Debt Ceiling Thoughts

American exceptionalism at its worst. (Plus some history!).

To set context, allow me the conceit of quoting myself from 2017:

To use the technical political science term, the debt ceiling is dumb. It is dumb regardless of who is in the White House and irrespective of which party controls Congress. It is dumber than the day is long. It is so dumb that the depths of the ocean cannot contain its dumbness. An infinite number of monkeys typing on an infinite number of typewriters could not write up how dumb it is.

It does not constrain spending. It does not affect the size of government. It has nothing to do with influencing the budget.

It is just plain dumb.

(If you need a definition of the debt ceiling, see my 2011 post).

Not only has my view on this not changed, it has deepened. The ability of the minority party in the Senate to complicate this process simply amplifies in my mind that allowing a vote like this is a bizarre and indefensible way to hold the economy hostage. The reality is: the debt ceiling has to be raised and will be raised because the alternative is a wholly preventable, wholly man-made economic mess of global proportions (and that is not hyperbole).

Keep in mind that one of the ways that the United States maintains its global dominance is the stability of its currency and economy, including government bonds. Our credit rating is literally a matter of national security, and yet the alleged “American first” crowd seems to utterly miss this fact.

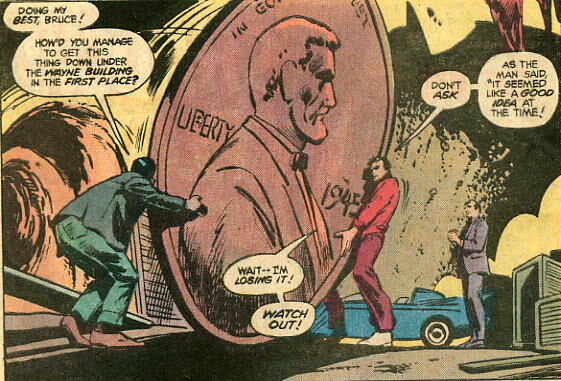

The absurdity of it all is why I have come to the point that I actually am not opposed to the utterly ridiculous $1 trillion coin idea (which is the inspiration of the graphic above–in my fantasies it is like Batman’s giant penny). Sometimes the only way to address the absurd is an even deeper absurdity.

Paul Krugman, who has also apparently reached a similar point as I on this topic describes the process thusly:

there’s a strange provision in U.S. law that empowers the Treasury secretary to mint and issue platinum coins in any quantity and denomination she chooses. Presumably the purpose of this provision was to allow the creation of coins celebrating people or events. But the language doesn’t say that. So on the face of it, Janet Yellen could mint a platinum coin with a face value of $1 trillion — no, it needn’t include $1 trillion worth of platinum — deposit it at the Federal Reserve and draw on that account to keep paying the government’s bills without borrowing.

Alternatively, Biden could simply declare that the 14th Amendment to the Constitution, which says that the validity of federal debt may not be questioned, renders the debt ceiling moot.

And there may be other tricks I don’t know about.

Would any of these approaches basically mean using silly gimmicks to avoid catastrophe? Possibly yes. But given the stakes, who cares if the approach sounds silly?

What stakes, you ask? As I noted above,

U.S. government securities are the bedrock of the global financial system, used for collateral in many transactions. Threatening federal cash flows could therefore provoke a worldwide meltdown.

Obviously, we have avoided the need for the coin until early December, but we can have this conversation yet again soon. Fun, isn’t it?

It is worth noting that while 11 Republicans in the Senate voted to allow debate to end, the bill to temporarily lift the debt ceiling passed the Senate on a party-line vote of 50-48. This underscores the weird veto that the Senate debate rules create: the needed votes to pass the legislation existed in the hands of the majority party, but they could not actually vote without the acquiescence of the minority party. And it further brings into question why any Democratic member of the Senate would want to maintain this set of rules. The Republicans are clearly willing to threaten to create a massive crisis to gain political leverage. This is not an example of fostering deliberation.

This is not new.

Going back in time, there was a similar crisis in 2011 (a decade ago), wherein the Republicans used to leverage a spending deal. As Ezra Klein wrote in the middle of that crisis:

Republicans have leverage because the debt ceiling needs to be raised and it can’t be raised without their support. But they don’t have popular support behind their position or their leadership. They can push this up to the brink and win, because Democrats really, really, really don’t want a debt-ceiling crisis that could set back the economy. But if they push it over the brink, they’re likely to lose, as the public really, really doesn’t want Congress to create an economic crisis that will set back the economy, and they’re primed to blame the GOP if one does in fact come to pass.

Sound familiar? The debt ceiling rules combined either with the filibuster by itself or a divided Congres means a leverage game can be played. And the Republicans are incentivized to play it for a number of reasons. One is their general minority status in terms of public support. As I frequently note: they haven’t won the popular vote for the presidency since 2004 (and prior to that it was 1988) and they know it and they know what their actual level of national support is. Further, as the party oriented toward blocking governance, tactics like playing chicken with the global economy work to their advantage.

Keep in mind, the debt ceiling was created in 1917 but it has not been the source of political standoffs until recently. The ceiling was raised largely as a pro format exercise during most of its history. However, this started to change as the parties started to sort out more purely in terms of ideology, which meant that the Democrats were no longer home to a liberal and conservative wing the fostered compromise and, instead, the Republicans became a more fully realized conservative party (as I wrote about here and here) after the 1994 election.

And so we see this (from a NYT piece in 2002):

The issue last arose in 1995 and 1996. Led by Newt Gingrich, who was House speaker, Republicans blocked an increase in the debt limit in an effort to force President Bill Clinton to sign a Republican budget or risk sending the country into default.

Note:

from 1979 to 1995, a House rule proposed by Rep. Richard Gephardt made increases automatic by raising the ceiling whenever new spending is approved. The new Republican majority repealed this rule in 1995 in order to use raising the debt ceiling as leverage in getting President Clinton to agree to spending cuts.

In 2002 the conflict was at least in part between the Republican-led White House and the Republican-led House. The Democrats in the Senate were more than happy to try to use the debt ceiling to underscore their criticisms of the Bush tax cuts, but they were not the main problem.

Mr. Bush has repeatedly asked Congress to raise the limit before the debt gets to a point where the government cannot legally borrow.

House leaders have refused to bring up such a bill. Not only would many Democrats vote against it to embarrass the president, but many Republicans who argued against lifting the ceiling when Mr. Clinton was president would feel compelled to vote against it now for consistency.

Here is how 2002 was resolved:

Under intense pressure to avert a government default that loomed for as early as this weekend, the House tonight narrowly approved an increase in the legal limit on the national debt, with Republicans swallowing their own reservations about the bill to pass it over the objections of Democrats.

The legislation would raise the debt ceiling by $450 billion, to $6.4 trillion, and was identical to a measure adopted this month by the Democrat-controlled Senate.

President Bush had urged the House to approve the measure before the government bumped against the current debt limit on Friday, leaving the Treasury department to choose between financial gimmickry to keep the government operating and failing to meet obligations, including the payment of Social Security benefits.

The vote was 215 to 214.

We saw similar crises to include in 2011, as already noted above, and in 2013, and now in 2021 (with an encore already scheduled).

In October of 2013, the issue was resolved as follows:

The Senate overwhelmingly ratified the deal Wednesday evening, 81 to 18, with more than half of Senate Republicans voting yes.

A few hours later, the House followed suit, approving the measure 285 to 144. Eighty-seven Republicans joined a united Democratic caucus in approving the measure, allowing Congress to meet a critical Treasury Department deadline with one day to spare.

Note that the measure only passed the Republican-majority House because the Democratic caucus voted for it. If it had been left up to the majority party, the deal would have fallen through, the government would have remained closed, and defaulting on the debt would still have been on the table. This is not the first time the majority-Republicans needed Democratic help to avert a crisis (see below).

Look, I understand legislative hardball and the fact that in politics you take the avenues that are open to you to accomplish your goals. But, playing games with the health of the global economy is a bit much (if I can use a little understatement).

But this is more than just hardball, it is about responsibility in government, and the Republicans are overwhelmingly the party willing to take the economy hostage and then threaten to shoot it.

I would also note the following from the Sunlight Foundation that addressed these votes from 1993-2009:

Now, the piece is entitled How the Parties Flip-Flopped on the Debt Ceiling and it is true that in the two votes during the Bush administration that the Democrats in the House were overwhelmingly opposed to the deals in question. But that ignores that in the pivotal 2002 vote that had 3 Democrats not crossed over, the deal would have failed (despite the Republicans controlling the chamber). And, again, as noted above the Democratic Senate passed the deal well before the House and the Bush administration was asking for the ceiling to be raised! To put it directly, this is not a case of “both sides do it” despite the post’s headline. Democratic help was needed in 2011 as well (twice, actually, to include the October 2013 vote I noted above). (Republicans did help the Dems in 2006).

In fact, what the chart clearly shows is that the Republicans only passed a debt ceiling increase by themselves once out of the thirteen times cataloged (and the House was unanimous in February of 1996). They did so barely, despite being in the majority.

Bottom line: the debt ceiling needs to go and the Democrats need to include that provision in whatever its final reconciliation package looks like. The provision accomplished nothing save giving the Republicans the chance to hold the economy hostage. Leaving it intact would be foolish (which, sadly, I expect to be the outcome). I would note that history clearly dictates that this is not a tool that Democrats can use, as they are unwilling to shoot the hostage, but Republicans have demonstrated that some of them will.

I think you are looking at the debate from the wrong direction. Many people want a default. It’s a way to cleaning the house on what they hate, which is the modern state. 20 years ago, conservatives wanted to privatize SS. That would have been great for investment banking, which would have been given cash flow. But the plan was crap, because the insurance aspect of SS was too popular to kill off and it failed.

Since that moment conservatives haven’t had other ideas about how to make a modern state livable on their terms. Privatized SS was going to be the same as Public SS, but better, because of the market. That, to quote Walter Sobchak, is at least an ethos. Now it’s all just cruel nihilism which turns basic goods like being able to have a decent life at 75 into insane luxuries. If that ideology is your baseline, then every crash is welcomed, because why wouldn’t you want one? If you think the state is coddling everybody, then shoot it in the head.

What you said. Except to rant, I’ve nothing to add.

@Modulo Myself: Clearly, there are some reactionaries who think that defaulting will bring forth a return to a glorious past (which is why the Dem have had to help bail out the Reps a number of times).

People like Mitch, however, aren’t actually wanting to crash the economy–they just want to use the threat thereof to leverage other things they want.

Most the investor class doesn’t want the economy to crash, either.

@Steven L. Taylor:

Yet, the investor class hasn’t turned its back on the GOP. Go figure…

@Scott F.:

Well, the GOP blinked, so there’s that. (The point being that despite the reactionary faction of the GOP, they have not defaulted).

And the investor class likes tax cuts, especially of the type the GOP provides (also deregulation and courts that are pro-business).

@Scott F.: And have I ever mentioned that there are only two viable choices in our system (which in turn explains a lot of behavior)?

The trillion dollar coin has another advantage: it’s stupid. Really, really stupid. “Does not fit into a political ad” level of stupid.

One 24 hour news cycle and we’re done with the debt limit forever. 48 or 72 if they really push it. But it’s too stupid to last beyond that.

How do you say “Joe Biden minted a trillion dollar coin” without it being a little awesome? That’s how powerful Biden is — he can mint a trillion dollar coin.

“Socialism! Socialist Joe Biden mints socialist trillion dollar coin of socialism!”… still sounds awesome.

“Is AOC’s face on Socialist Joe Biden’s Trillion Dollar Coin?” Ok, a little better, but given how much of it goes to paying off the Trump tax cuts to the wealthy, let’s just put Trump on it. Idiots will start putting pictures of it on flags.

@Steven L. Taylor:

There’s one viable choice in our system.

The other choice is to back white supremacy, delusional conspiracy theories, wanton corruption, and sedition. It surely sucks that the Democrats aren’t as sycophantic as the corporatists would have them be, but at some point there needs to be judgements based on what some are willing to accept in order to get their way. “The other choice is worse” has to have its limits or we can no longer claim to be a civil society, let alone an exceptional one.

My guess is that there are some members of the caucus who don’t actually support the goals of the party whose ticket they run on, but maybe I’m too cynical, too.

@Gustopher:

Oh, no. If you put Benito in the coin, his deplorables will assume he merely lent one of his many trillions (he has the best trillions) to the Deep State.

I propose either in reconciliation or regular order (if sanity breaks out in the Dissenting Two), Democrats set a permanent and unbreakable upper limit on the debt of 100 Quintillion Dollars.

A quintillion is a million trillion. I’d like to see the GQP tax cut their way past a hundred of these,

@Just nutha ignint cracker: Well, I expect that every member of the caucus has some differences with the rest of the caucus. That’s just how people are.

At the moment, Joe Manchin believes it helps him with re-election to get Democrats mad at him, so that’s what he’s doing. He’s also supporting the Democratic majority in the Senate, which may be a bigger deal, since that affects every chairmanship, etc.

Oh, good Lord, is Krugman at it again with this platinum coin thing?