform.

@James Joyner:

Wow. That is some f*cked up special pleading. The criterion for getting the tax break was that the groups not be political in nature. OF COURSE a group with “Tea Party” or “Republican” in the title got special scrutiny. They should get special scrutiny. Just as ones with “Democratic” or “Elect X” in their name should get special scrutiny. That fact that so many Republican leaning groups were caught out as lying tax cheats should be a source of shame, not a chip on the Republican’s collective shoulder.

But, you know, “Sure I got caught stealing money and dealing drugs, but why are they always coming after people like me!” actually does work. We have a couple of corrupt city officials here in Baltimore that are fairly successfully riding the, “They are only investigating us because we are black!” train.

IMO it’s incorrect to think of the top 1% as rich. I believe that is more properly reserved for the top .1%. That’s where most of the abuses being pointed to are anyway. Disclosure: I am not in the top 1% of income earner.

or, alternatively, we could do what every other developed country does and rely on a VAT at the national level, possibly with prebating to make it more progressive.

@Andy: Simplifying the tax system is a worthy goal but it is incredibly difficult to do because there are so, so, so many interest groups and wealthy individuals heavily invested in having a complicated system. Most of the previous “attempts” have been nothing more than lies and scams. Republicans, especially during the Reagan years, ran on “simplifying” the tax code by making a flat tax. That was their mantra, their talisman, their ne plus ultra. As if, after filing out dozens of pages of complex forms, determining whether a couple of hundred exemptions or schedules applied to you, and decoding the sometimes byzantine language necessary because of all the exemptions created for special interests, the most difficult thing of all was to take the resultant number, go to the back page of the instructions and look that up in a small table see what bracket your income fell in.

But there is a sucker born every minute, and suckers love them some meaningless slogan, and “Flat Tax at 18%” had such a beautiful sound to it! Of course, 95% of those suckers thought the 18% applied to all the deductions from their pay packet. Heck, a good portion of them didn’t pay anywhere near 18% in income taxes and so what they were cheering was going to end up as a significant tax hike for them.

@HarvardLaw92:

I added the qualifier “legal” for a reason.

As I noted before, the cited figures are derived from a study titled “Tax Noncompliance and Measures of Income Inequality.”

It would be a stretch to assume that, in this context, “noncompliance” refers to a lefty bro code.

@Andy:

Do you like just making stuff up?

Rather than being at the “top end of a range,” these figures may actually be an understatement, the Treasury Department paper notes:

@mattbernius:

Crap, I have not had enough coffee and I need to correct a glaring error in that summary sentence.

In statistical analysis, disparities are a comparison in outcome between two different groups that controls for disproportionalities in volume.

In other words, theoretically, if the system is tuned correctly, there should be little difference between the outcome percentages of group A and B regardless of whether group B is 100x the size of group A.

So yes, there was a significant increase in volume for conservative groups applying for 501C3 status in the aftermath of 2008. However, that should not (theoretically) have any impact on disparate outcomes for those groups in a balanced system. The success/rejection percentages should have been roughly the same.

This is why attention was paid to how the BOLO list was constructed and the role it had in creating a disparity in outcomes.

Nov 20, 2017, Bloomberg

GOP Surrenders Cherished IRS Scandal at Last

The fiction served the GOP for years, yet died quietly this month, forsaken and alone.

The whole article is worth reading.

It’s remarkable anybody continues to believe this f–g farce.

Then again, we are a nation facing a shortage of horse dewormer paste.

@mattbernius:

By this logic, the 1/6 investigation is biased because they’ve subpoenaed a much higher percentage of Republican legislators than they have Democratic legislators.

@drj:

Out of the gate, I’m going to discount anything harping on income inequality as lefty bro code.

That said, from your cite:

There is a reason for that – they can afford to have firms like mine ensure that, at the end of the day, they’re found to be in compliance – because we make sure it turns out that way.

Again – to preva and collect this phantom cash, you’re going to have to create a scenario where those folks at the IRS win. They invariably don’t. They win against some middle income business owner trying to hide personal expenses in his LLC – the guy they can scare into admitting everything. They don’t win against us.

@Stormy Dragon:

You beat me to it…

@mattbernius:

Yes, you should, ya lazy prick.

@Andy: Alas, we’re not going to fix the tax system. It has been designed (I think specifically with the goal in mind) to provide benefits to people who can afford to have staffs of accountants working for them that those lower in the pecking order cannot access–and probably wouldn’t benefit from on an ROI basis anyway. Still, one can dream, eh?

‘

@Andy:

I don’t. I’m a very lucky American citizen, it’s my duty to help pay for the needs of my country. I’ve never sought out any kind of tax dodge. Thought about it, sure, but didn’t. Doesn’t mean I love paying taxes – bear in mind, mine don’t magically disappear from my paycheck, I have to write big scary checks – but you don’t have to enjoy a duty in order to perform it.

My bigger complaint is that so much of it is pissed away to no useful effect.

@MarkedMan:

That is definitely true! But that also makes enforcement difficult because the complexity makes the tax code more shades of gray than black and white. How do you increase enforcement for shades of gray?

And just full disclosure here – I’m not really opposed to more spending on enforcement as long as it doesn’t lead to abuses. I’m merely extremely skeptical that it will do much, much less meet the goals that promoters claim.

@drj:

Oh, I forgot, you are one of the people here who can’t seem to respond without behaving like an asshole. So, never mind, I don’t really have anything to say or discuss with you until your behavior here improves.

@Michael Reynolds:

Couldn’t agree with you more on that. One of my longstanding complaints is the relatively low value we get for dollars spent. It’s another one of those subjects that our political class ignores.

@steve: “I expect we will get one and one that wont favor the wealthy sometime in the next 25 years.”

Sure, wait til I’m dead! 😉 But seriously, on the idea that we will get a simplified tax code that won’t favor the wealthy, “sometime in the next 25 years” is in the same interdimensional void that “fusion power is just a decade away” lives in.

@Stormy Dragon:

This is exactly the same logical argument that racists deployed to argue that because blacks are disproportionately convicted of crimes they are inherently more criminal and the outcomes of out criminal legal system are not systemically racist.

Or most forms of racial profiling…

There were increases in the volume of 501c3 submissions of all types during that period. The BOLO system was designed to help mitigate that. Controlling for volume, in a balanced system applications should have been flagged as similar rates. They were not.

Again, I’m talking here about impact. I’m steering clear of intent.

@Andy:

It’s the age old problem that specific benefits will always win out over generalized losses because the parities receiving the benefits will be willing to put much more effort into keeping them than everyone else will be willing to put into stopping the loss.

Suppose you corruptly get $1 billion in tax payer dollars from the National Science Foundation budget, that’s $3 per person for the rest of the US population. How much are they going to put into getting that $3 back vs how much you’re going to put into keeping that billion?

That’s assuming they’re even aware of the $3, since the nature of opportunity costs is that people can’t miss things they never had. If you ask someone how their life we be different today if we’d spent an extra $1 billion of research last year, they’ll have no clue.

@Matthew Bernius:

So you think the 1/6 committee is the equivalent of racism? That’s a pretty extreme statement.

@gVOR08: I’m not a sure that “we go after waste, fraud, and abuse anyway” as much as we (or at least some of us) whine about needing to. Then again, I’ve become convinced that both “waste, fraud, and abuse” and “tax evasion” are both parts of the slight of hand tricks that constitute some portion of what passes for “Congressional action” these days.

“Pay no attention to what’s behind the curtain and note that I have nothing up my sleeve.”

@Matthew Bernius:

Sigh, so neither the coffee or the edit button is working for me. 2 connections to that statement… first the argument isn’t logical. Second, that should have read “convicted of crimes at disparate rates” — again disproportionality has to do with volume, disparities have to do with rates. While disproportionality is still a huge issue within criminal legal systems, the disparities in outcome between white and BIPoC individuals is the far bigger problem (though to be fair the two–disproportionality and disparities are tied together).

@HarvardLaw92:

Simple rule:

Tax avoidance = legal

Tax evasion = illegal

@Stormy Dragon:

Honestly, because Matt’s old post came up when I was searching for my two posts from 2019 and it provided an example illustrating a broader point I’d made. It’s really tangential to the post.

@mattbernius:

That’s fair enough. Again, though, I was just adding a parenthetical amplification of a generic point I’d already written.

@CSK:

Mmhmm. I said as much further up the page. This stuff inevitably boils down to “it’s unfair!” more than “it’s illegal”.

@mattbernius:

The problem with the “minorities commit more crimes” isn’t the argument per se, it’s that one of the priors is wrong. It’s quite easy to show that “minorities commit more crimes” is factually wrong.

For example, studies have shown that while minorities are far more likely too be searched, they’re far less likely to have contraband on them:

A large-scale analysis of racial disparities in police stops across the United States

In other words, if someone makes the syllogism “If A then B. A. Therefore B” when A isn’t actually true, that doesn’t make the syllogism an invalid argument and doesn’t mean it will be wrong in other contexts where A is true.

@Stormy Dragon:

I accidentally deleted my response… Here is try 2.

This isn’t a fair summary of my point.

The issue I was taking was the flaw in your initial comparison:

What I originally wrote was:

I should have clarified that I’m talking about a neutral system. The 501c4 is intended to be neutral (i.e. no political biases or baises against specific organizational missions). It’s about whether or not the application is correct and fits within the (somewhat nebulous) ruleset. The BOLO review process. as I understand, was likewise intended to be neutral.

Under those rules, there shouldn’t be any significant disparities. But there were. And if the intent is to explain them away by saying “of course the Conservatives were doing something wrong and therefore deserved to be profiled” then you are deploying the same sort of argument as a race-based outcome defense of profiling.

The 1/6 investigation isn’t an appropriate comparison because it’s an investigation. I should have connected those dots more.

@Stormy Dragon:

You are again proving my point about disparities with the Nature link (a paper I’m deeply familiar with).

The point I am making is that BOLO was essentially a profiling tool for what was supposed to be a *neutral system.* And that’s what the disparities prove out–intentionally or not–it returned disparate results of more Conservative applications being flagged than other applications (again regardless of volume).

Again, this is an acknowledged flaw in that “algorithm”–see the congressional report.

@Stormy Dragon:

I agree that dynamic is in play. I just don’t think that can last forever, at least not to the extent indicated by current trendlines. But that seems to be what the American people want in aggregate – lots of government benefits, but low taxes (on themselves).

As I have to do with every time @Keef posts a link to a John Solomon article as “fact” I must point out that your link is from Bloomberg Opinion, not the news branch. And so this is an opinion piece blurring the lines with reportage (and doesn’t go through the same level of fact-checking).

As with Solomon (or anything we write here at OTB), these are not the best articles to cite as evidence.

@HarvardLaw92:

Yes. I was just reiterating your point.

I understand that Rush Limbaugh, whom I despised, used to inform his audience regularly that “only the rich pay taxes.”

@mattbernius: I don’t understand what you’ve been saying. If the system flagged more of group A’s applications than group B’s, then there’s no way to say that that’s good or bad without knowing whether the applications were actually judged to be legitimately flagged. Were more of group A’s legitimately flagged?

Ideally, they would take a random subset of the applications, apply the algorithm, and see how well it did in both the false positive/negative senses, tweaking as necessary. If 2020 started seeing an uptick in group B’s use of “antifa party” in their names (which I’m assuming should legitimately be flagged), then the system should be updated to reflect that. You want an effective system (i.e. flags all cases that should be flagged and no others), not one that’s “fair” to all groups. In my limited understanding, flagging “patriot” or “tea party” seems perfectly sensible, especially at that time.

Having said that, James’s wording was indeed poor, reinforcing the “outrage” of the day that Obama himself was targeting his enemies.

@mattbernius: I don’t see how you can conflate a neutral system with neutral participants. Right now we have one political persuasion more likely than another to use horse dewormer in an off-label manner, but that doesn’t mean the veterinary dispensary system is non-neutral. This is not the same as racial profiling. Skin color is an immutable characteristic.

@Daryl and his brother Darryl: “My fear with the IRS is that they will simply go after the low-hanging fruit. Middle and Lower Class Citizens will get scrutinized and punished for innocent mistakes.”

This is actually what happens now. The IRS doesn’t have the resources to go after rich people, who fight back, so they target the poor and weak.

@HarvardLaw92: “They don’t win against us.”

Nice. You sound just like the Gotti family’s lawyer.

@Han & @reid, et. al.:

I appreciate the points you are making. I am clearly not doing a good job of communicating my point. I acknowledge that I am taking the argument to an extreme for the sake of simplicity. I agree race is immutable and therefore a different category.

At that historical moment, there was a significant increase of organizations of all stripes applying for (the somewhat confusing) 501(c)4 status. So there is an assumption in my argument that rejection rates should have been pretty similar regardless of the political party. I’m basing that assumption of what I know from government forms and application processes.

Honestly, this is also something I wrote about a decade ago, so I probably need to step away at this point because I’m not able to do the requisite research necessary to refamiliarize myself with the topic.

So I’m going to step away from this debate for the rest of the day.

@wr: Hit post too soon — didn’t mean to accuse you of being a Mafioso.

But there’s a big difference between “we are so scrupulous we make sure our clients are following the law in every way” and “we are so tough we take our clients’ criminal behavior and find legal justifications for it.”

No disrespect, but your comment came across — to me, anyway — as the latter.

@wr:

Not really. They’re just that inept, outmatched, and under-resourced. No specifics, obviously, but a client of ours, who tmk we’ve saved better than $30m in taxes, got called in for review. I wasn’t there, obviously, but I got the story afterward from someone who was. There were two IRS personnel in the room, against five or so on our side, one of whom is one of the top three tax attorneys in the country. By the time it ended, our client’s tax burden had actually decreased further. They lost money on the engagement. Tbh I’ll never apologize for looking out for a client’s best interest, and Treasury isn’t our client.

I won’t disagree that the tax code is needlessly complex and arcane, but we didn’t write it and our clients are entitled to take advantage of it.

@wr:

Didn’t take it that way. The simple truth is that the tax code is filled with grey, and our job is to stretch that grey as much as possible without breaking it. The interest of the client is all we can be concerned about. We don’t and won’t enable illegality, but there is a lot of flexibility in grey. Blame Congress – they wrote it.

@Matthew Bernius: You are losing me here. You are talking as if there is no difference between rates of Republican leaning groups engaging in tax fraud vs. Democrats. But it has been obvious for years that there is a huge number of Republican fund raisers who are just scammers, raising money to spend on services they supply themselves. It is a reasonable assumption that a bunch of scammers are also a bunch of tax cheats. So I would absolutely expect that any investigation looking for tax cheats would uncover more Republicans than Democrats.

@HarvardLaw92:

And they wrote it just the way they were paid (off) to do.

@Mikey:

I think there’s a lot of popular support for tax loopholes, or at the least idea that taxes are to be avoided. Why sell and pay capital gains on X when you can avoid the gains by doing the following? But instead of HarvardLaw92 giving you advice it’s your twice-bankrupt brother-in-law or a guy like Michael Cohen. It’s not just the super-rich.

@mattbernius:

Except the lefty groups are less obviously named.

The Tea Party non-profits were part of the right wing grifting campaign that existed to scare people about the frightening black man so they would donate money, and then shuffle that money to contractors in self-dealing schemes. The politics is on the surface (and not really the point… the point is the grift)

Lefty groups the skirt the edges or just cross the line are doing less grift and think they are non-partisan… so they will be ineffectively lobbying against childhood poverty or something and have a staff of underpaid social workers.

Where are the underpaid social workers in Tea Party Patriots For Freedom Stopping The Democrats Socialist Agenda? Or little old ladies with tea carts? They just aren’t there.

Also, if I changed my name to Osama bin Laden or Islamic Jihad Against Delta Airlines, I would expect to get extra scrutiny at the airport.

@steve:

Uh, it’s a lovely thought, Steve. Surly luddite that I am, though, all I can hear is the plaintive strains of “Imagine” while I’m shoveling unicorn s*** in the stable. My mind keeps coming back to the real reason for paying taxes, especially if you’re wealthy. “We’re gonna have to use entrails, Cletus, we’re fresh outa rope!”

@mattbernius:

And, FWIW, I think that a priori assumption is incorrect. The question raised above is the crucial one: once the flag was raised, did a higher or lower percentage of right wing organizations turn out to be fraudulent, which would indicate bias one way or another, or was the rate of frauds the same percentage-wise, which would indicate no bias. A half dozen congressional investigations concluded there wasn’t a significant disparity, hence no bias.

@HarvardLaw92:

Yep. And what I think a lot of people don’t realize is that complexity benefits the big and the rich who can afford the experts game the complexity. The complexity of our tax system hurts the poor and middle class who have to get by with the predatory practices of Turbotax or HR Block, and can’t defend themselves if the IRS chooses to pick on them.

@mattbernius:

I think you’ve been clear here and I get what you’re saying and agree to a certain extent about neutrality. I went back and read the few posts you wrote and realized I’ve forgotten most of the details.

For me the bigger – and primary – issue is the entire tax status apparatus from the various laws that try to draw a fine line between the various categories. My view is that the IRS simply should not be put in a position of making such subjective determinations, nor should they unilaterally choose to apply additional scrutiny based solely on names or political-sounding themes, which is what they did. The BOLO should never have happened in the first place, regardless of which side was on the short-end of the stick.

I do think you are completely right about this:

That happens all the freaking time in this and many other contexts.

@CSK: Rush hadn’t become forceful on that statement before I stopped listening to him, but it also wouldn’t be the only time that he’d said something outrageously stupid either. My favorite was “America has more forest now than it did in 1776.” (I don’t remember anymore whether that one was just a lie or whether he was playing at being ignorant about the fact that the United States covers 15 or 20 times the land mass that it controlled in 1776 and just pretending to be innumerate.)

@HarvardLaw92:

This is my main beef with it. “The guy they can scare into admitting everything” admission of what? Fraud. Likely. But you are correct large firms take the spaghetti of transactions the S corps and their subs create, ask the questions, is this legit following this and that, owners say of course, even though tax firm and owner know this spaghetti is sometimes impossible to legitimize, and may not even fully understand it themselves but they know IRS are inept to catch on really understand and uncover it. Thing that irks me is the ethics of it. You know it’s wrong but can make it look right, does not make it right. Happens all the time for sure. Firms can only attest to what they have been told even though they know it’s BS. That’s a ethics issue to me and it’s sad.

@Gustopher:

What are the objective criteria as well as the evidence that the Tea Party nonprofits – and not other nonprofits – were part of a grifting campaign? How, exactly, was/is that different from left-wing or other groups?

IMO, your comment kind of encapsulates the general problem of the IRS attempting to make neutral but inherently subjective judgments about “political” groups as well as the particular problem of applying “intensive scrutiny” to some groups and not others based on names or themes that sound political. Eye of the beholder and all that.

@Just nutha ignint cracker:

This is one of those things that is both accurate and intentionally misleading.

America in 1776: Thirteen colonies, and colonists had been living in many of those areas for well over a hundred years. They clear-cut a lot of forest. Here in NH, you can walk through many forested areas and see the stone walls that used to be farm property markers. So yeah, in those areas forests have grown back. New Hampshire is more forested now than it was in 1776.

But it’s a silly metric, because the country is much larger.

@Just nutha ignint cracker:

I sometimes wonder if Limbaugh was trying to assure his listeners that he himself paid HUGE taxes on his $30 million dollar a year paycheck.

@CSK:

And of course, he moved to Florida, which has no personal income tax.

@Jc:

To be fair, the tax code is loaded with esoteric loopholes that just aren’t very applicable to Joe the local plumber. He has some benefits to seek out, sure, but the really big holes – the ones you can drive aircraft carriera through – involve trust structures and selective recognition of income / deferral and things like carried interest and tax treaties. They’re just not that beneficial to Joe. He could try to take advantage of them, but he’d have a difficult time finding an attorney in his town who’s equipped to structure it, and the cost would be prohibitive relative to what he’d save. It’s mostly a question of scale.

Full disclosure: I am not a tax practioner, and don’t want to be one, but what I do (M&A) does invariably involve input from the tax guys. The bulk of what we do is much more planning with regard to how to structure and selectively recognize revenue across multiple tax jurisdictions (timing, etc.) than it is helping folks flat out hide income. Treasury is honestly far too capable when it comes to conceptualizing assets and revenue streams than most would believe, so legit hiding income is a bad idea (and something we won’t touch). It gets you disbarred and prison time. It’s more a case of “how can we best structure this scenario to minimize taxation on the income, all of which we’ll be upfront about”.

@HarvardLaw92: “Blame Congress – they wrote it.”

I do blame Congress — but I also blame the people, some of whom may be your clients, who paid members of Congress to write it that way. Both sides are corrupt here.

@Andy: “And what I think a lot of people don’t realize is that complexity benefits the big and the rich who can afford the experts game the complexity.”

Seriously? I’d love for you to present one person above the age of five, with an IQ greater than 20, who doesn’t realize this.

Even Trumpies know this — but somehow they have turned their hero’s stealing from them into a great victory for their side.

@mattbernius:

“John Solomon??”

You feel it’s appropriate to compare a regurgitation from the fetid slab of human debris that is John Solomon, to a piece from the Bloomberg Opinion Editor – a piece chock full of actual, real word facts and in which every word rings not only truthful, but righteous?

Really?

What… a Dinesh D’Souza, Sean Spicer or Sarah ChucklesBee Sanders comparison not readily available? A Lump O’ Shite not handy, so you have to instead pull out John F-g Solomon?

@Andy:

You castigate/inquire of Gustopher:

Dear Jesus.

Really?

How about we turn to Bill Buckley’s National Review for an answer. That good enough for ya?

June 3, 2019 –

The Right’s Grifter Problem

There are about a thousand or so other articles that concur with everything reported in this NR piece. The Modern Right is in fact the party of Grifting Obtuse People.

Historian Rick Perlstein did a masterful expose on this FACT, back in November 2012:

The Long Con

Mail-order conservatism

(sorry, ability to link to these articles is gone)

@Andy:

The fact that a half dozen congressional investigating committees controlled by Republicans spent five years and untold dollars trying to find a disparity and were unable to do so. Which means that the effort turned more right leaning groups because they were more likely to be committing tax fraud and not because they were right wing.

You are trying to make theoretical arguments to sow doubt, but we long ago moved beyond the theoretical in this.

@Fortunato:

Yes, I do. Because the opinion page is still the opinion page and that means a different type of writer and a different level of fact-checking. And the fact that Bloomberg posts “This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.” at the bottom of that and every opinion piece means something.

To that point, check Francis Wilkinson’s bio and the final sentence notes that “he’s been a communications consultant and a political media strategist.” A bit of digging points us to the fact that was a *Democratic* media strategist.

And again, I’m happy to point out lots of articles by folks like Bret Stephens and other conservative commentators on the NYT and WSJ pages that are full of citations too.

But ultimately, I think most people’s milage (and habits of citing opinion essays as facts) tends to tie to end of your post: “in which every word rings not only truthful, but righteous.”

Everyone loves an opinion piece that they thing “rings ‘truthful’ (to their ear), and ‘righteous’ (to their preexisting positions).” Actual fact-checking by the parent publication or it standing behind that opinion piece (as they must do with their reporting or have to issue corrections) be damned… all I care is that it supports the version of the story that I already believed in!

@mattbernius:

Ok, sorry to pile on, but I’d like to note something about “bUt ItS wElL cItEd!” I just read through the Wilkinson opinion piece and I found 7 actual citations/links to other articles.

Of those 7 links, only 2 have anything to do/contain facts about the BOLO IRS investigation:

– https://thehill.com/homenews/house/349846-gop-lawmakers-furious-after-doj-declines-to-prosecute-lois-lerner

– https://www.washingtonpost.com/news/post-politics/wp/2013/05/15/boehner-on-irs-scandal-whos-going-to-jail-over-this-scandal/

The rest are essentially using a post speakership interview with Boehner to attack a number of members of his caucus. None of those touch on the IRS issue at all. They just remind us of how big a jerk Daryl Issa is. So I’m coming up a little short on those “real word facts” pertaining to the IRS case you were telling me about.

@mattbernius: I got busy and inadvertently stepped away for the day, too.

I think the root of my issue with what you’re saying is this:

“So there is an assumption in my argument that rejection rates should have been pretty similar regardless of the political party.”

I have no idea why you think that should be true. It likely wasn’t true, don’t you think?

@wr:

Tax simplification has been a hobby-horse of mine for some time. I get a surprising amount of pushback on it which generally comes from people on the left who think I’m secretly advocating tax cuts for the rich. Including here at OTB on occasion.

These are usually the same people that talk about marginal tax rates as if they were effective rates.

@Fortunato:

My first instinct was to respond that I don’t consider an op-ed from a partisan and ideological publication to be “evidence.” And 95% of the time, that is true. But I took the effort to find what you referred to since you were unable to link it (Link here), and it contains actual evidence and links to more.

I haven’t reviewed it all, but consider me sufficiently convinced that many of the Tea Party groups were, in fact, grifters. Thanks for the pointer to the op-ed.

@MarkedMan:

Please don’t presume – in ignorance – that I’m operating in bad faith. It gets extremely tiresome and it’s not nice.

Also, read my response above to Fortunato.

And this will be accomplished by tracking absolutely every non-cash transaction you make.

I remember living with this. In China under the CCP.

@Andy:Whoa, I am most definitely not accusing you of acting in bad faith! My comment was poorly worded. Let me try again. Your arguments seem to me to be, basically, “How can we know? There is no evidence the Right leaning groups were actually committing tax fraud at a higher rate than the Left leaning groups.” I was pointing out that there is actually plenty of evidence. Numerous Republican committees spent years trying to demonstrate the basis of your argument and could not do so. Basically they investigated what you and Bernius are alleging and were unable to prove it despite being highly motivated to do so and having endless resources to investigate. So we are beyond the point where it is still appropriate to use theoretical arguments.

@MarkedMan:

You’ve wrongly assumed the basis of my argument. Here’s what I asked:

Although this was a reply to Gustopher, it was in response to several people making claims about tea party groups. Asking for evidence to back up claims is only that.

I think it is perfectly legitimate to ask for evidence when people make claims, regardless of what the claims are. It is not trying to sow doubt, or suggest there is no evidence, or anything else. My view is that if someone wants to claim that something is true, then they had better be able to pony-up evidence to support their case, and that anyone has every right to ask for that evidence.

Now secondly, that debate is different from what Matt is discussing about how the IRS handled applications for tax-exempt status, all of which occurred before any of these groups collected any money and therefore before there was any factual evidence about whether they were grifting or not. My opinion on that is, as I stated before:

People are free to agree or disagree with that – but it is an opinion that doesn’t rely on whether or not conservative groups were unfairly scrutinized by the IRS. I think the IRS shouldn’t be doing that at all, and I suspect if the IRS did that with, say, BLM groups, then lefties would – quite reasonably – be furious.

@Andy: Sorry, I thought you were arguing the other point.

As to your last comment, this lefty has no problem with the IRS going after any partisan, political group who falsely claim to be apolitical. Although I wouldn’t think that being in favor of justice for blacks means a group is inherently political and partisan, but if they championed BLM but in reality collected money to promote particular candidates then they are committing fraud and I want more such groups to face real penalties, not less.

In an ideal world the solution would be that no one gets a tax break, and then everyone can be as political as they want. But since we as a nation have decided that non-partisan apolitical groups should get such a break we should ensure that only legitimate organizations get it.

@Mu Yixiao:

Is your position that someone making $50,000 per year via PayPal and Ebay should not pay taxes?

How else is the government to get people to pay their fair share if they can’t see half the transactions going on?

I’m all for this.

@MarkedMan: In an ideal world, we’d be taxing the churches, too.

@reid:

I think you are right that is the major point of disagreement here.

I’m basing my arguement on my understanding on (1) the general rejection rates on government applications (which is something I’m diving deep into in my current role), (2) the lack of understanding (within both the general public and IRS review board) of the newly created at the time 501(c)4 criteria (earlier I had mistakenly said this was about 501(c)3 status which was well established by this point), and (3) the fact that there was a spike in applications across all political groups (there were also a lot of Occupy-related groups applying for recognition at the time too).

I know folks have been raising the astro-turfing aspect of this up thread, but the reality is most astro-turf groups had the money to hire experts to get them through the process (which also is true of the broader tax arguement). Going back to what I remember of the report, the folks who were getting caught up in this, on all sides, appeared to be more of the “true believers.”

I admit, those underlying assumptions could be wrong. And if I have time this weekend, I’ll reread the report and all of my articles. So it’s also possible that I’ll be posting a mea-culpa at some point to this thread.

@Andy: “I get a surprising amount of pushback on it which generally comes from people on the left who think I’m secretly advocating tax cuts for the rich. Including here at OTB on occasion.”

I would suspect that the pushback you get has more to do with the solutions you propose than the problems you identify. We can agree, say, that the tax code is complex in ways that exist to benefit the wealthy and powerful without both believing that the answer is, for example, a flat tax. (Not saying you’re pushing the flat tax — can’t remember — just an example…)