April Jobs Report: Good, But Not Good Enough

The April Jobs Report was good, but not exactly anything to write home about.

The April Jobs Report ended up being better than anticipated, but we’re still at a level of jobs growth that is less than ideal for getting out of the jobs recession that started ended back in 2009 any time soon. Going into this morning, expectations were that we’d see about 150,000 jobs added, but as it turned out we did slightly better than that:

Total nonfarm payroll employment rose by 165,000 in April, and the unemployment rate was little changed at 7.5 percent, the U.S. Bureau of Labor Statistics reported today. Employment increased in professional and business services, food services and drinking places, retail trade, and health care.

The unemployment rate, at 7.5 percent, changed little in April but has declined by 0.4 percentage point since January. The number of unemployed persons, at 11.7 million, was also little changed over the month; however, unemployment has decreased by 673,000 since January. (See table A-1.)

Among the major worker groups, the unemployment rate for adult women (6.7 percent) declined in April, while the rates for adult men (7.1 percent), teenagers (24.1 percent), whites (6.7 percent), blacks (13.2 percent), and Hispanics (9.0 percent) showed little or no change. The jobless rate for Asians was 5.1 percent (not seasonally adjusted),

little changed from a year earlier. (See tables A-1, A-2, and A-3.)In April, the number of long-term unemployed (those jobless for 27 weeks or more) declined by 258,000 to 4.4 million; their share of the unemployed declined by 2.2 percentage points to 37.4 percent. Over the past 12 months, the number of long-term unemployed has decreased by 687,000, and their share has declined by 3.1 percentage points. (See table A-12.)

The civilian labor force participation rate was 63.3 percent in April, unchanged over the month but down from 63.6 percent in January. The employment-population ratio, 58.6 percent, was about unchanged over the month and has shown little movement, on net, over the past year. (See table A-1.)

Bigger than the news that April’s numbers beat expectations are the revisions that were made to previous month’s reports. February’s job creation numbers were revised upward from 268,000 to 332,000 and March’s were revised upward from 88,000 to 138,000. At the very least, these numbers are better than what they were initially reported to be, and the February numbers are the best we’ve seen in 2010 when one month’s report was boosted by temporary Census hiring, taking that month out of the equation and February is the best month we’ve seen in jobs growth since some time in 2005. If we were to have more months like this, then we could legitimately say that the economy, and the jobs market, is finally turning around. Unfortunately, it looks like February was something of an outlier. So far this year, we’ve added 148,000 jobs in January, 332,000 in February, 138,000 in March, and 165,000 in April. That’s an average of just about 195,000 jobs created per month, but if you take the February numbers out of the mix, and the average drops down to roughly 150,000 new jobs per month, which is barely above the level needed to match population growth.

CNBC sees good news in the report:

Job creation accelerated in April, with the U.S. economy adding 165,000 new positions and the unemployment rate edging lower, quelling worries of a spring slowdown.

New figures from the Bureau of Labor Statistics indicated that a light March payrolls report may have been an aberration, as higher taxes and reduced spending due to the fiscal stalemate in Washington failed to deter growth.

The unemployment rate edged lower to 7.5 percent, due partly to the jobs gains and to a labor-force participation rate that remains at a 35-year low.

Reuters, however, is more sanguine:

[S]ome details of the report remained consistent with a slowdown in economic activity. Construction employment fell for the first time since May, while manufacturing payrolls were flat.

The average workweek pulled off a nine-month high, with a gauge of the overall work effort falling, but average hourly earnings rose four cents.

The relative strength of the data was particularly surprising given other recent signs that suggested the economy had slowed sharply in recent weeks. Although the economy expanded at a 2.5 percent annual pace in the first quarter, a wide range of data suggested it ended the period with less speed. Further, factory activity barely grew in April.

Economists feared uncertainty over the full impact of higher taxes and deep government spending cuts on already sluggish demand was making businesses reluctant to hire. A 2 percent payroll tax cut ended at the start of the year, and $85 billion in federal budget cuts went into effect on March 1.

“The idea that the employment is holding as well as it is in the face of the fiscal headwinds the economy is currently enduring is a very positive sign of the economy’s underlying fundamental improvements,” said Russell Price, senior economist at Ameriprise Financial Services in Troy, Michigan.

While the pace of hiring was stronger than expected in April, it remained below the pace needed to put a significant dent in the jobless rate.

And The New York Times write-up is best described as cautious:

With the unemployment rate well above 6.5 percent, the Federal Reserve has promised to keep buying billions of dollars of bonds, in an effort to help bolster growth. The Fed’s stimulus efforts have helped buoy the markets, but the job picture has remained weak.

Economists also noted that the number of hours worked fell in April, another sign that the economy is having trouble generating enough additional income and jobs to help lift spending.

The government could be the wild card in the coming months. Automatic, across-the-board spending cuts officially went into effect in March, and if the mandated spending cuts continue, layoffs could increase. Apart from the job figures, the economy has been showing signs of weakness of late. Several indicators beginning in March have pointed to much slower growth, with everything from retail sales to manufacturing looking soft recently.

“What’s the biggest drag on the economy? The government,” said Diane Swonk, chief economist for Mesirow Financial in Chicago. “If the government simply did no harm, we could be at escape velocity.”

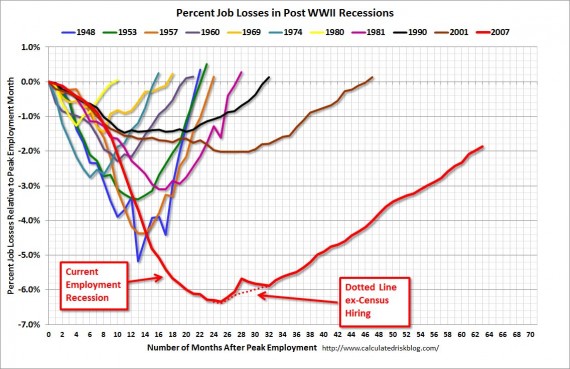

The question as we get further into the year will be whether we’ll continue to follow the pattern of the past several years in which job growth seemed to tick up early in the year only to slag off in intervening months. The data so far suggests that this is exactly what’s happening, and that means that the jobs market will continue to grow, weakly, for the foreseeable future. What we really need is growth on the level we saw in February, but we only seem to get anomalous months like that on an occasional basis anymore. As it is, it’s going to take a long time before this chart stops looking scary:

At our current rate, we won’t be back to where the job market was when the recession started until well after Barack Obama has left office.

Update: Binyamin Applebaum diagnoses the problem:

The American economy continues to add jobs in proportion to population growth. Nothing less, nothing more.

The share of American adults with jobs has barely changed since 2010, hovering between 58.2 percent and 58.7 percent. This employment-to-population ratio stood at 58.6 percent in April. That is about four percentage points lower than the employment rate before the recession, a difference of roughly 10 million jobs. In other words, the United States economy is not getting any closer to recreating the jobs lost during the recession.

This lack of progress has been obscured by the steady decline of the high-profile unemployment rate, which continued in April. But the unemployment rate is easily misunderstood. The government counts as unemployed only those who are actively looking for new jobs. As people have given up, the unemployment rate has declined – not because more people are working, but because more people have stopped looking for work.

The share of adults looking for work peaked at 6.4 percent of the population in 2010. It fell to 4.7 percent in April. But recall that over the same period, the share of adults with jobs did not change. What grew instead is the share of adults no longer counted as part of the labor force.

Regarding the Labor Force Participation rate, Applebaum makes this crucial point:

[T]he decline of labor force participation – the technical term for the share of adults working or searching – is primarily the result of a bad economy.

Baby boomers are aging into retirement. Even before the recession, the government projected in 2007 that participation would decline to 65.5 percent by 2016, from 66 percent. But the April rate of 63.3 percent means the labor force has lost roughly five million additional workers.

Furthermore, the projections were wrong. Participation has actually risen among people older than 55. The decline is entirely driven by younger dropouts.

The federal government counts 11.7 million Americans as unemployed. The real number, it follows, is more like 17 million.

In other words, there are millions of people who are basically sitting on the sidelines, not working and not looking for work. Until the jobs market picks up, they’re likely to stay there.

And we’re still losing government jobs. This is the type of recovery that Republicans should love, right? Tons of private jobs, and continuing eroding of public jobs.

I can only hope that by some miracle the Dems take back the House in 2014 so that we can actually pass some job creating bills.

ROMNEY RECOVERY!!!!

/OTB post from an alternate universe.

Maybe we’re looking at different charts, Doug, but according to the chart you inserted in your column, that line has been consistently ticking up 1% every 8 or 9 months for a few years now. Assuming that rate stays steady, we’ll be back to zero in 16 or 18 months (right around election day 2014). Obama will still have a couple more years in office at that point. So I don’t know what in the world you are talking about.

I’m curious, Doug. How in the world can you keep posting these doom-and-gloom prounouncements about the economy, month after month, without also noting that your political team-Republicans, conservatives, whatever- have been dead wrong about what’s needed for economic recovery and indeed have been doing everything they can to sabotage efforts to grow the economy since Day One of the Obama Presidency? Sure the economy isn’t doing all that well, but its because the Republicans have been busy stabbing it in the back. When will you acknowledge this?

(Guess that’s a rhetorical question, but it needed to be asked.)

I am really enjoying @danariely’s course on Irrational Behavior at @coursera.

How this might relate to Doug’s jobs and economic coverage is left to the reader.

@Ben:

Well, Doug is looking at the charts through his “Obama-can-do-no good” googles, so that explains it.

Or maybe he using fellow libertarian Megan McArdle mathematics.

Or maybe he is he is calculating things a la Reinhart-Rogonoff style.

Let’s face it, data analysis and math aren’t strong points of the conservative/libertarian set.

@Ben: We won’t be back to zero; we will be back to the number of jobs we had five years ago, with a larger population that has grown in the interim. See, e.g., NPR on this chart.

So. Doug. There really is no mystery about to how to improve the situation. Obama wants stimulus. Bernanke goes in front of congress every now and then and gets as close as a Fed Chair can to begging for fiscal stimulus. Whatever argument there was in academic economics for austerity has has pretty much collapsed under the weight of reality. We could turn employment around in months with federal support to the states for hiring, or at least retaining state and local employees.

The only obstacle is that Republicans in congress won’t support fiscal stimulus, and in fact are willing to hold the debt ceiling hostage to force austerity measures, despite the totally predictable consequences. So what do you and James propose we do to drag Republicans back from the dark side? Or do you just plan to continue rooting for bad numbers every month to prove…what actually?

God in Heaven, why doesn’t this article tie to the Federal Reserve’s indictment of fiscal policy?

We gained 176,000 private sector jobs, and lost 11,000 public sector jobs. We’ve lost 89,000 public sector jobs in the past year, and 741,000 since June 2009.

One thing is primarily responsible for slowing down this recovery: Republicans.

@mantis: Unless of course number of public sector jobs has been declining before the Great Recession, in which case longer-term trends are responsible.

@Doug:

Did you mean “peaked” or perhaps “officially ended” instead of “started” in that sentence? Your calculated risk chart labels its line for the current recession 2007.

http://money.cnn.com/2008/12/01/news/economy/recession/

http://economix.blogs.nytimes.com/2010/09/20/the-recession-has-officially-ended/

@john personna:

Because in Doug’s view, what the Fed recommends is totally contrary to the gospel according to Reason.org and also is consistent with what the Democrats have been trying to do, so it must be wrong. The Fed:

That’s pretty much the Fed equivalent of Bernanke shouting: ” Hey Republicans , stop screwing up the recovery by blocking efforts to stimulate the economy.” But Doug won’t admit any of this.

@PD Shaw:

Er no. Boosting public sector employment now will help reduce the unemployment rate, regardless of long term trends. Its the Republicans.

@stonetools:

Well, we had that tremendous illustration in the background checks bill. Senators voted against the 90%-plus position of their constituents “because they did not want to help Obama.”

That is f’ing crazy, but that is their party right now.

(Glad to be an independent!)

Increasing the number of public employees just to keep unemployment rates down is problematic. One thing is to have a stimulus during a downturn, creating long term artificial economic conditions is another thing.

@PD Shaw: http://politicolonel.com/2012/07/27/bca-research-since-reagan-public-sector-jobs-have-increase-more-under-republican-presidents-than-democratic-presidents/#axzz2SF8cCV3y

http://thinkprogress.org/economy/2012/06/01/493849/obama-bush-jobs-record/

@Andre Kenji: That’s not the situation we have. We have been decreasing the number of public employees in the name of austerity.

@Jeremy R:

Bingo. And instead of responding to the crisis the way FDR did after 1933, we responded the way the Republicans did 1929-33-thanks to Hoover’s clueless ( or maybe treasonous?) descendants in Congress.

@Andre Kenji:

The high level question tells you whether you “can or can’t” expand public workers. That question should never block the second, which is whether good projects are available (or necessary).

IMO now that we know we “can” expand at least somewhat, we should discuss where public spending has the most advantageous effects. As an example of a good past project, installing more weather insulation in public schools provided short term jobs and long term savings on energy costs. That was a pretty clear and non-ambiguous return on investment.

In a functional democracy we’d now be arguing the relative merits of plans. We’d smother both “more teachers is always good” as well as “more aircraft carriers is always good” arguments. Both need a higher test of returns.

@Andre Kenji:

But we are still in a downturn in real life.

In any case , “efficiency” is overrated in a situation like this. Sure, the CCC was “inefficient” and not a “long term solution”. But it offered hope and relief to many Americans in the depth of the Depression, and is cherished by many Americans who lived through that time as one of the favorite efforts of Roosevelt Administration. “Efficency” aint everything.

@Gromitt Gunn: There are long-term economic realities beyond petty partisan obsessions.

Total federal government employment has been declining for twenty years: Link

Federal government employment as a percentage of the workforce has been decreasing over the last 35 years (mostly in the 90s) Bill McBride

From 1995 to 2005, the share of the labour force employed in the public sector (government and public corporations) declined in 9 of the 11 OECD countries for which data are available, with the Netherlands and Spain being the two exceptions. Link

To me, it’s inefficient to have a significant chunk of your population sitting around doing nothing. What a waste of human resources (unless you think such people have no value, but that’s another matter).

What we’re doing now is muddling through. Treading water. As the post says: basically keeping pace with pop growth (or just a tiny bit better than that). The private sector adds some jobs, the public sector sheds a few, and the net result is “good but not good enough” to use Doug’s title.

This has been the story for a long time now. It should surprise no one. I think it should be more upsetting to our elite, but apparently most of them are fine with this state of affairs. Everybody they know is doing fine (this is true for me as well, so I understand how easy it can be to stick your head in the sand).

I compare this (loosely) to the 80s. Then, we practiced (weaponized) Keysenianism (while denying this was the case). Government expenditure rose and added to economic growth. Of course, the national debt also tripled. There’s the downside to more spending.

But look, the way I see it is this: we can pay $X to dole out safety net payments to unemployed people or we can spend money on hiring (direct, indirect… whichever) and employ some more people. This should reduce $X (fewer on the dole), but involves adding $Y (all borrowed, of course), which is bigger than the reduction in X. But doing so also increases aggregate demand which should, hopefully, increase private sector hiring more. All this then results in rising tax revenue (exactly how much, of course, is the subject of debate amongst economists).

Of course it’s not good enough. The blame there lies at the feet of the obstructionist GOP! President Obama has a jobs bill that they would not sign onto. Republicans much prefer to see the country suffer than to help this president one iota on any issue he puts forward. So when I hear them say what the American people want I just laugh. The American people wanted President Obama for a second term and expected Congress to work with him. Ideology over the people is an embarrassment but this party has no shame, no shame at all. Vote them out in 2014 and get people in there who actually care!!

Roosevelt was clear with the public that he was not married to specific recovery programs, didn’t know in advance if they would work, and did not promise particular results other than ditching the non-working programs and trying something else until something worked, and never giving up.

Compare to what we do today where public policy is paralyzed by partisian primary grandstanding.

@PD Shaw:

Look at the military vs executive + legislative and judicial. and it looks to me like the total decline of federal workers is primarily due to uniformed military not civilian federal workforce

@john personna: Was going to ask the same rhetorical question John, even did a quick search at the Guardian to find a link. Of course, we both know the answer: Doug is not about to admit that despite everything the GOP does, the economy is slowly but surely improving under Obama. And he backs up his POV through cherry picking.

Another post from Doug whining about weak employment growth while completely ignoring Public Sector losses/stagnation.

And I’m still waiting to read anything on OTB about the Reinhart/Rogoff debacle.

OTB…all

austerityfailed economic theory all of the time.Regarding # of federal employees, as is often pointed out, one has to somehow deal with the increase in the use of contractors. If the Feds cut 50k jobs but outsource to contractors who employ 25k, that’s a cut of 25k, not 50k. But I don’t know there are any reliable figures (probably we could figure out how much the feds spend on contractors, but figuring out how many people that money employs is harder).

Just something to add in when thinking about trends in governmental employment.

@C. Clavin:

Cliff,

Doug avoids the issue himself, but he quoted the NYT article that closes with this:

@PD Shaw:

I didn’t pick those two because they demonstrated partisanship, I picked them because they were the two that I easily found that showed governmental employment rates pre- and post- the most recent recession. What they both demonstrate is that, prior to the current recovery, we have expanded governmental employment during recession since at least 1980.

If I was being a “petty partisan”, why would I grab graphs that show that the Bushes and Reagan were doing the right thing in response to a recession??? That’s completely illogical.

And? Apples and oranges. Public sector employment in the US is the total of all federal, state, and local governments. Picking out just one portion doesn’t tell you anything about the overall impact of governmental employment upon the economy. According to the top chart in that link (the bottom one – taking out school systems and higher ed – is meaningless when looking at overall economic impact), it appears that overall governmental employment as a proportion of total population has been hovering between roughly 9.5% and 9.8% for at least a couple of decades. That marginal difference is pretty much just going to produce statistical noise in any multivariate analysis.

And, finally, I (apparently incorrectly) assumed that you were thinking about the trends since the last recession, since generally when doing this type of analysis, one is concentrated on a given boom-bust cycle. Which is why I was looking specifically for a comparison that would cover as much of 2001 – 2007 vs 2007 – 2013 as possible.

It’s noteworthy that while Doug works this broken record over and over, we don’t hear a peep about the recovery of the real estate market. I guess they don’t talk about that on Fox News.

@Rob in CT: This is the best attempt I’ve found on government employees versus contractors:

Federal government jobs (Civil Servants, Postal Workers, Military):

1990: 5,161,000

2005: 4,075,000 (21.042% decrease)

Estimate of federal government contractors and grantees:

1990: 7,474,000

2005: 10,526,000 (40.835% increase)

“The New True Size of Government (2006)”

@Gromitt Gunn: I didn’t intend to suggest you were being petty partisan. I find it disappointing so much effort in the blogosphere is put into trying to fit everything into a Bush v. Obama or Republican v. Democrat construction.

I am making the same point that I’ve made about Obama and coal. The loss of coal jobs has to be seen within the context of long-term trends in which there are fewer jobs per ton of coal extracted.

@PD Shaw:

This is the best attempt I’ve found on government employees versus contractors:

And it’s only eight years old and includes this:

Yes, enormous number of contractors were employed for our wars in Afghanistan and Iraq and feed public money to the Bush Administration’s friends in the security theater industry. That was not a permanent condition.

That study also does not include state and local public sector employment, which dropped far more since 2008 than federal employment. Do you think all those jobs have been given to contractors using money the states and municipalities don’t have?

So, in short, that study is basically useless now. Thanks for sharing, though.

Also, too, this:

@PD Shaw:

I’m not sure I get the framework. When you say reduction in government is ongoing, and independent of partisan politics … what are you saying is driving it?

I’d accept that the population has moved right, but that doesn’t mean you can’t overlay a heck of a lot of government dysfunction atop that shift.

Indeed, Republicans demand more of a shift, or they will be dealbreakers, every time.

(PD – this paper http://www.newyorkfed.org/research/staff_reports/sr277.pdf suggests the 1990-2005 period was one of marked IT-related productivity improvements. What portion of that large reduction you show in govt employee count+contractors is attributable to improved productivity? I don’t know the answer)

@rudderpedals:

The government certainly employed many typists and draftsmen at one point.

@john personna: Add to those good examples switchboard operators and file clerks.

@PD Shaw:

PD,

Thanks. Taking those numbers at face value (accepting that it stops 8 years ago),

Total direct & indirect via contractors employment:

1990: 12,635,000

2005: 14,601,000

Adjust for pop: ~248 million in 1990, ~296 million in 2005

1990: 19.6 people per government employee/contractor

2005: 20.3 people per government employee/contractor

A slight increase per capita. Of course, as has been pointed out, 2005 may have been inflated by the Iraq war. Not sure (we still utilize contractors in Afghanistan, a war which expanded since 2005).

Since then, the direct governmental employee number has dropped. If contractors are also dropping, I suspect we’re back under 1990s per capita number.

Oops! I got mixed up. 20.3 people per governmental employee of course represents a drop, not an increase. Silly me.

And indications are this drop continues.

@PD Shaw: Gotcha.

@gVOR08:

and

@mantis:

Ok, let’s assume those public sector jobs were not lost and lets also assume we added some more – let’s round it up to an even one million public sector jobs. If we had a million more public sector jobs we’d still need 9 million more jobs to return to normal levels of unemployment and labor force participation. So, while public sector job losses certainly do negatively impact the jobs numbers, but they are a relatively small piece of the total pie.

This is the reality of unemployment in the U.S.

http://moslereconomics.com/wp-content/graphs/2013/04/us-unemployment-rates.jpg

11.7%. This is an ongoing economic crisis which is not correcting. At this rate we will never return to full employment, and that isn’t counting the number of people who want full-time work but are forced to do with part-time. One need only work one hour per week to be counted as employed. When we add those people in we get an unemployment figure of about 17%, and no one in Washington is proposing anything to aid these people.

@Andy:

I don’t think the “stimulation” argument is that you make it up in raw numbers, or IMO it should not be. There should be follow-on jobs, as in interstate highways and Internets. Proponents of high-speed rail say they have something like that, but I’d prefer more two-way freight lines (to reduce delays and increase overall efficiency of freight delivery). Given that energy prices are expected to rise for the foreseeable future, two-way rail pays back forever.

Maybe a big build-out in municipal wi-fi would be stimulative and push innovation forward, though of course it faces entrenched players with government enforced monopolies.

@john personna:

I’m pointing out that the number of government workers has been on a long-decline. I work in a state capitol and this is widely known, particularly by restaurant owners and similar retailers.

Why?

1. IT improvements, fewer office support positions. This is probably what Rudderpedals paper shows.

2. More contract workers. The OECD studies say most Western countries are shifting their work service from direct to indirect with the hopes of saving money or having flexibility.

3. Total compensation for government workers is increasing faster than the rest of the economy, either because of medical/pension benefits, higher skilled employees, or sticky union contracts. Could be more management positions overseeing contract workers. Could be too many lawyers in management — lawyers tend to create rules and science that are best understood by lawyers. But this is not FDR’s government workforce.

@PD Shaw:

Well, because I think ROI is possible and that this is about more than government as a direct employer, I think that is all a big orthogonal to the “jobs” question.

With your piece, what have we got?

1. Direct employment by government is falling.

2. Government borrowing costs are at a long term low.

3. Ben Bernanke says that fiscal policy is retarding growth.

What does that tell us?

There is a reason that Doug hasn’t responded on this thread. Its because he can’t respond without admitting that his side got it dead wrong, and has compounded their stupidity by stopping the government from enacting pro-growth policies.

It’s also why Jazz Shaw is busy trying to find any reason for the slow recovery that doesn’t have to do with Republican obstructionism.

We could have a more productive discussion if you conservatives would just admit you were wrong,that the Republicans have been pursuing job killing anti-growth policies, and that we should dispense with the sequester and go forward with fiscal stimulus.

A recent New Yorker piece speculates that a lot of the unemployed may be working underground.

“Off-the-books activity also helps explain a mystery about the current economy: even though the percentage of Americans officially working has dropped dramatically, and even though household income is still well below what it was in 2007, personal consumption is higher than it was before the recession, and retail sales have been growing briskly (despite a dip in March). Bernard Baumohl, an economist at the Economic Outlook Group, estimates that, based on historical patterns, current retail sales are actually what you’d expect if the unemployment rate were around five or six per cent, rather than the 7.6 per cent we’re stuck with. The difference, he argues, probably reflects workers migrating into the shadow economy.”

@Latino_in_Boston: I thought that those TARP/stimulus bills were supposed to create tons of “shovel ready” jobs. Instead, billions went to weird university grants such as the infamous $400,000 Twitter study and some study of African male sex habits (UCLA or USC). There are many more examples, see top stimulus bill ripoffs.

“It seems some of those jobs weren’t so shovel ready!!” President Obama.

@Tyrell:

Wouldn’t an honest summary include the tax cuts, which had immediate impact?

@Tyrell:

And of course, if you look at actual data you see spending kicking in quickly:

Today’s teachable GDP moment: Slower government spending => slower GDP growth

@john personna: Yes, I agree. You do not cut taxes while a war is going on. I would not advise raising taxes. There are other ways to get citizen involvement and support for a war.

@ Tyrell

Really? Got proof? There is a big difference between 400K and “billions”.

Where I live, stimulus funds helped pay for a lot of infrastructure work. Of course we know conservatives seem to have some sort of hatred of spending US taxpayer dollars for infrastructure work outside of Iraq.

@Tyrell:

So you think Obama’s payroll tax cuts at the tail end of the wars was the problem, rather than Bush’s big income tax cuts at the front end? Not following.

Both cuts were “stimulus” of course, but the income tax cut added more trillions to the deficits, being much larger and more long lasting, of course.

I have to complement Tyrell, for someone fed on right-wing media, he seems still slightly tethered to reality. 😉

@anjin-san: Infrastructure work is fine and the best use. One other way the government could help would be to start replacing and upgrading the aging and obsolete electrical grid of this country. Its condition costs money and has the entire country vulnerable to a disastrous breakdown that would bring this country to a doomsday like state.

This would be a long term project that would provide thousands of jobs. No, I am totally in favor of infrastructure improvements: certainly a wise use of tax money.

Government jobs may be a good short term fix, but you´ll always need a long term solution. Specially because sometimes it´s not easy for someone that works in the public sector to work in the private sector. And specially because scenarios of long term unemployment and slow growth are not rare(Europe, Japan and Latin America are the living proof of that), and you need something more than economic stimulus to deal with that.

There are deeper issues with unemployment in the US: the US government and the US society chose the path of increasing the number of college graduates(Many of them outside technical areas). As I like to point out, the countries that chose this path have high unemployment numbers. The countries that preferred to invest in vocational training, on the other hand, have low unemployment(Denmark, Germany, Austria, Netherlands, Finland, all countries famous for vocational training, have the lowest unemployment rate in the EU). One can argue that in the US you have a shortage of skilled technical workers, people without college degrees but that have to do complex tasks.

The worst thing is, that, considering the political climate, where entitlement programs and taxes are sacred, it´s very difficult to create or to expand these kinds of programs.

@Andre Kenji: That doesn’t really explain the huge disparity in the US between unemployment of people with a bachelor’s degree and those who don’t.

For example: http://www.businessinsider.com/heres-the-massive-difference-in-unemployment-between-people-who-do-and-dont-have-a-college-degree-2013-5

@Andre Kenji:

But a public sector doing that training supports the private sector. Appropriate funding for education is accepted throughout the world. The argument is about what is appropriate for a national situation, rather than that teachers are zero-payback government jobs.

What is the government’s definition of unemployed ? What information do they use to get these figures? Where does the information come from. ?

@Tyrell: Go to this site, type in the words “What is the government’s definition of unemployed”, then press the enter key.

@Gromitt Gunn:

No.What explains the disparity is that many college graduates come from a higher middle class backgrounds, and have familiy connections and things like that. Besides that, people that are more intelligent than average tends to go to college. But you also have many people that entered college and did not graduate. Their economic situation is worse than many people that never entered college.. And many people that did graduate, did not find a job and now are in Graduation School.

@Andre Kenji: Eh. I don’t mean this as an insult in any way, but because you’ve never lived in the US, you’re operating with imperfect knowledge. Because of that, you’re missing the fact that a Bachelor’s degree is the watershed moment in the US that changes everything (on a macro level – of course specific individuals make bad choices / have bad luck).

I can’t link to the study here because it is behind a paywall at the Chronicle of Higher Education, but even a Bachelor’s degree from an online university or one of the for-profit bottom feeders equalizes future opportunities. This is not the case at the community college and technical certificate levels, where for-profits and online education are virtually worthless except in circumstances where they lead to specific professional licensure or industry-recognized certifications. In fact, onlines and for-profits tend to be harmful below the bachelor’s level economically due to the way our student aid and bankruptcy laws work.

@Tyrell:

LOL!

Not to worry, you guys can redefine “unemployment” when you take back the presidency. In fact, you could probably get rid of the term altogether and declare “full employment.”

The (false?) dichotomy between government jobs and private sector jobs complicates any discussion about how best to architect a stimulus program. That is assuming the Republicans would ever allow anything to pass Congress which helps (or even fails to injure) the president. Party First!!!

On one hand, government jobs that give money directly to the worker from the government are great because they put more money in the person doing the actual work – the best possible trickle-up economics. Unfortunately those programs are historically fraught with problems of patronage and corruption.

On the other hand, government programs hiring private companies to build infrastructure will typically help the rich get richer (reference every project in Iraq involving Halliburton subsidiaries and their like), and they do so at the direct expense of the people doing the work.

We have tried middle ground efforts such as privatizing all materials purchases, with laborers work directly for the government. FDR, as noted above, was a great experimenter – and we certainly need more political boldness in his model.

The economist that resolves this tension with a mutually acceptable compromise that appropriately rewards the right stakeholders deserves the Nobel prize!