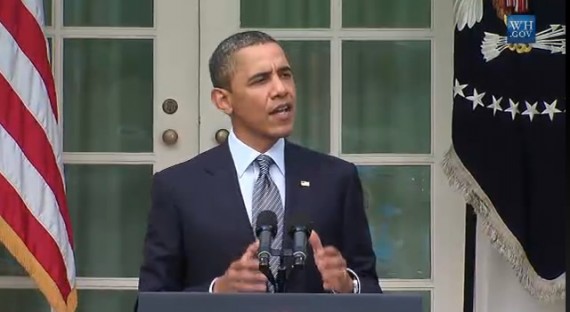

Polls Indicate Strong Public Support For President Obama’s Jobs And Tax Proposals

The public supports the Presidents tax plans, but will that matter on Election Day?

Two new polls show that, at least when it comes to taxing the rich and some of the details of his jobs plan, President Obama has the public behind him.

First, there’s this from Gallup:

PRINCETON, NJ — Americans generally favor raising taxes on higher-income Americans and eliminating tax deductions for some corporations as ways of paying for President Obama’s proposed jobs plan.

Obama laid out his proposals for the jobs bill in an address to Congress on Sept. 8, and sent the bill to Congress a few days later. Since then, the president has been pushing Congress to adopt the plan, although there are no signs yet as to when either House of Congress will begin to debate the bill.

The president also proposed raising taxes on wealthy Americans in his deficit-reduction proposal announced on Monday at the White House. Republican leaders have responded that this idea represents nothing more than “class warfare,” but the current data show that the majority of Americans generally favor increasing taxes on the rich as a way to increase revenue.

Here’s how the numbers come down on taxes:

And here’s how they come down on the jobs plan proposals:

Even the partisan breakdown on both parts of the President’s plans is largely to his advantage:

- 53% of Republicans and Republican leaning independents favor raising taxes on corporations by eliminating certain deductions

- 41% of Republicans and Republican leaning independents favor raising taxes on individuals earning $200,000 per year and more, and families earning $250,000 per year and more

- Majorities of Republicans and Republican leaning independents favor tax cuts for small business (86%), providing additional funds to hire teachers, cops, and firefighters (56%), giving tax breaks to companies hiring people who have been unemployed for more than six months, and providing funds for public works projects (50%)

- 41% of Republicans and Republican leaning independents favor extending the Payroll Tax Cut

The only element of the President’s plan that didn’t get at least 40% support among Republicans is extension of unemployment benefits.

There are similar results to be found in two questions buried in last weeks CBS/New York Times Poll:

q75 Do you think any plan to reduce the federal budget deficit should include only tax increases, or only spending cuts, or a combination of both tax increases and spending cuts?

Both – Total Yes — 71%

…Republicans answering Yes 57%

…Democrats answering Yes 82%

…Independents answering Yes 70%q76 In order to lower the nation’s budget deficit, do you think taxes should be increased on households earning $250,000 a year or more or should the government address the budget deficit without increasing taxes on those households?

Increase – Total 56%

…Rep 39%

…Dem 70%

…Ind 55%

None of this should be surprising. We’ve seen it plenty of times before. In 2008, the idea of not letting the Bush tax cuts continue to for people earning more than $200,000 per year was a regular part of Obama’s stump speeches, and polling at the time showed that the public was behind him. When extension time came up in December 2010, polls one again showed broad support for the idea of letting tax rates increase for this group of taxpayers, a fact that made the President’s decision to make a deal with the GOP that allowed all the cuts to be extended through the end of 2012 all the more puzzling. Yes, he had just suffered a huge election setback in the mid-term elections, but on this particular issue the public was behind him and yet he chose not to exploit that support.

In any event, these numbers are all the explanation you need for why the Administration has chosen to go down the route they have on taxes and deficit reduction. First, they approaching this from a direction that is going to make the base of the Democratic Party happy, which is necessary if only to counter the fact that Republicans are already heavily engaged and heavily enthusiastic about their party’s chances in 2012. It’s also aimed at the Indpendent voters who have been drifting away from the President in the wake of a stagnant economy and persistently high unemployment rate.

Will it work? Will the President be able to divert public attention from a faltering economy and high jobless rates by repeating the same “tax the rich” mantras we heard from Democrats in the past., or will this be another repeat of the Walter Mondale and Mike Dukakis fiascoes? Only time will tell, of course. Envy and resentment are powerful emotions and politicians have been appealing to them throughout history. I’ve got to wonder, though, if people who are primarily concerned with the future of the economy are going to have their mind changed by worries over how much Warren Buffett pays in taxes.

“Envy and resentment are powerful emotions and politicians have been appealing to them throughout history. I’ve got to wonder, though, if people who are primarily concerned with the future of the economy are going to have their mind changed by worries over how much Warren Buffett pays in taxes.”

Electorally, who knows what’s going to happen. Our system is built to allow highly motivated minorities to overcome passive majorities.

Economically, the President is at least putting forth an economic vision that has a chance to work, despite Doug’s delicate sensibilities. He wants to raise revenue and he wants to cut spending. Contrasted with the GOP’s combination of resentment, gibberish and neo-feudalism, it’s an easy choice.

Mike

It’s really possible that the bulk of those wanting tax increases are being pragmatic, and that they are only painted as emotional … by the emotional.

We have a $14T debt. We have a lot of people making $250K plus. What do we do?

Why we call taxing the wealthy “envy and resentment” of course.

(Further experiments in “running the government on air” to follow.)

Public, shmublic.

What do they know?

Why should what they think matter? Who do these people think they are?

I was unaware that Walter Mondale or Michael Dukakis were ever President. So I’m wondering to what “fiasco” it is to which you are referring.

Shorter Doug: “The Presidents’ plan s popular with the public, so it’s doomed to fail.”

@EddieInCA:

Yeah, this representative democracy stuff is so misguided.

Add to that “envy and resentment” and the petty just drips off this post.

How long can the Congressional Republicans continue to thwart the will of the American people before it begins to cost them in the voting booth?

The Republicans’ rich masters have just set up a free lunch program for them to keep Republican members in line:

http://www.huffingtonpost.com/2011/09/20/koch-funded-academy-congressional-civil-justice-caucus-academy_n_971868.html

Not doubt more bribes will be coming their way as political pressure grows.

I see Doug is in full “toady-the-rich” mode.

Maybe if he’s a good boy they’ll let him join their club.

In a separate poll, “free beer for all” received support from 87% of respondants………..

Not when the so-called liberal media has decided that taxing the rich might affect their own members. Such poll results are never to be used for support of the President’s policies on the Op-Ed pages or on TV commentary.

When extension time came up in December 2010, polls one again showed broad support for the idea of letting tax rates increase for this group of taxpayers, a fact that made the President’s decision to make a deal with the GOP that allowed all the cuts to be extended through the end of 2012 all the more puzzling.

Suffering from amnesia, Doug? The reason the tax cuts were extended for high earners in late 2010 is the Republicans hostage-takers. They were unwilling to extend the tax cuts for the rest of Americans as well as the payroll tax cut, tuition credits, tax incentives for businesses, and unemployment benefits unless the rich kept their tax cut. So it’s not real puzzling at all why he struck a deal. The economy would have suffered even more than it has if he had not, thanks to the Republicans, and they would have blamed him for it every single day.

or will this be another repeat of the Walter Mondale and Mike Dukakis fiascoes?

Ah yes, I remember the days under Presidents Mondale and Dukakis. Wait, what?

@Drew:

And, as usual, Drew was in the 13% voting no due to the fact that the rich weren’t getting enough beer, despite the fact that it was free.

meanwhile so-called republican leaders have demanded that the fed do nothing to help the economy.

http://blogs.wsj.com/economics/2011/09/20/full-text-republicans-letter-to-bernanke-questioning-more-fed-action/

to the four idiots who signed this letter power is far more important than actually helping the country.

the choice:

one party is trying to dig out of the hole, even if you think their efforts are not 100% spot-on. the other party is content to let the country wallow in the ditch in the hopes that it helps them regain the power they previously used to put us in said ditch. one party wants to take actions that most of the country agrees with. the other party is only interested in their own political gain. one party thinks the richest amongst us can return to tax rates that helped balance the budget. the other thinks it is better to shift costs to the poor and sick and elderly in order to provide lower tax rates to people who are already enjoying historically low effective tax rates.

simple.

You nailed it, Doug. However, it’s Obama’s last viable card in his deck — to play off these raw emotions to the hilt. However, even though such a strategy might appeal to a majority of his audience, will it help the economy improve?

Bill Clinton doesn’t think so.

This is from a guy who had it both ways during his two terms in office. He first raised taxes, and saw the law of diminishing returns in action, by only achieving a third of the revenues anticipated. Then he lowered taxes, and the revenue stream improved.

@jan: “He first raised taxes, and saw the law of diminishing returns in action, by only achieving a third of the revenues anticipated. Then he lowered taxes, and the revenue stream improved.”

Needless to say, that’s not really what happened.

Mike

Um…no. That’s not what really happened.

In addition the revenue increases that Obama is proposing are not immediate. Essentially, if you had the ability to form an independent thought, you would see that Clinton and Obama are on very similar pages.

@john personna:

There are numerous analysis out and about, showing that even if you “tax the rich” all the way up to 100%, very little numerical value will be achieved in inching down the deficit. In fact, the population making a million dollars is relatively small — somewhere around 250,000 people. And, as I’ve posted earlier, “rich” people have avenues to take their assets, move them around or overseas, where they can circumvent being caught up in any overreaching taxation mandates.

Just look at Buffett! Here’s a guy who, on one hand, is Obama’s token rich guy calling for higher taxation of the rich, while his company, Berkshire-Hathaway INC., has been avoiding paying a billion dollars worth of back taxes since the early part of 2000. Even liberal icon, Ted Turner came out saying “No one likes to pay higher taxes.” Rich people, though, have the ways and means to extract their capital and play in other more lucretive markets. It will be the middle income, the small business person, and ultimately the worker, though, who will reap the consequences of higher taxation by being squeezed more and having higher unemployment.

In the meantime, Obama will get what he wants which is an issue that sounds good in the ears of the electorate.

And of course, jan also misses that Clinton spends far more words saying we should not cut spending, as well. So of course we should take jan as being in favor of waiting until the economy picks up to reduce the deficit. Right, jan?

It’s nice that jan has access to an alternate history where, by amazing coincidence, everything happened exactly as her political biases predicts it would.

@Drew:

I’d say a $14T debt, and “tax cuts for all” are closer to what you are claiming.

@jan:

I don’t know why you’d tell me that, when I don’t want to tax the rich up to 100%.

All I want is a mildly progressive tax code, and not even one sized to eliminate the deficit by itself. What was the grand bargain? 4 to 1 spending cuts to tax increases.

Ok, let’s to spending cuts “4” to tax increase “1” and do it with a progressive code.

@jan:

Berkshire-Hathaway has paid taxes, and Berkshire-Hathaway lawyers are in negotiations with the IRS about how much they owe. That might be confrontational, but it is our system. And I bet you think it is OK for every company but one run by Buffett, right?

@Jan…

You have been asked this numerous times and you never answer the question.

Please…given that we currently have historically low effective tax rates, yet are suffering from anemic revenues and 9% unemployment, at what level should taxes be to actually achieve the economic effect that you think low taxes achieve?

Please please please, for once answer the question.

@Xenos:

Yea, they elected this fraud in the first place!

In a compromise with Republican Congress, Clinton did sign on to a decrease in the capital gains tax from 28 to 20 percent in his second term. However, the income tax rates passed during his first term remained. So, Jan is right about the decrease, albeit wrong about the reasons (big surprise). The decrease was partially offset by adding an additional 15 cent per pack tax on cigarettes.

Clinton may not agree with tax increases at this point, but he’s not calling for decreases either; nor does he want to see government spending slashed. Republicans are calling for both measures.

@ponce:

“How long can the Congressional Republicans continue to thwart the will of the American people before it begins to cost them in the voting booth?”

Hmmm, the historic election of 2010, the failed recall elections of Wisconsin, the huge defeat of the meat tweeters seat in NY9……

I guess they will wake up soon.

@john personna:

Nope! My husband and I pay our taxes, quarterly, as do many other citizens.

Buffett is the one who is publically making an issue about not paying enough, which is why it seems strange that he and his lawyers are fighting, tooth and nail, to not pay the billion or so the IRS is asking them to pay.

@Fiona:

Legislation between two opposing parties is usually derived by some kind of compromise being enacted. However, part of Clinton’s compliance to a tax decrease was seeing, first hand, how negatively his tax increase effected revenues. And, as for any offsets by a cigarette tax, that is so minor in it’s financial impact — a symbolic tax.

@ Jan…“

I guess that means the concept of paying only what you are required to pay seems strange to you.

You have been asked this numerous times and you never answer the question.

Please…given that we currently have historically low effective tax rates, yet are suffering from anemic revenues and 9% unemployment, at what level should taxes be to actually achieve the economic effect that you think low taxes achieve?

Please please please, for once answer the question.

@Hey Norm:

…start with Simpson-Bowles.

@Drew:

Actually, no, most people oppose tax breaks for big oil and bailouts to big banks and . . . Oh, sorry, I misunderstood you. You didn’t mean the hundereds of billions of dollars in free beer doled out to the rich. You meant the twenty bucks a working mother might get.

Of course.

What rax rate is that, Jan?

I brew my own beer and have been for about 12 years. My latest batch was ObamaBrew.

Quite bitter, flat and no head.

And they may very well reelect the “fraud”…won’t that make your toes curl…

@jan: “However, part of Clinton’s compliance to a tax decrease was seeing, first hand, how negatively his tax increase effected revenues.”

The Clinton capital gains tax cut was passed in the middle of 1997.

Federal tax revenues (in current dollars)

1992 – 1.091 trillion

1993 – 1.154 trillion

1994 – 1.258 trillion

1995 – 1.351 trillion

1996 – 1.452 trillion

1997 – 1.579 trillion

Mike

@jan: So you think we need a bigger tax increase because the actual revenues will be lower than projected?

Doug? Anything?

You seem to have time for 20 posts a day but no time to respond to those pointing out your idiocy.

Well considering the fact that most people are not rich..I am sure they think that they would rather see taxes raised on the rich than on themselves. There is a lot of the better thee than me mindset going on here.

But in the end, it won’t help the economy or the deficit and people will go right on feeling like they have been lied to.

@jan:

Tell that to the current crop of Republicans who are willing to take the economy down with them rather than compromise.

And your evidence for this is what? Some right wing pundits trying to read Clinton’s mind? The economy grew during Clinton’s first term as did tax revenues. The income tax rates set in place during his first term remained the same during his second term. Clinton vetoed a number of tax increase bills prior to signing on to the capital gains tax decrease. That he eventually signed on is more a reflection of a President dealing with a majority Republican congress and needing to give on some of his desires, than a failure of his initial policies.

The tax rates on capital gains and income are now far lower. At some point, tax increases will have to be on the table to reduce the national debt.

@Terrye: Taxes must follow the wealth. That should be obvious.

@An Interested Party:

The chances of the One getting another term? You odds are better at becoming another millionaire.

I hope for change and really truly desire to see a Democrat primary contender. I am not really excited at any on the Repub side(as usual) and would love to see a moderate Democrat run against Obama. If one had the balls to face the charge of being a racist, he or she would stand a great chance to win the election.

@ Fiona…

You might also point out to Jan that Bush 41 had also increased taxes. You might also point out that during this time America experienced the longest expansion in recent memory, and the 10 years spanning the later part of the Bush 41 Presidency and the Clinton Presidency are one of the longest periods America has ever gone without a recession. You might also point out that spending during this period was reduced.

Folks like Jan thanked Bush 41 by voting him out of office. I’m glad Jan seems to be embracing Clinton economic policy. So-called republicans at the time screamed that these policies would destroy the economy. They were wrong then. They are wrong now. Some things never change.

Twelve years and you still can’t make a decent beer? Just like a conservative. Keep doing what doesn’t work, over and over again.

@ Jan…

Simpson-Bowles calls for a larger increase in revenues than Obama is proposing. Simpson/Bowles, the Obama/Boehner Grand Bargain, and Obama’s current proposal are all in the same wheel house.

So you are on board with Obama’s proposal?

If I were Sam I would check some of my brewing equipment. Exposure to certain materials in the process, such as lead or galvanized metals, could be the cause of…well…how do I put this…his (or her) condition.

@Hey Norm:

Hey Norm, find that brick yet and shoved it up you ass to hit your brain?

@mantis:

Oh no, This batch was a perfect representation of the man. I have had some locally award winning brews as well.

@mantis:

“Keep doing what doesn’t work, over and over again. ”

Like stimulus spending………

@john personna: That’s exactly what I was thinking, jp. It’s pretty twisted to always assume nefarious intentions behind every policy proposal.

@jan:

What She Said

@Hey Norm:

Yep, Bush 41 increased taxes. As did Reagan when it turned out that his tax less, spend more budgets tripled the national debt. I keep forgetting that Reagan and Bush 41 would be drummed out of today’s Republican party for being too moderate.

jan is making use of a little trick the fringe right discovered at the very beginning of the internet:

It’s a lot easier to tell lies than it is to counter them.

@mantis:

Ooh, Sam loses again.

@ Fiona…

Drummed out? Today’s so-called republicans would call Reagan a socialist!!!

@jan:

Wow. When you can’t make progress on-topic, bend to some other issue you can factually distort. People will correct your distortions, moving conversation further off-topic.

Classic, though transparent.

This is a typical terrible poll question….

Should have been asked: Would you support tax increases on those making over 200k if it meant increasing the odds you might lose your job?

The free beer analogy was the most accurate. A question needs to have two sides (a benefit, of you not having to pay, plus the jerk at the top of the hill does, as well as a pitfall). If you ask a kid if he wants candy, he’ll say yes. If you ask them if they want candy but will have to miss their favorite cartoon to get it, they’ll at least consider their options.

@NickNot:

I’ve noticed that keeping their tax rates at 50 year lows hasn’t exactly led those making over $200K to create new jobs, just ship existing jobs overseas. Perhaps if we just lower their federal tax rates to zero, remove all regulations, and stop letting anyone who makes less than $200K a year vote, we can entice them to become “job creators.” Ah, the Gilded Age. Those were the good old days.

Would you support tax increases on those making over 200k if it meant increasing the odds you might lose your job?

Because when taxes went up for the rich under Clinton, unemployment shot up, right? Oh wait, the opposite happened. Hmmm.

I love when people complain about polling questions and recommend completely obvious leading questions. I’m guessing you would prefer if poll questions such as:

“Do you approve or disapprove of President Obama’s performance as president?”

should be changed to:

“Do you approve or disapprove of evil communist Kenyan Muslim usurper Obama’s performance as president?”

You know, for fairness.

Keep hoping, baby, keep hoping…

Well considering 1/3 of the stimulus bill was in the form of tax cuts, you’re actually partially right for a change…

Where is the proof to support such a claim…

@NickNot: Based on what we saw over the last 20 years, here’s another take on a fair question:

In the 90s Republicans said the tax increases would harm the economy, but the economy grew and we added jobs instead. In the 00s, Republicans said the tax cuts would help the economy, but we had sluggish economic growth and very little job creation. Would you support tax increases on those making over $200k even though the Republicans oppose them?

@NickNot:

Its not Class Warfare, its Math

.

So many pathetic, childish responses…………so little time.

@Drew:

So, you’ve noticed that too!

@mantis:

Make it less expensive to hire and employers will create jobs. It sounds logical, and on an individual, or micro, level it is. But those rules often go out the window when dealing with economies on the aggregate (macro) level. That’s why macroeconomics is so important, because what happens when everybody dies something is very complex and often counterintuitive. The biggest flaw in conservative/libertarian thought is that it doesn’t acknowledge this.

And so little ability to defend your self-serving point of view.

Indeed, like this…

I think, big picture Obama must know the dynamic. As shown by this poll, most people support a progressive tax, possibly a smidge more progressive at the high end. But, all Obama has to do is talk about that, and he can incite a whole “oh no, we can’t tax the rich” response.

Maybe he is a troll, but it’s working.

To the extent that this puts the angry right on the wrong side of the voters, that weakens them for the coming election.

By what right do we take more from the rich with the stated goal of paying for governmental mismanagement? This question seems to me particularly potent when one considers that the proposed increased taxation on the supposed rich, won’t even scratch the surface of paying the debt.

@Eric Florack:

I’ll repeat for you since you seem a little slow on the uptake.

.

What She Said

Which “governmental mismanagement” do you mean?

The trillions we squander on wars, the hundreds of billions we give to Wall Street, the tens of billions we give to oil companies, or the hundreds of dollars to hungry children?

Yeah.

Thought so.

Seriously Drew, stop whining. It’s kind of hard to have any cred as the grownup in the room when you do it so regularly.

Go to Morton’s, have a nice dinner. Order a ’05 Bordeaux, perhaps a Pape Clément, and chase it with a good cigar and some Osborne brandy.

Then come back and try to contribute something worthwhile to the discussion.

So bit, you have still not backed up your sliming of Jerry Kellman – a man you call “an avowed communist”.

I know punking out is sort of your stock in trade, but this is pretty low even by your standards. So why don’t you man up and support this fairly serious accusation? Better yet, make the drive up to Park Ridge and tell the congregation at Mary, Seat of Wisdom that their Adult Faith Formation Director is a commie. Why don’t you make your accusation to Kellman’s face?

Oh wait, it would take a man to do that. Sorry, what was I thinking?

@Eric Florack:

As I say, the public is overwhelmingly in favor of progressive tax rates.

If you argue against that simple proposition, you marginalize yourself (further).

@Loviatar: That’s not an answer, That’s an equivocation, and not a very good one. Try again..

Of course! Ask two wolves and a sheep to vote on dinner. What kind of response do you expect?

The question you keep ducking is do the wolves have the right to eat the sheep simply because they have the votes for it?

Eric,

When was the last time someone won an election making the argument that taxation is inherently immoral?

@Eric Florack: “The question you keep ducking is do the wolves have the right to eat the sheep simply because they have the votes for it?”

Let’s try and put this in the sort of black-and-white, pseudo-macho terms guys like you seem to favor.

The only rights you have are those you can defend. The wolf has the “right” to eat the sheep because the wolf has claws and teeth and the sheep does not. If there were a lot of sheep, they could band together and kick at the wolf until he leaves the flock alone. In your analogy, however, we’re talking about a handful of sheep and thousands of hungry wolves. Right now, the wolves just want a little nibble to keep from starving. Pretty soon, they’ll want to eat all the sheep and won’t care about what might happen after that.

Mike

The whining from the rich and their handmaidens is really pathetic.

The rich have a really sweet deal here in the US, and it’s been getting sweeter for decades. Now, when it’s proposed that they chew on something bitter for a change for the sake of the rest of the country (for whom swallowing bitter pills is part & parcel of their lives of late), they (or rather some of them) cry class warfare.

Quit crying. If you want to cry about something, cry about the financial services ubermensch who shit the bed (and/or the brilliant minds behind our excellent Iraqi adventure) and got us into this mess.