What Lies Past October 17th? A Big Unknown, And That’s The Problem

If Congress isn't able to reach a deal, the big problem going forward would be uncertainty.

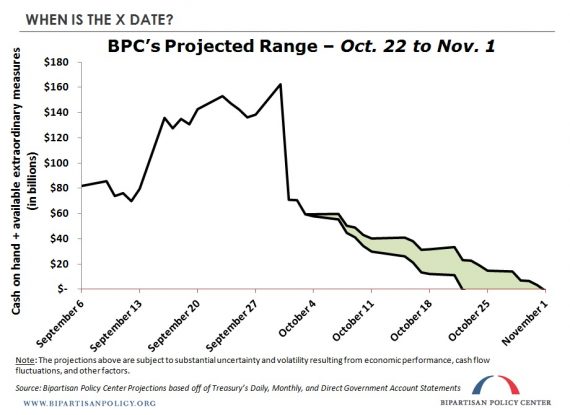

Tomorrow, October 17th, is the date that the media is focusing on in connection with the debt ceiling largely because that is the date that the Treasury Department has stated the United States will officially run out of the authority to borrow money and will have to rely solely on cash-on-hand and cash receipts to finance the bills that will coming due in the ensuing weeks, including everything from financing the National Debt to paying Social Security benefits, salaries, and government contractors. In reality, though, the real question is when the Treasury Department actually might run out of cash, because that won’t necessarily happen on Thursday. One calculation from the BiPartisan Policy Center puts the date somewhere between October 22nd and November 1st:

Updated data on Treasury cash flows through the first week of October show that the range for the Bipartisan Policy Center’s (BPC) X Date – the date on which the United States will be unable to meet all of its financial obligations in full and on time – has narrowed to between October 22 and November 1. The updated range is consistent with BPC’s earlier estimate.

No one can predict with absolute certainty the date and time when Treasury will have exhausted all its extraordinary measures and run out of cash on hand. Therefore, policymakers should not assume that they have until October 22 to make decisions concerning the federal debt ceiling. In all likelihood, markets will begin to demand higher interest rates to bid on and hold United States debt. In fact, this behavior is already apparent in short-term Treasury debt interest rates. The U.S. Treasury will roll over at least $302 billion in outstanding federal debt between October 15 and October 31; $120 billion of debt is scheduled to mature on October 17.

Here’s one chart showing the expected cash flow situation over the remainder of October:

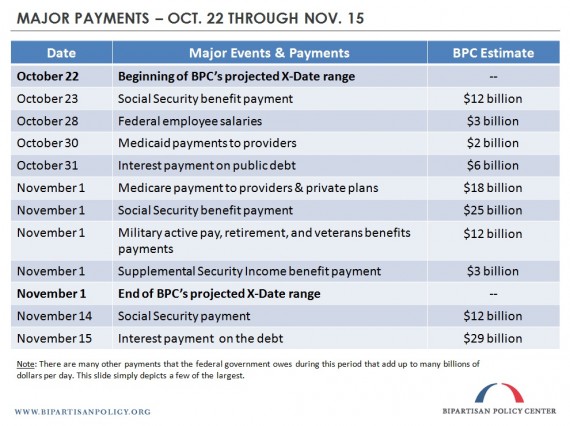

And, as this table shows, there are a whole host of obligations coming up during that time period:

Now, obviously, there will be cash coming into the government during this time period, although we can’t be sure how much, so it’s not at all clear at one point we might reach the point where there is literally no money in Uncle Sam’s bank accounts and, as the report notes, that uncertainty actually makes the situation more dangerous.

Moreover, as I’ve explained before, even if we manage to keep being able to service the debt, there’s still going to be a serious problem:

Interest obligations on the national debt and paying off redeemed bonds is only one of the many payments that the Treasury Department is required to make on a regular basis. In addition to those payments, there’s everything from salaries for Federal Employees, Social Security payments to beneficiaries, Medicare payments to providers, obligations owed to contractors who have provided services and supplies to the Federal Government, and any number of other obligations that the Federal Government owes that come up on a regular basis. As a simple matter of mathematics, it is quite often the case that the money that the Federal Government owes under all of these obligations is more than the amount of revenue (from tax payments and other sources) that comes into Federal coffers. Under ordinary procedures this isn’t a problem because the Treasury Department regularly floats new bonds to cover ongoing obligations.

If the debt ceiling is not raised, the Treasury Department’s authority to issue new debt to cover these already-incurred obligations would would be in serious legal doubt to say the least. Some have argued that the provision of the 14th Amendment which states that the public debt of the United States “shall not be questioned,” authorizes the President to order Treasury to issue new debt. However, as I noted in two posts that examined the issue (see here and here), that issue is by no means settled and it would appear that the most this provision would authorize Treasury to do is to issue sufficient new debt to ensure that it can meet its obligations to pay existing debt, not that it could issue new debt to cover obligations that don’t fall under the category of “public debt.” Furthermore, even if that interpretation of the law is correct, it would still have the potential to create vast legal uncertainty about the validity of any debt obligations issued after the debt ceiling is breached. For financial markets, uncertainty like that would be nearly as bad as an actual default.

So, that leaves us with the probability that tens of thousands of Federal obligations that don’t fall under the “sovereign debt” category would go unpaid if the nation went along for an extended period of time without raising the debt ceiling. That means, potentially, Social Security and pension recipients not being paid, Federal employees not being paid or being paid late, and Federal contractors and suppliers not being paid. For better or worse, the Treasury Department will be forced to make choices about who gets paid and who doesn’t, and those who don’t get paid are going to suffer real economic harm even if it just means that there is a delay in receipt of payment. The economic implications of this should be blindingly obvious.

You would think that a political party that claims to pride itself on its economic prowess would understand these things.

The Tea Party folks have been telling us this is all no big deal. We’re just cutting up the family credit card. I assume they have a solid understanding of the economics involved. They’re geniuses.

To recap the last half-dozen threads: That party does not exist anymore.

Doug, I am not sure but I think I am a little older than you, and I have to say that in my voting life (1976 on) nothing, and I mean absolutely nothing the GOP has ever done made me think they had any economic prowess whatsoever. I would have thought Bush II would have curbed you of any such delusions.

Seriously…have you ever seen one of the major political parties f’ up this badly?

They’ve caused massive turmoil…and gotten absolutely nothing for it.

Their polling is dropping off the side of the table.

Their leaders have shown themselves to be weak and ineffective; and they have made it perfectly clear that the inmates are indeed running the asylum.

They have had their a$$ kicked by the very person they constantly call incompetent, and the Affirmative Action President.

I mean…if you step back…this is amazing, really.

Oh wait…the same party invaded and occupied Iraq for no reason…and empowered Iran in the process.

I forgot…my bad…

The irony of it all is that the GOP were constantly blaming the President for causing uncertainty when all they have done is create severe uncertainty while agreeing to kick the can down the road which ensures more uncertainty!

Punt the Social security and Medicare payments. The only way we’re going to get rid of these idiots is if they get angry letter after angry letter from their pasty white old constituents about Not Getting My Medicare and Where Are My Social Security Payments?

At that point, anyone who says anything about the National Debt will be throttled.

Exactly.

Do you know why these tea party clowns can’t be trusted to govern, and should be ignored? It’s not just that they’re arrogant. It’s not just that they’re hateful. It’s not just that they put party before country. It’s not just that they’re dishonest. It’s not just that they are radical and extreme.

Here’s the reason that overwhelms all the other reasons: they’re frigging stupid. Intensely, deeply, profoundly so. Josh Barro has the best summary of the entire situation (link):

And here’s one of the many signs of how stupidly stupid they are: for years they have made a fetish out of stupidly describing Obama as a stupid community organizer. So now the allegedly stupid community organizer has outsmarted them, again, and all he had to do was essentially nothing.

These people are failures. They are losers. They need to sit down and shut the hell up.

Did you see Lindsay Graham’s latest? It’s a real peach.

He admits to “overreach” and then claims that if/when the Dems do, the Republicans would “give a little” for the good of the country. Utter, complete bullshit. “Pay us some ransom, because we picked a fight we couldn’t win and played with fire and… well, someday you might be in our shoes.”

If the Democratic Party ever finds itself in a position like this, it will deserve embarrassing capitulation as its reward. Of coursethat’s just a hypothetical. Here and now it’s the GOP that lept off the building (because you’re the goddamned Batman!) and wants the Dems to catch them. Babies.

And keep in mind…while all this pointless, wasteful, silly political theater is going on…Obama is working a deal on “nukular” materials with Iran.

Incompetent indeed.

Meep-meep…as Sully would say.

Actually…refer to the zany liberalism of the 60’s and 70’s and the time Democrats spent in the wilderness because of that.

The parties have simply changed roles.

The Democrats are now the adults…and the only ones who can get stuff done.

@OzarkHillbilly:

I’ve been voting since 1968. My parents were Democrats because during the depression they’d seen Republican bankers try to take my grandparents’ farms and Democratic politicians save them. Everything I’ve seen since says Republicans are still what they were in the ’30s.

Damn straight, they will.

I know that many Republicans find this hard to believe but, there are non-trivial economic consequences to leveraging an animus toward the president and his signature legislative success into a possible (let alone, actual) default. Domestic and international markets take into account political instability and a political willingness to intentionally cause instability and uncertainty. The markets will, in the short term, raise interest rates based on our willingness to entertain default. In the long-term? If we insist on going through this again in 2 to 4 months, and we will, the markets will place a negative value on that too.

To add a weird postscript to all of this, despite default being orders of magnitude worse than a shutdown, there’s been zero contingency planning guidance given. We spent a lot of time planning for the shutdown and its impacts on the school, salvaging the teaching schedule as a consequence. By contrast, we have zero idea whether we’ll be furloughed again if the debt limit hits.

A lot of people are edgy. My wife counsels a disabled vet in an ALF who’s terrified the VA disability benefit that pays for his support and the ALF won’t arrive. The poor guy has zilch savings and a host of medical issues. This guy, and your situation, multiply by 5 million.

@James Joyner: Actually, the Financial Times had a rather interesting article about that this morning. It looks like the Treasury and the Fed definitely have plans, but they’re not letting out a peep. For obvious reasons.

As the man said: “the alternative of being hanged in the morning concentrates the mind wonderfully.”

@C. Clavin: yet you sound worried for some reason? i doubt if it’s your stock portfolio- maybe you’re realizing that we’re still floating on a false economy and it’s bound to collapse- and you may not be able to blame Bush?! don’t worry, the msm has your back.

@gVOR08: yes, there’s a word for it- “shrewd”. most successful entities are shrewd as well.green is green, that’s all.