The Size of Government Is a Non-Issue: A Late Night, Caffeinated Manifesto

It's not the size of your government that counts -- it's what you do with it that matters.

Forewarned is forearmed. This is LONG. Also, I wrote it pretty late at night under the influence of caffeine. I also wrote it on a whim and didn’t plan it out so it’s a little stream-of-consciousy — but it’s also an attempt to summarize where I stand politically, so I hope it’s useful.

Introduction

In the comments to James post on the middle class, I made a note to one commenter that:

93% of the total wealth of a nation being concentrated into the hands of 20% of its population is prima facie indicia that government policies lean towards the enabling of rent-seeking and unearned wealth. And money tends to buy both power and influence, meaning that without signficant counterweights, the trend of the wealthy having more money and hence, more power will continue, and will increasingly rig the game so that it stays that way.

To which regular commenter Drew replied:

Alex – The first sentence is the quinessential argument for smaller, less intrusive government. Yet I almost never see anything but left/Democratic (read: more goverment) essays from you, especially on the subject of taxation. What up with that?

I started to reply in the comments but realized that I needed a lot more space to reply. So here’s my thoughts on the matter.

It’s Not the Size of the Government That Counts

First of all, let me just say that I think the entire question of “large” or “small” government is a distracting non-issue. Government is a tool that is used to achieve certain ends. Government should be as large or small as it needs to be to achieve those ends. Debating the size of government is absurd. Indeed, I’d refer everyone to Jason Kuznicki’s excellent essay on this subject, because it encapsulates the issue perfectly. Here’s a snippet:

Many of the freedoms that you value the most are easily and inexpensively stomped upon—stuff like public worship, the free press, or the right to independent political association. Arbitrary government costs less than the rule of law, if only because codifying the law and establishing the quality-control mechanisms inherent in doing the job properly can be expensive. Other things being equal, secret laws are cheaper than published ones, and the cheapest laws of all are the ones that the guard dogs make up right there on the spot.

A small government can be tyrannical; a large one benign. What matters is what the government does — not how big it is.

So let’s look at the second of Drew’s axis — intrusive government. Well what does that mean, exactly? I mean, I don’t want a government that intrudes on my basic freedoms such as speech, religion or assembly. On the other hand, I would like very much for it to intrude upon actions of others when those actions violate my rights or person. Again, it’s a vague standard that can mean anything you want it to mean. A platitude that doesn’t get at real issues.

A Word or Three About Taxes and Concentrations of Wealth

Okay, now let’s talk taxation. It’s true that at the present time I do support raising taxes in order to close the budget deficit. But I also do, in fact, support a government that generally speaking, spends less than it does now. But I’m not going to lie. I do also believe that taxation should be as much a policy tool as it is a means to finance the government.

I believe very strongly in progressive taxation (a belief, I might add, that I share with Adam Smith). I believe even more strongly in high estate taxes to diminish the concentration of wealth into families and those who haven’t earned it. I believe in these things for two basic reasons: the first is that simply put, I think that those who have more money are the logical persons to tax at a higher rate — after all, they have more money to begin with, and so taxing the wealthy at a higher rate does less injury to a rich person than taxing a poor person at the same rate. The second reason I believe in it is because I believe that the concentration of wealth into the hands of the few is a positive harm to society. And I believe that history bears this out. The most common form of government in human history has been some variant of oligarchy, and the results have rarely been good for individual liberty.

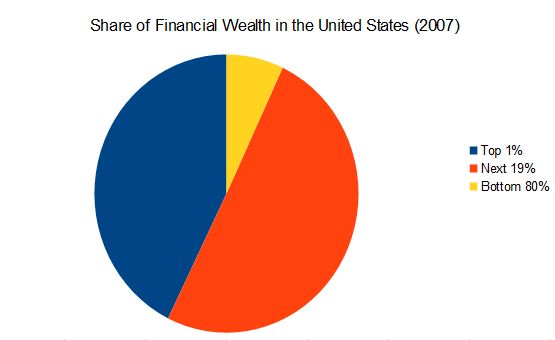

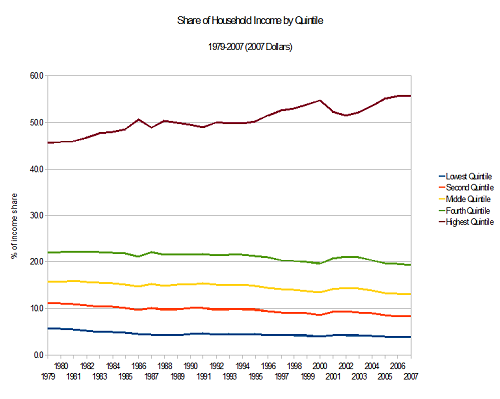

Additionally, I believe that the evidence bears out the fact that concentrations of wealth lead to social rigidity — denying people the opportunities to better themselves economically and raise themselves up beyond the economic conditions they were borne in. Consider the following couple of charts:

This is the share of financial wealth in the United States as of 2007. In it, you can see that 80% of the population has only 7% of the total wealth. And that has consequences. Here’s another chart:

As you can see, the rich in the United States not only have a greater share of the total wealth, they also have greater shares of total income. And the results of that are predictable: compared to most of our industrialized peers, the United States has one of the most rigid socioeconomic class structures. In other words, in the United States, you’re more likely to remain in the same socioeconomic class than you are in Canada–which is significantly more economically mobile than the United States.

Now, please don’t take this to mean that I’m an egalitarian. I have no problem with doctors making more money than janitors. My problem is that the doctor’s son is more likely to be a doctor and the janitor’s son is more likely to remain a janitor. That’s a real problem. I believe in the power of entrepreneurship and the ability to work your way and be economically successful. But that’s less likely in economic circumstances where wealth is concentration and economic classes are rigid.

(As a side note, let me deal with the most common objection: “But it’s my money!” That’s partly true. I definitely think that property rights exist. But they don’t exist absent a government that can enforce them. A free-market system simply cannot exist in the absence of government. In other words, unless you grew up on a desert island with no parents and no society and created all your wealth yourself, you couldn’t have earned that money without government. So pay up what you owe and quit ignoring the giants upon whose shoulders you’re standing.)

Now, that said, I don’t think that all taxes are created equal, and I think that, in particular, our tax system could use a healthy dollop of reform. The only deductions that make any sense to me are ones for business expenses for the self-employed and business concerns. Every other deduction, credit, and what have you ought to be eliminated. H&R Block’s market capitalization is, at the time of this writing, around $4.5 billion, so I’m guessing that there’s plenty of deadweight loss we can eliminate by simply taxing income at progressive rates without mucking about with deductions and credits.

Yes, Dammit, the Budget Should Be Cut

To answer the next question, yes, I think the federal budget is too big. And while I think that budget cuts should be prudent, and while I also have some serious concerns about cutting the budget in the current economic climate, there are plenty of things I think the government shouldn’t do. I briefly outlined this here. Let me go into it in a bit more detail now.

Rent Seekers, Begone!

If it were up to me, there would be no subsidies for businesses. None, nada, zero. As a general rule, regulations would be blunt instruments rather than attempts to fine-tune the economy, and those regulations would be focused on preventing actual harms. And the effectiveness of those regulations would be subject to empirical scrutiny, with incentives provided to regulators for doing their jobs well based on those metrics. I other words, I would focus and simplify regulations and use incentives to make make enforcement more effective. The simpler and cruder regulations are, the harder rent-seeking is, the more certainty there is, and the easier enforcement is.

I would also use the supremacy clause and commerce clause to centralize a hell of a lot of types of occupational licensing. Artificial barriers of entry for professions across state lines is something that the federal government shouldn’t countenance. There’s no reason why a licensed plumber who lives in Oregon should have to jump through a bevy of licensing processes to become a licensed plumber when he moves across the state line to Washington. I would also, for that matter, get rid of a lot of occupational licensing. It makes sense for doctors and nurses. It makes a bit less sense for hairdressers and interior decorators.

Bottom line: I want there to be more entrepreneurs. I want more people to work for themselves. The United States is pathetic on both scores. We rank near dead last when it comes to the number of self-employed and small business owners. I’d like to change that.

Let’s Please, For the Love of God, Get Rid of the Prison-Industrial Complex

Incarcerating a prisoner costs about $25,000 per year. Supervising a prisoner on probation/parole costs about $3,600 per year. For non-violent offenders, isn’t this a no-brainer? I’m sure that there are plenty of programs that are cheaper and more effective for preventing recidivism among non-violent offenders than locking them up in prison. The “Land of the Free” should not have the highest prison population rate in the world.

I would also recommend the legalization of at least marijuana, and the decriminalization of most others. It’s just not worth the cost in lives, money, and liberty.

Yes, I Favor Universal Health Care. Because Numbers Don’t Lie.

I favor universal health care. I favor it because I don’t think that most forms of health care — and especially the most expensive ones — are very amenable to market forces. It’s one thing to do cost comparisons for the cost of a physical. You can make appointments at your leisure. But when you have a heart attack, you can’t exactly comparison shop. Furthermore, it is pretty much indisputable that the pre-PPACA health care system in the United States was lousy. Our health expenditures are much higher than other OECD nations, without any commensurate benefits. We’re paying almost twice the OECD average for health care, but have lower life expectancies and higher infant mortality rates than many other countries with a universal health care system.

Now, the PPACA isn’t perfect — it’s just a start. If it were up to me, we’d have a single-payer plus optional private insurance system similar to that of other European countries. But we obviously have to do something.

Cut Defense Spending. A Lot.

This is the latest news out of Iraq:

Iraqi security forces detained about 300 people, including prominent journalists, artists and lawyers who took part in nationwide demonstrations Friday, in what some of them described as an operation to intimidate Baghdad intellectuals who hold sway over popular opinion.

[…]

Despite that, tens of thousands of Iraqis turned out for the protests, which began peacefully but degenerated as forces fired water cannons, sound bombs and live bullets to disperse crowds.

The death toll rose to at least 29 Saturday, as officials reported that six more protesters, including a 14-year-old boy, died from bullet wounds. The deaths were recorded in at least eight places, including Fallujah, Mosul and Tikrit.

I don’t think that an eight-year war to replace one dictatorship with another in a foreign land is what the Founding Fathers had in mind when this country was born. Indeed, there were significant factions among the Founding Fathers that opposed large standing armies entirely. As James Madison so eloquently stated at the Constitutional Convention:

In time of actual war, great discretionary powers are constantly given to the Executive Magistrate. Constant apprehension of War, has the same tendency to render the head too large for the body. A standing military force, with an overgrown Executive will not long be safe companions to liberty. The means of defence agst. foreign danger, have been always the instruments of tyranny at home. Among the Romans it was a standing maxim to excite a war, whenever a revolt was apprehended. Throughout all Europe, the armies kept up under the pretext of defending, have enslaved the people.

We don’t need as large an army as we have to defend our country. We can afford to make it smaller and more effective. More to the point — we can’t afford not to.

A Hasty Conclusion

I am now past 2100 words on a single blog post, far too much for anyone to read, let alone write. But to go back and simply answer the original question: why don’t I support smaller and less intrusive government? The answer is I do! As I hope you can see by now, if you’re still reading this, there are many areas in which I’d like the government to pack up and go home. But there are also many areas in which I think there ought to be a bigger and/or more effective role for government to play.

There are obviously many areas of policy that I haven’t even started talking about here. But I hope it provides some clarification as to my overall outlook on the role of government, the economy, etc etc etc. Oh, and because this is a manifesto, and Mark Levin has taught me in his manifesto to always end on a quote, let me end on this one — another goodie from James Madison:

If men were angels, no government would be necessary. If angels were to govern men, neither external nor internal controls on government would be necessary. In framing a government which is to be administered by men over men, the great difficulty lies in this: you must first enable the government to control the governed; and in the next place oblige it to control itself.

On that note, good night folks.

Tacitus on Rome’s credit crisis of 33 A.D.:

“Meanwhile a powerful host of accusers fell with sudden fury on the class which systematically increased its wealth by usury in defiance of a law passed by Caesar the Dictator defining the terms of lending money and of holding estates in Italy, a law long obsolete because the public good is sacrificed to private interest. The curse of usury was indeed of old standing in Rome and a most frequent cause of sedition and discord, and it was therefore repressed even in the early days of a less corrupt morality. First, the Twelve Tables prohibited any one from exacting more than 10 per cent., when, previously, the rate had depended on the caprice of the wealthy. Subsequently, by a bill brought in by the tribunes, interest was reduced to half that amount, and finally compound interest was wholly forbidden. A check too was put by several enactments of the people on evasions which, though continually put down, still, through strange artifices, reappeared… ”

“Hence followed a scarcity of money, a great shock being given to all credit, the current coin too, in consequence of the conviction of so many persons and the sale of their property, being locked up in the imperial treasury or the public exchequer. To meet this, the Senate had directed that every creditor should have two-thirds his capital secured on estates in Italy. Creditors however were suing for payment in full, and it was not respectable for persons when sued to break faith. So, at first, there were clamorous meetings and importunate entreaties; then noisy applications to the praetor’s court. And the very device intended as a remedy, the sale and purchase of estates, proved the contrary, as the usurers had hoarded up all their money for buying land. The facilities for selling were followed by a fall of prices, and the deeper a man was in debt, the more reluctantly did he part with his property, and many were utterly ruined. The destruction of private wealth precipitated the fall of rank and reputation, till at last the emperor interposed his aid by distributing throughout the banks a hundred million sesterces, and allowing freedom to borrow without interest for three years, provided the borrower gave security to the State in land to double the amount. Credit was thus restored, and gradually private lenders were found. The purchase too of estates was not carried out according to the letter of the Senate’s decree, rigour at the outset, as usual with such matters, becoming negligence in the end. ”

http://classics.mit.edu/Tacitus/annals.6.vi.html

In short, the rich weasels always win in the end.

All what you say just makes sense. Ironically, even Charles Koch pointed to Canada as a model in recent opinion piece (http://online.wsj.com/article/SB10001424052748704288304576170974226083178.html) although he didn’t necessarily realize the irony of his statement.

As Tim Mak points out (http://www.frumforum.com/canada-shows-the-gop-how-its-done), Canada remains much more liberal than the US and spending has been kept under control in part because they have a much more efficient health care system.

Good post. I know I don’t always agree with you on details, but as a statement of intent I can support this 100%.

As you know, Alex, I agree with nearly all of your prescriptions. I’ve written out much the same list myself from time time. However, I disagree with you on, ironically, the hook of your post. I do think the size of government matters and I’ll present two arguments for why that might be.

The first argument goes something like this:

1. There is strong empirical evidence that the acceptable level of taxation differs from country to country, that preference is culturally mediated, and, barring some national calamity, tends to be invariant over time.

2. The evidence of the past few months strongly suggests that we have not reached a point at which our culture would accept a level of taxation higher than the post-war norm.

3. The difference between what the government takes in and what it spends must be borrowed.

4. The United States is large enough, its spending is large enough, and the discrepancy between taxation and spending (the amount we must borrow) large enough that it places severe strain not just on U. S. credit but on world credit.

5. The strain is unsustainable and will inevitably lead to calamity.

Note that I am not saying that we shouldn’t raise taxes, that there isn’t room to raise taxes, or picking a precise number for the maximum acceptable level of taxes or the maximum size of government that can be afforded in the long term. Those are all irrelevant to this argument. I’m merely pointing out that there is a ceiling.

My second argument is deadweight loss. There is some point at which the deadweight loss is sufficiently high that it produces a degenerative spiral.

“The evidence of the past few months strongly suggests that we have not reached a point at which our culture would accept a level of taxation higher than the post-war norm.”

There will never be a point where “our culture” accepts more taxes. However, even Reagan and Bush Sr ultimately took the very unpopular step of raising them.

Any politician who supported the extension of the Bush Jr tax cuts isn’t serious about the debt. Letting them expire would have brought back taxes to the 90s level, i.e. the lowest since WWII up until then.

Nor is anyone else who supports those tax cuts…

You know, lol, I find much to agree with in Alex’s piece, and little to disagree with.

Dave’s comment starts with agreement, so he and I should be good, right?

Oops! This is the kind of comes-from-nowhere argument that shallow conservatives fashion from whole cloth whenever they want to reject a documented, working, solution.

“How can the Italian/Malay/Danish solution work here, when we are not Italian/Malay/Danish!”

It is simpler to say that in all countries policies have momentum, and are not (bullshit) “culturally mediated” (insert genetic implication). Momentum always exists, and yes, takes some event or decision point (including “calamity”) to change.

(On one level you list was good Dave, you gave me my morning pick-me-up in item one alone.)

” Nor is anyone else who supports those tax cuts…”

:O) agreed.

I was just trying to make the point that elected officials must sometimes have the courage to make unpopular choices and not wait for “our culture” to be ready, but I wasn’t to clear about that.

Dave,

“2. The evidence of the past few months strongly suggests that we have not reached a point at which our culture would accept a level of taxation higher than the post-war norm.”

Good thing, then, that taxes as a percentage of GDP are at the lowest levels seen since 1960. There’s plenty of room to increase it, while keeping it below the tax levels of the 1970’s, without crushing the economy.

On what we get from government.

Shikha Dalmia posted an interesting piece on Reason’s website, Long Live the American Dream: Why India and China have nothing on America. As might be gathered from the title, the author is concerned to debunk the notion that the US is somehow wanting in regard to China’s and India’s emergence as economic powers. In the course of the piece, we find this:

Alex –

First, I’d like to thank you for taking the time to write this. Yes, its long, but time is valuable and it shows a certain dedication to the blog and furthering the idea exchange, especially for someone who is still probably running sleep deprived from the little one.

Second, I’m feeling somewhat vindicated. Part of my goal with a strident posting style is to provoke just such responses.

So now……

I’ve got to run to a conference call in a few minutes and will have to come back for the taxation part, but as for big government – and in spite of the “largely agree with you” comments – I beg to differ; I think your (and this other cat’s) argument falls flat on its face in its basic assumption.

.

Things like: “Government should be as large or small as it needs to be to achieve those ends.” “What matters is what the government does — not how big it is” etc are meaningless.

They ignore all the personal and organizational problems that undermine the efficacy of government: power seeking, greed, graft, turf wars, spending other people’s money for self gain, re-election considerations and on and on. Those assumptions about good government remind me of undergraduate physics classes – imagine a perfect, frictionless sphere, travelling through an ideal gas and bumping into another mass with perfect energy transfer…………..great simplifications to illustrate a concept, but useless in practice.

James recently offered a suggestion that defense spending might be cut 50%. I don’t know if 20%, 30% or 50% is right, but unless there are two employment lines – one for the defense department (where all the inefficient no good employee candidates go), and one for the balance of government (where all the bright, efficient and well intentioned employee candidates go) then I can’t imagine that the balance of the goverment could not be cut materially. Government is simply not efficient, and should be minimized, not given carte blanche to “be as big as it needs to be to achieve its end.” Government has no governors, like profit motive, return on capital, firing etc. A larger government will bring down the weighted average of the public/private aggregate capability of the country to grow and prosper.

Think I’m wrong? Look at the state of our finances. The government has run us into a ditch. Think I’m wrong? We declared a war on poverty in the mid-60’s, and the poverty rate – despite enormous resources poured into government – bounces around plus or minus about 2% over time. Should we allow the government to “be as big as it needs to be to achieve its end??” Think I’m wrong? We are on the verge of wasting huge sums of money on a white elephant – high speed rail. Think I’m wrong? Two major government subsidized activities: education and health care are fiscally out of control, and the public schools overall are awful. That’s not chance.

And the truth be told, my original comment simply was the observation that the connected, the rich, the powerful will always bend a larger and more intrusive (and that’s what it does Alex, intrude through its ability to tax, regulate and pick and choose winners) government to their own ends, rarely the proverbial little guy. Think I’m wrong? Start with railroad regulation back in the 1800’s. Then consider that GE’s Jeff Immelt is now influencing energy policy……………and GE has invested billions in energy projects. You think Immelt will advocate things that help Joe the Plumber, or GE? You only get one guess.

The size of government matters tremendously, Alex. An efficient and efficacious government is simply something with which I am not familiar. And as the country is coming to realize, after years of kicking the can down the road, the dead weight loss and financing requirements that accompany said large government are simply not sustainable. As Dave Schuler has pointed out, no amount of practical taxation can finance this mess. Government has got to shrink. Size matters.

We declared a war on poverty in the mid-60′s

Declaring war on something and actually doing something about it are two different things. Countries with much larger governments than ours, relatively speaking, have managed to virtually eliminate poverty among their populaces. Think I’m wrong?

Who decides what government should do and not do? Small government proponents see the government doing too much . Add in the fact that the larger the government the more it wants to do regardless of what the citizens want it to do and it becomes very clear the size of government matters a great deal.

Large governments exist mostly for their own benefit and trot out programs with marginal value in order to serve themselves first. That manner of governing has put us, our children, and who knows how many other generations in debt.

There are other reasons the size of government matters and I believe with some more thought they will become apparent to those who say otherwise.

Drew’s points are made much more eloquently than anything I can say. As far as serious people supporting the present level of taxation there are those of us who see higher levels akin to the killing of the golden goose. All wealth in this country originates in the private sector and especially within the businesses of the private sector. Handicapping them with excess taxes and regulations impedes economic growth needed to finance the government. Entitlements must be dealt with by various cuts and I am prepared to endure those cuts myself but giving me less is not the same as taking more from me.

What a great post, and what a fascinating response.

Dave Schuler, as others have pointed out, responds in part with a fatalistic shoulder shrug:

And Drew slides into a similar posture:

Sorry to both men, but what utter bullshit.

Culture is not some fixed reality, immutable. On the contrary, it gets yanked this way and that on a daily basis. We went from very few women in the workplace or in higher education to virtually all women in the workplace and dominating higher education in the blink of an eye. Not even a lifetime, a third of a lifetime.

That is a huge cultural shift. And we pulled it off without so much as a bullet being fired. Culture not only can change, it does change. In point of fact it is changed. Acted upon. Altered.

As for Drew not being familiar with an efficient government? Really? I am. It’s right there in France. Same in Sweden. Netherlands. Germany. Efficient governments are thick on the ground in wealthy, developed countries.

Excuse me, I mean wealthy, developed countries without the Republican party.

Because what we have here is two men saying the same thing: it isn’t that way, so it can’t be that way. But in reality what we have is that it isn’t that way because one political party doesn’t want it to be that way. Because if it is, then they lose political power, and they lose the self-pity and resentment that form the core of their belief system.

Culture doesn’t grow up like mushrooms after a storm. Culture is formed. It is biological to a degree, but it is also environmental, and environment is a product of actions taken and ideas promulgated. Culture is in large part, art. That canvas can be re-painted. It’s been done again and again.

So, we can absolutely have a competent, efficient government that does the things we need and doesn’t do much else. But we can’t have it so long as one political party insists that we can’t, and forms a culture of failure.

“All wealth in this country originates in the private sector and especially within the businesses of the private sector.”

Really? You give no value to the environment which govt promotes which allows the private sector to prosper? So there is no loss of potential value in setting up a business in France vs. the USA? Or Libya vs. the USA? It may not be tangible, but I would posit the value is there. I’m not trying to put words in your mouth here–I’m attempting to understand your thinking behind this statement.

Let me ask you small government advocates a question. In response to Alex’s demonstration that the bulk of the wealth in this country is held in, relatively, few hands as a result of rent-seeking, etc. Drew responded that this is “quintessential argument for smaller, less intrusive government.”

Well, in 1870 we had much smaller, much less intrusive government, and in that year

This seems to militate against Drew’s , implicit, claim that absent a large and “intrusive” government, we wouldn’t see the concentration of wealth we see today. For surely by any measure, the government of 1870 was much smaller and much less intrusive than the one we have today, yet the concentration of wealth in a few hands was much greater then than today.

Why should we suppose that under the minimalist regime you folks favor, the same, or a worse, distribution of income wouldn’t result?

Because libertarians don’t prove, they assert. It’s faith, not reason.

“Sorry to both men, but what utter bullshit.”

“As for Drew not being familiar with an efficient government? Really? I am. It’s right there in France. Same in Sweden. Netherlands. Germany. Efficient governments are thick on the ground in wealthy, developed countries.”

Speaking of utter bullshit. Those are NOT efficient governments. But more importantly, that is about as relevant as the government on Mars. We happen to live in the USA, and the empirical evidence of 70 years of post WWII is in. We are going broke, and the stated goals of massive government intervention have not been met.

If you have a plan to make the USA government a model of efficiency and efficacy please share it, MR. You will get a Nobel Prize. Otherwise, you are just masturbating.

I read the whole thing:)

sam –

Your argument would have more credence if you could tell us how larger government created more equal wealth distribution.

I’d argue that more equal wealth distribution has been a direct result of more entrepreneurs starting and owning businesses, and employees being part of that benefit. The days when either you worked for US Steel, Westinghouse or GM are over. (company towns etc) Small to medium sized business is what we should be promoting. And the current government is no friend to those entities, but surely a friend to Goldman Sachs, or GE.

You have to decide if you are for promoting opportunities for the little guy, or paying lip service to that while really promoting a Big Government subsidy agenda that is for all the world Big Corporate, Big Labor, and Big Law oriented. The little guy has little chance against the lobbyists of GE, ADM, Goldman, the AFLCIO, the trial lawyers etc etc.

That’s not responsive, Drew. Your argument was that a large government leads to rent-seeking and wealth concentration. I offered 1870 as a counter-example: small government, very large wealth concentration. You still haven’t shown why a minimalist government wouldn’t result in such a concentration today.

“I’d argue that more equal wealth distribution has been a direct result of more entrepreneurs starting and owning businesses, and employees being part of that benefit.”

Most businesses in those days were small businesses — shops, small farms. and so on. Didn’t seem to prevent the wealth being concentrated.

And, BTW (and I know this is pure snark, but I can’t resist) — Your anthropology seems to consist of the big guys (Goldman, etc); the little guys (small business owners); and the microscopic guys – that would be those of us in the 80% who have only 7% of the wealth.

And to be clear, I am on your side re small business as employment engines. You are absolutely right there. I just think you’re naive to suppose that reducing the size of government will somehow deter the Goldmans of the country. My reading of history tells me that the one thing that unites those at the top of whatever heap I’ve read about is that their primary goal is to stay at the top of the heap. I don’t see a minimalist government as a bar, in fact quite the reverse, as the 1870 example was meant to show.

I’d argue that more equal wealth distribution has been a direct result of more entrepreneurs starting and owning businesses, and employees being part of that benefit. The days when either you worked for US Steel, Westinghouse or GM are over.

If that were true, why is the wealth distribution even more imbalanced now? Sorry, your argument makes no sense.

As they say on the BBC – “And now, taxation…….”

“I believe very strongly in progressive taxation (a belief, I might add, that I share with Adam Smith).”

You’ve got your wish. Fewer are now paying the freight than certainly in my lifetime. But we are going broke. How’s that been workin’ out? Want to double down? In fact, what we have is a travesty. Our current Clown in Chief routinely goes on the air and promises goodies to the masses under the pretext of “don’t worry, YOU don’t have to pay, its just those 3% no good asshole rich people.” This is just sick, and not viable.

“I believe even more strongly in high estate taxes to diminish the concentration of wealth into families and those who haven’t earned it.”

Your dismissal of property rights is noted.

“I believe in these things for two basic reasons: the first is that simply put, I think that those who have more money are the logical persons to tax at a higher rate — after all, they have more money to begin with, and so taxing the wealthy at a higher rate does less injury to a rich person than taxing a poor person at the same rate.”

Indeed. And why we should rob banks, after all, that’s where the money is. And after that, our rich neighbors. Screw’m. I can rob them and not even use a gun. Ever consider dealing with the causes of the changes in income distribution rather than sticking a knife in people’s faces and demanding their money?

“The second reason I believe in it is because I believe that the concentration of wealth into the hands of the few is a positive harm to society. And I believe that history bears this out. The most common form of government in human history has been some variant of oligarchy, and the results have rarely been good for individual liberty.”

That’s because the rich – think Kings – stole the money. Do you have evidence tht Bill Gates stole anyone’s money, outside of government granted monopoly? Now the rum running Kennedy’s……..but I digress. Do you have any evidence that a $250K income small business owner has stolen anyone’s money, or that penalizing them is good for business growth and job creation?

“Additionally, I believe that the evidence bears out the fact that concentrations of wealth lead to social rigidity — denying people the opportunities to better themselves economically and raise themselves up beyond the economic conditions they were borne in.”

Complete BS. My entire career has been spent dealing with people who defy this assertion. People who have come from nothing – literally nothing – to start and grow businesses from their garages to $30MM – $300MM revenue businesses that we buy and take to yet the next level. Yours is a defeatist worldview that is not only at odds with reality, but is dangerous in that it implicitly advocates government redistributionist policies – in effect converting up and coming generations into soylent green, and the benefactors of government largesse into our national pets.

“This is the share of financial wealth in the United States as of 2007. In it, you can see that 80% of the population has only 7% of the total wealth. And that has consequences.”

What consequences? And just how does taxation and wealth redistribution yield a better outcome?

“Now, please don’t take this to mean that I’m an egalitarian. I have no problem with doctors making more money than janitors. My problem is that the doctor’s son is more likely to be a doctor and the janitor’s son is more likely to remain a janitor. That’s a real problem. I believe in the power of entrepreneurship and the ability to work your way and be economically successful.”

You say the words, but it is obvious you don’t really believe it. Please explain how taxing the doctor or the doctor’s son, and giving it to the janitor or janitor’s son is going to make the janitor’s son a doctor. You are talking to a guy who worked in a steel mill first out of school, and is now in the private equity business. Tax policy didn’t get me there. Brains, drive, risk tolerance, perserverence, experience and ballxs got me there, not tax policy. And tax policy won’t get the janitor’s son there either.

“(As a side note, let me deal with the most common objection: “But it’s my money!” That’s partly true. I definitely think that property rights exist. But they don’t exist absent a government that can enforce them. A free-market system simply cannot exist in the absence of government. In other words”

This is the usual red herring. Nobody argues for zero government, or against a government that does what it was originally designed to do. The argument is over the ever expanding tasks government takes on. Tasks that it was not designed for, and tasks that we know, empirically, it is poor at executing.

“Now, that said, I don’t think that all taxes are created equal, and I think that, in particular, our tax system could use a healthy dollop of reform. The only deductions that make any sense to me are ones for business expenses for the self-employed and business concerns. Every other deduction, credit, and what have you ought to be eliminated. H&R Block’s market capitalization is, at the time of this writing, around $4.5 billion, so I’m guessing that there’s plenty of deadweight loss we can eliminate by simply taxing income at progressive rates without mucking about with deductions and credits.”

Agreed, and good luck. But – heh – with large government this is but a pipe dream.

“Rent Seekers, Begone!

If it were up to me, there would be no subsidies for businesses. None, nada, zero. As a general rule, regulations…………………

Agreed, and good luck. But – heh – with a large government this is but a pipe dream.

“I would also use the supremacy clause and commerce clause to centralize a hell of a lot of types of occupational licensing.

Agreed, and good luck. But – heh – with a large government this is but a pipe dream.

“Bottom line: I want there to be more entrepreneurs. I want more people to work for themselves. The United States is pathetic on both scores. We rank near dead last when it comes to the number of self-employed and small business owners. I’d like to change that.”

And a large, more taxed and regulated country will accomplish that how?

“Let’s Please, For the Love of God, Get Rid of the Prison-Industrial Complex

Incarcerating a prisoner……………………….I would also recommend the legalization of at least marijuana, and the decriminalization of most others. It’s just not worth the cost in lives, money, and liberty.”

Agreed.

“Yes, I Favor Universal Health Care. Because Numbers Don’t Lie.

I favor universal health care. I favor it because I don’t think that most forms of health care — and especially the most expensive ones — are very amenable to market forces.”

Ballxs. Why?

“It’s one thing to do cost comparisons for the cost of a physical. You can make appointments at your leisure. But when you have a heart attack, you can’t exactly comparison shop.”

Another of the usual BS red herrings. You don’t shop for health insurance when you are having a heart attack any more than you shop for homeowners insurance when the house is on fire. Health insurance decisions can be made in the calm, and with advice, well before disease or health catastrophy presents itself.

“Furthermore, it is pretty much indisputable that the pre-PPACA health care system in the United States was lousy. Our health expenditures are much higher than other OECD nations, without any commensurate benefits.”

Too long to get into. We have divorced the health care consumption decision from price, (no one eats hamburger on an expense account) “We’re paying almost twice the OECD average for health care, but have lower life expectancies and higher infant mortality rates than many other countries with a universal health care system.” Suspect stats, and they restrict access. The laws of economics are not suspended in canada, Europe………

“A Hasty Conclusion

I am now past 2100 words on a single blog post, far too much for anyone to read, let alone write. But to go back and simply answer the original question: why don’t I support smaller and less intrusive government? The answer is I do! As I hope you can see by now, if you’re still reading this, there are many areas in which I’d like the government to pack up and go home. But there are also many areas in which I think there ought to be a bigger and/or more effective role for government to play.”

Well, I read it all. And I simply think your last sentence is an idealistic goal that the evidence of the past 70 years indicates you will be very dissappointed in. Of course government has a role. But it is in fact rather limited – perhaps at 15% or so of GDP – and after that is the proverbial money down the sewer.

Madison’s quote was at the same time true, but idealistic. More realistic: “Beware men of good intention but great zeal.”

sam –

See my (lengthy) remarks to Alex.

Also, sam, please, do you really want to make the argument that today’s government, with all its lobbyists, isn’t tilting the game board in the favor of Big Business, Big labor etc. Do you really? Do you want to make the argument that GE isn’t lobbying for their pet energy projects? That Big Pharma or Big Ag isn’t lobbying for their interests? That the Greenies aren’t lobbying for their “alternative energy” projects, high speed rail and the like? That the unions aren’t lobbying for exposing certification voting to public scrutiny, not to mention votes for perks? I could go on.

You’d think the US was about to turn into a third world country if you listened to all the activists and their greivances – and their government financed; read: taxpayer financed – “solutions.” Look at the number of laws on the books and regulations. Its exploding. Every single one is designed to take a dollar from someone, and reallocate it to someone else.

You don’t really want to deny that, right?? And THAT is income redistribution, and wealth concentration. I doubt you, as a little, or micro, guy are the beneficiary of any of it.

“Also, sam, please, do you really want to make the argument that today’s government, with all its lobbyists, isn’t tilting the game board in the favor of Big Business, Big labor etc. Do you really?”

Why do you persist in misunderstanding me? Can you find in what I’ve written a defense of the status quo? I’ll make what I’m arguing simple: Big money will always, always, seek and find ways to maintain its hold on the levers of power, be those levers financial or political. If you think reducing the size of government will halt that, you are naive.

Thanks Drew.

How much corruption and graft comes form going along to get along. Hey, what’s another $5B here or there? Over and over again. Of course, I’m a heartless rightwingnut who wants children to starve and old people to just die — as though that’s any more in my power than they imagine the opposite is within theirs. But I digress.

Drew says: Please explain how taxing the doctor or the doctor’s son, and giving it to the janitor or janitor’s son is going to make the janitor’s son a doctor.

Well, okay, I’ll give it a shot, although I’ll bring the suppositions back in line with reality. We tax the people who have lots of money — doctors or bankers or whoever — and use that money to create a system of public universities, where the sons of the janitors can go.

I realize this may sound like a pipe dream to you, but this was the state of California, which built one of the great university systems in the world, until insane, tax-loathing Republicans destroyed our state.

“We happen to live in the USA, and the empirical evidence of 70 years of post WWII is in. We are going broke, and the stated goals of massive government intervention have not been met.”

You, like most conservatives, know but talk around the issue that is making us broke, health care costs. Everything else is just nibbling around the edges. The number of federal employees has hardly changed for 50 years. The percentage of budget/GDP spent on non-defense discretionary spending has hardly changed. Defense should be handled by paying for wars when we have them, then it is good. Social Security? Easy to fix as it is a small contribution to the debt. (I would prefer that it based upon 90% of national income which IIRC, was the Greenspan fix. Much more income is now exempt.)

That leaves Medicare/Medicaid. Politically, that really means Medicare. Solve medical costs, and we have no long term debt problem.

“You’ve got your wish. Fewer are now paying the freight than certainly in my lifetime. ”

Federal revenue from payroll taxes is now about the same as from income tax. One should also note that fewer people control our money than ever in my lifetime.

Rather than go through and pick apart everything I would note two things.

1) We should decide what we want government to do and not do. Then fund it accordingly. We do this by voting. Some people will always think it is too big. Some too small. Meh. The important thing is that we fund it and get away from this starve the beast crap. The most toxic political philosophy in my lifetime. If you think govt is too big, cut it. Dont just run up debt.

2) It is in the makeup of conservatives to think that things are getting worse. To think that govt is awful. Name me a govt which has functioned better over the last century. Yes, we have problems, but perfection is not on the table.

Steve

2)

Okay: eliminate the mindset of people like you. You’re the problem. You demand an inefficient government because anything else threatens your ideological underpinnings.

The fact is that in wealthy countries where people demand and expect a competent government they generally get one. And your blanket dismissal of every other government on earth just proves my point. You’re an ideologue whose conclusions come not from facts but from an emotional commitment to a political faith built on self-pity and sophomoric Randian bullshit you picked up in college.

The sum total of what you have to offer is this: Drew as wise old soul who has seen it all and knows it doesn’t work. But I don’t think you’re wise. I think you’re narrow and not very widely-experienced. And you’re an ideologue committed to reaching a predetermined conclusion and to experiencing the emotion of self-pity and resentment.

We have two parties. One, the GOP, is committed to the failure of American governance. Which is a shame because that’s the party with the math skills. People like you could actually help us have a government as well run as France or Canada or Netherlands. Instead you’ve committed yourself to American failure.

Could not have said it better.

@Me

“Big money will always, always, seek and find ways to maintain its hold on the levers of power, be those levers financial or political. If you think reducing the size of government will halt that, you are naive.”

And right on cue: Wife’s Charity Offers Corporate Tie to a Governor:

lol……….. we have achieved the final Synthesis….again……

“The percentage of budget/GDP spent on non-defense discretionary spending has hardly changed.”

Nice sleight of hand, steve. Penn and Teller would be proud. A huge portion of my point is that governement has turned into an income redistribution machine – and it isn’t necessarily going to the poor, by the way. So skip the “discretionary, non-discretionary” crap. That’s just a fiction designed to take a portion of spending off the table. (I’d fire any manager who came to be with such BS.)

I often here government spending apologists talk about how spending as a % of GDP has remained “constant” at about 20% for decades. They conveniently forget to mention that the defense portion has fallen from low teens to, what, 3% in the same time frame?? Ergo, “social spending” has been a juggernaut, now consuming another 10% of GDP with no end in sight. Hence the looming debacle.

As an aside, the vaunted Clinton surplus (acctg and bubble economy aside) was done totally on the back of defense cuts. Look at the numbers. The social spending machine moved along quite nicely. But I digress.

There is no way around it: government intervention in pensions, education and healthcare have been total debacles, with financial consequences that are now coming home to roost. Its a shixtstorm.

“Okay: eliminate the mindset of people like you. You’re the problem. You demand an inefficient government because anything else threatens your ideological underpinnings.”

Blah, blah, blah………..vapid and vacuous.

How do you like the alliteration, author boy?

Drew, strange, but I missed your demand for an inefficient government, especially to avoid threats to your ideological underpinnings.

Ever get the feeling that the reeducation camps are just around the corner?

charles –

Heh. The leftist manifesto: When you can’t argue the facts, pound the table and attack the man……….

At least he didn’t accuse me of wanting to poison the children and force grandma to eat dog food in the snow. That comes when they are backed a bit more into the corner……..