Paul Ryan Unveils Plan To Cut Federal Spending By $6 Trillion Over Ten Years

Paul Ryan unveiled an ambitious plan to cut the deficit today. The question is whether it will be the beginning of a debate, or an opportunity for Democratic demagoguery

House Budget Committee Chairman Paul Ryan unveiled a budget plan today that marks the first serious attempt to bring Federal spending under control that I’ve seen in quite some time:

WASHINGTON — House Republicans on Tuesday unveiled a far-reaching budget proposal that cuts $5.8 trillion from anticipated spending levels over the next decade and is likely to provide the framework for both the fiscal and political fights of the next two years.

The ambitious plan, drafted principally by Representative Paul D. Ryan, the Wisconsin Republican who chairs the Budget Committee, proposes not only to limit federal spending and reconfigure major federal health programs, but also to rewrite the tax code, cutting the top tax rate for both individuals and corporations to 25 percent from 35 percent, reducing the number of income tax brackets and eliminating what it calls a “burdensome tangle of loopholes.”

(…)

“This budget improves incentives for job creators to work, invest and innovate in the United States,” said a summary of the proposal, which Republicans are calling the “Path to Prosperity.”

The introduction to the proposal said the spending blueprint disavowed what it called the “relentless government spending, borrowing and taxing that are leading America, right at this moment, toward a debt-fueled economic crisis and the demise of America’s exceptional promise.”

Republicans say their proposal would reduce the size of the federal government to 20 percent of the overall economy by 2015 and 15 percent by 2050 while President Obama’s plan introduced this year would not hold the size of government below 23 percent of economic output.

Democrats, however, say the emerging proposal amounts to a conservative ideological manifesto showing that Republicans intend to cut benefits and programs for the nation’s retirees and neediest citizens while protecting corporate America and the wealthiest people from paying their share of taxes. They will be certain to challenge the budget plan and make its bold efforts to reshape Medicare and Medicaid — the health care programs for older Americans and the poor — a theme of their political argument to regain control of the House and hold the White House in 2012.

The budget resolution is not a binding law even if approved by Congress; if adopted, it would direct the relevant Congressional committees to draft spending legislation putting in place its dictates. Because Democrats control the Senate, the proposal is unlikely to be adopted. Even so, it will become the marker for Republican economic policy and Republican lawmakers and candidates are likely to be tested on where they stand on its many components.

In The Wall Street Journal this morning, Congressman Ryan has an Op-Ed outlining the proposal:

• Reducing spending: This budget proposes to bring spending on domestic government agencies to below 2008 levels, and it freezes this category of spending for five years. The savings proposals are numerous, and include reforming agricultural subsidies, shrinking the federal work force through a sensible attrition policy, and accepting Defense Secretary Robert Gates’s plan to target inefficiencies at the Pentagon.

• Welfare reform: This budget will build upon the historic welfare reforms of the late 1990s by converting the federal share of Medicaid spending into a block grant that lets states create a range of options and gives Medicaid patients access to better care. It proposes similar reforms to the food-stamp program, ending the flawed incentive structure that rewards states for adding to the rolls. Finally, this budget recognizes that the best welfare program is one that ends with a job—it consolidates dozens of duplicative job-training programs into more accessible, accountable career scholarships that will better serve people looking for work.

• Budget enforcement: This budget recognizes that it is not enough to change how much government spends. We must also change how government spends. It proposes budget-process reforms—including real, enforceable caps on spending—to make sure government spends and taxes only as much as it needs to fulfill its constitutionally prescribed roles.

• Tax reform: This budget would focus on growth by reforming the nation’s outdated tax code, consolidating brackets, lowering tax rates, and assuming top individual and corporate rates of 25%. It maintains a revenue-neutral approach by clearing out a burdensome tangle of deductions and loopholes that distort economic activity and leave some corporations paying no income taxes at all.

The most controversial part of the proposal, though, involves the ways in which the plan would revamp Social Security, Medicare, and Medicaid:

• Health and retirement security: This budget’s reforms will protect health and retirement security. This starts with saving Medicare. The open-ended, blank-check nature of the Medicare subsidy threatens the solvency of this critical program and creates inexcusable levels of waste. This budget takes action where others have ducked. But because government should not force people to reorganize their lives, its reforms will not affect those in or near retirement in any way.

Starting in 2022, new Medicare beneficiaries will be enrolled in the same kind of health-care program that members of Congress enjoy. Future Medicare recipients will be able to choose a plan that works best for them from a list of guaranteed coverage options. This is not a voucher program but rather a premium-support model. A Medicare premium-support payment would be paid, by Medicare, to the plan chosen by the beneficiary, subsidizing its cost.

(…)

We must also reform Social Security to prevent severe cuts to future benefits. This budget forces policy makers to work together to enact common-sense reforms. The goal of this proposal is to save Social Security for current retirees and strengthen it for future generations by building upon ideas offered by the president’s bipartisan fiscal commission

Ryan also explained the plan in a video released today:

The reactions from the punditocracy to all of this are about what you’d expect. Ezra Klein speculates this morning that the Ryan plan will actually make a future government shutdown amidst a battle over the FY 2012 budget almost inevitable:

It’s also completely, almost gleefully, unacceptable to Democrats. Some thought that the introduction of Ryan’s 2012 budget would make it easier for the GOP to compromise on funding for the rest of this year. I’m doubtful. By raising the stakes on next year’s battle, it’s just as likely to leave both sides less willing to show weakness on this year’s battle. And then there’s the question of how Republicans and Democrats will avoid a shutdown when 2012 rolls around: Republicans are committing themselves to, and getting their base excited about, a truly radical series of changes to the federal government. That’s going to make it very difficult to agree on a more modest budget when the time comes. Federal officials who’re getting information today on what to do in the event of a shutdown might want to hang onto that pamphlet. I suspect they’re going to be consulting it a lot over the next few years.

In a later post, Klein speculates that the Ryan plan may actually have the (unintended?) effect of giving the Simpson-Bowles plan released last year new life:

I wouldn’t be surprised if, a year from now, it’s broadly agreed that the main thing Paul Ryan’s budget did was persuade Democrats — and perhaps some Republicans — to adopt something pretty close to the Fiscal Commission’s recommendations (which are currently being turned into legislation by a bipartisan group of senators).

There are real similarities between the two plans. Perhaps most importantly, the Ryan budget and the Fiscal Commission rely on similar mechanisms to reduce the deficit: They both cap stuff. But the Fiscal Commission’s caps are more flexible and fair than those in the Ryan budget; the Fiscal Commission makes revenues part of the solution, where the Ryan budget includes a deficit-busting tax cut; and the Fiscal Commission doesn’t try to sneak an ideological wish list into law under the cover of deficit reduction.

(…)

Is the Fiscal Commission’s plan perfect? Not even close. But it’s a lot more reasonable, and a lot less ideological, than Ryan’s budget. And I think Ryan’s budget is going to persuade a lot of Democrats to give it a second look.

This wouldn’t necessarily be a bad development. The Simpson-Bowles plan had much to recommend to itself, as I noted when I wrote about it last year, but it went largely ignored as the political universe got hijacked by a tax cut debate and Don’t Ask, Don’t Tell during December’s lame duck session of Congress. Additionally, if Democrats were to respond to Ryan’s plan with a plan of their own, that would be a good thing overall. As I said back in November, what we need from Washington if we’re going to solve the looming debt crisis is for both sides to act like adults:

If we lived in a country with adult political parties, the release of the Commission’s report would serve as the beginning of a long overdue national conversation about how to get our fiscal house in order. Liberals would recognize that social spending would have to be cut, and conservatives would recognize that defense spending cuts and tax increases would have to be on the table. Instead, what we’re likely to see is more of the same political gamesmanship — liberals accusing the GOP of wanting to starve Grandma, conservatives accusing liberals of just wanting to raise taxes so they can spend more. And the debt will continue to rise.

At some point we’re going to be forced to deal with these problems, but it’s not going to happen until we start feeling the pain that we could ward off if we’d just grow up already

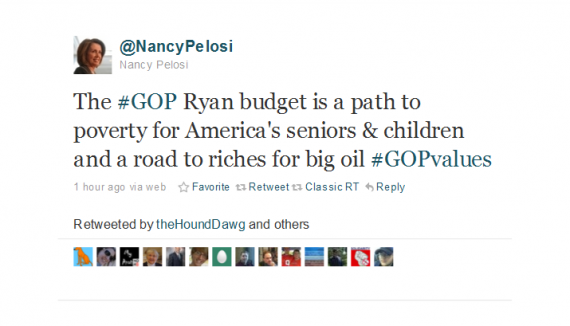

So far, though, we aren’t seeing many Democrats act like adults in response to the Ryan Plan. When it became public this morning House Minority Leader had this to say on Twitter:

This is, of course, the standard Democratic line whenever someone wants to cut spending, and this talking about has already been picked up by Talking Points Memo, Atrios, and Paul Krugman among others. I’m sure we’ll see it repeated tonight on MSNBC and elsewhere. It’s unfortunate, really, because instead of demagoguery we could be starting an adult conservation about a serious problem. This being America, though, I think you can count on more demagoguery.

This is, of course, the standard Democratic line whenever someone wants to cut spending, and this talking about has already been picked up by Talking Points Memo, Atrios, and Paul Krugman among others. I’m sure we’ll see it repeated tonight on MSNBC and elsewhere. It’s unfortunate, really, because instead of demagoguery we could be starting an adult conservation about a serious problem. This being America, though, I think you can count on more demagoguery.

Ryan’s plan isn’t going to become law any time soon, if ever, and it isn’t perfect. To my mind for example, it does far too little cutting with respect to the defense budget and expecting you’ll be able to do this without reforming the tax code significantly strikes me as short-sighted at best. Nonetheless, it is a start and, as David Brooks notes today, a pretty gutsy one at that:

Today, Paul Ryan, the Republican chairman of the House Budget Committee, is scheduled to release the most comprehensive and most courageous budget reform proposal any of us have seen in our lifetimes. Ryan is expected to leap into the vacuum left by the president’s passivity. The Ryan budget will not be enacted this year, but it will immediately reframe the domestic policy debate.

His proposal will set the standard of seriousness for anybody who wants to play in this discussion. It will become the 2012 Republican platform, no matter who is the nominee. Any candidate hoping to win that nomination will have to be able to talk about government programs with this degree of specificity, so it will improve the G.O.P. primary race.

The Ryan proposal will help settle the fight over the government shutdown and the 2011 budget because it will remind everybody that the real argument is not about cutting a few billion here or there. It is about the underlying architecture of domestic programs in 2012 and beyond.

The Ryan budget will put all future arguments in the proper context: The current welfare state is simply unsustainable and anybody who is serious, on left or right, has to have a new vision of the social contract.

I hope Brooks is right, because we’re coming to the point where it will be too late.

Any plan that calls for tax increases on 90% of Americans and reduces actual tax revenues seems flawed, especially when its helping to pay for a big tax cut for the remaining 10%.

The irony of his medicare plan is that its basically the same process as ACA: exchanges for seniors, not medicare only with vouchers that don’t increase with inflation(or if the providers increase price).

Why do conservatives believe Ryan’s plan is courageous? Its primary negative effects are on generally Democratic constituencies and its benefits are largely to the Republican donor base. In today’s politics, I guess it passes for courage when politicians are honest about where their priorities lay.

People have the shortest memories in politics. A health care act that meant to take on a huge issue in America that was actually composed of both liberal and conservative ideals (“RomneyCare”) was met with “Death Panels” and Mao references, but Democrats are supposed to pat Ryan on the back for being brave about replacing Medicare with a voucher program. This despite the fact that Republicans campaigned on Democrats destroying Medicare. It’s hilarious that this is what you get out of this Doug.

“It’s unfortunate, really, because instead of demagoguery we could be starting an adult conservation about a serious problem. This being America, though, I think you can count on more demagoguery.”

Given the amount of demagoguery coming from the R’s in the last 2 years (Death Panels, anyone), and how well it worked at the polls, why on earth would you expect anything different?

In the world according to Doug, it’s “serious” to wipe out Medicare, raise taxes on the poor and middle class while lowering them (further!) on the wealthy, and destroy any semblance of social safety net and still not coming close to balancing the budget.

To point out that this is what is being proposed is “demagoguing.”

If you actually care about the people of this country — that is, the people who don’t have millions in assets — you’re not acting like an adult. Because adults know that only the very rich deserve anything.

Doug said:

My first thought was: Did Doug not see the Simpson-Bowles plan or did he not consider it serious? Later in the post Doug says that S-B was fairly good, so apparently it’s neither of those options. I guess 5 months = “quite some time” to Doug.

Or he was just writing really lazily. (Seems to be a lot of that going around this site lately.)

Most of the savings comes from non-defense discretionary spending and Medicaid. The two parts of the budget the GOP is most likely to want to decrease. How is this courageous? His plan for Medicare is to put put seniors into private insurance on exchanges. If private insurance cannot keep down costs for those under 65, how will it do so for those over 65.

Steve

“So far, though, we aren’t seeing many Democrats act like adults in response to the Ryan Plan. ”

Any plan to reduce the deficit that doesn’t include raising taxes on the rich, which 81% of Americans support, is just fringe right wankery.

Kudos for Ryan for stating exactly what he and his allies stand for. But if he thinks the elderly will be better off in this half-a**ed voucher plan, he’s an idiot. Insurance companies increase profits by denying coverage. I just can’t imagine my 83 year old mother and 87 year old father on the phone with some insurance company hack looking to bully them out of what they are entitled to. But Ryan isn’t an idiot, he knows this is the death of Medicare and Medicaid. That’s what the Republicans have been about since Reagan. Oh, and throw in another tax cut for the wealthy. Sheesh. We have to throw these bums out in a landslide.

Can someone explain to be how the mind of a republican will say its OK for Ryan to force people to buy medicaid from a private company but then turn around and say Healthcare reform is unconstitutional for the same reason?

Also, I am 41 years old, and Bush senior sign the deal when I was around 19 or 20 years old. I’ve been paying roughly 82.00 per month (averaged out over the last X years). Paul Ryan is actually steeling from me with his plan. Unless Paul Ryans plan includes refunding my money then he might as well be giving me a retro-active tax increase.

Another couple points:

1-the “savings” is from Ryan’s numbers, not the CBO. I’d like to see the CBO score on this.

2-1.4 trillion of his “cuts” is from repealing the ACA, the CBO has said many times that if you repeal the ACA you add to the deficit. Especially since you lose the 147 billion dollar cut to Medicare.

Math Fail.

Huge tax cuts for the rich and tax increases for everyone else, plus a dismantling of Medicare which forces taxpayers to support the elderly’s benefits today while taking theirs away for tomorrow? Wow.

If there was any doubt that the GOP is anything but bought and payed for by the rich, serving only them, while duping the rubes into supporting their own demise with social con bullshit, this should pretty much remove it.

What happened to being against tax increases? Oh, that’s only for rich folks.

What happened to the 2010 campaign, when Republicans across the country ran against Democrats claiming they were cutting Medicare benefits when they weren’t? Oh, now we should just eliminate Medicare altogether.

The Republican Party: working hard to guarantee more Americans suffer, go broke, and die early.

Pretty great that Ryan’s Op-Ed can slam Democrats up one side and down the other, but if Democrats respond in kind, they’re engaging in “demagoguery “.

I also like this part:

Who decides which people have “greater health risks”? Will it be some sort of…. panel?

“raise taxes on the poor and middle class while lowering them (further!) on the wealthy”

Could someone please explain where this comes from? Cause my understand of the tax side of this is thats its supposed to be revenue neutral. It lowers the marginal rates but gets rid of a lot of the deductions and credits and loopholes. So mr “evil” rich person may have a lower statutory trax rate, but he/she actually pays 25% now not hit with 35% and then a ton of deductions that lower the base being taxed.

This is exactly one of the problems Doug is talking about. As soon as you see this, lets start those same old tired politics that Obama supposedly chastised in his campaign.

If the democrats dont like this plan, then they need to put something out themselves, because as of now they have nothing.

Where do these numbers come from? Magic pony land?

I have one question: why is it necessary to abolish Medicare in order to give the rich an additional massive tax cut?

If you can provide a logical answer to that I will support the plan.

So for instance, as a renter, i for one would love to stop paying higher income taxes than other people who make the same amount of money for the sole reason that I have decided not to buy a home. When rates are high and there are a lot of deductions, it means that tax treatment is not fair at all. Some people are able to take advantage of deductions and credits and pay little or no tax, while others get hit with a really high tax rate.

You’d think more liberals would be able to get behind this. It would prevent the warren buffet types from minimizing their taxes so much by alligning their behavior. But no, its easier to be fixated by that marginal rate that means nothing regarding your actual tax burden, while at the same time defendeding a tax code the is overly complex and eocnomic distorting that rewards those with the best tax accountants.

Yeah I’d like to see something supporting this. So far I see revenue neutral/closing loopholes and deductions–i.e. fewer deductions but lower rates. I suppose it depends on exactly which deductions are removed and such, but that is the problem with targeted deduction they make for a very confusing and convoluted tax system which by itself is a waste.

“I have one question: why is it necessary to abolish Medicare in order to give the rich an additional massive tax cut?”

Unless i misunderstand this, it it not a tax cut – it is neutral. It trades in a lower rate for a larger base, because many deductions are removed. Taxes paid = rate x base. In this plan, rate goes down, but base goes up. The biggest one I’ve heard about is limiting the home interest deduction which currently primarily benifits high income earners.

also the bracket thresholds are important. If the top rate is 90% but doesnt kick in until you make 5 million a year (ie like we had in the 50s), it doesnt mean much. But if the top rate is 35% but kicks in lower (like it does now at 300k), it does. So you also have to ask what the income thresholds are for given rates to see the effective tax rate.

“No deficit” does not necessarily mean “prosperity”.

To those who don’t think this plan was courageous, please compare it to Obama’s plan. Crickets…

Well, the elimination of the mortgage deduction will not just affect rich people. A lot of middle class families own homes, including my wife and I. This year, my wife and I were able to deduct well close to 20% of our income due to various deductions. Will our rates drop enough to cover the elimination of those deductions? If not, then it is functionally a tax increase for us.

Ben, well yeah that would be. However, the proposal out there is to replace it with a limited credit so lower your income less the deduction would effectively be removed.

But this is an example of how this change would work. If enough interests are all willing to give up their prefered deductions, then the rate can come down signifigantly. But there will be some winners and losers. Those who currently benifit from lots of deductions will end up paying more. Those who do not will end up paying less. But on average it makes the system simpler, less costly and more fair with fair being defined as people who make similar levels of incomes will pay similar amounts of taxes.

@EJ

“So for instance, as a renter, i for one would love to stop paying higher income taxes than other people who make the same amount of money for the sole reason that I have decided not to buy a home”

Dude, you’re being taxed for not doing something. Or for deciding not to do something. Say, doesn’t that sound like, wait a minute…

It had better not be the start of something serious, I’m at a loss to see how anything in it is an improvement over doing nothing. Everyone is treating Ryan with a lot more respect than I think he deserves, as I will not discuss him or his plans in the future without letting the well deserved expletives fly.

“This is not a voucher program but rather a premium-support model. A Medicare premium-support payment would be paid, by Medicare, to the plan chosen by the beneficiary, subsidizing its cost.”

I gather from the language, “premium-support payment”, part of the cost will be borne by Medicare recipients. How big a part? And what happens if the premium support payment does not keep pace with the rate of health care cost increase? Wouldn’t the beneficiaries be paying more and more as time goes by for the policy (unless they choose a less comprehensive, i.e., cheaper policy)? What are the political ramifications of this?

Anyway, as someone pointed out, by 2022 we will have had five congressional elections and three presidential elections. Lots of things can happen.

@ej

I think you misunderstand….this is a huge tax cut for the rich paid for by abolishing Medicare. There is really no discussion until everyone accepts that fact, and the so-called conservatives admit it.

@Steve Verdon- The 90%-10% claim comes from a study by the Center of rTax Justice, or something like that. Yglesias had it up yesterday.

http://yglesias.thinkprogress.org/2011/04/will-paul-ryan-propose-a-giant-tax-hike-to-make-tax-cuts-for-the-rich-affordable/

Steve

The more you dig….

The same old republican fantasies…tax cuts are going to lead to 2.8% unemployment. And anyone is calling this a serious proposal?

How much of that is due to the AMT part of Ryan’s plan…that Congress basically “fixes” anyways…i.e. its a phantom cut.

Who pays based on statute and who really pays are two very different things, is the Center for Tax Justice taking this into account? The answer looks like it is, “No,” based on this statement,

Sure a business my try to pass on the VAT to consumers, but since consumers will have a demand response the business will end up paying part of the tax too save in the case where demand is highly inelastic and supply is elastic.

So, I’m not sure I trust the Center for Tax Justice’s numbers.

@steveverndon

And you trust the heritage foundation numbers? 2.8% unemployment? Really?

Oh and the Center for Tax Justice document is over a year old and is comparing it to Obama’s proposal that never passed. I’m not even sure it is comparing Ryan’s current plan for that matter.

So nice try steve, but F.

WTFAYTA? Did I say that? STFD STFU and stop ascribing positions to me I didn’t take.

@EJ “But there will be some winners and losers.”

How much do you want to bet that the Republicans will make sure that the ultra-wealthy end up being among the winners in this deal? And that the middle class will be the losers? I’d bet a lot on that.

Easy there Steve. I was just passing it on since you asked. I did not read the report. TBH, I am not really familiar with the Tax Justice place.

Steve

@steve v

I apologize…I assumed you were saying that thane numbers added up. My bad. Please forgive.

Damn autocorrect … Ryans numbers not thane

What exactly are the differences between Ryan’s replacement for Medicare and the Affordable Care Act? Aren’t Ryan’s “menus” the same as Obama’s “health exchanges”? Aren’t Ryan’s “vouchers” the same as Obama’s “subsidies”? Yes, I know Ryan’s plan only applies to elderly. But since Doug apparently supports it and hates the Affordable Care Act, he must know the substantive difference between the two. I wish he’d share his knowledge with us.

Hey Norm,

I have no idea if his numbers add up. The 2.8% unemployment number sounds too optimistic, IMO, so I’d highly discount that.

I do think we need a radical restructuring of Medicare, and unfortunately I don’t think there is a “pain free” solution. Is vouchers the best way? I think it overlooks a number of issues.

@steve v

We don’t need to restructure Medicare…we need to address health care costs…that’s the root of medicares problem. The ACA attempts to do that. Ryans budget takes the easy way out and just eliminates Medicare. It’s non-sensical. And it takes the money from Medicare and gives the rich another tax cut. And again, Ryan uses the age old republican fairy tale about tax cuts creating growth. That’s been proven wrong over and over again. And this is what passes for a serious conversation? Anyone who says that can’t be serious.

I don’t think you can address one without the other. Medicare subsidizes some of the biggest consumers of health care resources. Yes, part of the reason is that costs are rising faster than every other sector of the economy, but I think there is some positive feedbacks there.

“Medicare subsidizes some of the biggest consumers of health care resources.”

There’s a reason for that.

All right, let me state this as plainly as I can:

We live in the richest country in the world…. But we cannot take care of our aged? Our children? Germany can…. France can…. Britain can…. Hell, CANADA can….

But we can not, because we have to give tax breaks to the rich?

I am disgusted, the people in this country are… Words fail me… no they don’t: The citizens of this country are sheep, pussies, idiots….

I am 52. I could not get health care on the private market because of pre-existing conditions…. period… no matter how much I paid.

I want to take a poll: How many people here know somebody 65 and older WITHOUT a pre-existing condition???? Do you really think $15K of subsidies is going to cover it?

This is a joke. I repeat, we live in the richest country in the world, if France, Germany, Britain, Spain, Denmark, can do it…. why can’t we?

Taxes were not raised to pay for the Iraq and Afghanistan wars.

If a major earthquake devastated San Francisco tomorrow, Right wing talk radio and Fox News would demand that not one cent would be used to rebuild that “liberal cesspool”.

Without cutting spending and reversing what the donks have wrought, we will lose our freedom. Some say that is the aim of the donks. I think they are wrong because the ensueing civil war would eliminate most donks. You all are not that stupid are you? What are you going to do when the rich move rather than pay for your sh*t? Is there some part of taking responsiblity for your own needs that you miss? Move to Cuba.

For all the Sturm und Drang over this supposedly “courageous” plan, it really is much ado about nothing, as it doesn’t have a rat’s ass chance of going anywhere…does anyone really believe that the elderly (you know, all those folks who vote) will allow these radical changes to take place? As for acting like adults, when will be see conservatives and Republicans admit that tax increases are going to have to be a part of any plan to get our fiscal house in order? I guess it’s far easier to practice demagoguery and howl about how raising taxes even a few percentage points on the wealthiest is tantamount to socialism…

tom p – when I was 47, I tried to get health insurance as an individual. I have typical middle age stuff, cholesterol & high blood pressure. Never had a major illness. I simply could not get coverage. Had to go back to corporate life to get benefits, which was not really what I wanted to do.

So, if someone has real health problems, and/or don’t have the skills to get a corporate job with good benefits, or are over 65, guess they will just be fvcked. Welcome to tea party America. And these rocket scientists are not bright enough to see where this is really going…

This is just a laughable “serious” plan. Doesn’t add up, doesn’t address the deficit, could not be passed, and just a bunch of tired Republican talking points.

I guess if you define “couragious” as willfully stupid, then yes, this is couragious.

Well, i’ve long asked for vouchers. Its a start. GOP may not recognize it as a path to universal coverage .. will they back off when that registers?

To all the people who praise this plan’s tax scheme being “revenue neutral”, can you explain how being revenue neutral helps to lower the deficit?

To those who want to see Obama’s plan, you are aware that there is a bipartisan group of Senators working to put together legislation based on Simpson-Bowles, right? You know, Obama’s commission? They’re working quietly because they know that if they come out with an Op-Ed with guns a-blazin’ at the other side, that will greatly reduce the chances that the other side is interested in voting on it.

Ryan’s plan is a PR stunt.

In other words, it mimics much of what the GOP considers running a government these days…

Doug, your post is bad, possibly one of your worst. Ryan’s plan has been thoroughly gutted by people who’ve been far, far more right than the plan’s advocates.

“So far, though, we aren’t seeing many Democrats act like adults in response to the Ryan Plan. When it became public this morning House Minority Leader had this to say on Twitter:”

Which was a simple statement of truth. I’d call that acting like an adult.

And as has been stated above, the plan is basically cutting taxes on the financial elites, while raising taxes and reducing services on everybody else, and throwing in magic asterisks to still make it work.

This “budget” is an absolute joke Doug. It is going nowhere and the fact that the OMB has it increasing the deficit makes me wonder about what your real priorities are.

Yes, because insurance works via probabilities. If the probability is between 0 and 1, then insurance can work. If the probability is 0 or 1 then insurance wont work. For you the probability is 1.

Because like us, all those countries are also going broke because of their health care system, they just aren’t quite as bad as we are right now. I have found two sustainable health care systems: Singapore and the Netherlands. I’m not sure you’d be happier with either system.

Tell us how you feel about health care savings accounts? It is typical for people on the Left to heap loads of scorn on them.

Verdon — Actually those countries are “going broke” because of a consortium of banks and ratings agencies perpetuated an enormous scame on the financial industry that took down the world’s economy, and the governments decided to bail out the banks and protect the criminals to stave off a worldwide depression. You might want to read up on Ireland, for instance. Or Iceland, where they actually told the bankers to piss off instead of bankupting their citizens to keep the billionaires afloat, and are now seeing their economy coming back to life.

But to your main point — insurance. You are right. Insurance works on probabilities. Which is why no insurance company would cover the people who are currently eligible for Medicare. What’s your solution again? Medical savings accounts? Forgetting for the moment about the tens of millions of people who saw their life’s savings wiped out by the real estate crash and those who have had to burn through their retirement funds when they found themselves unemployed for two years or more, how exactly do you see these accounts working? A middle class person making maybe $60 grand a year needs to save for retirement, and now also has to put away some money to pay for health care once his working days are done. If he gets cancer, say, the bills can run into the millions. How much has he managed to save? A few thousand? What happens when it’s gone?

Oh, right. He dies.

The Republican health care plan: Die fast.

According to a Wall Street Journal article I read a few years ago, both the Massachusetts health insurance plan and the Affordable Care Act are modeled on the plan used in the Netherlands. I wonder if Steve Verdon or somebody else knowledgeable in this subject would explain the difference between the health insurance system in the Netherlands and the one called for in the Affordable Care Act.

Nice story, but not true. All those countries had issues with their health care systems and their sustainability prior to the financial market meltdown.

There we have it, scoffing at the medical savings accounts. I knew it would happen. Never mind that they are a key component of Singapore’s system which is, as I noted, one of the two sustainable systems I know about.

As for my solution, we need a fundamental change to our health care system. We probably should either tax health care benefits or something that will remove that distortion. We also have a supply issue. For example, we basically import our nurses from the Philippines. I think a pure market based approach is not going to work, but at the same time harnessing some of the incentives that markets tend to create should be considered such as a voucher program or a tax credit or something of the likes. In any event the change necessary is more than can be hashed out in the comments section on a weblog.

He has to save for his retirement, but he doesn’t have to save for his medical expenses during said retirement? Even at least in part? That doesn’t strike you as…odd? You have to provide your own food, shelter, and such, but health care, forget about it, those still working will pick up the tab, sure there will be some payments, but by comparison they’ll be miniscule. Is that your position? Survive to retirement age and a Joe’s health care expenses are pretty much the responsibility of Anne who is still working?

Our system is riddled with bad incentives all over the place and that is one of them. Yes, we should probably force that $60,000/year person to funnel some of that money into paying for their future medical expenses…after all they are their medical expenses. Is that going to solve all of the problems? Hell no, but lets not let the perfect the enemy of the good.

I don’t think the Netherlands system would work here. Different type of government structure, different population, etc. So even if it is true that the Massachusetts plan is based on the Netherlands, something I’m skeptical of, just because something works in one country does not mean it will work here.

And have you looked at Massachusetts? Their health care system is not working so well.

More here,

So, perhaps you can explain why reform didn’t work there, but if Obama’s plan is based on Massachusetts why it will suddenly start working?

“Survive to retirement age and a Joe’s health care expenses are pretty much the responsibility of Anne who is still working?”

And when Anne is retired, then she’ll get Medicare, too. Or we could go back to the good old days, when rich people got doctors and the poor died young. Which is apparently what you’re advocating — didn’t make enough to save up for that million dollar hospital bed? Too bad you were irresponsible, we’ve got a nice unmarked grave for you.

I love Esquire and so do you: http://www.esquire.com/blogs/politics/paul-ryan-budget-plan-5519000

Here’s an answer to the question I asked upthread.

Representative Ryan Proposes Medicare Plan Under Which Seniors Would Pay Most of Their Income for Health Care

Hows about this steve: They are a joke. one person, in a thousand years of saving, cannot possibly save enuf to cover 3 months worth of chemo/radiation for cancer.

Next question?

and yeah, I exagerate…. but really, how stupid can your questions be?

Nice story but not true. All those countries had issues with their health care systems and their sustainability prior to the financial market meltdown but they were within the realm of reasonable…. after…. not so much.

I repeat, if the richest country in the world cannot take care of it’s aged, it’s children, it’s disabled…. It is a disgusting pile of festering sh*t.

Doug, when will you face the fact that we have a choice: Continue to line the bed of the super rich (and all the rest of us) or take care of those who do the grunt work (the guys who empty out the JOTSpots)

The same old republican fantasies…tax cuts are going to lead to 2.8% unemployment….

Right, just like it did in the early 80’s. Perhaps you’re too young to remember that?

Everyone hates the rich, until they become wealthy. Then, they just want to talk about the great opportunities in America. The same ones that Democrats want to regulate and legislate out of existence. Democrats always need an evil enemy to blame and they studiously avoid mirrors lest they should have to face up to the one they will find facing them there.

Reagan raised taxes – perhaps you are too old to remember that correctly.

Basically, any mature right-winger and conservative would have given Ryan a spanking and then handed him a textbook in basic economics. Ryan’s budget is very poor at fixing the deficit, is filled with unicorn caveats and makes a mockery of the entire field of macroeconomics. It’s not a budget, it’s a f***ing internet screed. I know about those – I write many.

But the modern Anglo-saxon right is alsmot 100 % populistic. Mataconis and the others are reduced to chattering puppies who are ready to abandon math in favor of romanticism by years of conditioning. In comes a Very Serious Budget-hawk and scolds them about the deficit and Mataconis gets wet in a way only women are supposed to.

The reason Mataconis and the others like this budget is that it is the same lying and partisan obfuscation, but dressed up in a way they think they can easily sell. It’s a “budget” so they can pass it off as something other than extremism, marketing and demagoguery. Ryan’s budget is an escalation, and apparently many of you are promising “bipartisanship in our time”. And yes, I used a Godwin. I have a yearly allocation and I spent my voucher.

I don’t see any Democrats who want to tax the rich out of existence. Most Democrats feel, as I do, that the taxable capacity of upper income people is much greater than that of the average American, and that taxing them more to pay for the social safety net is the right thing to do. They get the benefit of living in a stable society that allows them to become wealthy, and the poor get help from the government in return for accepting the necessary but unequal laws of private property. It’s called the social contract.

Speaking personally, I favor John Rawls’ view that changes in the economic order are acceptable morally only if they benefit the most economically disadvantaged among us. From this point of view, Ryan’s idea of cutting government aid to the poor and the elderly in order to give tax breaks to the wealthy is deeply immoral unless it increases economic activity so much that it benefits the poor as well as the rich. I see no evidence that it does, hence I regard Ryan’s plan as a disaster from every point of view.

Reagan was president during one of the most dramatic collapses of the world oil market we ever had. Now I’m pretty sure if Obama could figure out a way to get OPEC to lower prices down to about 20 bucks a barrel you would see some jobs starting to spark up. Reagan was lucky or else his deficits would have been double what they were.

The same old republican fantasies…tax cuts are going to lead to 2.8% unemployment….

@Gullible:

“Right, just like it did in the early 80′s. Perhaps you’re too young to remember that?”

Ahem … Heritage Foundation Removes Unemployment Data From Budget Study

I’m sure there’s a reasonable explanation for the removal…something along lines of, “Yeah, we pulled that figure out of our ass and got called out on it.”

“I’m sure there’s a reasonable explanation for the removal…something along lines of, “Yeah, we pulled that figure out of our ass and got called out on it.””

Which nails it down further, for me. The Heritage Foundation is huge, has been in business for decades, and should have no shortage of economists and analysts. But to make things look like they’d sorta come out OK, they made at least one assumption which no honest economist would make. (BTW – what does an assumed 2.8% unemployment rate do for the current White House proposed budget?)

See. I rest my guess tom p. Health care savings accounts are one of they key parts of the Singapore model. Everyone MUST have one. Opting out is NOT an option. Are they the only reason why Singapore has a sustainable health care system? No, but they are a contributing factor.

Medicare right now discourages savings. Why save for your future health care expenses (even in part) if you know people still working when you retire are going to pick a high percentage of the cost? The rational response is to not save, consume now. Further, low savings, absent foreign investment, means lower investment and lower future economic output making it even harder to support the Medicare recipients.

But WTF, they are a joke.

Prior to the recession they weren’t sustainable, the recession has made things worse…seems like what I wrote was true.

I do not support anything in this bill, I like medicare as it is These tea party fools must think we are all idiots. They claimed Obama -care was going to let grandma die, this will make sure if you get sick your a gonna for sure. Old people should not have to go through a lot of bureaucracy just to go to the doctor, and then fight what they will pay and not pay. I hope this is brought up in every media outlet , every senior center across the nation, because these nutcases are trying to take over.