GDP Figures Show Economic Growth Slowed In Second Quarter

The GDP report shows the economy slowed in the second quarter, to the surprise of nobody.

There were already plenty of signs that the second quarter didn’t go quite so well for the U.S. economy before this morning. We had weak jobs reports in April, May, and June along with reports showing a decline in consumer spending, retail sales, corporate earnings forecasts, and a whole host of other economic statistics. Today, we got the first look at the GDP numbers for the second quarter and, as expected, it showed that the economy had slowed to a tepid rate of growth in the spring:

The United States economy grew by a tepid 1.5 percent annual rate in the second quarter, losing the momentum it had appeared to be gaining earlier this year, the government reported Friday.

Growth was held back as consumers curbed purchases and business investment slowed in the face of a global slowdown and a stronger dollar. Analysts had expected a 1.4 percent rate.

The sluggishness of the recovery makes the United States more vulnerable to trouble in Europe and increases the likelihood of more stimulus from the Federal Reserve, which has lowered its forecasts in recent weeks. It also illustrates the election-season challenge to President Obama, who must sell his economic record to voters as the recovery slows.

In part, the economy subsided after an unseasonable spurt during the warm winter, and in part it followed the pattern of the past couple of years — one of hopes raised, then dashed by wary business owners and households trying to reduce their debt.

In the first quarter, the economy grew 2 percent, according to the revised figures released Friday by the Commerce Department. Its previous estimate was 1.9 percent.

“You can’t blame all of it on Europe — we have our own problems yet,” said Joshua Shapiro, the chief United States economist at MFR Inc., a financial consulting firm. “When you have a credit bubble or asset bubble that’s popped, the recovery process from that is just really long and really painful.”

The main reason for the slowdown was a drop-off in consumer spending, combined with weakness in many other sectors of the economy:

Much of the slowdown in growth in the second quarter was caused by a softening in consumer spending as Americans eased off on automobile purchases due to tepid job and income growth.

Consumer spending, which makes up about 70 percent of U.S. economic activity, increased at a 1.5 percent rate, a step down from the 2.4 percent pace logged in the previous three months.

Consumer spending was the weakest in a year. Much of that reflected a drop in spending on long-lasting goods such as automobiles, which had buoyed consumption in the prior period.

(…)

Labor market weakness, marked by three straight months of job growth at less than 100,000 jobs per month, remains a major constraint to spending.

The economy needs to grow at a rate of between 2 percent and 2.5 percent to keep the unemployment rate stable.

Business inventories rose $66.3 billion in the last quarter, contributing nearly a third of a percentage point to GDP growth. However, with domestic demand slowing, businesses could find themselves with unwanted stock, which would hurt growth in the third quarter.

Excluding inventories, GDP rose at a 1.2 percent rate, the weakest pace since the first quarter of 2011. In the first quarter, the comparable figure was 2.4 percent.

Export growth pushed higher, despite slowing global demand, especially in Europe and China. But that was offset by a strong rise in imports. Trade subtracted almost a third of a percentage point from GDP growth.

Government spending contracted for an eighth straight quarter, but the pace of decline slowed. Defense spending fell marginally after two quarters of hefty declines.

There was no relief from state and local government spending, which has been a drag through much of the recovery. State and local government spending fell at 2.1 percent rate after dropping 2.2 percent in the first quarter.

The two areas that showed some signs of a silver lining were services, where consumer spending increased 1.9% as opposed to 1.3% the previous quarter and housing, which grew at a 9.7% pace which was good, although far below the 20.5% pace it grew in the first quarter.

The markets actually reacted slightly positively to this news given that analysts had expected GDP growth to be at 1.4%, although one has to admit that a one-tenth of a point difference isn’t anything to write home about. Indeed, As Matthew Yglesias notes, the trajectory of the economy has gone from disappointed to worse over the course of the first six months of the year, and there seems to be little indication of improvement in the near-term future. There was a final revision of the first quarter number form +1.9% to +2.0%, but again that’s not much of an improvement and, in reality, it only makes the second quarter drop look worse. Indeed since the fourth quarter of 2011, which was oddly revised from 3.0% growth to 4.1% growth, the economy has essentially hit a wall. Assuming for the moment that the revised 4Q 2011 is accurate, we went from a very healthy quarterly pace of 4.1% to 2.0% to 1.5%. By all accounts the numbers for the third and fourth quarters are likely to be no better than what we’ve seen the past six months and the revisions to the second quarter are as likely to be downward revisions as upward revisions. We can debate why until the cows come home, but the fact of the matter is that at the start of 2012, the economy hit a brick wall and it has been steadily decelerating ever since, to the chagrin of those who may be looking for jobs and, presumably, the Obama Campaign.

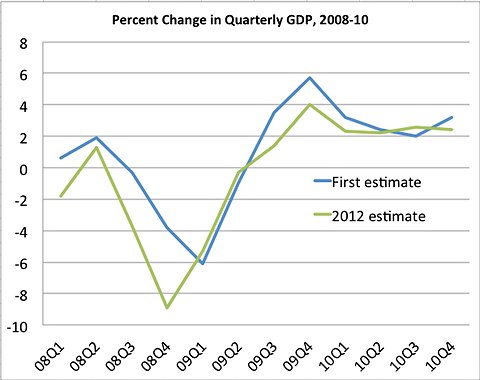

There was also some historical perspective added by today’s BEA report in the form of revisions to the GDP figures from the previous recession:

The Commerce Department also released updated estimates of economic activity for 2009, 2010 and 2011. Those figures showed that the recession was less deep than it seemed in the most recent reports — though more pronounced than in initial readings — and, as a consequence, that the pace of recovery also appears somewhat slower.

The new estimates show that economic activity fell by 3.1 percent in 2009 and then rose by 2.4 percent in 2010. The government previously reported that activity fell by 3.5 percent in 2009 before rising 3 percent in 2010. The estimated pace of growth in 2011, 1.8 percent, remained basically unchanged. It was previously reported as 1.7 percent.

The revisions, part of an annual process, reflect the imprecise nature of the agency’s work. Its initial estimates are derived from a mix of comprehensive data, samples and educated guesswork, and refined over time. In this case, officials said they had significantly underestimated spending by state and local governments in 2009, and overestimated corporate profits and purchases in 2010.

The adjustments were largely offsetting. The agency now estimates average annual growth of 0.3 percent over the three-year period, rather than 0.4 percent.

One thing that the new figures do bring to light is that large corporations did not recover from the recession as quickly as expected, and that state and local government spending did not drop off in the manner conventional wisdom holds. On that issue, the figures show that spending by state and local governments actually increased in 2009 before dropping off in the following two years. Some will think that this was the results of the 2009 stimulus, and while that would seem to make sense, the figures show that the spending increases in 2009 did not go to personnel or infrastructure. It seems more likely that states benefited to some extent in 2009 from tax revenues based on income earned in 2008, but when it came time to collect taxes in subsequent years there was a far smaller pot to draw from. Since states are generally required to balance their budgets, they had no choice but to cut spending.

The New York Times’s Economix blog puts the revised historical figures in perspective:

[T]he latest revisions also underscore that on the whole the recession was much worse, and the recovery much slower, than we understood at the time. The chart below compares the first estimate of quarterly growth, released by the Bureau of Economic Analysis one month after the end of each quarter, with the latest figures published Friday. (The numbers for 2008 were not revised Friday; the comparisons for that year are between the original estimates and the bureau’s most recent revisions, which were published last summer.)

The pattern is obvious, but it’s worth underscoring the magnitude: The changes have erased more than $800 billion from the three-year period, roughly the annual economic output of the Netherlands.

As always, the charts tell the tale:

So the recession was deeper, and the recovery has been slower, than previously believed. That really isn’t news to those of us out here in the real world where economic statistics only tell part of the story, but it’s worth keeping in mind. As far as the future goes, it seems rather obvious that the economy is going to remain weak for the remainder of 2012 at the very least. The possible political implications of that are rather easy to see, but for the people out there trying to find a job this is nothing but bad news and there doesn’t seem to be much good news ahead.

Two paragraphs at the NY Times capture it:

and

We have further global trouble(*) and the real problem is the “really long and really painful” climb out of a credit crash.

So how does one “be real” in this situation?

* -not just Europe but an Asian one as well, with Chinese growth at a three-year low

@john personna:

Yes, the developments in China have gone largely unnoticed by the American press (big shock there huh?) and there are plenty of analysts who believe that the “official” numbers we get out of Beijing aren’t entirely reliable and that the situation there may actually be worse than the trend reveals.

@Doug Mataconis:

I’m sure their numbers are completely fictional, though also somewhat reliable.

Good blog post. Thorough and sentient. Something you rarely see on the Internet.

It is in fact gruesome out there. FWIW, we barely go a week without a customer or two shutting their doors or filing BK. With rare exceptions these are small, mom & pop-style businesses.

An ancillary part of what we do is to invest in commercial real estate. In that regard we’re seeing REO anchored shopping centers with 50% vacancy rates. We’re seeing major supermarkets like Vons and Ralph’s simply give up, pull up stakes, and bail out of locations entirely, despite having to pay six or even seven-figure early termination fees. Granted, we’re seeing these things in California and Nevada, which especially have been hard hit, but still when grocery stores are having trouble making ends meet the inescapable conclusion is that the economy truly is fubar.

I’m glad this gem of a quote was featured:

I’m always amazed by the disconnect between the commentariat’s analysts and the real world, but never moreso than on economic and financial matters. You didn’t need a fancy degree nor a complex statistical measuring model to know the “recovery” was smoke and mirrors. All one needed to do was to have opened one’s eyes.

Lastly, regarding the pure politics of all this, the implications are obvious, but for my money they’re not dispositive. I don’t believe GDP rates flip elections. I believe layoffs and net job growth flip elections. If the election were next Tuesday I suspect Obama would eke out a very narrow win. If however the job market further deteriorates between now and November then I suspect it’ll simply be too much for Team Obama to overcome.

@Tsar Nicholas:

Have you really internalized “the recession was much worse, and the recovery much slower, than we understood at the time?”

I’m pretty sure I understood that it was very bad at the time, and for that reason I’m happy that we had upward motion at all. The “worst since the great depression” really could have been “GDII”

That isn’t smoke and mirrors.

If we had sensible people in Congress , we would already be legislating a new round of the fiscal stimulus. Unfortunately with the Tea Party morons ascendant in the House ( and their many right wing ideologues ascendant in the conservative press) we have no hope of passing such a stimulus.

Meanwhile, what is China doing?

Presumably, China hasn’t heard the Tea Party gospel that whats needed in a recession is to cut back sharply on government spending and to reduce the deficit ( since that worked so well 1929-33). China responded to the 2008 recession with a big stimulus too-and boomed.

@stonetools:

“Presumably, China hasn’t heard the Tea Party gospel that whats needed in a recession is to cut back sharply on government spending and to reduce the deficit ( since that worked so well 1929-33). China responded to the 2008 recession with a big stimulus too-and boomed.”

And the countries in Europe which went the austerity route are in their second or third recessions. Poor as 1.5% growth is, it’s better than the vast majority of OECD

Just as the turnaround in the US real estate market has gone unnoticed by OTB…

@anjin-san:

Yeah, that housing market is just smokin ain’t it?

http://www.zerohedge.com/articles/node/node/article/www.newyorkfed.org/research/staff_reports/images%7Clast_scored_timestamp%3A1343259935%7Clast_scraped_timestamp%3A1343259935%7Clast_scored_timestamp%3A1343292148%7Clast_scraped_timestamp%3A1343292147?page=6

@Drew:

The link button isn’t that hard. Double click on a word to highlight it, click “link”, paste in the URL, click OK

If you have more disciple than me you can hit “preview” every time, rather than just some of the time. Then you can right-click your link and “open in new tab.”

(If you are on a phone I understand the difficulty. Doing links from Android is a PITA.)

Oe more time: this is the economic policy you want, Doug. Local and state governments have been cutting. The Feds have been largely holding the line.

I’m not sure what “conventional wisdom” you’re talking about here. In greater Wingnuttia, government spending is always exploding upward. In the reality based community, it is understood that from 2010-present the local & state governments have been doing their “50 little Hoovers” thing, and the federal stimulus ran out. The only info that is “news” to me is that the reason they basically held the line in ’09 is tax revenue from ’08 earnings, instead of Stimulus money plugging holes (though I clearly recall my town using Stimulus funds to plug a hole, so I suspect it’s not either/or, rather a question of which effect was dominant).

Household debt overhang + high, persistent unemployment = low consumer demand. Governmental policy is acting to reinforce this (or, at the least, not acting to counter it) and, thus, the recovery sucks.

This is not hard to figure out. Unless you have ideological blinders on, I guess.

Tax Cuts, Spending Cuts and a pony are all we need to fix the economy – Doug Mataconis/Generic Republican

Changes in GDP since 2009

h/t Balloon Juice

@Drew: Man, half that link flowed right off my monitor and dripped on my desk.

Good to see the Times and professional know-nothings like Yglesias catching up with those of us who, right on this here blogs, projected this outcome for the second quarter months ago. MMT has provided a solid and robust framework with excellent predictive power, and being right again and again should count for something. Recall that earlier this year the Times was reporting projected growth in the 3-4% range, yet no followup on how inaccurate the CBO/Fed projections turned out.

You don’t have to be brilliant to understand how the system works, all that’s required is effort and a willingness to throw out economic and political dogma.

FWIW, on the housing thing, I remember reading Calculated Risk and etc. in 2009. They were saying they expected a 2012 turn. And so when people asked me I’d say the same thing. That people (inc. again CR) are now saying this is a turn makes the old predictions look good … but that doesn’t mean anything will turn on a dime. This was a 4 year down-trend, more or less.

@Rob in CT:

On what Doug wants versus what we are getting,

Ritholtz: Spot the socialists

@john personna: We’ve got a real big-government president:

http://moslereconomics.com/2012/07/08/public-employment-by-president/

@Ben Wolf:

Yeah, basically the same data series, but without the census adjustment

I think seasonal adjustments are affecting the interpretation of the numbers, certainly in the jobs market; and by default probably every economic indicator (though not sure) -the fact is the markets are creating and losing millions of jobs. If we flatten the last 3Q – the growth average is 2.5%-which is not bad. I wonder what impact the short buyers in the stock market who are taking a bath and losing tens of billions will have in the economy (self fulfilling prophecy?).