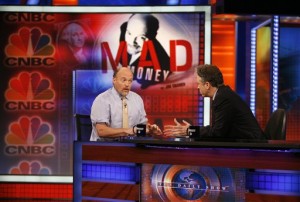

Cramer Didn’t Know!

WaPo’s Richard Cohen says that the glee over Jon Stewart’s embarrassing of Jim Cramer is misplaced. While it’s true that Cramer was spectacularly wrong on just about everything, so were the people with inside information:

WaPo’s Richard Cohen says that the glee over Jon Stewart’s embarrassing of Jim Cramer is misplaced. While it’s true that Cramer was spectacularly wrong on just about everything, so were the people with inside information:

Let’s start with Maurice “Hank” Greenberg, who was instrumental in building what is now probably the world’s most reviled corporation, AIG. He resigned as chairman and CEO in 2005, but still it is logical to assume that few people knew more about the company than Greenberg. He kept much of his net worth in AIG stock. He’s now lost much of that worth.

Or take Richard Fuld. He is the former chairman of Lehman Brothers, which, as we all know, is no more. He lost about $1 billion.

Or take Citigroup’s former chairman, Sanford Weill. He lost about $500 million.

Or take all the good people at Bear Stearns, the company Cramer adored almost to the bitter end. They went down with their stock.

If these people kept their money in these companies — financial and insurance giants they had built and knew from the inside — how was even Jim Cramer to know these firms were essentially hollow?

That’s fair enough. But here’s the problem: Cramer and company didn’t portray themselves as “entertainers” who were just giving us their best guess. Nor did they admit that the “experts” they invited on were actually shills who had a personal stake in the stocks they were touting.

So, no, it’s not fair to hammer Cramer for not knowing what he could not reasonably have been expected to know. It is, however, quite reasonable to go after him for pretending that he knew things he knew he didn’t know and then shouting advice from the rooftops.

Photo: MoneyNews

“touting” is a very good work in this context.

As it happens, I have CNBC on right now, and I’m enjoying Meredith Whitney’s analysis … but I still worry that the network is set up a little too much to tout.

Why haven’t real journalists taken Cramer to task for his nonsense? I’m just not comfortable with a comedian doing the heavy lifting.

Do you know why Mr. Greenberg is no longer chairman and CEO of AIG?

It isn’t Cramer, it’s the idea that a network should have a wild-man yelling trading advice at a mainstream audience. That is institutionalized touting.

(We can hope that his viewers start young and lose a little, early, as a learning experience.)

To be fair, I grew up with the quiet and respectable Wall Street Week in my house every Friday. It was subdued, but it was also structured touting. Though, Lou definitely gave some cautious and sensible advice between the analysts and their buy recommendations.

I listen to Cramer at least when He’s not talking to some caller asking the same question he answered 5 minutes ago. I also listen to Kudlow, Santelli and the rest of the staff of CNBC. I use what I hear in Independently making investment decisions.

I make decisions based on every available resource and if you have ever actually listened to Cramer that is what he advises everyone to do.

I know a lot of “twenty somethings” who think that Stewart is right more than 5% of the time, and would fight you to defend him as a journalist and their primary source of news!

As for Stewart as a comedian? Well the “Daily Show” would be a lot smarter and funnier if his time were given to Stephen Colbert.