The Scariest Economic Chart You’ll See Today

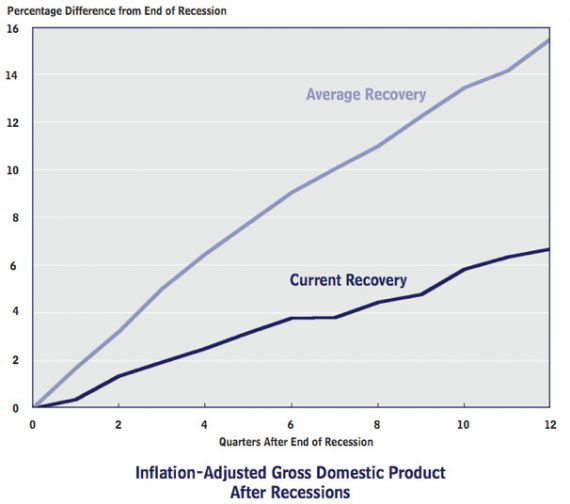

Neil Irwin at The Washington Post shares this chart:

The chart comes from a new study from the Congressional Budget Office, and leads Irwin to comment:

In other words, you’re not imagining it: This economic recovery has been a big disappointment relative to what the United States has usually experienced after a recession. Growth has been 9 percent below what was seen in past recoveries on average in its first three years. The CBO report tries to disentangle where that underperformance is coming from and its answer is deeply unsettling: The U.S. economy just isn’t as good at growing as it used to be.

The new CBO report claims that two-thirds of the underperformance of the economy over the past three years compared to a typical recovery is due to a slower rate of growth in potential GDP. Only one-third, in this analysis, is due to factors related to this recession.

Potential GDP is the measure of what the economy is capable of producing if almost all of the people who want jobs are able to get one and almost all its machines and buildings were humming at their potential. While it has grown consistently through modern U.S. history (we can thank a growing population and steadily improving technology for that), it doesn’t always grow at the same rate. In periods when baby boomers were reaching their working years and women were entering the workforce in large numbers, the rate at which potential GDP rose was very high, over 4 percent at times, by the CBO’s reckoning.

In recent years, though, those trends have reversed. Baby boomers are starting to retire and the proportion of women who work has leveled off. The CBO’s estimate of potential GDP was rising at gradually steady rates for most of the 2000s even before the great recession hit, and has continued that downward trend since then.

So part of what is showing up in the CBO’s analysis of how this recovery has proceeded since 2009 reflects the simple fact that earlier post-war recoveries took place in times when potential GDP was growing faster. “Although some of the sluggishness of potential GDP since the end of the last recession can be traced to unusual factors in the current business cycle, much of it is the result of longterm trends unrelated to the cycle, including the nation’s changing demographics,” the study said.

What this suggests to me is that we’re not likely to see a return to the type of economy we saw before the recession for quite some time. At the very least, we’re unproducing based on Potential GDP by nearly a trillion dollars a year, and until we’re able to overcome that gap, we’re likely to see quarter after quarter where GDP growth stays within a range that goes no higher than somewhere in the neighborhood of 2.0%. Good, better than negative growth, but certainly not the sign of a healthy, recovering, economy.

It never ceases to amaze me that people who are alleged to possess basic competency, or sometimes mastery (this is from the “Wonkblog”!), do not understand basic math concepts.

This author is not aware of the difference between percent and percentage points. The difference is enormous.

I think things like this are every bit as useful as the many “No president has ever won with…” scenarios. The past does not somehow dictate the future. This isn’t the law where precedent holds sway. The sun does not rise because it always has, it rises because of the laws of physics. There is no law of physics to dictate that the line should rise faster, or that it should rise at all.

Um, we’ve been telling you this isn’t an average recovery for 3 years now?

(IOW, if Mr. Rip Van Winkle is in the audience, he is suitably shocked.)

Yeah, yeah, we’ve heard it’s all changed before. Like back in FDR’s depression and until the Reagan boom kicked in. But perhaps there is some relevance to this made up number. Fact is, even if the number of women in the workforce wasn’t leveling off, we’d just have much worse unemployment and GDP. Plus, we need to factor in the dumbing down of the workforce by our fine public indoctrination system which produces few skilled workers.

But nothing is likely to change until January 2017 at the earliest. It is unlikely that Obama and his minions will change their ways. And we have Obamacare to work through the system. Probably take until 2017 for those costs to migrate through to consumer prices making hiring a rational proposition again. Of course, as more and more of a families income goes to feed the Obamacare monster, less and less money will be available to spend on productive aspects of the economy.

In any case, because the voters chose “no change” earlier this month, we’ve got at least 4 more years of sluggish recovery due to the same policies, if not worse. After that, after a change in regulatory and whimsical economic interference, then we’ll be able to tell if it was real or Obama/Progressive policies.

I’ll tell you what’s scarier – despite how slow this recession is, we’re doing better than virtually every other country hit by the financial collapse. The Eurozone has slipped back into recession.

“how slow this recovery is”, I mean.

Well, I would say that the catastrophic 2008 crash of the financial and housing markets was not like most recessions.

Only delusional or pollyanna-ish observers expected the deleterious consequences of that crash – the vaporization of nearly $20 Trillion in wealth and income – to have been put in the rear view mirror by now. The wealth in housing markets that was liquidated in 2008 is not going to be restored anytime soon.

@al-Ameda:

I really think you mean partisan or ideological observers. Anyone data driven has seen the remarkably stable trend, going way back. The difference between the contraction and “typical” was established in 2009. The rate of recovery became consistent in 2011. Nothing in 2012 broke the trend.

In late 2012 the trend is not news nor surprising in the least.

That news from overseas keeps getting worse is another sad and sadly stable trend.

Get some new material Doug. You are like a bad comedian who is not aware enough to realize no one is laughing at his jokes.

I personally find these charts scarier:

Europe in recession

The hardest thing though would be for a government “reductionist” to explain those, and why the US is actually doing better.

Maybe Doug will realize from this that maybe another round of stimulus is needed, because the 2008 crash was more like the Great Depression than like the average postwar recession? NAAAAAAAAAAAW….

First off this was not a typical recession, most recession you could just cut interest rates and get the rebound. This one we cut interest rates pretty much as far as they will go, and even after the recession ended we have kept them very low.

This recession was akin to the Depression than to the 1980’s recession, and will take longer to fully recover from than it did in the 1980’s.

Thankfully unlike other nations that have pursued an austerity program, we are actually not slipping back into a recession

@Alex Knapp:

Even scarier: Europe chose to fall into recession, and we’re talking about walking the same path via Grand Bargain.

There’s another factor: During these periods it was policy for government to pursue full employment.

If only we weren’t raising taxes on rich people next year this last four years would have gone much better.

@michael reynolds: A quantum physicist might just disagree with you about the sun rising.

The difference was that in the past we did not give the Treasury keys to China. Watch a video about this at:

defeatthedebt.com

@Whitfield:

Hey, those people can’t tell a live cat from a dead cat.

@Whitfield: The Chinese have savings accounts at Treasury. Not a critical issue.