Little Public Support For Bowles-Simpson Deficit Reduction Plan

A new poll about the proposals coming out of the Deficit Commission makes it clear that the American public needs to grow up.

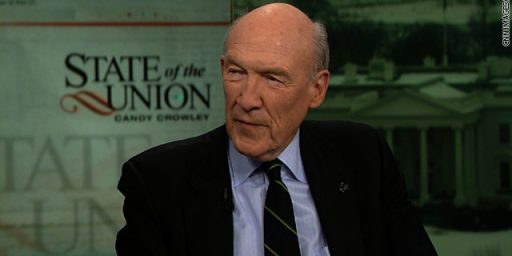

A new NBC/Wall Street Journal poll shows that the public is, to put it mildly, very skeptical of the spending cut plan put forward by Deficit Commission Co-Chairmen Erskine Bowles and Alan Simpson:

The sweeping plan put forward by President Obama’s bipartisan deficit commission last week, with its calls for deep spending cuts in sacrosanct programs as well as tax increases, has drawn howls of protest from across the political spectrum. The New York Times observed that one of the things the panel hoped to accomplish by proposing measures such as ending the home-mortgage-interest deduction was to “jar the public into recognizing the magnitude of the nation’s budget deficit and some of the drastic steps that might be needed to close it.”

The commission has at least succeeded on the “jarring” part if the results of a Wall Street Journal/NBC News poll, conducted Nov. 11-15, are any indication. But the outlook for convincing the public to get behind many of the proposals does not look encouraging.

Here are some of the numbers:

“The commission recommends 75 percent come from spending cuts and 25 percent come from increases in tax revenues. Spending reductions include cuts to Medicare, SocTial Security, and defense spending. The tax increases include higher gasoline taxes, lowering the corporate tax rate but limiting business tax deductions, and placing a limit on the tax deduction for homeowners with mortgages over five hundred thousand dollars.”

When it asked those surveyed what they thought, 40 percent called it a bad idea, 25 percent said it was a good idea and 30 percent had no opinion, with 5 percent undecided.Getting more specific, the poll asked about the comfort level with cuts to Medicare, Social Security and defense spending. Seventy percent said they were very or somewhat uncomfortable with those actions, while 27 percent were somewhat or very comfortable with them. Three percent were not sure. Only 6 percent described themselves as “very” comfortable.

(…)

Fifty-nine percent were not comfortable with increasing taxes on things like gasoline and limiting the home mortgage interest deduction compared to 39 percent who were very or somewhat comfortable seeing that done. Only 10 percent were “very” comfortable. Two percent were undecided.

Public attitudes like this are going to make it very easy for politicians on both sides of the aisle to trash this proposal, or whatever it is that ultimately comes out of the commission when it issues its report next month. In fact, that process started within days after the Bowles-Simpson draft had been released to the public.

The most distressing thing about this poll, though, is that it makes clear that the public still hasn’t gotten the message that dealing with our fiscal and economic problems is going to require sacrifices from all sides. Sacrifices will need to be made, and we’re all going to have to make them. The left is going to have to accept the fact that we cannot afford the kind of welfare and entitlement state that they’ve spent the last seventy years trying to build. the right is going to have to accept the fact that, yes, taxes are going to have to go up in some respect, especially on those most able to pay those taxes. The vast American middle is going to have to accept the fact that you can’t have your cake and eat it too, and that in the end, it’s largely their fault that we’re in this mess. They put the people in office who created this leviathan and stood by and said nothing while they spent money the government didn’t have. Now, it’s time to fix it. It’s going to be painful, but not nearly as painful as it will be if we let this continue until everything collapses for the next generation.

When the Bowles-Simpson plan was released, I raised the hope that our politicians and pundits would act like adults. It’s time for the American people to do that too.

Refresh my memory, Doug. What sacrifices did we make in the 90s when we eliminated the deficit that time?

That occurred thanks largely to increased tax revenues from the Tech Bubble which, of course, collapsed.

I don’t think we can count on any economic bubbles happening any time soon

There’s an intimate relationship between this post and my post on Dr. Bernanke’s remarks about “emerging economies” this morning.

So, the problem in a nutshell is that it’s “wonky” to understand the trade-offs. The average citizen, catching a little news between work and dancing with the stars, it’s going to get why any pain is necessary.

Well, it wasn’t like the the campaign messages that assaulted them in the last election were high on necessary trade-offs either.

We all have to sacrifice. The poor and middle class have to sacrifice by working until they die or living in squalor. The rich have to sacrifice by paying less in taxes and seeing Wall Street bonuses skyrocket as the banks and the government continue their thirty-year campaign to transfer the nation’s wealth to the top one percent.

No one’s fooled by this, Doug, except for Beltway insiders who believe that if enough (poor) people suffer, then it must be good policy. Oh, and libertarians with their visions of the world as a jungle (and they are all lions). We’ve been suckered by these “serious” people for years, and we’ve seen our country decline as the fortunes of the ultra-rich rise and rise.

There is, of course, another way. We could restore the notion of a progressive income tax structure — with multiple brackets above 250K. That alone might make the looting of America less attractive and lead some of these “producers” to actually share the wealth with the people who do the real producing — the workers, rather than just the owners. We might recommit to the idea that it’s better to have a strong middle class rather than a feudal system of lords and serfs.

Lets remain focused on the basic underlying truths here. I know all the ideologues want to seize the crisis in order to advance their beliefs, but….

The biggest factor, by far in this mess is spending for health care. If we could deal with that, all other aspects of the budget are eminently manageable. All this talk about irresponsible spending is somewhat overblown. As Bit has alluded to – with 90’s style tax rates, we were able to balance the budget. Reverse the Bush cuts (maybe over time, given the need for more demand) and there would be no great crisis whatsoever. Except healtcare. This graph puts it in perspective:

http://motherjones.com/kevin-drum/2010/11/deficit-commission-serious

And as this chart shows:

http://en.wikipedia.org/wiki/File:Medicare_and_Medicaid_GDP_Chart.png

it is not really the demographics of the baby boom that is contributing all that much to the explosive growth of healthcare spending.

Maybe a proper description of how sacrifices need be allocated would tell both sides that not every single breakthrough in medical technology will be able to be fully deployed, and that real decisions will have to be made regarding the extent of care to be given, especially in the most expensive areas – end of life. How incredibly easy these issues are to demagogue however.

The truth is that the solution must satisfy the political equation, which is a very different equation that the actual budgetary equation. Although healthcare is the primary driver of the problem, the pain will be spread far wider, since it seems to be important that everyone’s ox be gored to some extent, and there are so many other agendas at work trying to make headway for their ideology out of this crisis. It would be helpful though to keep a clear eye on the real problem.

> That occurred thanks largely to increased tax revenues from the Tech Bubble which, of course, collapsed.

Ah, so it was just the bubble. So of course the same thing happened during the real estate bubble.

It wasn’t just the bubble, but the increased revenues that it brought into the Treasury made it possible for Congress and the White House to merely nibble around the edges when it came to spending cuts, while still helping to bring about what seemed to be a reduction in the deficit.

Heh, it only “seems” that way when you use that thing called “math,” eh?

And the math worked in the 90s because they took more than a few items off the books

“they”?

Would that show up in CBO data on deficit?

I use the graph on the top of this page for convenience.

(The CBO, while not perfect, is certainly the least-BS source of data for the US economy.)

Sure, on one hand, the public should be better informed about what’s going to need to be done. On the other hand, I can’t blame them too much for fighting for their share of the Federal pie just like every other interest group. Those people who want to repeal the estate tax or lower taxes on the top brackets are going to fight to the end,. Every Federal contractor and beneficiary of a subsidy has lobbyists working to see that the get “their” money. if you’re “reasonable”, the likely outcome is that you get screwed over the most, as opposed to everyone else suddenly wanting to compromise.

And, it doesn’t make the public more likely to accept big entitlement cuts if they’ve spent the last year+ being constantly told that attempts to rein in the cost of Medicare (the biggest fiscal worry) are the equivalent of “death panels” or that you can make balance the budget though some combination of eliminating government waste and cutting taxes or just by raising taxes on other people.

So, yeah, I guess the public does need to “act like adults”. But, maybe they’d be more likely to do so if our media and politicians and special interest groups would “act like adults” as well.

You mean living longer and having a the population on Medicare growing isn’t the problem? Sorry, but our health care issues are pretty much confined to the over 65 crowd. Dave Schuler had a very nice graph on that. Eliminate that spending (obviously we can’t, but theoretically speaking) there would be little or no crisis in health care.

The problem can be summed up as follows: people want access to any and all types of health care, they just don’t want to pay for it. They’d rather somebody else paid for it.

Such an approach never will be sustainable…well not in a civilized society at least. The bottom line is some sort of rationing needs to be done.

Graph is here

Note that the US spending for those under 65 is slightly higher than Canada and about the same as every other country.

The data come from this NBER working paper.

“You mean living longer and having a the population on Medicare growing isn’t the problem?”

No, I mean what I said. That the explosive growth expected in healthcare spending is not primarily driven simply by the increasing numbers of the elderly, as the graph (from the CBO) in the second link of my comment, shows.

“Sorry, but our health care issues are pretty much confined to the over 65 crowd.”

No one is arguing against that. Did you look at the graph? The main driver is the effect of excess cost growth in Medicare and Medicaid. So yeah, it is largely a function of care for the over-65 crowd, but it is not necessarily the increase in numbers of those people, but the increase in ocsts (medical inflation, you could call it).

“The bottom line is some sort of rationing needs to be done.”

I do believe that is pretty much what I said.

“real decisions will have to be made regarding the extent of care to be given, especially in the most expensive areas – end of life. How incredibly easy these issues are to demagogue however.”

“Graph is here” link is permission-blocked.

It is two factors:

1. Demographics–more elderly.

2. Increased longevity.

That is why the spending goes up up and up.

Medicare cost growth has been unsustainable for a long time. Will it accelerate in the future? Probably…due to the Baby Boomers retiring. Will it slow once that “demographic bulge” moves through the system? Probably not due to the increased longevity.

I’ll copy it and post it here in a post time permitting.

“It is two factors:

1. Demographics–more elderly.

2. Increased longevity.”

So, in other words, you completely disagree with the CBO and their graph.They show that these factors make a relatively insignificant part of the expected growth of Medicare. Would you explain a bit why you think they are wrong?

Tano, keep trying. It took several attempts before it cane up for me. Verdon’s interpretation of the graph looks correct. In fact, we come out below Britain (maybe that’s equal to, hard to tell), France, and Germany. Ever-so-slightly above Japan and a little above Canada.

To clarify, by “Verdon’s interpretation” I meant the explosion in costs that come post-65 and not the reasoning for those costs. My views on the latter are similar to Tano’s. All of this new technology and better care is coming at a steep cost. New drugs, new tests, new treatments. The CBO could be wrong on demographics, but right now our demographics are not any worse than Europe’s (as far as I know) and yet post-65 care is much, much, much more expensive.

No Tano, my view is compatible with the CBO graph. I’m not saying the CBO graph is wrong.

That last is a reference to the CBO graph. And technological advancement may play are role as well, but it is demographics and increased longevity that are at work here.

See it isn’t just that health care expenditures are rising faster than the growth in GDP. While that would eventually be unsustainable for any population, it is particularly problematic when you consider that the elderly cost a huge amount more than non-elderly. By removing any effective rationing mechanism on health care for the elderly you are going rapidly rising costs.

In fact, without the elderly I bet the growth of health care costs would drop. Its like a feedback loop.

To use some made up numbers to give this come concreteness, suppose GDP is growing at 3%, health care costs at 4%. Way down the road we’d have a problem if that continued. Now if you have a segment of your population start consuming far, far more health care resources then your health care costs might grow at 5%. Now the insolvency date zips forward maybe a couple of dozen years. If that high cost population also starts living longer and longer and people keep entering that high cost population and the growth rate hits 6% now you are in real trouble.

To be clear, I’m not disputing that we don’t have a problem with the growth of health care costs. I’m saying what is the source of that excessive growth? Heck, lets throw on bad incentives too. In no particular order, the list is

1. bad incentives

2. demographics

3. increased longevity.

Those three things are making our health care costs and medicare in particular grow at unsustainable rates. And yes, you are right any attempt at a solution is easy to demagogue which means we probably wont solve the problem….it will solve itself which will be really, really ugly.

You might want to read Uwe Reinhardt’s paper, It’s the Prices, Stupid.

Steve,

We are not connecting here. Are you sure that you have been looking at the same graph that I have been talking about? I did give links to two graphs – and it sure sounds to me like you are not focusing on the second one, as I have been. Because I cannot see how your list is compatible with this graph. Here it is again:

http://en.wikipedia.org/wiki/File:Medicare_and_Medicaid_GDP_Chart.png

As you can see, the CBO projects that Medicare/aid spending will increase from about 4% GDP to about 5.5% of GDP over the next 60 years, because of the factors you list – the aging of the population (boomer demographics, including longevity). But Medicare/aid spending will actually go up to 19% of GDP in that time primarily because of the effect of excess cost growth.

Here is a little blurb from a CBO report on just this point:

“Among adults, average medical spending generally increases with age, so as the population becomes older, health care spending per capita rises. However, over the past three decades, the effect of aging on health care spending has been relatively modest. The demographic effect will become more pronounced with the aging of the baby-boom generation, but it will continue to have a modest effect not only on national health care spending but also on federal spending on Medicare and Medicaid.

Historical Trends

When analyzing historical trends in the growth of health care spending, it is useful to disaggregate the various components. Factors that affect spending on health care include general inflation; growth in the size of the population; and, to a lesser extent, changes in the age distribution of the population. Removing their effects reveals the amount of spending growth that is attributable to factors beyond inflation and demographics. There are at least two ways to measure such additional spending growth: as the increase in real annual health care spending for an average individual (“real per capita cost growth”) or as the increase in health care spending for an average individual relative to the growth of per capita GDP. The latter measure is commonly referred to as “excess cost growth, signifying that it measures the extent to which growth in per capita spending on health care exceeds the growth in per capita GDP, after adjustments for changes in the age distribution of the population. ”

In other words, the graph clearly shows that the vast majority of expected increase in Medicare/aid are due to this umbrella category of factors that remain after population size of the elderly and their longevity (and general inflation) are factored out.

“Those three things are making our health care costs and medicare in particular grow at unsustainable rates.”

Sorry, but those seem to be minor factors.

The American public needs to ‘WISE UP’………this is all 1 more instance of why the ‘greatest criminal enterprise’ in the history of the world (ie the United States Government) should be dismantled and completely reconstructed! It could be likened to an old beat up coin with digs, gauges, scratches, and holes in it!! On one side are the Dem’s on the other Rep’s, and around the edge are independants, tea partiers, etc. A coin in this condition would be sent back to the mint by any bank to be melted down!!!!!

We need to shut down the senate, congress, and the federal reserve. Each state then electing one representative with a few ‘monitors’ to monitor any attempts to reach the rep by the rich, corrupt puppeteers that control the politicians today! Any caught will immediately be stripped of their assets and imprisoned!

‘Parties’ will no longer exist!!!! One of the greatest hindrances to government is having ‘representatives’ taking sides due to devotion to a ‘party’ rather than devotion to the people they are supposed to be representing!!!!

Lobbyists will no longer exist, as they fall into the category of the rich and powerful attempting to take control of a representative (as above)

Senate and congress will be one body! Bills being introduced will no longer be hundreds of pages, even thousands long for the purpose of ‘hiding specific laws, etc to benefit the corrupt!!! They will be no more than a few pages long, with one issue in them, and they will be written in simple language that any average ‘layman could understand!!!

Election donations will no longer go to certain individuals, but placed in a state pool to be equally distributed to any and all individuals who wish to run for office!!! (a national pool for federal elections)

Without sme type of drastic change as above….the only thing that will ever happen under the current system is eventually experiencing the ‘flying nukes’ because THAT IS THE ROAD our current system is on!!!!!