How Much Revenue Would The “Buffett Rule” Bring In? Not Much At All

The Atlantic’s Daniel Indiviglio tries to figure out how much money this “Buffett rule” would bring in to Federal coffers. As Indiviglio notes, it’s not easy to figure out because the Administration has been, perhaps deliberately, vague about what they mean by this rule. Nonetheless, as he notes, the President did say it would create a new tax rate for those earning more than $1,000,000 per year and starts from there:

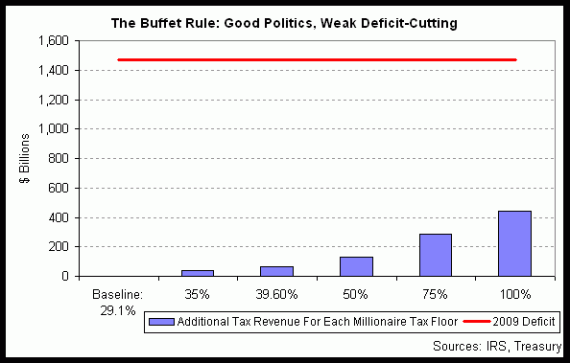

I used IRS data for 2009* adjusted gross income (which I know isn’t perfect, but it was the best they had). I then calculated the effective tax rate based on its data to be 29.1% for all Americans who earned more than $1 million. I consequently took the total income of the group and multiplied by different tax rates (as shown). I subtracted the taxes already paid (at the 29.1% effective rate) to figure out how much additional revenue they’d provide to the U.S. government at those new tax floors.

As you can see, the short answer is: some, but not enough to make a dent in the deficit. If you put a floor at their current marginal tax rate of 35%, the government would obtain $37 billion more dollars. That might sound like a lot, but it amounts to just 2.5% of the 2009 $1.5 trillion deficit (which is the red line shown). If you increase the floor to the pre-Bush-tax-cut marginal rate of 39.6%, the additional revenue grows a bit — to $66 billion, or 4.5% of the year’s deficit.

Even if you get really aggressive, it doesn’t help much. Even a tax floor for these individuals at 75% would cover less than 20% of the year’s deficit. And, of course, even most populist among us probably worries that a tax rate that high could do more harm to the U.S. economy than good. All of these calculations also assume that these wealthy individuals wouldn’t find new and creative ways to ensure that their income was shielded from very high tax rates. (They would.)

So this Buffet Rule is a great populist proposal if the president wants to score some political points, but it has little practical value.

In other words, it is, as I’ve said, a campaign slogan, not a serious tax proposal.

So why do it?

In Doug-land, a serious tax proposal is one that collects money from the poor. A campaign slogan is one that collects money from those who have it.

So this is the latest excuse in the series.

It doesn’t matter that there is this thing called “carried interest” that disproportionately benefits wall street managers at the high fringes of income.

If they don’t total enough, in national accounting, give them their 15% tax rate, on millions of income.

@WR:

You want a serious tax plan?

Read this

Or, this

@Eric,

Conversely, if it doesn’t collect that much, it can’t be sending anyone to the poorhouse. So why not?

Doug makes WR’s point, by endorsing the Huntsman Tax Plan, which would eliminate taxes on capital gains and dividends and repeal PPACA and the Dodd–Frank Act…while Doug proclaims that this plan will allegedly create a boom in economic activity, and I can certainly understand why he really likes this plan, is there any proof to back up his claim…

Classic false dichotomy: “Action X doesn’t complete solve the problem, therefore X is worthless”. NO. NO. NO. No one action has to fix the budge by itself! In something as complex and massive as a government budget, this incompetent reasoning can be used to justify avoiding any change.

“Reducing Government waste won’t fix the budget, so it’s a worthless priority”

“Reducing military spending won’t balance the budget, so it’s absurd”

“Defunding welfare won’t balance the budget, so there’s no point.”

This crappy, broken level of logic can be used by any partisan to counter any budget change they don’t like.

When libertarian ideology is on the line Doug doesn’t care so much about facts or logic.

Doug, Doug, Doug… don’t you get it? This proposal isn’t about fixing the budget shortfalls; it’s about punishing the successful. It’s not about helping us win; it’s about making sure the right people lose. It’s not about righting a wrong; it’s about finding a villain to blame.

Funny, though: when previous discussions about the deficit, I was challenged to say how I’d solve it. I’d toss out a few ideas, and was thoroughly lambasted for not coming up with the entire solution all at once. Now we see it turned around. The difference is, I freely admitted that it was only a start, albeit a good, common-sense start; here, it’s pushed as a key element and an absolute necessity.

J.

@michael reynolds:

I provide links to two separate broad ranging comprehensive tax reform plans that accomplish far more than that trope to the Democratic base that the President put out on Monday and you accuse me of orthodoxy?

Yea, okay, go with that.

@Jay Tea:

No, this is about the effort you’ll go through to prevent the closing of a loophole.

If you cared about fairness, and about the deficit, you’d say “yeah, close it, what’s next?”

Instead you WANT us to focus on this issue.

http://www.offthechartsblog.org/the-case-for-the-buffett-rule-in-one-chart/

Interesting Doug, I went back to your reaction to the debt commission report at the time:

Emphasis yours.

So … why the heck are you on the other side of your old position?

@john personna: What you call a “loophole” I call “an incentive to invest your money, not sit on it.” And Buffett’s a colossal fraud — if he really thought he should pay more taxes, he can cut a check to the government — there’s an office set up just to process voluntary overpayments. What he’s saying is “I think people like me should pay more money, so I want the government to make us all do what I think we should do.”

Personally, I’m in favor of private investments. After all, not everyone can count on their political connections to grant them federal loan guarantees that actually violate the law to keep my dying business afloat just a wee bit longer…

J.

@Jay Tea:

Jay, buddy.

“Carried interest” does not require you to invest one penny.

@john personna: Still doesn’t explain why Buffett doesn’t write a check today… or why his company is fighting about a billion or so in back taxes.

Buffett seems to have a bad case of liberal guilt… “I feel guilty, so everyone else must atone, too.”

J.

If I had a nickle for every time some wingnut suggested that, because raising taxes on the rich wouldn’t totally close the budget gap, we shouldn’t do it…Obama would be trying to raise my taxes.

@Jay Tea:

You really should avoid that kind of petty distraction. It just highlights that you are trying to dodge.

I know that Berkshire-Hathaway has paid taxes, and is in negotiations about how much they owe. That is business at the billion dollar level.

@Doug Mataconis:

What She Said

Its not Class Warfare, its Math

.

@Doug Mataconis: The Huntsman plan slashes taxes on the rich and raises them on the poor. The fact that you advocate for it is not surprising, since you tend to be in favor of punishing the little folks and letting the super-wealthy turn this country into their own little feudal states.

But I’m amused you can call it serious. Even the Russian oligarchs couldn’t get something like this passed. Or Berlusconi.

@Andyman: Why not?

The answer is simple… would you rather that money end up in the hands of governments or the unions, or would you rather see it in private hands where jobs get created? Government can’t create jobs… and if you need proof of that, look closely at the job losses since Obama took office.