The Coming End Of Checks

Once ubiquitous, checks are disappearing as a means of payment.

Matt Phillips at The Atlantic notes that the use of checks has declined precipitously in the last decade or so:

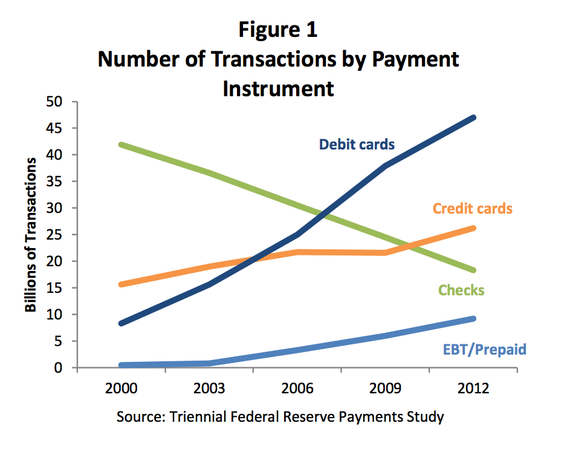

The usage of checks as a payment system has plummeted in the U.S. in recent years. In 2000, checks were used in more than 40 billion transactions, according to a recent report from the Federal Reserve’s Cash Products Office. That number is down to less than 20 billion, according to the Fed’s most recent numbers, which are based on a survey conducted in October 2012.

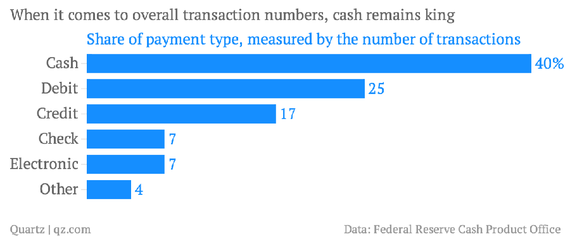

When it comes to American payment preferences, checks run a distant fourth. (At least when you measure the overall number of transactions. Checks are used for about 19 percent of the value of all purchases, slightly higher than debit or credit cards.)

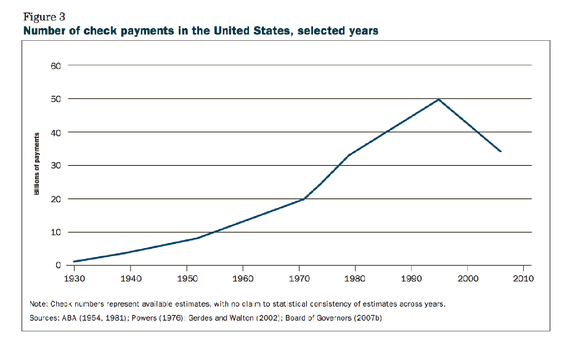

There was a time when checks were the hot new payment technology. In the years after World War II, newly affluent American households adopted check writing like never before. The overall number of checking accounts in the U.S. doubled between 1939 and 1952, rising to 47 million. The number of checks written hit about 8 billion in 1952.

As this chart shows, the use of checks continued to grow until well into the 90s, but has been on a downward slant ever since:

And this chart shows that, since the start of the century, checks have declined to third place on the list of non-cash methods of payment:

Of course, cash is still king, even in an era where electronic forms of payment are so ubiquitous:

There’s been a lot written about the coming of the so-called “cashless” economy, where electronic transactions in one form or another would constitute the majority, if not all of the spending that people do on a daily basis. For many reasons — convenience, the fact that small businesses don’t always invest in the expense of credit card machines, and the lack of any easy way to pay electronically for things like a vending machine Coca-Cola or Girl Scout Cookies — that hasn’t happened nearly as quickly as some people may have anticipated. Moreover, as I noted earlier this year, there are some good privacy reasons for not cheering for an era when every transaction we make can be tracked and traced electronically.

On the other hand, there aren’t many reasons to bemoan the fact that checks are disappearing from the financial world. When they came into large scale use in the 50s, they were a convenient way for people to spend money without having to carry around large amounts of cash and, because charge cards and credit cards were largely unknown at the time, they became quite popular. With the rise of credit cards and, especially ATM Cards that can be used at the point of sale, though, there really isn’t much reason to use them anymore. Speaking for myself, there are at most a handful of transactions for which I would regularly write a check rather than using some other form of payment, and as soon as those move to some form of electronic draft payment, I’d likely move to that immediately. Indeed, while did have to order a new set of checks a few months back the 200 or so that are in that package are probably going to last me for a quite a long time.

This process seems to be further along in other countries. Great Britain announced back in 2009 that it was phasing out the use of checks, with a target date of October 31, 2018 for the end of the system that country uses to clear checks. That process seems to be moving forward. There hasn’t been any discussion of anything similar here in the United States, though, and I would imagine that such a plan would be met with protest here even though check use has declined significantly in recent years. Even if the U.S. check clearing system doesn’t get shut down like the British system apparently is, though, the trend is clear. Check writing will be as foreign a concept to future generations as the concept of making a “long distance” phone call.

I have been on the same box of checks for years.

I almost never write checks. Most of my bills are done online or through schedules payments.

I pay exactly one bill by check and that’s our water hill because our city doesn’t take credit, debit or electronic checks. They also don’t have an online payment system.

The other times I write checks are for school events.

I don’t see cash going out anytime soon but I can see a check less society but then small town across America will have to get on board and support the ability to use something other than checks or cash.

I hate being stuck in supermarket checkout lines behind checkwriters.

@DC Loser: pretty much my first thought when I read the headline!

That happened to me the other week. It was the first time in……years.

It kind of made me think that person was floating the check. That seems to be the only reason to write a check at the grocery store in these days of ubiquitous debit cards.

@DC Loser: @Steven L. Taylor:

Yes, and when that happens, it’s always someone buying four tins of cat food and a bottle of Pellegrino Water.

True enough for the most part. On the other hand, there are some transactions – for small contractors like electricians or plumbers for instance – in which cheques are by far the most convenient method of payment.

Or buying a used car/snowmobile etc.

The only times recently that I’ve used a check was to pay for a heat pump/air conditioning system which was on a payment plan with a local company (no way to pay electronically). Pretty much everything else I do is done with my checking account’s debit/credit card.

Although, right now I have a refund check sitting on my desk from my local community college which took them two weeks to send out after I dropped a class which I had paid for with my debit card.

I am still forced to write one check a month since I sold my house – rent. The landlord of this large project does not have the ability to take electronic payments although I suspect they scan the checks rather than physically taking them to the bank since they usually clear within 24 hours. My other bills are all deducted from my checking account automatically.

I still use the ATM to get cash and use cash for most purchases. For security reasons I use a prepaid American Express card for internet purchases and only load it when I’m going to make a purchase.

One of the major problems I have with writing checks is I haven’t written much of anything for a couple of decades – everything is done from a keyboard.

I would be willing to bet a shiny new dime that checks will still be around in ten years. Some of the reasons have already been mentioned—that businesses that accept debit cards will need to expand tremendously for it to happen, for example.

What hasn’t been mentioned is that for some transactions a bank draft is the only viable form of payment. That’s what checks are—a directive to your bank to pay. As long as banks continue to exist we’ll continue to have checks in one form or another.

The more interesting phenomenon is the large number of people who have no relationship with a bank, the “unbanked”.

@Dave Schuler: Sorry Dave but I’m not really sure that’s true. A debit card payment or automatic withdrawal shows up almost instantly on my account.

As for the “unbanked” , that’s going to become increasingly impossible since the Federal Government no longer offers checks as an option and I’m sure many businesses will follow..

There was a time when I would buy new checks when I moved, but the box of checks I am currently using I bought in 2010. I’ve moved four times since then.

With smartphone banking apps, checks are more convenient now. No need to go to a bank to deposit them, so I am not sure there should be a hurry to phase them out.

@David M: At the same time however, application developers for iPhones and the Android have created programs and peripherals that let you use cell phone as a credit card terminal.

We’ll at most supermarkets around here if you do write a check-you just have to sign it-everything else gets printed. I have only used checks in stores when my debit card wasn’t working or more often than not my daughter used my debit card shopping or something for me and forgot to give it back to me (doesn’t happen much anymore now hat she is away at college).

One other app I really like is the one for our main gas station. If you used the smartphone app you get a 10cent per gallon discount and no debit card required. In some ways I think electronic banking is going to head more into the smartphone app area.

@CSK: Or a prescription and a TV Guide.

Most children today have no idea what a check is.

Going the way of newspapers.

@David M: My problem with the smart phone ap is that my bank requires me to have such a long and complex password it takes so many tries to log on that it’s easier just to go to the bank.

1) USA is woefully behind most of the developed world in finance.

2) in most countries, electronic fund transfers are a breeze between individuals. Here “wire transfers” are close to being some sort of magical mythical religious event. This is just stupid. With a bank routing and account number, I should be able to send money from any bank webpage to any other institution.

3) since this system here is SO f’ed up, companies like paypal make a killing in providing poor service at high cost… which most other countries would just assume would be a free service from your financial institution.

4) if you keep your money in a bank, you are akin to a pig in being readied for slaughter. Except they don’t even bother to fatten you up.

(Disclosure: I hold stock in banks, I keep my money in a credit union. Thank you for continuing to pay high fees. You make my stock continue to rise)

4) recently, I sold a car on a Saturday afternoon, after banking hours. After working with the buyer’s bank call center, we found that raising his ATM limit and buying money orders at the local grocery store was faster and easier than trying to do a transfer between two different banks.

Face it: the free market system sucks when it comes to making life easy for the average American.

Paper checks are cute in a world of 0’s and 1st … like looking at an old icebox or a rug beater

For the “unbanked,” the Social Security Administration now offers a debit card not connected to a bank acc’t.

I have a credit union acc’t., but I haven’t had any checks for six or eight yrs. I had little use for them, & the credit union wanted a ridiculous amount for just a few checks. Possibly I was spoiled, as I used to work for a bank & simple checks were free for employees.

I worked for what was once the fifth-largest bank in Calif. The Southern California division employed as many as 100 people to deal w/ the errors that occurred processing something like six million pieces of paper daily, & close to 20 people to deal w/ returned checks. I’m sure the banking industry is happy to be rid of all the hassles & salaries.

My primary reason for preferring checks used to be that it gave me an independent record of all of my transactions, which I could use to verify (in court if necessary) that I had actually paid. With more and more banks now refusing to provide cancelled checks (or even scans of them) as a free service — and deleting records after some not-very-long period — that motivation has waned.

But I miss it. I’ve found too many errors in my bank statements over the years to want to rely on their version of what happened. The bottom line with electronic transactions is that there’s no (current) way for me to verify my version of what happened.

@DrDaveT: Don’t you do online banking? If I go to the grocery store and use my debit card it’s already posted by the time I get home. I have 24/7 access to my bank records including an image of the one check a month I write. I don’t even keep a check register anymore, all I have to do is log on. I may be 68 but I don’t miss the days before electronic banking

@Ron Beasley:

OK. And if it’s wrong? Wrong amount, not what you were told you were going to be charged, double counted the cash back you asked for — what do you do? You have no independent record of the transaction.

No, you have 24/7 access to their records. Which isn’t always the same thing, in my experience.

You’re a very trusting person. I hope your bank is a lot more honest and competent than mine have been.

(And no, I don’t do online banking or bill-paying, despite being reasonably tech-savvy. The marginal convenience isn’t worth it.)

@DrDaveT: Perhaps you need to find a new bank or take some drugs for your paranoia. I do compare my store receipt with what appears on my online banking and I have not seen a problem for years. I do check my account daily, something I couldn’t have done in the days before electronic banking. In the days before internet banking it would have been days or even weeks before I discovered a problem, now I can do it almost institutionally. . Now I’m not a young person but a 68 year old baby boomer who appreciates electronic banking..

@James Pearce: Remember that as more and more POS skimmers start to show up on in-store card readers. Writing a check is inconvenient, but more secure. Crooks can’t drain my account dry with a check, the bank is liable if they do. If I had to choose between a check and a debit card linked to my bank account, I’d write a check. Luckily I can use a credit card (which also puts the liability on the bank/merchant.)

@Jon Marcus: Ah, but crooks can indeed drain your account with a check – no, they don’t need the physical check; just like a credit or debit card, they need the numbers on it. The “maker identification” (routing number and account number) is all they need, and they use that to ACH pull your cash right to their dummy account, which they then convert to cash at an ATM. This isn’t uncommon, nor is it new.

@Dave Schuler: What kind of transactions require a bank draft and not an ACH push?

Talk about anticompetitive – this makes Uber’s competitors look like kids.

Mandate ACH outbound capabilities for all checking accounts and there goes the wire transfer

profit centerripoff.Tune in for the next episode on using government power to promote free markets.

@Ron Beasley:

You really feel that was called for, in this conversation?

I have used numerous banks in different cities in different regions in my life. All of them have been fallible. Not all of the mistakes they have made would have showed up in a same-day comparison of my receipt and an online transaction record. All of them were easily corrected using the canceled check.

I have actual evidence; you have unexpected vitriol. Hope that works out for you.

In some ways, I’m a curmudegon. I still use checks quite a bit. Some of it is just plain inertia. Some of it is practical.

I think checks will hang on, but for increasingly narrow uses.