Are 80 People Richer Than Half the World? Not Really.

While the issue of income inequality is quite real, Oxfam's numbers are not.

The global charity Oxfam is making its usual round of headlines with its annual report showing rising inequality. Most are focusing on the meme that the richest 1% own more than the rest of the world, the statistic that’s most startling to me is that just 80 people own more than the 3.5 billion people in the bottom half of the world. While the issue of income inequality is quite real, Oxfam’s numbers are not. Or, at least, they’re quite misleading.

Ryan Bourne of the London-based Institute of Economic Affairs warns “Beware Oxfam’s dodgy statistics on wealth inequality“:

Oxfam’s claim that the richest 1 per cent own 48 per cent of the world’s wealth (and will soon own more than half) rests on Credit Suisse data. This data is on net wealth, which throws up all sorts of weird findings when you try to add it up across large populations. That is because net wealth is calculated by adding up the value of assets and taking off debts.

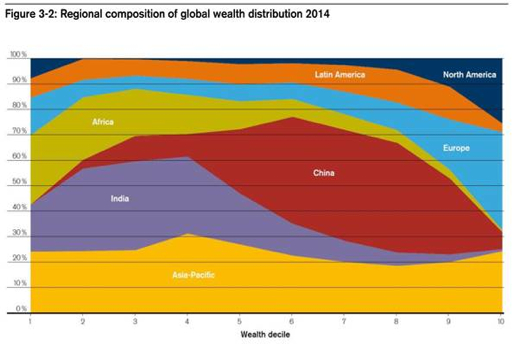

To see this, look at the figure below from the Credit Suisse report. If we were to split up the data into deciles, this methodology would suggest China has no people in the bottom 10 per cent – the world’s poorest – with most Chinese in the top 50 per cent. North America on the other hand supposedly has around 8 per cent of the world’s poorest population – because significant numbers of people in the States are loaded up with debts of various kind, making their net wealth negative!

According to this methodology, the poorest 2 billion people in the world have a negative net wealth. Someone who has 50p but no assets or debts would be above the bottom 30 per cent of the world’s population. It doesn’t take an advanced mathematician to work out that adding up lots of negatives at the bottom to an overall wealth share figure for the bottom 99 per cent will of course make that figure much smaller than a gross wealth figure. Oxfam has then taken this bogus figure, looked at recent trends (which show the share of the top 1 per cent rising) and simply extrapolated into the future to get their headline (which seems a huge assumption given the potential QE unwinding).

Aggregating net wealth figures is largely meaningless and not the way most people think about poverty, or indeed the ‘rich’.

Salmon’s column from last April (“Stop adding up the wealth of the poor“), which introduces the chart above, elaborates on this point:

How is it that the US can have 7.5% of the bottom decile, when it has only 0.21% of the second decile and 0.16% of the third? The answer: we’re talking about net worth, here: assets minus debts. And if you add up the net worth of the world’s bottom decile, it comes to minus a trillion dollars. The poorest people in the world, using the Credit Suisse methodology, aren’t in India or Pakistan or Bangladesh: they’re people like Jérôme Kerviel, who has a negative net worth of something in the region of $6 billion.

America, of course, is the spiritual home of the overindebted — people underwater on their mortgages, recent graduates with massive student loans, renters carrying five-figure car loans and credit-card obligations, uninsured people who just got out of hospital, you name it. If you’re looking for people with significant negative net worth, in a way it’s surprising that only 7.5% of the world’s bottom 10% are in the US.

And as you start adding all those people up — the people who dominate the bottom 10% of the wealth rankings — their negative wealth only grows in magnitude: you get further and further away from zero.

The result is that if you take the bottom 30% of the world’s population — the poorest 2 billion people in the world — their total aggregate net worth is not low, it’s not zero, it’s negative. To the tune of roughly half a trillion dollars. My niece, who just got her first 50 cents in pocket money, has more money than the poorest 2 billion people in the world combined.

Or at least she does if you really consider Jérôme Kerviel to be the poorest person in the world, and much poorer than anybody trying to get by on less than a dollar a day. All of whom would happily change places with, say, Eike Batista, even if the latter, thanks to his debts, has a negative net worth in the hundreds of millions of dollars.

Now $1.7 trillion is undoubtedly a lot of money: there is an astonishing amount of wealth inequality in the world, and it’s shocking that just 67 people are worth that much. You could spread that money around the “bottom billion” and give them $1,700 each: enough to put them squarely in the fourth global wealth decile. But let’s look at just the top two-fifths of the 3.5 billion people referred to in the Oxfam stat. That’s 1.4 billion people; between them, they are worth $2.2 trillion. And they’re a subset of the 3.5 billion people who between them are worth $1.7 trillion.

The first lesson of this story is that it’s very easy, and rather misleading, to construct any statistic along the lines of “the top X people have the same amount of wealth as the bottom Y people”.

The second lesson of this story is broader: that when you’re talking about poor people, aggregating wealth is a silly and ultimately pointless exercise. Some poor people have modest savings; some poor people are deeply in debt; some poor people have nothing at all. (Also, some rich people are deeply in debt, which helps to throw off the statistics.) By lumping them all together and aggregating all those positive and negative ledger balances, you arrive at a number which is inevitably going to be low, but which is also largely meaningless. The Chinese tend to have large personal savings as a percentage of household income, but that doesn’t make them richer than Americans who have negative household savings — not in the way that we commonly understand the terms “rich” and “poor”. Wealth, and net worth, are useful metrics when you’re talking about the rich. But they tend to conceal more than they reveal when you’re talking about the poor.

Again, none of this is to say that disparity isn’t an important issue—it is!—but that we need to measure it in a thoughtful way.

I’m not sure whether it’s problematic that Charles and David Koch and Sheldon Adelson have $118 billion in wealth between them (coincidentally occupying spots #6, #7, and #8 on the Global 80). But I do worry that they have so much more influence over our elections and access to our policymakers than the bottom 300 million Americans combined.

I’m pretty sure there’s something wrong with people who’ve done nothing more significant than being related to the founder of Walmart occupying spots #9, #10, #13, and #14.

And, frankly, I’m probably more disturbed that I have no idea who probably 60 of the 80 people are. It’s one thing for Bill Gates (#1), Larry Ellison (#5), Larry Page (#17), Jeff Bezos (#18), Sergey Brin (#19), and even Mark Zuckerberg (#21) to be phenomenally rich; they at least made some major contribution to how people live their lives.

Regardless, though, aside from skimming some of their wealth to finance improvements in the infrastructure and funding welfare programs, the concentration of wealth at the very top really has very little to do with the plight of the poor. To the extent that they’re keeping money that would otherwise be going to people who work for them, that affects the middle class, not the poor.

Indeed, we’ve actually made significant strides in improving global hunger, infectious disease, access to drinking water, and other traditional problems of the poorest of the poor.

Saying debt does not really exist is like explaining that while there’s no such thing as an actual border between Mexico and the United States you will get shot for trying to cross an imaginary line deemed the ‘border’.

I would also question the reality of any wealth held. You can’t say that something–property, painting, yacht, bauble, equity portfolio–is worth 32 million and then deny that an entity can be meaningfully worth -32 million.

Umh, if you want to compare wealth, what exactly would you use except net wealth?

It is interesting that most people have forgotten that this country was founded on the principle (among many) of meritocracy. People immigrated to get away from the inherited, landed wealth of the home country.

In general, for generations, we frowned on inherited wealth as antithetical to the American idea and had policies to inhibit that.

Somewhere along the way, we’ve flipped the script.

Look I agree with the idea that people have a huge incentive to juice the numbers to make a point. Not hardly new, hell just look as some of the wild jobs figures being thrown around the Keystone pipeline debate. But I disagree that the wealth of those at the top don’t have a lot to do with the plight of the poor.

Conservatives and libertarians love to scold people like me about how the economy not fixed, and that it’s not necessary to tear down the rich to improve the lot of the poor. But what the Conservatives and libertarians don’t seem to want to come to terms with is that the Economy is also not “bandwidth on demand. There is only some much raw material, labor, equipment, expertise, and so on in the queue at any given time and if you really truly think that the economy is infinitely elastic you’re nuts.

Ask yourself this question, if you were goring to sit down with someone else had had absolutely no leverage over you, nor you over them, would anyone in their right mind design an economy with this level of wealth disparity? I mean I not talking about coming up with a system communistic levels of equality here. I’m talking about an economy where hard work, industry and discipline are richly rewarded. Even then there would be no one who would come up with the level of wealth disparity we have today. No one. The only what this happens is when the interests of many are have to yield to the interests of a few in a game that rigged.

So the whole debate over what the real level of wealth disparity is angels dancing on the head of a pin. The answer is it’s too much and the solutions are pretty simple. Higher level in progressiveness in the tax code and use that money to fund infrastructure. not really rocket science, and if a few bazillionairs have a few fewer yatchs to ski behind then fine.

I could be worng about your thought process but this premise usually comes from a place that assumes most poor folk are happy where they are and will continue to recieve hand-outs. I disjagree with the notion that it only effect the midlle class and not the poor. When buying power increases in the middle class there will be more demand. And where there is more demand there are more opportunities for the poor to get better paying jobs.

Maybe junkboxgrad can explain how the top 1% can pay off all American debt…

“To the extent that they’re keeping money that would otherwise be going to people who work for them, that effects the middle class”

Only in America is the catch-all term for those who work hard for their money the “middle class”. In the rest of the world, they’re called the “working class”. Just saying.

@Scott: @Rick DeMent: Yup. The Founding Fathers loved them some inheritance/estate taxes. Seriously, the last thing they wanted was an hereditary elite. How come the word of the Founders is sacred, unless it costs rich people money?

blah, blah, blah….

A bunch of nonsense to cover the fact that 30 years of chasing Republican Economic theory has not worked. Reagan’s crap about a rising tide was pure, unmitigated, horse $hit.

Larry Summers:

Note that date; 1979. When was Reagan elected? Coincidence?

Inequality is rising…wages aren’t. If you account for inflation the average American household is making less than when Bush 43 took office.

There are plenty of things we could do about it. But we won’t. Because Republicans are still peddling the same happy horsee $shit that Reagan was peddling. Until we can get them to stop it…to face the real world…to acknowledge their complete failure…nothing changes.

@munchbox:

That’s easy, first you confiscate their stock and sell it. But wait, those who buy the stock at the value when it was confiscated will then be the wealthy and we’ll have to confiscate their property. We’ll just keep up the confiscation/sell iterations until we have enough “cash” for the national debt. One glitch is that how much buyers will pay for the confiscated property should decline rather precipitously to a point where possessing it puts you below the confiscation threshold, for the moment.

@gVOR08: Maybe there isn’t a better way to compare (at least in this context), but at the same time, asserting a middle-class American is somehow poorer than a Zimbabwean laborer because the American has high credit card balances just seems kind of…ridiculous.

@Modulo Myself: I’m not saying that we should pretend that debt doesn’t exist. I’m saying that the fact that I owe half a mil on my house doesn’t make me poor.

@gVOR08: My point—which is the same Salmon comes to—is that “wealth” is a stupid concept in comparing the rich and the poor. As @Mikey puts it, “asserting a middle-class American is somehow poorer than a Zimbabwean laborer because the American has high credit card balances just seems kind of…ridiculous.” Paper wealth just isn’t a meaning concept at that level.

Yes, that noted advocate of wealth-confiscation and socialist bank, Credit Suisse.

Suffice to say that the wealthiest 80 people in the world have, by any measure, including data from the communist Credit Suisse operation, a widely disproportionate share of the world’s wealth.

I think that inequality is a problem. Imagine that the best coach in football, Bill Belichick, was in charge of the rules of football; the Patriots would never lose. If society started with everybody on the same starting line and was totally meritocratic, there would be winners. The winners would then be able to turn their victories into power and influence, and the result would be a society with a poor Gini coefficient where wealth and position are largely hereditary, where a nurse pays a higher marginal tax rate than a multimillionaire, where better infrastructure is built in the better neighborhoods (including better schools), where the cops and military protect the rich, and where the instruments of the media spend all their time telling folks that things are the way they should be. This is how the world looks to me at a first approximation.

Recognition of the problems arising from inequality have led the Brits away from empowering the monarchy; they do not want Prince Charles to actually rule them some day. Look at the list of candidates for the 2016 election. They are a bunch of Prince Charles clones, and that is why we should worry about inequality.

I’m reminded that OTB denigrated the Occupy Movement as nothing but hippies and hackey-sack games and drum circles.

Yet here OTB is, years later, still trying to distract from inequality and the Oligarchy it has engendered. Shorter James:

Guaranteed…inequality is going to be front and center in the 2014 campaign. Obama’s SOTU and his tax proposals will tee that up tonight…and Republicans will be forced to connect the dots between their populist rhetoric and their economic policies; an impossible task.

Drum Circles, indeed.

How do you divorce the 2, James? Especially after the Supreme Court just put a great big “For Sale” sign in front of Congress**?

** or the White House, or the Governor mansions, or State houses, and coming soon to a court house near you.

Interesting, you don’t point out George Soros, who, through his funding of activists, has a much more active political influence life. Oh and his net worth only increased by 20% and he made his money by trying to break the Bank of England. I guess if you’ve on the side to keep the “journalists” from mentioning your name, then wealth doesn’t matter?

Actually, they are keeping wealth generated by investing in productive enterprises that hire individuals who trade their know-how and willingness to work for a piece of the revenue generated, although most expect to be compensated even in revenue is negative, thus extracting a portion of the owners’ wealth when the enterprise is not making a profit. Theoretically, they could give monies in excess of market pay to the workers but this would come at the expense of being able to see the enterprise through period of net loss on revenue.

@Scott:

Really? That’s what you think?

@JKB:

Nonsense.

@JKB: Interesting, you don’t point out George Soros, who, through his funding of activists, has a much more active political influence life.

You see, there are “good” billionaires and “bad” billionaires. The Kochs and Adelson are “bad” billionaires; the “good” ones like Soros, Tom Steyer, Michael Bloomberg, David Boies, et al are good liberals, so they get a pass.

And let’s look at the arguing here: you can earn all the money you want, and that’s great. But when you die, it’s all forfeited back to the government, who then decides how best to distribute what you leave behind. Oh, they’ll let you leave some to your loved ones and favorite causes and the like, but only a “reasonable” amount — and they decide what is “reasonable.”

Unless you set up some sort of structure to take over your money while you live, and express your wishes after you die. Like the Kennedy family — I don’t think any of them have done honest work in a couple of decades. However, how often do you hear about them, vs. the Waltons — whose fortune was earned in a hell of a lot more honest fashion than the Kennedys’?

But the key point needs to be emphasized — the disparity is a total red herring. If I make 10% more than I did last year, then I’m happpy. And if someone else who makes ten times more than I do manages to double their income, then so what?

As much as I despise most of the Kennedy family and their legacy, I have no desire to see their ill-gotten wealth confiscated. BUT if such confiscation is to be done, let it be done equally, even to the Lions of Liberalism.

@C. Clavin: Interesting, you don’t point out George Soros, who, through his funding of activists, has a much more active political influence life.

Nonsense.

Sod off, Swampy.

Here’s the list of the biggest donors from the 2014 election cycle.

So, Soros & Son spent about 27% more than the Koch Brothers combined.

It was a sad day lo these years ago, Cliffy, that you stopped to think about something… and never started up again.

@Slugger:

It’s fine for him either way, because he just cheats.

@James Joyner:

What does it make you? In 1984, my parents bought a house for maybe 100K. My dad was making around 50 a year (salary plus Navy pension). My mom did not work. They paid it off pretty quickly.

That’s about as dead center middle-class as you can get. Compare that to the person/persons with income of 240K or 120K who buy houses in the 600-700K range.

http://www.lewrockwell.com/2015/01/gary-north/humans-beings-are-highly-unequal/

None of this is news, nor has it been since 1897.

My goodness. In 1984 that was upper middle class. Median income was twenty grand back then. It was upper middle class not “dead center”.

Net wealth or net worth is of course only measured by net wealth. It’s a definition.

Presumably if one does not lose the perception or reality of ability to service debt, it is gross wealth that controls lifestyle.

Smearing debt or wealth all over, per capita like peanut butter, is silly.

As JKB observed at 10:11, redistributionist policy in any material way is bone headed as asset values crash.

@Guarneri:

Do you consider our federal income taxation system to be a redistributionist policy in a material way?

@al-Ameda:

Of course it is. Any system with refundable credits in which one can get back more than one paid in is by its nature redistributionist.

That having been said, people tend to miss the primary effect of taxation – recirculation of capital.

@Guarneri:

So you are advocating the cessation of billions in subsidies to fossil fuel corporations?

You intend on waiving your insurance and housing subsidies (assuming you get health insurance through your employer and claim a mortgage deduction)?

You want to end the subsidies to Walmart and McDonalds and otheres who refuse to pay employees a living wage?

Just want to make sure we are clear on what your thoughts are here.

@Jenos Idanian #13:

Once you account for all the dark money which is not required to be reported…then I will pay attention to whatever point it is you think you are making. Until then you are just lying by omission. Pathological, you are.

Redistributionist policies are stupid. All of the monetary wealth in the world could be evenly divided amongst all of the worlds inhabitants and in a very short time, it would all be back in the hands of the original owners.

Since you did not redistribute productivity the inequality would immediately start establishing itself again.

That’s why the “Great Society” has never taken shape. There are those who produce more than they consume who get wealthy, while many consume more than they produce continue their existence as “poor”.

@Jack:

I am willing to bet you any amount of money that an insignificant amount of “poor” people actually consume more than they produce which makes your entire argument crumble.

Given the wages paid by 9, 10, 13, and 14 on that list you might want to rethink that statement.

@C. Clavin:

You might want to look up marriage rates, who married who, women in the work force, out of wedlock birthrates, etc before you start comparing 1979 to today. Unless the demographics are similar, you cannot compare across decades. Also, the global economy is much different than in 1979 (think South Korea). Do you really think that if the U.S. had kept 70% marginal tax rates than somehow the U.S. would be more like South Korea and less like Greece?

@C. Clavin: Once you account for all the dark money which is not required to be reported…then I will pay attention to whatever point it is you think you are making. Until then you are just lying by omission. Pathological, you are.

So, instead of the official, accessible records, we should trust your accounts of shadow funds and just trust that they make your point? And that’ll trump Steyer’s $73 million?

Sod off, Swampy.

@Jenos Idanian #13:

Ooooh…a new insult. And such a powerful one from behind your keyboard. Who did you steal this one from?

The point is that since the SCOTUS has obfuscated the records…no one knows. You claiming to know, based upon an incomplete accounting, is tantamount to a lie. The fact that a direct line can be drawn between the SCOTUS and the Kochs is informative…but no more than that…still no one knows. Thus the claims you and JKB make are indeed nonsense.

@LaMont:

Is that why there are so many people getting more back in taxes than they paid. Is that why 68% of all Federal taxes are paid by the top 10% and the top 20% pay 90%. Meanwhile, the bottom 40 percent…pay negative 9 percent. Yeah, I’ll take that bet. Bring on your evidence.

http://www.cnbc.com/id/101264757

@C. Clavin: Ooooh…a new insult. And such a powerful one from behind your keyboard. Who did you steal this one from?

Google it, git.

The point is that since the SCOTUS has obfuscated the records…no one knows. You claiming to know, based upon an incomplete accounting, is tantamount to a lie.

No, Swampy, you’re the liar.

I gave publicly accessible records, and quoted them accurately. You then said that there are more important data. THEN you jumped to the conclusion that the secret information contradicts the records I cited. As you said, the phantom information is “no one knows,” but you know for certain that it shows the opposite of what I said.

Pick your argument, Swampy. Is this spooky, shadow info unknowable, or does it contradict the public records I cited?

Nah, don’t bother. I’m asking you to speak coherently and logically, and we all know that’s impossible.

@superdestroyer:

Well we have had historical, or near historical, tax rates since Reagan and where are we today? Where is the economic boon predicted? Why is it failing so badly in Kansas, Minnesota, Wisconsin, and New Jersey? The proof is in the pudding and the pudding ain’t even close to what all you voodoo economic guys said it would be.

Is 70% the right rate? Don’t know. Some think so. Some think not.

All I know is that the Republican 30 year war on the middle class has been tremendously effective.

@Jenos Idanian #13:

If you can’t muster an coherent argument…you might as well go back to the hole you were hiding in after you were ridiculed over Benghazi.

@Jack:

Apparently your comprehension of re-distributionist policies is stupid.

@Jenos Idanian #13: “You see, there are “good” billionaires and “bad” billionaires. The Kochs and Adelson are “bad” billionaires; the “good” ones like Soros, Tom Steyer, Michael Bloomberg, David Boies, et al are good liberals, so they get a pass.”

Yes. Those billionaires who spend money to help the country and the world even when it is against their own personal interest are the good billionaires. The ones who spend money to push a political agenda designed to advance their own bottom line at the expense of those who can’t afford to counther them, they’re they bad billionaires.

You might want to write this down if it’s a hard concept for you.

Doing good = good.

Doing bad = bad.

Financial status of person doing good or bad = neutral.

@C. Clavin: The purpose of redistributionist policies is to take wealth from those who have it and give it to those that do not. Period. Stop.

There is no redistributionist policy that takes from the poor and gives to the rich or takes from the uber wealthy to give to another uber wealthy.

From WIKI’s excellent summary of Piketty’s:Capitalism in the Twenty-First Century:

The central thesis of the book is that inequality is not an accident, but rather a feature of capitalism, and can only be reversed through state interventionism. The book thus argues that, unless capitalism is reformed, the very democratic order will be threatened.

… there was a trend towards higher inequality which was reversed between 1930 and 1975 due to some rather unique circumstances: …

…the world today is returning towards “patrimonial capitalism”, in which much of the economy is dominated by inherited wealth: …

Piketty predicts a world of low economic growth …

He proposes that a progressive annual global wealth tax of up to 2%, combined with a progressive income tax reaching as high as 80%, would reduce inequality.

@wr: So your guys are good, and ours are bad. Even for you, that’s an incredibly simplistic argument. I look at the things Steyer, Soros, Bloomberg, et al support, and I think it’s bad. But that doesn’t count, because you get to say that “we’re the good guys, and you’re the bad guys.”

Keep pushing the envelope there, genius.

@Jack:

Seriously?

So when my taxes goes to the fossil fuel industry it’s not being re-distributed?

Capital gains and dividend subsidies?

Carried interest?

A trillion dollars in tax expenditures go to the wealthiest amongst us.

Your view is tainted by your prejudices.

@gVOR08:

So, what is my incentive to work if someone will confiscate 82% of my income?

And people wonder why we have generations of welfare “earners”.

@C. Clavin: So when my taxes goes to the fossil fuel industry it’s not being re-distributed?

You need some new whines, Swampy.

@Modulo Myself:

Yes, but it’s also ridiculous to suggest that a homeless bum is wealthier than a suburban mom that’s underwater on her mortgage.

@Jack:

Snort. You say that as if it’s, you know, a fact…..

Happens all the time. And it’s endorsed by your city council/local government. Probably paid for with your license plate fees or a mill levy.

I got names. Would you like to hear them?

@Jack: So, what is my incentive to work if someone will confiscate 82% of my income?

And people wonder why we have generations of welfare “earners”.

The plan is to sneak up on you and take it. Pass it quickly, make it retroactive if necessary.

First, of course, the “good guy” billionaires will be tipped off so they can protect themselves. Only the “bad guys” will be hurt.

And if you refuse to go along with working just as hard and making just as much as they confiscate so much, you’re a “bad guy” and deserve what you get.

@Jack:

So you are saying no one worked during the Eisenhower Administration when the top rate was 90%? I’ve never read about that major work stoppage. Can you link to more information regarding it?

@Jack: I know. Such an excellent argument you’ve got there, what with American workers’ productivity scaling with wages over time.

Oh wait, that’s not true, you’re talking about a rich man’s dilemma of whether to work or not.

@Jenos Idanian #13:

https://www.outsidethebeltway.com/are-80-people-richer-than-half-the-world-not-really/#comment-1995549

@Jack: One, same as it was when the US had a confiscatory 90% top rate. Back in the 50s, when equality was better and the economy was growing. Two, Piketty is focused on inherited wealth. What difference would it make if Alice Walton quit working? Did she ever?

@gVOR08:

The problem with wealth taxes is that it encourages me to spend all my income on hookers and blow, thus leaving myself with no wealth to tax, rather than saving for the future and watching that money get chipped away year after year.

@C. Clavin:

The fact that large corporations, like the average taxpayer, are abiding by the tax code and taking authorized deductions is not a subsidy. Your taxes are not going to them, the government is simply not getting as much.

sub·si·dy

/ˈsəbsədē/

nouna sum of money granted by the government or a public body to assist an industry or business so that the price of a commodity or service may remain low or competitive.

A subsidy is what we give wind and solar producers–a cut out because they cannot make it on their own because they produce crap.

You cannot be so ignorant as to confuse deductions with subsidies. Or maybe you are.

@Stormy Dragon:

Thinking about it, it seems to me that solution is not ignoring debt but adding in three assets being ignored for most middle class people in the Oxfam study:

1. The value of any education obtained (a person with a BS is better off than a high school dropout, this needs to be quantified).

2. Treat unused credit as an asset.

3. NPV of expected future income either from investments or from working.

@C. Clavin:

They don’t. It’s interesting how many people (essentially EVERYbody) draws the paying for / being paid for line precisely at themselves. Taken in terms of net tax payments versus net benefit from federal spending, most of them are placing themselves on the wrong side of that line, i.e. most of them are net takers.

Which is fine. It’s the only way that a civilized society can operate, but recognize it for what it is, and for where you fall in the bigger picture.

Capital gains treatment incentivizes investment, which benefits you (and anybody else with a 401(k) or a pension) a great deal more than you think. That said, for upper bracket taxpayers, the capital gains rate is now 20%. Dividends, as of 2013, enjoy no beneficial treatment at all. They are taxed as ordinary income.

Absolutely. Eliminate it today, but it’s not as much of a benefit as it’s perceived to be. Net estimates place the potential additional revenue to Treasury from eliminated carried interest treatment to be around $11 billion

That one is a whopper. How, exactly, are you deriving this figure?

@Jack:

Wait…are you completely un-aware that the fossil fuel industry receives billions in subsidies each year? Yes, or no?

@Jenos Idanian #13:

You make it sound like they are making him out to be a bad guy, when it’s his own argument that portrays him thus. He’s the one claiming the only reason there are poor people is because they don’t work enough to produce more than they consume. He claims high taxes are a disincentive from work, therefore he claims the government, by redistributing, is making him feel like a bad guy since he’s not working as much as he could to get the money he’s being taxed out of.

So when the government doesn’t tax him out of his rightly-won earnings, he can stand on a mountain of dreck and know he is better due to having the most stuff. This is the right way of things.

@gVOR08:

Few taxpayers actually paid anywhere near the top rates. The prosperity of the 1950s was due to across the board employment in an economic environment where we had the world as a captive marketplace and could sell everything we could possibly produce.

While I will agree that taxation recirculates capital, and that is a good thing, the net effect of it tends to be that the wealthy get wealthier, because the additional spending thus created just increases the sales of their businesses and the value of their assets.

The net wealth of the middle classes doesn’t really increase that much (you have to factor assets against debt), but their standard of living does increase. That said, those two are not the same thing, and you can’t substitute one for the other.

@C. Clavin: There was never a 90% tax rate. There were so many loopholes that the top tax rate was effectively 17%. Also, higher rates on a few wealthy taxpayers didn’t produce higher revenues and the overall tax burden on the public was actually lighter, not heavier, than it is today.

States raise taxes on cigarettes and alcohol to get people to stop smoking and drinking by increasing costs. If you raise taxes on working, the purpose must be to get people to stop working.

You would be an imbecilic to think peoples behavior would not change under such a burdensome tax.

@C. Clavin: @Jack: Just to complicate the picture further, the federal government gives subsidies out to everyone. More to renewables (solar/wind) in recent years, but only in recent years it seems from my brief skim.

@C. Clavin:

CBO testified before Congress in 2013 that fossil fuel subsidies “cost” (i.e. lost revenue, not direct expenditure – they are different things) $3.2 billion that year.

Renewable energy, in contrast, cost $7.3 billion, much of which was direct expenditure.

@HarvardLaw92:

My numbers, cut and pasted in a hurry in a lunch-line, are off…it’s roughly half a trillion…the top ten expenditures send 50% of $900B to the top quintile…but the basic point is not.

I am borderline amazed at some people’s willingness to carry water for the 1%.

@HarvardLaw92:

@Tillman:

My original point…which has apparently been lost…is that they are re-distibutive upward…which Jack claims does not exist.

@Jack:

Link me up to a credible source.

@C. Clavin:

What is the source of these numbers, and what are you defining as “expenditure”?

A tax situation where I am afforded a reduction in what I would otherwise nominally owe isn’t an expenditure – it’s a benefit, or if you prefer, a subsidy.

Expenditure, by necessity, only encompasses money being directly paid to you by the government that you wouldn’t otherwise receive.

A fine distinction, no argument, but a distinction nonetheless. Trying to equate someone being allowed to pay less in taxation on profits that they have earned external to government is not the same thing as government sending a check to unemployed citizen X.

@HarvardLaw92:

Sorry…forgot the link.

http://www.scribd.com/doc/144501063/CBO-Report-On-Tax-Expenditures

@C. Clavin:

He’s trying to explain that 90% was a nominal rate, applied in such a way (i.e. so many different opportunities to deduct various things from taxable income) that few taxpayers ever actually had any taxable earnings which were subject to it.

We won’t even get into the enduring confusion most people have between nominal and actual tax rates.

Taken at net, the 90% nominal tax rate didn’t produce anywhere near a actual 90% tax burden. It wasn’t even close.

@C. Clavin:

Exactly. They are treating foregone potential revenue as expenditure, and they are not the same thing. They need to distinguish between the two.

@C. Clavin:

That’s like saying that when I take my deductions for my rental property costs (mortgage, repairs, taxes, etc.,) that taxes are being redistributed upward from the poor to me.

You really are that thick headed!

@HarvardLaw92:

I understand the concept of effective tax rates. It’s the 17% he quotes that I doubt.

According to the IRS the effective rate in 1954, when the top rate was 91%, was 70%.

@Jack:

Still waiting for your answer on subsidies to the fossil fuel industry.

While I’m somewhat loathe to fall on his side of he argument, Jack does have a point.

if I have $X, and instead of taking 0.5 * $X from me, you instead take 0.2 * $X, you haven’t given me 0.3 * $X.

Giving me anything would, by necessity, imply that I end up with more than $X in the end.

I realize a BENEFIT – ostensibly to incentivize me to engage in behaviors which government views as beneficial to society – not an EXPENDITURE.

@HarvardLaw92:

“Taken at net, the 90% nominal tax rate didn’t produce anywhere near a actual 90% tax burden.”

And yet, when it suits his argument, Jack acts as if Piketty’s proposals will do exactly that (“So, what is my incentive to work if someone will confiscate 82% of my income?”)

@James Joyner:

I think that means that you roughly own half a house, and your mortgage holder owns half a house. There’s an agreement for you to buy the rest of the house from them, but you can easily get out of that agreement by selling the house. Your half-a-house is pure asset.

Credit card debt, on the other hand, cannot be discharged during bankruptcy (thanks, Biden!), and is not directly attached to something of value which the creditor has claim to. You’re stuck paying that off. That actually is real debt, and should be included in a net worth calculation.

@C. Clavin:

Rather than reinvent the wheel, I’ll direct you to this

Taxation WAS somewhat more progressive in the 1950s, but it had little to do with income tax rates.

@Jack:

Says the person that attached an empty link!

So allow me to clarify. Never-mind the false premise that the poor get back more in taxes than they paid considering everything they purchase to just live is also taxed along with their income and, thus, any tax credit they might get back is meant to offset the cost of living – you are arguing that because the poor contributes less money in the tax pool they are somehow by default consuming more than they probably should? You are insinuating that a significant number of “poor” people take in more than they produce out of choice and will remain that way. I argue that they are not consuming any more than anyone else. In fact, they are likely consuming less and what they are consuming is not enough to adequately live on (thus the tax credits). I also argue that many that are poor are poor because of existing economic conditions that strains their upward mobility. Not because they simply have an unfortunate habit of spending more than they take in. What many are taking in is simply the cost of living.

BTW – A passage on consumer spending in a New York Times artical;

http://opinionator.blogs.nytimes.com/2013/01/30/the-hidden-prosperity-of-the-poor/?_r=0

@C. Clavin: A deduction or tax break is not a subsidy.

@Gustopher:

Come again??

@LaMont:

What does the laudable goal of the net credit have to do with the fact that there is a net credit?

EITC, for example – By it’s very nature (as with any refundable credit), taxpayers can – and do – get back more than they paid in. That doesn’t make them bad people, nor does it make what the EITC is trying to accomplish a bad goal, but they ARE, in the end, getting back more than they paid in.

@HarvardLaw92:

It all depends on your outlook. The EITC is a benefit for the “takers”. Carried interest is a benefit for the wealthy…who are only to be admired. As I said…it’s all about your prejudices.

@HarvardLaw92:

And I’m loathe to dispute you, but all such considerations of more and less are relative not absolute. If the cost of a ticket to a play is $10 but I discount yours to $8 I have in fact given you two dollars relative to the guy who is paying $10. You have two dollars more than you would have had I not taken the action. You’ve been given an advantage.

Of course as a political reality you haven’t just received that benefit, you’ve probably lobbied for that benefit. You will have fought for relative advantage, and if your effort is successful, you will in fact receive that advantage. You will have more, relative to someone else.

@Jack:

And your claim of a 17% effective rate.

@Jenos Idanian #13: “Even for you, that’s an incredibly simplistic argument. ”

No, it’s just being read by a simpleton. Apparently you are unable to distinguish between someone working in his own interest and someone working to achieve a goal that he feels is good for others while being against his own interests.

Really, your reading skills are even worse than your writing skills, and that’s saying a lot.

@C. Clavin:

LOL, no, EITC is a direct PAYMENT to the takers. It’s not a bad thing – in fact, it’s probably a pretty good thing – but it’s not remotely the same thing as a tax break for an upper income shareholder.

You’re trying to equate a situation where someone ends up with $X + Y to one where someone ends up with 0.6 * $X instead of 0.5 * $X.

In the first, the person ends up with more than they had. In the second, the person loses less than they otherwise would have, but still ends up with less than they had. Surely you can see the difference between the two.

@Jack: “There is no redistributionist policy that takes from the poor and gives to the rich or takes from the uber wealthy to give to another uber wealthy.”

You mean that, for instance, local or state governments don’t impose income or sales tax on the populace to give hundreds of millions of dollars to a multimillionaire to build a stadium for his sports team?

@michael reynolds:

You’ve actually given me an intangible benefit that can be equated to $2, but it still misses the point. It’s still not the same thing as giving a ticket to someone who pays $0 in exchange for it.

@C. Clavin:

Everything depends on outlook, and I don’t think (as I’ve repeatedly said above) that the EITC is a bad thing. I think it’s a good thing, for a variety of reasons – only some of which have to to with direct benefit to the recipient.

I don’t think one has to despise the poor, but I don’t think one has to despise the wealthy either. The folks who do, on BOTH sides of that argument, are pushing an emotional position, not a rational one.

@LaMont:

I am in no way arguing that the poor are consuming more than they should. If you read my post, I said that they are consuming more than they produce. Period.

A farmer of corn cannot reap more corn than what he has sewn. He cannot reap 50 bushels if he has only sewn 10. However, through various programs, if that farmer needs more than the 10 he has sewn, he can get the government to confiscate bushels from a farmer that has sewn 5000 bushels.

Additionally, after redistributing wealth through EITC or other programs, that money is not saved by the poor. They go out and spend it on stuff…which means the money is going back to those producing more than they consume.

Nothing has changed in the production / consumption scale.

@HarvardLaw92: “He’s trying to explain that 90% was a nominal rate, applied in such a way (i.e. so many different opportunities to deduct various things from taxable income) that few taxpayers ever actually had any taxable earnings which were subject to it.”

And the current top rate is ALSO a nominal rate, which is why Mitt Romney pays less than half of it.

There’s this great pretense by anti-taxers that the higher rates of the past were only nominal, while the lower rates of today are actual.

@wr:

Research indicates that public subsidies for sports stadiums tends, more or less, to be a zero-sum game.

Try again.

@wr:

The money wasn’t “given” to the multi-millionaire. Given implies he could walk away and keep the money. What you indicate is a contract to perform an agreed upon action in return for an agreed upon benefit. Failure to abide by that contract would result in likely jail and fines. What you describe is capitalism friend. Not a subsidy.

From Sullivan:

https://sullydish.files.wordpress.com/2015/01/screen-shot-2015-01-20-at-11-41-29-am.png

@Jack: “A farmer of corn cannot reap more corn than what he has sewn”

Congratulations on what is probably the stupidest thing ever written on the internet.

If what you’re saying was true, mankind would have starved to death thousands of years ago. Because each kernel of corn planted would yield exactly one kernel of corn.

Instead, one kernel of corn yields one ear, which contains roughly 800 kernels. The farmer takes one kernel, adds water, soil, energy and care and vastly multiplies his wealth.

munchbox:

Already did. It’s math. It is indeed the case that “the top 1% can pay off all American debt.” By the way, there is a direct connection between the size of their wealth and the size of the debt. To a great extent, both of those things were created together, as part of the same process.

If we wanted to completely eliminate the deficit and the debt we could, just by raising taxes on the top 1%. 100% of the current deficit would be eliminated if the top 1% resumed paying the effective tax rate they used to pay in the period 1942-1981. Link.

Major conservative commentators lie about this, routinely. I could show you many brazen, transparent examples. That’s why people like you are so confused.

The Reagan tax cuts for the rich are what’s unsustainable, and that problem will eventually be addressed.

@HarvardLaw92:

Agreed.

So how would you address, without emotion, clear trends of social and economic inequality?

@wr:

I don’t think that’s what they are saying. The comparison is somewhat flawed, since very few taxpayers in the 1950s were actually subjected to the highest marginal rates.

In real dollar terms, the top marginal rate in the 1950s, 90%, phased in at the current dollar equivalent of $3 million in earnings. The current top rate phases in at $450,001 (married filing jointly cited in both scenarios).

The net result is that far more wage earners (as opposed to asset holders) are exposed to higher taxation on wages relative to the 1950s, while asset holders are exposed to far lower rates of taxation relative to the 1950s. The shift was among segments of the (relatively speaking) wealthy.

@HarvardLaw92: Oh, goodie, lies from the American Enterprise Institute trying to convince us that having poor people buy rich people’s toys for them is a good idea. No thanks.

But somehow I doubt even the vile AEI would claim that there isn’t a tax transfer from poor to rich where, which is what idiot Jack was denying ever happened.

In 1952 and 1953 the top rate was 92%. The top rate was 91% in the period 1954-1963. Link.

@Jack: “The money wasn’t “given” to the multi-millionaire. Given implies he could walk away and keep the money. What you indicate is a contract to perform an agreed upon action in return for an agreed upon benefit. Failure to abide by that contract would result in likely jail and fines. What you describe is capitalism friend. Not a subsidy.”

I was wrong. Your corn statement is not the single stupidest thing ever written on the internet.

This is.

You just go ahead and line up to give the richest men in America your tax dollars while you receive nothing in return. And be sure to keep complaining about “takers.”

@HarvardLaw92: “The net result is that far more wage earners (as opposed to asset holders) are exposed to higher taxation on wages relative to the 1950s, while asset holders are exposed to far lower rates of taxation relative to the 1950s. The shift was among segments of the (relatively speaking) wealthy.”

I agree, which is why I feel we should greatly expand the number of tax brackets. Right now we pretend there is no difference between an income of half a million — which can buy a pleasant, if not opulent life in NY or SF — and half a billion.

@C. Clavin:

I think that you do what you can. Ideally, of course, you find a way to put people to work, but our transitioning economy leaves the unfortunate reality that, for a growing segment of the population, there is no real place for them in the workforce aside from menial labor (I’m not using that in a derogatory sense). There is no magic pill that can make it be 1955 again, and manufacturing as a component of the US economy will continue to decline – manufacturing employment, which historically was the means by which we uplifted the middle class, will continue to decline along with it. There is no reversing that trend beyond the trivially anecdotal instances, which are essentially meaningless.

Those folks – unless we propose to put them all on a bus to some deserted island – will have to be supported if they are to maintain any sort of standard of living. That’s the cold, hard truth.

I prefer things like the EITC, and publicly funded employment, over benefit programs like Medicaid & food stamps because they tend to generate more of an overall beneficial impact on the economy as a whole, but at the end of the day, those folks will have to be subsidized if they are to maintain any sort of standard of living that doesn’t involve living in a cardboard box.

@wr:

I think perhaps it would be better to lower income tax rates, while grossly increasing estate tax and associated asset tax rates.Wage earners like myself get lumped in with people like Christy Walton as being the hated 1%, and the reality of the situation is that our realities are nowhere, even remotely, close to one another.

I pay a higher effective federal rate than Christy Walton does, and if that isn’t the definition of insanity, I’m not sure what is.

@C. Clavin: If you can’t muster an coherent argument…you might as well go back to the hole you were hiding in after you were ridiculed over Benghazi.

I said you need a NEW whine, Swampy. Dusting off an old one hardly counts.

@wr: Apparently, spoon feeding you is insufficient. I said,

An average acre of corn yields 100 bushels. A bushel (corn) is defined as 56 pounds and around 27,000 kernels. Each bushel is composed of around 34 ears. An average ear of corn has 16 rows and 800 kernels.

You dope. You still cannot reap more than what you have sewn. When I sew one kernel, the result is a stalk which I expect to contain one or two ears. I cannot however reap 5000 ears from one stalk.

@HarvardLaw92:

No…they are both tax expenditures where person “X” ends up with a smaller tax liability than they would have absent the tax expenditure.

HarvardLaw92:

The correct number is 92%, not 90%.

Forget the top rate. Marginal rates were also high for people earning a lot less than that. For example, there was a marginal rate of 80% for income over $1 million (1953, married filing jointly, in constant 2013 dollars). PDF, scroll to p. 30 in your pdf reader.

Anyway, the top rate is a distraction. What matters the most is the effective rate. It used to be much higher. Link.

@wr:

Give it a rest, You attacked the source of the piece without even trying to address the substance of it.

Nobody is claiming that, in instances where stadiums are funded via add-on sales taxes (not all of them are) that there isn’t an initial nominal transfer of capital. What has to be taken into consideration is the overall picture – capital transferred versus capital received.

I’m not a huge fan of these publicly funded elephants, but the guy is a PhD specializing in sports economics who does make a credible case for them being more or less a zero-sum proposition. In that light, assuming his conclusions are accurate, I’m not bothered enough by the stadiums to make a fuss about them.

@wr: So, apparently you need a Capitalism 101 course. Please attend your local community college, on your own dime, not mine.

Jack:

Except for when it did. Revenue as a % of GDP:

1952 18.5%

2014 17.5%

Explain how 18.5% is “lighter” than 17.5%.

@C. Clavin:

Yet again, taking less from me than you otherwise might have is not an expenditure. It’s a benefit. Expenditure implies by its nature the net transfer of something from one to another. Allowing me to keep more of something that I already had to begin with doesn’t meet that definition. In that instance, I’m expending capital on you, not the other way around.

Giving me something that I didn’t already have, meanwhile, does. They’re different animals.

@Jack:

No, Jack. We’re talking about straight-up tax-payer funded giveaways to companies with millions of dollars in revenue. If you think that’s “capitalism,” you need to revisit the concept.

HarvardLaw92:

It’s time to start talking about what Milton Friedman proposed: a negative income tax (which means a guaranteed minimum income). In 1968 he discussed this with William F. Buckley (link). An idea that today’s GOP would definitely call socialism.

Manufacturing may actually increase in the US while human employment drops.

If a machine makes a widget with only minimal human involvement then labor cost is irrelevant and shipping speed and cost, and things like energy costs, become more important. So a machine-made widget in India will have the same cost as one made in the US, eliminating India’s advantage in labor costs.

Of course the machine that makes the widget may be made in India, but not if the machine that makes the widget is itself made by a machine.

Actually, given 3D printing and related technologies, some manufacturing will be done in the home. I need a piece to fix the blinds in my living room. I could just dial up the plans and print it off. If I break a cup I may be able to print its identical companion. Or change the color. I broke a piece of molding in my car – why not pull up the specs and hit “enter” and have the piece printing off while I get back to work. If my printer doesn’t have the right materials, it will order them and they’ll be delivered by a self-driving truck.

@Jack: No, but there is a tax law that taxes “carried interest” much more cheaply than Ordinary Income.

The reason that the money will end up back again in the hands of the rich isn’t because they’re so much better than the rest of us: it’s because they write the rules governing the transfer of money.

I’m for redistributionist policies because that’s the only way you can maintain the existence of a large middle class. And the existence of a large middle class is the best protection, bar none, against revolution.

Think of progressive taxes as the insurance you pay against getting dragged from your house and being hanged from a lamppost.

@jukeboxgrad:

We must be looking at a different page 30.

@jukeboxgrad:

In real terms, whatever we choose to call it, it will remain a case of “those with will have to support those without”. As far as I can see, the EITC IS a negative income tax 😀

Could someone release my comments from the anti-spam jail please?

Kthnxbai

@HarvardLaw92:

Well if you want to make up your own definitions…fine.

I’m merely working with the accepted definitions.

The EITC and Carried Interest are both Tax Expenditures.

From the peoples encyclopedia:

http://en.wikipedia.org/wiki/Tax_expenditure

Your encyclopedia may differ.

From the GAO:

http://www.gao.gov/assets/660/654273.pdf

Your personal GAO may differ.

@grumpy realist:

Truthfully, it’s because the lower down the economic ladder one goes, the greater the propensity / necessity of the people who are slotted there to spend capital. They spend, and they consume, thereby driving economic expansion, but they largely do not own the means of production or the sources of materiel, and that is where the capital eventually flows back to in a capitalist system.

So, bizarrely, given the recirculatory effect which taxation has on capital which would otherwise stagnate at the top of the economy, even though you tax the wealthy and transfer said wealth to the lower brackets of the economy, in the end analysis they’ll usually end up better off than they were before.

HarvardLaw92:

From your article:

Your words are not a particularly honest summary of the article.

@michael reynolds:

This is the case:

http://mercatus.org/publication/us-manufacturing-output-vs-jobs-1975

Since 1975, US manufacturing output has more than doubled even as the number of manufacturing jobs dropped almost 50%. For all the talk about factories moving to Mexico or China, the dirty secret is most of those jobs didn’t actually move, they disappeared entirely.

@michael reynolds:

We have two “maker-bots”, or 3-D printers, in our office.

I’ve already printed small clips to replace pieces from a motorcycle fairing that had snapped off.

Who knows what that technology looks like in 10 years?

@grumpy realist:

Exactly. And I’ll add this from Chris Rock:

Every four years we get the inevitable, “Candidate X didn’t even know what milk costs!” Well, guess what, even I don’t know and I’m only wealthy-adjacent. Actual rich people don’t know what cars cost or what houses cost. They snap their fingers and something like a car purchase, which is a stressful, miserable and often humiliating experience for normal people, just happens, boom.

It’s why Elizabeth Warren could actually win a general election – there are a whole lot of Americans who keep going on the false hope that life will get better. They are losing that hope, and if there’s one thing you don’t want it’s a big bunch of people who feel their just aspirations are categorically canceled. People get pissy when you do that. Poor and working class people have votes and hope, and if they stop feeling that they have votes and hope, they’ll find bombs.

The phrase is supposed to “enlightened self-interest,” not “narrow and short-sighted self-interest.”

HarvardLaw92:

My crystal ball says you are using the Reply feature to reply to me. Don’t do that.

@C. Clavin:

I’m not making up anything. GAO chooses to call foregone revenue an expenditure, which is inaccurate. Note: GAO also calls a reduction in planned tax increases a tax cut, even though taxation goes up. They live in their own little world which has little to do with reality.

They could call it a washing machine if that’s what gets them off, but it doesn’t make it accurate.

@HarvardLaw92:

Not if increased income at the bottom creates sufficient excess income that they can invest.

HarvardLaw92:

This is an important point. There is a ton of cash being hoarded, doing nothing (link). Conservatives find it hard to grasp this concept, because the capitalist fable teaches that money in the bank is always working.

Jukeboxgrad:

They are when you include the next sentence of that paragraph, which you seem to have omitted:

This suggests that the public-good benefits are worth just enough to pay for the subsidies.

Maybe they are; maybe they aren’t, which is why I qualified the remarks with “assuming his conclusions are accurate”. He’s a PhD specializing in sports economics; I’m a lawyer, so I’m inclined to think he knows more about the subject than I (or you) do. Just saying.

@HarvardLaw92: “I pay a higher effective federal rate than Christy Walton does, and if that isn’t the definition of insanity, I’m not sure what is.”

It is nice to find something on which we can completely agree.

@michael reynolds:

Agreed, but as a rule, they don’t. It would be great if they did, but historically, they do not.

@HarvardLaw92: “Give it a rest, You attacked the source of the piece without even trying to address the substance of it.”

In exactly the same way I won’t bother to read arguments that North Korea is the greatest country on earth if they’re financed by the North Korean government.

@Stormy Dragon:

Indeed, and yet I keep hearing people tell me that technology has not and will not cost jobs. Of course it has cost jobs, and it will continue to do so. Unless some sudden evolutionary spurt sends homo sapiens hurtling ahead of machine capabilities.

Machines are effectively a competing species, a species which evolves far faster than we do. This species has already pushed us out of a large number of economic niches, and in order to believe that this won’t result in fewer human jobs you have to believe that we can create new economic niches faster than the machines can fill them. I see no way that can happen.

And I for one welcome our new silicon overlords.

HarvardLaw92:

And he points out that “the public-good benefits” are amorphous and hard to measure.

Which is why you should not ignore and distort his central thesis:

@HarvardLaw92:

I will be sure to verify any widely accepted definition with you in the future.

@jukeboxgrad:

The “90%” tax burden affected far fewer people in 1952 than the 38% tax bracket does in 2014. It’s simple math. In 1952 the number of millionaires numbered in what, the thousands? Today, however he number of households with net worth of $1 million or more, excluding their homes, is at a record 9.63 million.

http://articles.latimes.com/2014/mar/13/business/la-fi-mo-number-of-millionaires-in-us-reaches-a-new-high-20140313

There were only 56 million returns in 1952, from a population of 157 million, (while there are 145 million returns today from a population of 320 million). The tax base has broadened. In your statistical example (I didn’t see a link), 18.5% of GDP was collected from only 56 million people, while today 17.5% of GDP is collected from 145 million. Effectively, since 1952, the percent of the population filing taxes has gone from 35% to 45%.

http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?DocID=564&Topic2id=30&Topic3id=32

https://www.census.gov/popest/data/national/totals/pre-1980/tables/popclockest.txt

So, yes. the overall tax burden on the public was actually lighter, not heavier, than it is today.

Mods, please release my comment.

@HarvardLaw92: “So, bizarrely, given the recirculatory effect which taxation has on capital which would otherwise stagnate at the top of the economy, even though you tax the wealthy and transfer said wealth to the lower brackets of the economy, in the end analysis they’ll usually end up better off than they were before.”

I don’t think anyone suggesting impoverishing the rich — in fact, you make a strong argument here for increased taxation, since under that every benefits.

wr:

The problem here is not that AEI shouldn’t be trusted (although I agree that they shouldn’t be trusted). The problem here is that HL92 is misrepresenting the article. The core point of the article is this:

@James Pearce:

Then show me one, because the example given was not that.

@wr:

So, in other words, he must absolutely be lying, or presenting flawed conclusions, simply because of where he is presenting them?

Wouldn’t it be better to refute his conclusions, rather than dismissing them out of hand because they weren’t sourced from a venue that you like?

I’m not saying he’s correct. I’m saying that he’s an expert in this field and I’m not, so I’m inclined to give him the benefit of the doubt. You’re dismissing him out of hand, without bothering to even consider his conclusions, because they disagree with your preferred narrative.

You’re smarter than that.

@HarvardLaw92: Actually, according to Jukeboxgrad, who did read the article, his conclusions DO agree with my preferred narrative. Go know.

@wr:

Increased taxation of asset holders, which is not the same thing as increased income taxation.

@wr:

Ok, if it will get us past this, we shouldn’t be building sports stadiums. The point is retired.

Next?

Jack:

My crystal ball says you are using the Reply feature to reply to me. Don’t do that.

HarvardLaw92:

“Increased taxation of asset holders” is a concept I like. Here’s another one (link):

Also see his similar column here.

HarvardLaw92:

“Increased taxation of asset holders” is a concept I like. Here’s another one (link):

Also see his similar column here.

[Message split because it has too many links.]

Also see related commentary here, here and here.

HarvardLaw92:

And you’re misrepresenting “his conclusions, because they disagree with your preferred narrative.” The core point of your article is this:

@Jack: Gaylord Hotels, Magpul Industries, Cabela’s. Three off the top of my head in my state. I’m sure the names are different where you’re at, but the idea is the same.

Jack:

Cato Institute (link):

But Cato Institute is so Marxist.

I tend not to be a fan of consumption taxes, for the simple reason that they are more or less impossible to enforce in practice. How do you know what I really paid for anything, and can you prove it?

It also presumes that the wealthy don’t already allocate capital to generate the best rate of return, and worst of all (in my opinion anyway) it disincentivizes consumption, which makes investment less attractive (due to the reduced earnings of the companies being invested in caused by their reduced sales).

The more distributed and ephemeral you make the basis for a tax, the greater the number of people that will creatively avoid paying it.

It’s an interesting mental exercise though, agreed.

@Jack:

You do not understand the concept of subsidies…the fossil fuel industry receives billions in direct subsidies, and trillions in indirect subsidies, of many types.

http://www.iea.org/publications/worldenergyoutlook/resources/energysubsidies/

http://www.bloomberg.com/news/2014-11-12/fossil-fuels-with-550-billion-in-subsidy-hurt-renewables.html

http://grist.org/energy-policy/2011-10-26-direct-subsidies-to-fossil-fuels-are-tip-of-melting-iceburg/

Nor, apparently, can you back up your claim of 17%.

HarvardLaw92:

Wrong. It was a lot “more progressive.” Link:

Your article and this article are both discussing the same study.

Years ago J. K Galbraith argued for replacing the income tax with a Value Added Tax. He listed three reasons I (mostly) still find compelling:

– the government needs the money

– economists always prefer consumption taxes*

– it would remove the resentment of the wealthy over the (supposedly) progressive income tax, which would result in largely defunding the Republican Party

The Europeans seem to be able to collect a VAT efficiently. And they deal with its regressive nature with targeted subsides.

______________

* I’m becoming less convinced they’re correct. We’re swimming in capital, which fact was largely responsible for the ’08 crash.

Jack:

Conservatives unquestioningly assume (or pretend to assume) that rich people will work less if they’re taxed more. This fundamentally misunderstands the psychology of work.

I think that typically the most creative and successful people are not motivated primarily by the idea of making the largest possible amount of money. The money has some importance as a way of keeping score, but once a certain threshold is reached the marginal dollars don’t mean much.

People like Steve Jobs and Bill Gates would not have behaved differently if their taxes were higher. They kept working just as hard even after they became super-rich. This is the typical pattern. They are not in it primarily for the money. If you had told Gates in 1975 that his efforts were going to lead to a fortune of ‘only’ $10 billion (or $1 billion, or $100 million), instead of $50-100 billion, what would he have done differently? Answer: absolutely nothing. He would not have said, “oh well, in that case I might as well spend the next thirty years surfing.”

In most cases, and in the most important cases, it just doesn’t work that way. As a commenter elsewhere once said:

“Sport” vs. “instrumental value” is exactly the right way to put it. And the people who enjoy that “sport” give it their full devotion even when the expected or actual payday is ‘only’ ten million, rather than fifty or a hundred. And their workaholism tends to continue until they drop. Then their neglected heirs are well-positioned to support the market for luxury goods, therapists and anti-depressants.

I’m not talking about people who are trying to turn a 5-6 figure income into a 7 figure income. In that bracket, there are real incentives, because there is a real transformation in lifestyle. But a big chunk of income is going to people in a much higher bracket, where extra income indeed “has no instrumental value.” I think the biggest problem with our tax system is that we undertax people in those higher brackets. This is what Gates and Buffet are trying to tell us.

There is a related misconception. Let’s say that someone earning, say, a million a year does indeed decide to refrain from working harder, because the second million he earns would be heavily taxed. Or maybe he even decides to stop working entirely, as a response to high taxes. So what? Unless you are a singular genius like Jobs, you are not irreplaceable. If the economy actually needs the work you are refusing to produce, then someone on the ladder behind you will be glad to move up and take your place. This is not just true when unemployment is high. It’s always true.

Jack:

All taxation is a form of ‘income redistribution,’ because everyone pays taxes for things that help someone else more than it helps them. Citizenship is not a la carte. Children, libertarians and conservatives find this hard to grasp.

@C. Clavin: Doug and I had differing takes on Occupy. I focused initially on the contradictory statements coming from the non-leadership leaders and eventually came to buy into the validity of 3rd party interpretations of what held them together. At that point, my critique shifted to Occupy’s lack of a policy focus. That is, they were correctly pointing to a real problem but had no unified approach as to what to do about the problem.

@JKB: I glommed onto those three and not Soros et al because they jumped out at me from the list by virtue of being consecutively ordered.

@Scott: That’s just not true. We had a landed gentry almost from the beginning. Guys like George Washington and Thomas Jefferson were proud members.

@Modulo Myself: I think anyone who looked at my lifestyle would say that I’m solidly in the middle class, despite being in debt on two homes.

@Gustopher: I’m not arguing about how we should calculate “net wealth.” I’m arguing that “net wealth” is not a useful measure of comparison between the very rich and everyone else. A guy making $100,000 a year but with a large debt load on his McMansion and BMW might not be wealthy; he’s almost certainly much richer in any meaningful sense than a Chinese peasant, much less a minimum wage worker at McDonald’s with no loans to pay off.

Jack:

I always love to hear about the 47%. Do you know why the bottom 47% (or 43%) pays no federal income tax? Because for about 30 years it has been GOP policy to eliminate federal income tax for that group. National Review:

Also (link):

It is classic Republicanism to implement a policy and then whine about the result of the policy. It is also classic Republicanism for Republicans to suffer from Romnesia and be painfully ignorant regarding their own history.

@jukeboxgrad:

Besides which…Jack clearly doesn’t understand taxation.

Even his mythical 82% confiscation rate would only apply to income above “x” amount….let’s say $400,000. Would Jack only work hard enough to make $399,999? It’s a ridiculouos position to take.

It’s difficult to reason with someone who doesn’t come to his opinion through reason.

@C. Clavin:

It’s easy to push such a position when (I suspect, apologies if I’m incorrect) that it wouldn’t apply to you. You look at a figure like $400,000 and determine “that person doesn’t need any more than that, so I’m ok with taking the rest. Nobody should have that much money.” This is to an extent why I get so annoyed with the left – you are making an arbitrary value judgment about what constitutes “acceptable” based on your own standards & reality, and applying that across the board to everybody else. Those that are reticent about such a proposal get termed as mean spirited, callous and cruel.

But truthfully? At a marginal rate of 82%, I’m going to start to reexamine the various costs, in terms of quality of life and what has to be sacrificed to earn enough to subject myself to that rate, and I am going to balance those against what relative little I gain in return for sacrificing them.

For example, If I (as is often the case) have to spend additional weeks away from my family, living in a hotel room (which, even if it is luxurious, remains a hotel room …) in order to earn that money, which is the unseen and unattractive reality of my job, the incentive to do so drops considerably when I know that I’m going to end up with 18 cents on the dollar with regard to what I earned over that period.

It becomes considerably less attractive, and the incentive to forgo that compensation, or to defer it (which is the most probably course of action), increases exponentially. The probable truth is that there is a limit to what people will accept in terms of seizure of assets and capital. 82 cents on the dollar? That’s well above it.

Haysoos Christo, right, left, who cares? They are rich and you are not. What in Dog’s name makes any of you think any of them can identify with any of you? Here is a clue:

THEY DON’T GIVE A RAT’S A$$ ABOUT YOU.

Wake up and smell the roaches.

@HarvardLaw92:

I understand your point, and almost agree with it. But I have to ask, if you -because of your station in life- might find less of an incentive, does that automatically mean that someone else will be disincentivzed too?

I mean, give me 7 figures, I’ll do it! Tax me at 82%. Wanna make it 83%? I don’t care. I’m paying off my mortgage –the whole thing– after I pay the tax man. Hell, I’ll even stay at the crappy hotels.

Not saying that a big tax rate like that is desirable policy. But if it’s disincentivizing the unwilling and providing opportunity for the willing, that’s not such a bad thing, is it?

@HarvardLaw92: “It’s easy to push such a position when (I suspect, apologies if I’m incorrect) that it wouldn’t apply to you.”

Let me guess — you’re still working on that “trying not to come across as condescending” thing, right?

Beyond that, I believe we were talking about high marginal tax rates over, say, ten million or twenty million, not four hundred thousand. Even the little guys know the difference.

@wr:

Look, I’m not going to apologize to you for being successful. Is everybody who doesn’t enthusiastically jump on board your save the world with somebody else’s money train condescending?

If it’s that important to you, Tortured Idealist, pay 82% of your fecking money in taxes. Get back to me once you have. In the meantime, climb down off of your high horse. It’s getting old.

Maybe you should have read the comment I was replying to before opening your mouth (not that that has ever been a problem for you in the past …)

Here – let me give you a helpful link. You’ll want to pay particular attention to the numbers after the dollar sign.

@HarvardLaw92:

Sorry…you have been largely incorrect all day. I often argue against my self-interest as others here do as well.

The 82% is mythical.

Many studies show this concept is ridiculous and only exists in the right-wing echo chamber.

@James Pearce:

Everything is relative. It sounds like a great deal – until you’re the one paying it. When that happens, your perspective changes just a bit. What annoys me the most is these smug aceholes who act as though I should be thrilled at the opportunity of shelling out 82% taxation.

I’m not. If the seats were reversed, they wouldn’t be either. Let’s leave it at that.

@C. Clavin:

LOL, not if some of these do-gooders got their way, it wouldn’t be. It must be incredibly uplifting to save the world with somebody else’s money.

In the meantime, if you’re so keen on the idea of giving the government money, I hear they’ll be glad to take a check

@HarvardLaw92:

I thought you were smarter than to offer up that sillyness.

@HarvardLaw92:

Sure, but I think both the poor and the rich can agree: It’s better to be wealthy.

At any rate, I think there’s very little chance of such confiscatory tax rates coming into effect, unless of course, the very wealthy would like to continue hoarding their dough. Me, I’d trade every Wal-Mart heir for a Phil Anszhutz or Elon Musk clone. The world would be a better place.

@C. Clavin:

After a few servings of jukebox’s treatise on how the collective wealth of the top bracket in the US would be sufficient to pay off the national debt, I’m not sure how tongue in cheek any of this crap is any longer. Fundamentally, the far left annoys me just as much as the far right does.