Federal Workers Earn Twice Private Sector Counterparts?

The average federal government employee earns twice as much as the average private sector worker. An outrage? Not so much.

Continuing a meme that won’t go away, USA Today has a story headlined “Federal workers earning double their private counterparts.”

At a time when workers’ pay and benefits have stagnated, federal employees’ average compensation has grown to more than double what private sector workers earn, a USA TODAY analysis finds.

Federal workers have been awarded bigger average pay and benefit increases than private employees for nine years in a row. The compensation gap between federal and private workers has doubled in the past decade.Federal civil servants earned average pay and benefits of $123,049 in 2009 while private workers made $61,051 in total compensation, according to the Bureau of Economic Analysis. The data are the latest available.

The federal compensation advantage has grown from $30,415 in 2000 to $61,998 last year.

There’s a lot to unpack here.

First, federal workers do get a great deal in terms of annual salary and benefit bumps. It helps that the federal cost-of-living index has long exceeded real inflation. And that the body which oversees federal worker pay, Congress, has its pay and benefits tied to the overall pool. And that federal workers are unionized.

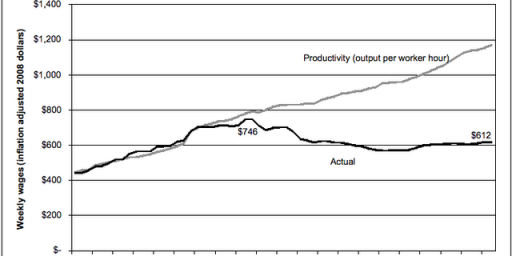

Second, the doubling over the last decade in the gap. Considering that the past decade has coincided with the post-9/11 ramp-up in security spending, thus raising the level of federal spending and hiring, and the burst of the dot.com bubble at the front end and the Great Recession at the tail end, thus holding down private sector wages, it’s not surprising.

Third, that federal workers “earned average pay and benefits of $123,049 in 2009.” That’s just staggering. Even when you take out the $41,791 in “benefits,” the $81,258 average salary is very generous. And implausible. For 2009, that’s just a little more than the base pay for a GS-13, Step 5. Which, even for the DC area, is a very senior civil servant. Even factoring in an average geographic locality adjustment, say, Miami’s 15.9%, we’re talking GS-12, Step 4. And federal pay is capped on the high end by law to ensure civil servants make less than Congressmen. For 2009, that was $155,500. A GS-15, Step 6 in the San Jose-San Francisco-Oakland metro area, the one with the highest locality pay, made that. And there are very few people, comparatively, making that kind of money. I’m not sure how that average was arrived at.

Fourth, that the average private sector worker makes $50,462 in salary strikes me as about right. Given the staggering amounts made by those in the upper reaches of the top percentile, it’s probably skewed a bit high; I’d bet the median is somewhat lower.

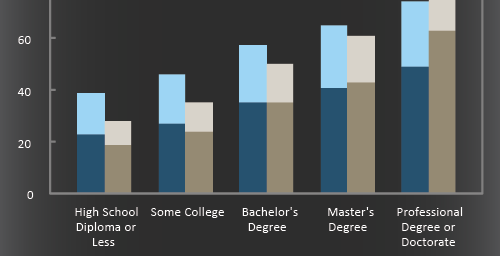

Fifth, and probably most importantly, comparing averages probably doesn’t tell the whole story.

Public employee unions say the compensation gap reflects the increasingly high level of skill and education required for most federal jobs and the government contracting out lower-paid jobs to the private sector in recent years. “The data are not useful for a direct public-private pay comparison,” says Colleen Kelley, president of the National Treasury Employees Union.

I’m not a fan of unions and think there’s a lot of bloat in the federal bureaucracy. But the barriers to entry are indeed higher. Most federal civil servants making anything like a decent wage are college educated. And the government employs a disproportionate number of attorneys, engineers, computer scientists, PhDs, and others who command high salaries in the private sector and comparatively few maids, janitors, and retail clerks.

But, of course, these weak reports yield a predictable chorus:

Chris Edwards, a budget analyst at the libertarian Cato Institute, thinks otherwise. “Can’t we now all agree that federal workers are overpaid and do something about it?” he asks.

Last week, President Obama ordered a freeze on bonuses for 2,900 political appointees. For the rest of the 2-million-person federal workforce, Obama asked for a 1.4% across-the-board pay hike in 2011, the smallest in more than a decade. Federal workers also would qualify for seniority pay hikes.

Congressional Republicans want to cancel the across-the-board increase in 2011, which would save $2.2 billion. “Americans are fed up with public employee pay scales far exceeding that in the private sector,” says Rep. Eric Cantor, R-Va., the second-ranking Republican in the House.

Again, we may be overpaying a lot of people in the public sector. And we’re surely employing too many. But it’s just demagoguery to call for pay cuts on the basis of comparing meaningless midpoints.

UPDATE: Commenter John Personna points me to an earlier USA Today piece titled “Federal pay ahead of private industry.”

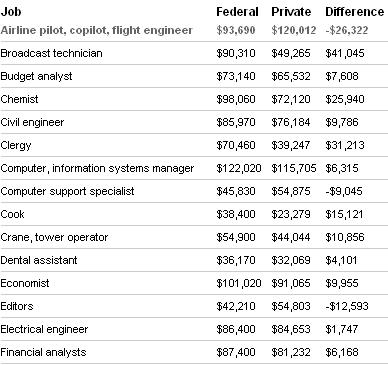

Federal employees earn higher average salaries than private-sector workers in more than eight out of 10 occupations, a USA TODAY analysis of federal data finds.Accountants, nurses, chemists, surveyors, cooks, clerks and janitors are among the wide range of jobs that get paid more on average in the federal government than in the private sector.

Overall, federal workers earned an average salary of $67,691 in 2008 for occupations that exist both in government and the private sector, according to Bureau of Labor Statistics data. The average pay for the same mix of jobs in the private sector was $60,046 in 2008, the most recent data available.

They include an interesting chart comparing occupation-to-occupation. Here’s the top few.

This is interesting, indeed. Some jobs pay radically more in the government sector; others, radically more in the private sector.

I wonder whether the comparables are really comparables, though.

For example, I presume most “airline pilots” employed by the Feds are military officers. While they fly planes, they’re doing a radically different job than the guy from Delta flying back and forth between Atlanta and New York.

Ditto cooks and clergy. The only ones that come to mind either work for the military or for Congress and the White House. In the private sector, cooks range from the guy flipping burgers at Mickey-D’s to the head chef at a Manhattan 4-star bistro. And clergy range from part-timers who preach to a congregation of 12 in a run-down single-wide to the big-timers who fill a mega-church and heal people on television.

None of this is to say that government employees don’t get a pretty sweet deal. Most of them do, in that their jobs are essentially guaranteed for life and they often come with very little stress. Others put in 12-hour days without overtime because they think the work’s that important. And others are risking their lives on a daily basis in foreign lands.

As in the private sector, there’s just an incredible range of stresses, rewards, and trade-offs. My only point here is that looking at a single variable — average pay — doesn’t do a good job of telling the story.

Wasn’t there a guy here a week or two ago who called on you to change the blog name to “inside the beltway?” That “not so much” comment begs it.

And actually this does seem a serious proof for the conservative claim that any program once created, will bloat, so fight program creation and reduce them where you can.

I suspect that these salaries have ratcheted themselves up by self- and selective- comparisons in salary surveys. That’s what we saw in non-profits. Probably a lot could be gained by going back to the tried and true market test: If you have a lot of applicants, your salary is too high. If no one answers an add, it must go higher.

Or, just cut whole programs, and rafts of those committee set pay scales with them.

Oh, I don’t doubt any of that and allude to it in the post. But, as already noted, I think there’s something funny going on with the calculations and don’t think we’re comparing apples to oranges.

Quite probable. But that’s also the nature of bureaucracy: There’s a need to standardize, which requires studies, which invites odd comparisons since most public sector jobs don’t have private sector analogues. (If they did, they should be done in the private sector!)

Don’t most good jobs get a lot of applicants? If you’re looking to hire people with strong credentials and work histories, the salaries have to be competitive enough to draw a decent applicant pool.

And federal jobs are mostly applied for by other federal employees, either trying to move up a notch or diversify their resume with a lateral move.

I think that all government workers should be payed no more than minimum wage. And that includes Obama, the anointed one, and the crooks and liars in congress and their staffs. If minimum wage is good enough for the folks in flyover country, then government leaches should set the example for the rest of us.

I think one problem with the government pay scale-and it is this way at almost all levels-is that pay increases are tied to years in service, not necessarily good work performed (although certain a promotion will also net a higher salary). Also most government jobs are tied to a COLA that raises yearly no matter what. Most private sector jobs do not have a structure that provides a yearly raise.

This makes me curious to see a specific comparison of pay in a specific type job with similar education level for the government and private sector. That would probably tell more than a comparison of an average.

Also the real win with a government job is the pension and post retirement benefit plan. It is this compensation that is breaking the bank in many state and local governments. Not sure how it is affecting the Federal government, but I am not a fan at all of congressional retirement benefits-I figure if the elected congress member doesn’t like the post retirement benefits they should spend a little less time in congress or open up their own retirement account like most people who don’t work for the government.

Isn’t that what the original comparison to market salaries is about? Are you saying they _must_ be higher than market rates to draw a decent applicant pool?

Definitely part of the problem. Look at attrition. If it is too low, salary increases are too rapid.

Man, I wish I could drink the right-wing Kool-aid. That way I can complain about how federal employees make too much money….and then make excuses for all the corporate executives at failed companies getting big-time bonuses or golden parachutes….

It appears that the disparity may be understated with respect to pensions. The article indicates that the largest portion of benefits is the “government’s contribution to pensions.” That assumes that the government’s contributions are actuarially equivalent to the benefits received by the employee. My brother, for example, will be retiring (and is planning to retire) with a full state pension at the age of 52. I would be willing to bet my retirement plan that the state’s contributions do not reflect the value of this defined benefits plan.

No, just that jobs that offer good salaries tend to attract a lot of applicants – both from people trying to move up and people looking to make lateral moves for one reason or another.

The attractiveness of government jobs isn’t the great pay. I don’t think it’s particularly high apples to apples. (Government attorneys and physicians, for example, make less than their private sector counterparts.) It’s a combination of stability, retirement benefits (although these have largely eroded outside the uniformed military sector), and, in some cases, the ability to influence policy.

sss

john persona: “private sector employees quit at a rate that was more than eight times higher than federal employees . . .. This indicates that federal employees recognize that the generous combination of wages, benefits, and job security is hard to match in the private sector, so they stay put.”

http://www.cato-at-liberty.org/2010/08/10/federal-employees-continue-to-prosper/

This is absolutely incorrect. federal salary increases are voted on each year by Congress. The civilian raise is generally tied to the military raise since who will want deny a raise to troops in the field. The federal retirement pay is tied to the COLA. Now just so you don’t waste your righteous anger, for the last year (and expected also for 2011), the COLA provided to federal retirees and social security recipients was zero(0) while the active federal employees did receive a across the board raise enacted by the current Congress.

Also, almost all the defined benefit retirement recipients (CSRS) have retired. The current workforce depend on their own savings in the Thrift Savings Plan (the government 401K) for their retirement. Federal retirement is one of the better ones but it isn’t what it was or what many believe it is. So yes, the health plan and the small defined benefit part of the FERS is better than many get but you can hardly begrudge a federal retiree the benefit of their contributions to their 401K. Those that didn’t save for their retirement in the Thrift Savings are going to discover that the government retirement isn’t what they thought it was.

Well, maybe. Certainly, it’s true that the security and benefits are hard to match.

At the same time, though, government employees can quit their job without changing employers. They hate their job as a secretary at HUD and become a secretary at EPA. And that counts as a satisfied employee who stayed with the company. In the private sector, if you hate your job with Starbucks you generally have to leave Starbucks and get hired at, say, Waffle House.

James: I’m pretty sure you’re wrong about comparing lawyer pay, if you take out the top and bottom five percent.

Anyway, here are some figures showing Average federal salaries exceed average private-sector pay in 83% of comparable occupations:

http://www.usatoday.com/news/nation/2010-03-04-federal-pay_N.htm

JKB: I didn’t realize the fed had gone completely away from defined benefits. I may be wrong about my comment at 10:18, since it’s not clear from the USA Today article how pension beneifts were calculated for state employees under defeined benefits plans.

So comparing averages is no good and using specific examples is considered anecdotal evidence. It seems when battling the public sector we just can’t win.

Not only are they overpaid they are under worked. The productivity of public sector workers is far below the private sector and I would expect getting worse.

The excuses are no longer working.

I just completed a one-year stint in a federal national security position, and am returning to the private sector. While I can’t speak to some federal agencies, I do feel compelled to point out that the people I met are (1) compensated at levels far below what their education and experience would translate into in a non-government job and (2) routinely work from 7:30am to 8-9pm. Folks working as congressional staffers or on the NSS often keep crazier hours. Also, while Federal workers did once receive great pensions, they now rely predominantly on defined contribution plans that are roughly equivalent to comparable jobs in the private sector.

This chart just isn’t that useful. As James Joyner implies, you really need data that compares across multiple demographic variables, including length of employment, level of education, and location of employment.

One final note, the federal civil service contains a disproportionate number of military veterans (veterans receive extra “points” on the system that produces short lists for federal jobs). That has also sorts of effects on the character of the workplace, but it also is just something to consider when looking at these numbers.

Also, the point about moving around within the civil service is really important. One doesn’t leave federal employment because of a crappy boss, one leaves the office or the agency.

And here’s the next move in the great game. First we wipe out retirement plans for employees of private companies, stealing the money and giving it to the top executives and shareholders, despite the fact that this is negotiated deferred pay for work performed. Then we drive down the salaries as more and more of the company’s income goes to the tiny handful on top.

And now we point to the one sector of society left that is still allowed to have a decent middle-class living and we say “They’ve got it better than you. Tear them down to your level!”

And moron Republicans go along with it. “Go ahead, slash my pay, wipe out my benefits — but make sure that other guy is getting screwed, too.”

Maybe the better answer is not “I don’t want that guy to have what I used to.” It’s “I want it too.”

Of course the only way to achieve that is to use the collective power of the workforce, and that means unions. And Republican morons have allowed their leaders to tell them that unions are evil.

So y’all go back to the trailers you can barely afford and scream about how terrible it is that some still have a middle class existence.

Steve Plunk: no, the important thing is to use multivariate comparisons. If the average private sector economist has a MA, lives in St. Louis, and is 30 years old and the average federally employed economist has a PhD, lives in Washington, DC, and is 45 years old than we should expect the latter to earn more (better educated, lives in a city with a higher cost of living, and is older). You need to control for these differences in your comparison.

Think of it this way: you would want to know if a particular federally employed economist would expect to earn *more* or *less* moving into a comparable private sector job.

@Joyner

My only point here is that looking at a single variable — average pay — doesn’t do a good job of telling the story.

It tells the story well enough… even with a generous dose of fudge, the burden on the taxpayer is almost twice the cost for someone in the private sector to do the same job. And this doesn’t even take into account that the public sector creates no wealth or expansion of the economy. It simply takes taxpayer dollars – often borrowed dollars – and shuffles them around.

DN, I agree more detail would be nice but there seems to be enough here to draw some conclusions rather than just dismiss it in it’s entirety.

I doubt the public sector workers could make it in the private sector. The level of productivity expected and the expectation of initiative would be too much for them.

It’s recognized that real wages have stagnated this past decade and also that a male worker makes less now, in real terms, than his counterpart did in the late 1970’s. So maybe, just maybe, public workers receive what private sector workers would be receiving had wage increases tracked historical trends prior to this turning point?

This whole meme about how govt workers don’t work is pure partisan BS. I’ve worked both sides, private and public, and there are good workers and bad workers in both. In my own experience, it depends on whether the person in charge avoids conflict. If so, there’s usually going to be dead weight, private or public.

“The productivity of public sector workers is far below the private sector and I would expect getting worse.”

You got proof for that?

“And this doesn’t even take into account that the public sector creates no wealth or expansion of the economy. ”

GDP = C+I+G+(X-M). The “G” being government.

I really think defenses of government pay fall flat, especially until we hear the following:

“Government departments face a dearth of qualified applications. The positions are open, a spokesman said, but we qualified applicants are not interested at these wage levels.”

Now, I get that you could say that workers are “sacrificing” for a higher ideal, and applying to positions which “pay below their qualifications” but that could always be claimed. at really any wage level. It is an open door to ever-higher wages.

@ taiko drum

“And this doesn’t even take into account that the public sector creates no wealth or expansion of the economy. ”

GDP = C+I+G+(X-M). The “G” being government.

You can place all of the formulas out there you wish. What you can’t address is the immutable fact that public employees are paid from dollars that are taken out of the money pool created by the private sector. They are not paid from profit income generated from their activities. Government workers do not create more wealth as a consequence of providing services, they only create additional ways of spending the wealth created by the private sector. Every Government job is an additional burden on the wealth created by business.

I’ve never seen MC Donalds refer to a burger flipper as a cook… You’d be laughed at if you applied to a Chedders or any other lower scale restaurant and said you had experience as a cook because you flipped burgers…

Of course. But I’m guessing these comparisons are based on some sort of government occupational code, itself based on IRS returns. That sort of system would aggregate burger flippers and real chefs.

“Every Government job is an additional burden on that which allows for the wealth created by business.”

There, fixed it for you Juneau.

I left federal service some years ago and so don’t know current conditions. In the mid-90s it was almost impossible to hire engineers and other professionals because of the low pay. And they (we) seldom stayed long as private industry recruited them heavily–often by agencies contracted to do the work that would normally have been done by federal employees. Federal wages are set by law, not so with private contracts in case you wonder how they can pay higher wages than the government allows.

As to unions, while federal unions do represent all federal employees as they claim and as the law requires, they, also by law, have to represent non-members. And they cannot negotiate either pay or benefits. I doubt their actual membership is over 10 or 20 percent of all employees.

As to pay, the reason it is set by wage surveys is that federal employees have no right to negotiate for salaries or engage in work actions, as Reagan pointed out when he fired striking Air Traffic Controller.

I’m SO GLAD! Thank you for pointing this out finally. It’s unbelievable how the entire nation is so easily hooked on this concept. Do people really think it’s as simple as comparing the averages? I was stunned at the amount of news pieces coming out all about the same thing, and nobody even bothered to think twice.

PS: Increasingly high level of skill my “bottom”.

BTW kudos to your image(s).