National Debt Hysteria?

In a front piece story in today’s NYT, Edmund Andrews warns that the bill is about to come due on the massive borrowing the federal government has engaged in.

In a front piece story in today’s NYT, Edmund Andrews warns that the bill is about to come due on the massive borrowing the federal government has engaged in.

Treasury officials now face a trifecta of headaches: a mountain of new debt, a balloon of short-term borrowings that come due in the months ahead, and interest rates that are sure to climb back to normal as soon as the Federal Reserve decides that the emergency has passed.

[…]

With the national debt now topping $12 trillion, the White House estimates that the government’s tab for servicing the debt will exceed $700 billion a year in 2019, up from $202 billion this year, even if annual budget deficits shrink drastically. Other forecasters say the figure could be much higher.

In concrete terms, an additional $500 billion a year in interest expense would total more than the combined federal budgets this year for education, energy, homeland security and the wars in Iraq and Afghanistan.

[…]

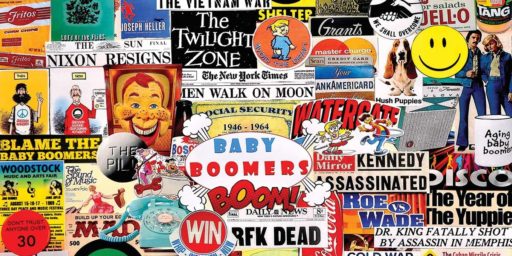

Americans now have to climb out of two deep holes: as debt-loaded consumers, whose personal wealth sank along with housing and stock prices; and as taxpayers, whose government debt has almost doubled in the last two years alone, just as costs tied to benefits for retiring baby boomers are set to explode. The competing demands could deepen political battles over the size and role of the government, the trade-offs between taxes and spending, the choices between helping older generations versus younger ones, and the bottom-line questions about who should ultimately shoulder the burden.

[…]

The problem, many analysts say, is that record government deficits have arrived just as the long-feared explosion begins in spending on benefits under Medicare and Social Security. The nation’s oldest baby boomers are approaching 65, setting off what experts have warned for years will be a fiscal nightmare for the government. “What a good country or a good squirrel should be doing is stashing away nuts for the winter,” said William H. Gross, managing director of the Pimco Group, the giant bond-management firm. “The United States is not only not saving nuts, it’s eating the ones left over from the last winter.”

Emphases mine.

This sounds ominous and unsustainable. But Paul Krugman, recent winner of the Nobel Prize in economics, say these fears are overblown.

As Dean says, the numbers don’t fit the scare story — a decade from now interest payments will reach a level not seen since … 1992. And the market seems unworried, since long-term rates remain low.

The “Dean” is question is Dean Baker of The American Prospect. He sarcastically titles his post, “In Just a Decade the U.S. Interest Burden Could Be as High as It Was in 1992!!!!!!!”

There is no evidence presented in this article that the rise in interest rates will place the U.S. government in a situation where it will be unable to pay its bills and no one cited in this article makes such a claim.

The article is also completely unbalanced in not presenting the views of any economist who could put the deficit/debt issue in perspective for readers.

Krugman makes the same charge but, oddly, neither of them bother to actually present a counterargument.

Andrews argues that most of the debt is in short-term loans whose price will go up as there becomes more competition for money. He makes what strikes me as a plausible case that higher interest rates, growth in entitlement spending, and a smaller tax base will make servicing the debt very, very difficult. Countervailing factors could offset this but neither Krugman nor Baker tell us what they might be.

It’s true that we had gloom and doom forecasts during the 1992 recession. But we only solved those through the dual magic of the dotcom bubble and the post-Cold War defense drawdown. It’s not likely that those events will repeat themselves.

Photo by Flickr user kandyjaxx under Creative Commons license.

My wife had a similar conversation with her father just the other day… what it boils down to is the fact that the average US taxpayer doesn’t give a rat’s butt about the deficit unless the economy is otherwise in great shape and it’s really the most pressing thing he or she has to worry about.

For someone without a job, without health coverage, without any prospects for retiring without having to move in with his or her own children to be supported, the deficit ranks somewhere below “buy socks” on the list of things to be worried about.

Do you understand how much a trillion is? I understand the Europeans do not even use the number. They say a thousand billion. Our debt is something like Twelve thousand billion. If that does not scare you, you are and idiot or a fool. Krugman is a fool and an idiot.

What I find amusing is that if we go back we’ll find many on the Left getting hysterical about the Bush deficits and Cheney’s comments that deficits don’t matter. Now when Krugman says it…why that’s okay.

Can we say partisan hacks?

Linky, and linky number two.

“It’s true that we had gloom and doom forecasts during the 1992 recession. But we only solved those through the dual magic of the dotcom bubble and the post-Cold War defense drawdown. It’s not likely that those events will repeat themselves.”

A couple of tax increases, one of which cost Bush the father his re-election prospects, and the other of which passed with no Republican votes, also had a significant role to play.

I would be very surprised if Krugman and Baker believed that permanently running high deficits is a good idea, or that inflation won’t rear its head at some point. But right now, getting people back to work is a much higher priority. And pace Steve, there’s no hypocrisy in decrying the deficits the Bush admin ran during the fat years, and advocating deficit spending when unemployment is around 10%.

The supply-siders are often (and rightly) derided for seeing tax cuts as the answer to every economic question. But right now, that prescription is actually more responsible than the Hooverite deficit reductions favored by the supposedly serious people in the center.

I’m 41 years old. For my entire existence, with the exception of a couple of atypical years during the late 1990’s, my government has always run a budget deficit. Everyone understands that deficits are unsustainable and that at some point the piper will be paid one way or another. Personally, I think it’s going to be paid in my lifetime by my generation and I’m not too excited about it.

kth,

You clearly did not read the second link which is the most damning.

Krugman was “terrified” (yes that is the word he used) about a 10 year budget prediction of $1.8 trillion in deficits and pointed to Social Security and Medicare imbalances.

Now he points to a 10 year budget prediction of $9 trillion with Social Security and Medicare imbalances still present and its, “Meh, we’ll grow our way out.”

As I’ve argued before, sure, if we had a good fiscal outlook and a bad economy then modest stimulus spending might be worth a shot. I’m doubtful it could work, but a trillion or two with an economy this big…okay we can take the hit if it doesn’t work out and the economy is pretty crappy.

But we DO NOT have a good fiscal outlook. Not even counting the Obama/Bush-carry-over (how ever you want to paint it) spending, its pretty bad. Necessitating large tax increases. With the added debt, those tax increases will have to all the larger. On top of it the Health Care Expansion and Entrenchment Act will make hiring workers a dubious prospect for many firms, especially small ones. Then there is the global warming legislation sitting out there like Jabba the Hut that is making investors nervous.

It is not a good picture. It is a bad picture. On top of it we are taking the same approach with our zombie banks as Japan did (oh and Japan did the fiscal stimulus too) and they “lost” a decade for their troubles.

So you aren’t looking at the complete picture, nor are you looking at the entirety of Krugman’s comments.

Andy,

Yes. And lets look back at those boom years in the 1990s…or more accurately lets look at the BUBBLE economy we had then.

Whoops. We got those surpluses during a bubble economy. Is that the new policy? Go for bubbles and hope they last long enough to get us out of the red ink? We’ve had two bubbles now and neither one really did the trick.

In 1992 we also elected a president who believed in fiscal responsibility and free trade and was willing to fight for them. In 2008, not so much.

I’d argue that the so called surplusses in the late 90’s were an illusion not only because we had a bubble economy, but because we had the so called peace dividend…….which then got spent.

I’m too lazy to look it up, but this economy has run a deficit in every year since 1960 or 1961 or 1962 (except as noted above). It used to be guns or butter. Then is was guns and butter, and then guns and a lot of butter and then fewer guns but scoops of butter………..and now heaping scoops of butter.

And kth, we have no shortage of tax revenue. We simply have out of control spending, and that’s been the trend for years now.

I dunno, Drew. Fighting a war, let alone two, takes a lot of guns. Or at least that was the theory when I was in.