Fate Of Senate Tax Plan Still In Doubt

With time running out in the year, it's looking increasingly unlikely that the Senate GOP will be able to meet its deadlines on passing a tax reform bill.

With less than twelve working days left for Congress before the start of the Christmas holiday, Mike Allen at Axios reports that Republicans still don’t have the votes to pass their version of tax reform:

- A senior administration official told me: “We’re still getting it done in a matter of a couple months, instead of a couple of years. It’s OK if it takes a few extra days.”

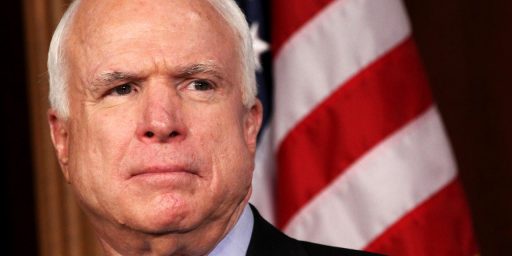

- The bill is in the ugly sausage-making phase, with senators taking advantage of their leverage to make demands. At least six GOP senators are holding out (John McCain and Jeff Flake of Arizona, Bob Corker of Tennessee, Susan Collins of Maine, Ron Johnson of Wisconsin and Steve Daines of Montana).

- Lose three of those, and the bill is dead.

- McCain says he’s undecided. His concerns? “A lot of things.”

- Will be drama to the end: The well-wired Chris Krueger of Cowen has “~8 Republican Senators on fence/lean-no … Any slippage, and momentum goes other direction with Alabama Senate election [Dec. 12], and shutdown negotiations next week.”

As things stand, Senate Majority Leader Mitch McConnell is hoping to bring the final bill, which has yet to be unveiled, to the floor for a vote by the end of this week, but that seems increasingly unlikely, First of all, the fact that the bill has yet to be finalized means that the clock hasn’t started running on how long a bill must be considered by the Senate before it can be voted on, Even under the relaxed rules of budget reconciliation that the Senate will consider the bill, these rules still generally require roughly 72 hours of debate before a final vote. Even if the bill is formally presented on the floor today, that means that the earliest it could be voted on would be some time on Friday. The longer the Senate GOP takes to finalize a bill, the less likely a final vote will be held before the end of the week even if McConnell chooses to bring Senators in on Saturday. Additionally, as Allen states, there are indications that there are more than enough potential “no” votes to defeat the bill in much the same manner that health care reform failed on the Senate floor in July. Wisconsin Senator Ron Johnson, for example, says that he remains opposed to the bill in its present form, and it’s unclear what if any changes could persuade him to change his mind. Johnson’s opposition seems to be based largely on the manner in which the bill would treat so-called “pass-through” businesses such as LLCs and Subchapter S corporations. Montana Senator Steve Daines has also said he’s currently a “no” vote based largely on the same grounds as Johnson, Additionally, Tennessee Senator Bob Corker, who has spent the past year clashing with the President and recently announced that he would not run for re-election is signaling that he too could end up being a “no” vote on the bill. Other potential “no” votes include John McCain, Susan Collins, Lisa Murkowski, Jeff Flake, James Lankford of Oklahoma, Jerry Moran of Kansas, and perhaps as many as a dozen other Republican Senators according to a report yesterday in Politico. While it’s likely that changes will be made to the bill to bring a good deal of these Senators on board, Republicans, this puts the Senate GOP in much the same position it was on health care reform since McConnell can only afford to lose two “yes” votes before the bill dies due to the failure to garner even the fifty votes needed to allow for the Vice-President’s tie-breaking vote.

FiveThirtyEight notes that this process could have an impact on when a vote occurs:

This horse-trading could lead to a bill getting passed, and if the final result didn’t increase the deficit but did include tax cuts for the middle class, it could ultimately be a better political move for the Republicans.3 But it’s easy to imagine this unruly process extending into January or February, and Republicans in the Senate once again spending months fruitlessly trying to write a bill that gets 50 GOP senators behind it. As with Obamacare, such a failure would make congressional Republicans and Trump look disorganized and unable to govern despite having the presidency and both houses of Congress.

Trump could still receive a tax cut bill on his desk as his Christmas gift. Or his present for Presidents Day (which is Feb. 19). But there are enough rankled Republican senators that he should be worried the package might never make it to the White House.

Even if the Senate manages to pass a bill by the end of the month, that won’t be the end of the process. The differences between what the House of Representatives passed earlier this month and what the Senate is reportedly considering are quite considerable, and House Republican Leadership has said that there would not be enough Republican votes to pass the Senate bill in that body. This means that the two chambers would have to form a conference committee to try to hammer out a bill that could pass both chambers, Assuming they’re able to come up with such a bill, that bill will need to pass both chambers without any changes whatsoever before it can make it to the President’s desk for signature. To state the obvious, it’s extremely unlikely that all of this can happen before the end of the year. This means that the bill will be sitting out there to be poked, prodded, and challenged by the left and the right. In any case, we’re likely to end the calendar year without a single major legislative accomplishment for the President and the Republican Congress.

If this fails I have no idea how the Conman-in-Chief is going to match the billion dollar Christmas gift this was to his kids. Santa has a stupid comb-over.

Calling it tax reform is weird.

This bill just wrecks the deficit, applies pressure to choke medicaid and Social Security, hurts grad students and people in higher-tax states, and gives big tax cuts to the already wealthy.

And lots of trump supporters are going to lose money in the end.

But what else is new.

@teve tory:

And you know damn well in a year or two the Trumplicans will be screaming that we need to slash SS and Medicare because they are (because of their giveaway to the wealthy) unsustainable.

yeah some of them have already explicitly said that.

@Daryl’s other brother Darryl: @teve tory: And they will build in that slashing those programs will be for people currently under 55 because “it is not fair to those who currently count on them to have their benefits cut.” So older people and wealthier people will get tax cuts and protected benefits, while younger and poorer people will get tax hikes and smaller benefits. I am sure that this is coincidental and not pandering to Trump’s base at all.

Seriously I know that Republican party leaders have decided that they need to get on board with Trump because they are terrified of his base. Do they not realize that Trump is in his 70’s, overweight with by all accounts an unhealthy diet, and term limited? He won’t be president forever. Do they have any succession plan at all?

I’m old enough to remember when the president was a total disgrace who once wore a tan suit and was so elitist he wanted mustard on his burger so fancy and obscure that you can buy it at Food Lion.

@teve tory:

The fools have no idea they are being taken, and if they stood a chance of being smart enough to figure it out…they would delude themselves into no believing it.

It’s a con that makes Trump University seem like a little 3-card monte game.

@Pete S:

Shoot, by 2024, a lot of the Republican Senators will be retired/dead; what do they care about succession? Carpe diem!

@Just ‘nutha ig’nint cracker:

Tu ne quaesieris – scire nefas – quem mihi, quem tibi

finem di dederint, Leuconoe, nec Babylonios

temptaris numeros. Ut melius quicquid erit pati,

seu pluris hiemes, seu tribuit Iuppiter ultimam,

quae nunc oppositis debilitat pumicibus mare

Tyrrhenum. Sapias, vina liques, et spatio brevi

spem longam reseces. Dum loquimur, fugerit invida

aetas: carpe diem, quam minimum credula postero

(That “a’ on “credula” stumped me for the longest time until I remembered that this ode was addressed to a woman.)

Honestly, Republicans should strip out most of the fraudulent and toxic “middle class tax cut” stuff, reduce the corporate tax rate to 20 or 25 percent and incentivize domestic employment. Basically, do the least amount of harm that they can find their way to.

I’m sorry, what was I thinking?

@teve tory: That last guy played golf, too. What an embarrassment!

I’m always amazed at the blatant, utter hypocrisy involved.

@al-Ameda:

Well…if we are going to fantasize…what they should do is what they campaigned on doing.

No tax cuts for the wealthy and give a nice fat tax cut to the middle and lower classes. This would spur demand, which would incentivize all the corporations sitting on record profits to invest those profits in the manufacturing and the employees required to satisfy that demand. The economy would skyrocket.

The Bush Recession was a demand recession, and demand has never fully recovered.

– OR –

Spend the $1.4T on Infrastructure. Construction, while stronger than it was, has never really recovered from The Bush Recession, either.

Bottom line…there are far better ways to spend $1.4T than just giving it to Donnie Jr. and Ivanka.

Don’t they have to get a budget together too, to avoid a government shutdown? That’s bound to take some time in the Senate…

@Daryl’s other brother Darryl:

Ultimately it would just go to their lawyers anyway the way the Trump family seems to be headed.

@teve tory:

“This bill just wrecks the deficit, applies pressure to choke medicaid and Social Security, hurts grad students and people in higher-tax states, and gives big tax cuts to the already wealthy.”

From the point of view of Republicans, these are all virtues, other than (possibly) increasing the deficit.

It’s fascinating to see how many Republican Congress Critters really seem to believe the “magic tax cut = amazing growth and miraculous jobs’ theorY put out there in this bill. They actually take Ryan’s Libertarian foo-fo-rah and McConnell’s out and out BS at face value. No end to stupid in the Republican Party.

I was similarly astonished during the healthcare debate when I realized that a significant number believed the Republican leadership nonsense that they had a plan all ready to go and it would cover more people at a cheaper rate and you could go to any doctor any where and everything would be covered. Why could they do it and the Dem’s couldn’t? Because the Dems were evil bad stupid while the Repubs were smart shiny entrepreneurs! Of course, once it made it thought these nincompoops thick skulls that it was all smoke and mirrors and their leadership had nothing, they still voted with them. They may be credulous nincompoops, but they are craven credulous nincompoops!

A question: The preliminary headcounts look like they’re assuming Rand Paul will (1) be present to vote, and (2) vote yes. Has he actually indicated that he will designate a proxy to vote yes? That hardly seems like a given.

The sheer stupidity of a “Tax reform” bill that damages higher education…

If the US damages its higher education and investment in renewable energy tech, we will be forfeiting huge and booming industries to china.

https://www.bloomberg.com/news/articles/2017-10-26/china-s-global-ambition-could-split-the-world-economy

@Moosebreath:

They never give a fvck about the deficit unless a Democrat is President. They’ll happily spend far in excess of revenue if it means giving the 1% a tax cut. But try to help average Americans climb out of the hole (the Republicans put them in) and they throw a shitfit.

We are seeing the posturing, soapboxing, and grandstanding by the politicians. We have seen it before, and will see it again. This is typical and the way the system works, even if it does not make sense and is not the way business is done in the real world.

But a lot of wheeling and dealing, shuffling and bluffing, and passing the bourbon is going on in the back room that no one sees. And then a deal is worked out.

What they all can agree on is a fair cut for the middle class, simpler documents and forms, and reworking the indexes and tables. There should be some exemptions from income taxes for different groups of people, including veterans and the seniors group.

Other financial news related to taxes:

See: Forbes – “Senate tax reform bill cuts rates for small businesses”,

“How tax reform could radically change divorce”

“Amazon to be the first trillion dollar company?” (John B. Layfield, Fox Business.

@Pete S: Good point! They’re gonna really need that money. We wouldn’t want to the First Family to have to sell assets to defend themselves from scurrilous left-wing accusations, after all.

(Yes, I do realize that implies that they have assets that are unencumbered enough to sell, but…)

@Moosebreath: Deficits don’t count during Republican administrations. The projected growth estimates wipe out the deficits making net growth of the Federal budget not only possible but also necessary to handle all the new money the economy is generating.

@Tyrell: I really wish I believed what you do about the process, but I don’t think it works that way anymore. And it probably didn’t back then either.

“Gee, Toto, I don’t think we’re in Kansas anymore.” (And thank god for that considering what a mess it’s in.)

@Moosebreath: “From the point of view of Republicans, these are all virtues, other than (possibly) increasing the deficit.”

It’s been three waves now where Republicans scream about Democratic deficits, and then blow them up like parade balloons when they get into power.