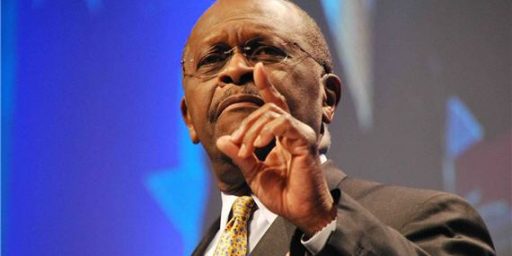

Herman Cain Was Against A National Sales Tax Before He Was For It

Less than a year ago, Herman Cain was denouncing a tax plan that is remarkably similar to the one he now advocates.

I’ve noted before that Herman Cain’s history as a radio talk show host, public speaker, and op-ed columnist was likely to come back and bite him at some point. You simply cannot engage in a long career of speaking off the top of your head on various issues without saying something at some point that is going to annoy someone, or prove to be somewhat embarrassing to you should you ever decide to run for public office. In Cain’s case, we’ve already seen that he spent a good part of the run-up to the 2008 economic crisis (see here, here, and here) arguing that the media was exaggerating bad economic news to harm Republicans. Cain has explained that way when asked by saying “nobody” saw the economic crisis coming, which isn’t entirely true, but probably good enough for his supporters, especially since they were part of the crowd buying the “media conspiracy” argument back in 2007 and 2008. Cain may find a newly revealed, less than a year old, column a little harder to explain.

On November 21st, 2010 in a column at website called The New Voice, Herman Cain wrote this about a proposal made by the Simpson-Bowles Commission:

The worst idea is a proposed national sales tax, which is a disguised VAT (value added tax) on top of everything we already pay in federal taxes.

Here are three of the biggest reasons the national retail sales tax is the worst idea on the table.

First, we have a spending problem in Washington, D.C. not a revenue problem. The Commission claims their goal is to reduce the deficits by $4 trillion over the next decade. The task force says its plan would save $6 trillion by 2020. It’s sort of like dueling promises that would never happen, because when has a proposed cut in Washington D.C. ever produced the intended savings over 10 years? Never!

Even worse is reason number two: In every country that has established a VAT with the promise of reducing their national debt, the VAT has eventually gone up or expanded on top of the existing tax structure. After discovering many of the tax grenades in the recently passed health care deform bill, which is already driving costs up and access down, it would be real easy for an overzealous bureaucrat to insert the language in the legislation “national retail and wholesale” tax.

For the liberal naysayers who say that would not happen, you lose! Just look at the Social Security system, Medicare and Medicaid. Over the years since their inception, taxes have gone up, benefits have gone down and they are still on a path of insolvency.

Both the Commission and the Task Force say very little about how costs would be contained, because that’s the real big bodacious problem. Even if their plans could achieve their stated goals over the next 10 years, the current administration and Congress have increased spending nearly $4 trillion in the last two years. And the only hope that it will slow down is the new change of control in the House of Representatives.

Giving the administration and Congress another tool to tax us and confuse us is like giving an alcoholic a key to the liquor store with no supervision, only to discover that he locks the door after he is safely inside.

A national retail sales tax on top of all the confusing and unfair taxes we have today is insane! It gives the out-of-control bureaucrats and politicians in denial one more tool to lie, deceive, manipulate and destroy this country.

Cain goes on in the piece to advocate for the adoption of the so-called FairTax, a proposal that has been batted around for the better part of a decade that would replace the entire existing tax structure, to include repealing the 16th Amendment, with a national retail sales tax. Indeed, Cain’s own 9-9-9 plan claims to be the first step on the road to implementation of a FairTax system, although he’s never made clear how he thinks he could pull off two major revisions of the U.S. Tax Code, and the repeal of a Constitutional Amendment, over the course of 4-8 years. In reality, 9-9-9 is his tax plan and, while we all know that it’s never actually going to become law, the fact that only a year ago Cain was arguing against the very type of system that he now proposes is, to say the least interesting.

The criticisms that Cain leveled against the Bowles-Simpson proposal are virtually identical to those that many on the right have leveled at 9-9-9 in the months since Cain introduced, and especially in the past month as he has risen in the polls. What’s ironic here is that, less than a year after arguing that National Retail Sales Tax on top of our existing tax system was a bad idea, Herman Cain proposed a tax plan that does exactly that. Does this mean he thinks his criticism of the Bowles-Simpson plan was a mistake? Or, as I suspect, does it mean that this is yet another issue on which he hasn’t invested much actual thought? I’ll leave that for the reader to decide.

Found via Twitter

Who cares? I guess since Palin is not running for president, everyone needs to find someother irrelevant person to obsess about.

I guess obsessing about irrelevant people keeps people from thinking about trillion dollar debts and an unsustainable economic situation.

This irrelevant person is leading the polls, superdestroyer, and while I find it unlikely he will win he’s a bit more of a factor that a former Governor from Alaska

They are all Romney now.

That was before he played SimCity.

Aside from their potential for doing harm, is there any way in which any of the GOP candidates are not irrelevant?

Your utter obsession with nitpicking whomever may be leading the GOP race at any given time while basically ignoring almost everything else is bizarre.

Speaking of obsessions…what’s the deal with the republican obsession with crushing the middle and lower classes with regressive taxation? I mean…what’s the end-game?

@Hey Norm:

Power.

@Hey Norm: How is it regressive?

That’s right. Change the topic to another talking point, Yawn.

If you were able to confront Cain directly on this seeming contradiction, I’m pretty sure his answer would have the words “apples and oranges” and make no sense at all.

OBVIOUSLY , Cain is ONLY for a federal sales TAX if the CURRENT SYSTME IS OVERHAULED WITHTHE REST OF HIS PLAN

Check the intelligence of the person who wrote this article.

This is bull. His article makes it perfectly clear that he thinks putting a national sales tax ON TOP of the existing system is complete nonsense. As you saw, he went on to say that the Fair Tax was the way a national sales tax should be implemented (a view shared by many). The 9-9-9 plan is consistent with this – it’s not on top of the existing system. It throws out the existing system, with all of its loopholes and thousands and thousands of pages of tax code that nobody on the planet can claim to fully understand.

He was for the Fair Tax then. He’s for it now.

Of course he is, that’s what 9-9-9 is, but in one of the debates he seemed to have a hard time when the fact was pointed out that the national sales tax would be an additional federal tax on top of whatever state taxes most people are paying their states. That was when he said the whole “apples and oranges” thing, which is pretty much irrelevant. Of course a federal and state tax are two different things, but they both get paid by consumers all the same and two taxes added together equals higher taxes.

@Pete:

It is regressive because poorer Americans will pay a higher proportion of their income in taxes, and wealthier Americans will pay a lower proportion of their income in taxes.

In other words, it’s the opposite of progressive.

I have to disagree with you. Cain has repeatedly said this is a “re-place-ment” tax, emphasizing the fact that his 9-9-9 plan replaces the existing tax structure. Furthermore, he has insisted that the sales tax portion of his plan is not a VAT tax.

In this article, he argues that adding a sales tax on top of the existing tax structure is a bad idea, because we have a spending problem (something he has stated repeatedly in his campaign speeches).

Rather than seeing a flip flop here, what I see is the difference between arguing that adding new taxes is a bad idea while completely restructuring the entire tax system is a good idea.

Linton, two taxes added together only equals higher taxes when no other taxes change. Cain’s plan would only increase income taxes on earners under $40,000 annually *if* no exceptions are made for them (and Cain has indicated that there would be. The 9% sales is not regressive for this reason – it replaces the 6.75% FICA tax that everyone pays – even the poorest earners in the nation. That means an increase of 2.25% in taxes (compared to FICA) for everyone, but that would be offset by an increase in income. Why? Because the employer is no longer paying the 6.75% FICA share on the employee’s earnings, so that money can go to the employee in the form of an earnings increase.

Perhaps some employers would keep some of the FICA money, but the political pressure to increase employee’s pay by a minimum of the 2.25% would be immense, and a strong argument could be made that they shouldn’t keep any of it since it’s already built into their cost structure. Were that to happen, employees would see an increase in take home pay from the current system of 4.5%

Furthermore, employers paying a 9% income tax rather than the current 35% would surely be encouraged to create more jobs and further boost the economy for everyone. A stronger economy and increase sales would lead to more and higher paying jobs, a win win for everyone.

Fair enough. But he did a terrible job of explaining it in the Nevada debate with all the “apples and oranges” stuff. In a literal sense the actual sales taxes would go up for most Americans. Maybe that would be offset, but he really seemed unwilling to concede that point even when he was trying to explain its being offset.

I can’t help Cain with his ability to explain a complex subject in 30 seconds, but his plan does have merit.

The modern conservative movement has reached its logical conclusion. The GOP is a reality TV show…

I noticed that no one could explain why spending one minute analyzing Cain’s positions should matter.

The first question when thinking about any candidate is whether the candidate has any chance of winning. That is why the media feels comfortable ignoring Ron Paul even though he usually polls second or third in every poll. Yet, they are all obsessing Cain when everyone who is the least big serious about politics knows that he will never be president.

Why not have a post looking at current taxes, why the Obama would do if given a free rein and then compare it to currently spending. Would giving the Obama Adminisration everything they want really help the private sector employed middle class? Or would giving the Obama Adminisration everything it wants just create a nationalized version of Chicago with a few rich, connected elites, a middle class employed by the government, and a large number of poor third world immigrants?

@superdestroyer:

Doug responded to your comment 5 minutes after you left it.

Because the employer is no longer paying the 6.75% FICA share on the employee’s earnings, so that money can go to the employee in the form of an earnings increase.

Good one. Tell another.

Or would giving the Obama Adminisration everything it wants just create a nationalized version of Chicago with a few rich, connected elites, a middle class employed by the government, and a large number of poor third world immigrants?

Have you ever even been to Chicago? It’s not Pyongyang. But what do I know? I’m just a member of the Chicago middle class not employed by the government. Superdemented says I don’t exist! My siblings and I are disappearing from this old photo! I better play this song so Mom and Dad kiss and we can still have capitalism in Chicago in the future!

@mantis: Well, I need to correct what I wrote, because FICA is now 15.3% shared equally between employer and employee. So the employee’s share is 7.65% meaning that the 9% sales tax would only increase the tax for employees by 1.35%.

As for your snark about employers, if your opinion is that corporations will always cheat their employees over compensation, there’s not much I can do to convince you otherwise, so I won’t bother.

No! Herman Cain is against a VAT and for a NST!

What is a national sales tax (NST)? It is a tax that is paid by a customer when they purchase a retail item.

A VAT is a tax that is applied to a product at each stage of the production process.

Today, because of the way our tax system is configured, 22% of the retail price of any item purchased is due to hidden taxes embedded into the price

Business Income taxes are applied to a product at each stage of the production process

Income taxes are a VAT.

Cain’s proposal ends the hidden VAT (income tax), and replaces it with a visible, in-your-face NST.

A National Sales Tax is a discretionary tax. The family can elect to pay it or not to pay it. The limits to our spending will be clearly quantified as a 9% national sales tax + ~5% local sales tax at the checkout line.

If we don’t spend it we save it, tax free! Wealth retention (savings) is a good thing!

In the original article cited in the one he quoted, Cain said he was against a VAT. He than says at the end of that article he is for a flat national sales tax.

@mantis:

The Chicago public schools are 9% white and with 70% of the students on free or reduced lunch program (that is, poor). Where do all of the middle class white live in Chicago. Unless you give me a zip code or neighborhood name, it is hard to disprove you concerning the absence of middle class whites living inside the City limits of Chicago.

Chicago survives by shaking down the commuters who pay taxes but have no say. What is why David Axelrod wants to put the the upper middle class whites in the U.S. into the economic niche of suburbaniates in Chicago: taxpayer who have no say.

The Chicago public schools are 9% white and with 70% of the students on free or reduced lunch program (that is, poor).

Chicago has many, many private schools as well. You can pretend they don’t exist, but they do.

Where do all of the middle class white live in Chicago.

Only whites count as middle class? What about middle class blacks, latinos, etc.? Oh right, I forgot to whom I was talking.

In any case, middle class folks live in the south, west, and north sides of the city (i.e. all over).

Unless you give me a zip code or neighborhood name, it is hard to disprove you concerning the absence of middle class whites living inside the City limits of Chicago.

Again with the whites. You claimed the middle class in Chicago are all employed by the government. I noted this was false. Now all you can talk about is middle class whites, and how they don’t exist. They do. I’m one of them. I don’t work for the government. You’re a racist idiot.

Chicago survives by shaking down the commuters who pay taxes but have no say.

Every city has commuters from the burbs who pay some forms of taxes in the city where they work. It’s not unique to Chicago, or the United States.

What is why David Axelrod wants to put the the upper middle class whites in the U.S. into the economic niche of suburbaniates in Chicago: taxpayer who have no say.

Again, I’m middle class, white, and live in the city. You’re a racist idiot. GFYAD.

@mantis:

The number of students attending catholic schools has also been doing down. It takes real money to get a college prep education if you are living in Chicago.

the single biggest employer in Chicago is the federal government, followed by Cook County, the City of Chicago, the Chicago public schools, and the Chicago transit authority. The largest private sector employers have moved into the suburbs.

Many states do not have commuter taxes. DC does not get to tax commuters other than sales taxes Chicago has been losing population for forty years. If one is not connected, why live in such a corrupt city?