Our Present Crisis: Recession, Depression, Or Something More Fundamental?

The world is likely to get worse before it gets better.

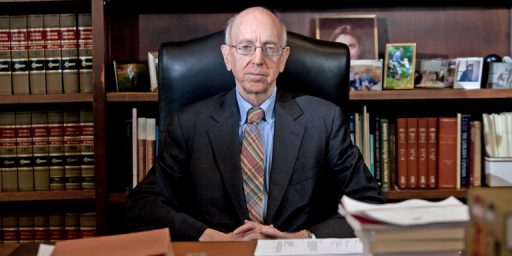

In a post over at his own place, my colleague Dave Schuler brings attention to an Op-Ed by Judge Richard Posner arguing that, regardless of what the economists call it, we are in the middle of a depression:

The American economy currently has both a short-term problem and a long-term problem. The short-term problem is that the economy is depressed; it is growing more slowly than the population, with the result that per capita income is declining. The high rate of un- and underemployment is a factor, but is itself the product of other factors, having mainly to do with the reluctance of over-indebted consumers (over-indebted in major part because of loss of equity in their houses, the major source of household wealth) to spend, the reluctance of the impaired banking industry to make risky loans, and the reluctance of businesses to invest and to hire, which is due in part to weak consumer spending and in part to profound uncertainty about the nation’s economic future.

The roots of this catastrophic situations lie primarily, I think, in the incompetent economic management of the Bush administration and the Federal Reserve. The persistence of the depression, however, is due in part at least to surprising failures of the Obama administration—poor leadership, poor management, the sponsorship of incomprehensibly complex health care and financial regulation laws that have created widespread uncertainty that has discouraged consumption and investment, and the inability to explain the nature of the economy’s problems to the general public. These failures caused the stimulus enacted in February 2009 to be botched in both in its design and its administration, resulting in the discrediting of deficit spending as a response to depression.

Posner goes on to argue, as others have recently, that there doesn’t seem to be much we can do about the short term economic problem at this point. More spending is out of the question politically, and also out of the question fiscally because of the growing long-term deficit problem. As for the long term problem, Posner is even more sanguine:

It’s not clear that we have enough years. Suppose that the economy recovers by the end of 2012, and in 2013 and subsequent years grows at a 4 percent annual rate. (The long-term growth rate is about 3 percent, but growth is usually more rapid when it starts from a low level.) The public debt won’t continue to grow at 17 or 18 percent a year, but suppose it grows at 7 percent a year. Then the already very large federal deficit will continue to grow, and indeed, to compound: At a 7 percent annual growth rate, our public debt in 2012, estimated at $12.4 trillion, will grow by 40 percent in five years if none of the reforms designed to limit that growth are implemented before the end of that period. Yet if they are implemented while the economy is still struggling, the result may actually be to increase the deficit by driving tax revenues down (because incomes will be depressed) despite the elimination of loopholes, and by increasing transfer payments to the unemployed and others hard hit by the economic crisis.

Over at Reuters, Felix Salmon finds problems more fundamental than the economic ones that Posner points to, and if he’s right then it makes the prospect of solving the economic problems even more unlikely:

[W]hat I’m seeing as I look around the world is a massive decrease of trust in the institutions of government. Where those institutions are oppressive and totalitarian, the ability of popular uprisings to bring them down is a joyous and welcome sight. But on the other side of the coin, when I look at rioters in England, I see a huge middle finger being waved at basic norms of lawfulness and civilized society, and an enthusiastic embrace of “going on the rob” as some kind of hugely enjoyable participation sport. The glue holding society together is dissolving, whether it’s made of fear or whether it’s made of enlightened self-interest.

(…)

[C]ountries and institutions can ultimately survive only with the will and consent of those they govern — and that consent is evaporating around the world. Europeans have no love for Europe’s institutions, be they the euro or the ECB or the EFSF. Unemployment, in much of Europe, has reached the point of no return — the point at which it becomes endemic, stubbornly immune to attempts to tackle it. In turn, that results in broad-based cynicism and disillusionment when it comes to politics and politicians generally.

Salmon points to Rick Perry and his comments about Ben Bernanke and the Federal Reserve Board, both in his recent campaign appearance and in the book he released last November, as an example of that phenomenon reaching this side of the pond. However, I think limiting the analysis to Perry misses the point significantly. The political movements that have sprung up in the United States in the last five years or so, on the left and the right, seem to express a profound distrust of government at it’s most fundamental levels, and a willingness to believe the worst about the motives of politicians one happens to be opposed to. The Tea Party movement specifically has tapped into a strand of distrust in government that has run through American politics since the Colonial Era, and created a mass movement that more resembles the rhetoric you would’ve heard in the era when the states were parties to the Articles of Confederation than the type of political discussions we would’ve been having even five or ten years ago. Call them crazy if you want, but ignoring what the Tea Party represents is a mistake, because it’s revealing serious fault lines in our political culture that won’t just be repaired with a single election.

Salmon sees this political breakdown, which seems to be happening around the world in different fashions, as the next step in a process that began with the 2008 financial crisis:

It looks increasingly as though we’re entering Phase 2 of the global crisis, with 2008-9 merely acting as the appetizer. In Phase 1, national and super-national treasuries and central banks managed to come to the rescue and stave off catastrophe. But in doing so, they weakened themselves to the point at which they’re unable to rise to the occasion this time round. Our hearts want government to come through and save the economy. But our heads know that it’s not going to happenS. And that failure, in turn, is only going to further weaken institutional legitimacy across the US and the world. It’s a vicious cycle, and I can’t see how we’re going to break out of it.

Salmon is largely on the nose, I think. It may not lead to regime instability, for the reasons that Ezra Klein points out in his response to Salmon, it seems pretty clear to me that continued slow economic growth, combined with the consequence of failing to deal with our long term debt problems, is likely to lead to social instability and more Americans concluding that there’s no point in putting any hope in the government. What the consequence of that might be I don’t know, but I doubt they’ll be good.

When all you’ve got is a juvenile libertarian hammer…

Taxes have never been lower.

Our current economic problems have nothing to do with the government…it’s our greedy, incompetent business class that’s responsible for America’s slow economic growth rate.

We have a combination of chronic and acute problems. On the chronic side we have had a credit based economy, public and private, since about 1980. Much of what we thought of as growth, was not real. Much of what we think we produce, was actually made overseas. We spend too much on health care, education and defense. Acutely, we have an international banking crisis. This has created so much additional debt on top of our existing credit based economy, that it will take years to repair balance sheets and work off the excess. This is something more fundamental.

Steve

Anytime I see “its all Bush’s fault” I know I’m dealing with a dope. Similarly, although Obama has been a miserable disaster, its not all his fault either.

This is a problem at least 50, perhaps 60 years in the making. It all revolves around a fundamental re-allocation of resources from the private sector to the state……all in the name of “good intentions,” no doubt. And add actuarial impossibilities. Bang. You are fiscally dead.

Europe is obviously going to be the first to tumble. Hopefully they will be the canary in our mine, although I’m not hopeful.

The state is an inherently more inefficient user of capital and human resources. The state is also a necessary evil, to produce a humane and protected society. But the hand has been overplayed. And that’s the rub. When taxation became more than politically or economically feasible, the financing mechanism switched to debt. A nation as prosperous as the USA has a tremendous debt capacity. But even that debt capacity runs out – Doug’s scolding of me a few weeks ago notwithstanding. Yes, it took decades. But here we are. Further, the world has become more competitive over time. Its easy to be sloppy when you are King of the World. When you have BRICS, the margin for error declines.

Barack Obama has come along and doubled down on the state as the solution. The so called Tea Party, or at least a fiscally conservative view, is offering resistance. Its a fork in the road for the nation. Obama’s worldview has essentially been the winner with voters for decades. Its seductive – get your money for nothing and your chicks for free. But there is no free lunch. You can see what shape our fiscal house is in.

England is in meltdown. Detroit is in meltdown. IL just today announced yet another business leaving its high tax environment. I pity the young and the underskilled who are reliant on others for employment and a future, because the golden goose has a cancer.

People haven’t come to grips with it yet, but the state can’t fix it, and raping the rich can’t fix it, as much as some would like to declare it so. And time is growing short.

@steve: You are so correct but in addition we have nearly every major bank in the west that in spite of bailouts is still insolvent. The banksters have combined greed with incompetence and the fact they still exist as institutions is an indication that we have any thing but a free market economy. Businesses are holding on to their cash if they have it because of uncertainty but it’s not uncertainty about regulations or taxes – it’s uncertainty about the health of the world financial system.

Doug,

There is no public debt crisis. There is no magic number at which the debt level annihilates an economy. Government could do a great deal to alleviate the current problems, but people with an 18th century understanding of the economy continue to dominate the discussion.

We have a private debt and jobs problem. Until the average person can deleverage there will be no private sector spending, and everything we know about macroeconomics says both the private and public sectors cannot be savers at the same time without crippling the economy. This of course means if government spending is really off the table, we must create the conditions necessary for individuals to do so.

We need complete and total forgiveness of private sector debt, all $50 trillion of it. Do that and the economy will suddenly be flush with cash and increased demand at all levels. It’s time for a debt jubilee.

@ponce: Ponce you should heed what Steve says. He is right on. Our economic growth the last 50 years was supported and abetted by the Fed supplying the money and credit required by politicians’ promises, stupid wars, complacency of a greedy electorate, a tax code that became the “Blue Light Special” for pols and their lobbyists, short term, bottom line thinking by business versus longer term planning and growth, and many other individual freedom smothering policies and ideas introduced by “enlightened” elites and greedy businesspeople who sought government protection from competition and hard work.

You are a true dunce to assert the government had no hand in the decline. Big business and big government will go down in history as the unholy alliance that caused the coming decline of the US.

No doubt its a Depression, and it´s “man made”!

http://thefaintofheart.wordpress.com/2011/07/10/depression/

Anyone who believes that after two years of the Obama Administrations complete free reign to do whatever it took to countermand the problem, that this is Bush’s fault, is not being intellectually honest.

Isn’t it time we declare that Lyndon Johnson’s “war on poverty” is an intractable quagmire and that we should bring the troops home immediately?

On a different but related topic, Posner obviously took a hit off a crack pipe before he wrote that piece (either that or his Bush Derangement Syndrome is terminal), but like the proverbial stopped clock he makes a couple of cogent and salient points. There indeed are fundamental, structural problems with the U.S. economy. One of which can’t be fixed. Another three of which theoretically could be fixed but practically can’t be redressed as a result of unfortunate and quite ironic political realities.

These structural problems exponentially are exacerbated by the existing debt problem, which incidentally traces back through “Landslide” Lyndon all the way to FDR and the latter’s amazingly-flawed wealth transfer program, a/k/a Social Security.

The first structural problem with the U.S. economy is one of demographics. We have a massive entitlement generation (the baby boomers) who will need to be supported by a small generation (the baby busters; Gen. Y). The math doesn’t work out.

The second structural problem with the U.S. economy is overleverage of banks and the complete unwillingness of policy makers to allow market forces to engender a painful but necessary restructuring of these debts. The government has determined that defending bondholders from principal losses despite their having lent at spread (not coincidentally these bondholders are major campaign donors) is more important than standards of living for the rest of us. As a result they’ve fashioned a financial system that’s nothing more than a giant Ponzi scheme. The Federal Reserve is the primary culprit here. Ultimately the economy will remain in the shitter for as long as these poison debts are allowed to fester. Since nobody has the political cojones to let the banks’ bondholders lose their shirts we’re trapped in a vicious cycle of these bad debts.

The third structural problem with the U.S. economy is the piss poor quality of the public K-12 education systems. We could spend all day on this topic. Suffice it to say that left-wing ideologues + politically-active unions + too many Democrats holding public offices has created a situation where a large percentage of our kids are too stupid gainfully to be employed. Literally.

The fourth structural problem with the U.S. economy is that of overregulation of private enterprises. Environmental regs. Labor and employment regs. Tax regs. OSHA regs. DOT regs. Public contracting regs. It goes on and on. We’re losing out on millions upon millions of high-paying jobs as a result of government regulations.

The fact we haven’t constructed a nuclear power plant in 30 years is absurd. The fact we’re not drilling for oil in Alaska because a few caribou will have to walk 10 feet to take a dump is an abomination. The fact that businesses can’t hire because of “living wage” ordinances is a travesty. The fact that contractors can’t get public works projects because an insufficient number of their owners are women or racial minorities is a disaster. The fact that people can’t get hired in various states because they don’t want to pay union dues and thus don’t belong to a union is preposterous. The fact we’re not logging in the Pacific Northwest because a spotted owl or two will get depressed is an abomination. The fact we’re not developing our shale reserves because it’ll upset trust fund babies in Beverly Hills and Pacific Heights is ludicrous. The fact that companies have to piss away billions of dollars in legal fees each year to deal with class action shakedown lawsuits is a travesty. That’s just the tip of the iceberg. I could go on all day.

Ultimately the country began its descent when left-wing ideologues obtained political power. Demographics have now become gasoline on fire. A poor public education system is kerosene on the gasoline. Now we face the reckoning. It won’t be pretty.

“The third structural problem with the U.S. economy is the piss poor quality of the public K-12 education systems.”

Both Europeans and Asians who come to the US score as well or better than those who remain in their home country. Somehow, our people who go through our K-12 system go on to teach the best universities in the world.

Steve

Good analysis by Steve, he seems to crank them out like clockwork.

@Tsar Nicholas:

You have made some good points. We can turn your argument around, but I will not be as articulate as you. When Bush was president, all I saw was our jobs going overseas, our money going to Iraq, “deficits don’t matter”, “stay the course” and the neglect of our infrastructure.

There is plenty of blame to go around. The Tea Party is a one trick pony and it is always a one trick pony for those on the right. There are a multitude of problems that need to be dealt with. And what turns people off about the right is that they ignore our problems (laissez-faire). Okay, so government is the bad guy. Well, if they don’t do it, then who will? We need an infrastructure, we need to deal with globalization and 2 billion cheap laborers, we need our meat inspected and not at the sacrifice of tax cuts. Yes, companies are beholding to their shareholders, but someone has to enforce the laws. You have cited many of the wrongs of the left and some are silly, but the right also does silly things. If you are going to have tax cuts, then let us see a return instead of chanting tax cuts, tax cuts, tax cuts all the time. I am looking at closed factories, and I don’t see the good that tax cuts have done. In fact, you could ask, just where is that prosperity? But that is what Bush and the right wing has sold us. Yeah, all on borrowed money.

And for the price of labor, Foxconn has decided to put 1 million robots in to replace the workers in their plant in China. It is a race to the bottom and the oligarchy is winning. The Tea Party is out there in the forefront with cutting spending, but they have not answered on jobs and giving us anything for the future. People want an answer and a leader. We know that programs need to be cut. But add it up. Jobs taken away, cheap labor, social programs to be cut, less inspections, less infrastructure, and more for defense and wars. People feel left out of the process. And our jobs are gone with nothing to replace them.

It may be a hard fact to face but we are entering a period of low or no growth because of the increasing scarcity and cost of of resources. We hear about peak oil but it’s all resources – peak tin, peak iron, peak phosphorus – yes we are facing all of those and more. We have picked all of the low hanging fruit. There is lots of oil left but can we afford it? For transportation probably not which will mean de-globalization. Economies will increasingly become more local. Long haul trucking has always been more expensive than rail but until recently the convenience made up for the cost but that is about to end.

The economy is reinventing itself out of necessity and the world is about to become a lot larger again. You can say the same thing about the very large United States of America.

The economy is going to be different but it’s only going to be worse if we fail to adapt.

@Drew: Your suggestion that more and more resources have been transferred to state control is belied by the tremendous growth in private wealth, and thirty years of declining tax rates. Government spending adds net financial assets to the private sector, it doesn’t subtract them.

Everything Steve says is belied by the fact that America’s debt as a percentage of GDP was much higher after WWII than it is today.

The fact that our executive class has managed to secure for themselves massive salaries that aren’t tied to their performance is more responsible for our current economic doldrums than anything the government has done.

Add in the fact that our “best and brightest” are squandering their talents playing zero sum games against each other at hedge funds and you have a recipe for economic stagnation.

@Tsar Nicholas:

A brilliant post!

You touched on so many points all leading to our current faltering position in the world.

From the under regulation of Frannie/Freddie leading to the subprime crisis, to what is now the over regulation of Frank/Dodd, the pendulum of change seems to swing wildly from one extreme to another, with no positive effects.

The lopsidedness of the aging, liberal baby boomers depending on receiving their benefits from a continually shrinking, struggling work force which followed them.

Over-regulated aging energy sources, having no new refineries built in decades, a clean coal industry under attack by the new powers of the EPA, with the green energy infant given subsidy after subsidy, in hopes that it will take the lead to power our country. However, it’s like trying to plant a full grown tree with no root structure — that’s how insufficient our green energy infrastructure is in trying to have it be the main source of energy for this country, at this time.

Basically, ideology has supplanted pragmatic reality. Egalitarianism has become the siren call over work ethic, leading to over all prosperity of a nation. Europe has put many of the progressive’s philosophies into practice, and failed. But, instead of seeing the cause and effect of these overseas countries, and self-correcting, there are those who simply want to press forward and do more of the same so we can self-destruct even faster.

UK riots — the end of the liberals great moral delusion

If only………….

@steve:

Good summary.

(And anyone who defended a political leader without acknowledging that globalization let to global imbalances, bad summary.)

@Drew:

I understand that such complete fantasy is important to your identity, but you should have some awareness of how it plays with the rest of us.

A grand bargain, with $4 trillion in cuts and only $1T in tax increase is not in a million years “doubling down on the state as the solution.”

@Ben Wolf:

But I admit, Drew, you are not alone in fantasy.

woo-hoo…the UNCERTAINTY canard, and wisdom by Jan [Fannie and Freddie led to the subprime crash and clean coal – what pure unmitigated tripe].

This is a dream thread, really.

Funny that growth stopped right as the “botched” stimulus funds began to run out. What a funny coincedence. I wonder why that was?

@Tsar Nicholas: @jan:

The current manufacturing wage in China is less than $1.50 per hour. It is a willful blindness when you say the taxes or regulations on a $15 (or $30) per hour job moves it overseas. Seriously, you need to integrate your worldview with that bit of reality.

Or (@Drew) it’s because Obama is a socialist that $1.50 is less than $15

(Of course, this is a big and possibly insolvable problem, which is why so many won’t talk about it, and instead let their minds slide over to blaming some person – someone they can fix anger and indignation upon. That won’t help either, but hey, it feels so good.)

As the Stimulus was being designed the contraction of 07-08 was estimated 0.8%. We now know it was actually contracting at 1.9% – 2.4 times the original estimate. So the Stimulus was designed for conditions not even imagined. Yet Posner sees this as “poor leadership”…which fits right in with Doug’s favorite meme/canard. Nicely played Doug.

The United States government is no longer capable of great ventures like the Marshall Plan and the construction of the California system of higher education. American public schools at all levels are no longer funded adequately, and American consumers no longer have enough disposable income to sustain consumer spending. Amazingly, we can’t even maintain our infrastructure. Our inequality, as shown by Saez and Piketty, is the highest since the late 20’s. The top 1% of US wage earners now earn more than the bottom 50%. CEO’s of our major corporations now earn from 250 to 500 times the salaries of their average workers. At the same time, income taxes paid by our richest citizens are at their lowest level since the 20’s.

Supposedly, all this is due to economic factors. If so, one would expect other developed countries to mirror our experience. This hasn’t happened (with the partial exception of Great Britain), so I’m forced to conclude that the causative agent is the determination of our possessing classes to grab more of the pie. We’re in a state of class warfare instigated by the rich, and their side (to which I belong in a modest way) is winning. This wouldn’t be so bad if they understood their own self-interest in the way Henry Ford did when he started paying his workers enough to buy his cars. But they don’t, as we can see by the reaction to Warren Buffet’s proposal to increase taxes on the wealthy.

For this reason, I think we’re a nation in decline, and I don’t see light at the end of the tunnel.

@Stan:

This page contains individual projections for each of the European nations. In each, the “baseline scenario” looks pretty ugly.

@Drew:

None of that nonsense in Drewtopia. National motto: sauve qui peut.

@sam:

Since Drew cannot think about $1.50 wages, he must find some other (ideologically palatable) explanation.

The left does it too though. While the right has a blind eye turned to globalization, the left has a blind eye firmly (not) fixed on debt load.

@john personna:

I’ll tell you what I and many (most) others really think about that “philosophy”. Suppose Drew’s ideal were instantiated, and we returned to a pre-New Deal state of affairs. Many (most) of us think we’d also return to pre-New Deal levels of poverty and misery. But this would not faze Drew one whit. Oh, I’m sure he will deny it, but I don’t believe him. In his heart of hearts, he genuinely wouldn’t care. Nothing he has ever written in comments here or at Dave’s place would lead me to believe otherwise. After all, he believes in the “laws of economics”, and under that intellectual regime, there are winners and losers. Far, far more losers than winners, truth be told, but, hey, that’s the natural state of affairs.The losers lose because they just can’t cut it. And it would be immoral for the government to attempt to help those losers by any “re-allocation of resources from the private sector to the state.” Sauve qui peut (rough translation: I got mine, fvck you).

“the sponsorship of incomprehensibly complex health care and financial regulation laws that have created widespread uncertainty that has discouraged consumption and investment”

Just want to point out that the above statement is about as close to complete BS as you can find. Despite what Krugman and others may think, there are practical limitations on what the U.S. can do to respond to this or any economic crisis. But the greatest problem facing us is the ideological fetishes that have run wild through economic thinking like weeds through an open field, whether it’s right wing crankery from Posner or free trade globalism from Krugman.

Think the U.S. would be in slightly better condition today if it still had those manufacturing jobs Krugman and company were thrilled to see exported to other countries?

Mike

@Drew: That’s a thoroughly convincing argument as long as you ignore every single fact about the economy. What we’ve seen over the last 30 years is a massive transfer of the nation’s wealth from the broad middle class to the top one percent — or less. Democratic administrations have occasionally tried to ameliorate this — although not nearly enough — but the Republicans stomp the gas down to the floor whenever they get power.

Fortunately for your team there’s a large number of stupid, frightened people out there who are willing to listen to the pundits bought and paid for by the super rich who tell them the only way out of the current problems is to punish poor people and give even more to the rich.

I understand why the super rich want this to be a third world country. It’s just fine if you’re one of the guys behind the walls. But where their useful idiots come from, I can’t imagine. They all brag about how much they love this nation while working to destroy everything that’s made it great.

@Ben Wolf: Don’t bother Drew with facts. They will never pierce his impenetrable shield of ideology.

@Stan: It’s not that we are incapable. It’s that we choose not to. Instead we choose to shovel money back at the super rich instead of investing in our country.

And we have a screaming mob of Tea Party “patriots” demanding that we tear down all the structures we’ve built to make ourselves a great nation, simply so that they don’t have to pay a nickel in taxes.

And you have the “Jan’s” of the world — fake grass roots populists spreading the lies fed by her corporate paymasters.

@Ron Beasley:

I agree that we’re likely moving into a prolonged period of economic contraction and restructuring. The old model of perpetual economic growth and ever-increasing consumption will no longer hold sway. That party is over.

As resources become scarce and more countries compete for them, we’ll need to move back to more local models of sustainable economic activity. We’ll need to settle for something different than large suburbo-boxes filled with crap, half of which we don’t even use. A brave new world is coming. We can either deal with it’s realities now or keep pretending that they don’t apply to us.

“@Drew: Your suggestion that more and more resources have been transferred to state control is belied by the tremendous growth in private wealth, and thirty years of declining tax rates. Government spending adds net financial assets to the private sector, it doesn’t subtract them.”

Your denial of basic metrics has been duley noted.

@ WR…

If they were paying her then it would be understandable…but she is just part of the cult…conned liked the rest of the silly people wearing tea bags dangling from their hats. How a group organized and funded by grifters like the Koch Brothers and Dick Armey ever got to be called grass-roots is beyond me.

@Drew: “Your denial of basic metrics has been duley noted.”

When that “basic metric” seems to be, “Is the government bigger than it was in 1860?”, I don’t think you can blame people for not accepting your premise.

Mike

Hey Jan –

How you holding up in the land of the morons?

@Drew:

Unintentional irony noted.

@Hey Norm: Probably true. I think Jan and Jay Tea are desperately hoping that if they shovel enough BS, they’ll get picked up by the great Wingnut Welfare machine and start getting paid for repeating the standard set of lies. And who can blame them? If as useless a waste of human flesh as Jonah Goldberg can be given a “best seller” (courtesy of group sales) and a regular gig, why not them?

Because, really, what human being is willing to admit he or she is actually more worthless than Jonah Goldberg?

@Drew: Jan in the land of the morons? I’m sure she’s trying to be their queen…