Rick Perry’s Not Really Flat Flat Tax Plan

Rick Perry's tax plan isn't very impressive.

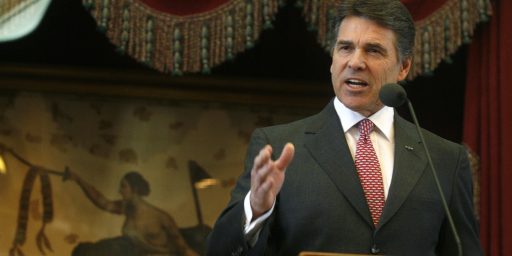

After sticking his foot in his mouth on CNBC, Rick Perry kicked off what he clearly hopes will be a re-invigoration of his campaign by introducing an economic plan that includes a tax plan that his campaign is describing as a “flat tax,” but which really isn’t when you look at the details.

Rick Perry, whose presidential campaign to date has largely focused on his accomplishments as Texas governor, expanded his scope Tuesday in South Carolina, where he formally unveiled a flat tax proposal designed to stimulate the economy and cut taxes.

The Perry plan, unveiled at an Upstate plastics company, comes at a time when Perry is rebooting his campaign after nosediving in the polls and losing ground to candidates like Herman Cain, whose 9-9-9 tax proposal has captured widespread attention.

The Texas governor’s plan, dubbed “Cut, Balance and Grow,” would allow taxpayers to choose between the current system and a 20 percent flat tax on their income. The new tax system, he said, would allow people to dispense with the hiring of experts each spring to help prepare their tax forms.

“Each individual taxpayer will have a choice: you can continue to pay taxes, as well as accountants and lawyers under the current system,” he said. “Or, you can file your taxes on a postcard, with deductions only for interest on a mortgage, charitable giving, and state and local tax payments.”

Not once during the 24-minute address in Gray Court did Perry cite his decade-long record as Texas governor. Instead he reiterated his five-point Social Security plan — an idea similar to former President George W. Bush’s failed second-term proposal for personal retirement accounts — and his Medicare proposal, which would raise the eligibility age and adjust benefits based on income.

“If we don’t act, in 25 years benefits will be slashed 23 percent overnight,” he said. “Protecting Social Security benefits begins with protecting the solvency of the fund, and stopping all current borrowing from the fund, just as we have done with the highway trust fund.”

Perry avoided mentioning GOP front-runner Mitt Romney by name, but he took a shot at the former Massachusetts governor’s 59-point economic proposal by suggesting it is more conventional that what he is proposing.

“My plan does not trim around the edges,” he said. “And it does not bow down to the established interests. But it is the kind of bold reform needed to jolt this economy out of its doldrums, and renew American prosperity. Those who oppose it will wrap themselves in the cloak of the status quo.”

Perry described the plan in a Wall Street Journal Op-Ed:

The plan starts with giving Americans a choice between a new, flat tax rate of 20% or their current income tax rate. The new flat tax preserves mortgage interest, charitable and state and local tax exemptions for families earning less than $500,000 annually, and it increases the standard deduction to $12,500 for individuals and dependents.

This simple 20% flat tax will allow Americans to file their taxes on a postcard, saving up to $483 billion in compliance costs. By eliminating the dozens of carve-outs that make the current code so incomprehensible, we will renew incentives for entrepreneurial risk-taking and investment that creates jobs, inspires Americans to work hard and forms the foundation of a strong economy. My plan also abolishes the death tax once and for all, providing needed certainty to American family farms and small businesses.

My plan restores American competitiveness in the global marketplace and provides strong incentives for U.S.-based employers to build new factories and create thousands of jobs here at home.

First, we will lower the corporate tax rate to 20%—dropping it from the second highest in the developed world to a rate on par with our global competitors. Second, we will encourage the swift repatriation of some of the $1.4 trillion estimated to be parked overseas by temporarily lowering the rate to 5.25%. And third, we will transition to a “territorial tax system”—as seen in Hong Kong and France, for example—that only taxes in-country income.

The mind-boggling complexity of the current tax code helps large corporations with lawyers and accountants devise the best tax-avoidance strategies money can buy. That is why Cut, Balance and Grow also phases out corporate loopholes and special-interest tax breaks to provide a level playing field for employers of all sizes.

To help older Americans, we will eliminate the tax on Social Security benefits, boosting the incomes of 17 million current beneficiaries who see their benefits taxed if they continue to work and earn income in addition to Social Security earnings.

The plan also calls for the sun-setting of many Federal regulations, and a requirement that new regulations be approved by Congress.

In some corners, the reaction to Perry’s plan has been pretty positive. Both Grover Norquist and The Club For Growth have issued positive statements about the plan, for example. National Review’s Kevin Williamson is similarly positive. Williamson’s NRO colleague Reihan Salam is decidedly less impressed and focuses his criticism on what has to be the oddest part of Perry’s plan, the fact that it is essentially optional:

Essentially, what Perry has done is reverse the Buffett Rule. He has guaranteed that no American will ever pay more than 20 percent of her income in federal taxes. Indeed, affluent homeowners living in high-tax jurisdictions like New York city and Los Angeles earning up $499,000 will likely pay much less than that, as they’ll continue to have access to the mortgage interest, charitable and state and local tax exemptions. Under Moore’s MAXTAX, these households would be treated the same as affluent households in Houston or Palm Beach or Clinton, Iowa who for whatever reason (good sense?) choose to purchase less expensive homes.

This plan defies credulity. One is reminded of Tim Pawlenty’s tax and spending proposals, released shortly before he dropped out of the race for the Republican presidential nomination. The difference is that Perry has managed to raise a considerable sum of money. One wonders how much of it comes from various friends and allies who have been beneficiaries of the Texas Emerging Technology Fund, and whether the Obama campaign might see fit to mention that fact if Perry does indeed secure the Republican presidential nomination.

Over at The Enterprise Blog, Andrew Biggs points out, correctly, that since Perry’s plan creates a new flat tax system and maintains the existing tax code, it ends up making tax compliance more expensive and more complicated:

To know which tax code to file under you need to do your taxes under both, undermining the simplicity of the flat tax. One of the reasons compliance costs are so high today is that there can be such a reward for figuring out strategies to minimize your taxes; it’s not clear that Perry’s flat tax fixes this problem. And finally, if people have the option of filing under the current tax code then all the economic distortions embedded in it will remain, at least for that significant portion of the population who would do better under current law than the flat tax. A person may say to himself, “I can pay lower taxes than under the flat tax plan so long as I [insert governmentally imposed distortion here].” Marginal tax rates for high earners would be lower, reducing economic distortions, but it’s unclear where you’ll make up the revenue if low and middle earners get to file under current law where they pay next to nothing.

This is perhaps the biggest flaw with Perry’s plan in my view. If you want to remake the tax system to make tax rates flat, or at least flatter, then why not do that instead of creating an entirely separate part of the tax code and forcing taxpayers to choose between the new system and the old system? For the average middle class taxpayer, it’s likely not going to be a big deal, but for anyone who is self-employed, owns a small business that gets passed through on via Schedule C, or has a high number of deductions or credits, you are requiring them to determine their tax liability under two different systems, thus increasing compliance costs. To the extent that simplification is a goal, and it should be, this is the wrong way to go about it.

A further problem with Perry’s plan is the fact that it preserves a large number of deductions and, thanks to the “optional” nature of the plan, it preserves all the distorting deductions and crony capitalism that exists in the current tax code. One of the perverse things this does is give taxpayers the incentive to engage in activity that makes them eligible for as many “old system” deductions as possibly in order to minimize their tax liability as much as possible. Additionally, even in its flat tax version, the plan maintains for most taxpayers the charitable, state and local tax, and mortgage interest deductions. Aside from the fact that they are politically popular, or at least supported by powerful lobbying groups, there is no economic reason to preserve these deductions, which is why I tend to prefer plans similar to the one proposed by Jon Huntsman, which eliminates these deductions while simultaneously lowering rates.

The other problem in Perry’s plan comes on the spending side. Without giving very many specifics, Perry said in the op-ed that he would reduce spending and reform entitlements:

We should start moving toward fiscal responsibility by capping federal spending at 18% of our gross domestic product, banning earmarks and future bailouts, and passing a Balanced Budget Amendment to the Constitution. My plan freezes federal civilian hiring and salaries until the budget is balanced. And to fix the regulatory excess of the Obama administration and its predecessors, my plan puts an immediate moratorium on pending federal regulations and provides a full audit of all regulations passed since 2008 to determine their need, impact and effect on job creation.

ObamaCare, Dodd-Frank and Section 404 of Sarbanes-Oxley must be quickly repealed and, if necessary, replaced by market-oriented, common-sense measures.

America must also once and for all face up to entitlement reform. To preserve benefits for current and near-term Social Security beneficiaries, my plan permanently stops politicians from raiding the program’s trust fund. Congressional IOUs are no substitute for workers’ Social Security payments. We should use the federal Highway Trust Fund as a model for protecting the integrity of a pay-as-you-go system.

Cut, Balance and Grow also gives younger workers the option to own their Social Security contributions through personal retirement accounts that Washington politicians can never raid. Because young workers will own their contributions, they will be free to seek a market rate of return if they choose, and to leave their retirement savings to their dependents when they die.

Jennifer Rubin isn’t impressed:

What is missing is the how . How do we get to these figures?

He offers scant specifics: “My plan freezes federal civilian hiring and salaries until the budget is balanced.” That’s not going to do the trick. Moreover, he is silent on whether defense cuts should be included, perhaps the most critical question facing the supercommittee. Perhaps he will provide more details later. But simply to say “we’ll balance the budget” is a dodge. The real work and courage come in spelling out the means by which we get there.

On entitlement reform, Perry dodges all tough issues. He is silent on Medicare. He is silent on Medicaid. Let’s hope that is all in the speech. And on Social Security he puts out this silliness: “Congressional IOUs are no substitute for workers’ Social Security payments. We should use the federal Highway Trust Fund as a model for protecting the integrity of a pay-as-you-go system.” Al Gore called this a “lock box.” It’s an accounting gimmick, not a plan for restoring fiscal soundness. Moreover, using the Highway Trust Fund is a blunder of the firstorder. That fund is bankrupt and relies on raiding the general fund. (This sort of error suggests that Perry paid little attention to the spending side of things.)

Then he offers this: “Cut, Balance and Grow also gives younger workers the option to own their Social Security contributions through personal retirement accounts that Washington politicians can never raid. Because young workers will own their contributions, they will be free to seek a market rate of return if they choose, and to leave their retirement savings to their dependents when they die.” Huh? What about fixing the current system? On that he takes a complete pass. (Mitt Romney has suggested two avenues for reform: indexing according to income and raising the retirement age.)

Rubin’s criticisms are largely correct. It’s probably not fair to expect a Presidential candidate to come up with a budget as detailed as the one that a President submits to Congress every year. However, one should at least expect that a candidate who says that they will work to keep Federal Spending at or below 18% of GDP to provide something more than tired slogans that don’t really answer the fundamental questions that Congress is trying to deal with as we speak. Perry’s refusal to address either Medicare or Medicaid may be understandable from a political point of view, but it leaves a massive, gaping hole in his plan that any one of his opponents could drive a truck through if they wished. His Social Security plan, on the other hand, adopts ideas that seem to have no realistic chance of ever becoming law regardless of whatever merit they might have.When it comes to the spending side of his plan, score Perry with a complete swing-and-miss.

The question for Perry is whether this plan will be the spark he needs to revive his campaign. That’s something we’ll only know as time passes, of course, but with the plan being criticized from both the left and the right, and his opponents as likely to focus attention on the flaws, real or perceived, in “20/20” as they did on 9-9-9, I’m not at all certain that it will.

Just more Republican sloganeering in a “plan” that doesn’t do what it claims, but does further explode the deficit in order to provide more tax cuts to the wealthy.

Grover Norquists support only reinforces how far out in right field he actually is.

The longer this campaign goes the harder it is to take this crowd seriously.

huge tax cuts for the wealthy, an inability to count, and cuts to government programs that would aid the middle class and poor- I’m ever so surprised.

God the worst part of the GOP isn’t even their slavish obedience to bad economic theories, it’s the god damn tedium of having to listen to the same asinine BS every time. At least Cain is crazy in startlingly new ways.

That alone is hard evidence that this is just another attempt at wealth redistribution from poor to rich, disguised as bread & circuses for the masses…

“would allow taxpayers to choose between the current system and a 20 percent flat tax on their income.”

I want to trademark the name “Alternative Maximum Tax” for this part of the proposal.

Well, at least the tax part of the plan isn’t designed to make the poor worse off. It just makes the rich better off, and wishes away the resulting cut in Federal revenues by saying we will cut the budget somehow. By Republican standards, this is a sane budget proposal.

Good afternoon, GOP, it’s nice to meet you. I just have a short list of questions for you.

Q: 1 plus 1 equals?

A: Tax cuts for the rich.

Q: 9 times 72 equals?

A: Tax cuts for the rich.

Q: What is the letter after J?

A: Tax cuts for the rich.

Q: What are the ingredients in pizza dough?

A: Tax cuts for the rich.

Q: GOP, tell me, what is the sound of one hand clapping?

A: Tax cuts for the rich.

Q: To be or not to be?

A: Tax cuts for the rich.

Q: Have you ever loved, truly loved?

A: Tax cuts for the rich.

In a Turing test Apple’s Siri app would beat the GOP any day of the week.

Here’s a flat tax plan that would lower taxes for most, bring in more people to the tax base, and increase revenues to the government. Eliminate all deductions except for charitable giving, and for dependents. Have a tax rate of 3% on everyone who is receiving any sort of income, including SS, food stamps, welfare, etc. No loopholes for the wealthy such as deferring taxes years into the future after they are gone or writing off their homes and private jets. This will increase the tax base by millions of people and increase the tax revenues by billions. It will give tax relief for the common working people. Same rate for everyone.

The important thing is not to have a tax plan that makes sense in this primary.

The important thing is just to have a tax plan.

Any tax plan.

No good deed possibly can go unpunished. On the Internet, that is.

In any event, this plan is a lot better than Cain’s (a complete abomination) but not as good as Huntman’s (a stellar plan). With a twist, however.

Huntsman’s plan never could pass, regardless of who is president and regardless who holds Congress. Sure, in an ideal world we’d get a true flat tax with no deductions or exemptions. But this is not an ideal world, Skippy.

The mortgage interest deduction is far too popular and far too entrenched with middle class voters for it to be eliminated. In a million years you could not get a majority of Congress to vote away that deduction. Perry’s people are cognizant of that reality. They’re also cognizant of the fact that millions of homeowners in states possessing state income taxes and who also pay county property taxes rely on two other key deductions (state and local taxes) to avoid much higher federal income tax exposures. Those people vote, Chief. Lastly, Perry’s people also are cognizant of the reality that small business owners who are set up as sole proprietorships rely on various other deductions (the self-insured health premium deduction; the deduction for 1/2 of the self-employment tax, etc.) in running their businesses and in planning their tax liabilities.

Ergo Team Perry has proposed a flat tax that keeps the deductions for mortgage interest and state and local taxes and they’ve couched it as an optional system, which allows people to pick and choose and to avoid disruptions in business and tax planning. Overall this is a good plan on its merits and it takes into account political realities to boot.

Incidentally, it’s amusing to hear country club pundits on the Internet whining about this plan not being simple enough. Talk about projection.

Perry’s plan correctly lowers the corporate tax rate. It correctly eliminates federal taxes on capital gains and dividends. Those are job creation reforms. We do want more jobs, right? It correctly eliminates the death tax. That’s arguably the worst tax out there. It correctly eliminates the tax on social security benefits. That should have been done eons ago. It correctly eliminates the tax on repatriation of foreign profits. Again, a job creation reform. There’s a lot to like here. No, it’s not perfect. Then again, if we wait for magical unicorn tooth faries to give us the perfect plan we’ll be taxing ourselves to oblivion for so many decades to come even Generation Y will be working and paying taxes by the time we fix things right.

The spending part of the plan needs development, true. Although it does contain several specific items which are very well taken. Eliminating base line budgeting is a good step. Capping the budget at a fixed percentage of GDP would be a good thing. The details on what would be cut need to be filled in. Rome wasn’t built in a day. A federal civilian hiring freeze is a no brainer. Paygo for new programs is a no brainer. All in all there’s a lot to like on that side of the ledger too.

Overall I’d give the plan a B+. The Internet’s analysis of the plan, however, would receive a F-minus.

Classic case of choosing a tax rate you like, and then handwaving that “resulting growth” will balance the budget.

Forget all you know about the GLOBAL economic cycle, magic rates can bring all the growth you have dreamed of.

@Tsar Nicholas:

You want serious criticism? Point to a real economic model for that “resulting growth.”

@Tsar Nicholas:

Tsar, an interesting analysis of Perry’s tax plan. I have only heard some superficial details. I agree with you about the mortgage deduction being hard-pressed to do away with, considering that the housing market is already in such bad shape. Eliminating such a deduction would only make it worse.

One question, though, what do you think about this plan being optional? One has a choice to choose his “flat’ version or simply carry on with what they are doing currently. Couldn’t one deduce that people would check which plan would produce the lowest taxes for them. Choose that plan, and what would ultimately occur would be less overall government revenue?

@Tsar Nicholas: If you want serious criticism, offer a serious plan.

If you look closely (or even not very closely), you’ll see that this doesn’t actually reduce the tax code one damn bit – it just grafts Perry’s bizarre ideas on top of the existing code. Show me a proposal that doesn’t have an enormous bald-faced lie right up in the topic sentence and I’ll spend some actual brainpower analyzing it.

@jan:

Tax software would automatically pick the low option. That is not a hurdle.

The problems are deep spending cuts and the claim of resulting growth (and as I just heard on tv, “millions” of resulting jobs). It is all made up.

Um, why is that?

Because it impedes the growth of an American aristocracy?

80% of Americans favor raising taxes on the rich, BTW, and the rich are the only people who pay estate taxes.

The death tax is bad because it affects Paul Ryan and Eric Cantor and the Koch Bros…people who talk about self-responsibility but had life handed to them.

@Hey Norm:

The fear factor in the economy makes inheritance seem more a survival issue for some. Don’t think rich kids, think unemployed kids.

Death tax is going to have more support in a strong economy.

Ideal…you keep using that word. I do not think it means what you think it means.

@ JP…but the death tax only really affects big money…about 2% of estates. Probate attorneys do more damage to inheritances.

At least that’s my sense of it. At any rate emotion probably trumps fact.

@ponce: I don’t understand the reasoning behind any inheritance, estate tax. I have already paid tax on that money, probably more than once. Why should my children have to pay any more tax on it?

@Racehorse:

Have your heirs paid tax on it? No? Why not when it’s clearly income?

By the way, it’s not likely to be “children” in the sense of youths unless you die very young. Much more likely to be your middle-aged, grown-up kids.

Will you be leving an estate greater than $5 million to your children, racehorse?

@Racehorse:

Because they didn’t earn it. The poor are expected to “pull themselves up by their own bootstraps”, while the wealthy produce Paris Hiltons.

Let’s say I have a rich uncle (I don’t). For Christmas, he gives me a check for 50k. He already paid taxes on it. Does that mean I should get a pass on taxes on my extra income of 50k? Of course not.

@anjin-san:

Actually, you as the receiver of a gift don’t pay a dime in taxes on that. I know this because my wife and I received a substantial gift from her grandmother for help with a down payment to our house. It is the giver of a gift who bears a tax burden, not the recipient.

http://en.wikipedia.org/wiki/Gift_tax_in_the_United_States

Reading through the last battalion of posts reminds me of the cop who sits in his cop car, radar gun poised to catch the first sucker coasting down the hill into town past the 25 mile per hour posted speed limit. Zing! A hit!

The same goes regarding estate taxes. Money was earned by the parents, whether it was below the so-called 5 mil threshold, or a zillion dollars. But, one cent over that government stipulated amount then the government zips in to exact it’s bounty of 35%, soon to be raised (I’m sure)f to a fill-in-the-space number — all to satisfy the thirst of the social progressives in their quest for redistribution of anything that is over the bounds of what normal people should have.

@jan:

Where does equal opportunity fit into the dream?

@michael reynolds:

It’s more bizarre than that now. I was born when my father was 26, which means if he lives to mean life expectancy (81), I’ll be 55 before he dies. Before two much longer, people may be retiring before their parents pass on.

@Racehorse: Excuse me, but how does a tax rate of three percent create a budget that is currently 16% of the GDP (and is still $1.6 trillion short of balance)? Are you making it up on volume, or just making it up?

@Tsar Nicholas: @john personna: The line your looking for is

“Hey Rocky, watch me pull a rabbit out of my hat.”

@jan: You do of course realize the part that is taxed is only that one cent that was over the exempted amount?

As far as Perry’s plan goes, it’s just astonishingly bad. It leaves the entire current income tax in place, but adds a new one to make tax planning even more complex. Unless there’s something I’m not seeing, a good number of people are going to be paying less taxes while no one would pay more, so it’s not even revenue neutral. Did I miss the memo from the GOP how deficits are OK again, or is that only if Perry is elected?

Silly me. I thought I wanted the government to make sure we have sufficient national defense, good road and, decent schools. I thought I wanted it to make sure that old people do not freeze to death in flophouses, and that we don’t have people with serous mental illness roaming the streets. I thought I wanted it to make sure we don’t have people living in the kind of abject poverty we see in third world countries, and that we don’t have dead bodies piling up in the streets. I though I wanted it to make sure we don’t have any more rivers catching on fire.

Jan, do you really believe any of the tripe you write? My boss owns a jet. I don’t begrudge it to him in the least, and I am certainly a “social progressive” by your standards.

@ Ben

My understanding of the gift tax is up to 13k is exempt. After that it gets taxed.

@Racehorse: It’s pretty likely that anything subject to the estate tax includes income that has never been taxed, as the capital gains tax doesn’t apply until investments are sold.

@Hey Norm:

That’s what I’m saying. In 1977 the estate tax exemption level was $120,000. Inflation adjusted, that’s $450,000 today. That we’ve pushed the exemption beyond inflation, way up to $5,000,000 is pretty crazy.

We’ve clearly moved from exempting poor kids to exempting rich kids and yet the symbolism and emotion continues to come from middle class (innumerate?) fear.

@anjin-san:

Anything over 13K is taxable to the DONOR. The recipient never pays any taxes on it, whatsoever.

@jan:

Well, golly. “What normal people should have”? “Normal people”? Should have?? What do “normal” people really have? Let’s take a look.

Top Earners Doubled Share of Nation’s Income, [CBO] Study Finds

Those facts should comfort Jan on her journey into helotry.

Related:

@sam:

Are these numbers self-referential? That is, do they relate current-year earnings to current-year earnings? I fear that any “cycling” of new people into and out of the 1% (on an income measure) might be hidden. A new NBA player might be in, a retired one out. Both end up retired at lake houses.

What I’d like is percentages income going to the top percents by wealth.

Probably nobody has the important data, the net-worth to income correlation data.

And this is important because … well look at the new data about suburban poverty. Incomes have dropped drastically, but the amount of hardship that represents varies with the net worth beneath it.

In 1977 the estate tax exemption level was $120,000. Inflation adjusted, that’s $450,000 today. That we’ve pushed the exemption beyond inflation, way up to $5,000,000 is pretty crazy.

Yet another example of facts not matching up with Conservafantasy. As with the top income tax rates, estate taxation has dropped – IMO to the point that it’s outright pathetic.

If you want an aristocracy, have the guts to say so. If you do not, you have to grapple with inheritance. Taxing the value of estates in excess of $5MM at 35% is a mild check on runaway accumulation of wealth. It hasn’t done much, frankly.

The last figures I saw, JP, were that the top 1% (of earners? Not clear) of the country holds ~40% of the wealth. The top 1% of earners took home 24% of income a few years back, though due to the recession that has fallen (to 17%, IIRC). Those are staggering numbers that, together with the correlation between parental wealth and your future wealth (very high, with only Britain worse in the wealthy world), make a mockery of our supposed “meritocracy.”

If these things were not so, I’d have far less appetite for redistribution via the tax code. But this is our reality and we have to face it.

@john personna:

I don’t understand the question, JP. The statement seems pretty straightforward: in 1979, the top 1% of the population commanded 8% of the national aftertax income; in 2007, the top 1% commanded 17% of the national aftertax income. Those are aggregate figures reflecting the spread in 1979 vs 2007, right? What’s problematic about them (conceptually, I mean)?

Also don’t forget that there’s a step-up in basis of any stuff that gets transferred at death. So yeah, unless you have an estate tax, a lot of the stuff actually WON’T be taxed.

I’m cranky enough to think we should treat all income the same, no matter how you get it–by inheritance, capital gains, salary….

It works out the same either way, irregardless of who pays it the gift is still taxed.

@sam:

It’s misleading if it is a different 1% in 1979, and 1980, and 1981. If people cycle in and out of the group then the fraction of population who have enjoyed those high gains is greater than 1%.

(I know people who have been in the 1% by income group for just 1 or 2 years.)

(If you are taking 1% by income each year from 1979 to 2007, and then calling it “1% of the population,” you are surely wrong.)

@john personna:

I’d thought of that but discounted it as not making that much of a difference. Well, in truth, what I’d thought of was that 1% in 1979 could/would be a smaller number than in later years (population growth, etc). But then I thought, well, how much of a difference could that really make? We’d still be talking about a very small percentage of the population as a whole, no? A very small percentage. Does this really undermine the central point?

@michael reynolds: I will probably set it up in some sort of trust fund. It probably won’t be over $20,000 anyway.

@sam:

I think the missing data cuts two ways. Income probably has been spread a bit further as people jump around year-to-year, but I think we might also see a delayed effect as people who fall lower turn to savings. Someone with a “poverty” wage, but a 401K to tap has a fall back that someone else with the same wage, but no 401k, does not.

Bill Would Allow People to Withdraw Money from 401K to Pay Mortgage

Stuff like that is an ugly sign of the times.

@jan:

This estate tax being some kind of redistribution of wealth deal busts my gut to no end. First of all, if the person who died has sold it the real property 1 minute before they died any capitol gains tax would have to be paid (at a much more favorable rate then wage income). One minute after they die you say it should not be taxed at all or it’s socialism. Why is it that you want to make death a tax loophole? what a crock. You literally have no clue about what you’re talking about.

Second the only time it even becomes an issue is if there was no estate planning. The whole 5 million exemption is a huge death subsidy, it not redistributive at all it’s simply capturing taxes that were never paid in the first place. Cash is a bit different as the tax was presumably paid earlier so you have a bit of a point there but frankly the whole socialists plot meme is wearing thin … you don;t have the first clue about what socialism is and from what I’ve read you never did.