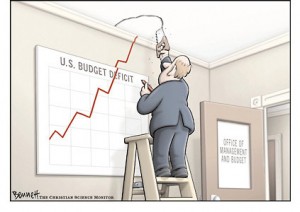

How Would I Solve the Deficit

Here's my plan for creating a budget surplus of $126 billion by 2015 and $592 billion by 2030.

Doug found a nifty toy over at the New York Times that allows the user to fiddle with various spending and tax programs to try and reduce the deficit. The first thing I wanted to see is what if I do everything but Social Security and Medicare, could the budget be balanced? The answer is yes, but it entails some fairly substantial increases in taxes and in the end you only delay the problem with Medicare. Or to put it another way, you’d better select the option that generates the largest revenue gain/spending cut in other areas because the surplus you generate will be necessary to pay for Medicare out past 2030. Such a program would be rather draconian, but the Medicare imbalance is huge.

Doug found a nifty toy over at the New York Times that allows the user to fiddle with various spending and tax programs to try and reduce the deficit. The first thing I wanted to see is what if I do everything but Social Security and Medicare, could the budget be balanced? The answer is yes, but it entails some fairly substantial increases in taxes and in the end you only delay the problem with Medicare. Or to put it another way, you’d better select the option that generates the largest revenue gain/spending cut in other areas because the surplus you generate will be necessary to pay for Medicare out past 2030. Such a program would be rather draconian, but the Medicare imbalance is huge.

Focusing just on the short term and trying to reduce the Medicare problem going forward though would allow for a somewhat less draconian spending cuts and tax increases for areas other than Medicare. Here is how it would look:

Foreign and Domestic Spending:

- Cut foreign aid in half

- Eliminate earmarks

- Eliminate farm subsidies

- Cut pay of civilian federal workers by 5 percent

- Other cuts to the federal government

- Cut aid to states by 5 percent

Military:

- Reduce nuclear arsenal and space spending

- Reduce military to pre-Iraq War size and further reduce troops in Asia and Europe

- Reduce the number of troops in Iraq and Afghanistan to 30,000 by 2013

Health Care and Medicare:

- Enact medical malpractice reform

- Increase the Medicare eligibility age to 70

- Reduce the tax break for employer-provided health insurance

- Cap Medicare growth starting in 2013

Social Secuirty:

- Raise the Social Security retirement age to 70

- Reduce Social Security benefits for those with high incomes

Taxes:

- The Lincoln-Kyl proposal

- Allow expiration for income above $250,000 a year

- Payroll tax: Subject some incomes above $106,000 to tax

- Eliminate loopholes, reduce rates (Bowles-Simpson plan)

In the end the budget deficit in 2015 would actually be a surplus of $126 billion and by 2030 there would be a surplus would be $592 billion.

Now before anyone thinks that this is great that we could not make some of these changes, I have to stress again that Medicare poses a very serious fiscal problem and that simply having balanced budgets in 2015 or 2030 might not be enough to address the problem. Hopefully some of the changes above would help “bend the cost curve down”. Such as the reduction in tax breaks for employer provided health insurance. Right now the growth rate for this tax break is the growth in health care costs. This strikes me as sort of self-fulfilling prophecy. This kind of policy ensures that more and more resources are devoted towards health care which given that resources are finite makes such a demand harder and harder to fill and driving up prices. This in turn would necessitate a tax break over and above economic growth in the following year. Hopefully by breaking the cycle it would slow the growth rate in health care costs.

I’m also not opposed to some of the other proposals, but I didn’t like how they were implemented. For example, I’d go for a carbon tax, but I’d like to see it replace or reduce the payroll tax. To the extent that it makes the labor market more efficient (i.e. more workers are hired) and lets people keep more of their take home pay all the better. And to the extent that it reduces carbon emissions, promotes fuel conservation and makes fuel alternatives look more attractive again, all the better. But such an option was not allowed so I didn’t select it.

I’d also go for some sort of national sales tax, or value added tax so long as it was revenue neutral. Right now income taxes distort the labor markets. The tax wedge that income taxes drive between the supply and demand curves reduces the number of workers that would be employed. So by switching to a value added tax we might be able to increase the number of workers while still raising the same amount of revenue.

As Doug implied, if politics were a rational process then we’d likely have very different institutions and tax/fiscal structures than we do. Many economists would prefer a consumption/value added tax over the income tax that we currently have. We wouldn’t have so many states in trouble with defined benefits pension plans and instead would have defined contribution plans. Instead politics is non-rational (i.e. it isn’t about picking the best or even a better outcome) and we get the mess we currently have. So much of the above is really just not feasible. Personally, I see our current situation as one that is unalterable. We’ll stay on this unsustainable path until we can no longer sustain it and go off the rails.

Would you go along with cuts to the National Science Foundation, or, in general, cuts to federal funding of basic research?

The problem with the NYT toy is that it offers spending cuts within the constraints of the liberal’s imagination. They don’t envision (or regard as kooky) the kind of serious cuts in mandatory spending necessary to balance the budget, whether long term or short term. The goal of this toy is to make readers think (not incorrectly) that balancing the budget is harder than they think, but in order to ensure that the reader gets that impression, they stack the deck. I’d like to see options for eliminating medicare/medicaid entirely, not just tinkering with them. And I suspect that the absence of options like that is because it would encourage too many people to see how dramatic an effect that has on the picture.

Simon’s right. For instance, if we simply executed everyone who turned 65 without at least half a million in the bank we’d save a fortune, but those commielibs wouldn’t let us even consider that notion, while all real Americans here in Galt’s Gulch are in favor of it.

“I’d like to see options for eliminating medicare/medicaid entirely, not just tinkering with them.”

Why put something in there that has less than zero possibility of ever, ever being offered up for serious consideration? I don’t doubt that the elimination of those programs would have a dramatic effect on the budget, but we can all come up with other eliminations that would have similar dramatic effects. The problem is, they’re all political nonstarters.

Steve, I’m surprised that you didn’t reduce the mortgage interest deduction. The description is somewhat ambiguous, but I assume they are talking about an aspect of the Wyden-Gregg tax reform that eliminates the decision for second houses, home equity loans and caps the mortgage at $500k.

You mean like limiting Medicare growth to GDP+1% (by my reckoning probably 3-4% for the foreseeable future)? Year-on-year increases in Medicare spending haven’t gone below 5% in more than 15 years.

Sam, if we could balance the budget by cutting unpopular programs, it would have been done by now. Look at the charts on page four of this; long term, medicare and Medicaid are the problem. Conceding this mathematical reality—no matter how politically unpalatable—is the admission price to be taken seriously in this debate.

I could accept pretty much any of these proposals. Perhaps my accommodation is shaped by my suspicion that we won’t have than many options in practice. We’ll be lucky if one quasi-workable plan approaches a vote.

A can say now, I’m for it 😉

Steve’s list yields a budget surplus of 126b in 2015. Lets look at his list of domestic and foreign spending:

* Cut foreign aid in half – 17b

* Eliminate earmarks -14b

* Eliminate farm subsidies – 14b

* Cut pay of civilian federal workers by 5 percent – 14b

* Other cuts to the federal government – 30b

* Cut aid to states by 5 percent – 29b

For a total of cuts in this category of 118b

In other words, you could decline to make all of these cuts and still end up with a budget surplus of 6b.

Now I had cutting farm subsidies on my list, but the others seem really ill-advised. Cutting foreign aid in half is, as shown here, utterly unnecessary, and really foolish, given that it comes with a decline in our influence, and our power in the world. Cutting pay of federal workers is unfair, unnecessary and damaging to the demand side of our economy. The “other cuts” are even worse – cutting into scientific research, our parks and museums, and energy research. Cutting aid to states is pointless. At best it merely shifts the taxation to the state level, at worst it will severely impact the most needy, since lots of this money goes for poverty, education, and public safety.

None of these cuts are necessary in order to achieve a balanced budget – and so their inclusion is to make an ideological point, not to actually balance the budget.

ooops, a total budget surplus of 8b, not 6b, if we dont do those cuts,,,,

Simon is right. NYT toy is constrained by its liberal’s imagination. About like someone setting up a computer model where you have to use their numbers, formulas and assumptions.

I like the idea of freezing most government spending at 2007 or 2008 levels. Cut some programs and keep the increases in others to a minimum. Besides getting the ever increasing spending under control, we need to create a business friendly environment that will get the economy booming again. Make other countries businesses play on a level playing field with U.S. businesses. Another area which would be great help to our economy is allowing the exploitation (no it is not a bad word) of U.S. assets especially in the energy area.

Do those things and we will have a surplus in short-order.

JP: “I could accept pretty much any of these proposals. Perhaps my accommodation is shaped by my suspicion that we won’t have . . . many options in practice. We’ll be lucky if one quasi-workable plan approaches a vote.

A[ll I] can say now, I’m for it ;-)”

Me too.

All I can say is we have to make difficult choices. I am unlikely to agree with you on what those choices should be be, but the need for them is indeniable.

We are f***ed.

Wayne: Make other countries businesses play on a level playing field with U.S. businesses.

Great idea: Eliminate corporate income taxes

Tano: Cutting pay of federal workers is unfair, unnecessary and damaging to the demand side of our economy.

You must work for the federal govt. There is so much waste, duplication, over pay, etc. in the Federal govt that this should be the first place to start. Let the states assume many of the tasks done by the feds. The demand side of the economy? You are certifiably obtuse. Federal workers produce NOTHING and are paid outrageous salaries. If you want to stimulate demand, send $1 million dollars to every tax payer. More jobs would be produced, more debts paid down and more charity dispersed than paying bureaucratic functionaries the 6 figure salaries they undeservedly receive.

On that we agree tom p.

Tano,

Yes, but the idea of putting that spending back in ignores the longer term problems associated with Medicare and to a considerably lesser degree Social Security. We’ll need those surpluses to fund those two things into the future. Unless of course you are willing to look at other cost containment options for those two programs.

I already addressed that in my post, but I know it is much more fun to put words in other people’s mouths. Keep up that principled position.

> we need to create a business friendly environment

Guess you have not noticed that corporate profits are at the highest level in decades…

“…Yes, but the idea of putting that spending back in ignores the longer term problems associated with Medicare and to a considerably lesser degree Social Security”

Hows that? My comment to you had nothing whatsoever to do with Medicare and SS. I posted my set of cuts and taxes in the original thread- I had only the farm subsidies cut from the category I discussed in this thread – and I was able to balance the budget for 2015 and 2030.

Here, I will post it again.

“35% from tax increases, 65% from spending cuts.

Eliminate farm subsidies.

Reduce nuclear arsenal to 1050 warheads etc.

Cancel or Delay some Weapons programs

Reduce troops in Iraq/Afghan to 60K by 2015

Malpractice reform

Reduce tax break for employer-provided health insurance

Cap Medicare growth starting in 2013

Tighten eligibility for disability

Alternate method for calculating inflation

Obama’s Estate Tax proposal

Obama’s Cap Gain proposal

Expire Bush Tax Cuts over 250K

Surtax on income over 1 million

Simspon Bowles plan to eliminate loopholes etc.

Thats a 6 billion surplus in 2015, and 149 billion by 2030.”

As you can see Steve, none of those foolish cuts to important spending, and neither is there any need to raise the retirement age or the Medicare eligibility age (both of which seem popular with commenters here, but are small potatoes for the budget with huge negative consequences in people’s lives).

On the Econ beat, I was surprised to wake up this morning to reports that the Fed was hampered by conservative criticism of QE2.

Reading further, I found this very good overview by John Mauldin:

Interesting stuff. You may recall that I made a “call” that we were on the Japanese path some time ago. My reading of the vibe then was that Beranke saw mild and persistent deflation, without serious risk of “spirals” and had accepted it.

If QE2 had been serious it might have proven me wrong, but if it is just a “sortie” then maybe not.

Please spare me your claims of ideology after writing something like that. Medicare is so out of imbalance that merely balancing the budget will not work.

sigh

Well you see Medicare is wildly out of imbalance, so much so that we are talking tens of trillions of dollars. Medicare alone is sufficient to gobble up almost the entire federal budget or nearly so, IIRC. In a sense, any surpluses we can build up between now and 2030 are already spent.

Congratulations, you’ve solved the problem of the deficits in 2015 and 2030, but you haven’t addressed the issue with regards to Medicare. Where are you going to find the other $40 trillion or so needed for that?

By raising the retirement age you at least take some steps towards that issue. Is it enough? I don’t know the web tool can’t answer that, but the liberal mantra of leaving Medicare and Social Security virtually untouched simply isn’t an option.

I know you think this is my minarchist kookiness coming through, but I think you’ll find that someone much more in the center such as Dave Schuler would agree with me. You might want to head over to his site and read up on his take on Medicare, the fiscal situation and so forth.

And yeah, the web tools introduction of the eligibility age changes is a bit problematic. I’d be willing to go with a slight budget deficit in 2015 with a gradual phase in of eligibility increases. Obviously someone who is 60 today seeing the eligibility age going up to 70 is going to be problematic. Of course, why should such people be exempt for sharing the pain. Fixing our fiscal situation is going to be painful. Trying to minimize any single groups pain is reasonable, but exempting one of the largest demographics strikes me as foolish.

BTW I find this position of yours curious. You seem either unaware of the fiscal problems Medicare poses over the coming decades. Tens of trillions of dollars. Yet I’m pretty sure you are very concerned about global warmings impact in the coming decades. Your disconnect seems rather…odd.

We must be in excellent shape if the Medicare is wlidly out of imbalance …