China’s Economy Appears To Be Slowing Significantly, And That Could Have A Huge Impact

China's economy is still growing, but it's most recently reported growth rate is slower than the nation has seen in quite some time.

For years now, China’s economy has been growing at an incredibly rapid rate as the government in Beijing continues a process of modernization that can trace its roots back to the mid-1970s and the first efforts to turn the nation away from the insular policies that characterized the nation during the first decades of Communist rule. Over that time, China has slowly but surely become a powerhouse economy in its own right. Cities such as Beijing and Shanghai grew at an enormous rate. Chinese manufacturing became the focus of the world thanks to lower wages and a government that essentially looked the other way when it came to worker safety and environmental damages. Port traffic in China’s major port cities surpassed that of anywhere else in the world. As time as gone on, though, many outside experts have wondered just how long the Chinese ‘economic miracle’ could last before there was some kind of readjustment or pause. The fact that economic statistics were, and continue to be, provided by a central government that certainly has the incentive to exaggerate success and minimize signs of trouble ahead, for example, has long led experts to distrust official numbers, or at least to assume that the books were being cooked to some extent.

Notwithstanding the unreliability of official Chinese government statistics, there have been some signs of what really might be happening in China behind the numbers. The stories about Chinese ghost cities — massive construction projects that were built in anticipation of business that never materialized — are well known and rather hard to hide even in a nation like China where information is tightly controlled. Additionally, the stock markets in Shanghai and Hong Kong have largely become beyond the ability of the government to control and are often taken as warning signs of weaknesses in China that the official numbers don’t necessarily reveal, though. Now, though, it appears that reality may be catching up with even the official statistics as China is reporting its slowest growth in more than two decades:

China’s growth slowed further last year, adding to the troubling economic picture that is unsettling investors around the world.

The Chinese economy grew at a 6.8 percent pace in the fourth quarter, according to data released on Tuesday. It was the lowest quarterly expansion since the global financial crisis in 2009.

Uncertainty about the Chinese economy — and whether the government can manage a slowdown — has been weighing heavily on global markets in recent weeks. Investors, in part, are trying to determine if China’s slump will spread, dragging down the rest of the world.

The latest data is not likely to reassure investors that all is well in China, the world’s second-largest economy.

The quarterly growth rate was lower than analysts expected. For the full year, China expanded at 6.9 percent, just below the government’s target of 7 percent.

It is a pace that would be the envy of many developed countries. But the figure represented China’s slowest expansion since 1990, when foreign investment shriveled in the year after the government’s deadly crackdown on protesters in Tiananmen Square.

“Signs of growth bottoming out are nowhere to be seen,” said Li-Gang Liu, the chief economist for greater China at the Australia and New Zealand Banking Groups. “Instead, we will see at least another two years of further growth slowdown.”

After decades of double-digit growth, the Chinese economy is entering a new era of more muted growth. While the government’s leaders have said they are comfortable with this shift, the slowdown creat-es a host of unexpected challenges

China’s growth is decelerating as its traditional industrial businesses struggle with excess capacity and dwindling demand. A slump in new housing construction is hurting consumption of building materials including steel, cement and glass, even as home prices show signs of a rebound.

China’s export base in lower-end manufacturing, once a powerhouse that drove growth and created jobs, has been hollowed out. Factories churning out goods like garments and furniture are losing competitiveness because of lower wages in Southeast Asia and South Asia.

Although consumer spending and more innovative private sector companies are expected to help China’s economy expand in the future, analysts worry that their development will be too slow to offset the current and painful industrial slowdown.

And the government’s response could add to the challenges. The government has rolled out a raft of stimulus measures to help bolster the economy. But that only threatens to leave already struggling companies even deeper in debt.

Taken collectively, China’s results could spell more trouble for global growth, even as the economy in the United States shows resilience.

Separate monthly data released on Tuesday offered no sign that China’s slowdown was bottoming out. In December, industrial production rose 5.9 percent from a year ago, retail sales increased 11.1 percent and investment rose 10 percent — all of which were slightly below economists’ forecasts.

In a news release on Tuesday, China’s state statistics agency said the growth rate last year was challenged by a “complicated international environment and increasing downward pressure on the economy.” However, it added that the economy “achieved moderate but stable and sound development.”

The weakness in China has reverberated around the world, as investors try to dissect what’s actually happening in the country’s economy. The plunge in Chinese stocks, which are now in bear territory, only clouds the outlook.

To be sure, 6.8% annualized economic growth is nothing to sneeze at, but it stands in sharp contrast to the past when China’s economy was growing at a double digit pace. Of course, to a large degree this was happening in response to the government’s ongoing efforts to modernize an economy that decades behind the rest of the world when the modernization process began and which was characterized by massive construction projects, a huge expansion of China’s manufacturing base, the creation of a real consumer economy, and, at least in the country’s major cities, the emergence of something that in some sense can be called a Chinese “middle class.” In many respects, what China experienced during that time period resembled the massive economic growth that history records in places such as the United Kingdom and the United States during the during the Industrial Revolution, and then again in the United States and elsewhere in the immediate years after the Second World War. History also tells us, though, that economic growth at that level is largely unsustainable, and it is replete with examples of economic slowdowns or even outright depressions that would interrupt growth for one reason or another. While China’s economy still remains tightly controlled in many respects, the fact that it is now nearly as dependent on the fluctuations of the market as the rest of the world seemingly makes a slowdown at some point inevitable. Additionally, while there is still much room for growth in China it seems inevitable that as the economy there matures it will enter a phase where the upper limit on sustainable growth will be lower than it has been in the past.

Economic slowdowns in China have long been a cause for worry in the West, of course, due to the extent to which China’s economy is now so deeply tied to the world economy and the potential impact that a slowdown in China could have around the world. The extent of that concern can be seen in the extent to which instability in Chinese stock markets so easily reverberates around the world now in much the same way that signs of stock market nervousness in Europe or the United States have long had an international impact. An economic downturn in China, investors and analysts fear, could end up slowing growth world wide thanks to the domino effect that it would create, and experts worry that the Chinese government may be responding to these signs of a slowdown in precisely the wrong way:

China has forgotten the first law of holes. It’s in one, but it’s still digging.

Specifically, China is adding debt at a pretty fast pace even though it’s already done too much of that the last seven years. And it’s doing it even though the economy is slowing — on Tuesday, the country reported that its economy expanded at 6.9 percent in 2015, the slowest pace in a quarter century.

Despite that slow growth — which many analysts say actually is better than the reality — new borrowing has climbed to its highest level in six months. It’s enough that China now has more total debt—including the government, households, and corporations—relative to the size of its economy than we do to ours.

Now wait a minute. Why is China racking up so much debt? Well, the simple story is that Beijing has tried to replace all the foreign customers it lost during the financial crisis with even more spending on roads, buildings and other infrastructure until Chinese customers are ready to take their place.

But that last part is a lot trickier than it sounds. It means building a stronger safety net so people feel like they can spend. And letting zombie companies go out of business so there’s room for actually successful ones that can afford to pay workers more. And then giving people enough time to get used to the idea of not socking every last yuan away. Beijing, though, hasn’t done any of this. Instead, it’s just told state-owned companies and local governments to keep borrowing more and more and more without much of a plan for doing anything else tomorrow.

(…)

This will not end well, and the government knows it. You just can’t add this much debt this fast without a lot of it going bad. And it looks like it’s already starting to. Developers have built cities where nobody lives, companies havebuilt factories that nobody needs, and local governments have built airportsthat nobody uses. So why hasn’t Beijing put the brakes on this? Well, it tried. First, it said that it wouldn’t let local governments, which have been a conduit for a lot of this borrowing, do any more. But then it changed its mind as soon as this made the economy start to sputter. It did bring back the limit a few months later, but there’s a big enough loophole in it—indirect liabilities are excluded—that it’s not clear how much it will really do. Now, you probably heard about the second thing it did. That was hyping up a stock market bubble that it hoped would help companies get the cash they needed by selling equity rather than taking on debt. That hasn’t exactly worked now that stocks are down 44 percent from their peak last summer.

So now it’s back to Plan B: borrowing, borrowing, borrowing some more.

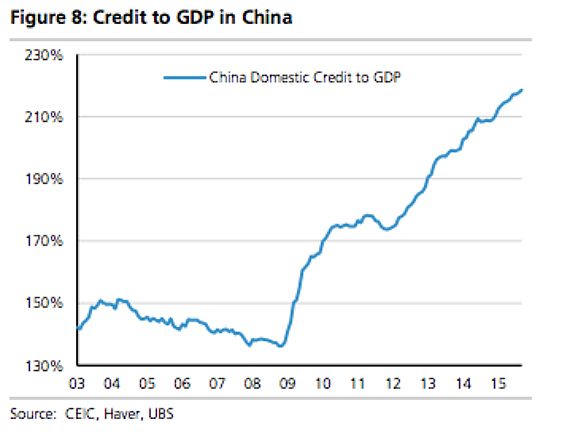

The extent of the increase in Chinese debt can be seen quite starkly in this chart:

Such an extraordinary increase in debt over such a short period seems indicative of the fact that Chinese leaders aren’t really sure about how to deal with the prospect that the Chinese economy could be slowing down to a much slower pace of growth that will, among other things, make placating the ambitions of a rising middle class much more difficult than it has been in the past. So far, the answer from Beijing seems to be to continue the strategy of massive infrastructure projects but that strategy doesn’t seem to make much sense when there clearly doesn’t seem to be the demand for the residential and industrial projects that it is forcing on the economy at this point. Instead, they seem to be just pouring money into projects hoping that someone will come along and use them, thus creating the economic growth that Chinese have become used to. The more likely outcome at this point seems to be more ghost cities, empty factories, and unused transportation that has already become the stuff of legend in China and around the world. That’s not a recipe for economy growth, it’s a sign that the growth that’s being reported is largely phony and that, at some point, the bubble the government has permitted to grow in the economy and the stock markets will pop, sending China into a new world where the economy actually starts to shrink.

The consequences of a Chinese economic downturn for the rest of the world are unclear, but it’s clear that it would have some impact outside of China itself. Chinese purchases of western goods would likely fall off, which would have a noticeable impact on international trade. Western investment in China would also likely slow down as corporations take a step back to wait and see what impact the state of the economy would have on their businesses. On the potentially positive side, a slower economy in China would also likely mean lower worldwide oil prices for a longer period of time as as demand from one of the world’s biggest energy consumers falls off for at least some period of time. Whether a downturn in China would automatically mean a downturn elsewhere in the world seems to be less clear. Analysts have noted that Europe and other parts of Asia are likely to be more immediately impacted by a Chinese downturn than the United States, largely because the United States has a larger trading relationship with nations like Canada and Mexico, as well as Europe and elsewhere, than it actually does with China. It’s also unclear what kind of impact a downturn would have on China itself and Chinese internal politics. For decades now, the government has kept various social forces mollified with strong economic growth, for example. If that slows down significantly, than we could see the some very interesting social developments in China, especially in the major cities. In any case, this is a story worth keeping an eye on going forward.

I don’t think China’s growth adjusting down to normal levels is the big concern. That was inevitable after they caught up with the rest of us. But the borrowing and useless construction to try and maintain unrealistic unneeded economic growth is pretty scary. They are behaving irrationally. Similar to the financial crisis of chasing yield by any means possible

And that chart shows how to make things look a lot more dire than they actually are. Not that they aren’t dire.

How about starting the Y-axis on 0%?

And of course Mr. Trump wishes to impose a 45% tax on Chinese goods sold here in the US.

I’m sure that would be helpful.

Mr. Bankruptcy going to take over and run the economy properly….

https://www.washingtonpost.com/investigations/trumps-bad-bet-how-too-much-debt-drove-his-biggest-casino-aground/2016/01/18/f67cedc2-9ac8-11e5-8917-653b65c809eb_story.html

The U.S. does have a large economic relationship with China since a large number of American corporations and financial institutions basically created system where goods were produced at low costs, with low cost Chinese labor, and shipped to the United States for sale, with capital exports going to China in the form of investments and U.S. Treasury bonds, with the large banks acting as intermediaries. A slow down in China’s domestic economy will not affect this cycle, in fact, it may increase it as the Yuan depreciates against the dollar. U.S. may be indirectly affected if the China slow down causes the more export dependent economies of Japan and Germany to slow, which in turn would slow U.S. exports to Europe and Japan while also encouraging these economies to take a bigger proportion of U.S. demand, even as that demand grows increasingly sluggish. http://www.businessinsider.com/oil-crash-impacts-on-us-consumer-spending-2015-7

What is keeping the U.S. economy afloat is small recovery in housing, a small recovery in commercial construction, health care, and that Government is not contracting spending in 2016. This will keep the U.S. economy limping along at 2% while the rest of the world is doing its best to kill it.

@Jc: Um, may I point out that Japan has done the exact same thing since 1960?

One thing that is not mentioned above is the negative impact of pollution. Major cities in China have to shut down airports, factories, power plants and limit motor vehicle traffic often several times a month. Vast areas of what used to be prime agricultural land is now unfit for growing crops because the soil is so contaminated. This is an example of what lack of regulation can result in.

@Ron Beasley:

While I take the point about China’s pollution problem, I’m not sure it’s caused by a lack of regulation. This is China we’re talking about. Isn’t the shutting down of factories and roads a form of not-very-effective regulation?

@grumpy realist: Maybe since 1980. Yeah, a lesson can be learned from Japan, but it seems like they are not learning. Japan increased their debt after the bubble burst and GDP blew up. China is massively over leveraged and their just slowing down to 6.9% – imagine when they blow up.

@Ron Beasley: Didn’t the president sign some sort of climate change agreement with them a while back ? Who is going to monitor that agreement ?

I think that the US technology and research can meet clean energy and efficient utility goals, without forcing a lot of regulations and restrictions on businesses and the people *.

If we can send a man to the moon (6 times, safely), then we can certainly develop alternative energy cars (gas fired turbines, hydrogen), and new forms of electrical generation (fusion). Diesel powered trucks and machinery, and jet aircraft pose another problem.

* I do not think the American people will take to the thermostat setting thing that we did in the ’70’s, or shell out $30,000 for an ev that has a range of 100 miles or less on a charge. “Turn down the thermostat and put on a sweater ! “

He who lives in a glass house……

The cluck-clucking about a debt fueled Chinese expansion resulting in nothing but about to burst bubbles………….sounds like the US.

“Didn’t the president sign some sort of climate change agreement with them a while back ? Who is going to monitor that agreement ?”

That one got filed under the same letter as the Iran agreement, “W” for worthless.

@Guarneri:

Really? I guess if you were the parent of one of those sailors that was released in 48 hours you’d be singing another tune about the power of diplomacy.

But nothing you say is factual or accurate anyway…so continue on with your delusions.

@Guarneri:

You’ve been whining about the economy crashing for years now. I suppose at some point it will and you will claim to be a genius. Hint…you aren’t. You’re just another mindless Republican who makes terribly wrong predictions…and is scared of his own shadow.

@C. Clavin:

The economy is “growing” at zero percent.

Hush, child.

Here’s one point of view.

“http://www.zerohedge.com/news/2016-01-19/when-hockeystick-breaks-imf-finally-gives-china-growth”

China’s economy is bringing the Dow down as we speak.

I’m fairly sure that Republicans will blame the economic slow down in China on Obama, and Trump will claim that he would have forced China to experience continued economic growth.

@Tyrell: I agree with most of what you are saying the major exception is fusion power. As an engineer and physicist I still think this is little more than a pipe dream. Hydrogen has some potential as they are making great strides there already. Small on demand H2 production plants powered by solar power is an example. Not in my lifetime perhaps (I’m 70) your vehicle could be powered by hydrogen fuel cells and perhaps even the electric power for your house.

@Tyrell:

Well of course, it all comes back to that climate change agreement.

@Guarneri:

Why keep linking to Zero-Hedge? They are nothing but conspiracy theorists, apocalypse fanboys, gold hawkers and inside traders.

More mush from the wimp

This is starting to get about as hilarious as the whole Blago mess. I remember one of Blago’s lawyers saying “I don’t expect a client to automatically approve of what I say, but I do want him to at least listen to it!”

@C. Clavin:

I think you answered your own question.

Of course deficit spending is the standard response to a slow down. It’s been done worldwide and had bi-partisan support in the US until the Black guy wanted some. However, for it to work, you have to be near the Zero Lower Bound on interest rates. At a glance, it doesn’t look like China is. You don’t have to buy useful stuff, but it’s way better if you do. Maybe power plant pollution controls.

The idea isn’t just to spend in bad times, but also to save during good times to support a deficit in bad times. Chinese government debt at, IIRC, 60-65% of GDP isn’t terrible, but less would have been better.

@Guarneri:

The economy is “growing” at zero percent.

Translation: I have no clue what I am talking about.

@mantis:

Whaaa? Guarneri says he’s a titan of industry, whose very presence at the negotiation table strikes fear in the hearts of all comers…

Who also happens to have the writing ability of a third grader…

And who has a lot of time in the middle of the day to troll comment boards…

You know, like most business titans.

I will again point out my ignorance of economics.

Economies do not grow at steady rates. There have been ups and downs at least since the events in Genesis 41. It seems to be a common tendency to claim credit when things are going up and point fingers when things are going down. There will be good times and down times, booms and panics. We need calmness. Let’s resist the temptation to try to get events to confirm our ideologies.

Our leaders are pretty good for the most part. Obama does get credit for the recovery from George II. Obama is good but not that good. Bush was bad, and I can’t make myself write that he wasn’t that bad.

@Neil Hudelson: And in the current Clinton/Sanders Debate thread says he speaks personally with the President of Purdue.

@gVOR08:

who is, apparently, as ignorant about economics as Guarneri is. Or, more likely, Guarneri didn’t understand what the man was saying.

@gVOR08:

That’s not even remotely true, especially with China where a reduction in interest rates results in an increase in the savings rate. In 2008 interest rates were higher in China than they are now and China initiated a massive stimulus package which has been credited with helping the global economy recover. So yes, China can enact a stimulus package if they so chose to. So far they haven’t because they have been saying for quite some time that they need to re-balance their economy to focus more on consumption and less on infrastructure development. What we’re seeing in China is the natural outcome from that malinvestment and subsequent re-balancing.

Perhaps he meant this Perdue…maybe Guarneri was down on the floor plucking chickens when the boss was passing through…

I have a nit to pick. The very common sloppy math in economic reporting is a pet peeve of mine. No one in the post seems to be predicting negative growth in China. China’s economy is not slowing, the growth of China’s economy is slowing. Not blaming Doug, that’s the way it’s commonly stated, but reduced acceleration is not slowing.

(I’m not at all sure, given China’s unreliable statistics and apparent reduced global demand, that China isn’t on the verge of recession. Semi-officially, defined as two quarters of negative growth. But if anybody in the OP said that, I missed it.)

It is not my first time to pay a visit this website, i am visiting this

web site dailly and get good information from here everyday.