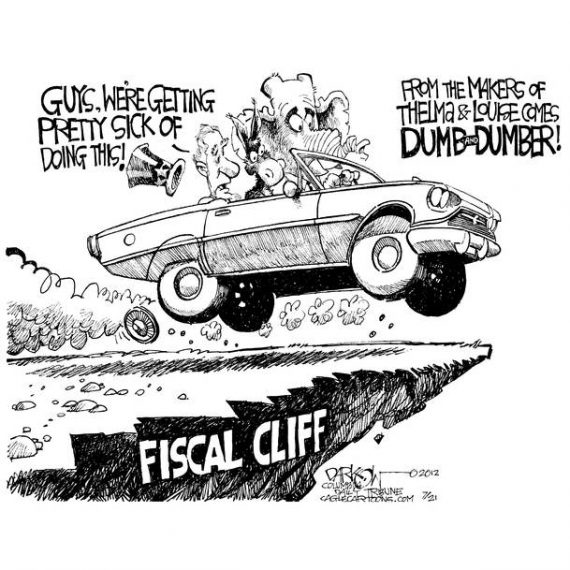

McConnell Not Willing to Raise Taxes to Avoid Fiscal Cliff

Obama thinks he has a mandate to raise taxes on high earners. Republicans think they have a mandate to stop him.

Senate Minority Leader Mitch McConnell insists that he will not agree to higher taxes to avoid the fiscal cliff.

WSJ (“Mitch McConnell: ‘We Have a Voter Mandate Not to Raise Taxes’“):

“Let me put it very clearly,” says the five-term Republican senator from Kentucky. “I am not willing to raise taxes to turn off the sequester. Period.” On Jan. 1, Washington faces both a huge tax increase and an automatic spending cut known as the “sequester,” which could tip the economy back into recession. A newly emboldened President Obama is likely to take his soak-the-rich case straight to the people, I remind the senator. The political pressure to capitulate could become intense.

“Look, he may think it would be helpful to his presidency to continue to divide and demonize us,” says Mr. McConnell. “But my answer will still be short and firm: No. We won’t agree to any tax increases that will hurt the economy.”

This isn’t to say that next week, when the lame-duck congressional session begins to negotiate some kind of budget solution, taxes are off the table. Mr. McConnell is a realist. Republicans are willing to be “flexible” on raising revenues but, he hastens to add, only “in the context of broad-based, comprehensive tax reform.” He’s open to prying more out of the rich by closing tax loopholes. But he and his caucus of 45 Republicans want lower, not higher, rates.

Two years ago, Mr. McConnell notes, Mr. Obama agreed to extend all the Bush-era tax cuts for two years. The president’s explanation for doing so was that raising taxes would harm the economy. “That logic still stands,” the senator says. “The economy’s actually growing slower now than it was then.”

[…]

So how should the president prevent another gridlocked negotiation that ends in a fiscal-cliff leap? The smart way forward, Mr. McConnell says, “is pretty simple. Let’s extend the current rates for another year for everyone—a bridge—and get busy working on the comprehensive tax reform that we need to do. There’s bipartisan support for that.”

[…]

“Until we adjust the entitlement programs to fit the demographics of today’s America, you can’t fix the problem. You can’t tax your way out of it. You can’t cut health-care providers as a way out of it. But Democrats laughed at those ideas even when we offered a quarter-trillion of higher revenues largely taken from high-income people.”

[…]

What kind of a deal would Mr. McConnell accept? The senator’s top priority is long-term entitlement reform. “Changing the eligibility for entitlements is the only thing that can possibly fix the country long term.” He wants means-testing for programs like Medicare. “Warren Buffett’s always complaining about not paying enough in taxes,” he says. “What really irritates me is I’m paying for his Medicare.”

The senator will also press for the Medicaid reforms, such as block-granting money to the states, that are part of Rep. Paul Ryan’s budget. But Mr. McConnell doubts that Democrats would ever go for the Ryan idea for Medicare premium support, allowing seniors to shop around for their preferred health-insurance plan.

The $16 trillion question: How much is Mr. McConnell willing to give on taxes in exchange for those entitlement reforms? “The country doesn’t need a tax increase; we have a spending problem. But they control a big part of the government and they insist on taxes. I’d be willing to pay the ransom [of higher taxes] if I thought we were going to get the hostage out.” By that he means every dollar of taxes would have to be matched by a dollar of entitlement savings.

[…]

But don’t Messrs. Obama and Reid think they’ve just been given a mandate to raise those tax rates? “Yes, well, we Republicans in the House and Senate think we have a voter mandate not to raise taxes.”

Now, this is a perfectly sensible starting point for negotiations. It would be foolish to concede the main issue in a newspaper interview before the other side agrees to give something up, too. While President Obama reasonably thinks he has a mandate to raise taxes on high earners, since it was after all one of the main points of contention in a campaign he just won, McConnell is right, too, that the Republicans have just as much claim to a mandate to fight such tax increases from their electorates.

But McConnell is not negotiating from a position of strength here. To be sure, the Republicans aren’t without leverage, controlling as they do the House and enough seats in the Senate to wage a filibuster. There’s a wee problem, though: Obama doesn’t need their votes to raise taxes. The Bush tax cuts expire, in their entirety, on January 1 unless and alternate deal is put in place.

Obama would ostensibly prefer to make the Bush tax cuts on income under $250,000 permanent, while reverting to the Clinton era rates for earnings above that threshold. But he might be just as happy to go back to the Clinton rates, period, if he can blame hiking rates on the middle class on Republicans.

For that matter, the poison pill of sequestration is an impending reality, too. Recall that it was put into the debt ceiling deal precisely to force compromise down the road. The massive cuts in defense and entitlements were designed to be so objectionable to both sides that allowing them to go into effect would be unthinkable. But, in fact, they were unable to reach a deal by the original deadline.

There’s been a lot of talk from the far right of the Republican base that going off the fiscal cliff wouldn’t be such a bad thing, since it would in fact massively cut spending. I haven’t heard the same thing coming from the Democrats. But I wonder if they wouldn’t be happy with an automatic tax increase and huge cuts in defense–again, especially if they can blame Republicans.

In terms of what’s good for the country, though, McConnell is right on one thing, at least: we need comprehensive tax and entitlement reform, not simply willy nilly cuts at the margins. It might be possible to get some means testing, modest increases in the age threshold, and a radical reduction in corporate welfare and other tax loopholes in exchange for a token increase in the top marginal rate. Rather than targeting $250,000, a number that even many Democrats on the coasts consider merely middle class, why not just make the number $1 million instead? At that level, almost everyone agrees that we’re talking about extraordinarily wealthy people and it gets all of the super wealthy–the Warren Buffetts of the world.

That’s an awfully ambitious deal, though, and we’re running out of time. In theory, it would make sense to kick the can down the road—passing a law extending the Bush tax cuts and avoiding sequestration for six months—to give some breathing room. But the recent history would seem to indicate that we won’t get serious about negotiations until the deadline approaches. So, the question remains: do both sides want to avoid the fiscal cliff enough to make major concessions on core issues? If I had to bet, I’d say no.

My God where do I start?

Number 1 – The republican electorate does not give them a mandate because their electorate is in the minority – by a landslide!

Number 2 – Romney ran on these same policies and LOSS.

Number 3 – Republicans are now asking for sweeping tax reform 1 and a half months away from a deadline to act – does not sound like they are taking this seriously. If they are, their solution is to kick the can down the road so as to give them time to work out such a deal – which leads me to my next point;

Number 4 – As a short term solution, the republicans want to kick the can down the road to allow time to work out a deal. I would not be so cynical if these same republicans were not blaming President Obama for his “imposing” policies that lead to uncertainty resulting in a sluggishly growing economy. Kicking the can down the road results in more time of uncertainty. Even a six month delay on these decisions would impose enough uncertainty on the economy to keep it from growing the way that it should by the time the 2014 election cycle comes around. I can bet you any amount of money that that is what will be motivating republicans to do nothing again.

The republicans problem are that they are between a rock and a hard place right now and they are desperately trying to shimmy their way out of it. They do NOT have a mandate and kicking the can down the road is clearly bad for the economy. So the President provides his short term solution of allowing the bush tax cuts to be extended for more than 90% of Americans and small businesses (including or course, the middle class) – a short term solution everyone can agree on. And oh by the way, that action would remove the majority of the uncertainty that currently plagues this economy.

So what can conservatives do? Any action (or inaction) against the President’s short term option clearly means they are holding the middle class hostage! Something they have shown a propensity to do during the debt ceiling discussions, only then, their “number one goal was to make President Obama a one term President”!

Conveniently ignoring history, senator? How your party brought us debt ceiling chicken, and what that did to the recovery?

Means-testing Medicare never made sense to me; I thought the idea was to spend less, not more. You’re just creating another bureaucracy that requires funding to achieve its goals.

While I agree re: targeting millionaires instead of $250k-daires, there’s no way McConnell is going to go for tax brackets higher than $250k/year. I enjoy how he’s okay with getting more money from high-earners, but touch that marginal rate and so help him God he’ll murder a gaggle of Senate pages.

Finally, I doubt after the last Congress that Reid and the Democrats will leave many of the legislative tools intact that allowed Republican senators to obstruct as easily as they did. McConnell probably isn’t a motive force in the negotiations, at least compared to Boehner.

Doesn’t that last depend upon what the Democrats do re the filibuster? What I’m hoping is that the filibuster is kept, but Senators will no longer be able to call in from poolside and say, “I’m filibustering”. I hope the Democrats force them to go to the mattresses like the old days. Then we’ll see what the strength of Republican convictions really amounts to.

Oh, and one thing I would most like to see go is that bogus 15% tax

rateloophole that hedge fund managers and similar captains of the universe enjoy.“… McConnell is right, too, that the Republicans have just as much claim to a mandate to fight such tax increases from their electorates.”

Except that, according to polls, their electorate favors a tax hike on high earners.

Obama shouldn’t negotiate with terrorists. Remember that the debt ceiling is also going to be an issue, so every penny of spending cuts and tax increases that doesn’t happen will give the Republicans leverage in that standoff.

Go over the cliff, let the taxes go up automatically, and then press the issue.

He’s not on the ballot in 2014–they are. If voters are going to want to punish someone, it’ll be them.

For all the happy talk about Republicans learning lessons from the election, the Republican party IS the Tea Party–the people who would dismantle the social safety net and use it to tie yachts of the wealthy to their docks. The ones who wanted the US to default on its debt. They negotiate only out of necessity, and respond not reason and the good of the country but rather strength, will, and force.

@Murray:

That, and his party lost 75% of the Senate races on Tuesday, including losses in red states like Montana, Missouri, North Dakota, and Indiana.

@:LaMont: We don’t have a parliamentary system. Obama got a majority of the vote for president, which entitles him to preside over the Executive branch of our federal government. Republicans won a majority of seats in the House, which entitles them to initiative tax and spending legislation. Republicans are a minority in the Senate but have more than 40 seats, which entitles them to thwart Democratic initiatives.

@sam: I don’t think we’ll see any significant filibuster reform. The Democrats could easily be in the minority again as soon as the next election.

@Murray: I don’t think the exit polls trump the election returns. It’s hard to argue that Republicans haven’t made opposition to raising tax rates a central part of their platform.

@Geek, Esq.: It’s silly to call the party that got nearly half of the presidential vote and won a large majority of House seats “terrorists.” And everyone negotiates out of necessity; we’d all rather get everything we want.

This arguement that conservatives are trying to use really bugs the crap out or me!

If we had a candidate that wanted to reinstitute slavery, just as sure as my name is LaMont, that candidate would still recieve the electorates of at least 2 or 3 states. If you don’t agree, you still catch my drift! By that arguement, would that mean the republicans still have as much claim to a mandate from their electorates??? As they say on ESPN, “C’MON MAN”!!!

@James Joyner:

” I don’t think the exit polls trump the election returns.”

On specific issues they do. Same sex marriage and marijuana legalization would not have past where they were on the ballot without a substantial support from republican voters. (Conversely Democrats are not all in favor.)

Just because someone voted Romney (resp. Obama) doesn’t mean he or she supports all of the RNC (resp DNC) platform.

@James Joyner:

To add some context – they did in 2010 on the strenght of a tea party that is now identified as “the crazies”! Democrats in the house won more vote than republicans in the house this year. And thanks to some redistricing efforts by republicans after the 2010 elections, they make sure it would be much more difficult for the democrats to regain the majority this year. So what exactly does that do for your argument. Bottom line is the republicans do NOT have a mandate. That is the furthest thing from the truth. While I agree that this is not a parliament, the republicans should not act like they are negotiating from a position of strength!

James, I have to say that from this corner of the Ozarks it seems that the only mandate the GOP has is that gerrymandering works. Here in MO we have 8 congressional districts 6 (R), 2(D). By that measure this state is overwhelmingly GOP. (And the State House and Senate have veto proof majorities for the GOP) And in this last election it was a safe bet that Obama was toast here.

Of all the other statewide races, the GOP won… One. Lieutenant Governor. (to a guy who frequents stripper clubs!) A job that if the Vice Presidency is not worth a bottle of warm spit, being the LG is not worth a bottle of warm piss. Every other state wide race from the Senate to the Gov. to Auditor, Sec of State, and Atty Gen. went to a Dem. Hell, if we had a State Dogcatcher he’d be a Dem.

There are many ways to disenfranchise a voter and MO shows the way.

@LaMont:

The GOP has the House. That is the position of strength they argue from. It is also their Achilles as every House seat is up again in 2 years. Obama is not running again. There is no political downside for him, only a historic down side (one which he cares about). Obama can play chicken with the GOP and let the Bush tax cuts expire. Then he can leave the GOP to twist in the wind of blowback from their constituencies about their rising taxes and screw the rich!

I will bet a deal gets done of rising taxes somewhere in the range of $500k to $1 mil. Personally, I would like to see all the Bush tax cuts get phased out over a period of years (10?).

@James Joyner:

Democrats got more votes for Congress than did Republicans–Republican majority is due strictly to gerrymandering.

‘Necessity’ means different things to the parties. To the Tea/Republican party, acting in the public’s interest isn’t a necessity, but obeying Grover Norquist is. Until they’re willing to acknowledge a sovereign other than Norquist, negotiations are pointless.

Economic myths: government can spend its way out of a recession. This always ends in failure.The best solution is for the government to do nothing. The economy will correct on its own. Obama has spent trillions: no improvement.

Economy was worse under Bush: 6% unemployment and was never higher during Bush’s two terms.

Government creates jobs: while some new jobs may be started, how many are lost because of higher taxes and more regulations?

Unemployment rate is accurate: it doesn’t account for those who are not looking for jobs or those who have taken seasonal (Christmas part time, low paying jobs) work.

For a more detailed explanation with facts and figures go to:

http://townhall.com/columnists/thomassowell/2012/11/07/gross_misconceptions

@Whitfield:

The American people rejected a return to Bushonomics.

whitfield:

The unemployment rate exceed 6% for five months in 2003. It also exceeded 6% for the last five months of 2008, and it was 7.8% in 1/09. Link.

When you can’t correctly state even the most basic facts, you’re letting everyone know that you’re a pathetic waste of time.

@OzarkHillbilly:

Agreed. But as you note in the latter portion of your comment, republican’s strenght is like that of a house of cards. In the end, they really have no chips to play. The President and the democrats can call their bluff every time and the republicans will be the ones to pay for it in the 2014 election cycle.

McConnell:

This claim is repeated incessantly, in many different forms, and it’s virtually never challenged, even though it’s wrong. You can “tax your way out of it.” It turns out that if you actually look at the actual numbers, you discover that raising taxes on the rich can indeed eliminate both the deficit and the debt, with no spending cuts at all. Link.

The mainstream press never mentions these simple, relevant mathematical facts, not even in the context of rejecting such a proposal. That darn liberal media.

@LaMont:

That is what I hope…. But Democrats run in 2014 too. It all depends on the messaging. I hope the Dems were paying attention to what Obama just did.

james:

I find it amusing to notice that famous R economist Feldstein, repeatedly cited by Mitt because he supposedly proved that Mitt’s tax plan can work, made Mitt’s tax plan work by defining middle class as $100K and over (link):

Feldstein said this:

The GOP is going to argue that the line should be at $1 million, not $250K. They will need to be reminded that one of Mitt’s favorite economists said the line should be at $100K. In a study that was repeatedly and personally cited by Mitt.

@James Joyner: The “Republicans are terrorists” comment has 3 updings, 0 down. Your response has zero updings, three down.

Vox populi.

Just out of interest: Is this consensus? I know that the U.S has a somewhat higher household income than Europe but around these parts the middle class ends somewhere around 65.000$/year. Everything above that is upper class (if not necessarily “rich”).

Statistical data I can find seems to show similar findings for the US. Am I doing it wrong or is this simply a perception problem within the political U.S?

In the US it’s considered ‘class warfare’ to describe anyone as ‘rich.’

@Ebenezer_Arvigenius:

I would say largely perception. My wife and I have a combined income of app $80k. I would consider that to be more or less the middle of the middle class, with the upper edge of it to be $150k.

I can see an argument for $250k, but not $500k.

The top 1% includes households where income is at least $352,900.

@OzarkHillbilly:

I should note that that is our income when I am fully employed. The last 2 yrs have been rough and we are avg $60k.

@Ebenezer_Arvigenius: @OzarkHillbilly: There’s no doubt $250,000 is a nice household income, even in Manhattan, Boston, DC, Los Angeles, or San Francisco. But a plumber married to a high school principal or a longshoreman married to an ER nurse can bring in that kind of money. While they may nonetheless be fairly rich, we consider those middle class jobs. Go to a million, and you’re talking two high-powered incomes or one fantastic one.

@jukeboxgrad: That is instructive….

@James Joyner:

This is the argument I can see for $250K, but as @jukeboxgrad: said,

@jukeboxgrad: Didn’t see this earlier; something odd is going on with my comment emails, sandwiching them somehow. I agree that $250,000 objectively isn’t “middle class.” I’m just arguing that a much higher threshold is needed to get beyond the perception of middle class, especially in our most expensive metro areas. I’ve seen several Democrats, such as Chuck Schumer, make the argument that the threshold should be a million. It strikes me as a reasonable end solution.

The real “fiscal cliff” is that of Social Security and Medicare. The items over which the chattering and politico classes currently are posturing in the greater scheme of things are child’s play.

It’s a nice accounting fiction that Social Security and Medicare are “off budget” items. But that won’t help us when the programs go belly up. Wallpapering over a hole in the wall doesn’t actually fix the wall.

The problem is that of a confluence of demographics, the collapse of our education systems and job market realities. How will a poorly educated, largely unemployable generation possibly support a giant class of recent and incipient beneficiaries?

Plus now that Obamacare for all practical purposes is permanent Medicare soon will become even more of an unfunded mandate and Medicaid won’t be able to pick up the slack, because states can’t afford it and accordingly will opt out or not meet matching requirements, thereby catching the feds in a negative fiscal feedback loop.

When the entitlement time bombs detonate all this talk about tax hikes on those earning more than $250k per annum will in hindsight be considered banal. At that point we’ll be what the PIIGS countries are today. But on a much larger scale.

If your household income is above $141,900, you are in the top 5% (link). Defining someone in the top 5% as “middle” is a gross distortion of language. We use the term “middle” that way in no other domain.

And this distortion was invented for the purpose of helping rich people get away with what they get away with.

Note: check my source to see the definition of “income.” It’s a comprehensive definition that includes a bunch of things other than salary.

I notice that sometimes they are a bit delayed or out of order, but generally they work well.

Fair enough.

I don’t necessarily object to that. Mostly I’m just arguing for a better understanding of basic facts.

If it was up to me, I would impose a small increase on the $250K group, a moderate increase on the $1M group, and a very large increase on the $10M group. The problem isn’t really the 1%. It’s the 0.1%, or even the 0.01%. At the very, very top, there is very extreme concentration of wealth. These are the people who just tried (and failed) to buy the election.

For context, take a look back at Ike’s era. $250K in today’s dollars is the equivalent of about $32,000 in 1951. So what was the marginal rate for a couple showing income of $32,000 in 1951? Answer: 51% (link). A lot higher than what Obama had once proposed for the same (inflation-adjusted) income level. So if Obama is a socialist, I guess Ike and JFK were uber-socialists.

No James, that is not how a sane man, in good faith, begins negotiations.

Absolutism is not pragmatism. It’s that simple.

To vent a little more, your article is really a fig leaf. McConnell went to the well and brought back absolutist bullshit. He staked out his position, again, as a blocker. He manned the walls for deadlock. “No tax increase shall pass.”

You said, “ah well, that’s how people negotiate.”

No, it is not.

@Tsar Nicholas:

Kevin Drum on “fixing” SS:

Now, of course, in one way Erica is right about the non-easiness of addressing Social Security. But I think we should be clear on exactly what the source of the problem is here. It’s not “Congress,” and it’s not “difficulty.” It’s the Republican Party. They’re just flatly unwilling to negotiate the kind of simple, long-term plan that was perfectly acceptable to Ronald Reagan three decades ago.

As for Medicare, Obamacare is not an end all solution for the problem with Medicare, but at least it starts to address it.

How do we avoid the tax hikes of the fiscal cliff by enacting tax hikes? Is no one else bothered by the complete incoherence of both parties?

Obama and the Republicans agree to an automatic austerity plan during their negotiations last year, consisting of tax hikes and spending cuts. They tell us this is necessary to prevent a financial calamity.

Now the very same people are telling us we must stop their austerity plan, because it will cause a financial calamity.

They then tell us we can only do so by coming to an agreement to impose austerity, otherwise we’ll have a financial calamity.

So the simplified argument is:

1) We must pass austerity to avoid disaster.

2) We most stop our austerity to avoid disaster.

3) We must pass austerity to avoid disaster.

The most likely explanation for this is that the Obama Administration and the House Republicans are ignorant of basic macro-economics, because they’re literally arguing austerity will both destroy us and save us.

@john personna:

Yes, that is what he said Do you think he is so stupid as to not realize that a tax increase has already passed? And that he voted for it? (assuming he voted for the extension last year) Or does he just think we are that stupid?

@Ben Wolf:

Obama’s position is mild course adjustment, isn’t it? Small tax increases, and small spending cuts, but acting over years rather than an in an immediate whammy.

@OzarkHillbilly:

I think he thinks brinksmanship and 11th hour drama are to his advantage. That in those dire straights he might avoid tax increases.

@ jukeboxgrad

Ike was a commie who wanted free stuff…

@john personna: The President is pushing the same tax increase, and if you’ll look back to the negotiations he insisted on the automatic spending cuts we’re now told are destructive. It doesn’t make him look good.

Furthermore why does it matter whether the President wants a more “mild” solution? Our economy continues to teeter, barely registering growth. Whether we cut by $600 billion or $250 billion, we’ll still end up back in a recession. There is no economically sound reason for the President to agree to spending cuts or tax hikes of any kind.

@john personna: “McConnell went to the well and brought back absolutist bullshit.”

McConnell has probably behaved as irresponsibly as anyone in our politics the last 4 years. But because he’s a long-standing member of The Village, it’s overlooked.

Mike

@Ben Wolf: “There is no economically sound reason for the President to agree to spending cuts or tax hikes of any kind.”

Is there any evidence that slightly increasing taxes on those who make over $250,000 will have a negative impact on the economy?

Mike

@James Joyner:

Hey, I thought those in that income bracket, in education, in union jobs voted for Obama so they voted to pay higher taxes. We wouldn’t want to deprive them of their choice just because their job titles used to indicate modest salaries?

I say hold fast, then break with compromise raising the taxes on those over $250k but with a repeal of the Hollywood tax breaks as well. That way no one will feel left out.

@Ben Wolf:

I agree with Mike that Obama’s mild desire is unlikely to slow the economy. And remember, we should always say “tax on income over $250,000”. The part below $250,000 would still enjoy historically low rates. The overall effective tax rate would still be very, very, low.

On spending cuts, I’m open in the abstract but uncomfortable with both parties tendencies to name numbers before naming programs. That said, I’m sure there are programs both parties could name to be cut, that I’d accept. Farm subsidies? Sure. Defense? Sure.

Of course that gets down to pragmatic negotiation, something McConnell is hoping to avoid by “hostage taking” until the 11th hour.

@JKB:

By “Hollywood tax breaks” do you mean the process by which state and local governments lower industry-specific taxes in an attempt to lure movie shooting to their area? In a classic race to the bottom?

I don’t know why the heck you think that’s national, or liberal.

But I’d love to see that kind of lure struck down, say by the Supreme Court. It is very destructive to economic efficiency.

@MBunge: It’s simple accounting. A tax increase reduces private sector wealth. It cannot be any other way. Will a tax hike on people who don’t spend much of their incomes cause much damage? I doubt it. But from an economic perspective it won’t help either, unless you’re making a case based on equality.

@john personna

It’s the size of the deficit that matters, not the particular program. I agree we need cuts to military spending and other areas, but not without increasing the deficit by an equivalent amount somewhere else, preferably (to me) with offsetting tax cuts for the middle class and poor. Permanently ending the payroll tax would be a good place to start.

One of the important insights from Keynes is that my spending is your income and your spending is my income. This means that everyone cannot save (run surpluses) simultaneously. Someone has to be spending more than their income. If the government sector attempts to save rather than spend this will damage or even eliminate the private sector’s (households and firms) ability to save and repair its balance sheets.

raising taxes isn’t going to solve anything aside from getting some cheers from the easily lead crowd. the spending problem is the big issue, and somehow the voters decided to change nothing a we have a nearly identical house and senate.

@Ben Wolf: “It’s simple accounting. A tax increase reduces private sector wealth. It cannot be any other way.”

1. How did Bil Clinton’s tax increases reduce private sector wealth? How did the many tax increases signed by Ronald Reagan in the latter years of his Presidency reduce private sector wealth?

2. George W. Bush’s tax cuts certainly increased private sector wealth, at least for some. They did not, however, produce significant economic growth.

Mike

@bill:

See: Math.

A dollar change is mathematically equal, spending or tax.

@Ben Wolf: “It’s the size of the deficit that matters, not the particular program”

For pete’s sake. George W. Bush ran up a huge deficit and it didn’t do a damn thing for the economy. Not all deficit spending is created equal.

Mike

If I understand things correctly conservatives believe a) that raising taxes and cutting spending will slow down the economy, and b) that John Maynard Keynes was wrong in everything he said. Apparently, conservatives can hold two contradictory thoughts in their minds at the same time and still function. I’m trying hard to understand their mental processes, but I’m not succeeding.

Means testing for Medicare and Social Security would be the first step toward eroding the social compact that made those 2 programs popular – they are for all Americans. Why is it that the debate never includes a discussion of (among other things) increasing the tax rates for those programs? Oh wait … I know the answer to that … never mind.

@James Joyner:

Taking Pennsylvania as an example, if you take all the votes cast for congress statewide, our 18 member congressional delegation should be evenly split between 9 Republicans and 9 Democrats. Thanks to gerrymandered districts, we’re sending 13 Republicans and 5 Democrats.

Can the Republicans legitimately claim a popular mandate when the composition of the house bears no resemblance to they actual results of the total popular vote for congress?

@James Joyner:

First, any plumber/principal or longshoreman/nurse combo earning $250,000 a year would be earning vastly more than the typical members of their profession.

Second, if they did earn that much, they’d be rich, no matter what the source of their income. Period.

@john personna: I think there’s a difference between one’s public position before negotiations and one’s actual negotiating position. The Republicans in the House and Senate are duly elected and have constituencies to reassure that their interests are being fought for. One often does that by taking absolutist public stands. But McConnell isn’t being absolutist, even: He (and Boehner) acknowledges that there will be revenue increases; he’s only being absolutist on rates. In the end, he’ll have to give a bit on rates, too.

@jukeboxgrad: @Rafer Janders: I’m not arguing as to whether $250,000 is actually in the middle of the income distribution; indeed, I’ve agreed that it isn’t. What I’m saying is that, from the standpoint of the coastal metropolitan areas, it’s not a fantastically high income. It’s an amount that two public servants or two union workers could bring in. A million, on the other hand, is a number that most everyone would agree constitutes “rich.”

@Ebenezer_Arvigenius: It really comes down to where in the U. S. one lives, because the general costs of living vary widely between locations.

Generally, in large metro areas and along the coasts, the cost of living is much higher and therefore a higher income doesn’t necessarily translate to a higher lifestyle. For example, a relatively modest home that costs $125,000 in a rural area could easily cost $300,000 or more near Washington DC or San Francisco. And while the costs of food and clothing do not increase that much, both still cost more in the metro areas.

So, $65,000 might put one into the upper-middle-class in some places, but not in others. It just depends on the area.

@James Joyner:

But as I understand it, the highest rates would only hit that amount of income which is in excess of 250k. So the tax increases don’t trouble your theoretical (and I agree, reasonable) example, right? If they make 300k then it’s a few points on the 50k overage, which barely budges their overall tax rate.

It doesn’t really start to bite until you’re making a very good living by just about any standard. And I don’t know whether that’s adjusted for married couples, etc… Maybe someone has that answer.

@Rafer Janders:

The average salary for a longshoreman is $120K/year. A foreman longshoreman can make nearly $200K. A senior nurse or nurse manager with an MSN can easily earn over $90K.

@James Joyner: “I’m not arguing as to whether $250,000 is actually in the middle of the income distribution; indeed, I’ve agreed that it isn’t. What I’m saying is that, from the standpoint of the coastal metropolitan areas, it’s not a fantastically high income.”

It’s also four times as large as the median family income in Massachusetts, a highly urbanized eastern state. But that isn’t the point of my post. If income tax rates aren’t increased on the not fantastically rich families earning $250,000, social welfare benefits will have to be cut for people earning a hell of a lot less. But that’s not something that concerns Republicans, I guess.

@MBunge:

Assume a simplified model where government spends $120 per year and taxes at $100. This creates a private sector surplus of $20 and allows it to save by that amount. So each year the private sector becomes $20 wealthier in terms of financial assets.

Now institute a tax hike to $110 per year. If the private sector wishes to save at the original rate of $20 it has two choices: it can spend less, creating unemployment, or it can turn to debt, which is what happened during the Clinton/Bush years.

In fact Clinton ran successive surpluses, equivalent to spending at $120 and taxing at $145 per year. The private sector under these conditions has the choice of either drawing down its savings to extinguish its tax liabilities, or it can turn to more debt.

That’s correct, there can be distributional issues as the Bush tax cuts were heavily weighted toward unproductive speculation. But you’re not taking the foreign sector into consideration. In the later Bush years we ran deficits in the $400 -$550 billion range, while our trade deficits were in the $500 -$600 billion range. So our deficits were barely sufficient (and sometimes not even that) to make up the financial leakages the private sector underwent as it traded with the rest of the world, and were not at all sufficient to address the desires of households and businesses to save.

The appropriate size of the deficit is one which precisely meets the savings desires of the American people. Of course we can never precisely hit that target, but you get the general idea.

No they didn’t. Tax cuts in principle were sorely needed, but the way they were structured to favor wealthy speculators rather than productive investors and consumers meant the money didn’t end up in the right pockets.

Our current deficits are largely a result of automatic stabilizers increasing welfare payments, which is much more stimulatory because those receiving the payments tend to spend all of it.

@James Joyner:

No, it still is a fantastically high income, no matter where you live. In New York City, which I think we can agree is probably one of the coastal metropolitan areas you are thinking of, the median household income is $48,631, and the mean household income is $77,685.

A household earning $250,000, therefore, would be far richer than average on any scale, even in New York.

Again, only if they are far above average for their profession. Also again, who cares what the source of income is? Acting is a typically low paying profession — but if you’re Will Smith, it’s not.

@Mikey:

You’re thinking of it wrong — in an area like DC or San Francisco, yes, the housing costs more. But if you choose to spend your money on a house in DC or SF, you do have a “higher lifestyle” — except that you are choosing to spend your money on the luxury good of an expensive location, rather than the good of a large house in an inexpensive location.

It’s sort of like complaining that because I chose to spend a million dollars on a diamond that I’m not rich because I no longer have the million in cash. True, I don’t, but I have the diamond. Similarly, the people in DC no longer have the cash, but they have the luxury good of a house in DC.

At least some Dems have said since July that they’re willing to go off the cliff. http://thehill.com/blogs/on-the-money/economy/238147-gop-leaders-hit-dems-for-threatening-to-take-country-over-fiscal-cliff Patty Murray’s opinions would seem relevant, as she’s expected to chair the Senate Budget Committee. I don’t know about the Dem base, but if push comes to shove, I’m up for it, and Larry O’Donnell has Off the Cliff campaign buttons. And McConnell is certainly changing his tune from four months ago.

Along with many above, I fail to see from what source McConnell claims a mandate. Perhaps it’s from getting a landslide majority of the lobbying money. Let us all pray that Harry Reid and the Democrats have the skill and the stones to reform the filibuster and that Mitch McConnell’s opinions become largely irrelevant.

Chris Hayes ( one of the “libs” on MSNBC) prefers to call it the “fiscal bump”.

http://www.washingtonmonthly.com/political-animal-a/2012_11/deficit_scolds_fundamental_inc041126.php

@James Joyner:

If two public servants or two union workers can bring in $250,000 in combined household income, then yes, they have a fantastically high income in present-day America, even in a city like NY, Boston, or LA. Especially so when compared to what most public servants or union workers earn.

@Rafer Janders:

I understand, of course, “location, location, location.” There’s a lot more to do in DC than most other places, it’s a “marquee” address, all of that. Still, the differences in purchasing power remain, and what puts someone into the “middle class” in some parts of the country would be a subsistence wage around here.

Is living here a “luxury good?” A lot of us had to come here because it’s where the jobs are (I used to live in the Detroit area), there wasn’t as much choice as one would think there would be when choosing “luxury.” Still, an interesting question.

No, you have the same purchasing power. You chose to use your purchasing power to buy a house in DC, which is an expensive good, and does not leave much over to buy other goods. Others may have chosen to use their purchasing power to buy a cheap house in Idaho and then have a lot of money left over, which they then spend on cars and vacations and high-end electronics. But you’ve all got the same amount of money — it’s just what you choose to spend it on that’s different.

@Rafer Janders: The purchasing power isn’t the same, because it’s more than houses that costs more here–EVERYTHING costs more here, including the most basic necessities. Food is more expensive, energy is more expensive, clothing is more expensive, gasoline is more expensive.

Also, houses are a necessity. Vacations and high-end electronics are not.

@Mikey:

Houses are not a necessity. Shelter is.

Houses are shelter, and showplaces, and investments, in some combination.

@Mikey:

That may be true, but it doesn’t change Rafer Janders’s point. An individual who chooses to consume the luxury good of expensive urban living is doing so for a variety of reasons – some of which may be perfectly reasonable – but they are not entitled to a subsidy for doing so.

There are also ways around this. Someone who wants to take advantage of Manhattan labor markets but not pay New York prices can live in more rural parts of the state or in New Jersey. They will have to endure a lengthy and perhaps unpleasant commute, but that’s part of why the Manhattan apartment is a lot more expensive. Similar arguments hold for other expensive metro areas such as San Francisco.

More generally, it would appear that the more expensive coasts are far more liberal than the remainder of the country. I’m not clear on why we should tailor a definition of the middle class to their cost structures, given that they already support higher taxes as a matter of policy.

@john personna: Yes, and in some areas, mere shelter costs the same as an absolute showplace would somewhere else.

@GeoffBr:

That’s true, but that wasn’t my point in my reply to Ebenezer–I was simply providing a reason why a certain level of income may be wealthy in some parts of the country, but fairly run-of-the-mill in another.

Whereas $1 million a year is wealthy no matter where you live.

So how do we define “middle class?”

@Mikey:

You’d have a stronger case if you were arguing rents.

@Mikey:

And yes, I think that “rent+commute” is a “shelter” argument.

@john personna:

When I lived in the Detroit area, I rented a three-bedroom townhouse in one of the better suburbs for $895 a month.

Where I live now in the DC area, rent for a comparable three-bedroom townhouse averages around $1800 a month.

@Mikey:

Detroit/DC are a good comparison. On the one hand you have to pay a lot more, on the other hand, your DC neighbors might not think the move to Detroit would be “equivalent lifestyle.” That second part would be Rafer’s point I think.

@Mikey:

Food is a bit more expensive. Energy and gasoline may or may not be more expensive — you actually benefit from living in a higher-density area. As to clothing and various other consumer items such as computers, TVs, smartphones, other electronics, books, etc., I buy most of that online, and J. Crew charges the same price for a sweater bought over the Internet whether you’re in DC or Boise.

@Mikey:

No, they are a choice. You don’t need to live in a house — you can live in a studio, or a one or two bedroom apartment.

@john personna:

Exactly. Living in DC and having access to all that DC has to offer in terms of culture, restaurants, jobs, career opportunities, etc., is the luxury good in and of itself.

@Mikey:

That’s because living in Detroit is less valuable than living in DC.

Look at it this way: the price of a Honda Accord is about $20,000, while the price of a Mercedes is about $60,000. You’re essentially saying “as someone who bought a Mercedes, I have less purchasing power than someone who bought a Honda, because they have one car and $40,000 in cash, while I only have one car and no cash.” This would be true if you just saw them both as two cars, with cars being a fungible unit.

But you’re ignoring the fact that different makes of car aren’t fungible, that you chose to buy the more expensive car, and that you have the luxury good of that expensive car, while the other buyer has a less expensive and therefore less valuable car (but more cash).

You both had equal purchasing power when you started out in that you had the same amount in dollars — you just had different values for how you chose to spend those dollars. Similarly, a house in Detroit is not the same thing as a house in DC, and therefore they cannot be compared to each other on a one to one basis.

@Mikey:

Meaning, at one level, that people value living in DC twice as much as they value living in Detroit. Living in DC is considered more desirable and there is therefore more demand.

@:LaMont:

With all due respect, 51% to 48% is not a landslide. I wouldn’t even call 332-206 a landslide, to be honest, and that’s a count that only applies to presidential elections.

@john personna: DC does offer more in certain aspects, but as far as the general lifestyle goes, Oakland County (MI) and Fairfax County (VA) are pretty similar.

@Rafer Janders: A better analogy would be the Honda costs $20K in Detroit but $30K in Fairfax. That’s what I’m trying to get across–the exact same product is more expensive here.

I’m going to have to drop out of the discussion, anyway, we had a death in the family and I’m going to be on the road for a while. In any case, thanks for a reasonable discussion and you made some good points I’m going to think about.

franklin

Of course you’re fully entitled to your personal opinion, but, with all due respect, it’s not of much interest to anyone other than you.

Various prominent Rs did indeed do precisely this: “call 332-206 a landslide.” Link. And a margin lower than Obama’s margin has also been described as a “mandate.” Link.

A mandate is what you make of it.